Financing Rental Properties: The Decisions That Make or Break Investors

Learn about Financing Rental Properties for real estate investing.

Most real estate investors think financing rental properties is just about finding the lowest interest rate.

That misunderstanding quietly wrecks portfolios.

When I help clients analyze deals, the financing choice is often more important than the property itself.

I have watched “great deals” turn into long-term cash flow problems because the wrong loan was attached to them.

I have also watched average properties outperform expectations because the financing strategy aligned with the investor’s goals.

When I rebuilt my own portfolio after bankruptcy, financing was not a checkbox.

It was a risk management decision.

It was a cash flow decision.

And it was a long-term control decision.

Financing Is Strategy, Not Paperwork

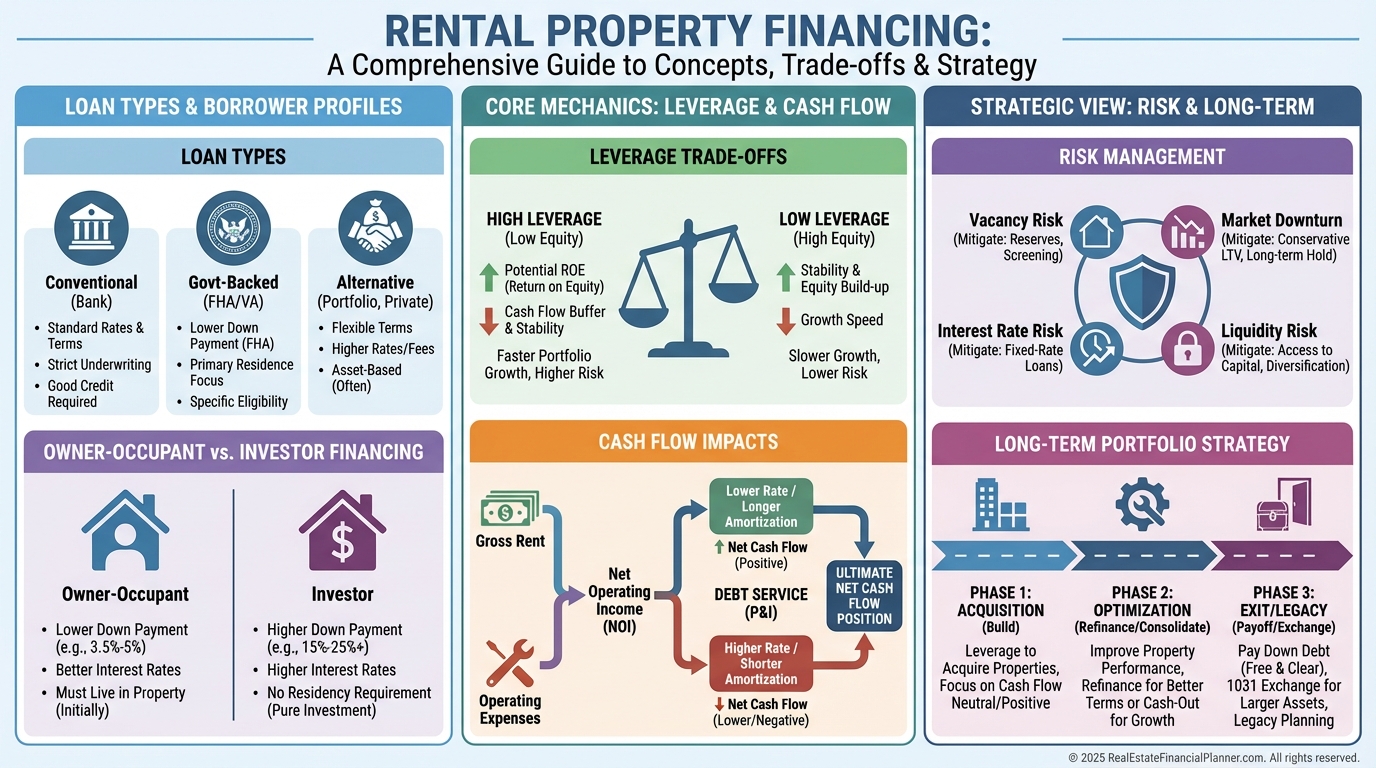

Financing rental properties determines how fast you grow, how resilient your portfolio is, and how much stress you carry during downturns.

Debt magnifies outcomes.

It magnifies wins.

It magnifies mistakes.

Before we talk about loan types, you need to understand one rule I model for every client.

If the financing does not support sustainable cash flow and long-term flexibility, it is the wrong financing—even if the rate looks great.

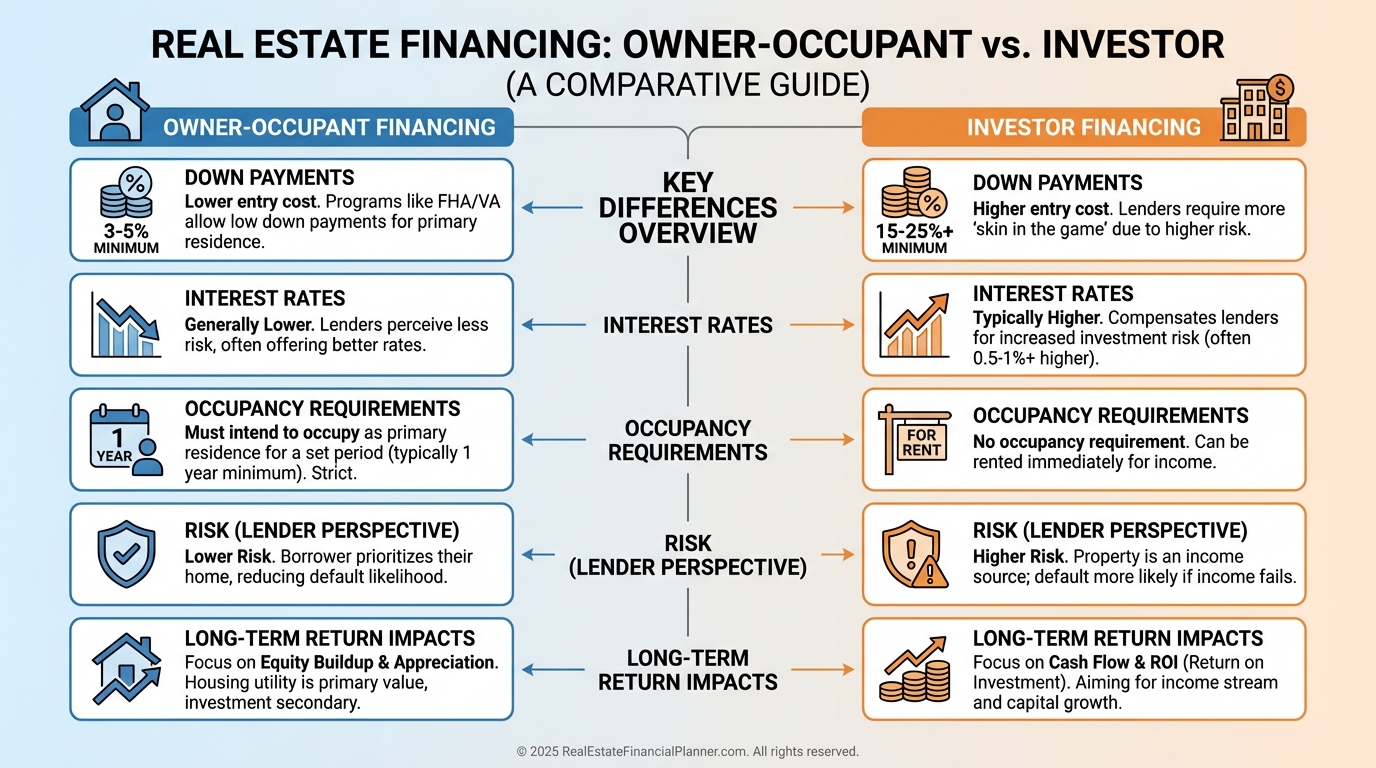

Owner-Occupant Financing vs Investor Financing

One of the biggest leverage advantages available to investors is owner-occupant financing.

This is the foundation of the Nomad™ strategy.

You buy a property as a primary residence, live in it for the required period, then convert it into a rental.

Lower down payments and better interest rates dramatically change returns.

When investors skip this option, they usually do it out of impatience.

That impatience is expensive.

Conventional Financing for Rentals

Conventional loans are the backbone of many rental portfolios.

They follow standard guidelines and typically require larger down payments for investment properties.

The upside is predictability.

The downside is rigidity.

When I analyze conventional loans, I focus on how many you can qualify for, how they affect cash flow, and how quickly they box you into lender limits.

Running out of conventional financing too early forces investors into worse options later.

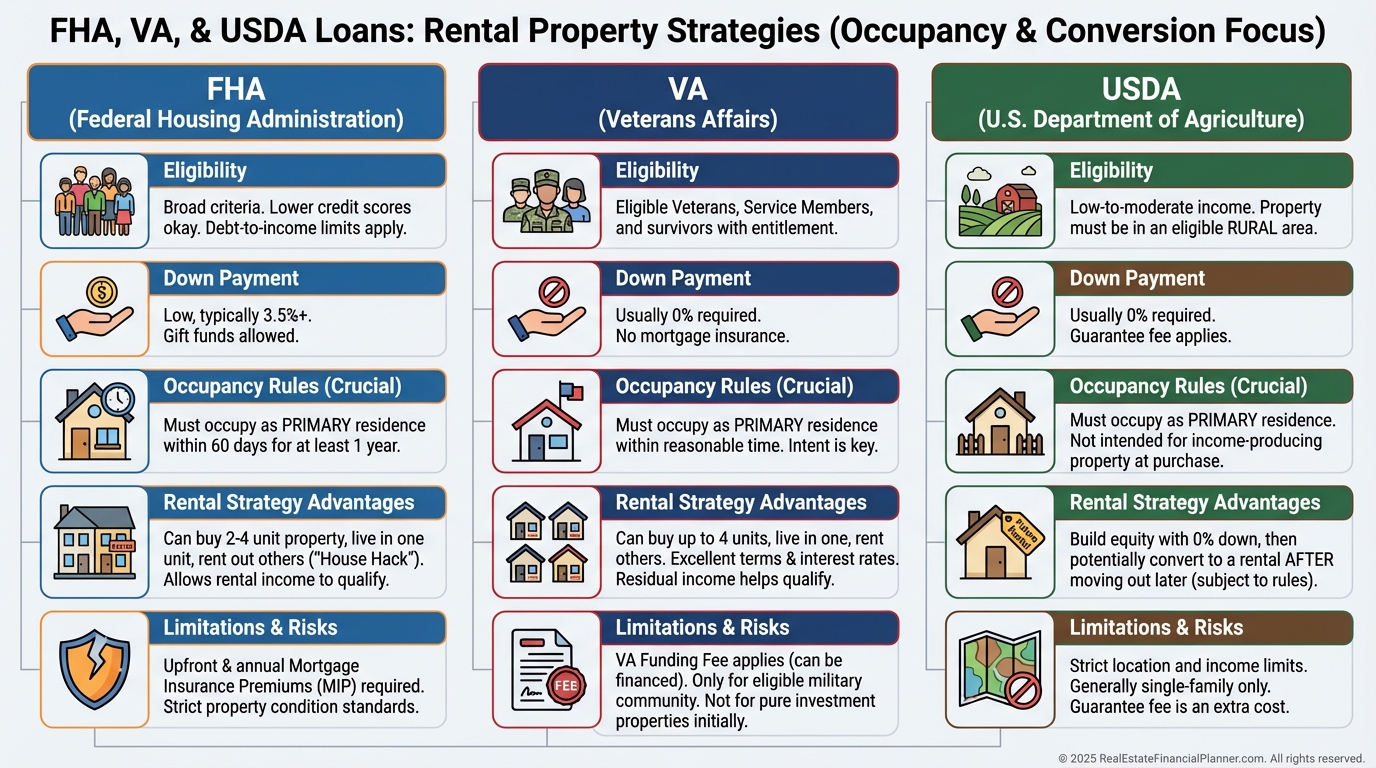

FHA, VA, and USDA Loans as Strategic Tools

Government-backed loans are misunderstood by investors.

They are not just for first-time buyers.

They are leverage tools for disciplined investors willing to follow the rules.

FHA loans allow small multifamily purchases with low down payments.

VA loans offer zero-down financing for eligible borrowers, often producing unmatched cash flow efficiency.

USDA loans open doors in specific markets that most investors ignore.

These loans are not loopholes.

They are designed pathways—if you respect the constraints.

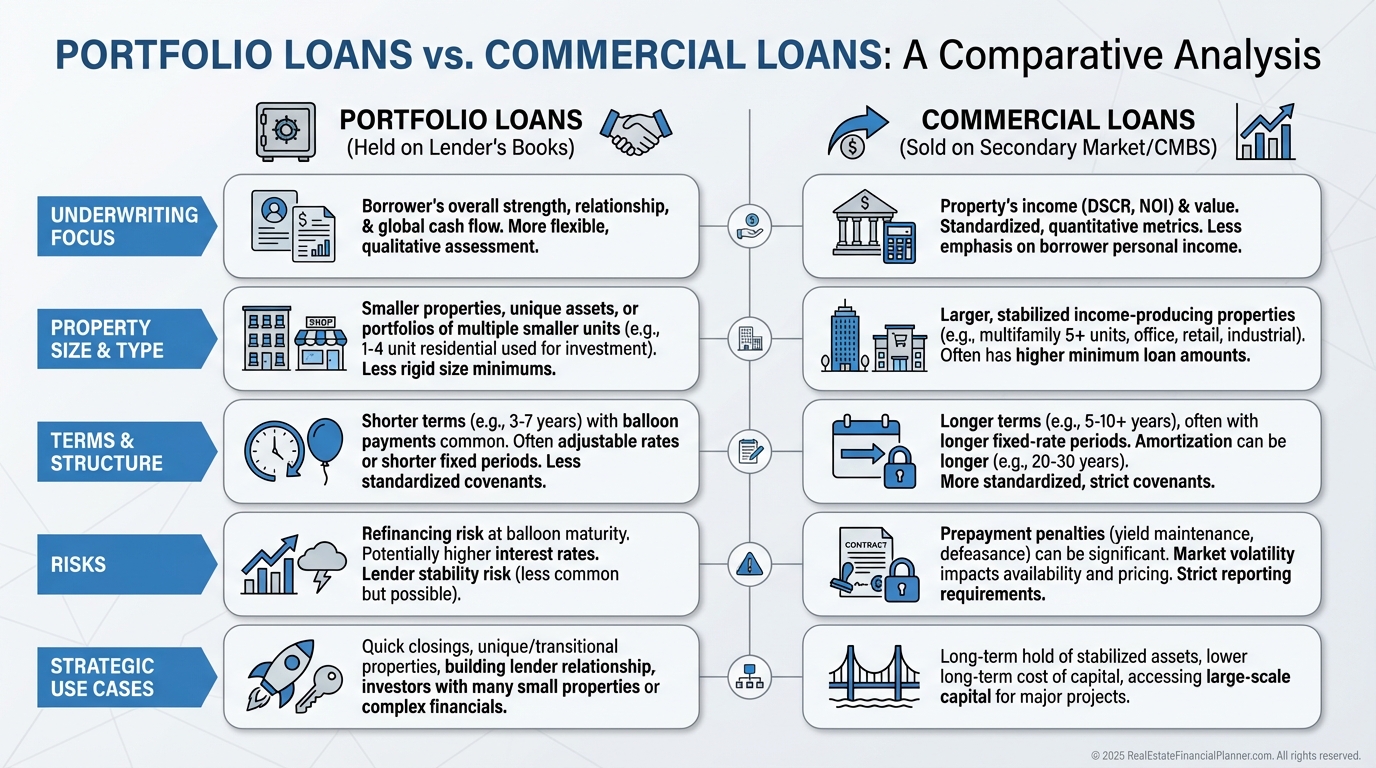

Portfolio Loans and Commercial Financing

Eventually, residential financing runs out.

This is where many investors panic.

Portfolio loans and commercial financing shift underwriting away from you and toward the property.

Income matters more than credit.

Reserves matter more than W-2 income.

When I model these loans, I pay close attention to interest rate risk, balloon terms, and refinance assumptions.

Flexibility often comes at a price.

You need to know whether that price is worth paying.

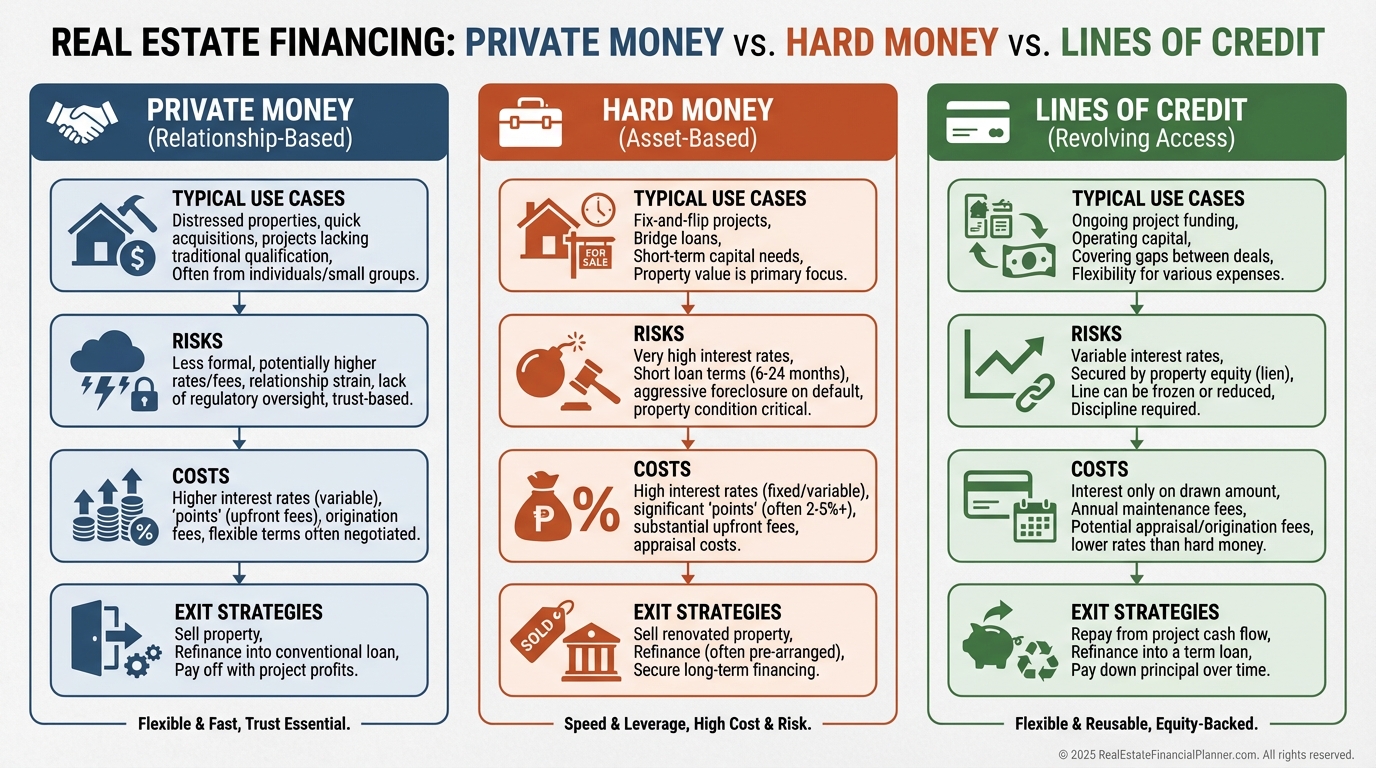

Private Money, Hard Money, and Lines of Credit

These tools are accelerators.

They are also dangerous when misunderstood.

Private money relies on trust and alignment.

Hard money relies on speed and a defined exit.

Lines of credit rely on discipline.

When investors fail here, it is almost always because they used short-term debt with long-term assumptions.

That mismatch creates forced sales.

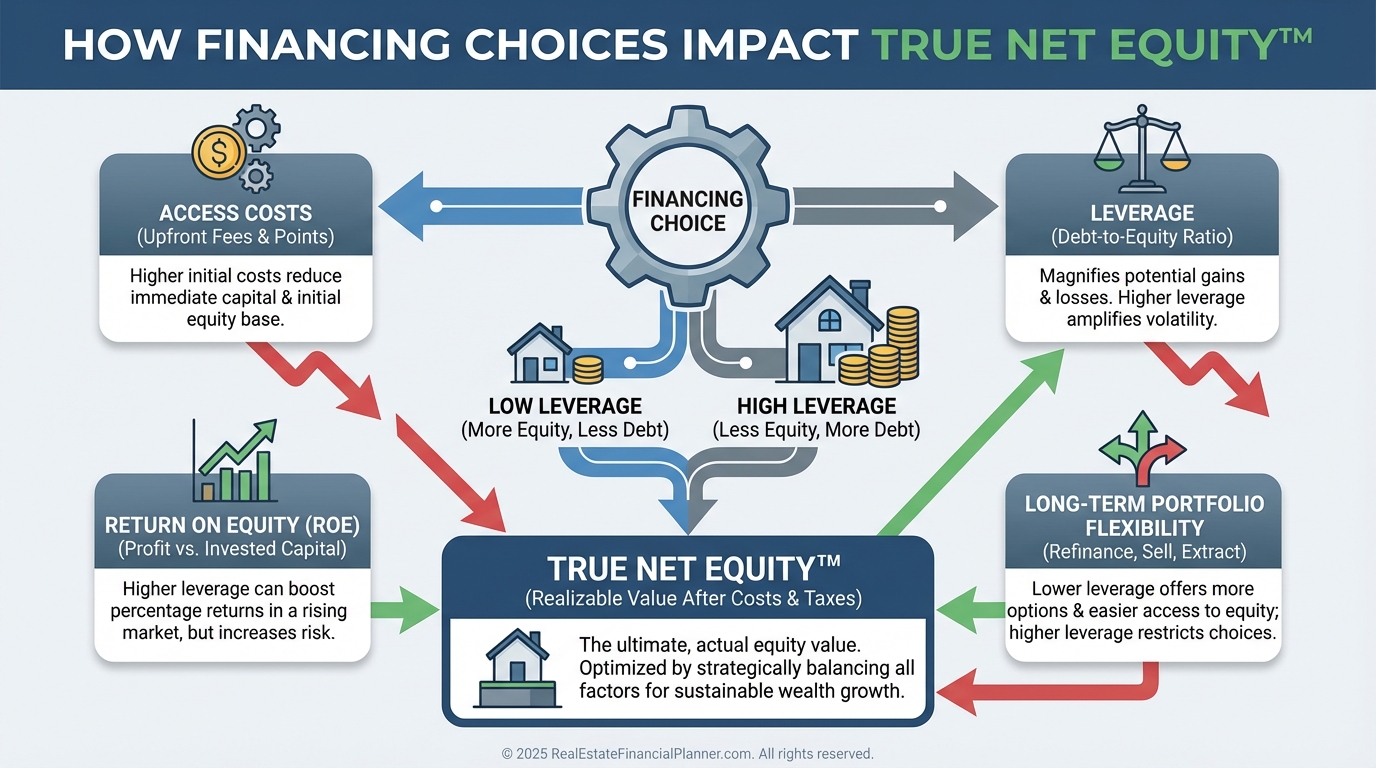

Financing Through the Lens of True Net Equity™

Most investors only look at loan balances.

I look at equity efficiency.

True Net Equity™ subtracts the costs of accessing equity, not just the debt balance.

A low-rate loan can still trap capital.

A higher-rate loan can sometimes unlock growth.

If you are not modeling return on equity, you are flying blind.

What I Warn Clients About Most

The biggest danger in financing rental properties is optimism.

Optimistic rent growth.

Optimistic refinance assumptions.

Optimistic appreciation timelines.

Debt does not forgive optimism.

I stress-test financing against flat rents, higher expenses, and delayed exits.

If the deal does not survive stress, it does not belong in your portfolio.

Financing That Serves the Plan

The right financing is the financing that serves your plan—not the bank’s.

Every loan should answer three questions.

Does it improve cash flow stability?

Does it preserve flexibility?

Does it align with long-term wealth, not short-term ego?

Financing rental properties is not about approval.

It is about control.