Vacancy: Analyze Rates, Reduce Downtime, Boost NOI

Learn about Vacancy for real estate investing.

Why Vacancy Is the Silent Return Killer

When I audit underperforming portfolios, the culprit is rarely the purchase price—it’s empty days.

One month dark on a $2,000 unit isn’t just $2,000 lost; it’s lost income plus ongoing expenses plus turnover costs that can double or triple the hit.

When I help clients underwrite, I treat vacancy as a line-item risk, not a rounding error.

Model it precisely before you buy, and your cash flow becomes predictable.

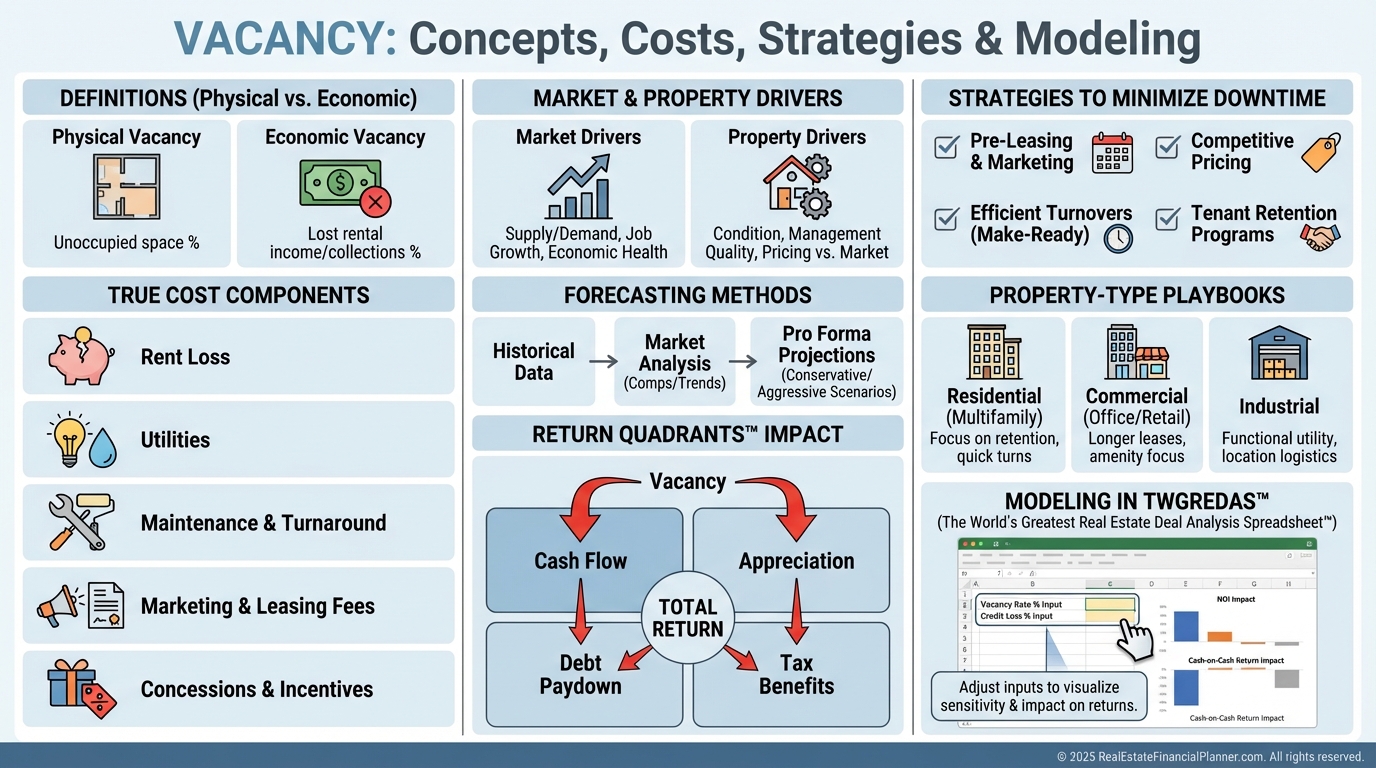

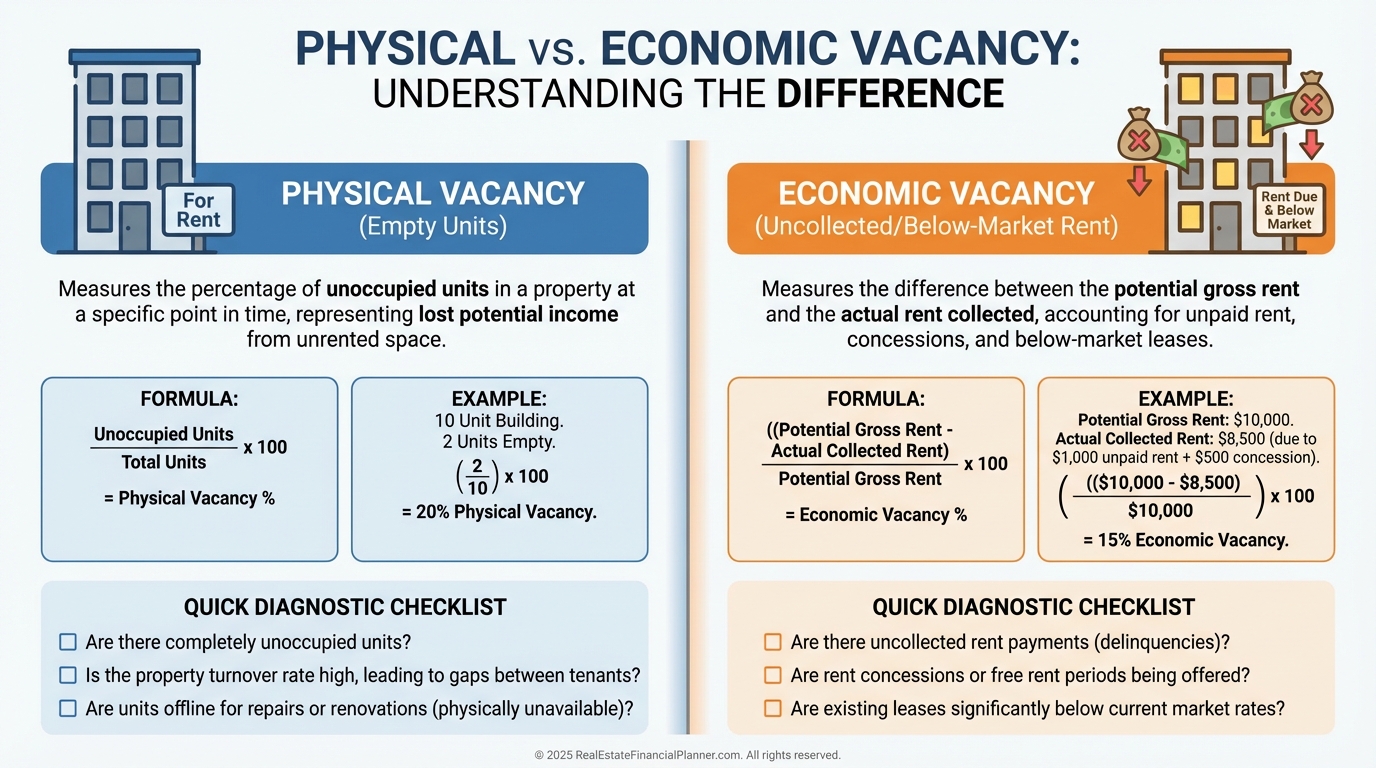

What Vacancy Really Measures

Physical vacancy is time a unit is empty.

Economic vacancy is the income you should have collected but didn’t—concessions, bad debt, or under-market rents.

A building can show 95% occupied but only 85% economically occupied.

I track both because economic vacancy tells the truth about collections and pricing.

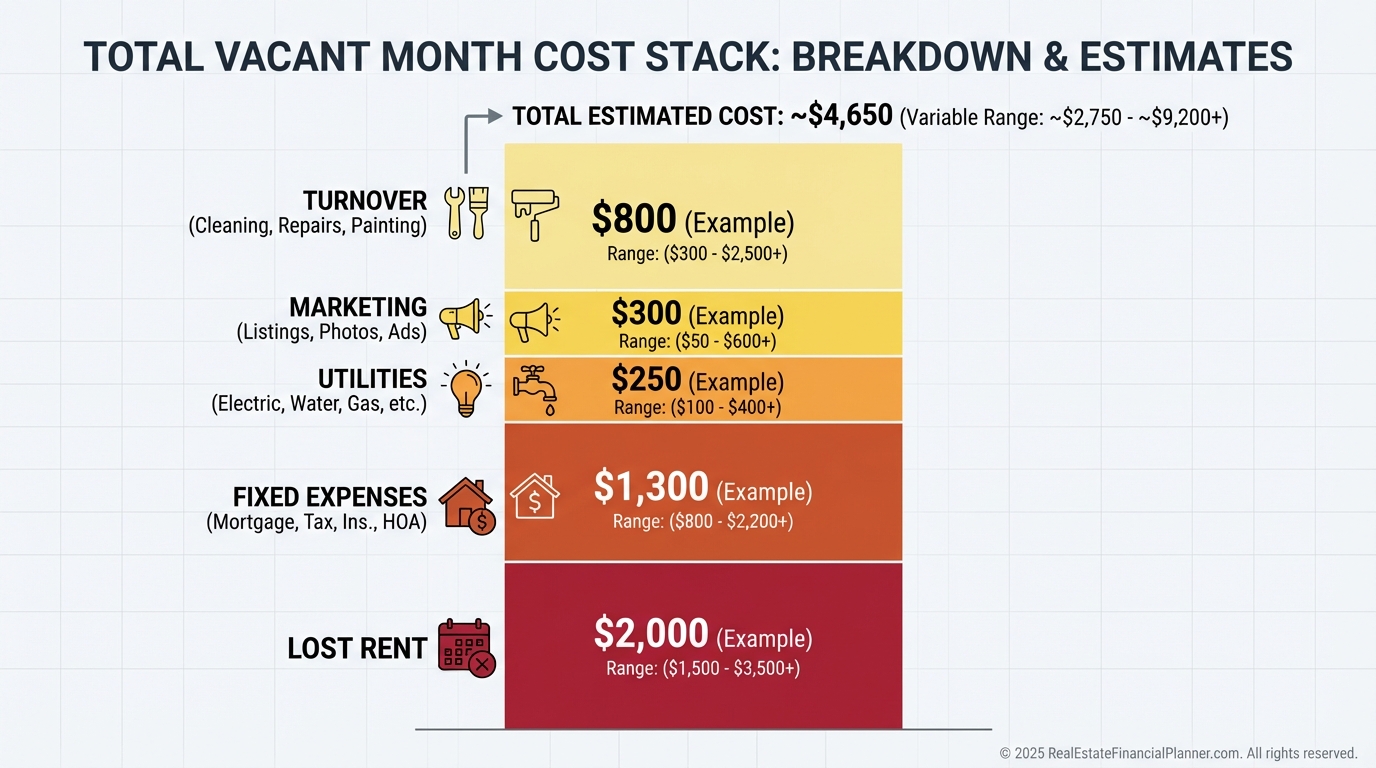

The True Cost of an Empty Month

Here’s a realistic example on a $1,500/month unit:

Lost rent: $1,500.

Ongoing fixed costs (assume 55% of rent): $825.

Turnover work: $1,200.

Marketing/photos/listings: $250.

Utilities/keeper costs: $150.

Total: $3,925 for one “cheap” vacant month.

Two such months can wipe out a year’s cash flow.

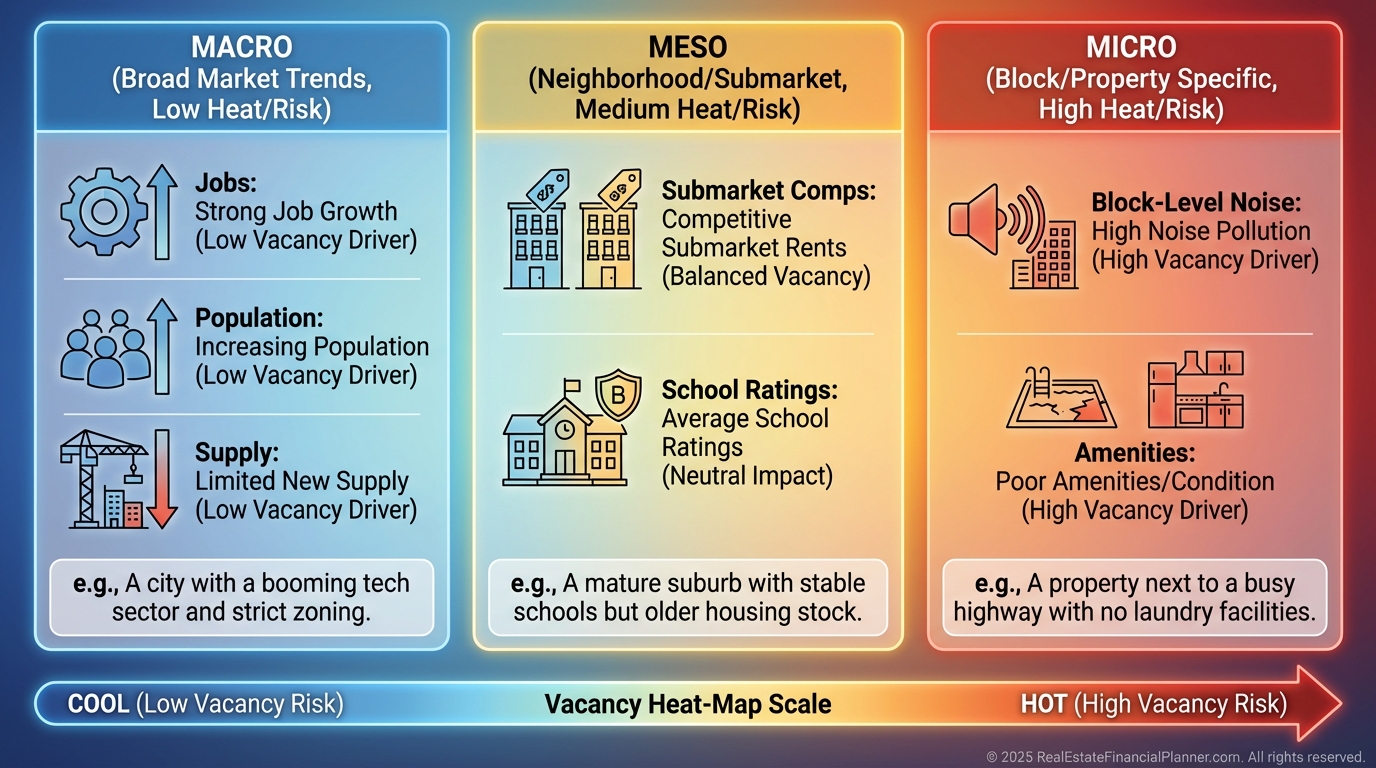

What Drives Vacancy in Your Market

Location matters most: proximity to jobs, transit, hospitals, and schools shortens days on market.

Micro-markets within the same zip can differ by 5–10% vacancy based on crime, amenities, and noise.

Seasonality is real—know your local leasing calendar.

Management quality is the sleeper variable; great managers often beat average vacancy by 2–5%.

Price too high and you’ll sit; price smart and you’ll lease.

Forecasting Vacancy Like a Pro

I start with 3–5 years of local data from property managers and listing portals, then adjust for seasonality.

If you’re new to a submarket, add a 2–3% training-wheel buffer until your systems prove out.

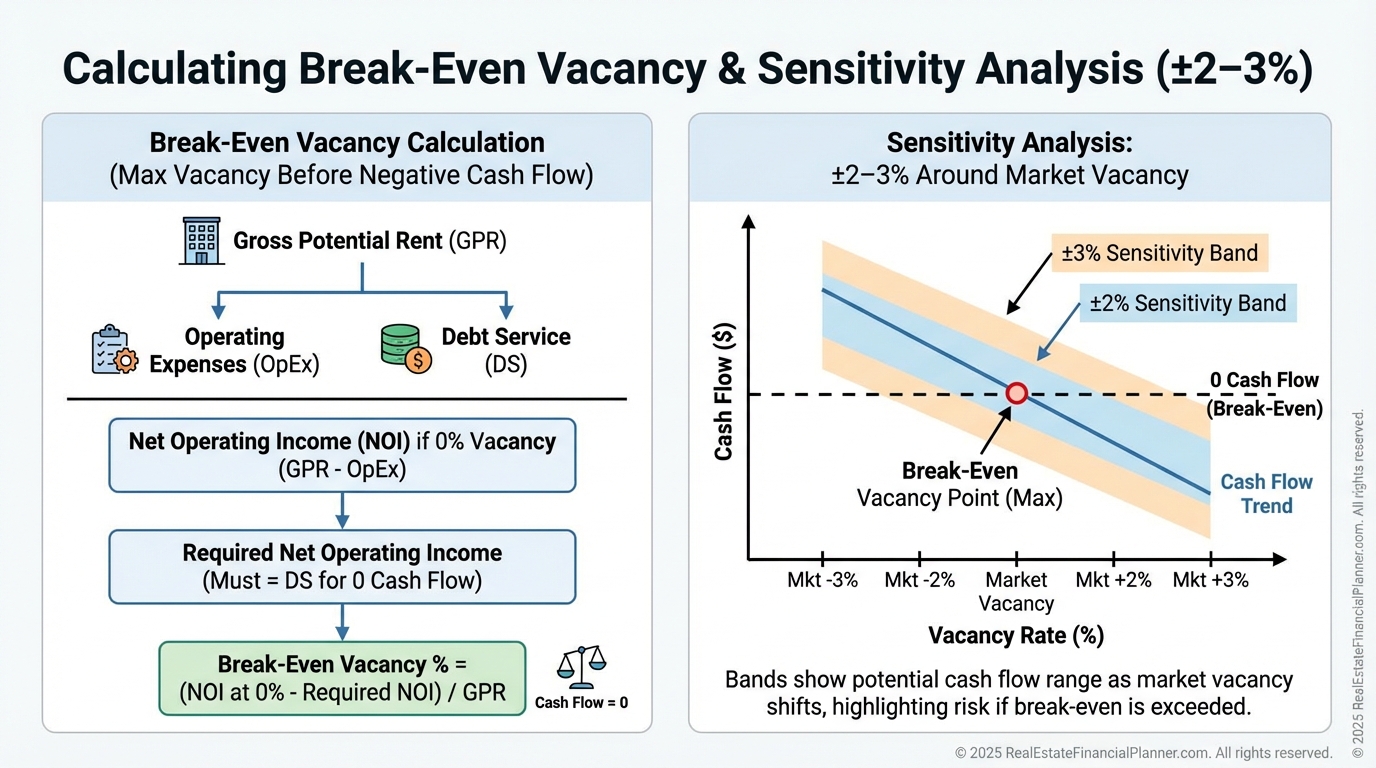

In The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I run three cases: optimistic (market minus 2%), realistic (market), conservative (market plus 3%).

Then I test break-even: the highest vacancy where cash flow stays positive.

If conservative is negative, I pass or renegotiate.

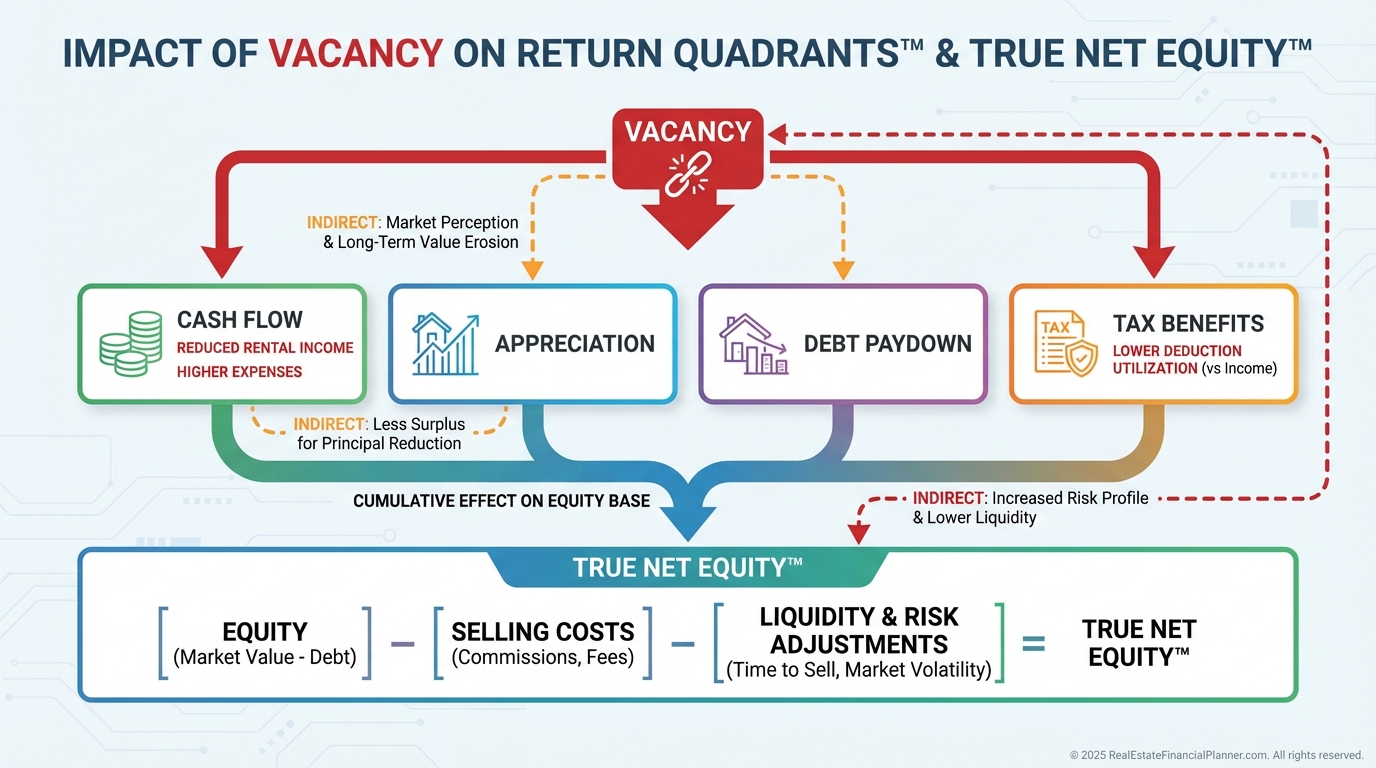

Where Vacancy Shows Up in the Return Quadrants™

Vacancy directly reduces the Cash Flow quadrant.

It can indirectly hurt Appreciation if chronic under-maintenance scares demand, and it stretches your timeline to realize Depreciation benefits effectively.

Debt Paydown continues, but if you’re feeding the mortgage from reserves, your True Net Equity™ is functionally lower.

When I coach clients, we model Return Quadrants™ with vacancy applied to cash flow and stress-test reserves in True Net Equity™ to reflect real survivability.

Tactics to Shrink Days Vacant

Retention beats replacement.

Answer maintenance within 24 hours, schedule proactive inspections, and fix friction points early.

Price 3–5% under the top of market to land longer-term, lower-turnover tenants.

Upgrade where it matters: lighting, paint, hardware, washer/dryer, and curb appeal.

Market everywhere on day one with great photos, a 60-second video, and self-showing tech where legal.

Screen hard on income, rental history, and background to avoid eviction-driven downtime.

Time lease expirations to peak demand; offer 2–3 month extensions to avoid winter ends.

Vacancy Playbooks by Property Type

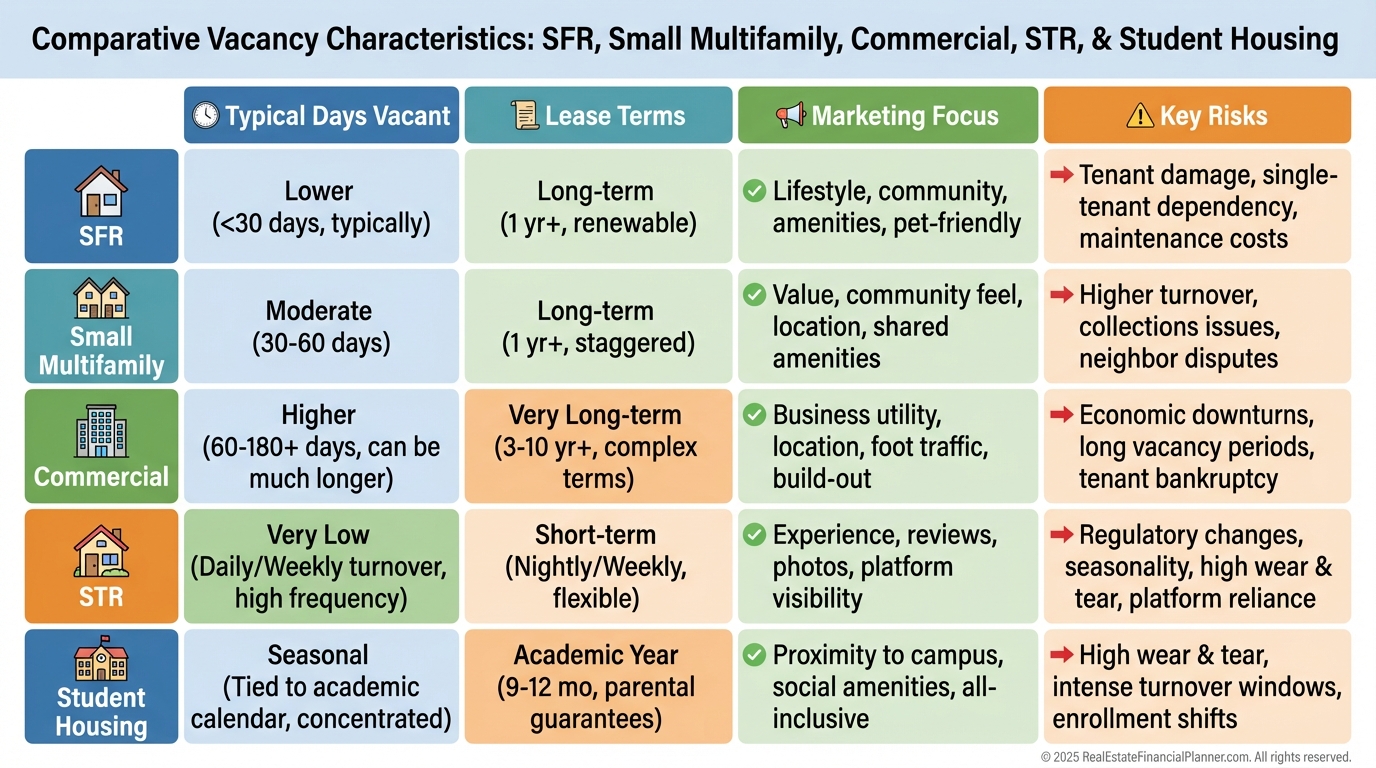

Single-family homes often have lower frequency of vacancy but longer downtime when they occur.

The key is pristine condition and pricing to the top 25% of value, not the top 5% of price.

Small multifamily smooths vacancy with portfolio effects but requires steady marketing and uniform standards.

Commercial can sit for 6–12 months; plan for TI allowances and longer lead times, offset by longer leases.

Short-term rentals have planned gaps; dynamic pricing and cleaning logistics drive effective occupancy.

Student housing runs on academic calendars; pre-lease early and align lease start/ends with move-in weekends.

Model Vacancy in The World’s Greatest Real Estate Deal Analysis Spreadsheet™

When I evaluate a deal, I enter current market vacancy, then run scenario tabs at ±2–3%.

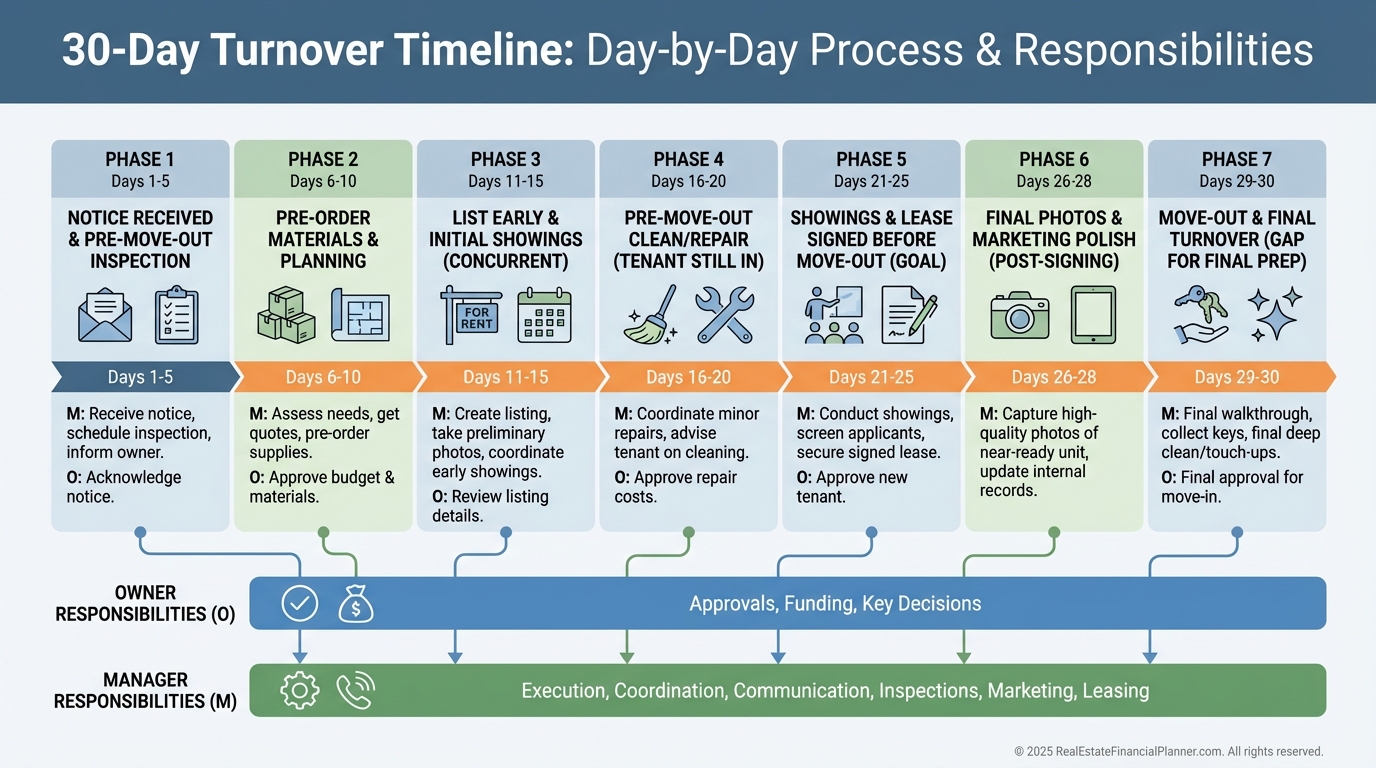

I use the Lease-Up and Turnover assumptions to bake in realistic downtime and costs.

I test a “Bad Year” case: two turnovers plus one month dark, then see if cash flow survives.

Finally, I export results to my True Net Equity™ worksheet so reserves reflect real vacancy risk.

If the conservative case can’t carry debt and minimum CapEx, I don’t try to “manage” my way out—I reprice or walk.

Special Notes for Nomad™ Investors and House Hackers

Nomad™ works best when your personal move-out lines up with peak leasing season.

I encourage clients to set initial leases at 10–11 months to align future expirations to spring/summer.

Pre-market your departing bedroom or unit 30–45 days out, and lock renewals early.

Your “rent by the room” strategy needs extra screening and roommate-matching discipline to prevent churn.

Your 30-Day Action Plan

•

Call three local managers and document real vacancy, average days on market, and seasonal patterns.

•

In the spreadsheet, run optimistic/realistic/conservative vacancy scenarios plus a Bad Year case.

•

Set a pricing rule: list at market, drop 1.5% every 7 days until 10+ qualified inquiries per week.

•

Implement a 30-day turnover playbook and pre-list with “coming soon” photos during the final week.

•

Track four KPIs: Days to Lease, Renewal Rate, Economic Occupancy, and Showings-to-Application ratio.

•

Recalculate True Net Equity™ by subtracting six months of total property expenses to reflect liquidity needs.

Vacancy isn’t fate—it’s a system.

Model it, price it, and manage it, and your returns stabilize fast.