Master the Multiple Listing Service: The Investor’s Playbook for Faster Deals, Better Comps, and Higher Returns

Learn about Multiple Listing Service for real estate investing.

Why the MLS Still Wins for Investors

When I help clients win deals in competitive markets, the edge is almost always speed and clarity from the MLS.

Consumer sites lag. The Multiple Listing Service is real time.

I model three things on every MLS-driven deal: motivation, margin, and time-to-offer.

That’s how we turn noise into decisions.

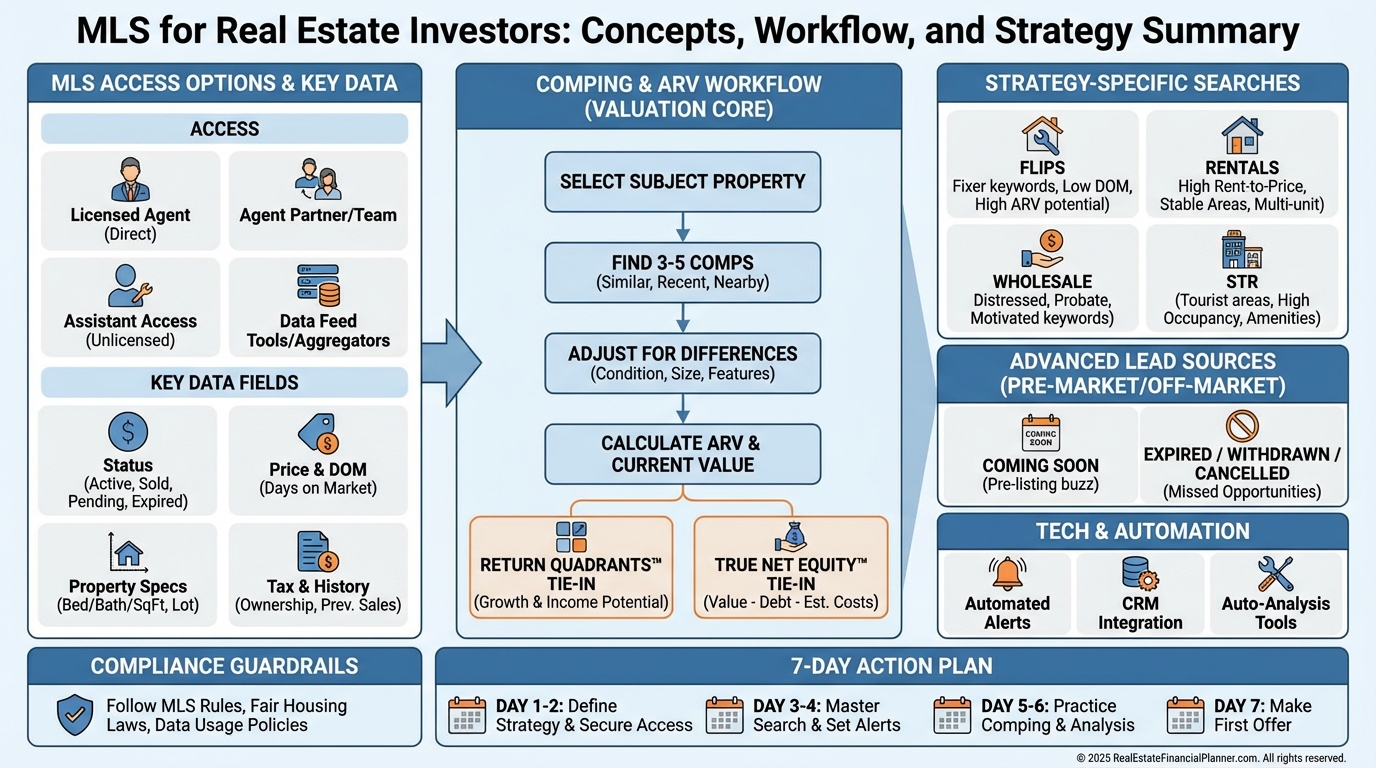

How Modern MLS Systems Work

MLS began as brokers sharing inventory. Today it’s a network of regional databases with strict data standards and penalties for errors.

Your market may have more than one MLS. Some overlap. Some do not.

Know which systems feed your zip codes. Missing one MLS can mean missing the deal.

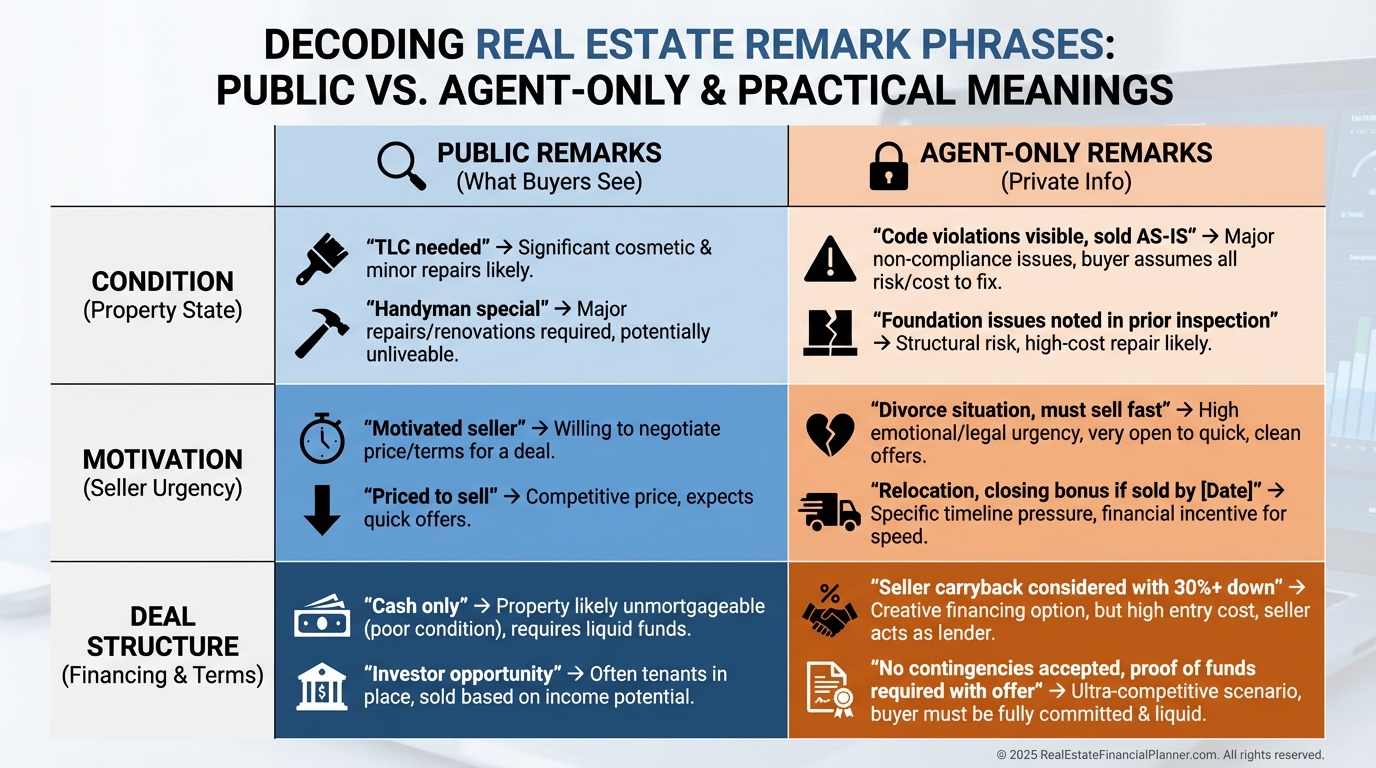

Agent remarks, showing notes, and history fields often contain the truth behind the brochure.

That is where investors find urgency, issues, and leverage.

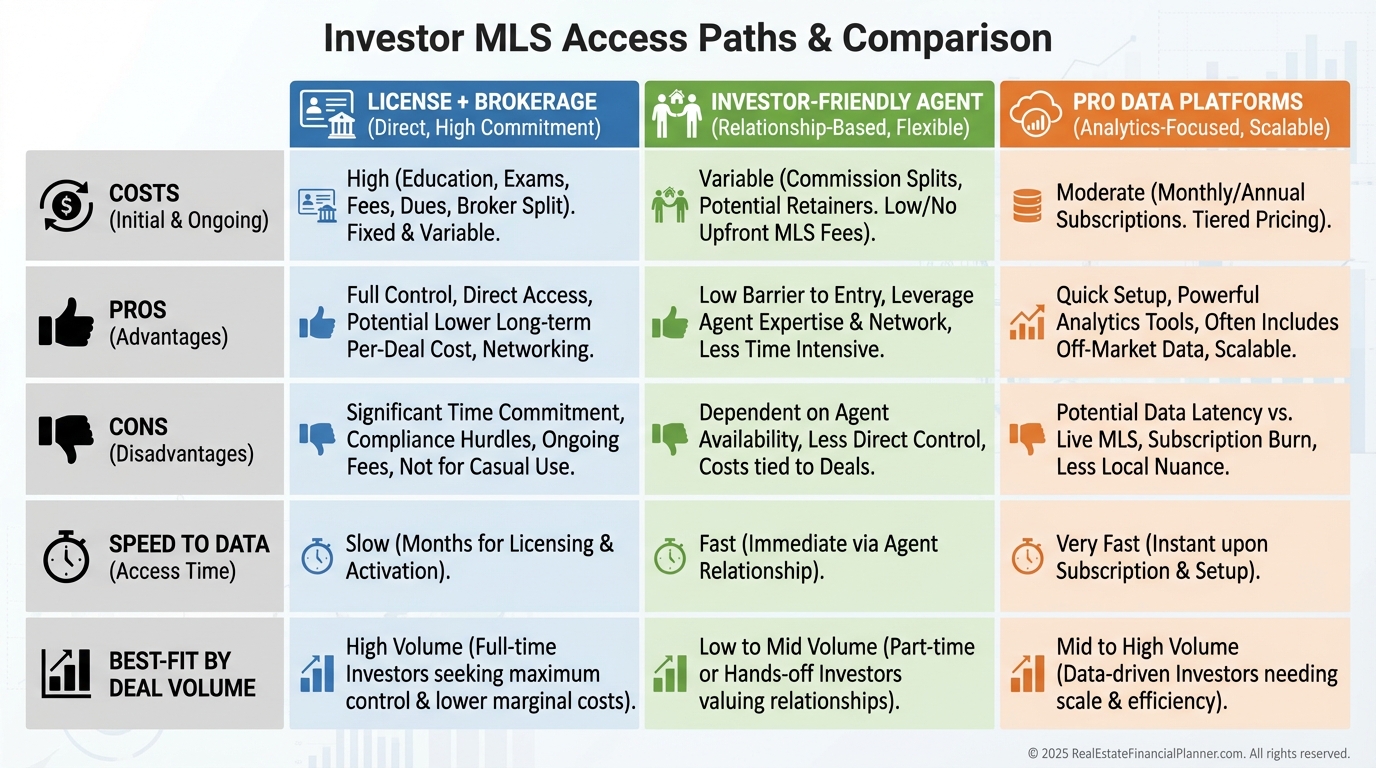

Getting Access Without Wasting Time or Money

There are three primary paths I recommend.

Get licensed for direct access. Work with an investor-friendly agent. Or use a professional platform that lawfully aggregates MLS with public records.

Licensing gives control, but it has costs and ongoing education. For active investors, the ROI often pencils.

If you do a few deals a year, a responsive agent with saved searches and instant alerts is sufficient.

Pro platforms add owner data, skip tracing, and marketing tools. They are a force multiplier when you scale.

Always follow the MLS rules. I review terms with clients so we avoid data misuse, solicitation violations, and fines.

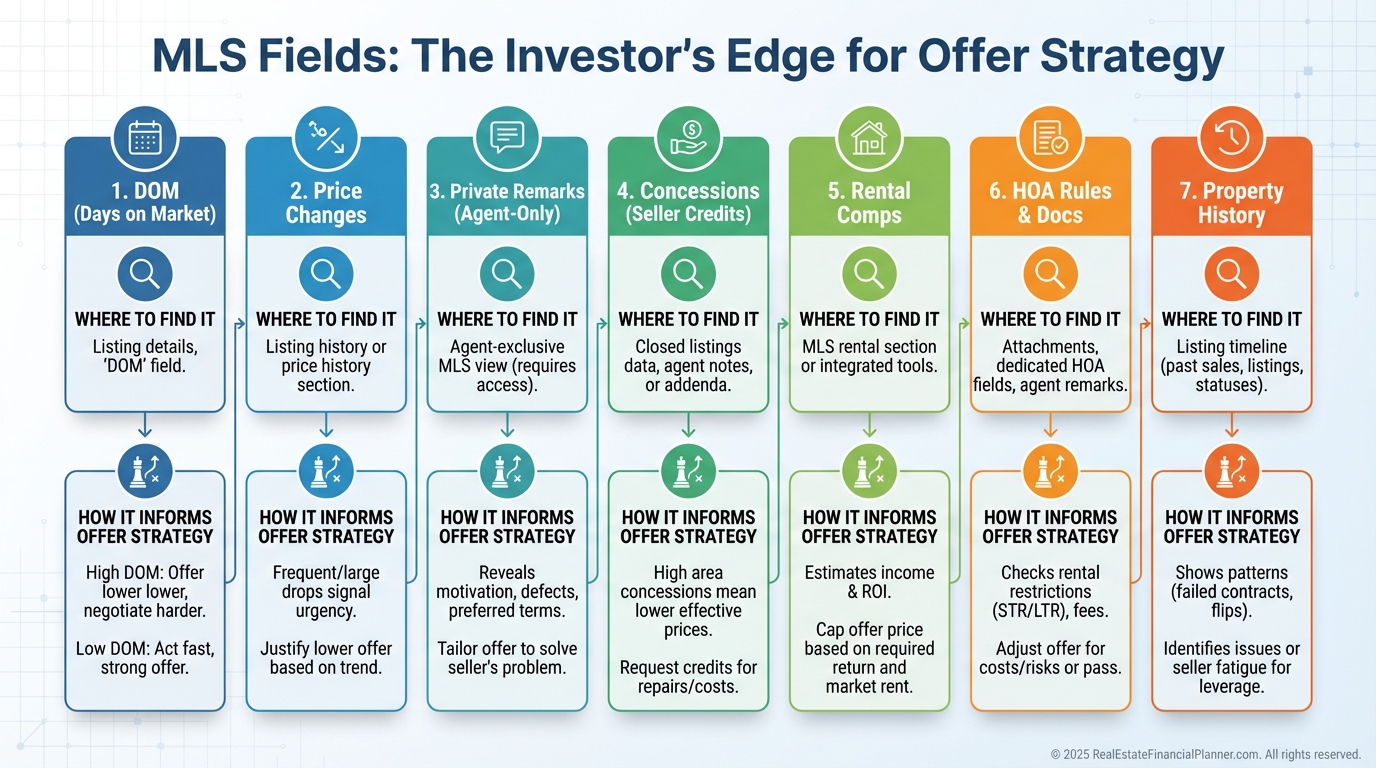

Turning MLS Data Into Deals

The MLS is a data river. The profit comes from what you choose to track.

I start with days on market, price changes, and original list price vs current.

Motivation often shows up as time and adjustments.

Then I comp with intent. I match not just beds and baths, but lot size, parking, condition, and concessions.

I verify square footage and year built in public records before I trust a comp.

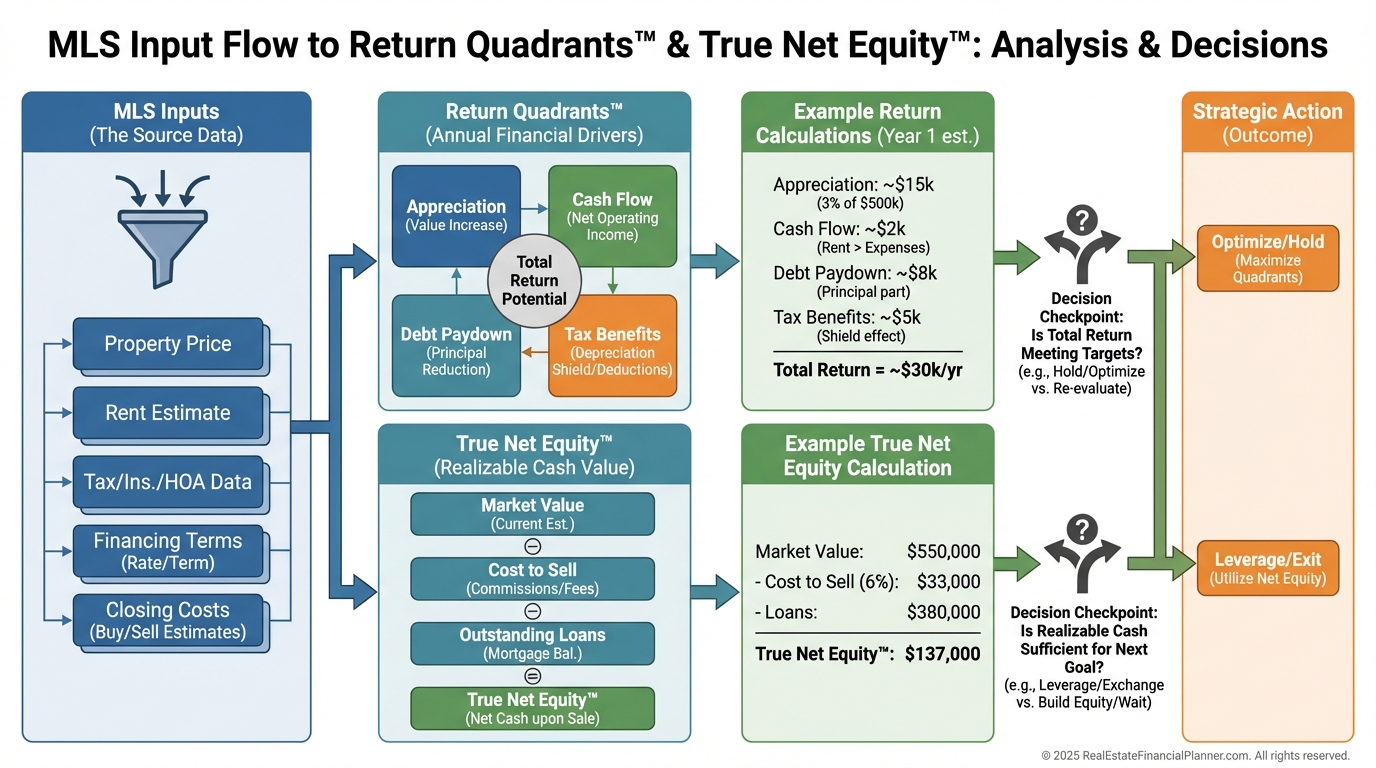

This is where The World’s Greatest Real Estate Deal Analysis Spreadsheet™ shines.

We drop in list data, renovation estimates, and financing terms. The sheet calculates ARV, cash flow, True Net Equity™, and stress-tests returns.

Saved searches are your pipeline. Start broad. Tighten by pattern.

Use keywords like “estate,” “as-is,” “handyman,” “subject to,” and “bring all offers.”

Instant alerts create same-day offers. That is how we win bids without overpaying.

Advanced Plays Most Investors Miss

Coming-soon and office exclusives often preview the market before launch.

I tell clients: attend broker opens. Be the fast, clean buyer agents want to call first.

Expired and withdrawn listings are my quiet favorites.

We track the listing history, the original pricing mistake, and days since expiration.

Then we write offers that solve the seller’s pain.

I read the remarks like a codebook. “Needs TLC” can mean roof, HVAC, and foundation. “Estate sale” usually wants speed over price.

Seasonality matters. Winter has fewer buyers and more motivation.

If you watch year-over-year patterns, you learn when to pounce.

Tailor MLS to Your Strategy

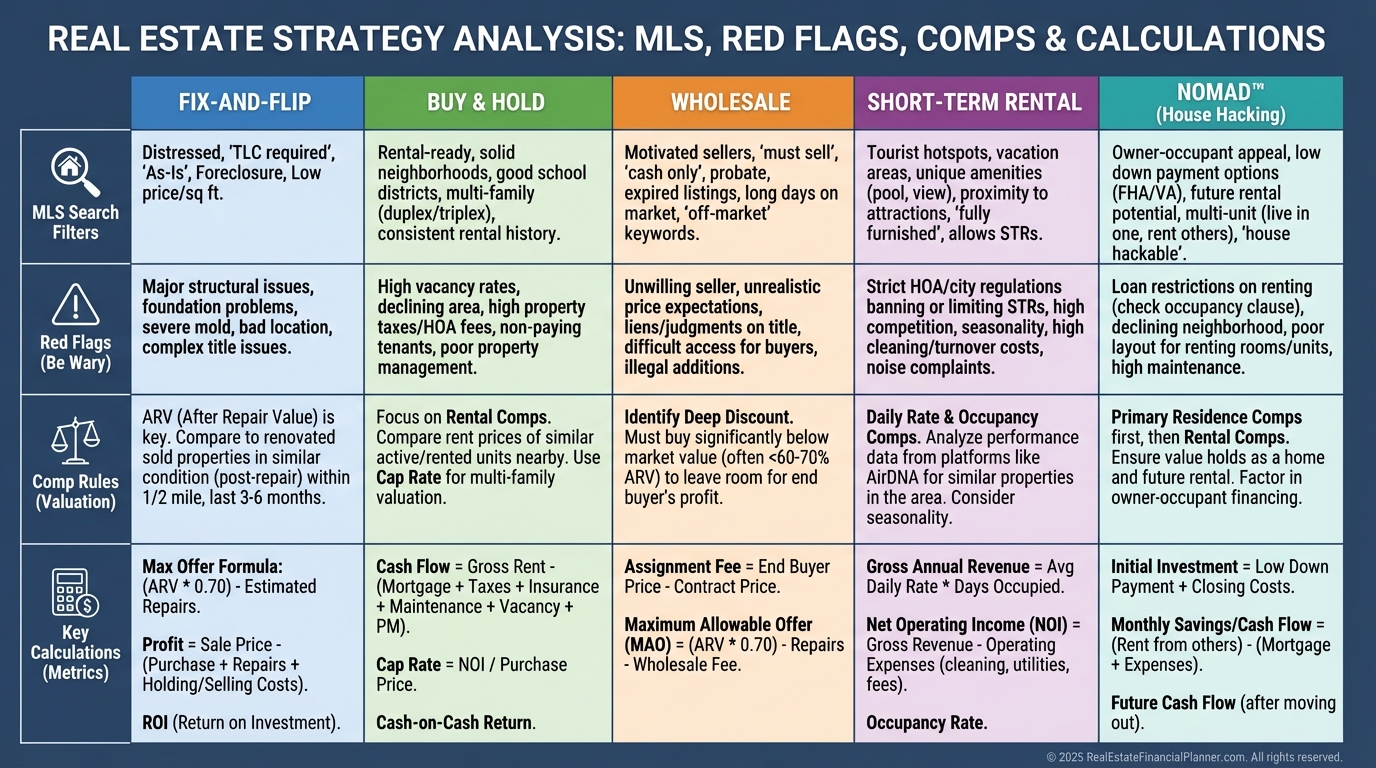

Flippers need margin and velocity.

I target long DOM, multiple reductions, and obvious condition issues I can price.

We comp ARV against renovated comparables within tight geography and time windows.

Buy-and-hold investors need different filters.

I pull rental comps from MLS and confirm with third-party sources. I check HOA rules that restrict rentals.

Wholesalers look for solvable problems at a discount.

I use tax records plus MLS to spot absentee owners and properties that retail buyers avoid.

Then I match the deal to my buyers list built from recent MLS investor purchases.

Short-term rental buyers need regulation-aware searches.

I layer in proximity to demand drivers and photos that show design potential.

Then I run True Net Equity™ and cash flow with conservative occupancy.

For Nomad™ buyers, I look for properties that work twice.

They must live well for a year and cash flow when converted to a rental.

That is an MLS search crafted around both livability and long-term returns.

Technology, Automation, and SOPs

I want offers crafted faster than the market can blink.

We push MLS alerts into a CRM. We tag by zip, DOM, and price movement.

When a listing crosses our thresholds, a checklist fires.

Comps get pulled. The spreadsheet runs. The call to the agent happens within the hour.

Mobile apps let me comp curbside. I take notes and photos tied to each listing.

The goal is consistent execution, not heroics.

Pitfalls, Compliance, and Guardrails

Trust but verify every critical field.

I confirm square footage, legal bedrooms, and lot size before I comp.

Photos can be old. Tenant-occupied homes can hide condition.

Analysis paralysis is a deal killer.

Set written buy boxes and go/no-go rules. If it fits, act.

Follow MLS rules.

No scraping. No mass solicitation. No sharing credentials or redistributing data.

I protect access like it’s my financing approval—because it is.

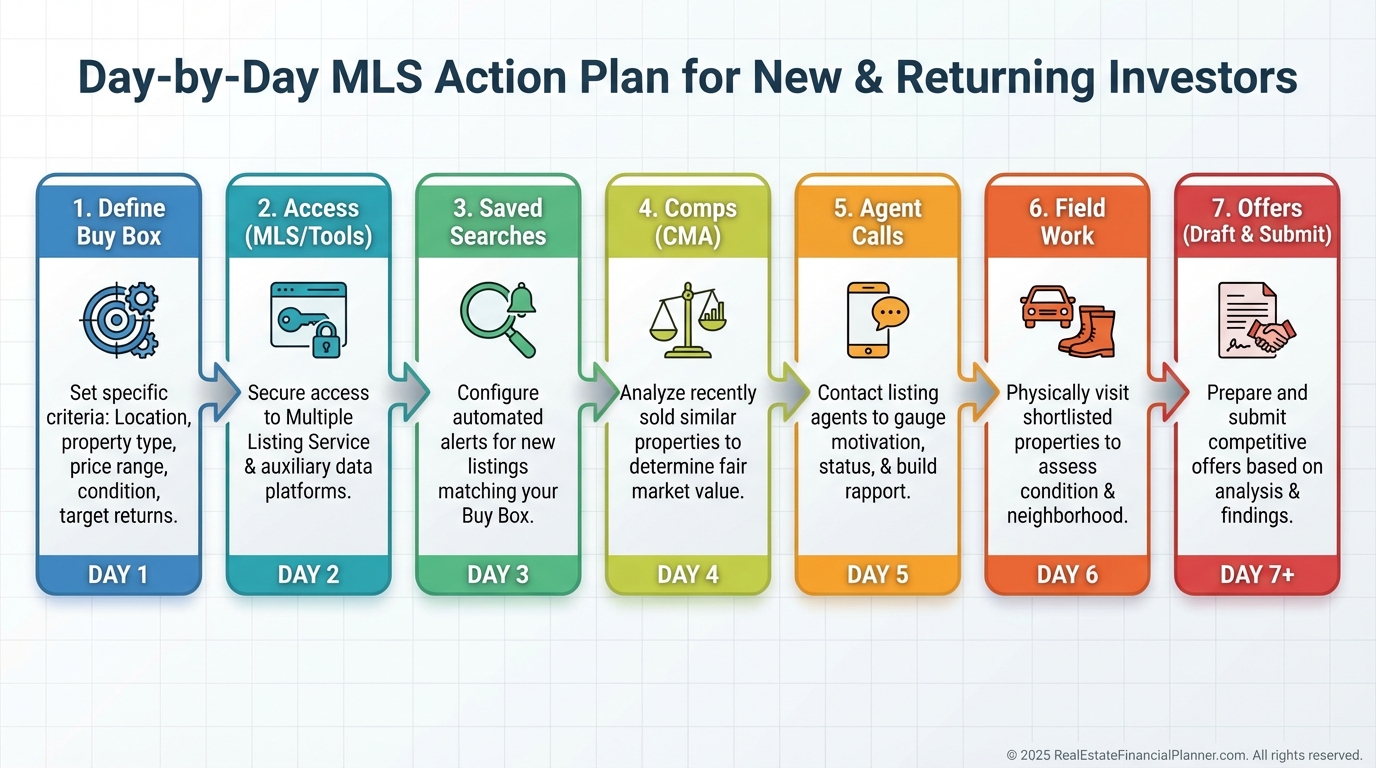

Action Plan: Your First 7 Days

Day 1: Define your buy box. Price, neighborhoods, property type, condition, yield targets.

Day 2: Secure access. License, agent partner, or platform. Turn on instant alerts.

Day 3: Build saved searches. Add motivation keywords. Include slightly above and below your target price.

Day 4: Pull 10 recent solds and 10 active comps. Run them through The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

Day 5: Call three listing agents on “almost” deals. Ask about condition, concessions, and seller priorities.

Day 6: Drive the top five and take curbside notes. Validate block-by-block value.

Day 7: Write two offers that fit your buy box. Small wins compound.

Final Thought

Data is abundant. Advantage is rare.

Use the MLS to see fast, decide faster, and execute cleanly.

That is how we turn listings into lasting returns.