Real Estate Investing Strategies: Practical Playbook

Learn about Real Estate Investing Strategies for real estate investing.

When I help clients choose a plan, I do not start with opinions.

I open the Real Estate Financial Planner™ and model the strategy.

I stress-test rents, rates, vacancies, and rehab costs before we commit a dollar.

That is how you avoid avoidable mistakes.

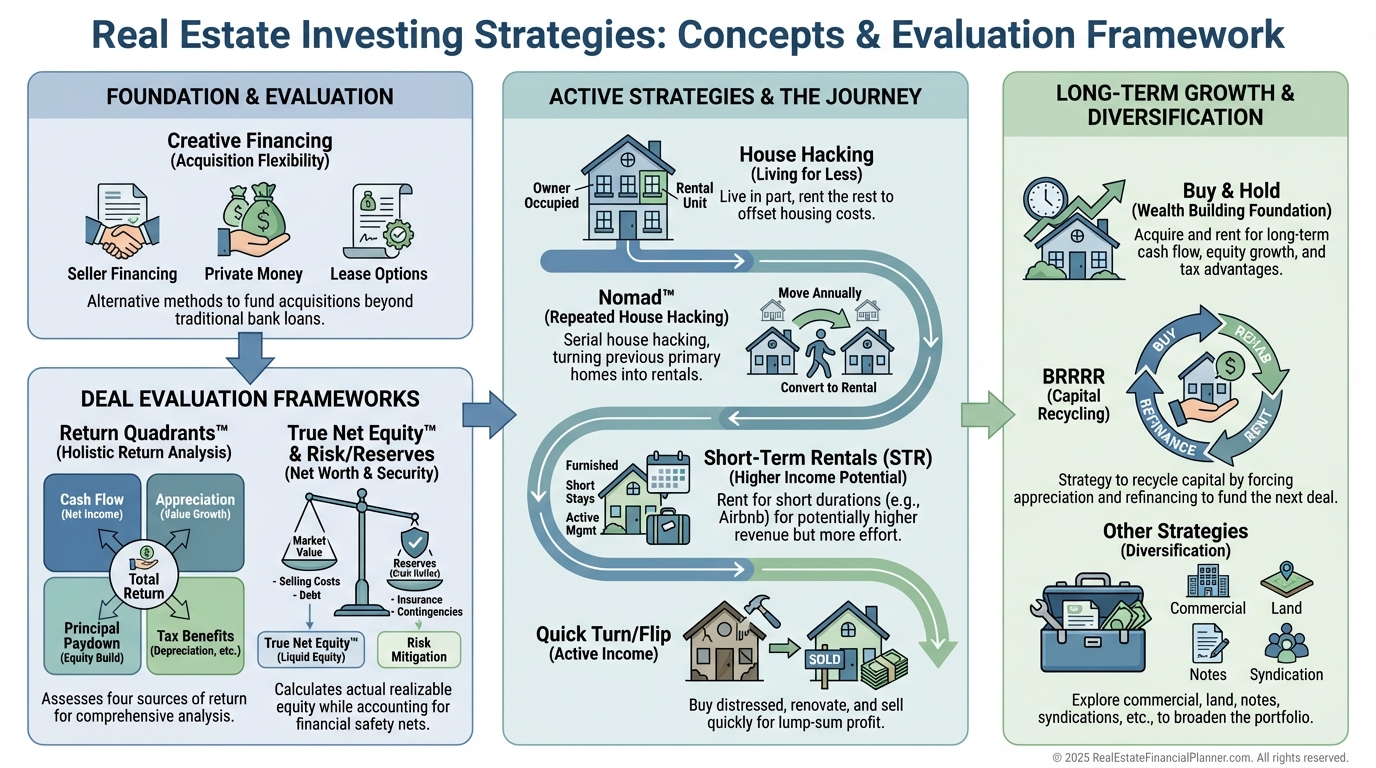

How I Evaluate Every Strategy

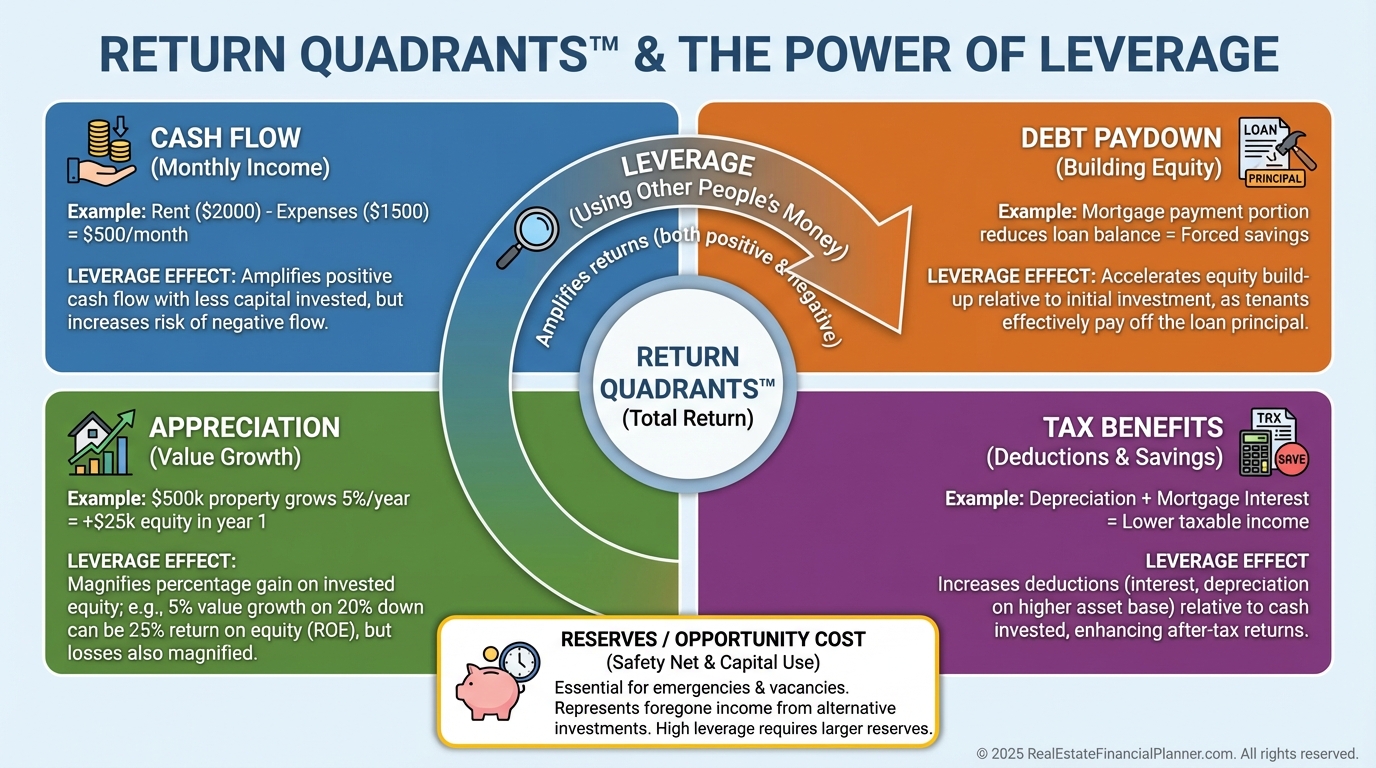

I begin with the Return Quadrants™ to see where the results come from: cash flow, appreciation, debt paydown, and tax benefits.

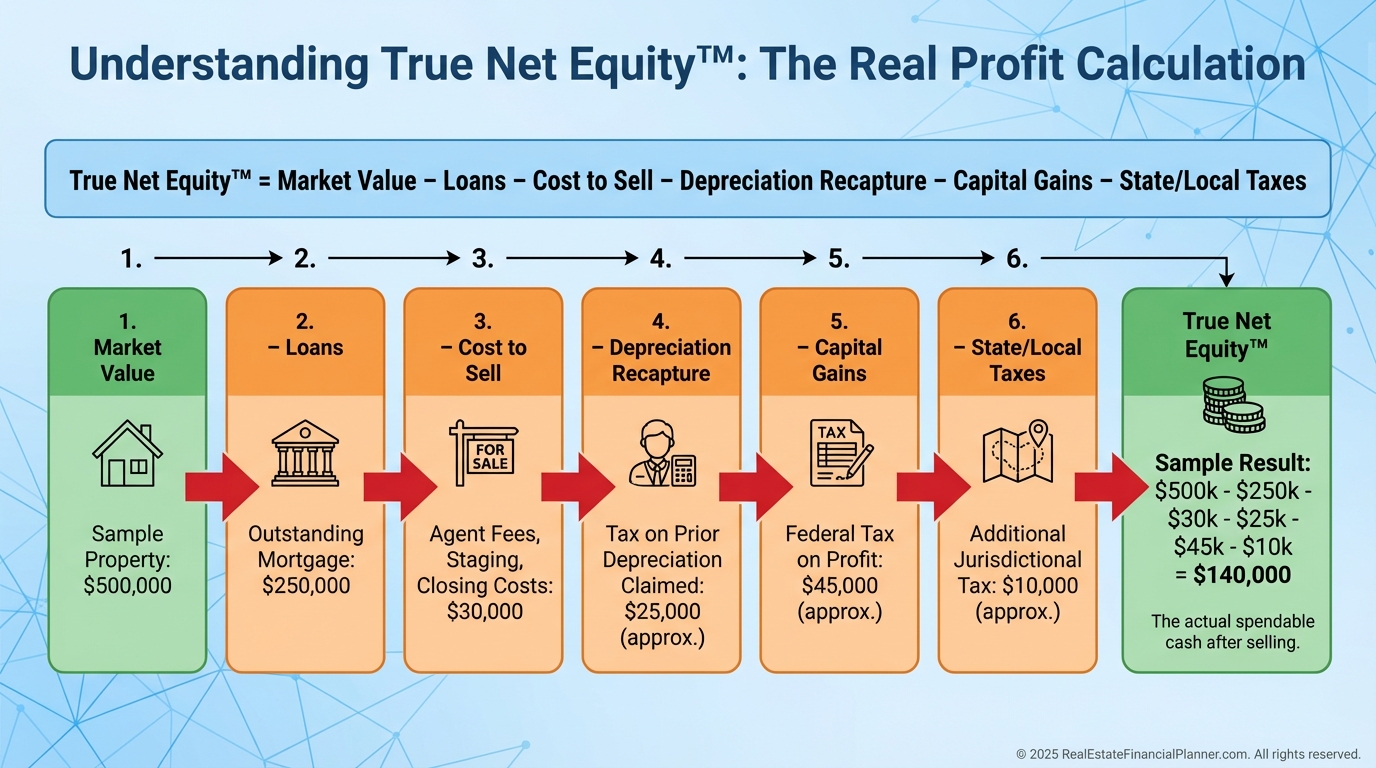

Then I verify what you actually keep using True Net Equity™ after transaction costs and taxes.

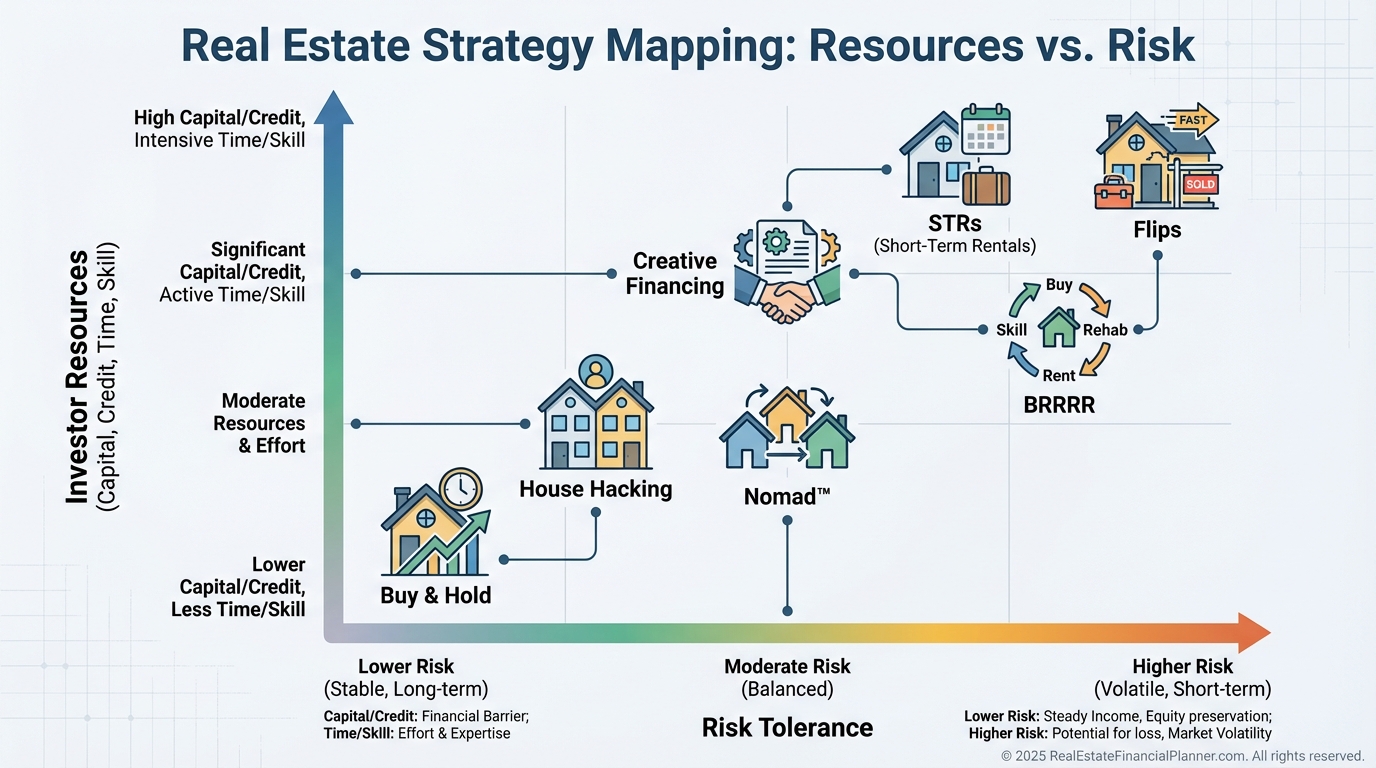

Finally, I match the strategy to your capital, credit, time, and skill so you’re not forcing a square peg into a round market.

Creative Financing

Owner financing can solve high-rate markets while preserving price for sellers.

I model payment terms, balloons, interest-only periods, and prepayment exposure to confirm cash flow and refinance risk.

Wrap financing lets you help a seller in distress, but the underlying loan remains.

I check for due-on-sale risk, written authorization where possible, and reserves for a forced refinance.

Loan assumptions can secure yesterday’s low rates.

I model the assumption fee, remaining amortization, and how fast principal paydown accelerates Return on Equity over time.

Lease-options and agreement-for-deed offer flexible paths to ownership.

I warn clients about compliance with Dodd-Frank, SAFE Act, and state-specific disclosures, and I budget for legal drafting as a line item.

Subject-to can work when speed matters, but it is not “free financing.”

I stress-test the plan for rate-reset clauses, insurance changes, and the cost of replacing the loan if called.

Buy & Hold

Traditional rentals are the backbone of many portfolios.

I look for durable cash flow first, then upside from forced appreciation and value-add amenities.

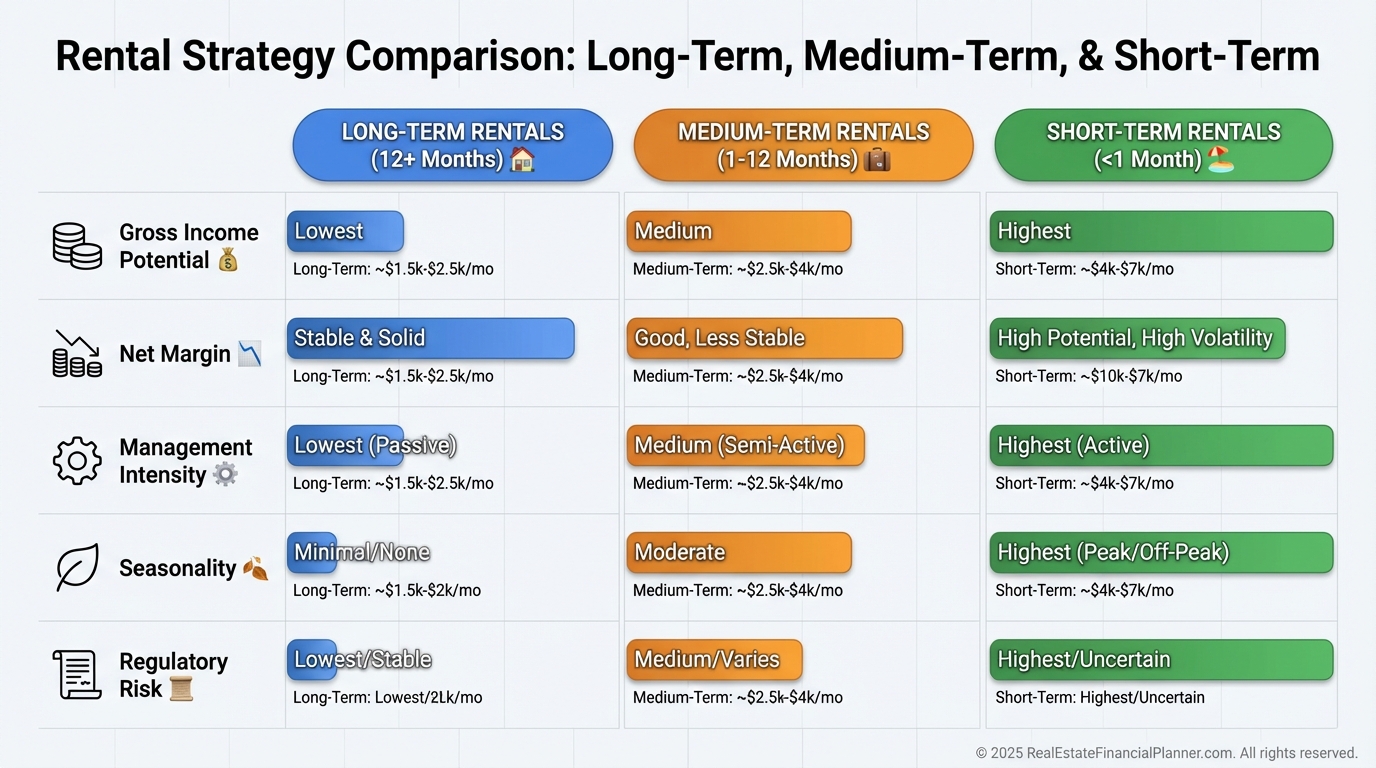

Short-term and medium-term rentals can boost income.

I model realistic occupancy, cleaning and management costs, regulatory risk, and seasonality buffers so you are not relying on peak nights to survive.

Student rentals, assisted living, storage, and mixed-use diversify income sources.

Each has specialized management and compliance; I include vacancy lag, licensing, and staffing in the pro forma.

The Nomad™ Strategy

Nomad™ is how many clients scale with minimal down payments.

Live in a home one year to access owner-occupant financing, move out, keep it as a rental, and repeat.

I model the sequence so your debt-to-income recovers as rents rise and you season each mortgage.

We stack Return Quadrants™ across properties and monitor True Net Equity™ to decide when to accelerate or pause.

Nomad™ by Proxy works for parents or adult children when one party lives in the property.

Nomad™ with House Hacking offsets the mortgage on day one and speeds up savings for the next purchase.

Nomad™ to Short-Term Rental boosts cash flow in the right markets, but I only green-light it after a regulatory check and an off-peak revenue test.

Lease-option exits can produce option premiums and reduce turn costs, but I confirm tax treatment and repair responsibilities.

House Hacking

When I rebuilt after a rough year, house hacking restored my savings first.

You live in one unit or room and rent the others, turning your biggest expense into a lever for wealth.

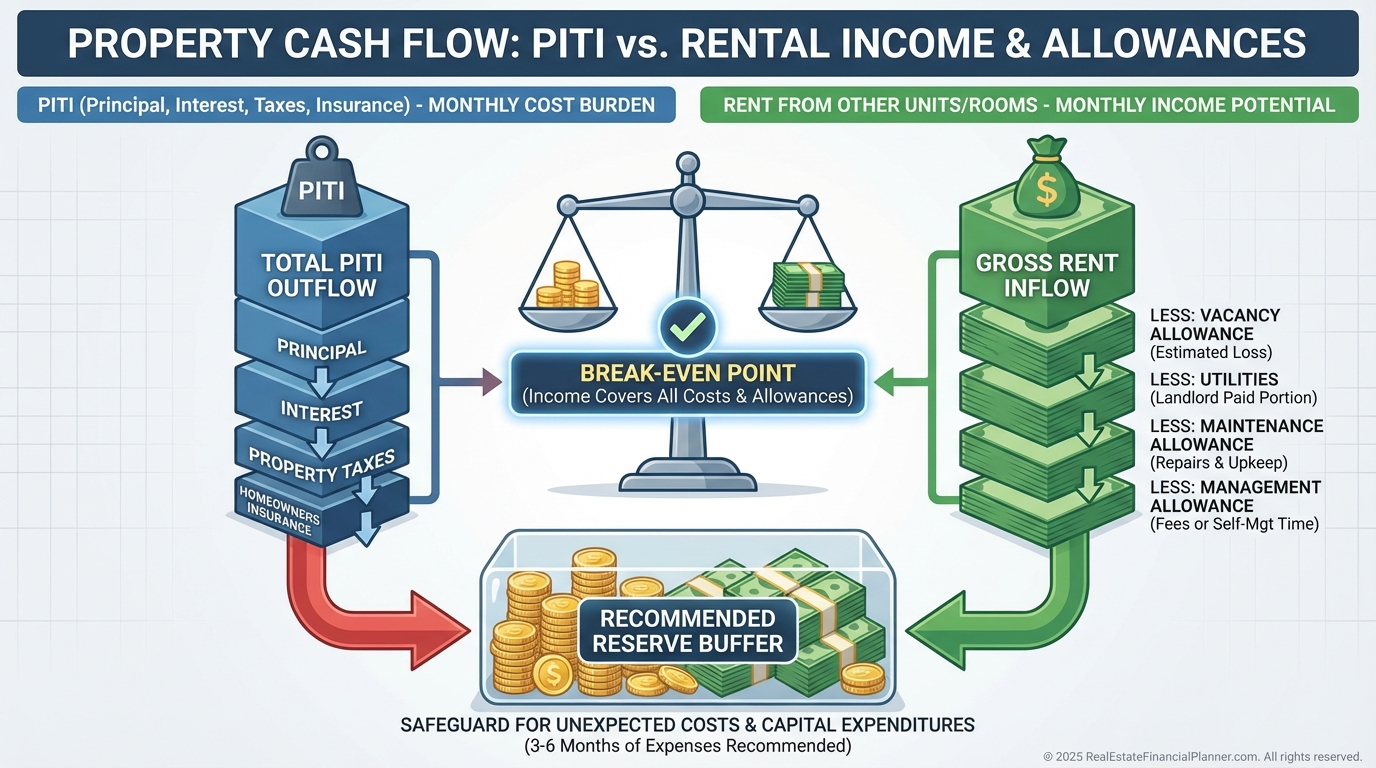

I underwrite PITI, rents from rooms or units, a vacancy buffer, utilities, and a repairs reserve.

Then I confirm your “owner-occupant DSCR” equivalent so your budget survives a roommate leaving.

Short-Term Rentals

Short-term rentals can outperform, but only if you treat them like a hospitality business.

I test three revenue tiers—peak, shoulder, and off-peak—and see if the deal still works at the lowest.

I also include dynamic pricing software, linens, restocking, permit costs, and a cleaning manager in the underwriting.

Finally, I simulate regulation risk by toggling revenue down and adding a reversion to long-term rents to see if you stay solvent.

Quick Turn/Flip

Flipping is a construction and logistics business disguised as investing.

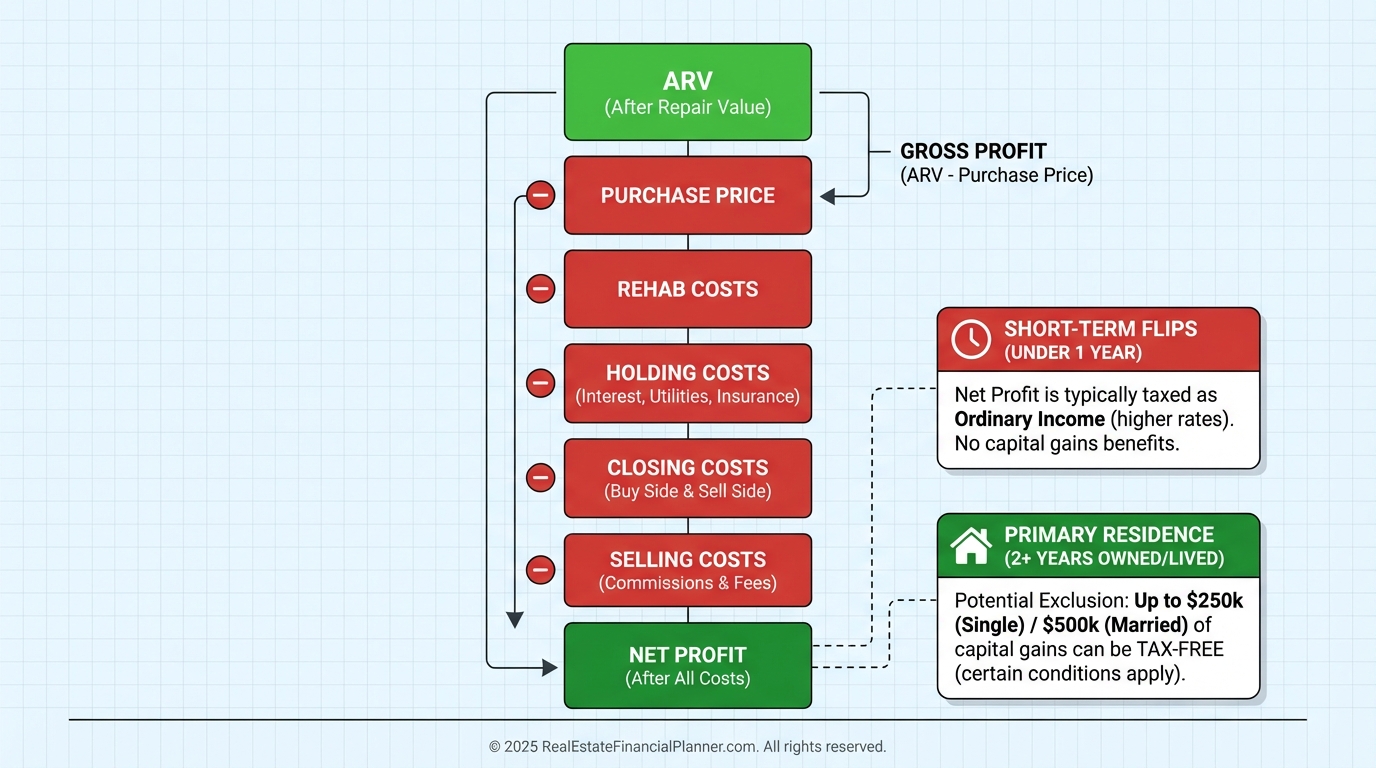

I underwrite ARV using conservative comps, include full holding costs, and add a contingency that actually covers surprises, not just hopes.

Live-in flips reduce holding risk and, if you stay two years, can benefit from the primary residence exclusion.

I model after-tax profit scenarios because a pretax win can be an after-tax disappointment.

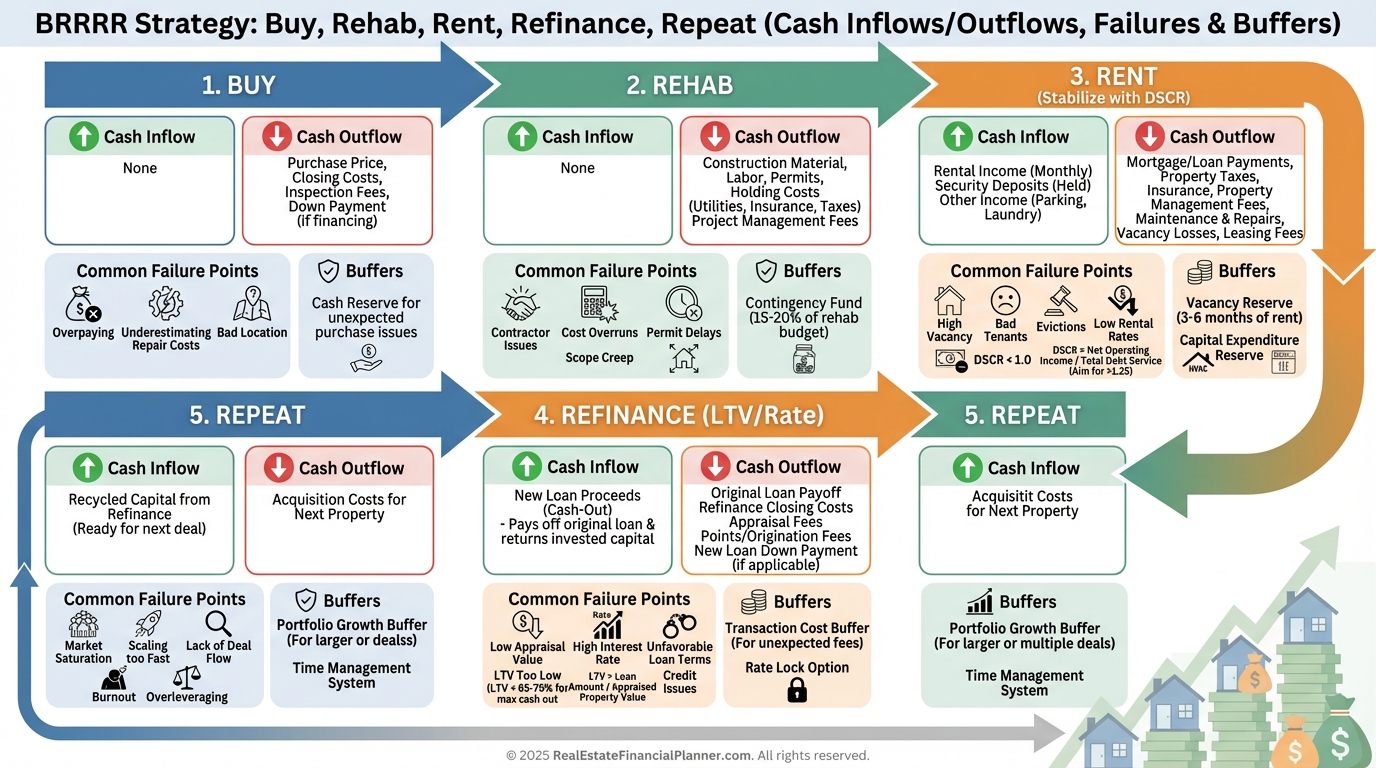

Buy, Rehab, Rent, Refi, Repeat (BRRRR)

I model rehab timeline risk, interest carry, lease-up lag, and refi terms so you are not surprised by leaving more cash in the deal.

I also simulate “refi doesn’t appraise” and “rate moves up 1–2%” to confirm the property still cash flows.

If the deal only works at max ARV and best-case rates, I pass.

Other Strategies

Wholesaling flips paper, not property.

I check assignment-friendly contracts, earnest money risk, and the cost of building a steady lead pipeline.

Wholetailing adds light rehab for retail buyers.

I budget hotel-ready touches, wholetail hold time, and retail closing costs.

Options and option-auctions cap downside and open creative exits.

I verify option consideration, timelines, and disclosure so you can resell cleanly.

Probates, short sales, and foreclosures can add equity.

I model legal timelines and the carrying cost of “dead time” while you wait.

Tax liens and deeds are more about due diligence than auctions.

I simulate property-level outcomes: you either collect interest or own a problem.

REITs are the allocator’s path.

I use them for liquidity or temporary parking while you hunt for your next operator deal.

Hard money lending is underwriting and collateral management.

I price risk, inspect draws, and secure a first-position deed of trust.

Partnerships and syndications pool resources.

I model preferred returns, splits, fees, and capital calls to see the true, after-fee IRR.

Putting It All Together

Pick one core strategy and one secondary that complements it.

Nomad™ plus House Hacking, or BRRRR plus Medium-Term Rentals, are proven pairs.

In Real Estate Financial Planner™, I build a 10–20 year plan with the Return Quadrants™ stacked annually.

Then I sanity-check True Net Equity™ at exit to make sure taxes and selling costs do not erase your win.

Finally, I add safety-first rules: 6–12 months of reserves per property, minimum break-even vacancy, rate-shock tolerance, and a capex plan that matches property age.

If a plan survives the stress tests, it deserves your capital.