Fourplexes: The 1–4 Unit Financing Advantage Most Investors Miss

Learn about Fourplexes for real estate investing.

Why Fourplexes Are the Overlooked Sweet Spot

When I help clients map their first 10 doors, I often watch them walk right past the fourplex.

They assume “multifamily equals commercial loan,” and that mistake costs them better terms, more income streams, and easier exits.

That is the asymmetry we exploit.

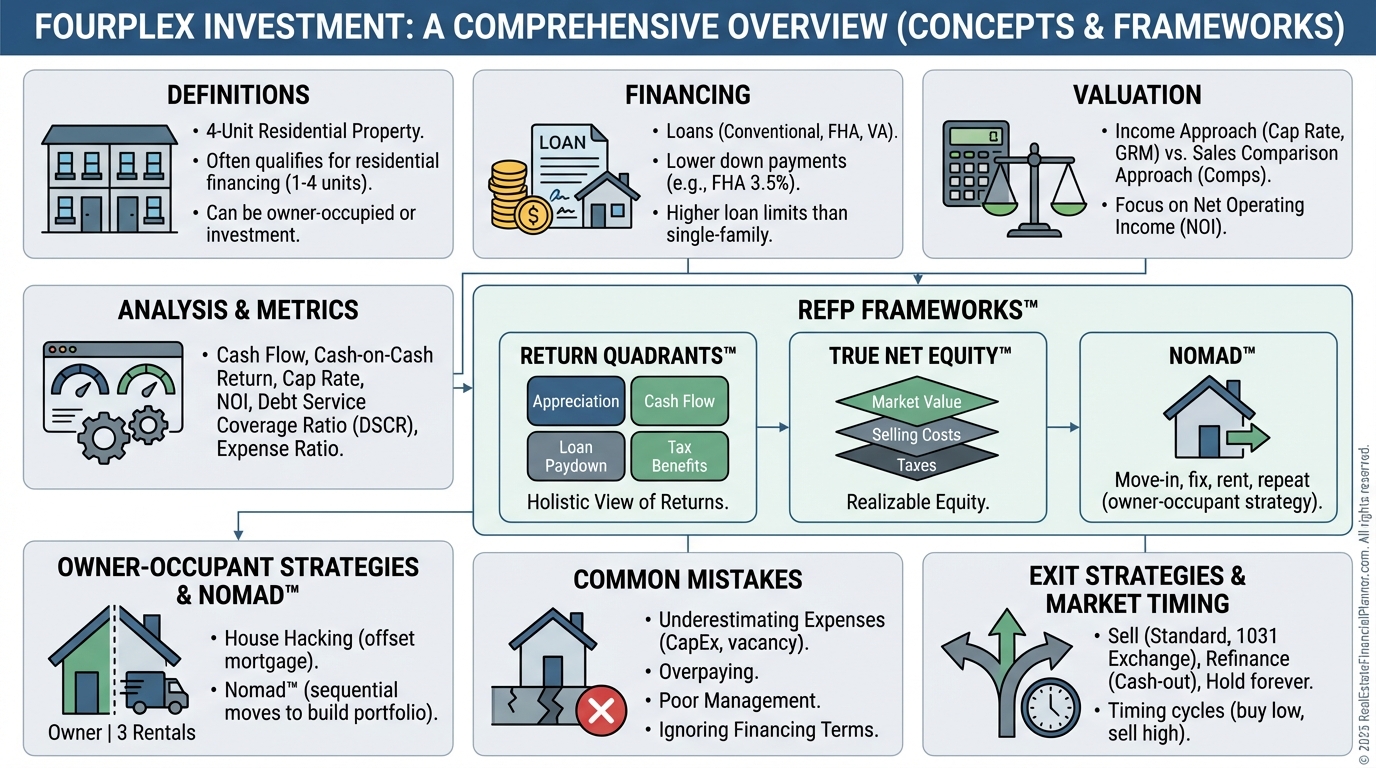

What a Fourplex Is (and Isn’t)

A fourplex is a 1–4 unit residential property with exactly four legal dwelling units.

Each unit has its own entrance, kitchen, and bathroom.

Because it’s four or fewer units, you still qualify for residential financing.

That’s the lever.

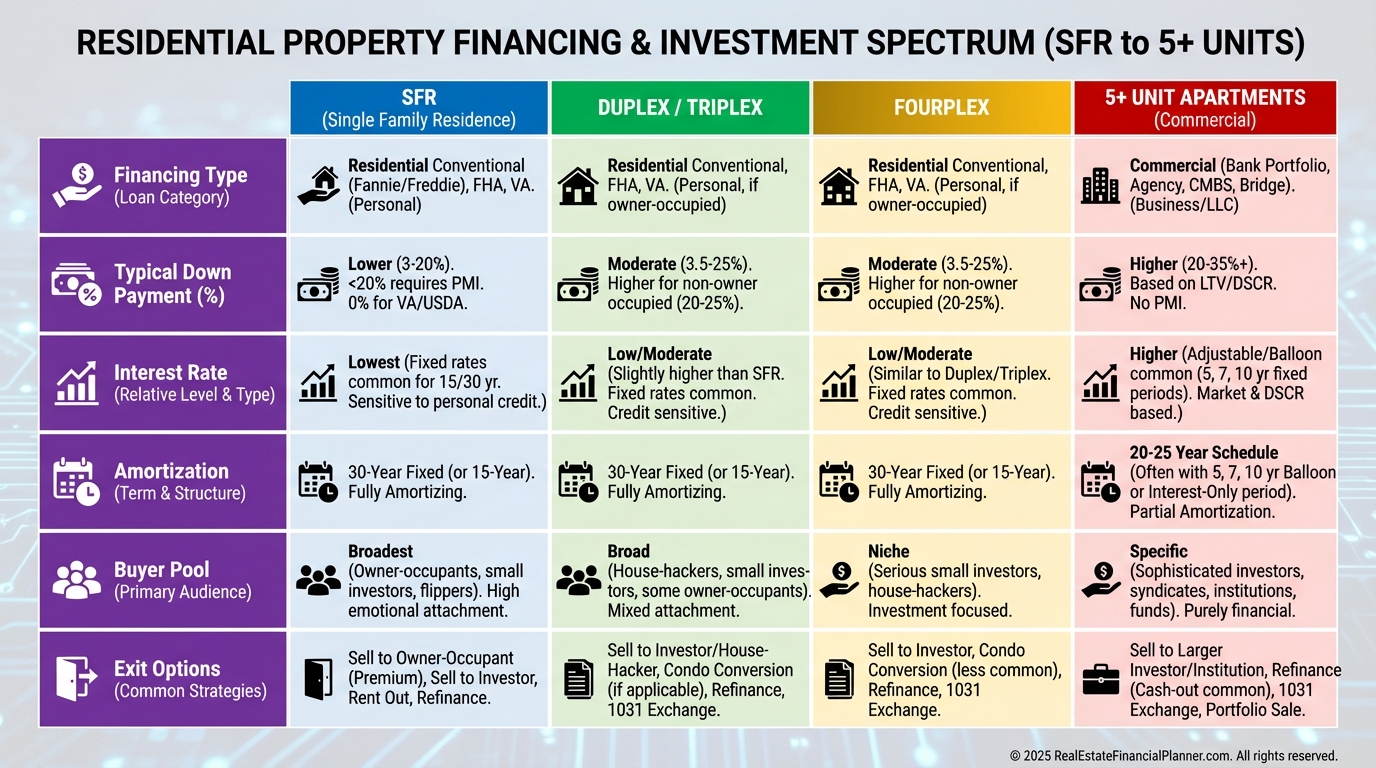

Compare that to a 5+ unit building, where down payments jump, rates are higher, amortizations are shorter, and balloons are common.

How Fourplexes Compare to Other Properties

Single-family rentals are simple but only give you one rent to collect.

Five-plus moves you into commercial lending with tighter debt coverage expectations.

A fourplex threads the needle.

It gives you four rents, residential terms, and more exit paths.

The Metrics That Matter

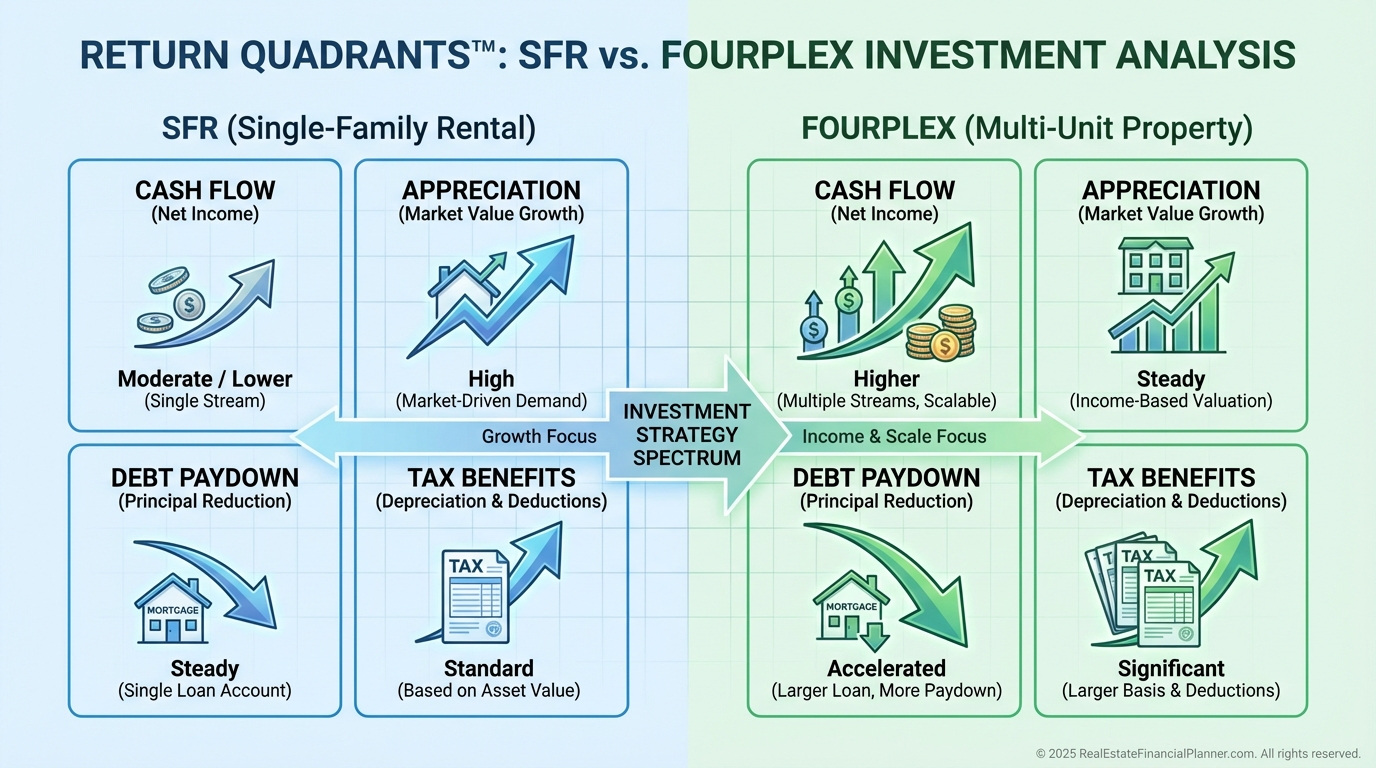

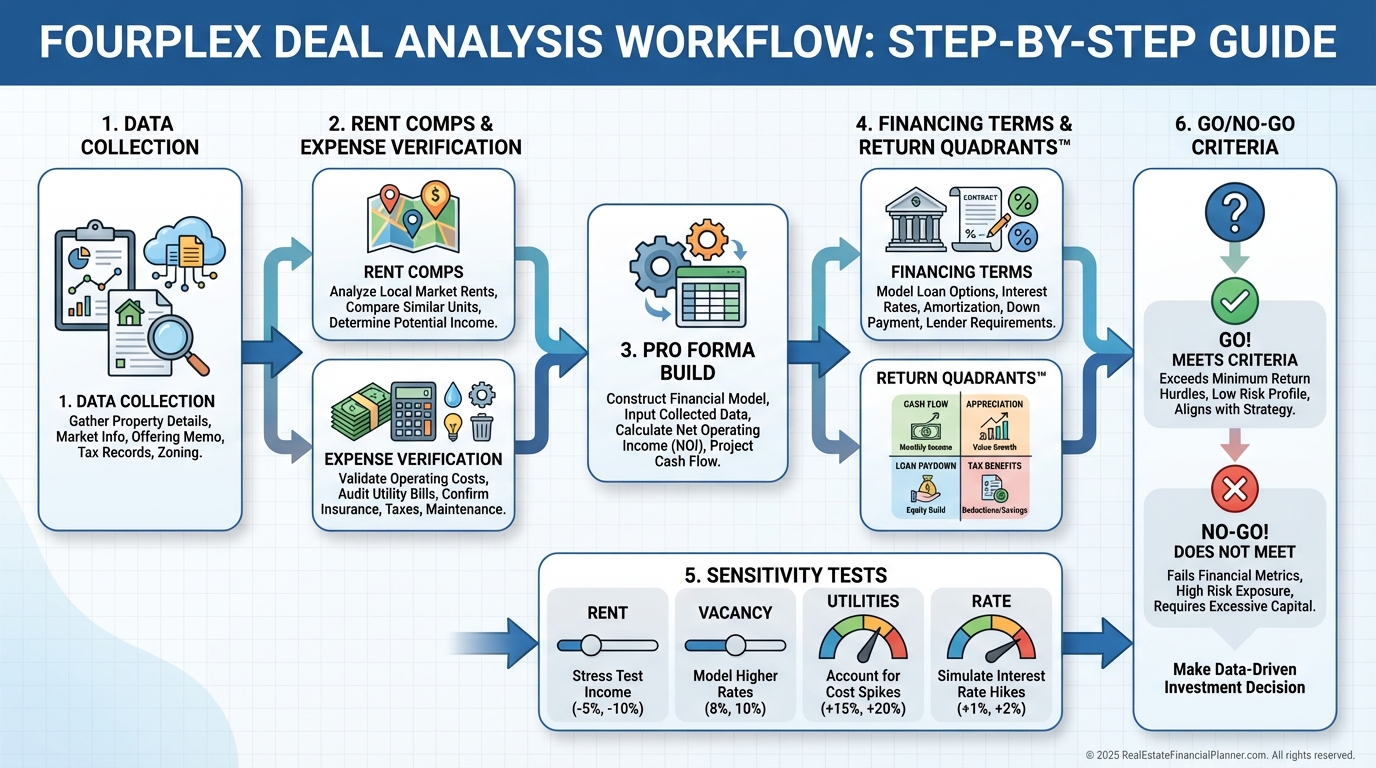

I teach clients to evaluate fourplexes using three lenses: price-to-income, operating efficiency, and the Return Quadrants™.

GRM on fourplexes often beats SFRs in the same submarket.

Cap rates tend to run higher by 1–2 points than comparable SFR rentals.

But the real picture emerges in Return Quadrants™: cash flow, appreciation, debt paydown, and tax benefits.

Fourplexes generally outperform SFRs on cash flow and debt paydown per dollar invested, especially when you use owner-occupant terms.

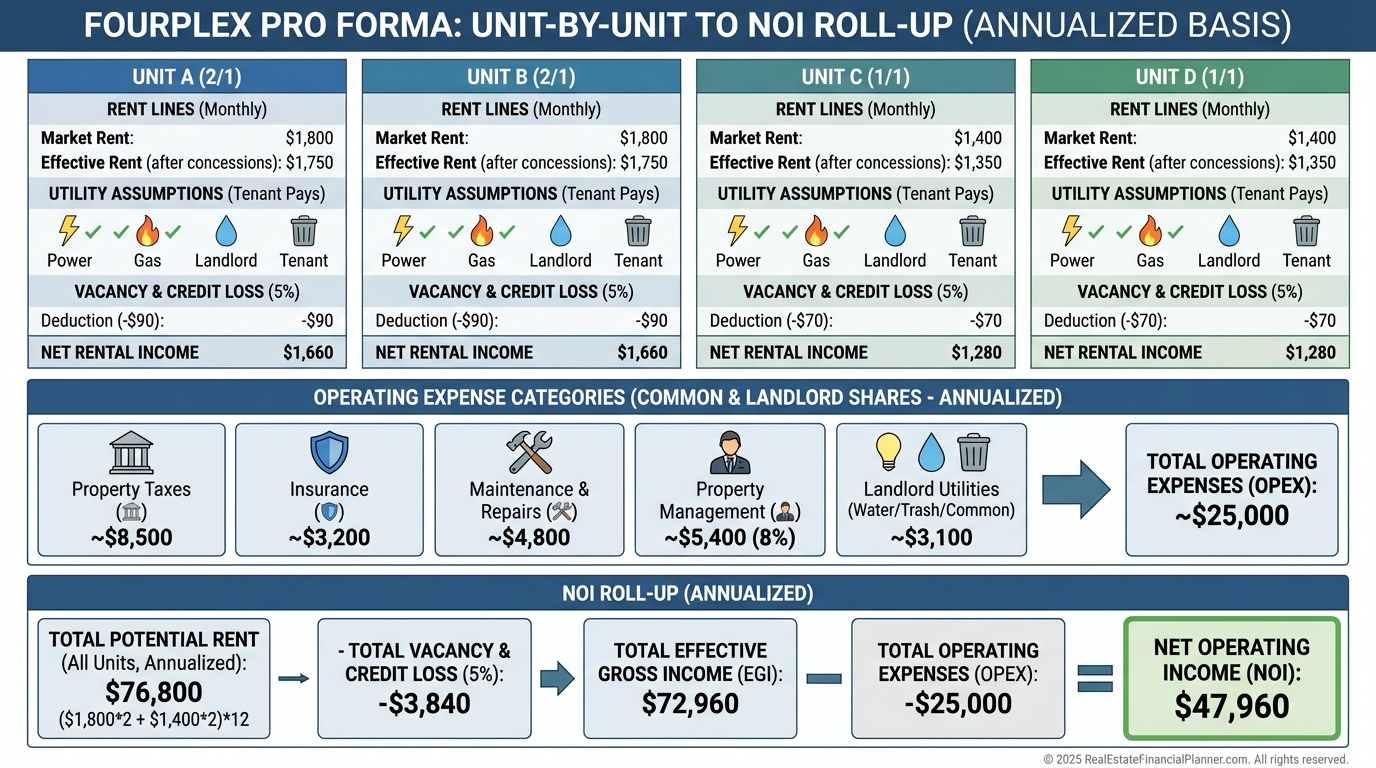

Deal Analysis: The Unit-by-Unit Approach

When I underwrite, I model each unit separately.

I assign rent by unit condition and lease end date.

I adjust vacancy to 5–8% to reflect more frequent turns.

I target 35–45% of gross income for operating expenses before financing.

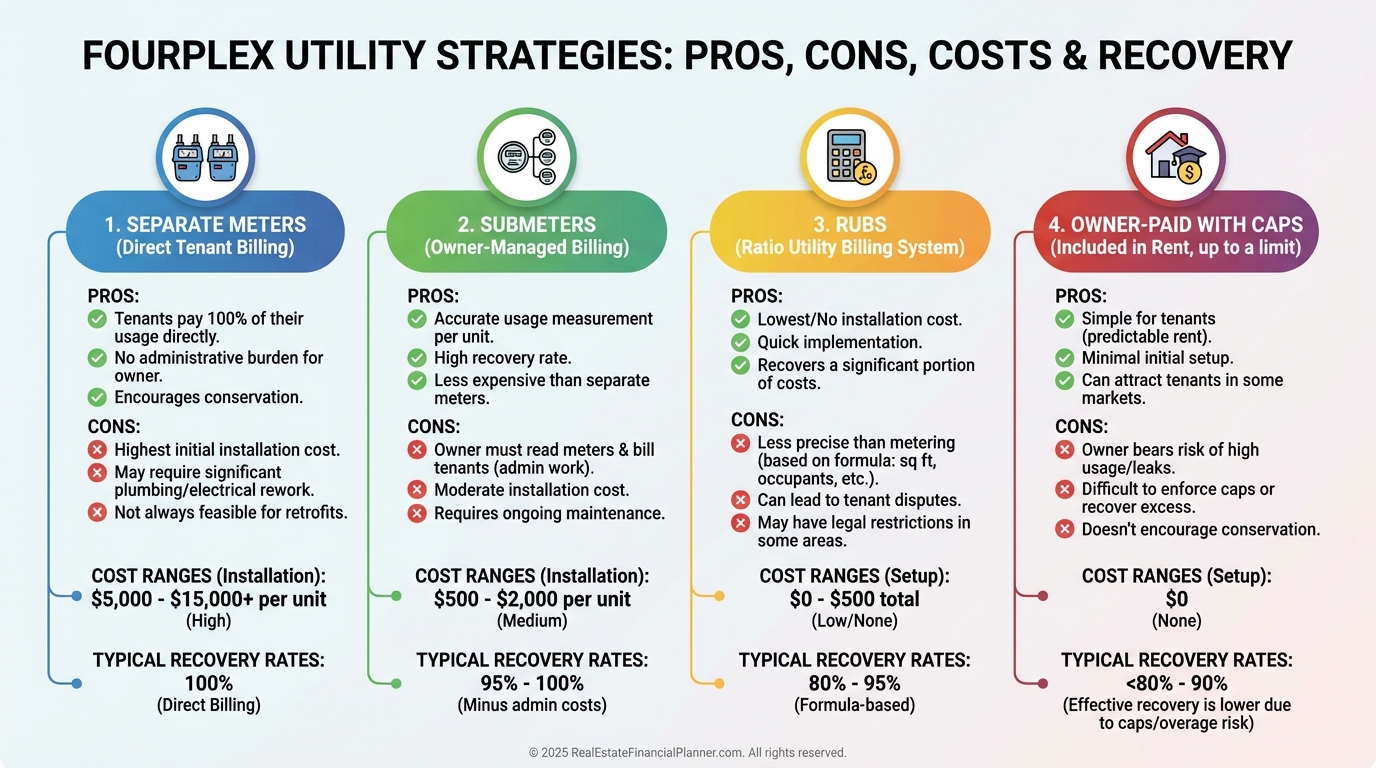

Shared systems matter.

Owner-paid utilities, snow removal, landscaping, laundry, and pest control can make or break the NOI if you don’t meter and rebill correctly.

A Quick Walkthrough Example

Let’s say Priya finds a fourplex at $480,000.

Three units rent at $1,150, and one is under market at $1,050.

Gross scheduled rent is $4,500 per month or $54,000 per year.

Use 7% vacancy to be conservative: $54,000 × 0.93 = $50,220 effective gross income.

Assume 42% operating expenses: $50,220 × 0.42 = $21,092.

NOI is $50,220 − $21,092 = $29,128.

Cap rate is $29,128 ÷ $480,000 = 6.07%.

That’s already stronger than many SFRs in the same zip code.

When I plug this into The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I model rent bumps on the under-market unit, utility bill-backs after submetering, and a turn schedule that staggers leases.

Small changes here drive big shifts in cash-on-cash.

Data You Must Verify

I confirm rent rolls with bank statements, not just a spreadsheet.

I hire an inspector who understands multi systems.

Think four HVACs, four water heaters, four stove/oven sets, and either one or four electrical meters.

I also price out submetering during due diligence.

It’s a predictable lift with a measurable payback.

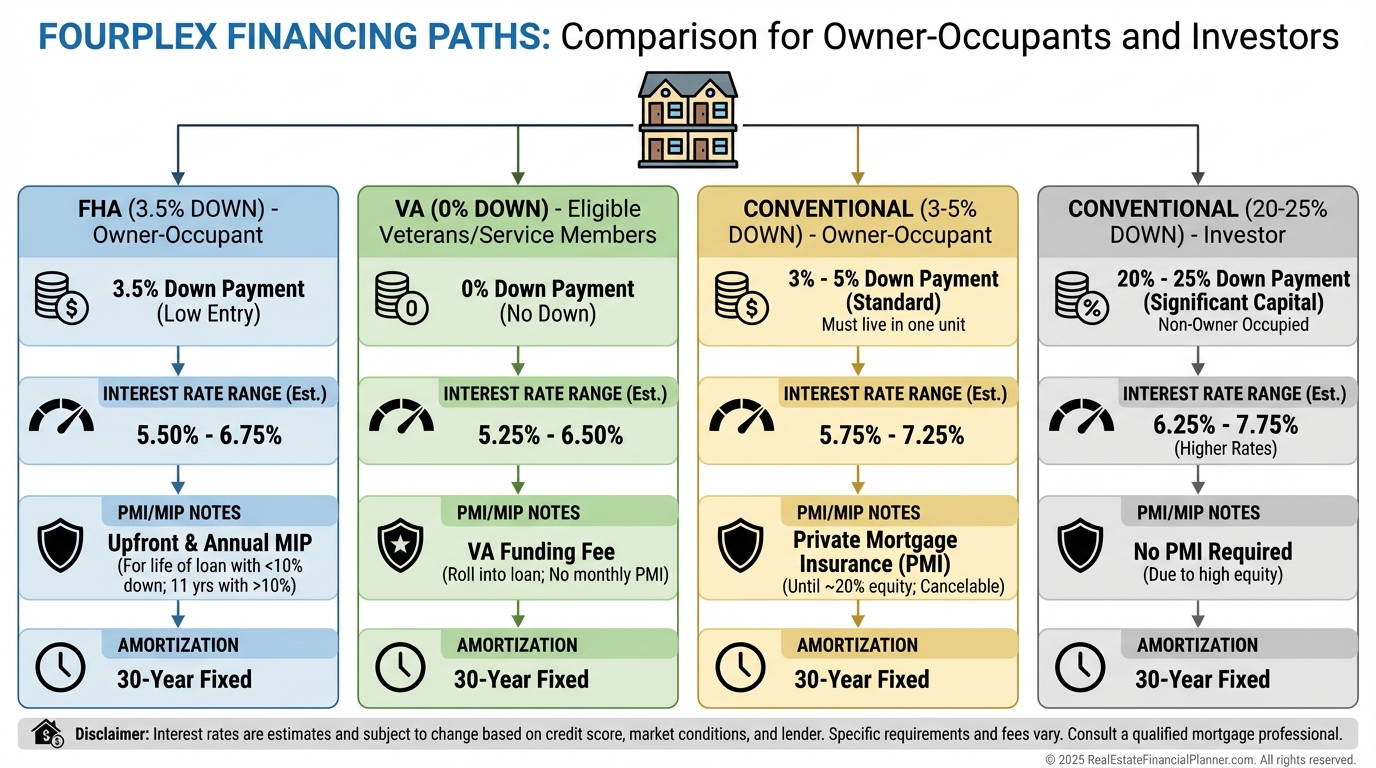

Financing: The Residential Edge

Fourplexes qualify for residential loans.

Investor purchases usually run 20–25% down with rates near SFR investment rates.

Owner-occupants can go 3–5% down with FHA/Conventional.

VA can be 0% down if you qualify.

That is how clients use leverage responsibly without balloon risk.

Valuation: What Appraisers Actually Do

Appraisers use a blend of approaches for fourplexes.

You’ll see income approach inputs, but residential comp grids still matter.

Limited fourplex comps often widen the geography or require adjustments from triplex/five-unit sales.

Know your market cap rates, but underwrite your deal on your actual NOI and financing terms.

That is the number you live with, not theirs.

House Hacking and the Nomad™ Twist

When I coach first-time buyers, I often pair a fourplex with Nomad™.

Live in one unit for a year, stabilize operations, then move to the next property and repeat.

Example: Marcus buys at $420,000 with FHA 3.5% down.

PITI is $2,950 per month.

He lives in Unit A and rents B, C, and D for $1,050 each, collecting $3,150.

His effective housing cost is near zero before reserves, and he gains debt paydown and appreciation.

After 12 months, he moves out, rents Unit A at $1,150, and cash flows with a fully amortizing 30-year fixed.

The Return Quadrants™ here shine: stronger cash flow and debt paydown, plus tax benefits he tracks with his CPA.

Utility Strategy: A Quiet Profit Center

I warn clients not to inherit bad utility setups.

Shared gas or electric without rebilling invites waste and volatility.

If submetering is impractical, implement RUBS and disclose it in leases.

It not only recovers expense, it improves conservation.

Common Mistakes I See (And How to Avoid Them)

Underestimating management intensity.

Four doors mean more turns, more calls, and more personalities.

Hire management or budget your time realistically.

Ignoring utilities.

Owner-paid everything can turn your pro forma sideways.

Screening shortcuts.

A weak tenant still hurts 25% of income.

Run credit, criminal, eviction, income, and landlord verifications every time.

Four water heaters don’t fail on a schedule that suits you.

Build robust reserves and pre-plan replacements.

Insurance gaps.

Use an agent who writes policies for small multis and understands inter-unit damage and liability.

Assuming commercial rules.

You don’t need a commercial loan to buy a fourplex.

You do need commercial discipline to operate it well.

Strategic Ways to Use Fourplexes

Portfolio building.

Start with one owner-occupied fourplex, stabilize, then refinance or save for the next.

You can reach 12+ doors faster than stacking SFRs.

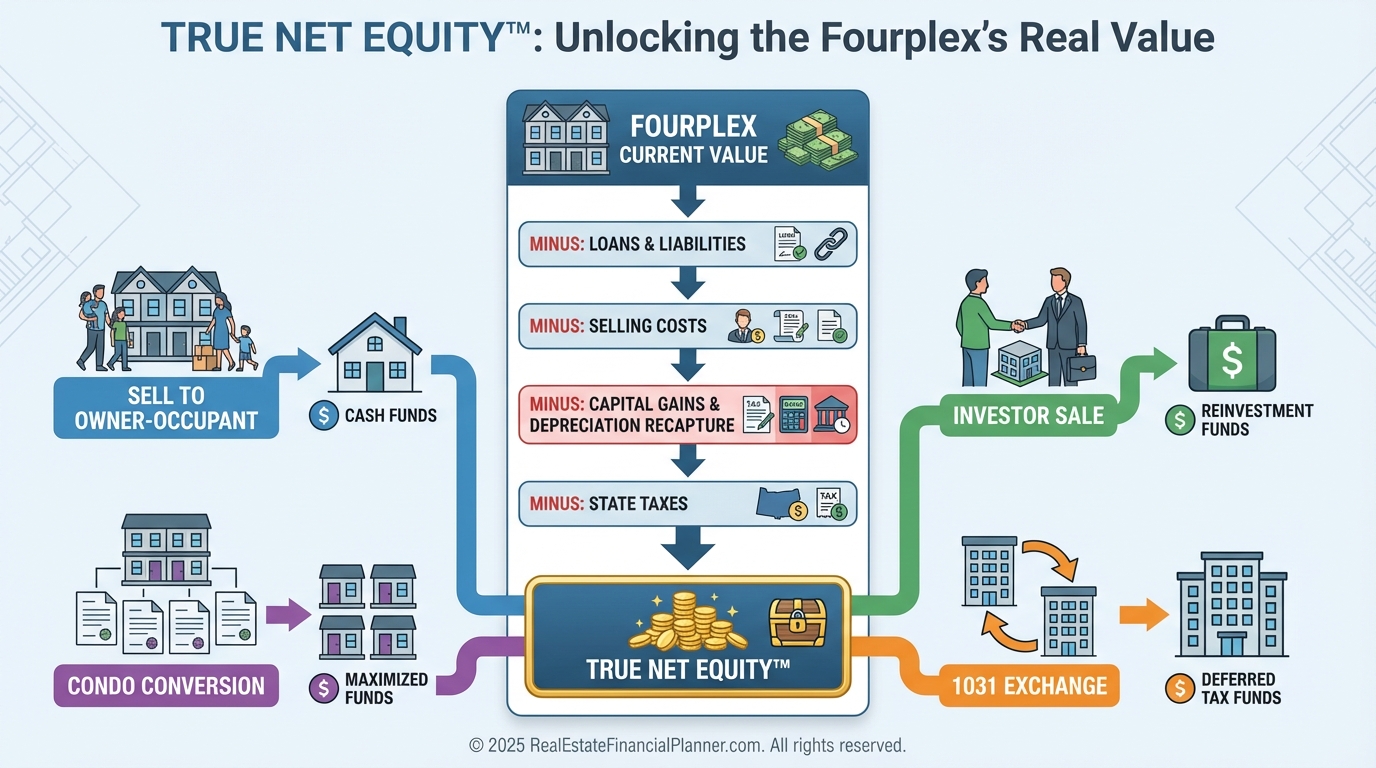

Exit strategy flexibility.

You can sell to investors or owner-occupants.

Some markets allow condo conversions to maximize disposition value.

Trade up into larger assets without immediate tax.

I align these moves with clients’ True Net Equity™ so they know the after-cost, after-tax equity they can redeploy.

Market Timing and Risk Management

Fourplexes typically appreciate a touch slower than hot SFRs in frothy markets.

But the diversified income stream makes them resilient when jobs wobble.

If one tenant misses, you still collect 75% of rent.

I model sensitivity.

I reduce rent 5%, raise vacancy 2%, and test utility surprises.

If the deal still pencils, I’m confident.

Putting It All Together with the REFP Toolkit

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to model each unit, layer utility strategies, and visualize Return Quadrants™.

Pair it with your Nomad™ plan and track True Net Equity™ to decide when to refi, 1031, or sell.

This is how you scale with discipline instead of hope.

Fourplexes give you four income streams, residential financing, flexible exits, and resilient performance across cycles.

While others chase thin SFR margins or wrestle with commercial balloons, you can grow a portfolio with better terms and more control.

Your next step is simple.

Identify fourplex opportunities, underwrite unit-by-unit, and test sensitivity.

Then execute the plan that aligns with your Return Quadrants™ and True Net Equity™.