Short-Term Rental Mastery: Strategies, Financing, and Systems to Scale Cash Flow the Right Way

Learn about Short-Term Rental for real estate investing.

Why Short-Term Rentals Work

When I help clients compare strategies, the math is simple but the execution is not.

Short-term rentals can produce hotel-like pricing on residential assets, turning mediocre long-term deals into top-quartile performers.

Higher nightly rates offset vacancy if you run the property like a hospitality business.

But this is an operations-first strategy, not a “set it and forget it” rental.

What Counts as a Short-Term Rental

Any stay typically under 30 days qualifies.

Medium-term rentals sit between 30 and 180 days and often simplify operations without killing revenue.

I use both, depending on seasonality and local laws.

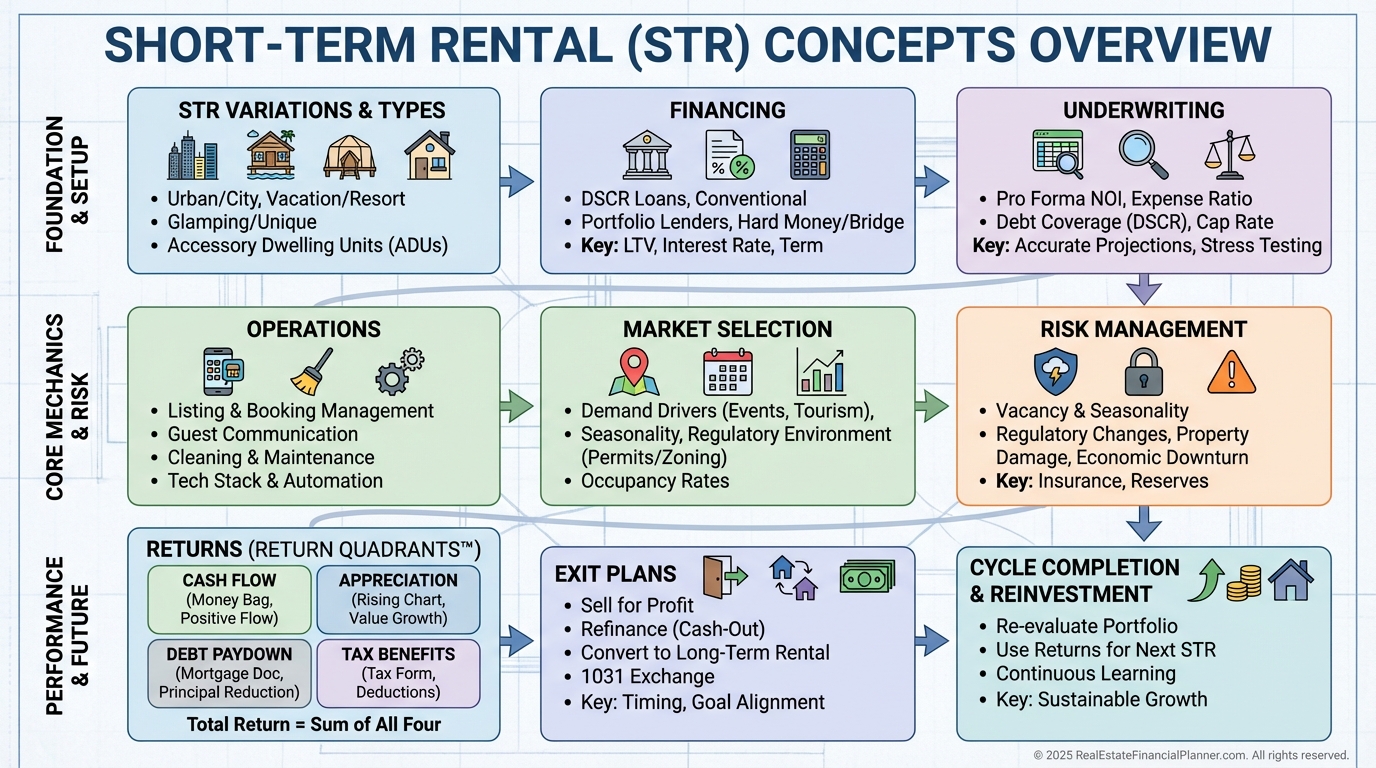

Core Variations You Can Deploy

•

Traditional STR: Entire unit, 1–29 nights, tourism and business travelers.

•

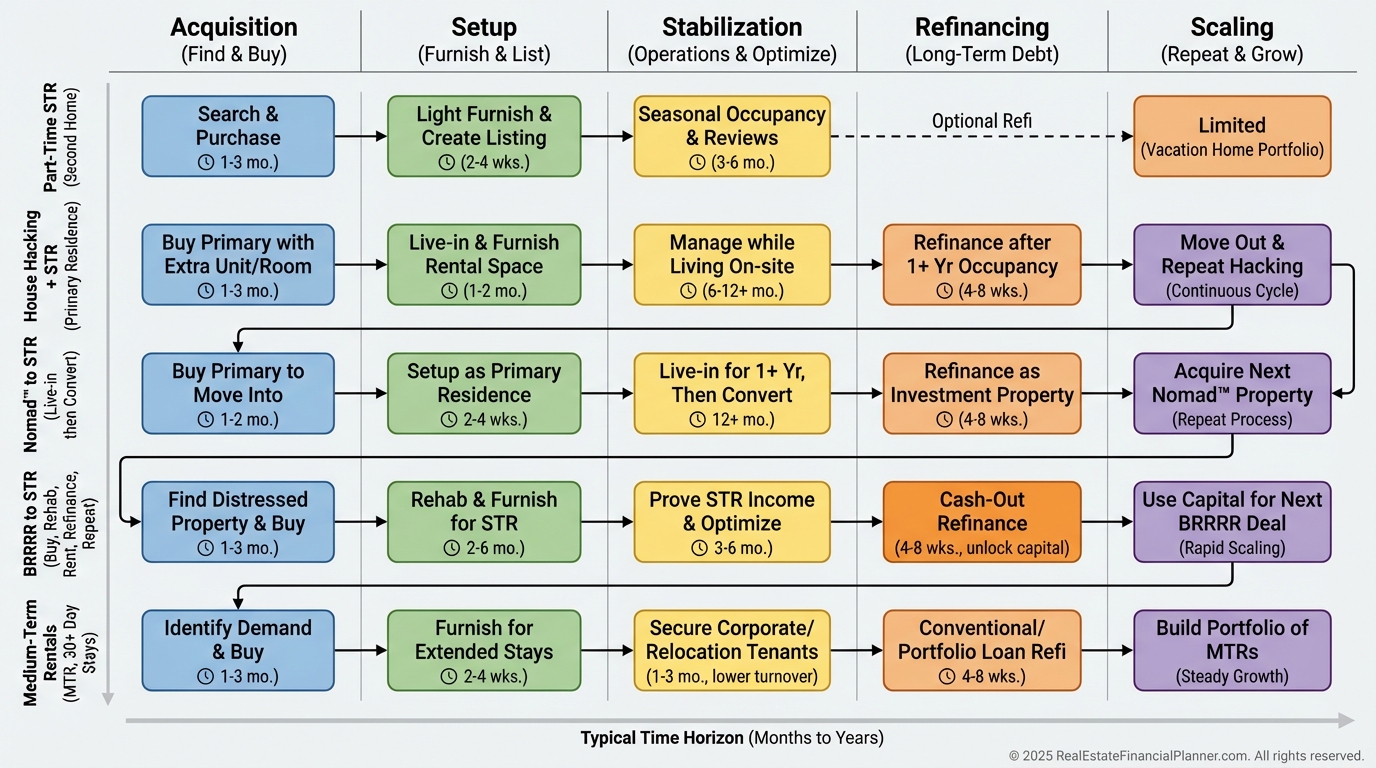

Part-Time STR: You rent your place during peak events or your vacations.

•

House Hacking + STR: Live in one unit/room, STR the other.

•

Nomad™ to STR: Owner-occupy for a year, then convert to STR and repeat.

•

BRRRR to STR: Buy distressed, renovate, STR, then refinance to recycle capital.

•

Medium-Term Rental: 30–89+ nights, traveling nurses, relocations, project teams.

When I model portfolios, I often mix Traditional STR with Medium-Term to smooth cash flow and protect reviews.

Regulations First, Not Last

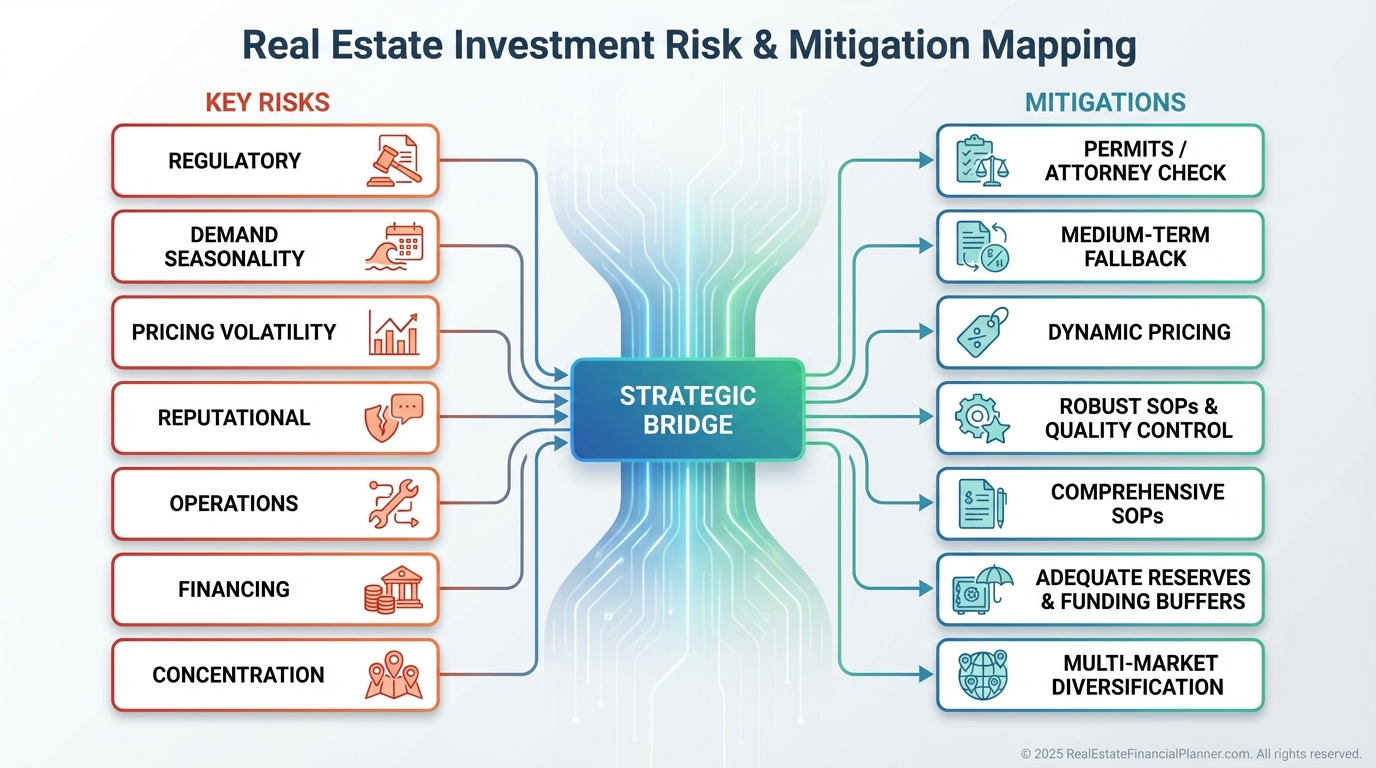

Before I let clients fall in love with a property, we verify licensing, zoning, caps, and HOA rules.

I also check if permits are tied to the owner, the parcel, or sunset dates.

If regulations are unstable, I underwrite as a medium-term fallback and still confirm legality in writing.

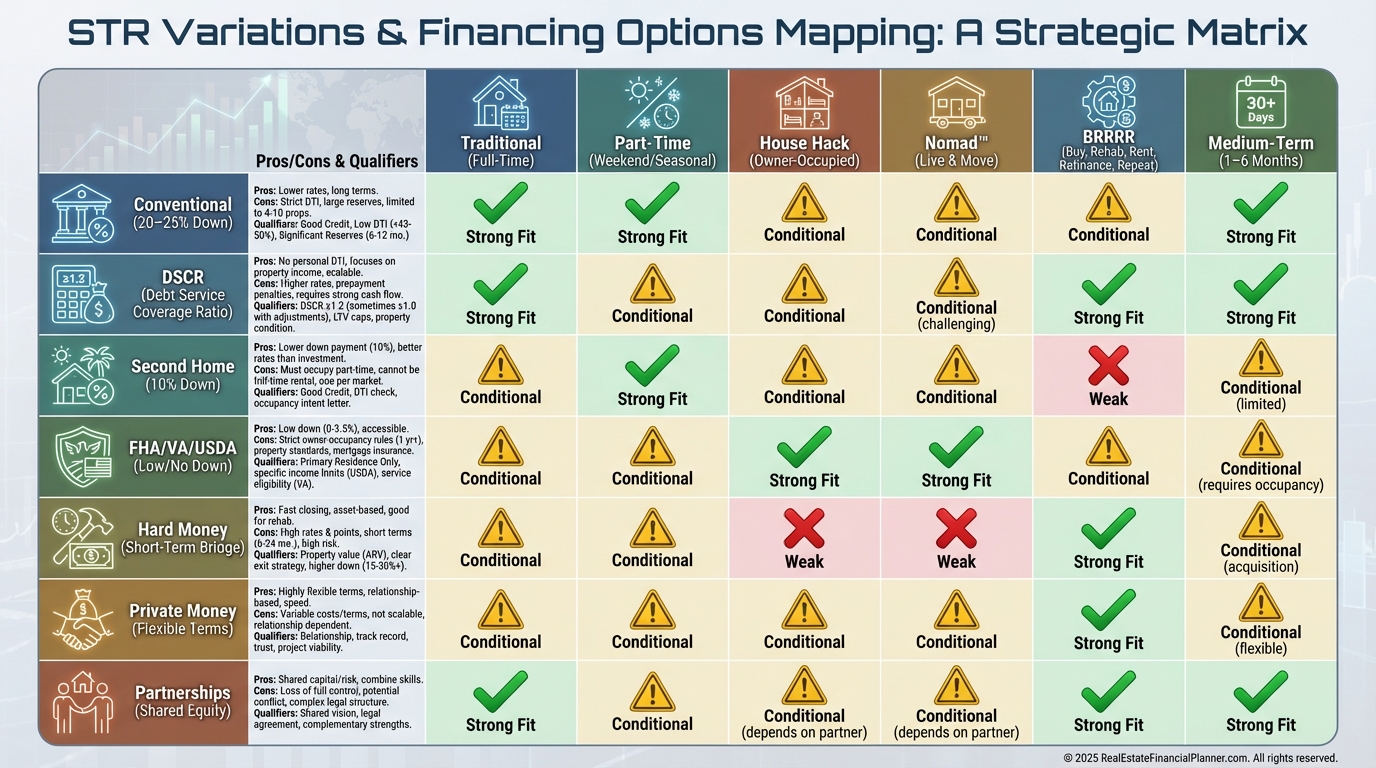

Financing That Actually Closes

I choose financing to match the variation, not the other way around.

For pure investments, conventional loans with 20–25% down or DSCR loans are common.

For BRRRR to STR, I often start with hard money, then refi to conventional or DSCR once stabilized.

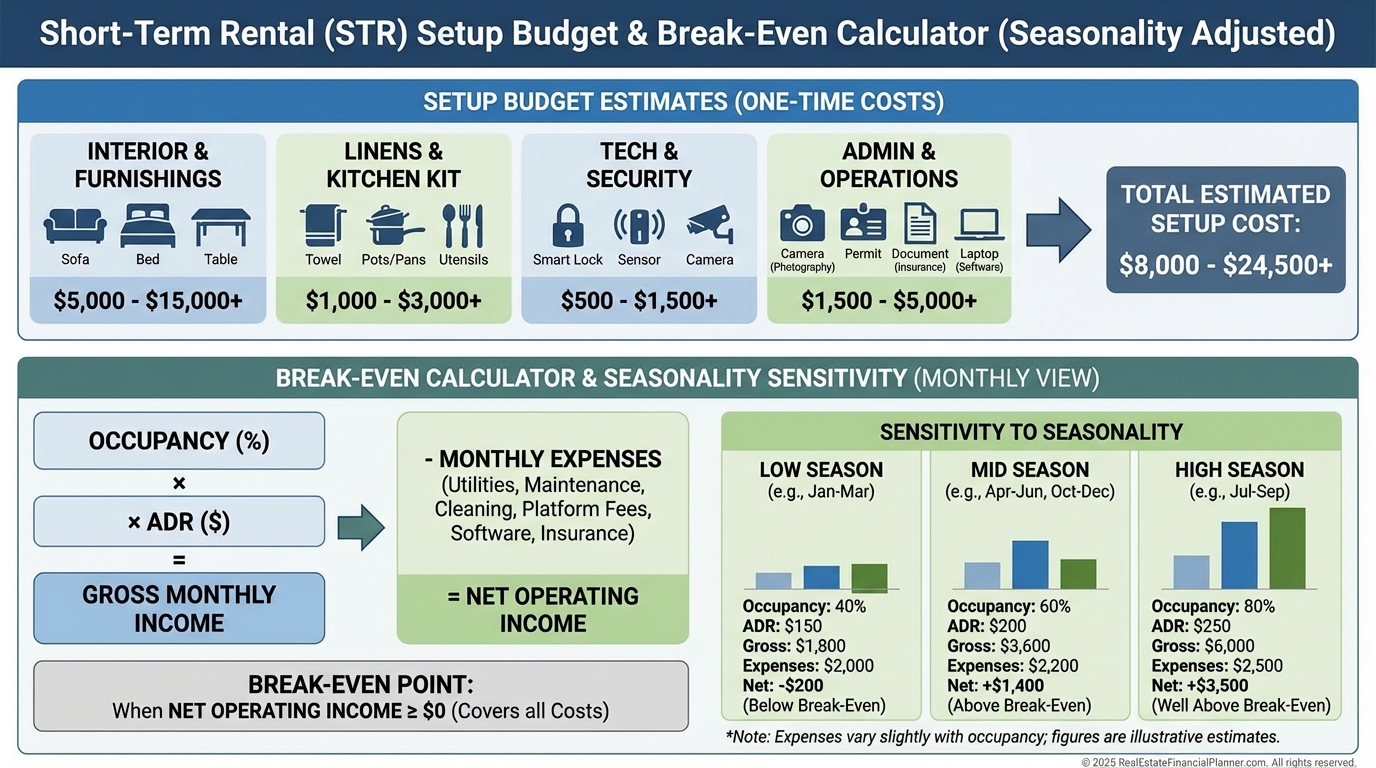

Money You Actually Need

Down payment and closing costs are just the start.

You’ll budget for furnishings, supplies, photography, insurance, permits, and software.

I also require clients to set aside Reserves plus Cumulative Negative Cash Flow to weather seasonality.

As a rule of thumb, I model six months of PITI + 3% of value for CapEx reserves on STRs.

Underwriting: The 10-Minute Screen I Use

I start with real data: comps from STR analytics, hotels, and local managers.

Then I test a conservative base case: 70% of projected ADR, 75% of projected occupancy.

I include cleaning fees, platform fees, utilities, supplies, sales/lodging taxes, and higher maintenance.

If Debt Service Coverage Ratio (DSCR) is below 1.2 in the conservative case, I usually pass.

A Quick Example

Assume ADR $210, 78% occupancy, 365 days.

Gross booking revenue ≈ $210 × 0.78 × 365 = $59,709.

Subtract platform fees (3%), cleaning offset variance, taxes (say 10%), utilities, supplies, insurance, HOA, maintenance, and mortgage.

If that nets $1,150/month before reserves in the base case, I still model a shoulder-season shock at 55% occupancy.

If cash flow stays positive after the shock, I greenlight further diligence.

Operations: You’re Running Hospitality

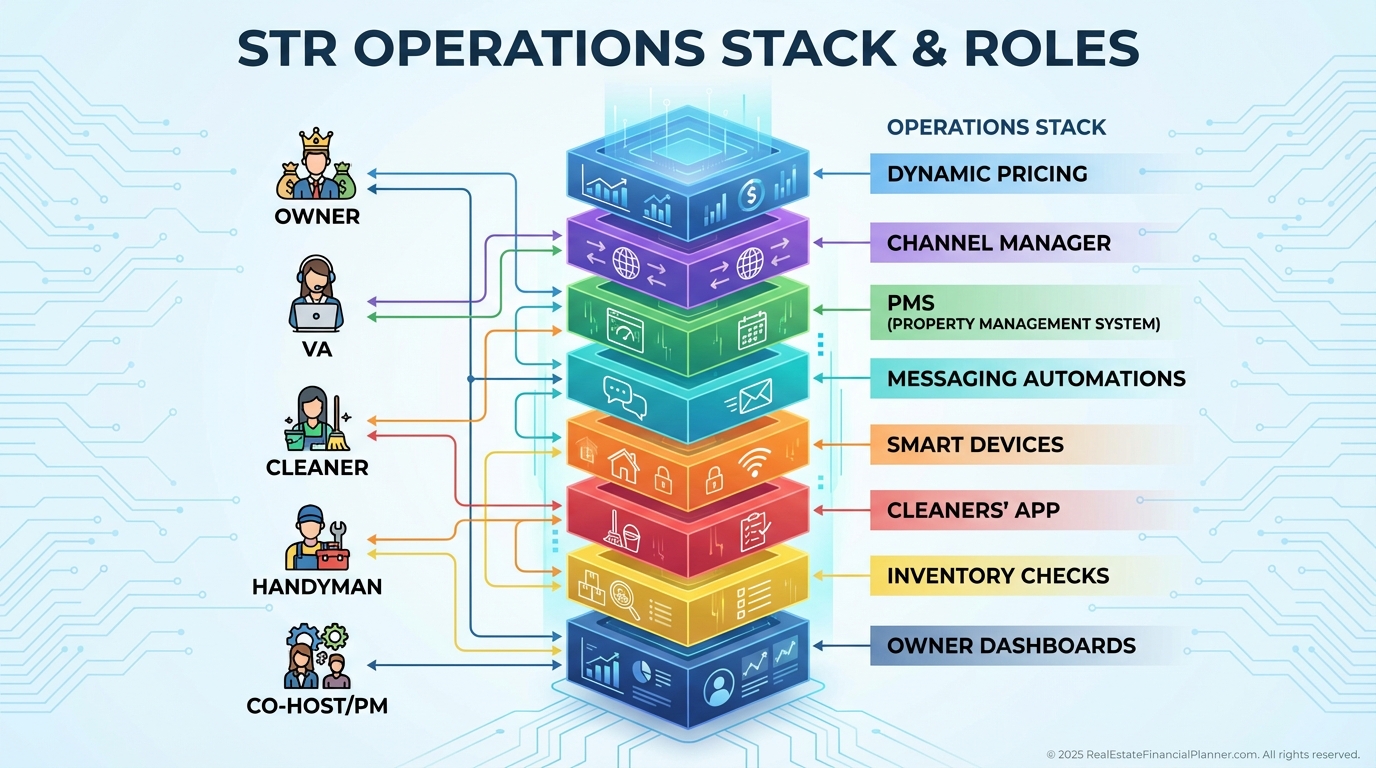

I install smart locks, noise sensors, and automated messaging.

I build a bench of cleaners with checklists, backup vendors, and photo verification.

When I rebuilt after a cash-flow crunch, automation kept me afloat: dynamic pricing, auto-replies, and direct booking capture with clear house rules.

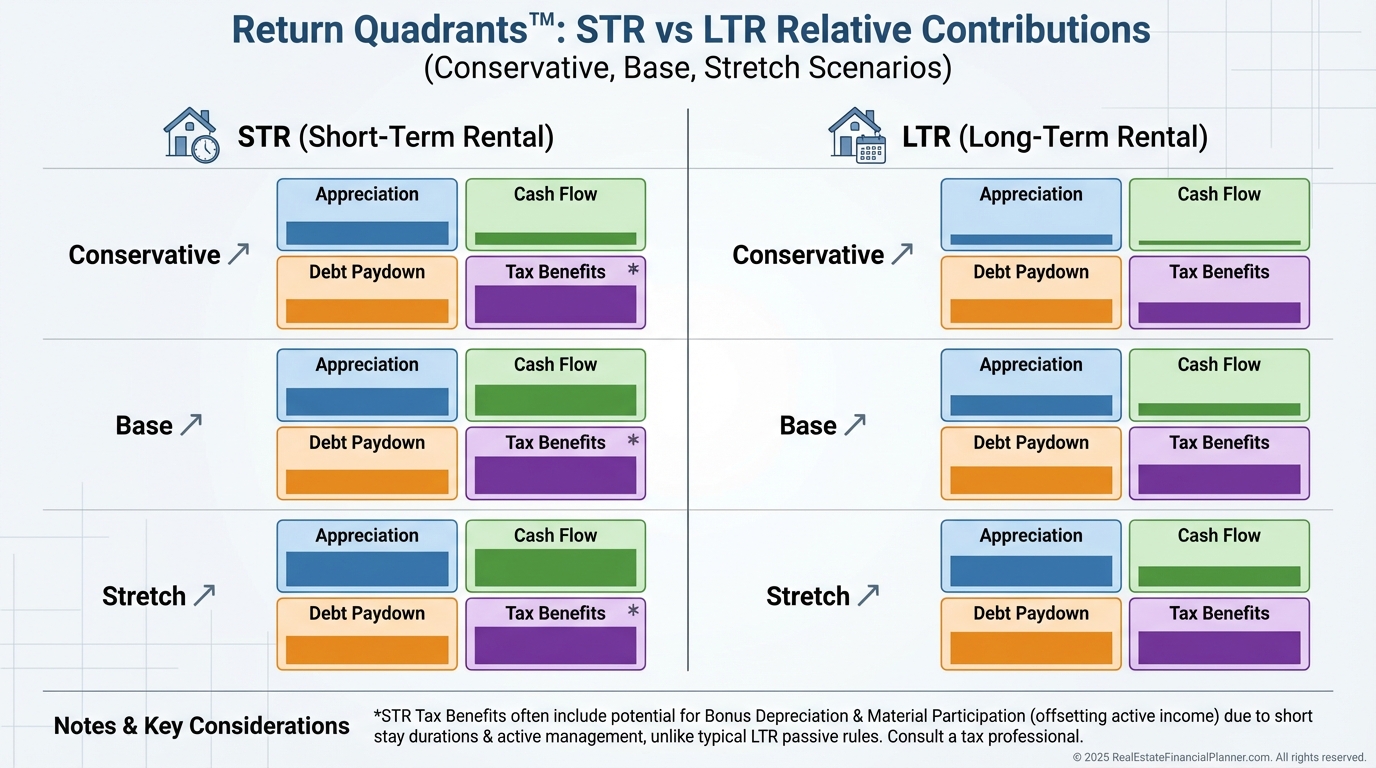

Return Mechanics: Think in Return Quadrants™

I evaluate four return drivers: Appreciation, Cash Flow, Debt Paydown, and Tax Benefits.

Short-term rentals can excel in Cash Flow and often Debt Paydown if run well.

Bonus depreciation and cost segregation may accelerate paper losses, but I coordinate with a CPA on material participation rules.

True Net Equity™ and When to Exit

I track True Net Equity™: what you keep after closing costs, capital gains, and depreciation recapture.

If your equity is under-earning versus your target, I’ll model a 1031 exchange into a better STR or a pivot to medium-term or long-term.

Sometimes the best “sale” is a refinance plus a management upgrade.

Holding Period and Lifestyle Fit

Most clients hold STRs long-term but simplify before retirement.

We prune weaker assets, keep best-in-class, or convert a few to medium-term for stability.

Decide how active you want to be, and pay for property management where the spread justifies it.

Risk: Model It Before You Feel It

I warn clients about regulatory shifts, seasonality, and reputational risk.

One bad review can cost thousands if it sticks; tight cleaning standards and fast responses prevent it.

I also diversify demand: near hospitals, universities, corporate hubs, or year-round attractions.

Market Selection That Survives Cycles

I prefer STR-friendly jurisdictions with written rules, not gray zones.

I want year-round demand drivers and ADR that meaningfully beats long-term rents.

If occupancy is thin, I underwrite a medium-term backup plan at competitive monthly rates.

Skills You’ll Need (and Can Hire)

Analyze deals, price dynamically, manage turnovers, and deliver hospitality.

You can buy these skills with a great cleaner, a local handyman, a co-host, and the right software.

Start narrow, standardize, then scale.

Credit Requirements in the Real World

Conventional and DSCR lenders want 620+ credit, with better pricing at 680 and 740.

FHA can work at 580 for owner-occupied house hacks, but mind DTI and reserves.

Hard money for BRRRR is flexible up front, but your takeout refi must qualify.

Scalability: Systems Make the Ceiling

STRs scale when you build repeatable setups, consistent decor packages, and vendor benches.

I template listings, house manuals, and inventory.

The better your systems, the lower your marginal headache per unit.

Profit Timing: How Fast Could This Pay?

Traditional STRs often produce income in month one once live.

BRRRR to STR has a slower start but can recycle capital faster.

House hacking reduces your living expense day one, which is a form of return most investors undervalue.

Finding Deals That Pencil

I hunt MLS for layout and location that photograph well and sleep more heads legally.

I also work FSBO leads, wholesalers, and agents who know which HOAs allow STRs.

I never buy before confirming licensing and neighbors’ tolerance.

Analyzing Deals with the Right Tool

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to compare scenarios, sensitivity-test ADR and occupancy, and calculate True Net Equity™ and Return on Equity.

Download it free at https://RealEstateFinancialPlanner.com/spreadsheet

When I coach clients, we evaluate base, conservative, and stress cases before we ever write an offer.

Exit Options and Buyer Financing

MLS brings the largest buyer pool, but private sale to another operator can trade on performance.

Sophisticated buyers ask for trailing-12 revenue, occupancy, and expense detail.

Expect investors to use conventional 20–25%, DSCR, or cash; homeowners may use low-down options if local rules permit primary occupancy.

Using Retirement Accounts (Carefully)

Traditional and medium-term STRs can be owned by self-directed retirement accounts if there’s no personal use or self-dealing.

House hacking, Part-Time STR, and Nomad™ are not allowed with retirement funds due to personal use.

Even when allowed, I often keep STRs outside retirement accounts to access cash flow and tax benefits more flexibly.

A Simple Action Plan

•

Confirm regulations and licensing in writing.

•

Pull comp data for ADR and occupancy from at least two sources.

•

Underwrite three cases and require DSCR ≥ 1.2 on the conservative case.

•

Line up funding that matches the variation you’ll execute.

•

Budget fully for setup, reserves, and a seasonal cash buffer.

•

Systematize operations before scaling to property two.

Execute slowly, verify often, and let the numbers—not the photos—make your decisions.