Appraisals: How To Survive A Low Value Without Overpaying

Learn about Appraisals for real estate investing.

Appraisals Decide The Deal You Actually Get

Most investors think the contract price is the “truth.”

Your lender usually thinks the appraisal is the truth.

When I help clients buy rentals, the appraisal is one of the final gates.

It can quietly change your down payment, your interest rate options, and whether a refinance works at all.

After I rebuilt after bankruptcy, I got ruthless about one thing: I never let a single number become “the number” without understanding how it was produced.

An appraisal is exactly that kind of number.

What An Appraisal Really Is

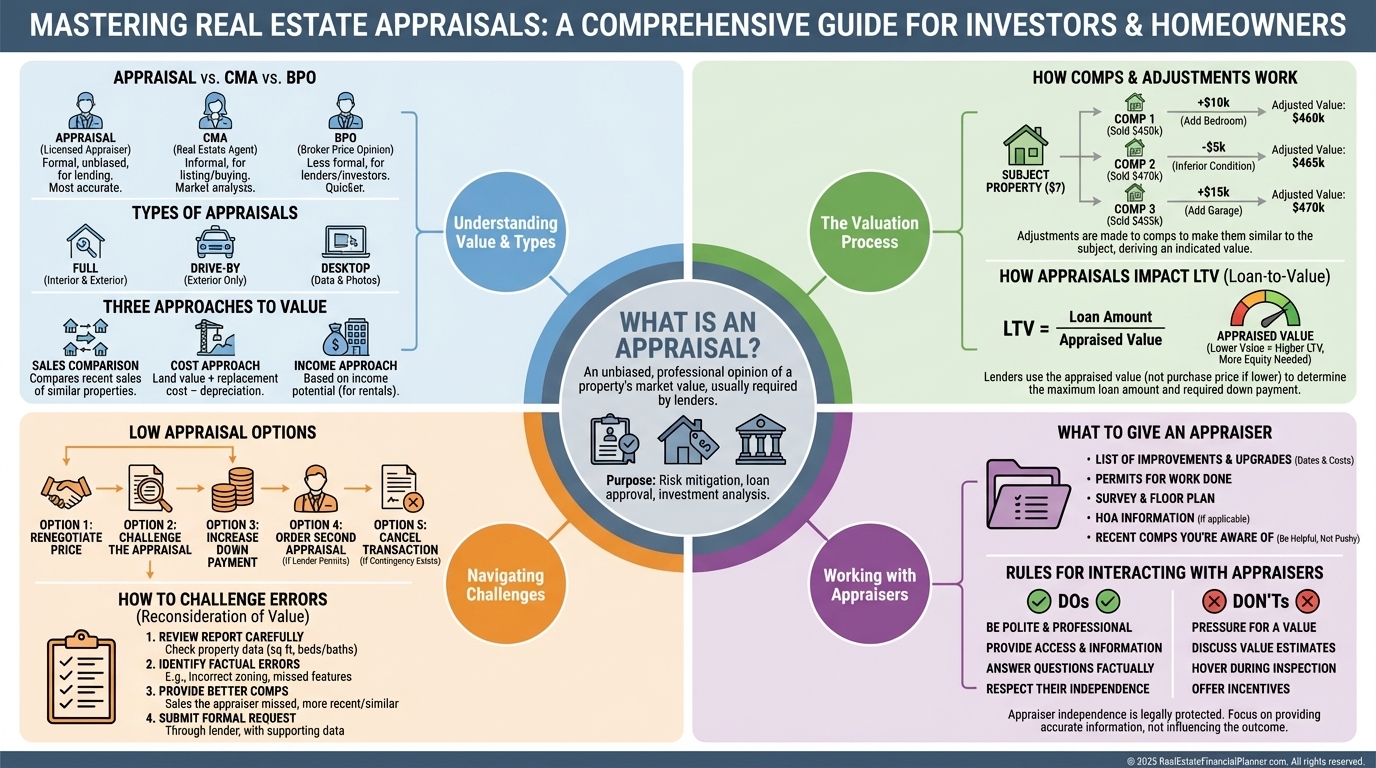

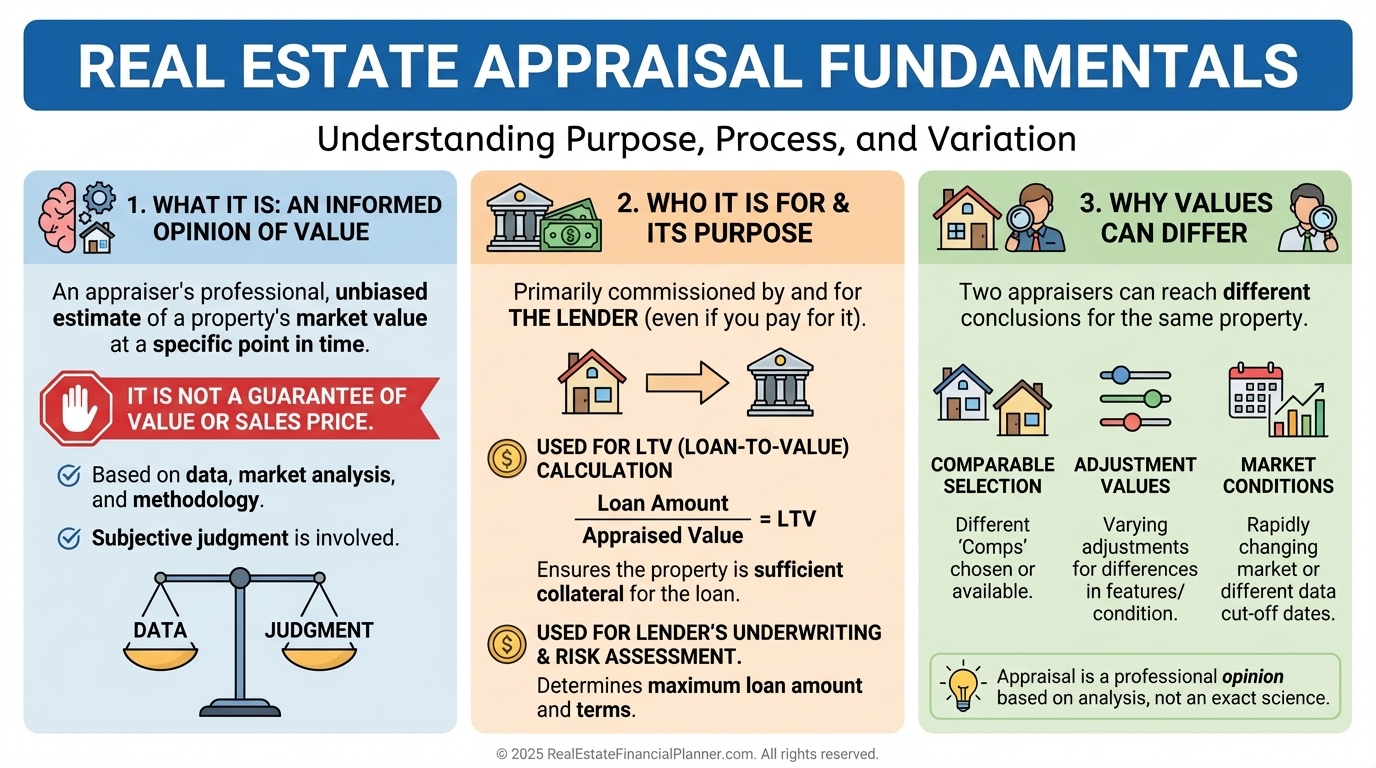

An appraisal is an informed opinion of value from a licensed appraiser.

It’s built from property facts, market data, and a valuation method that has to be defensible.

For most transactions, the appraisal is ordered by the lender because the lender is underwriting risk.

You pay for it, but it’s not “for you.”

The most important mindset shift is this: an appraisal is not a verdict.

It’s an opinion that must follow a process, using evidence.

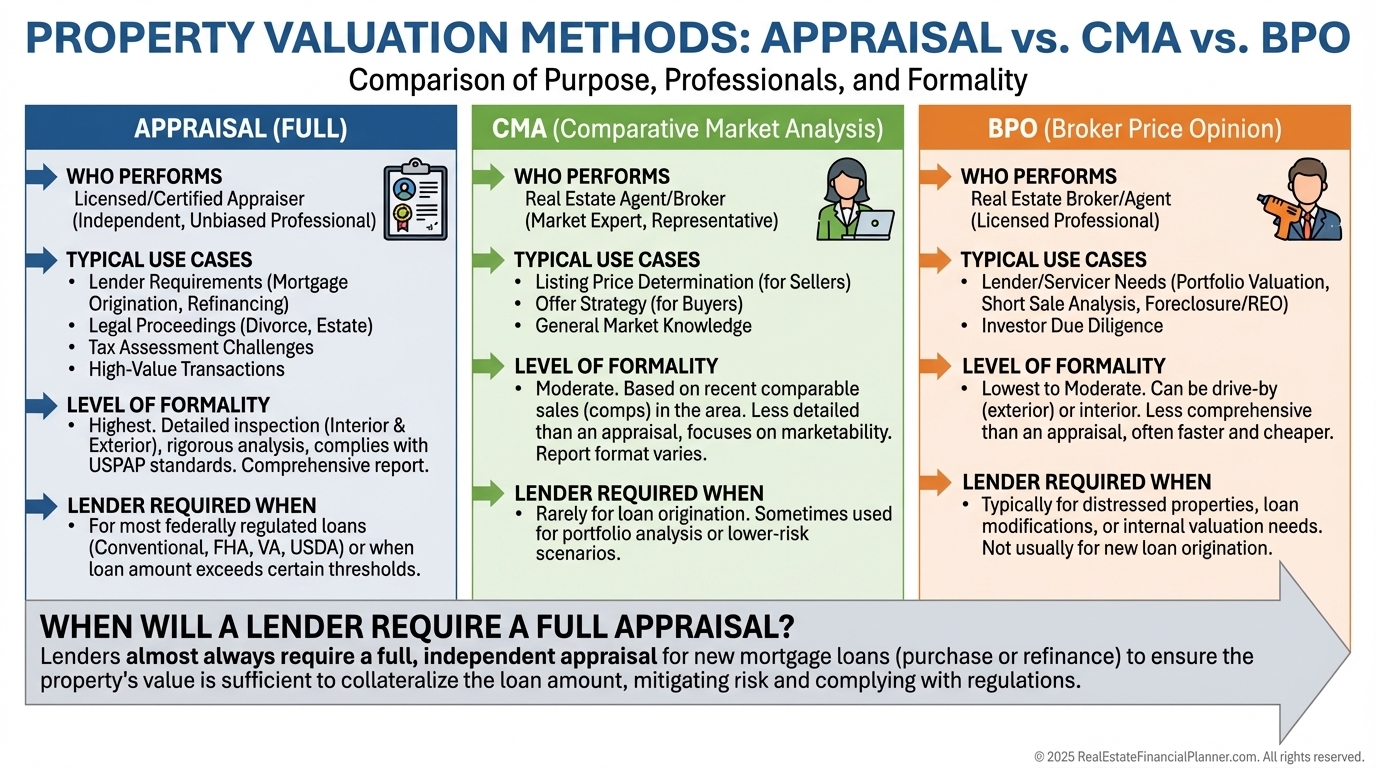

Appraisal vs. CMA vs. BPO

These three get mixed up constantly, and that confusion costs investors time and confidence.

Appraisal is the formal valuation used for lending.

It’s done by a licensed appraiser under specific standards and has a paper trail designed to survive scrutiny.

Comparative Market Analysis (CMA) is a pricing opinion from an agent, usually for listing or offering decisions.

It can be excellent, but it’s not designed to satisfy a lender’s underwriting rules.

Broker Price Opinion (BPO) is an agent’s formal opinion of value in a report format that lenders sometimes use for specific situations.

It can be more detailed than a CMA, but it’s still not a full appraisal.

Types Of Appraisals

Not every appraisal involves someone walking through your property with a tape measure.

Desktop appraisal uses data and comps without a physical visit.

It shows up in lower-risk situations, often refinance-related.

Drive-by appraisal includes an exterior visit only.

It’s still limited, but it’s more grounded than purely desktop.

Full appraisal includes an interior and exterior inspection.

For purchases and many higher-risk loans, this is the standard.

For the rest of this post, I’m talking about full appraisals because that’s where most investor pain lives.

It’s also where the most leverage exists if you know what to look for.

When You’ll Need One

Buying with a loan. The lender typically requires the appraisal after you’re under contract.

If you’re trying to be efficient, you usually want inspections handled first so you’re not paying for an appraisal on a deal you might cancel anyway.

Refinancing. The appraisal often determines whether the deal works.

This is where investors get surprised because the “zillow number” and the “lender number” can be two different worlds.

Removing PMI. Many lenders require an appraisal to confirm value and validate your loan-to-value.

That value can be the difference between keeping PMI for years or removing it now.

Setting a sales price. You can order an appraisal, but most sellers don’t unless the property is unusual or they’re selling without an agent.

And if the buyer uses a loan, they’ll still get their own lender-ordered appraisal.

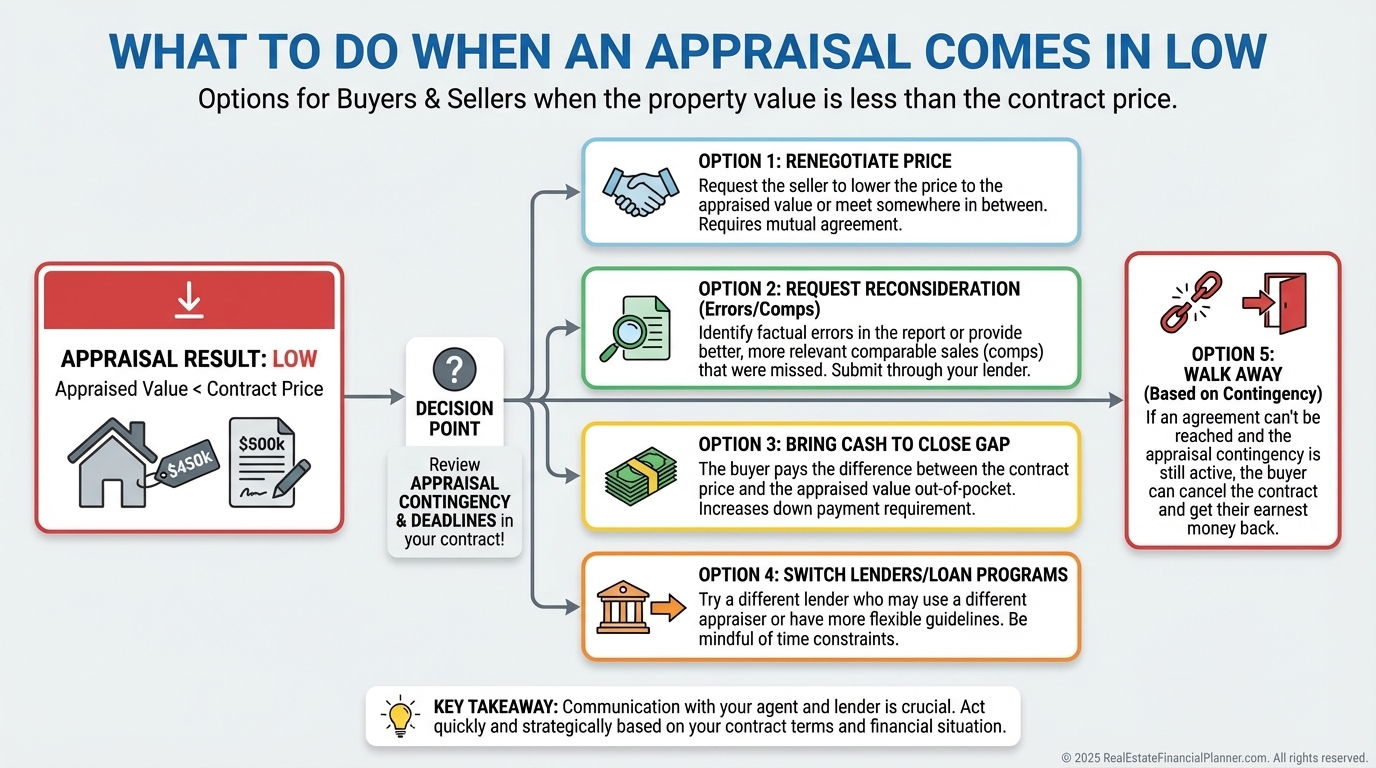

The Appraisal Contingency Is Your Escape Hatch

When I see investors waive appraisal contingencies casually, I get nervous.

Sometimes it’s strategic. Often it’s just optimism dressed up as confidence.

If the appraisal comes in low, the lender typically bases the loan amount on appraised value, not contract price.

That forces a decision: renegotiate, bring cash, challenge, or walk.

A lot of “bad deals” are just deals where the appraisal changed the math and no one adjusted the plan.

This is exactly why I like to model ranges in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ instead of one-point estimates.

Three Approaches To Value

Appraisers have three major toolkits.

They don’t always use all three equally.

Sales comparison approach. This is the bread and butter for single-family homes.

The appraiser finds comps and adjusts for meaningful differences.

Income approach. This is common for income-producing properties like multifamily and some commercial.

Value is tied to income, expenses, and expected returns.

Cost approach. This estimates value using replacement cost minus depreciation.

It’s more common for newer, unique properties, or markets with limited comps.

Most investors obsess over the final value and ignore which approach drove it.

That’s backwards, because knowing the approach tells you what evidence matters.

Comparable Sales Are The Core Of Most Residential Appraisals

For single-family rentals, comps dominate.

That means selection and adjustments matter more than anything else.

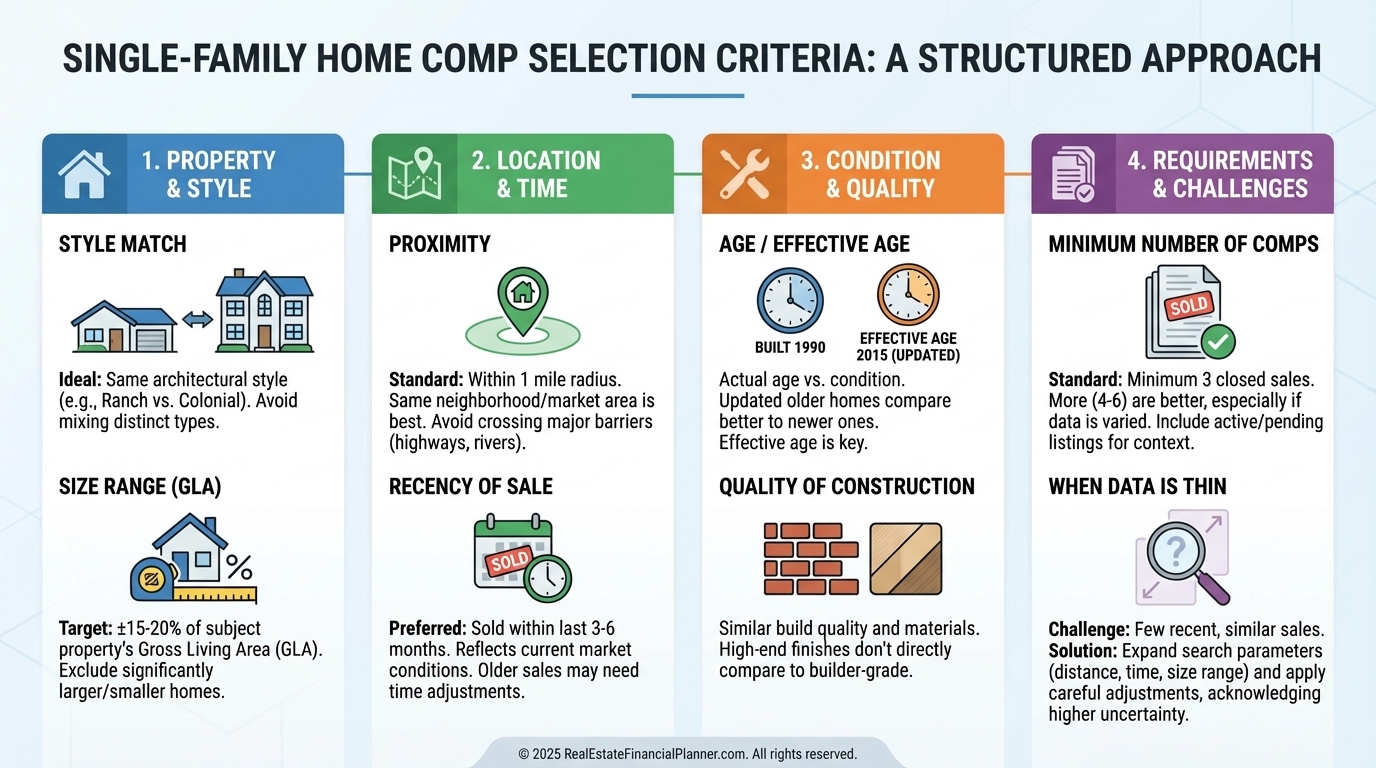

Typical comp selection looks like this:

Similar style and layout.

Similar size, often within a reasonable range.

Similar age or “effective age.”

Close proximity unless the property is unique.

Recent sales, with more emphasis on recency in a fast-moving market.

Here’s what I watch for when I review a report with clients: the comps tell a story.

If the story feels like “we tried to justify a number” instead of “we measured the market,” you should slow down.

Adjustments: The Hidden Engine Inside The Appraisal

Adjustments exist because properties aren’t identical.

The appraiser is trying to estimate what buyers would pay more or less for.

The simple rule is this: if the comp is superior, adjust it down.

If the comp is inferior, adjust it up.

The best adjustment is no adjustment.

That’s why great comp selection matters.

And here’s the part most investors miss: adjustment numbers vary by appraiser, neighborhood, and data quality.

Two appraisers can be honest and still disagree.

I’ve seen identical model homes in the same neighborhood get materially different adjustments.

That experience is why I treat appraisals as “useful but not sacred.”

Why Your $50,000 Remodel Might Not Add $50,000 In Value

Investors tend to think in costs.

Appraisers are forced to think in market evidence.

A remodeled kitchen can matter a lot, but it’s still constrained by the neighborhood ceiling and what the comps support.

Sometimes the market pays you back. Sometimes it shrugs.

This is also where Return on Equity thinking quietly shows up.

If you sink a pile of cash into upgrades, you might increase value, but your return on that equity can still be mediocre if the rent and overall market don’t support it.

Market Conditions Addendum: The “Timing” Problem

If the market is moving, timing becomes a valuation issue.

A comp from six months ago might represent a different market.

The Market Conditions Addendum documents whether prices are increasing, stable, or declining, and how the appraiser handled that.

If you’re surprised by a low value, this section often explains why.

How Appraisals Affect Loan-to-Value

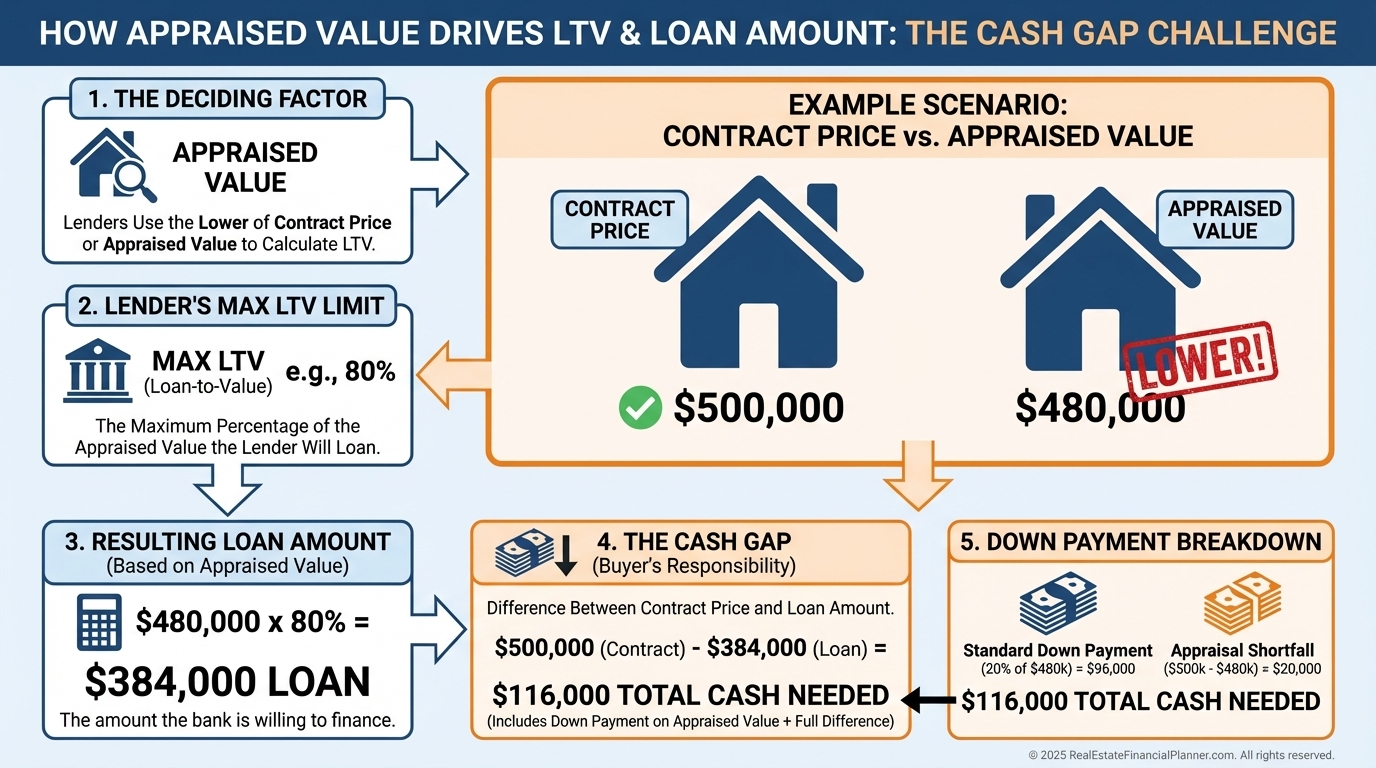

Loan-to-value is where appraisals become real money.

A small value change can become a big cash requirement.

If the appraised value is lower than the purchase price, the lender’s max loan is based on the lower number.

That can force you to bring additional cash, change loan structure, or renegotiate the deal.

When I model refinances, I always think in terms of True Net Equity™.

It’s not just “paper equity.” It’s equity minus the cost to access it, including refinance fees, selling costs, and taxes where applicable.

That’s how you avoid the trap of celebrating a high appraisal while missing the actual financial outcome.

You can be “up” on paper and still make a bad decision.

What You Can Give The Appraiser (Without Crossing The Line)

You can’t bribe, threaten, or pressure an appraiser.

You also shouldn’t try to “steer” them to a target value.

What you can do is help them be accurate.

Give them:

A clean list of upgrades and dates.

Receipts and a clear scope of work, especially for flips.

Floor plan or layout notes if the house is unusual.

Relevant comps you believe they may not have seen.

Notes about comps that look similar on paper but have hidden issues.

The goal is not to “win.”

The goal is to reduce the chance the appraiser misses key facts.

Challenging An Appraisal The Right Way

If the appraisal is low, the best first step is often renegotiation.

It’s faster and usually less emotionally exhausting.

If you need to dispute, focus on facts:

Incorrect square footage, bed/bath count, condition, or features.

Better comps that are more similar and more recent.

Missing adjustments that are clearly supported by local data.

A reconsideration request that reads like a tantrum tends to go nowhere.

A reconsideration request that reads like an audit sometimes works.

Why Many Appraisals “Magically” Hit The Contract Price

This is the part most people notice and few people understand.

If the data supports a range, and the contract price is reasonable within that range, many appraisers will land on the contract price.

Sometimes it’s because the market evidence genuinely supports it.

Sometimes it’s because the appraisal is designed to be defensible, and the contract price is the simplest defensible number.

If you’re on the good side of that, you say, “Thank you,” and move on.

My Investor Checklist When An Appraisal Comes Back

When I review an appraisal with an investor, I look for deal-breakers before I look for drama.

Verify the facts. Square footage, bed/bath count, lot size, garage spaces, condition, and upgrades.

If the facts are wrong, everything built on them is suspicious.

Evaluate comp quality. Similarity, proximity, and recency.

Bad comps create bad adjustments.

Read the comments. The addendum often reveals the “why.”

That’s where you find logic, assumptions, and constraints.

Model the new outcome. What happens to cash to close, LTV, and return?

This is where the spreadsheet earns its keep.

Appraisals don’t just measure value.

They test whether your plan survives contact with a lender’s reality.