Form 1098 for Real Estate Investors: Maximize Deductions, Prevent IRS Mismatches, and Strengthen Your Deal Analysis

Learn about Form 1098 for real estate investing.

Why Form 1098 Is a Profit Lever (Not Just Paper)

Most investors file Form 1098 away and move on.

Sarah thought her returns were fine.

Four years and three rentals later, our review showed misallocated interest and a mismatch with her lenders’ 1098s.

She recovered nearly $12,000 in deductions and stopped automated IRS notices.

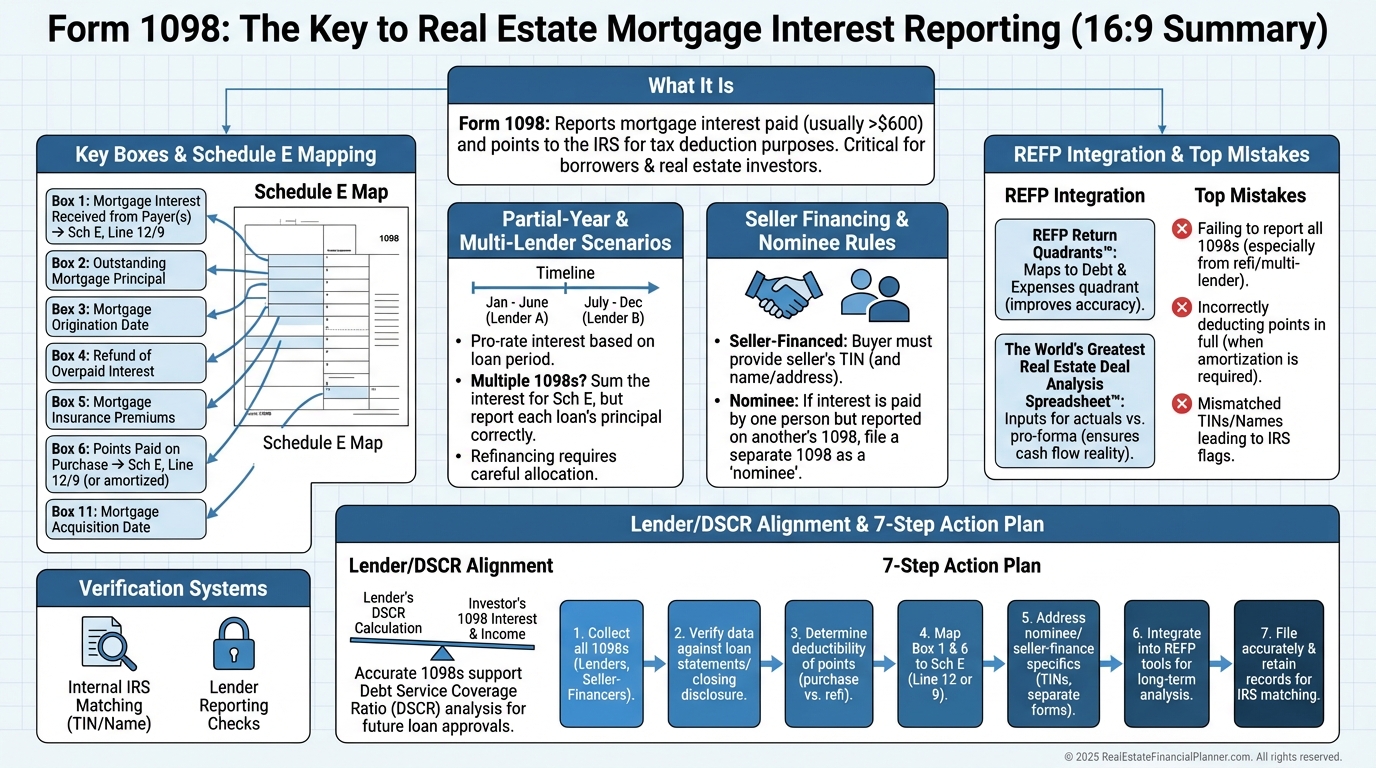

What Form 1098 Actually Reports (And Why It Matters to You)

Form 1098 is the Mortgage Interest Statement.

If a lender receives $600+ of mortgage interest from you for the year, they issue Form 1098 to you and the IRS.

For rentals, the interest is usually a Schedule E expense, not Schedule A.

That distinction matters for matching, audits, and how you model deals.

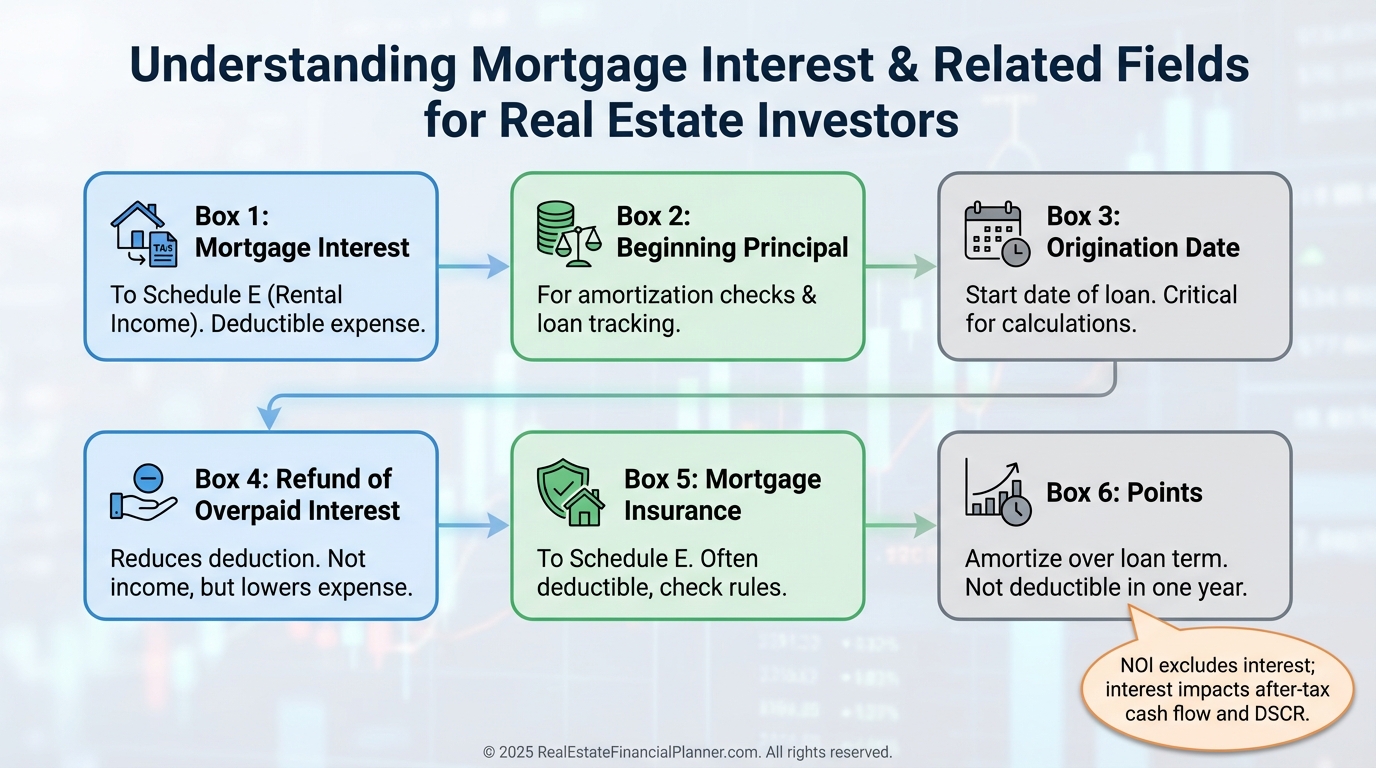

The Boxes That Move the Needle

Box 1: Mortgage interest paid. This usually goes to Schedule E for rentals.

Box 2: Outstanding principal on January 1. I use it to verify amortization and debt service in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

Box 3: Origination date. It helps track cumulative interest over your holding period.

Box 4: Refund of overpaid interest. Reduce your deduction by this amount.

Box 5: Mortgage insurance premiums. For rentals, treat as an operating expense on Schedule E.

Box 6: Points paid. For rentals, amortize over the loan term rather than deducting all at once.

When I review a client’s portfolio, I match these boxes to the right property and schedule every time.

It prevents misclassification and IRS mismatch letters.

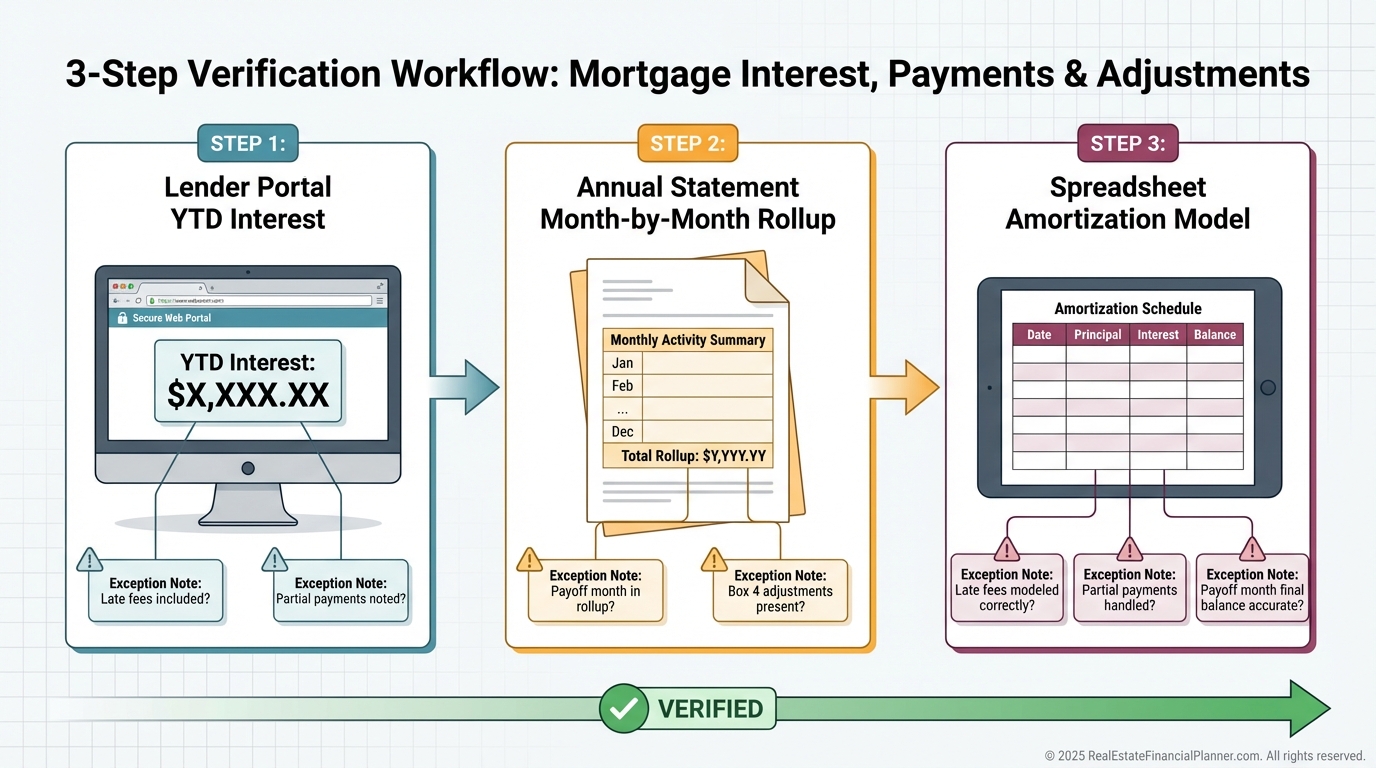

What Professionals Reconcile Every Month

Amateurs look at 1098s once a year.

Professionals reconcile monthly.

I have clients track each mortgage payment’s interest portion in a simple spreadsheet and spot-check it against the lender portal.

Then we verify year-to-date totals quarterly.

If anything drifts, we catch it before January.

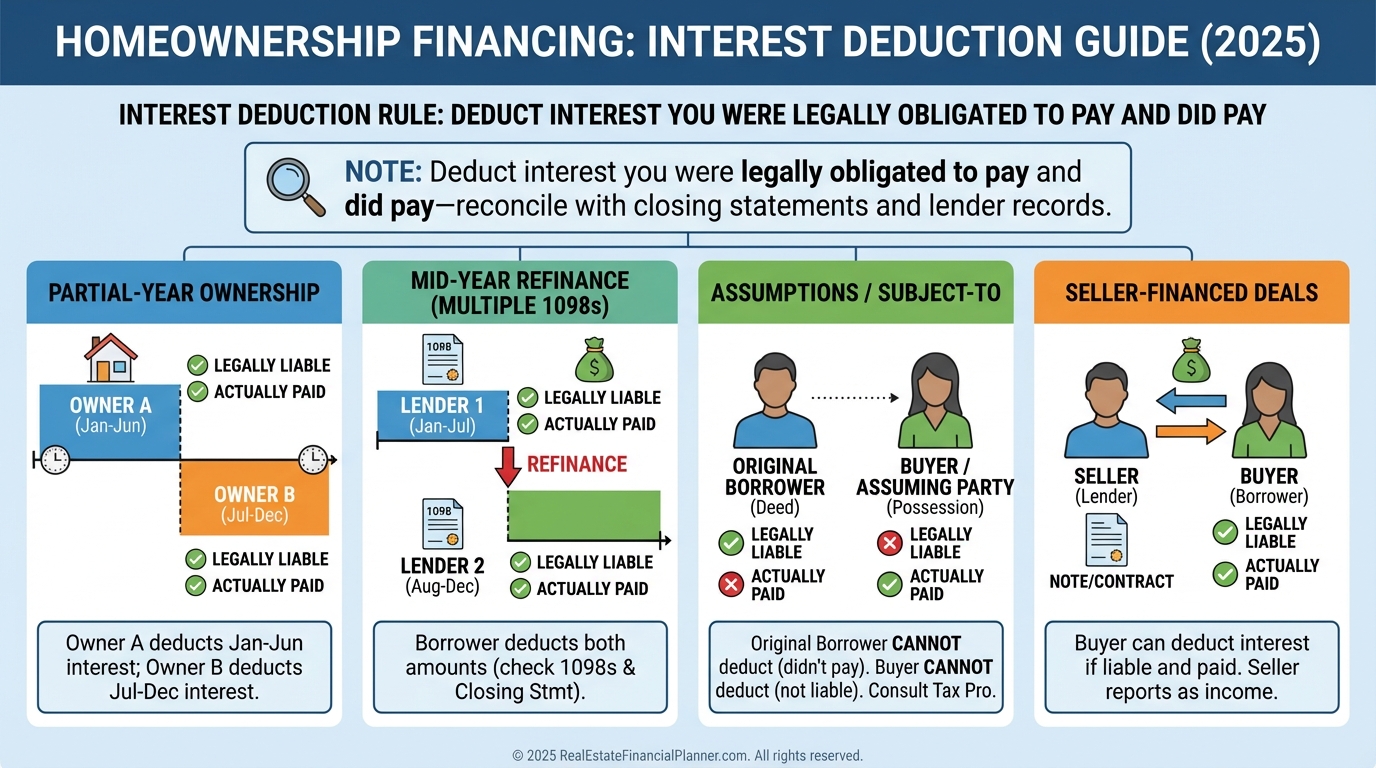

The Rule That Solves 90% of Confusion

You can deduct mortgage interest only if you were legally liable for the debt and you actually paid it.

That’s the principle I use to resolve partial-year purchases, assumptions, wraps, and creative finance.

If you bought mid-year and paid per-diem interest on your closing statement, that portion is generally deductible to you.

If you refinanced, expect two Form 1098s—one per lender—and add them, net of any overpaid interest refunds.

In subject-to or wrap situations, you may not receive a clean 1098.

You can still deduct the interest you paid if you were liable; nominee reporting or additional statements may be required. Coordinate with a CPA early.

Verification: The Three-Layer Check That Prevents Notices

I verify interest three ways.

First, lender portal YTD interest.

Second, annual mortgage statement that totals monthly interest.

Third, my amortization model in the Deal Analysis Spreadsheet.

Small timing differences are normal; big gaps mean an error.

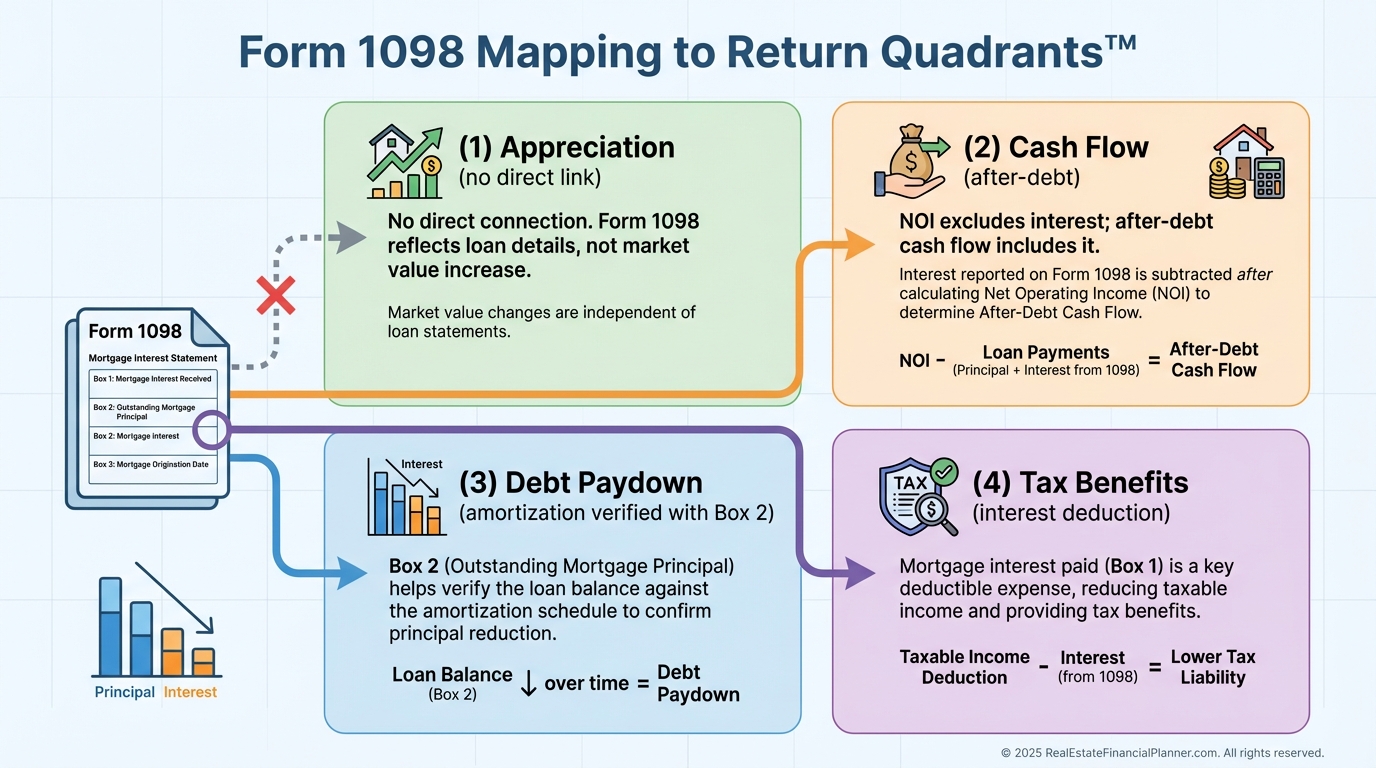

Integrate 1098s Into Your Return Quadrants™ and Analysis

Interest shows up in the Tax Benefits and Cash Flow quadrants.

In the Return Quadrants™ framework, don’t push interest into NOI, because NOI is before debt.

Instead, interest affects after-debt cash flow and your tax benefits quadrant.

When I model a deal, Box 1 supports the Tax Benefits in year one and helps forecast future years.

Then I update True Net Equity™ to reflect taxes saved and accurate debt paydown.

That gives me a cleaner, after-tax return picture.

Real-World Scenarios You’ll Actually Face

Marcus owned a triplex with a $180,000 loan at 5.5%.

He expected about $9,900 of interest based on the starting balance, but the 1098 showed $9,750.

The difference reflects principal reduction through the year.

Jennifer’s duplex brought in $2,400 per month.

Her 1098 showed $8,400 interest. In a 24% bracket, that’s roughly $2,016 in tax savings, which lifted her cash-on-cash return by about 2.5 percentage points on a $20,000 investment.

Refinances produce multiple 1098s.

I add both lenders’ Box 1 totals and subtract any Box 4 overpaid interest refunds.

In seller-financed sales where you’re the lender, you issue Form 1098 to your buyer.

If you forget, you risk penalties and your borrower may miss the deduction.

When I rebuilt after bankruptcy, I used Nomad™—owner-occupy, then convert to rental.

Robert did similar with a 4-plex.

Year one he lived in one unit and allocated his 1098 interest 25% to Schedule A and 75% to Schedule E.

Year two, it shifted to 100% Schedule E.

That small adjustment preserved compliance and lowered his interest cost via owner-occupied financing at the start.

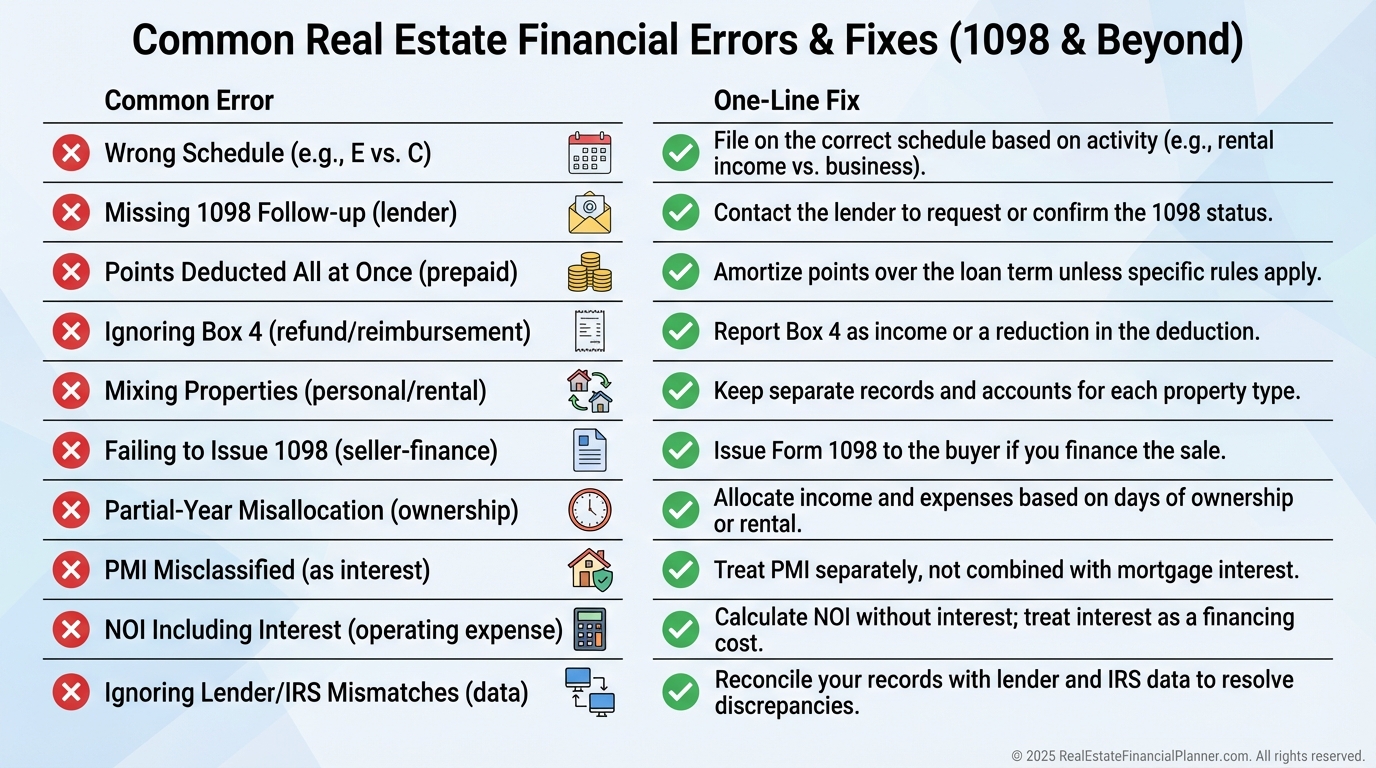

Mistakes That Trigger Notices or Cost You Real Money

Mixing primary residence and rental interest is common.

Each belongs on its proper schedule.

Missing a 1098 doesn’t remove your duty to report what you paid.

I contact the lender in early February if it hasn’t arrived and pull the portal statement.

Points on rentals must be amortized over the loan term.

Deducting them all at once is a fast way to get a letter.

Don’t allocate a single 1098 across the wrong properties.

I label every mortgage with the address and lender EIN in my files.

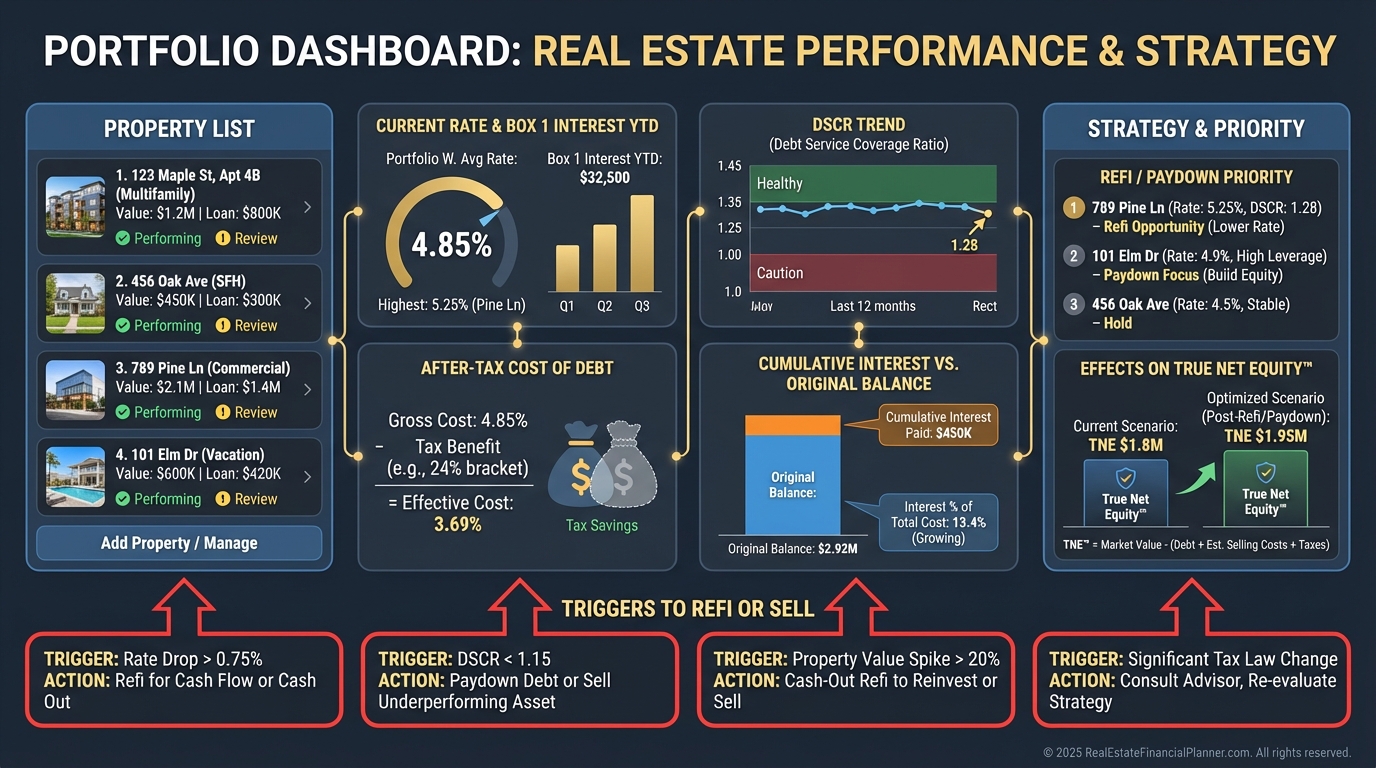

Lenders, DSCR, and Why Clean 1098s Win You Loans

Portfolio lenders look at your Schedule E and debt history.

When your returns tie cleanly to 1098s, your DSCR analysis is more credible.

I bring three years of 1098s to refinance meetings.

It shows payment reliability and speeds underwriting.

Portfolio Strategy: Use 1098s to Grow Faster

I rank loans by after-tax cost of debt, not just rate.

High net-cost loans get targeted for payoff or refi first.

I also watch cumulative interest.

When it approaches 20–30% of the original balance, I reassess whether a refi, rate-term change, or payoff improves Return Quadrants™ outcomes.

Coordinate interest-heavy years with passive activity rules.

Sometimes I accelerate deductible repairs to fully use losses.

For exits, cumulative interest helps me compute true, after-tax returns and sharpen list pricing.

Your 7-Step Form 1098 Action Plan

Step 1: Pull the last three years of 1098s for every property.

Step 2: Reconcile each 1098 to lender portals, annual statements, and your amortization model.

Step 3: Tie each 1098 to the correct property on Schedule E.

Step 4: If you refinanced, add all 1098s and adjust for Box 4.

Step 5: For Nomad™ or house hack years, allocate properly between Schedule A and E.

Step 6: Update The World’s Greatest Real Estate Deal Analysis Spreadsheet™ with actual interest to refine your Return Quadrants™ and True Net Equity™.

Step 7: Create a monthly interest log going forward and calendar a quarterly verification routine.

When I model this way, clients reduce IRS notices, reclaim missed deductions, and negotiate better financing.

As always, coordinate with your CPA, especially for subject-to, wraps, or nominee reporting.

Done right, Form 1098 becomes a growth tool—not just a tax form.