Closing On a Rental Property Without Surprises

Learn about Closing for real estate investing.

Closing Topic Overview

Closing Isn’t the Finish Line

Closing feels like the finish line because you finally get the keys.

But for an investor, it’s also the last chance to catch expensive mistakes before they become your problem.

When I help clients buy rentals, I treat closing like a controlled demolition.

Everything should be planned, labeled, verified, and timed, or something breaks at the worst possible moment.

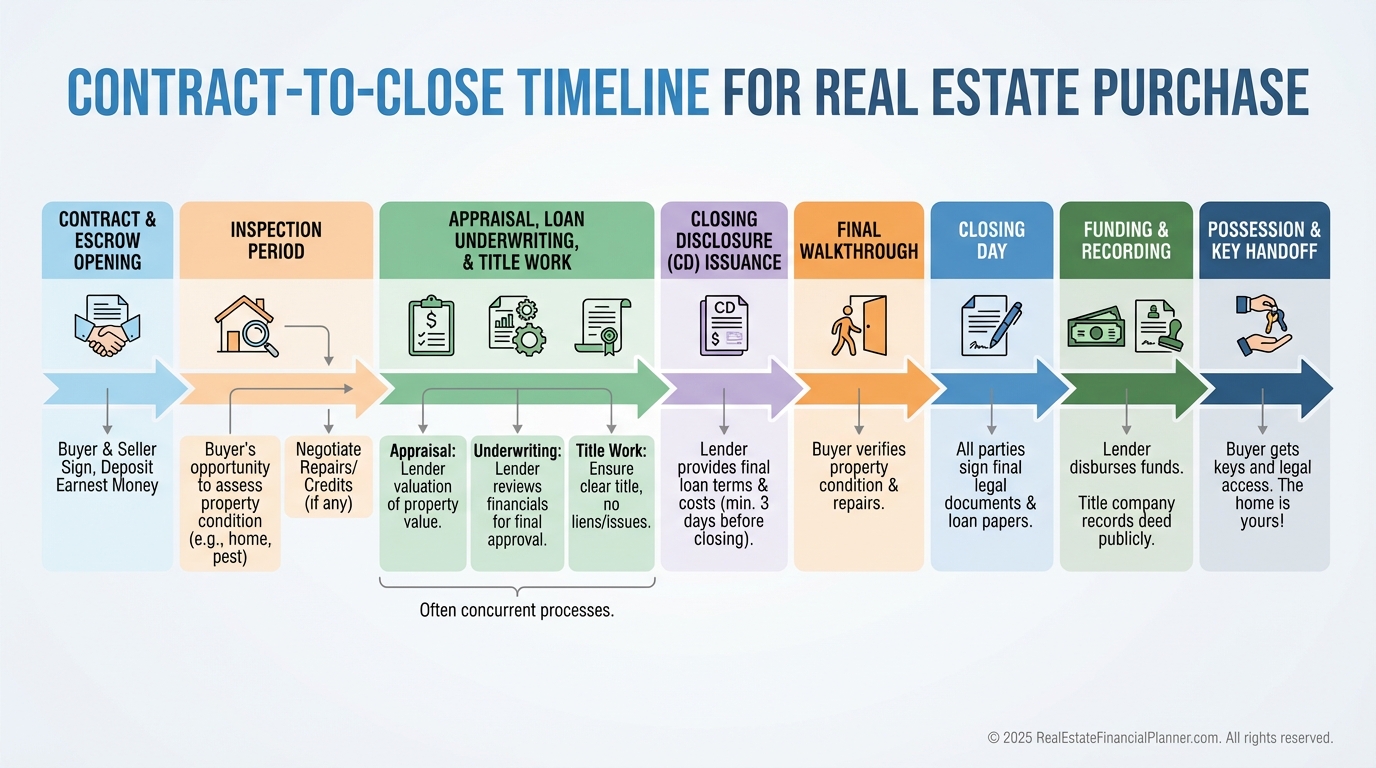

Where Closing Fits In the Buying Process

Closing is one step in a longer sequence.

Most investor pain shows up in the handoff between “contract-to-close” and “closing day.”

That’s where assumptions get people in trouble.

The Contract-To-Close Timeline

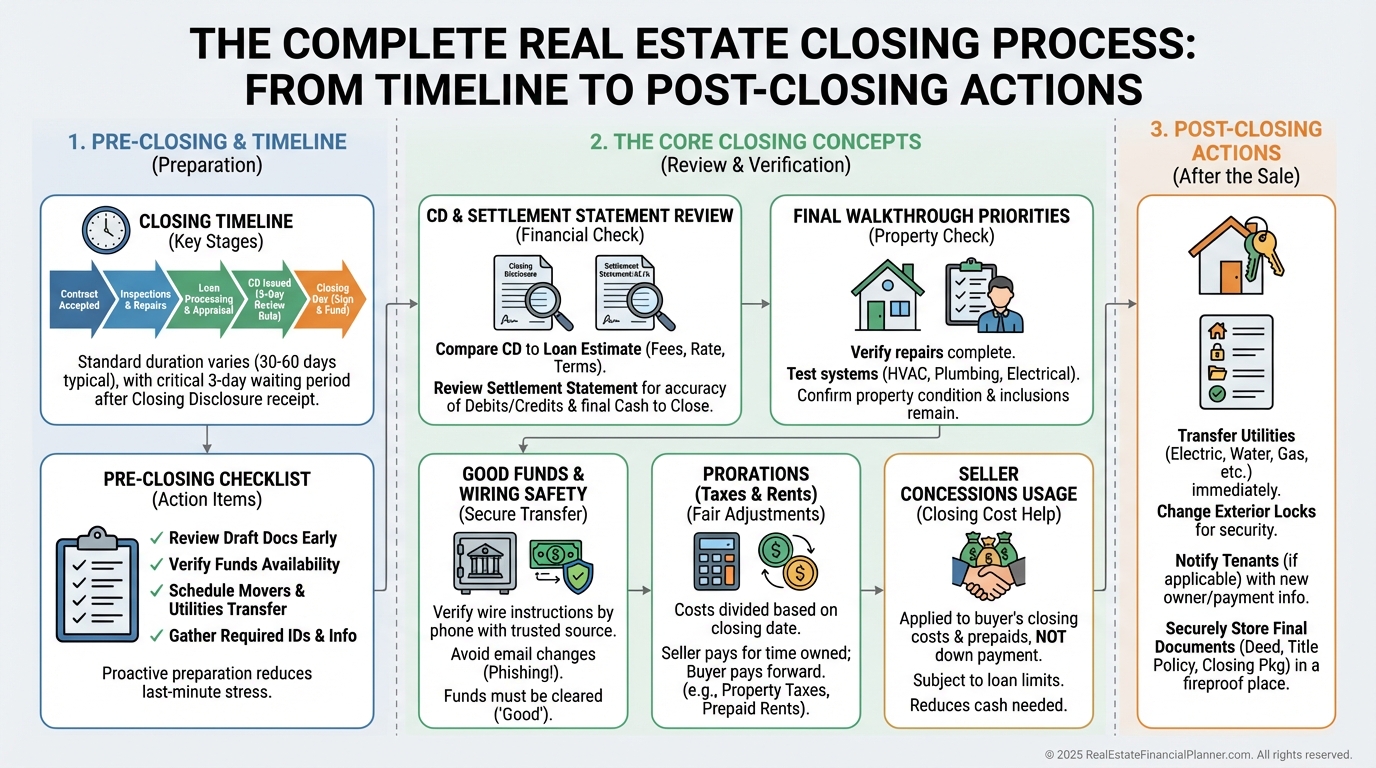

The Four Buckets I Use For Every Closing

Closings look chaotic when you treat them like one big event.

They get simple when you separate them into four buckets.

Prepare For Closing: Confirm documents, dates, “good funds,” and the final numbers.

Here’s the key: these buckets are not perfectly sequential.

You’ll work on multiple buckets at once, and you need a plan that can flex without breaking.

The Pre-Closing Checklist That Prevents “Closing Day Panic”

I’ve seen closings derailed by problems that were completely avoidable.

Not because the investor didn’t care.

Because nobody gave them a simple checklist early enough.

Here’s what I want true before you walk in to sign.

You Know The Exact Cash Required: No guessing, no “I think it’s about…”

You Verified Good Funds Rules: Certified check vs wire, limits, and deadlines.

You Reviewed The Closing Disclosure With The Lender: Rates, term, PMI, and fees match what you agreed to.

You Reviewed The Settlement Statement: Names, entity signatures, price, concessions, prorations, and credits are correct.

You Scheduled The Final Walkthrough: Close enough to matter, early enough to act.

You Made Utility Transfer Plans: Especially if it’s tenant-occupied.

You Have A Post-Closing Plan: Locks, tenants, document storage, and payment timing.

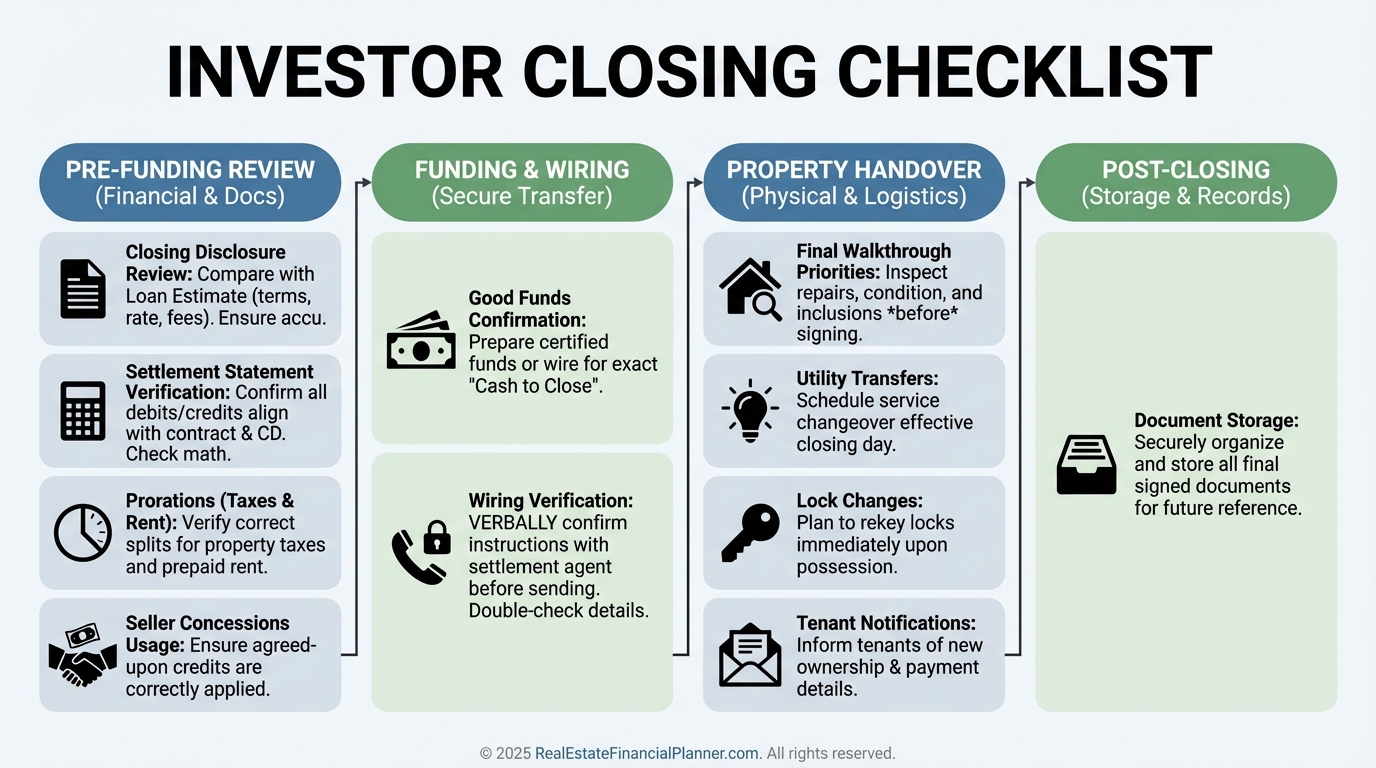

Investor Closing Checklist

Review the Closing Disclosure Like Your Deal Depends On It

Because it does.

The Closing Disclosure is where the loan becomes real.

When I rebuilt after bankruptcy, I learned to stop trusting “it’ll work out.”

The numbers have to match the agreement, and you have to catch issues while there’s still time to fix them.

Here’s what you verify:

Interest Rate: Matches the lock you accepted.

Loan Term: Thirty-year, fifteen-year, or something else you did not intend.

Cash To Close: The exact number and the exact method required.

If PMI is involved, get clarity on how it’s charged and how it can be removed.

If the lender can’t explain it clearly, that’s a warning sign.

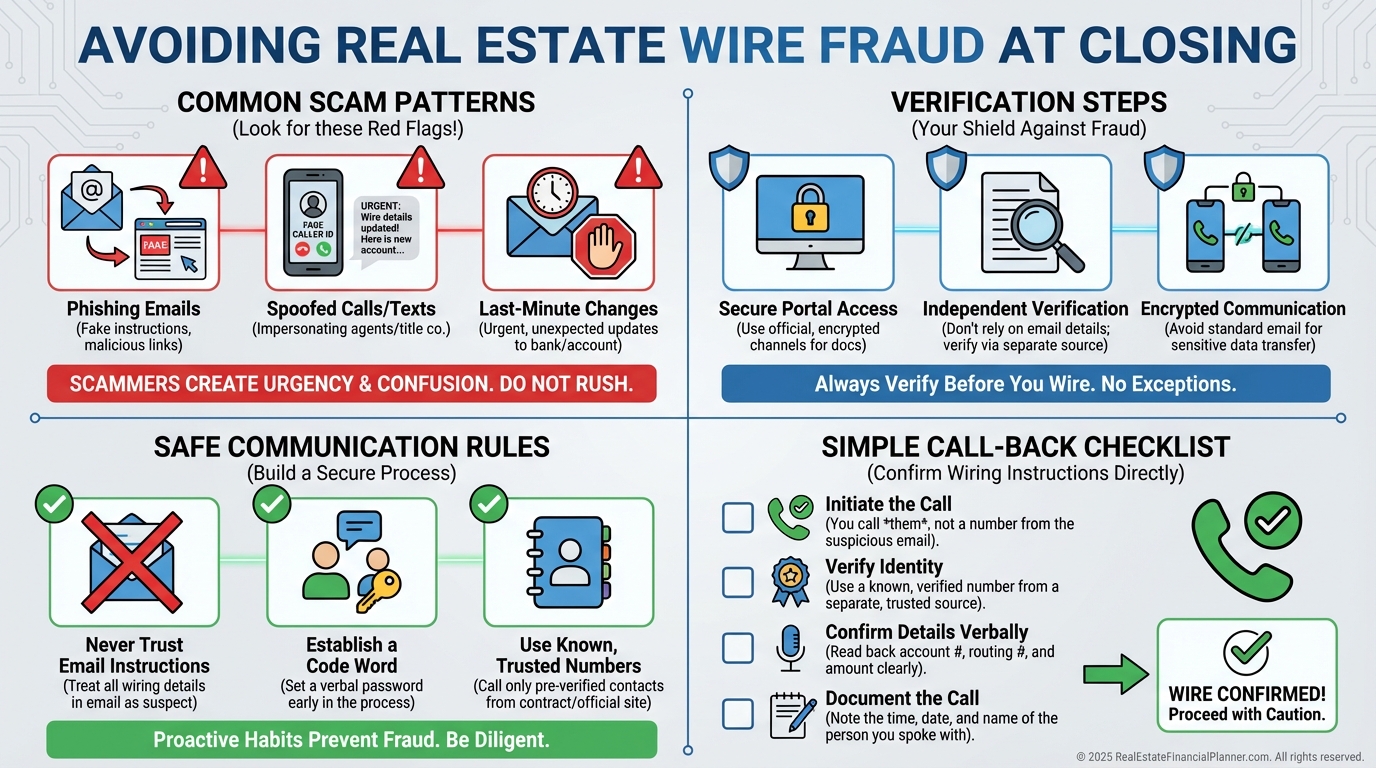

Wiring Scams Are Real, And They’re Getting Better

This is not paranoia.

This is basic investor survival.

Scammers watch for closings, and they target the moment you’re rushed and excited.

If someone emails you wiring instructions, treat it like a trap until proven otherwise.

Even if it looks like it came from your agent.

Never trust wiring instructions delivered by email alone.

Call the title company using a phone number you independently confirm.

Verify wiring instructions verbally, then verify them again.

One wrong wire can cost you the deal, your earnest money, and weeks of chaos.

And getting the money back is often not realistic.

Wire Fraud Defense Plan

Use One Hundred Percent of Seller Concessions

Seller concessions aren’t a gift.

They’re negotiated value, and unused value quietly returns to the seller.

If you discover you’re not using all concessions late in the process, be careful.

Last-minute changes can delay closing, change loan approvals, and create new underwriting conditions.

Common options include rate buydowns or shifting allowable prepaid items, but timing matters.

The best time to plan concessions is when you negotiate the offer, not the day before closing.

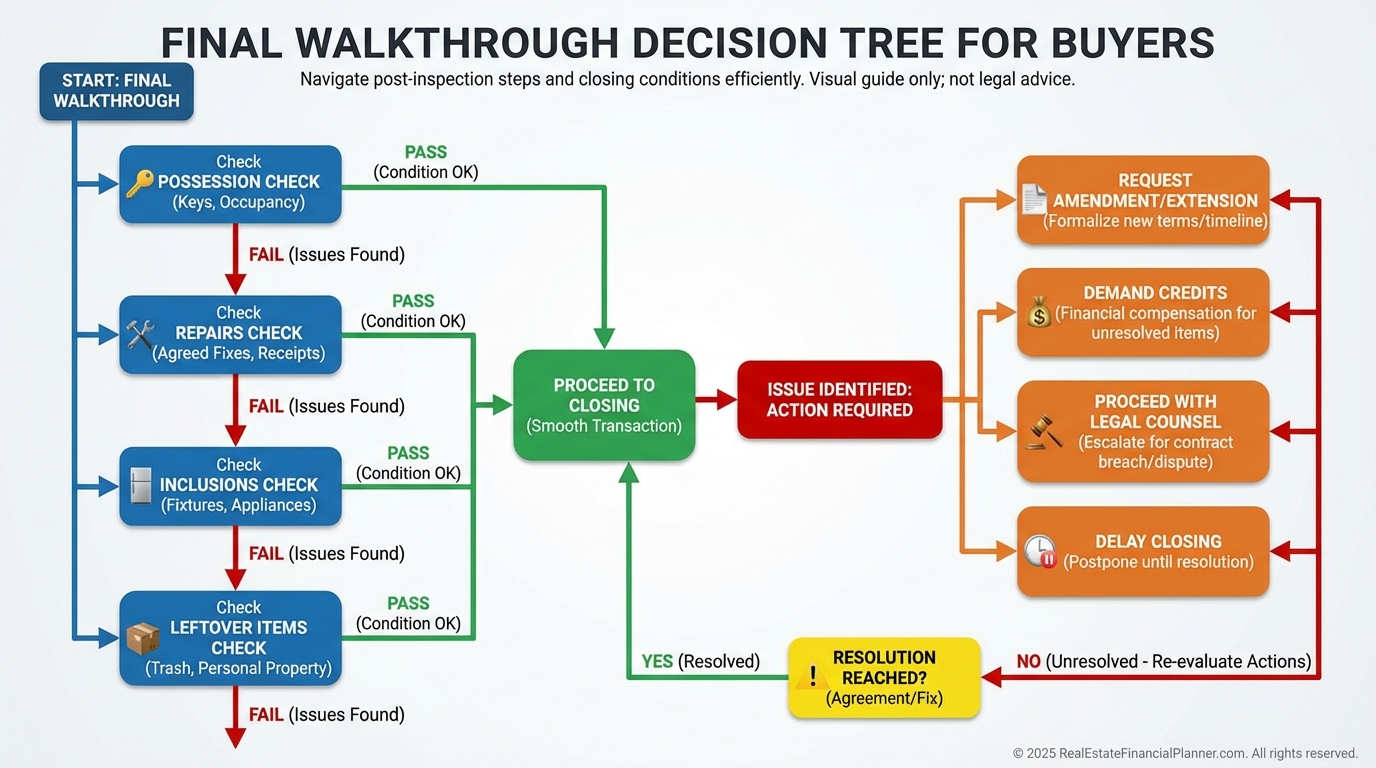

Final Walkthrough: Get Bad News Before You Sign

I like final walkthroughs about 30 to 60 minutes before closing.

You want enough time to react, but you also want the walkthrough to reflect reality, not promises.

Here’s what you check:

Possession: Seller moved out unless you have a written occupancy agreement.

Agreed Repairs: Completed, and completed well.

Inclusions: Appliances and items you negotiated are still there.

Trash And Leftovers: Seller removed what they agreed to remove.

If something is wrong, you want to know while you still have leverage.

After you sign, your options shrink and your costs rise.

Final Walkthrough Decision Tree

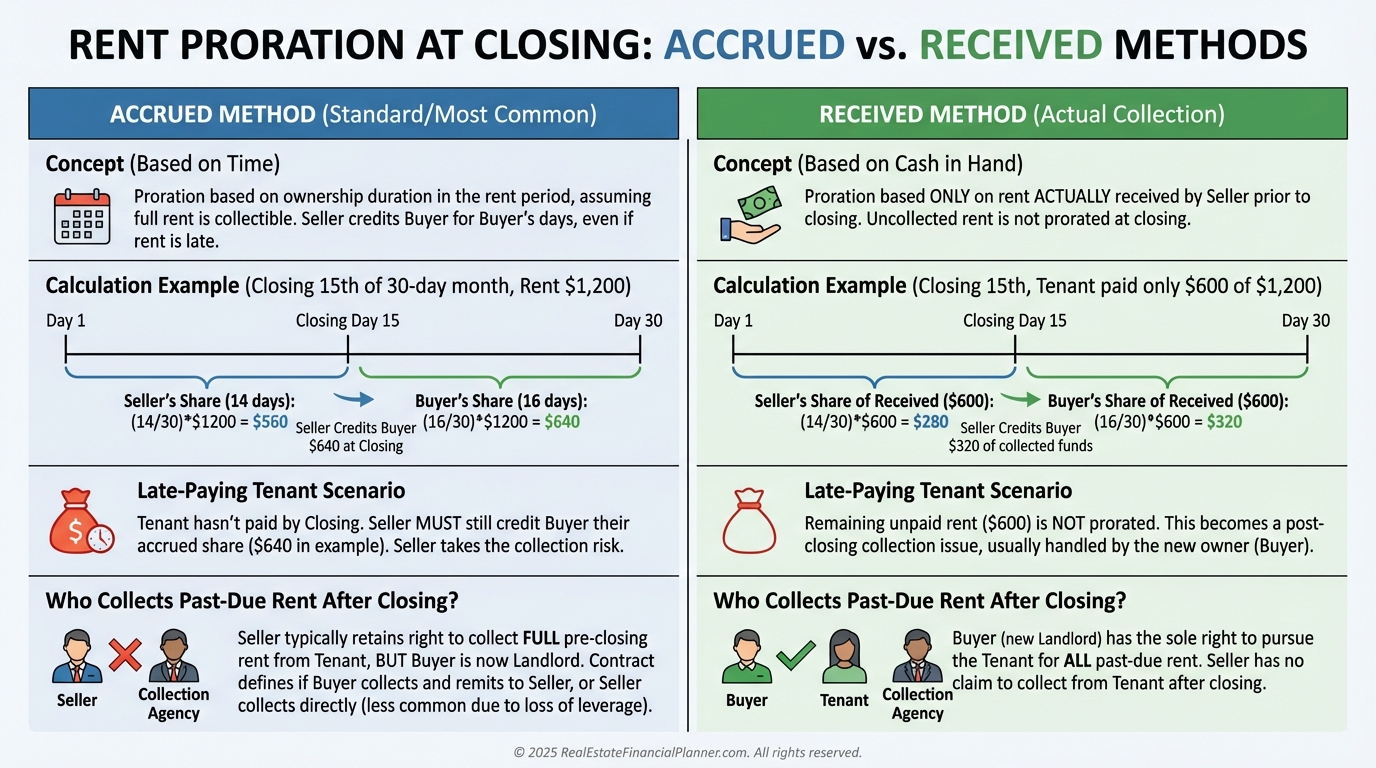

Prorations: The Quiet Math That Changes Your Real Returns

Closing statements are full of prorations that look like noise.

For investors, prorations can change the first month’s cash flow meaningfully, especially on rentals with tenants already in place.

Two that matter most:

Property Taxes: Seller typically credits you up to the day of closing, and you pay the full bill later.

Rent Prorations: Your contract should clearly say whether rents are prorated based on “accrued” or “received.”

If tenants are behind on rent, “accrued” and “received” create very different problems.

The “right” choice depends on your risk tolerance and the tenant situation, but it needs to be explicit.

Rent Proration Methods

Two Document Stacks You Should Expect

Most closing confusion comes from mixing document types together.

There are really two stacks.

Real Estate Documents: Transfer ownership, title-related items, settlement statement, deed, disclosures, and lease assignments.

Financing Documents: Note, deed of trust, riders, occupancy disclosures, and the final Closing Disclosure.

If you’re buying a tenant-occupied property, one document deserves special attention: the Assignment of Leases.

If you don’t have the leases properly assigned, you can end up with a mess when you try to collect rent or enforce the lease.

First Mortgage Payment Timing Can Help Cash Flow

Mortgage interest is typically paid in arrears.

That’s why a mid-month closing often means your first mortgage payment isn’t due the very next month.

Example: close January 15th, first payment often due March 1st.

That “gap month” can temporarily improve cash flow, but don’t treat it like free money.

It’s timing, not a discount.

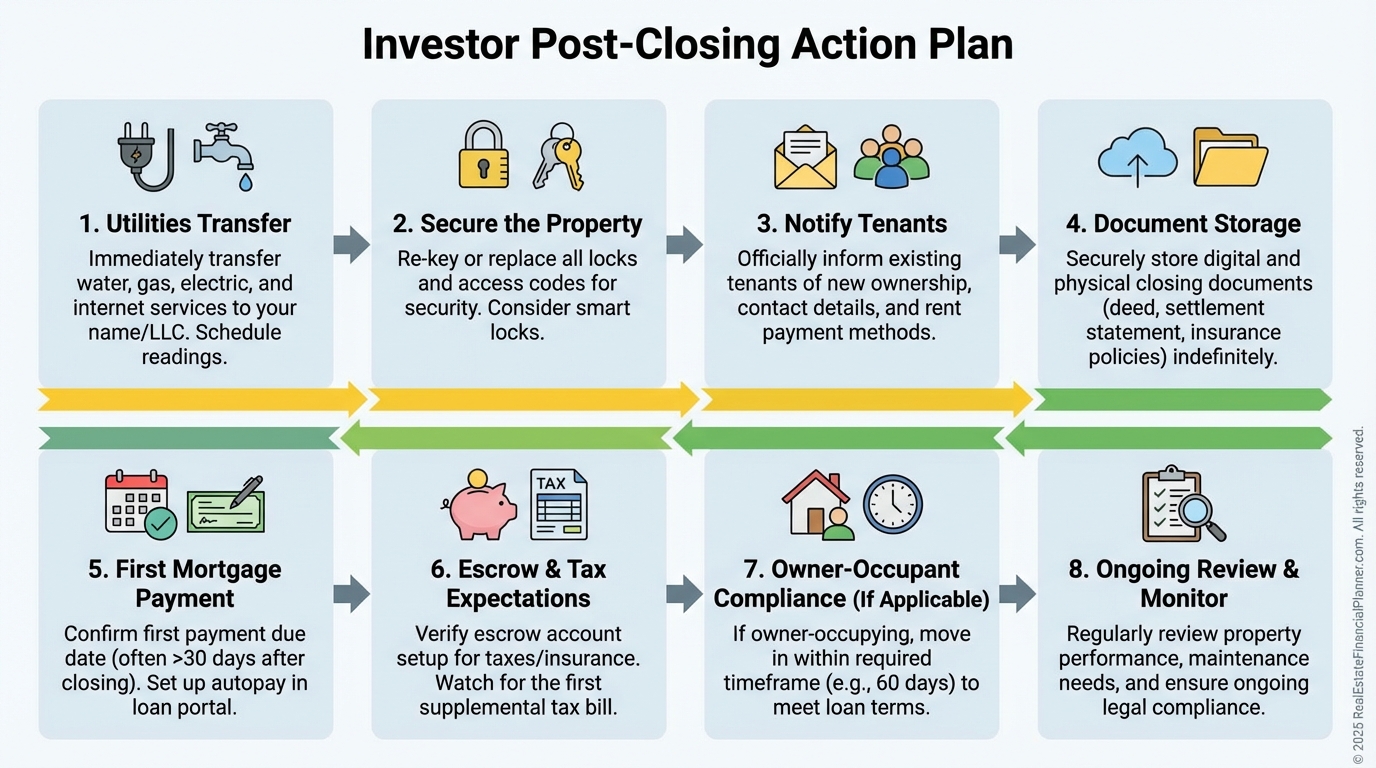

Immediately After Closing: Do These Before Life Gets Busy

Closings feel exhausting.

That’s exactly why investors skip the post-closing steps that prevent future pain.

Here are the ones I want handled immediately.

Switch Utilities: Effective on closing day, and consider landlord policies when tenants are involved.

Change Locks: Cheap protection against unknown key copies.

Notify Tenants: Introduce yourself, give payment instructions, and set expectations.

Store Documents: One digital folder for real estate, financing, and contract documents.

Confirm First Payment: Put the due date on your calendar and verify escrow expectations.

If you’re using owner-occupant financing (Nomad™ or house hacking), take occupancy requirements seriously.

Move in on time, and keep your paperwork clean.

Post-Closing Action Plan

The Point Of All This

Closing is not where you “hope” everything worked.

Closing is where you prove it worked.

When you treat closing like a checklist-driven process, you reduce risk, protect your cash, and prevent the kind of small mistakes that quietly destroy returns.