Debt-to-Income Ratio: The Silent Limit That Stops Investors From Buying Their Next Property

Learn about Debt-to-Income Ratio for real estate investing.

Why Debt-to-Income Ratio Stops More Investors Than Money

When I help clients analyze deals, the failure point is rarely the property.

It is almost always the borrower.

Specifically, it is their debt-to-income ratio.

I have watched investors with strong credit, solid reserves, and great properties get denied because DTI quietly crossed a line they did not know existed.

After rebuilding my own finances post-bankruptcy, I learned to treat DTI as a constraint you actively manage, not a number you hope works out.

DTI determines how many properties you can buy, how fast you can scale, and when you hit a wall.

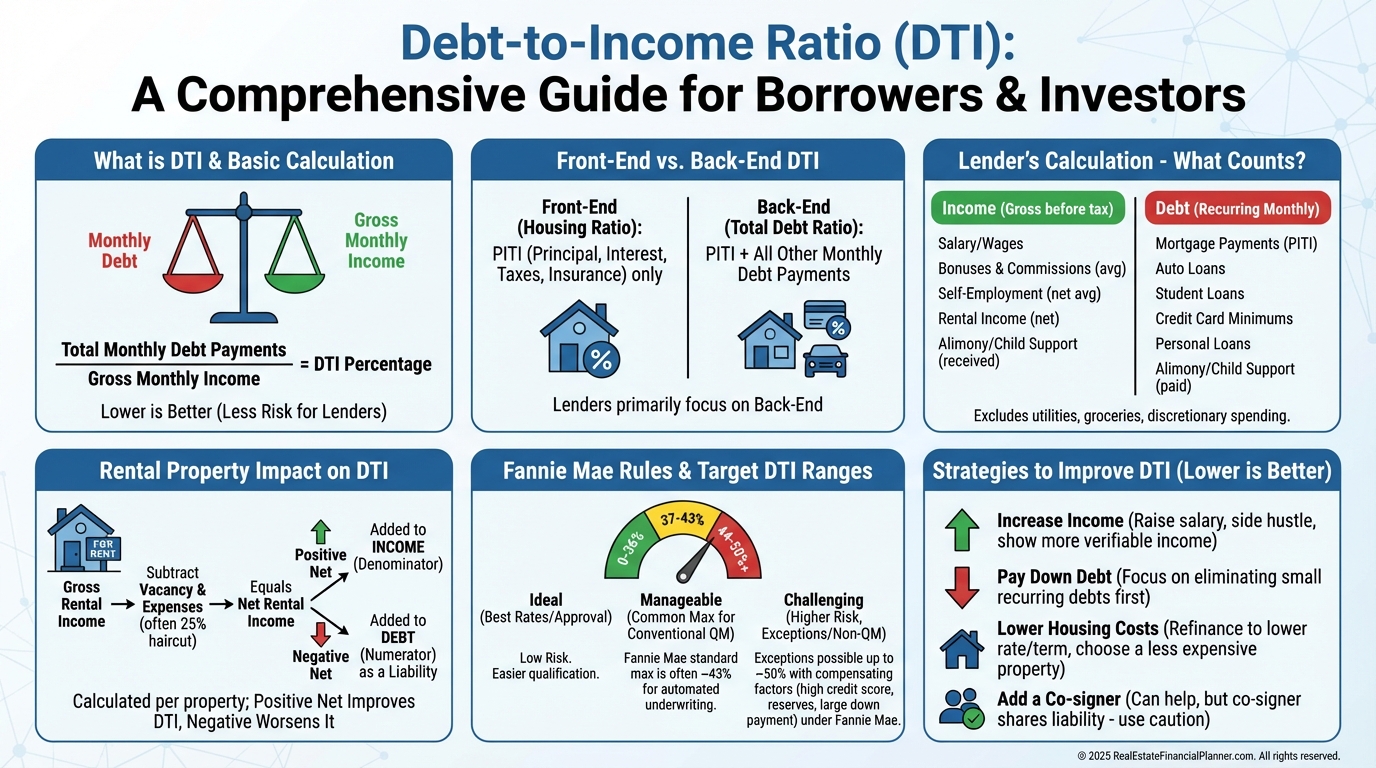

What Debt-to-Income Ratio Actually Measures

Your debt-to-income ratio compares how much you owe every month to how much you earn before taxes.

It answers one question lenders care deeply about.

“How much room do you have left if something goes wrong?”

DTI is calculated as:

DTI = Total Monthly Debt ÷ Gross Monthly Income

Lower is better.

Not because lenders are conservative.

Because math is unforgiving.

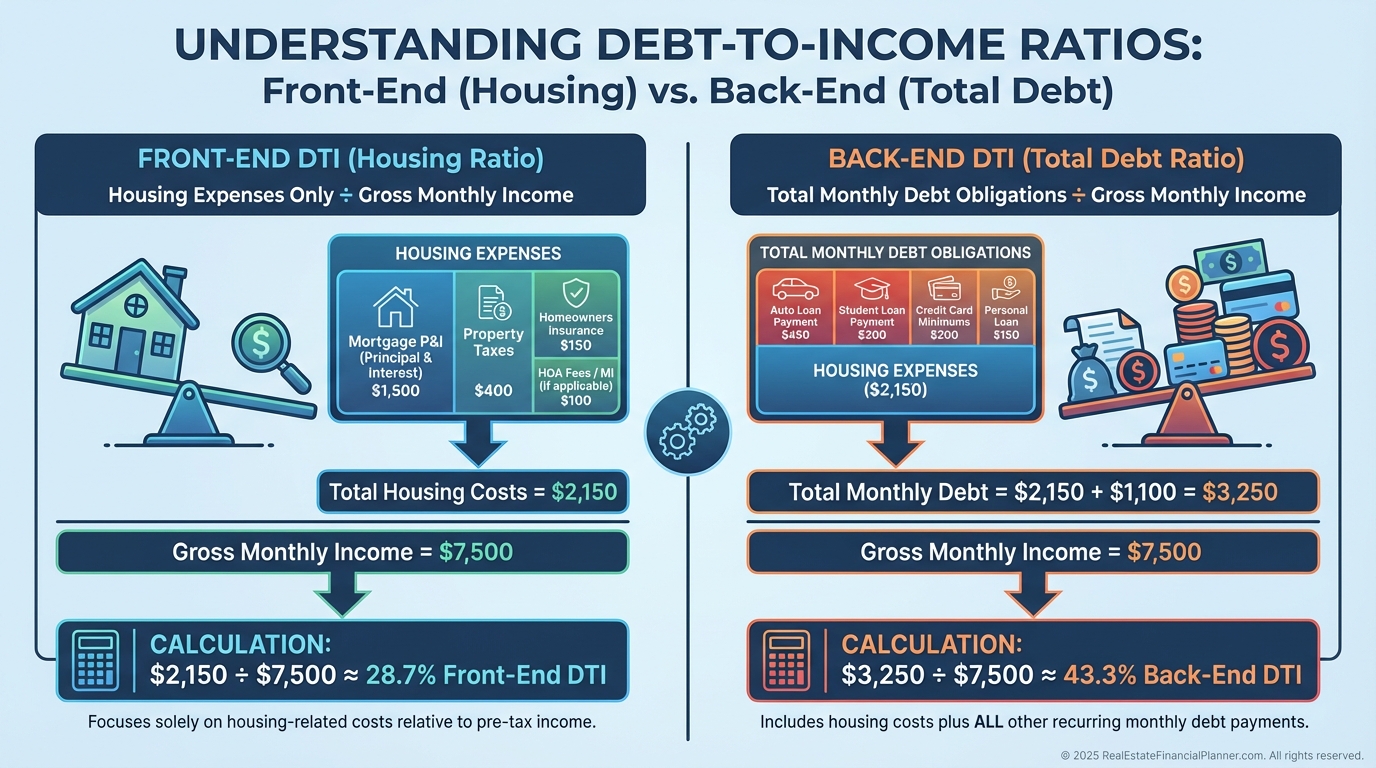

Front-End vs Back-End DTI

There are two versions of DTI, but only one really matters.

Front-end DTI looks only at housing expenses like principal, interest, taxes, insurance, and HOA dues.

Back-end DTI includes everything.

Car payments, student loans, credit cards, child support, personal loans, and housing.

When I review loan files, back-end DTI is what stops deals.

That is the number lenders use to judge risk.

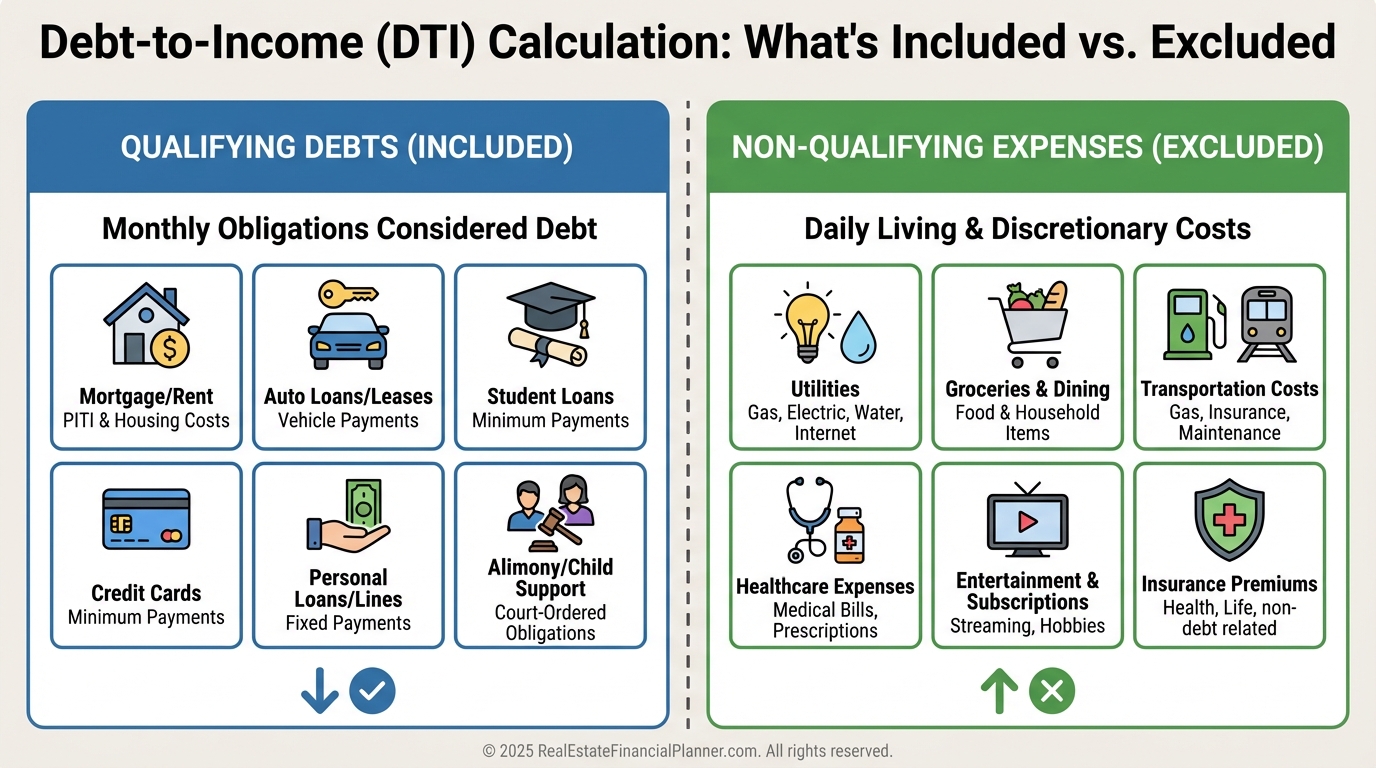

What Counts in DTI (And What Does Not)

This is where investors get tripped up.

DTI includes debts you are legally obligated to pay every month.

Mortgages, car loans, minimum credit card payments, student loans, alimony, and co-signed obligations all count.

Utilities, groceries, insurance premiums, and lifestyle expenses do not.

Your savings do not help your DTI.

Your net worth does not help your DTI.

DTI does not care how wealthy you are.

It only cares about monthly math.

DTI Is Not What Most Investors Think

I regularly hear investors say, “But I have plenty of money.”

DTI does not care.

Living off investments usually does not count unless income is documented, stable, and averaged.

Tax deductions do not reduce DTI.

Paying extra toward principal does not improve DTI unless the payment obligation disappears.

This is one reason I teach investors to separate emotional financial decisions from lender math.

DTI is not personal.

It is procedural.

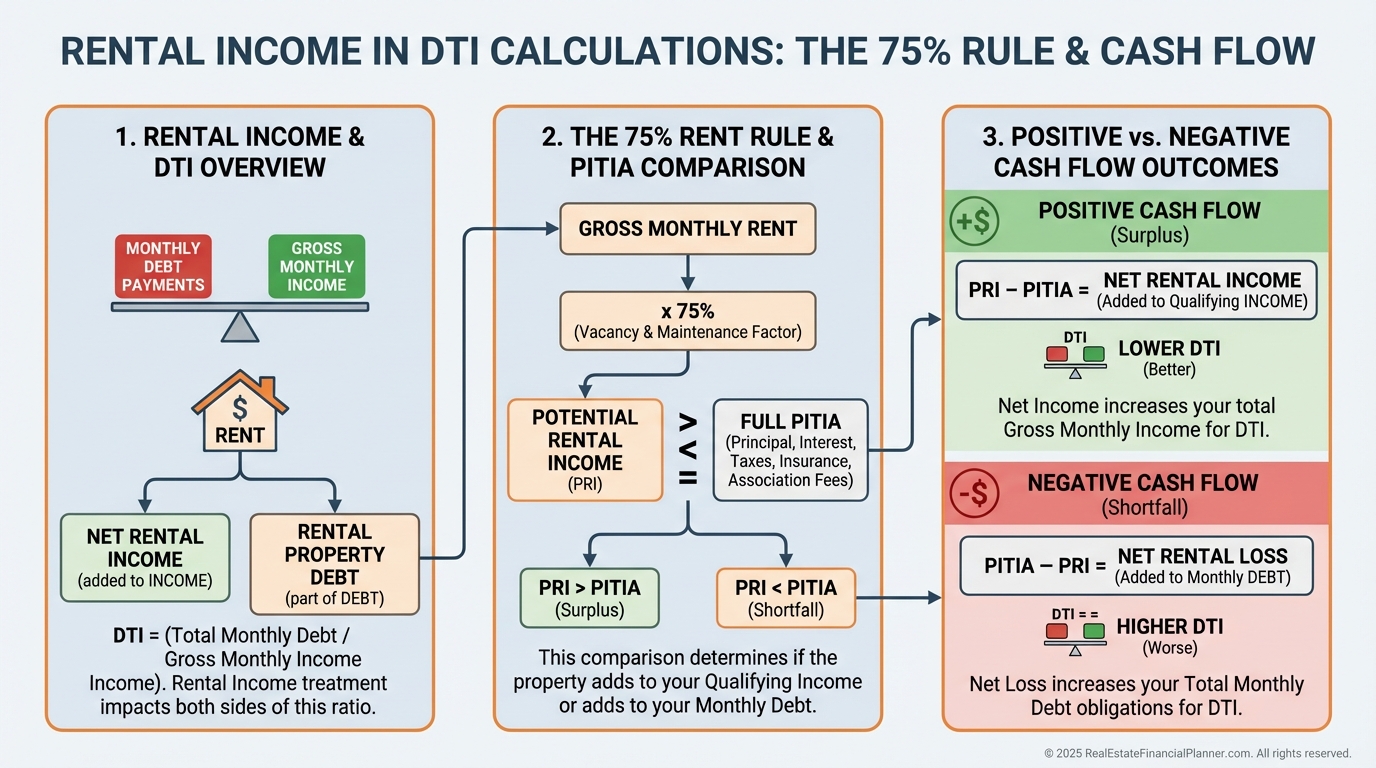

How Lenders Treat Rental Properties in DTI

This is where experienced investors quietly pull ahead.

Rental income can help or hurt your DTI depending on structure, documentation, and experience.

Fannie Mae generally uses seventy-five percent of gross rent.

That remaining twenty-five percent assumes vacancy and expenses.

What happens next depends on whether the property is your primary residence or a pure investment.

If the rental produces positive cash flow after applying the seventy-five percent rule and subtracting PITIA, the excess is added to income.

If it produces negative cash flow, the shortfall is added to debt.

This is why small monthly differences matter.

Income goes on top.

Debt goes on the bottom.

That placement changes everything.

Why Nomads™ Must Be Extra Careful

Nomads™ live in the gray area between owner-occupant and investor.

When converting a primary residence into a rental, documentation matters more than intent.

Signed leases, Schedule E, and property management history determine whether income helps you qualify.

When I model Nomad™ scenarios inside Real Estate Financial Planner™, I always stress-test DTI before the next purchase.

Ignoring this step is how investors stall after one or two properties.

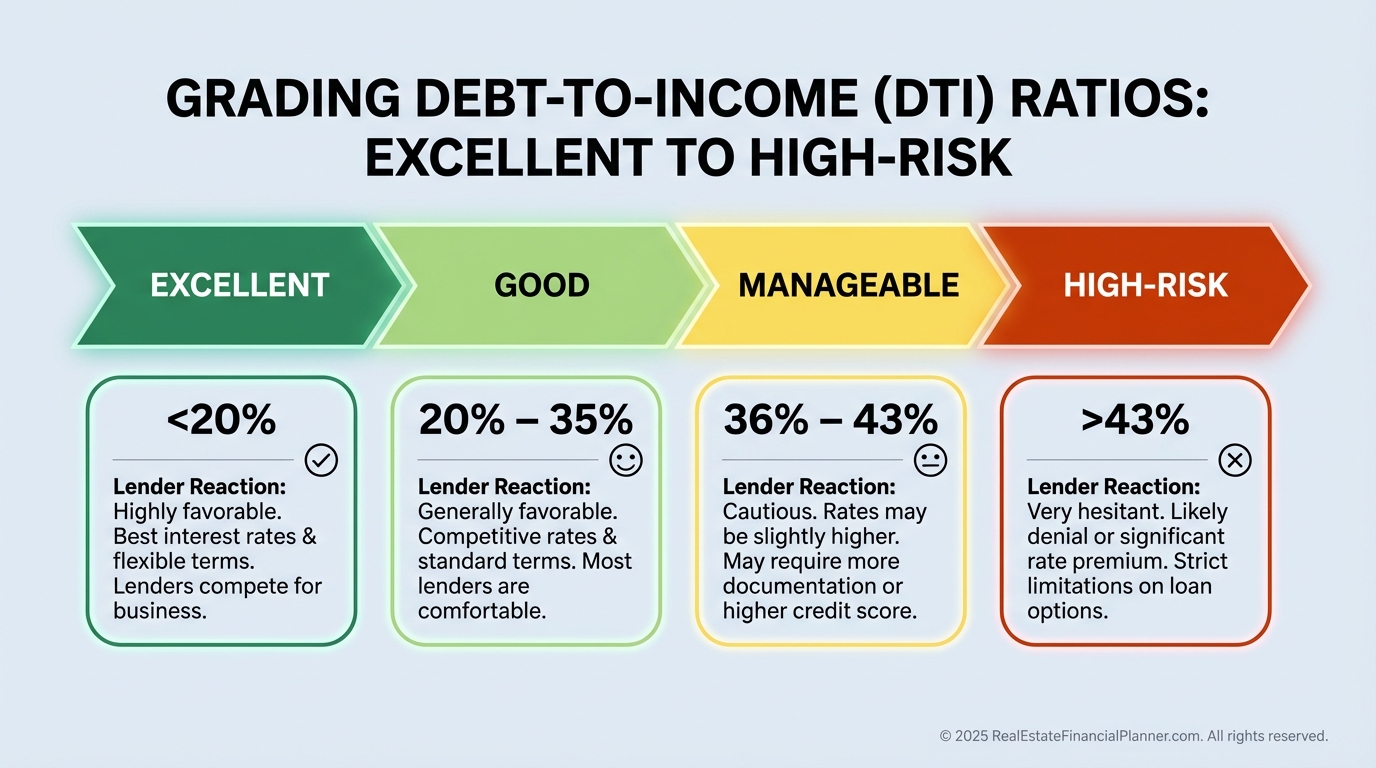

Target DTI Ranges That Actually Matter

These are not goals.

They are guardrails.

Conventional financing prefers thirty-six percent or lower.

FHA allows higher, often into the forties.

DU approvals can stretch toward fifty percent.

Above that, options narrow fast.

When clients ask how many properties they can buy, this is the number I check first.

How to Calculate Maximum Allowable Debt

Sometimes the smarter move is working backward.

If a lender caps DTI at forty-five percent, multiply income by 0.45.

That gives you total allowable monthly debt.

Subtract existing obligations.

What remains is your mortgage budget.

This approach prevents emotional overbidding and keeps financing realistic.

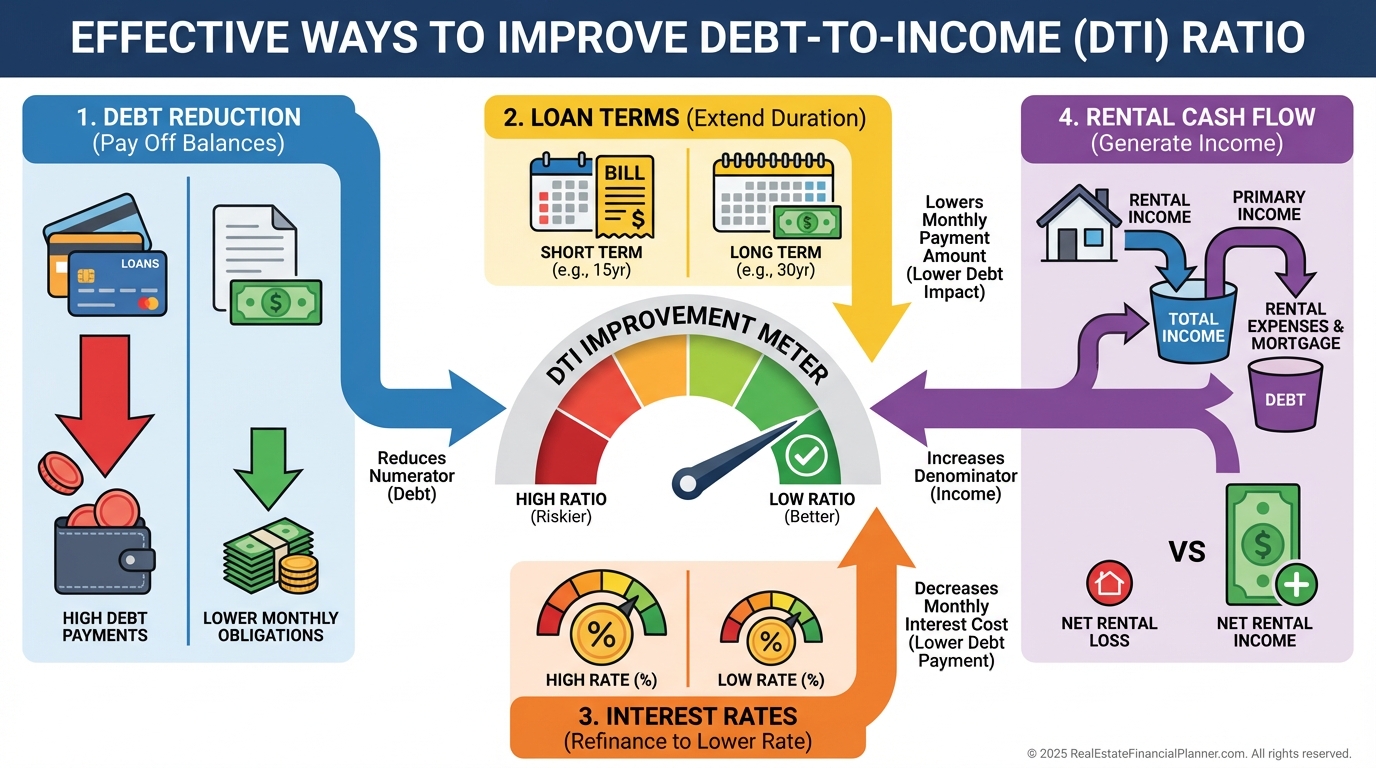

The Fastest Ways Investors Improve DTI

Reducing debt almost always beats increasing income.

A hundred dollars less in monthly debt often equals hundreds in required income.

This is why paying off small, annoying debts often unlocks entire properties.

Better interest rates help.

Longer loan terms help.

Positive rental cash flow helps.

DTI rewards boring, disciplined decisions.

Why DTI Is a Portfolio Risk Metric

I treat DTI as a risk indicator, not just a loan hurdle.

High DTI reduces flexibility.

It limits resilience.

It magnifies stress when rents soften or expenses spike.

Inside the Return Quadrants™, DTI quietly influences cash flow risk and financing risk.

Ignore it long enough, and it becomes the thing that stops momentum.

Manage it deliberately, and it becomes an advantage.