Price Per Bedroom: The Investor’s Edge Most Missed (How to Value, Compare, and Profit)

Learn about Price Per Bedroom for real estate investing.

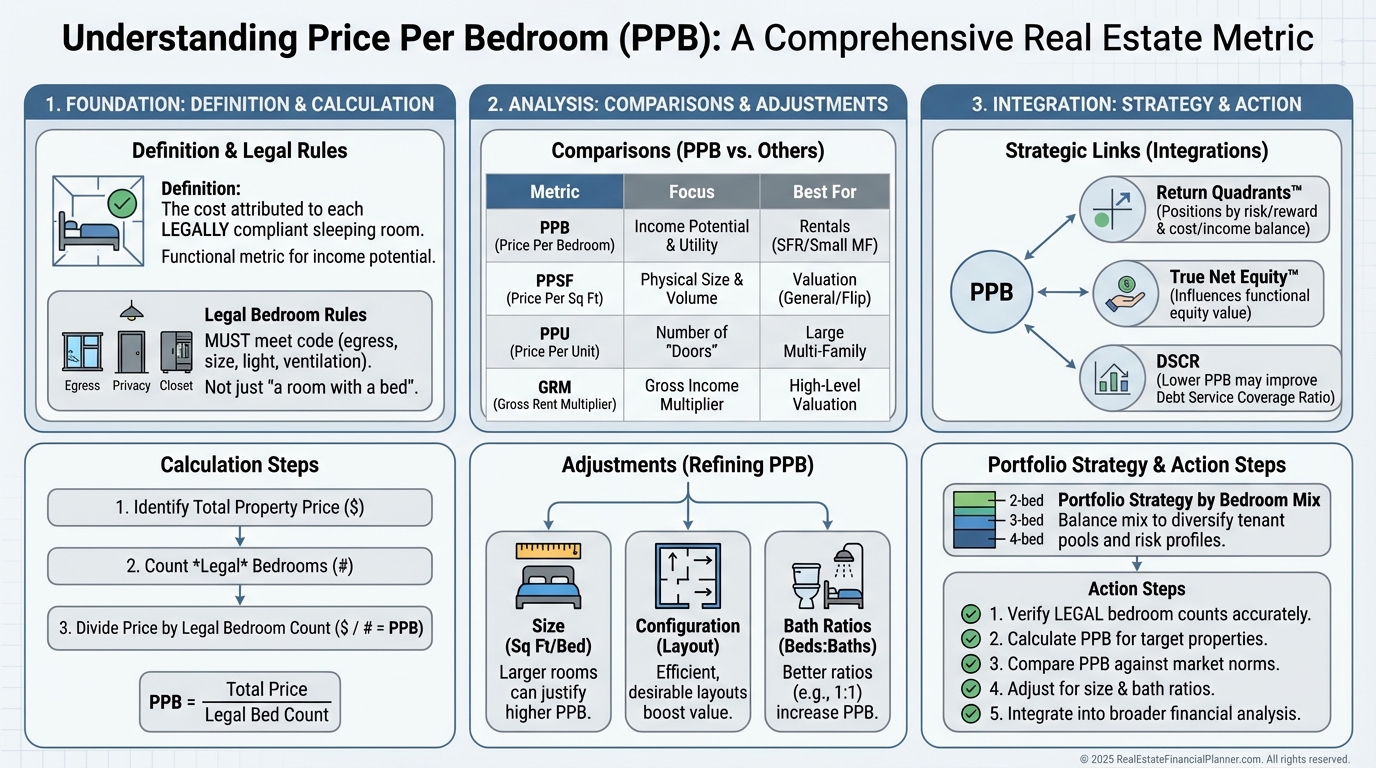

Why Price Per Bedroom Belongs In Your Toolkit

Most investors obsess over price per square foot and cap rate while overlooking the metric that better predicts rent: price per bedroom.

When I help clients hunt for cash flow, this single number regularly separates “cheap headaches” from “quiet winners.”

Price per bedroom is simple: total price divided by the number of legal bedrooms.

Simple does not mean shallow. Bedrooms drive tenant demand, rent ceilings, and holding stability more than almost any other feature.

I’ve modeled thousands of deals, and this metric consistently foreshadows which properties will hit the Return Quadrants™ the strongest.

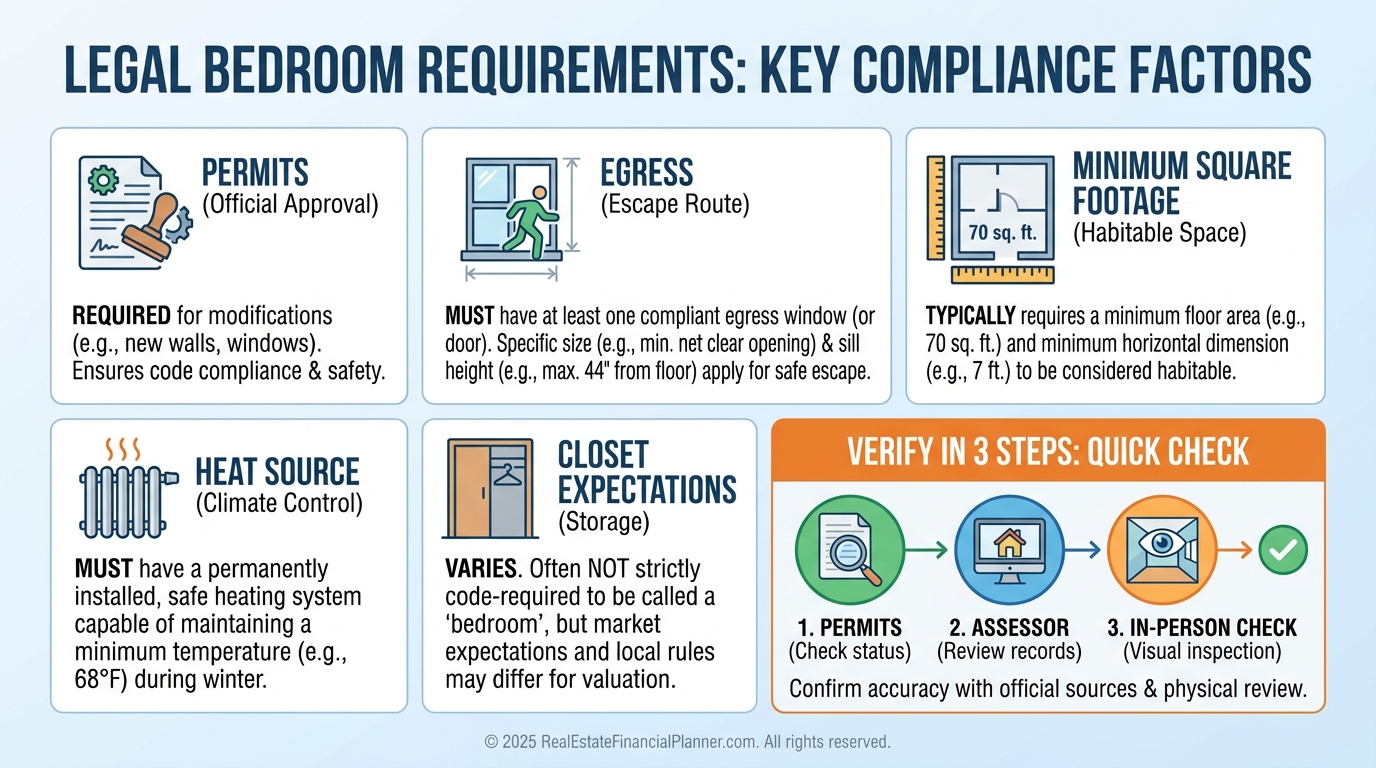

What Counts As A Bedroom (Legally)

“Legal” is non‑negotiable.

A bedroom must meet local code for egress, minimum square footage, natural light/ventilation, and often a closet.

When I audit deals, I verify with permits and assessor records, then confirm on site.

If it won’t pass permitting today, I treat it as zero bedrooms in my analysis.

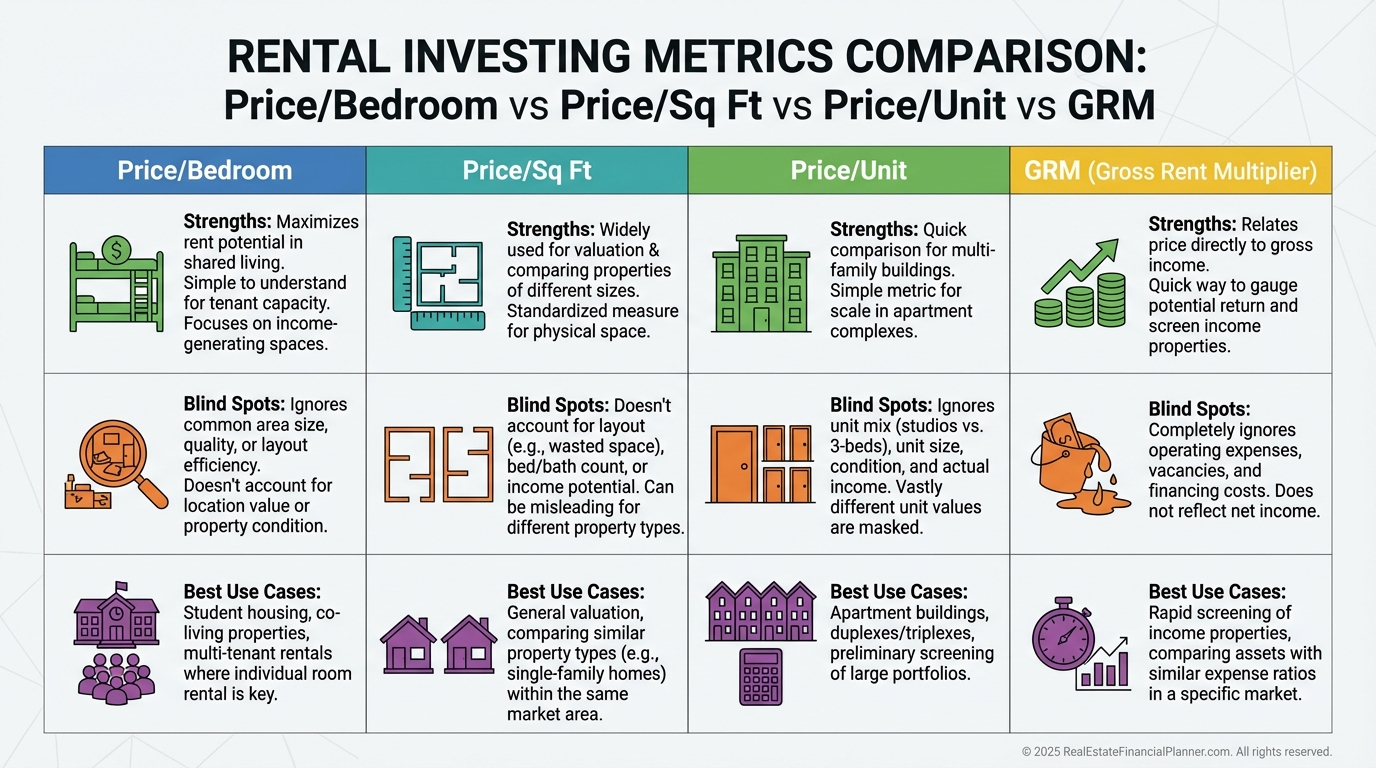

How Price Per Bedroom Differs From Similar Metrics

Price per square foot misleads income investors because square footage doesn’t rent, bedrooms do.

Price per unit hides the massive rent variance between a 1-bed and a 3-bed.

GRM highlights income relative to price, but it doesn’t explain why a property earns what it earns or what you can change to improve it.

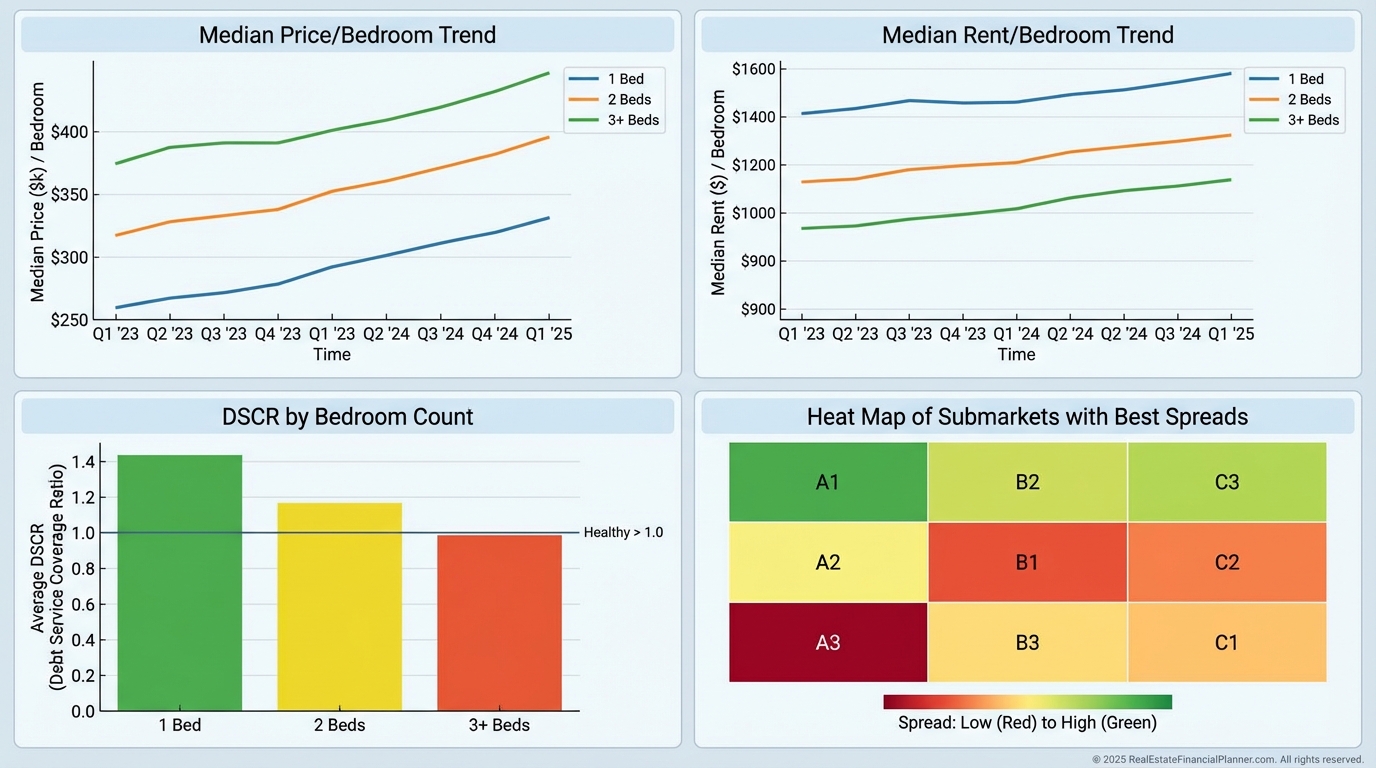

When I’m screening 100+ listings, I rank by price per bedroom first, then layer in rent-per-bedroom and DSCR.

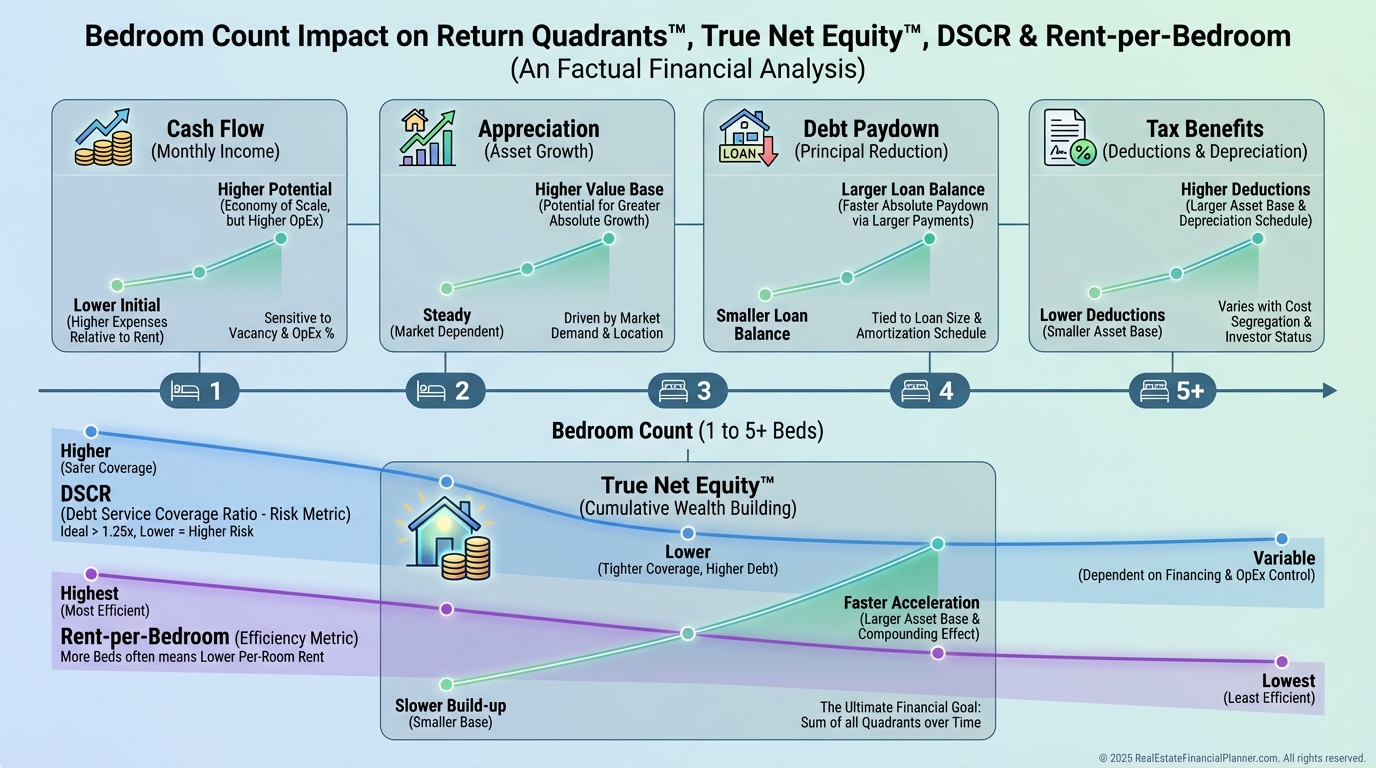

How It Connects To REFP Frameworks

On the Return Quadrants™, more conforming bedrooms usually lift cash flow and reduce vacancy, supporting appreciation via stronger comps.

True Net Equity™ often jumps when you add a legal bedroom because appraisers adjust for bedroom count.

For Nomad™, the best house-hacks frequently optimize rent-per-bedroom while you live in one room.

In The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I monitor price per bedroom alongside rent per bedroom to sanity-check pro forma rents and DSCR.

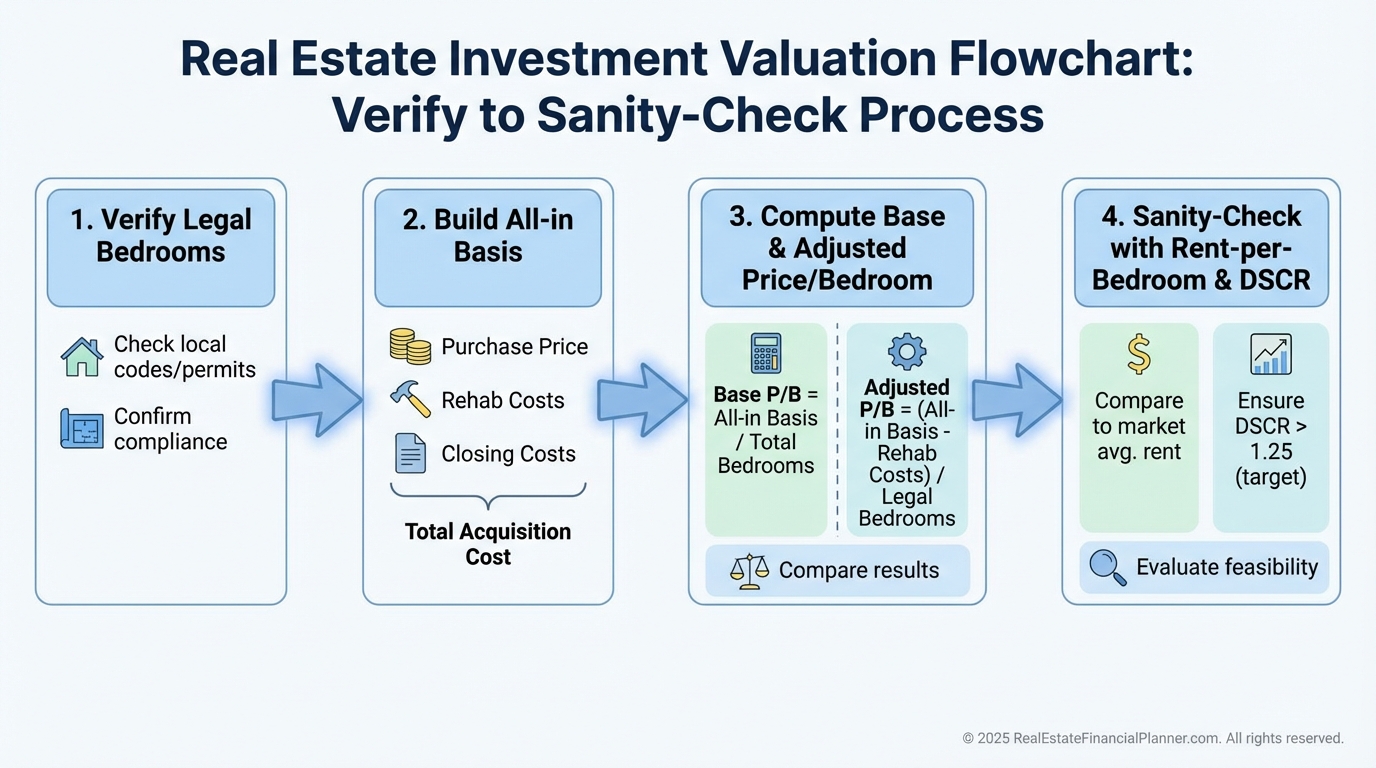

Step‑By‑Step: Calculate It Right

Start with all-in purchase price, not just the contract price.

Include closing costs, immediate make-ready, and transfer fees to reflect your true basis.

Divide by the verified legal bedroom count.

Then create an adjusted version that includes planned renovation costs if you’re adding a legal bedroom.

When I coach clients, we store both base and adjusted figures so we can compare apples-to-apples across deals.

Data Sources And Field Checks

Pull sold comps with identical bedroom counts from the MLS, then export to audit outliers.

Cross-check assessor data and permit history for additions or garage conversions.

Scan active rental listings and property manager reports to build a rent-per-bedroom table by neighborhood.

When I rebuilt after bankruptcy, I learned to trust what the market pays, not what a glossy listing promises.

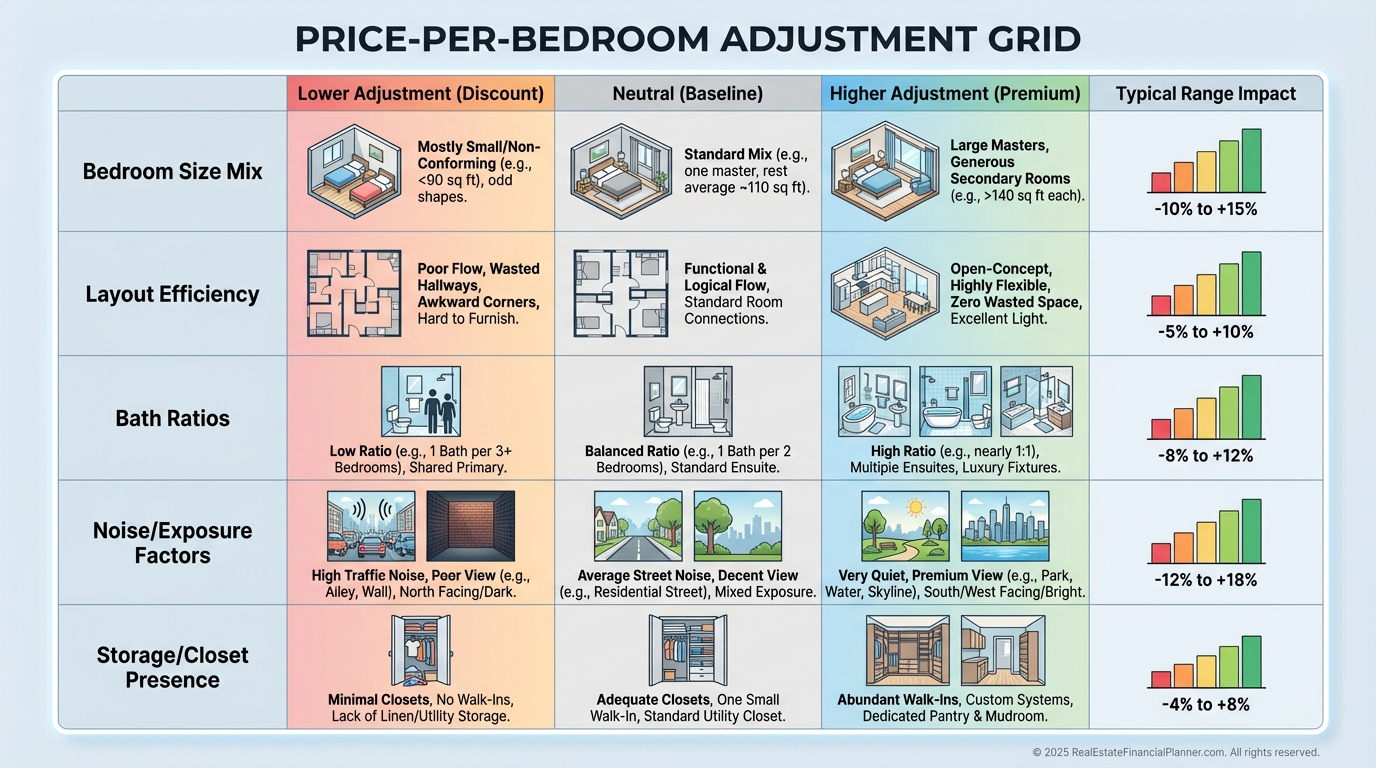

Advanced Adjustments Pros Make

Discount for tiny secondary bedrooms or awkward layouts.

Reward single-level bedroom clusters and balanced bath ratios.

I apply 10–15% discounts when three of four bedrooms are undersized or have poor egress location.

I’ll also bump value when a 4-bed has a 2:1 bedroom-to-bath ratio and sensible circulation.

Worked Examples You Can Copy

Sarah skipped a “too expensive” 4-bed at $220,000 and bought a 2-bed at $165,000.

Her 2-bed cost $82,500 per bedroom and rents for $1,200, while the 4-bed was $55,000 per bedroom and rents for $2,100.

Marcus reviewed a triplex at $300,000 with 6 total bedrooms renting for $3,250.

At $50,000 per bedroom, it sat below the $52,000 local small-multifamily average, and rent-per-bedroom supported modest upside after light updates.

Valuations, Appraisals, And Financing

Appraisers routinely adjust for bedroom count, often $5,000–$15,000 per bedroom depending on market conditions.

Owners who legally add a bedroom can unlock higher appraisals and refinance options sooner.

Conventional lenders prefer 2–4 bedrooms for single-family; unusual counts may need portfolio loans.

More bedrooms generally improve DSCR because rent scales faster than expenses, especially when utilities are tenant-paid.

Investor Returns And Thresholds

Across many markets I track, price per bedroom bands correlate to performance.

Below-market price per bedroom often coincides with 10%+ cash-on-cash when condition and location are solid.

Each $10,000 increase in price per bedroom typically compresses cap rates roughly 1% absent other value drivers.

I set “green zones” by submarket, often $45,000–$65,000 per bedroom for bread-and-butter homes, then adjust for condition and school zones.

Avoid These Common Mistakes

Don’t count non‑conforming rooms.

Don’t chase five-bedrooms in a two‑bedroom renter submarket.

Don’t ignore layout, busy-street windows, or bedroom-through-bedroom access problems.

Don’t compare single-family price per bedroom directly to multifamily without normalizing.

And never let a good metric blind you to location trends or deferred maintenance.

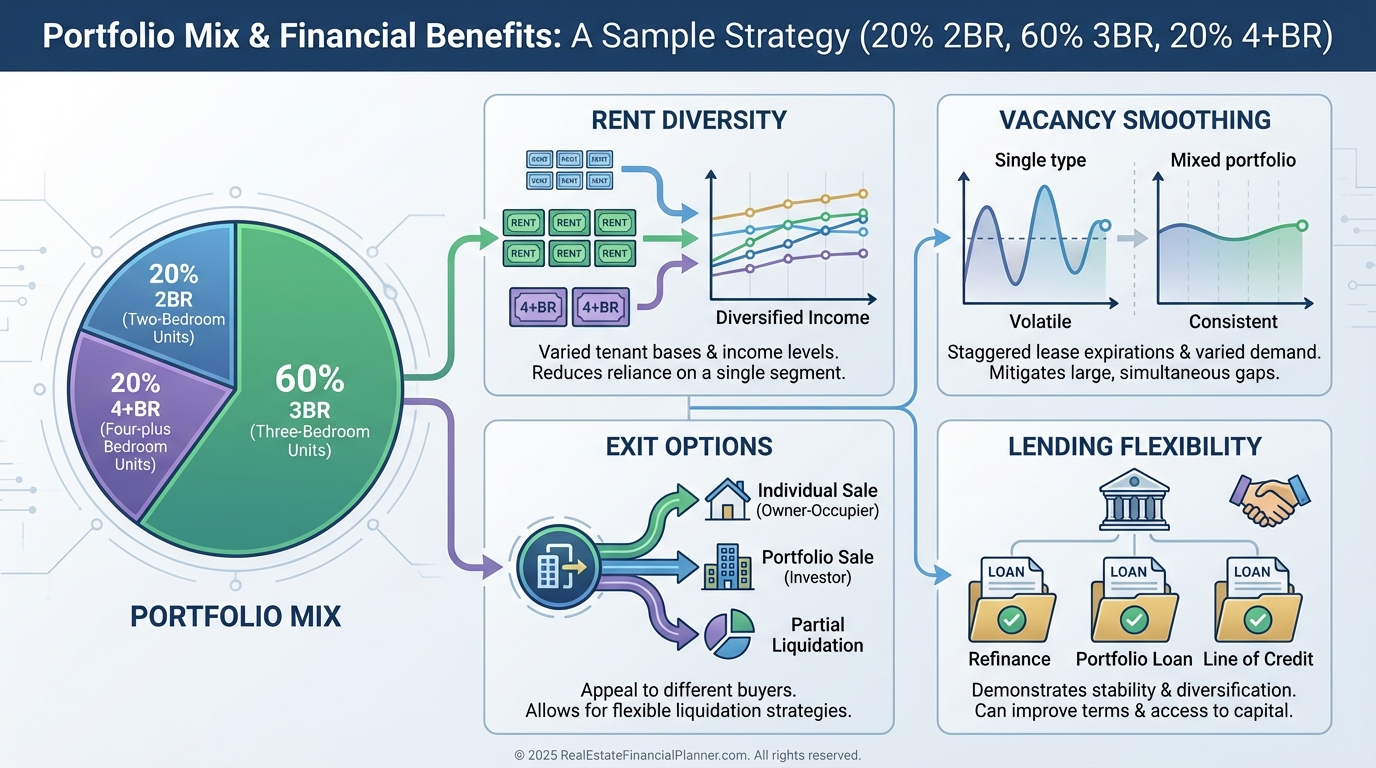

Strategy: Portfolio Design And Market Use

Start with 3–4 bedroom homes for the broadest tenant pool, lowest price per bedroom, and straightforward exits to owner-occupants.

As you scale, diversify with a measured mix of 2-bedrooms and select 4+ bedrooms to smooth vacancy across tenant segments.

I like a 20/60/20 mix for 2/3/4+ as a starting point, tuned to your city’s demand curve.

Track median price per bedroom quarterly by neighborhood.

It often leads broader price shifts by 3–6 months and reveals geographic arbitrage where rents are similar but price per bedroom is cheaper.

Exit Planning And Value-Add

Adding a legal bedroom is one of the highest-ROI value-adds when the price-per-bedroom premium exceeds renovation cost.

I’ve seen $15,000 bedroom conversions add $25,000–$40,000 in value and $200–$300 in monthly rent when layout and egress are right.

For sales, emphasize favorable price per bedroom to both owner-occupants comparing payments and investors comparing yields.

Case Study: Jennifer’s Fast Flip Or Hold

Jennifer bought a dated 4-bed ranch at $160,000 in a $55,000-per-bedroom area.

All-in after updates was $185,000, or $46,250 per bedroom, with rent potential near $1,900.

She sold at $240,000 to an owner-occupant after light renovations, capturing the appraisal bump tied to 4 conforming bedrooms and a clean layout.

Had she held, her DSCR and True Net Equity™ trajectory also penciled well against local comps.

Action Steps For This Week

Calculate price per bedroom for every property you own or are considering.

Build a quick spreadsheet of recent sales and rentals with columns for price, bedrooms, price/bedroom, rent, and rent/bedroom.

In The World’s Greatest Real Estate Deal Analysis Spreadsheet™, add price per bedroom and rent per bedroom to your default view.

Then set your buy box bands by submarket, and let the outliers bubble to the top.