Motivated Sellers: The Real-World Playbook to Find, Negotiate, and Scale Creative Deals Ethically

Learn about Motivated Sellers for real estate investing.

Why Motivated Sellers Power Profitable, Ethical Deals

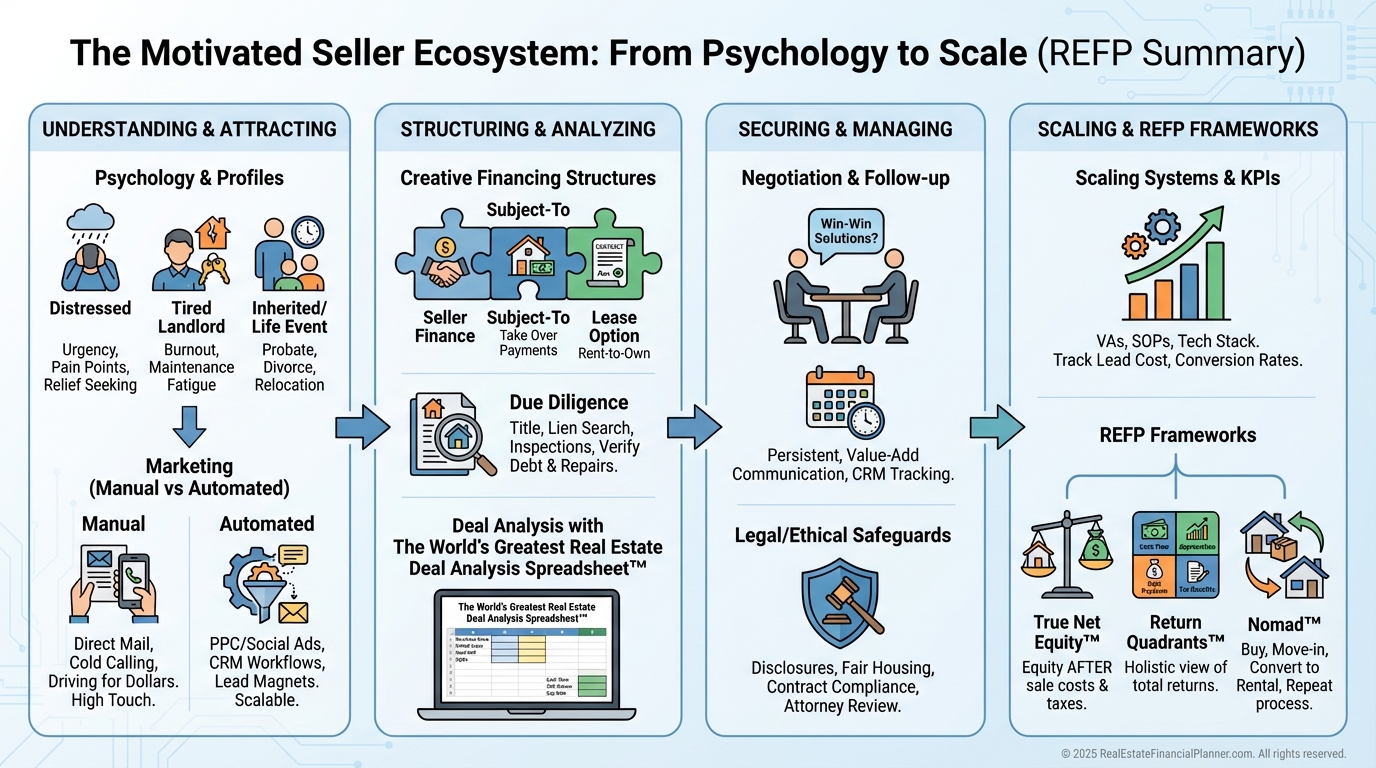

When I help clients build an active acquisition business, we start with one truth: profit follows problems you can solve quickly and cleanly.

Motivated sellers trade some price for speed, certainty, or terms. That’s the opening for creative structures and real value creation.

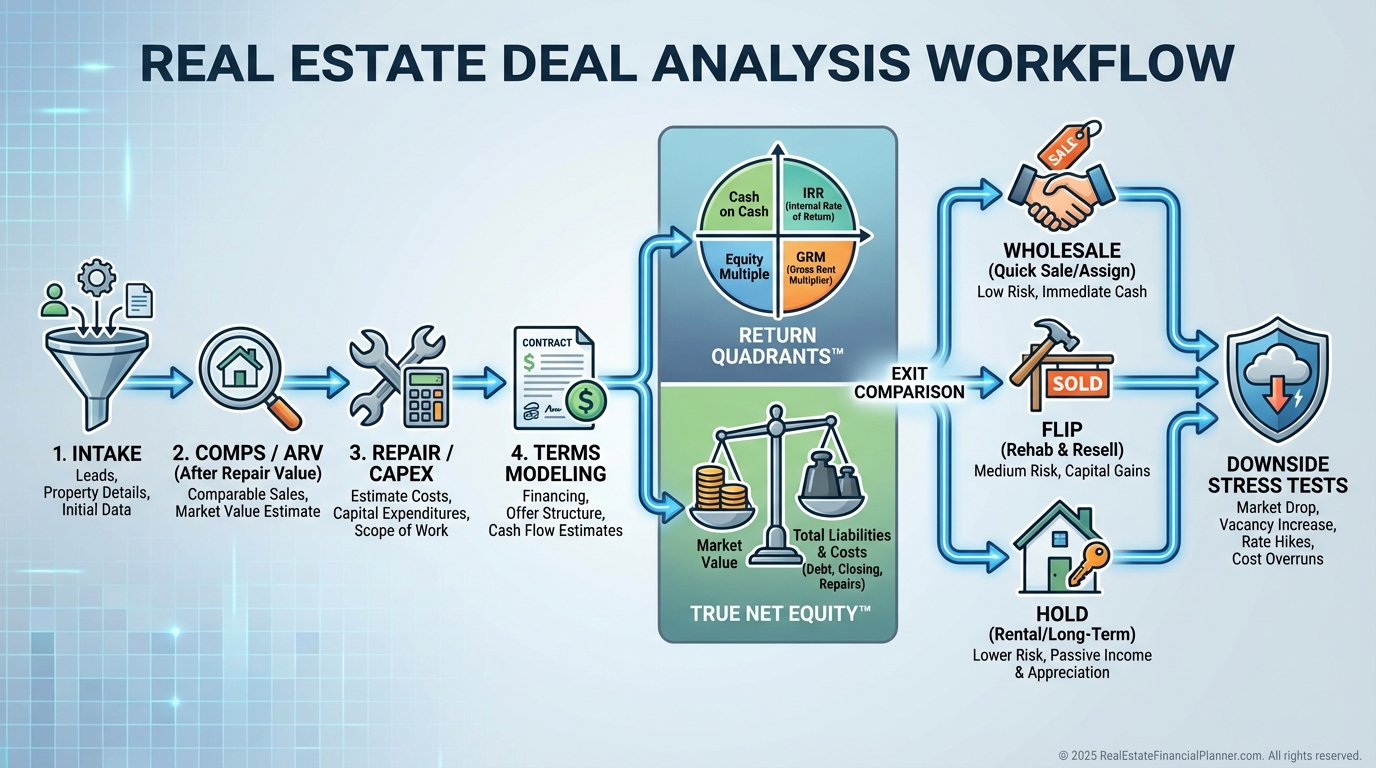

I model every deal with Return Quadrants™ so clients see where the profit actually comes from—cash flow, appreciation, debt paydown, and tax benefits. Motivated seller deals often shift returns toward terms, speed, and value-add, not just market lift.

I also check True Net Equity™ instead of “equity on paper.” After all costs of sale, repairs, turn costs, and reserves, how much equity is real and accessible? That number guides both price and terms.

The Psychology and Profiles of Motivated Sellers

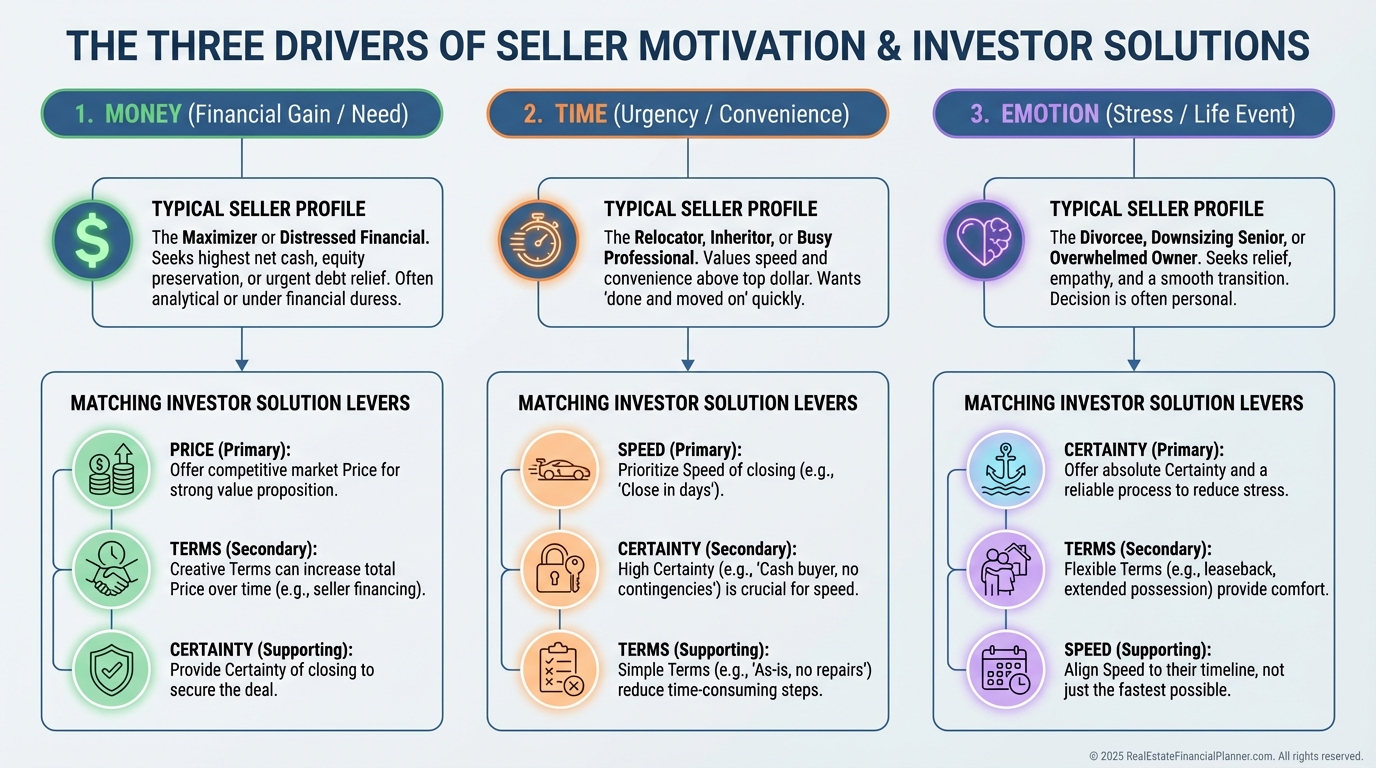

Motivation is usually a blend of money, time, and emotion. You’ll hear it when a seller says, “I just need this off my plate.”

Financial pressure shows up as pre-foreclosure, tax delinquency, or high monthly burn. Time pressure shows up as hard deadlines—auction dates, relocations, probate timelines. Emotional pressure shows up as divorce, death, or landlord fatigue.

I listen for the real constraint. If time is the constraint, I structure speed. If income is the constraint, I structure payments. If certainty is the constraint, I remove contingencies and simplify steps.

Common profiles I target:

•

Pre-foreclosure owners with equity but no time or capital.

•

Probate/estate heirs, especially out-of-state, overwhelmed by repairs.

•

Divorcing owners who need a clean, quick resolution.

•

Tired landlords with deferred maintenance or tenant issues.

•

Absentee owners and code-violation properties with visible distress.

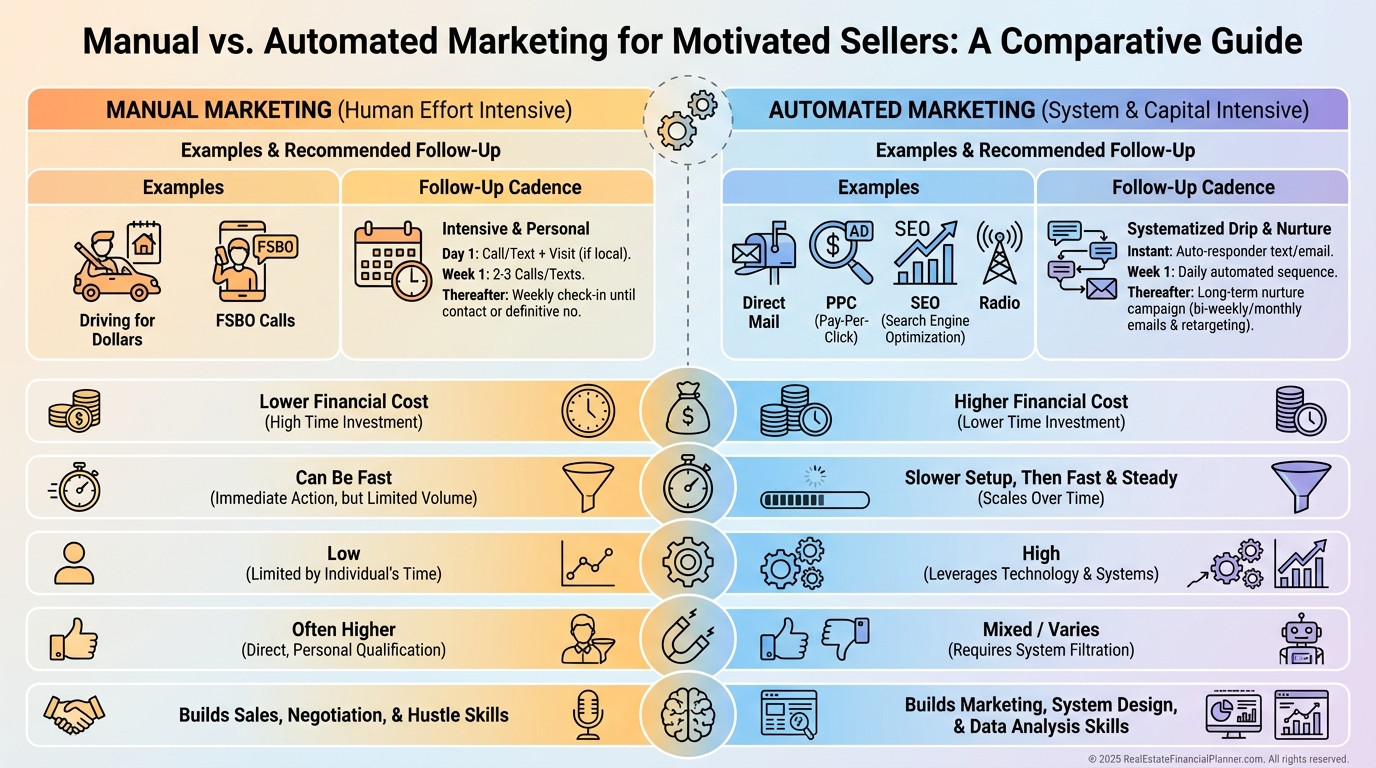

Where the Deals Come From: Marketing That Actually Works

In my playbook, “Poor” marketing means sweat equity. “Lazy” marketing means checkbook equity. Both work; the best businesses blend them.

Poor (manual) methods I use and model:

•

Driving for dollars with skip tracing and same-day outreach.

•

FSBO/expired calling with weekly value-based follow-up.

•

Door knocking on high-probability streets after targeted mail hits.

Lazy (paid) methods I scale when the numbers prove out:

•

Direct mail to stacked lists (pre-foreclosure + tax delinquent + code violations).

•

Google Ads for intent (“sell my house fast [city]”) and SEO content that answers urgent seller questions.

•

Branded radio and retargeting to lift response after mail and PPC.

I warn clients about two traps: inconsistent follow-up and untracked spend. Great channels die without multi-touch follow-up and clear cost-per-contract math.

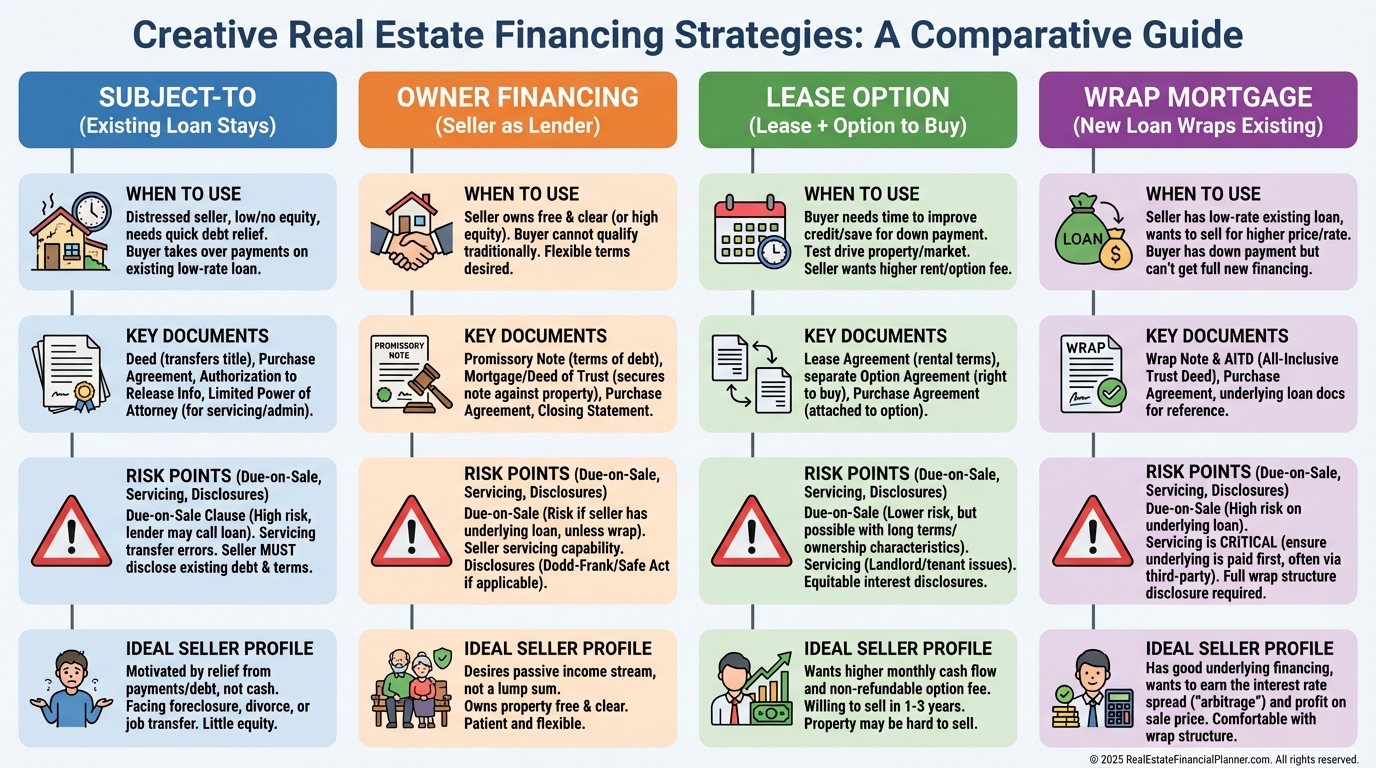

Creative Financing That Solves Real Problems

Motivated sellers are flexible because they need relief more than a retail process. I frame terms as tools to solve constraints, not tricks to win price.

Core structures I use:

•

Subject-To: I take title and keep the underlying loan in place. I protect the seller’s credit with auto-pay, escrow, and clear insurance endorsements.

•

Owner Financing: Seller carries a note. I often trade a higher price for payments that match my cash-flow targets, with balloons that fit my refinance timeline.

•

Lease Option: Great when sellers want income now and a price later. I use sandwich structures only when legal and ethical alignment is clear.

•

Wraps: I create a new note that wraps an existing loan and disclose the due-on-sale risk in plain English.

I avoid “one-size-fits-all” templates. I build terms around the seller’s constraint and my exit. Then I stress-test the deal if rates rise, days-on-market expand, or rents soften.

How I Analyze Deals in Minutes

I run every opportunity through The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to compare exits side-by-side.

For creative terms, I model payment, rate, amortization, and balloons, then I compare to conventional financing. I want to see my Return Quadrants™ under each scenario, not just a single profit number.

I calculate True Net Equity™ by subtracting all costs to access equity: transaction costs, repairs, reserves, and any negative carry during rehab or lease-up. If True Net Equity™ isn’t strong, I pivot terms or price—or pass.

I also simulate downside. When I help clients, we raise vacancy, add days-on-market, and bump interest rates. If the deal still performs, we proceed. If not, we renegotiate or walk.

Communication, Negotiation, and Follow-Up

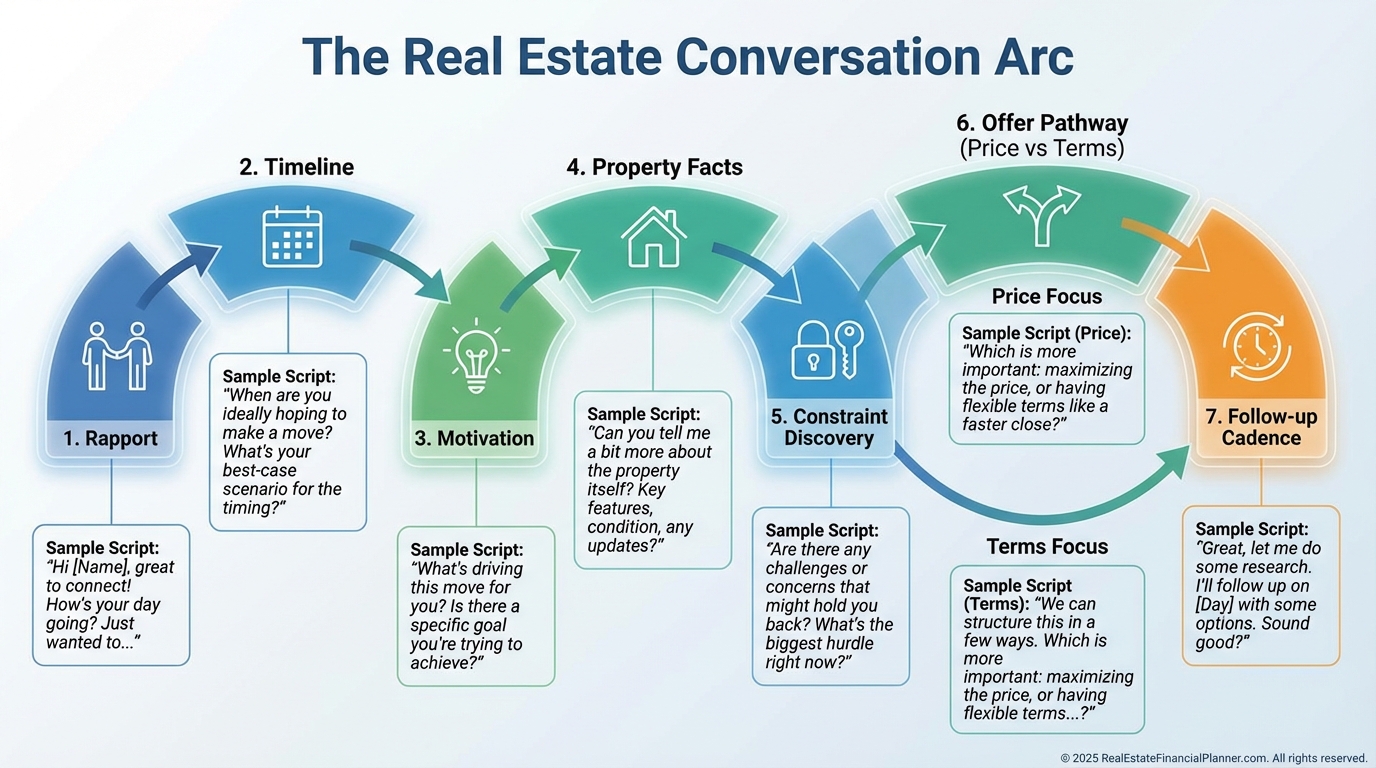

My first calls are problem-finding, not price-fighting. I ask, “What would make this a win for you in the next 30 days?” and then I stop talking.

I mirror and label emotions: “It sounds like the timeline is the hardest piece.” Sellers open up when they feel heard, not hunted.

When terms beat price, I anchor with payment and certainty. “If I could cover the payment, keep the insurance current, and close next week, would that solve the auction problem?”

I systematize follow-up. Hot leads get touched within 24 hours; warm weekly; cold monthly. Every touch adds value—timelines, checklists, or options they didn’t know they had.

Legal, Ethical, and Reputation Safeguards

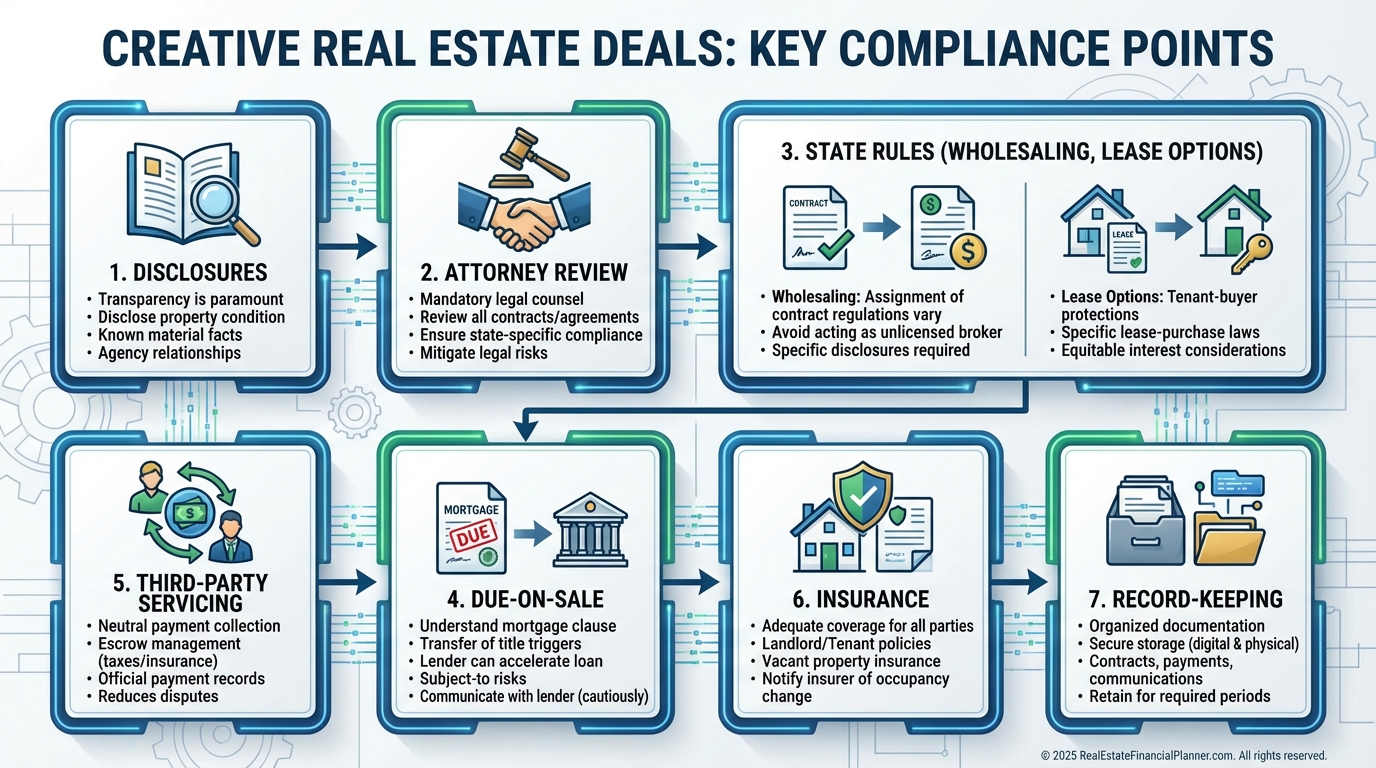

I disclose that I’m an investor, not an agent, and that I intend to profit. I put it in writing and say it aloud.

I engage local counsel to paper creative deals correctly. I follow state rules on wholesaling, equitable interest marketing, executory contracts, and any required disclosures.

I explain the due-on-sale clause, servicing setup, and what happens if I’m hit by a bus. I use third-party servicing for Subject-To and wraps, add lender loss-payee endorsements, and keep everything verifiable.

I avoid equity stripping. If a seller needs a second opinion, I encourage it. Long-term reputation beats short-term spread.

Systems and KPIs to Scale Confidently

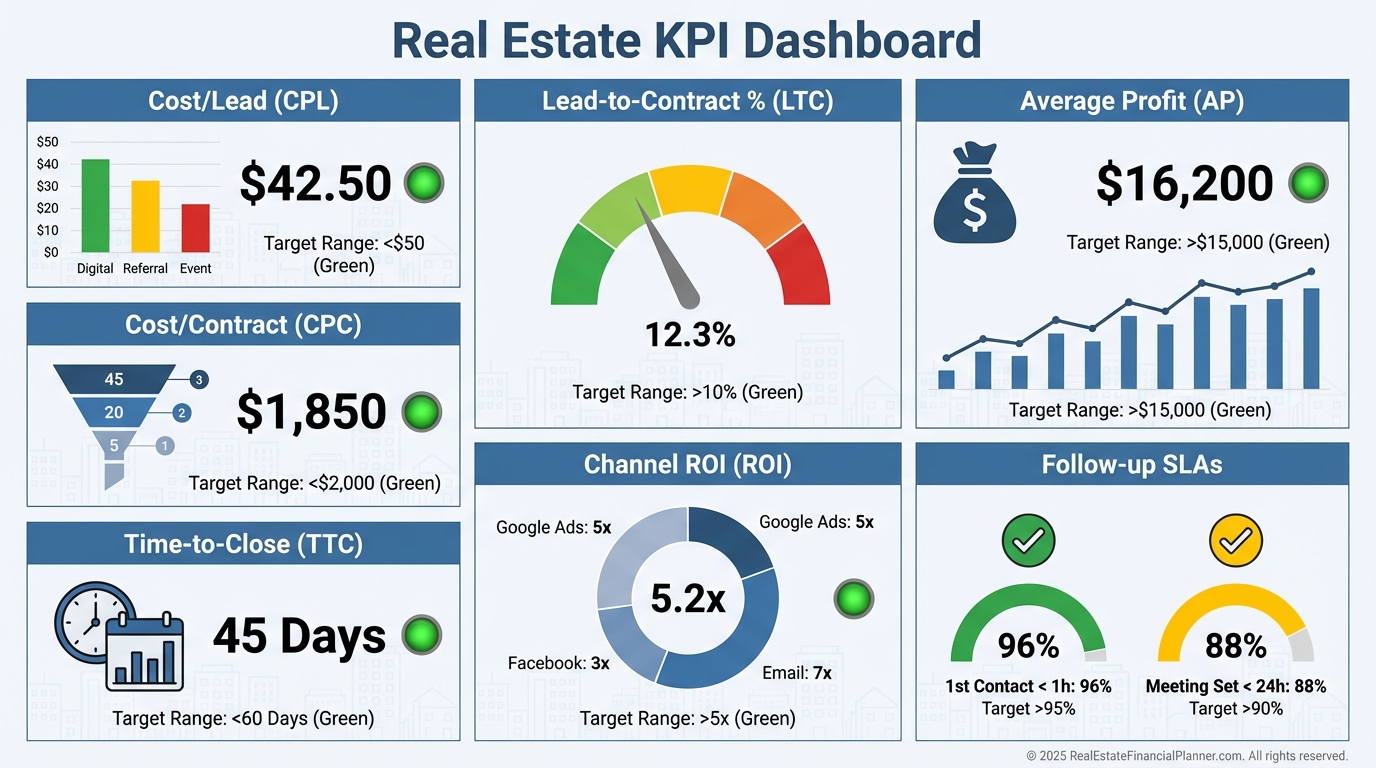

What gets measured gets multiplied. I track cost per lead, cost per contract, lead-to-appointment, appointment-to-contract, average profit, and days from lead to close.

I also segment by channel. When I rebuilt a client’s marketing mix, PPC delivered faster contracts while direct mail delivered higher spreads. We scaled both with different expectations and budgets.

I document SOPs for intake, comps, offers, follow-up, and closings. Then I delegate: VA for skip tracing and first touches, acquisitions for appointments and negotiations, dispositions for wholesales, and project management for rehabs.

Taking Action in the Next 7 Days

Pick one channel and commit for 90 days. Consistency beats clever.

Build a stacked list and launch a 3-touch mail sequence, or set a daily target of 25 quality seller conversations. Do not split focus until you have data.

Analyze every serious lead with The World’s Greatest Real Estate Deal Analysis Spreadsheet™. Compare exits, model terms, and calculate True Net Equity™.

Finally, follow up like a pro. Deals often come from the third or fourth conversation, after the seller has tested other options and learned that you kept your word.