Loss of Rent Coverage: Protect Your Rental Cash Flow

Learn about Loss of Rent Coverage for real estate investing.

At 2:17 a.m., my client Lily called from the sidewalk in front of her duplex, watching firefighters pack up hoses.

Her best unit was down, tenants safe, but repairs would take months.

Her mortgage wasn’t stopping.

Her taxes weren’t stopping.

Her cash flow didn’t have to stop either.

That’s the moment loss of rent coverage earned its keep.

When I help clients pressure-test their portfolios, I don’t ask if something will go wrong.

I ask which month it will happen and how long their income will be offline.

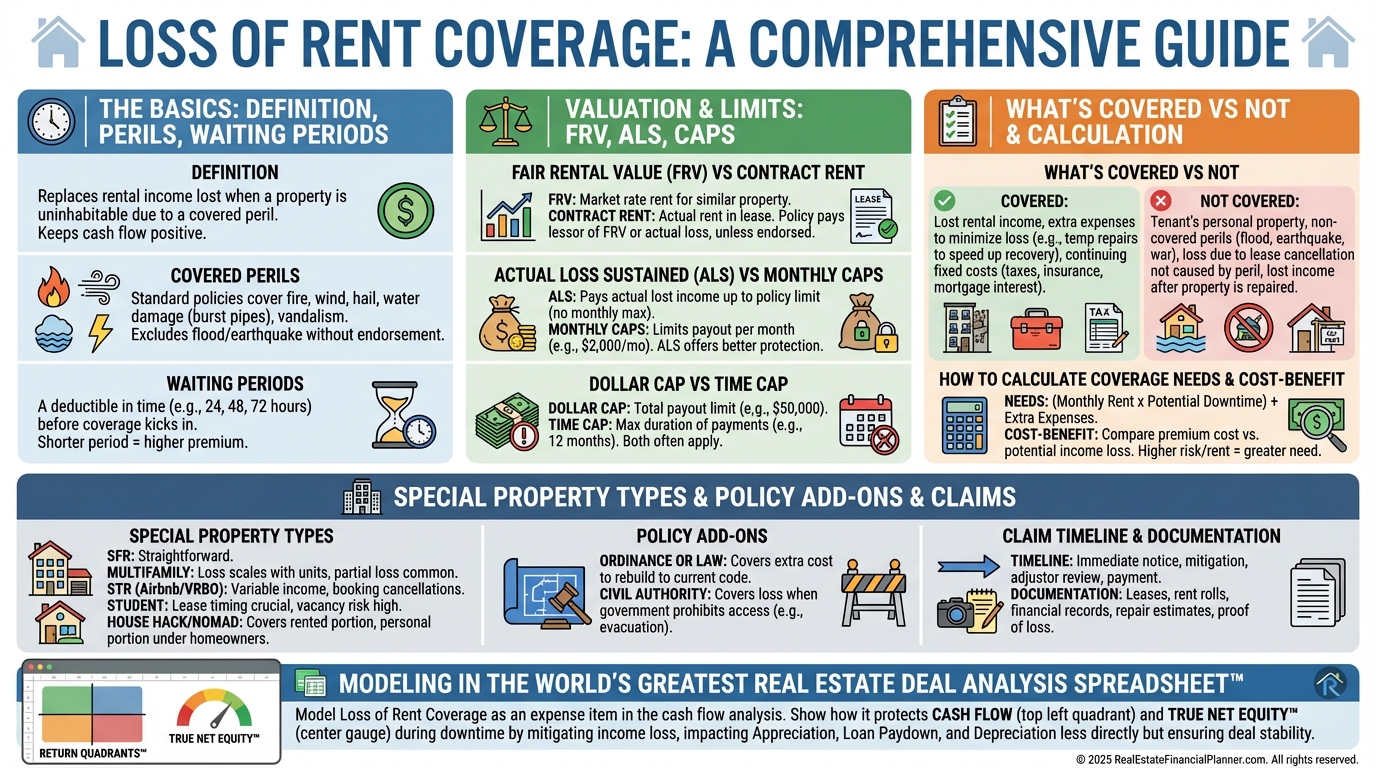

What Is Loss of Rent Coverage?

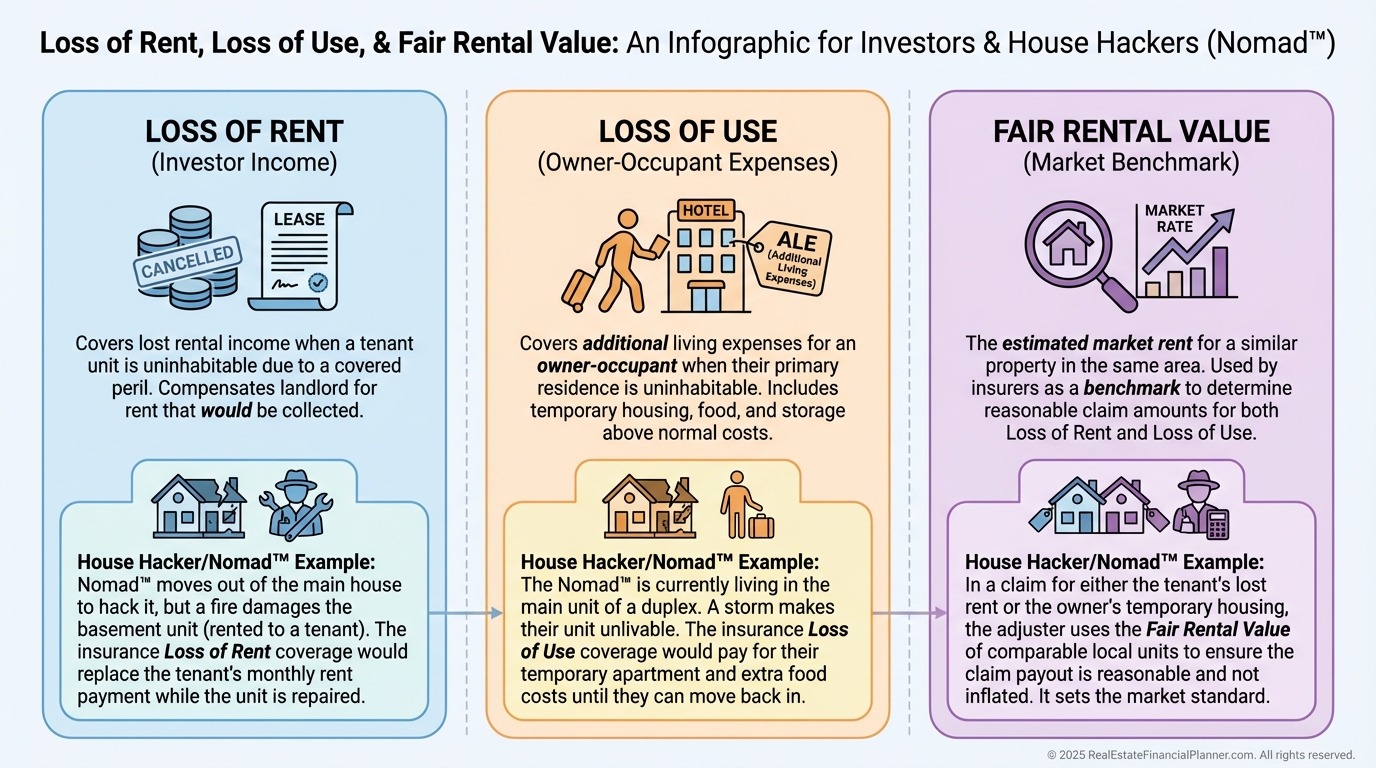

Loss of rent coverage reimburses you for rental income lost when a covered peril makes the property uninhabitable.

Think of it as a cash flow bridge between the day of damage and the day you can reasonably re-lease.

It’s typically an endorsement on a landlord policy, sometimes included, often optional.

It pays based on fair rental value in your market, not always the exact rent you charged.

It is different from loss of use.

Loss of use covers additional living expenses for owner-occupants.

If you’re house hacking or doing a Nomad™ move-in strategy, you may need both: loss of use for your unit and loss of rent for the tenant units.

When Does It Trigger?

Coverage kicks in when a covered peril renders the unit not reasonably habitable.

Common triggers include fire, sudden water discharge, wind/hail, and vandalism included in your base policy.

Flood and earthquake are excluded unless you buy separate policies.

Many policies have a waiting period of 48–72 hours to avoid nuisance claims.

If the loss lasts longer than the waiting period, payments typically backdate to the date of loss.

Civil authority orders that prohibit access can also trigger coverage if endorsed.

How the Money Flows

Insurers pay Actual Loss Sustained (ALS) up to policy limits, or they pay a set monthly amount.

ALS pays the real, documented rent you lost, usually capped by time or dollars.

A monthly cap pays a fixed amount regardless of seasonality or short-term rent variance.

Payments end when the unit is repaired and rentable, you reach the time limit, or you hit the dollar cap.

Here’s a simple pass-through.

You collect $2,100 per month.

A covered kitchen fire takes the unit offline for 4.5 months.

The policy has a 72-hour waiting period, ALS, and a 12-month time cap.

You likely miss about 3 days in month one, then the policy pays fair rental value for the remaining downtime until the unit is again rentable.

If you were undercharging relative to market, ALS uses fair rental value, which can help.

If you were charging a premium above market, expect your payout to be lower than your old rent.

What’s Covered vs. What’s Not

Typically covered:

•

Lost rental income from a covered peril while the unit is uninhabitable.

•

Reasonable utilities to preserve property and enable repairs.

•

Sometimes marketing costs to re-lease, if endorsed.

•

For house hackers, loss of use may cover your temporary living expenses.

Typically not covered:

•

Voluntary vacancies, renovations by choice, or slow lease-ups.

•

Eviction downtime or tenant non-payment unrelated to physical damage.

•

Market-driven rent drops or economic vacancy.

•

Floods and earthquakes without the specific policies that include loss of rent.

•

Code upgrades delays without ordinance or law coverage.

The test I teach clients: was the vacancy involuntary and tied to a covered peril?

If yes, you’re generally in bounds.

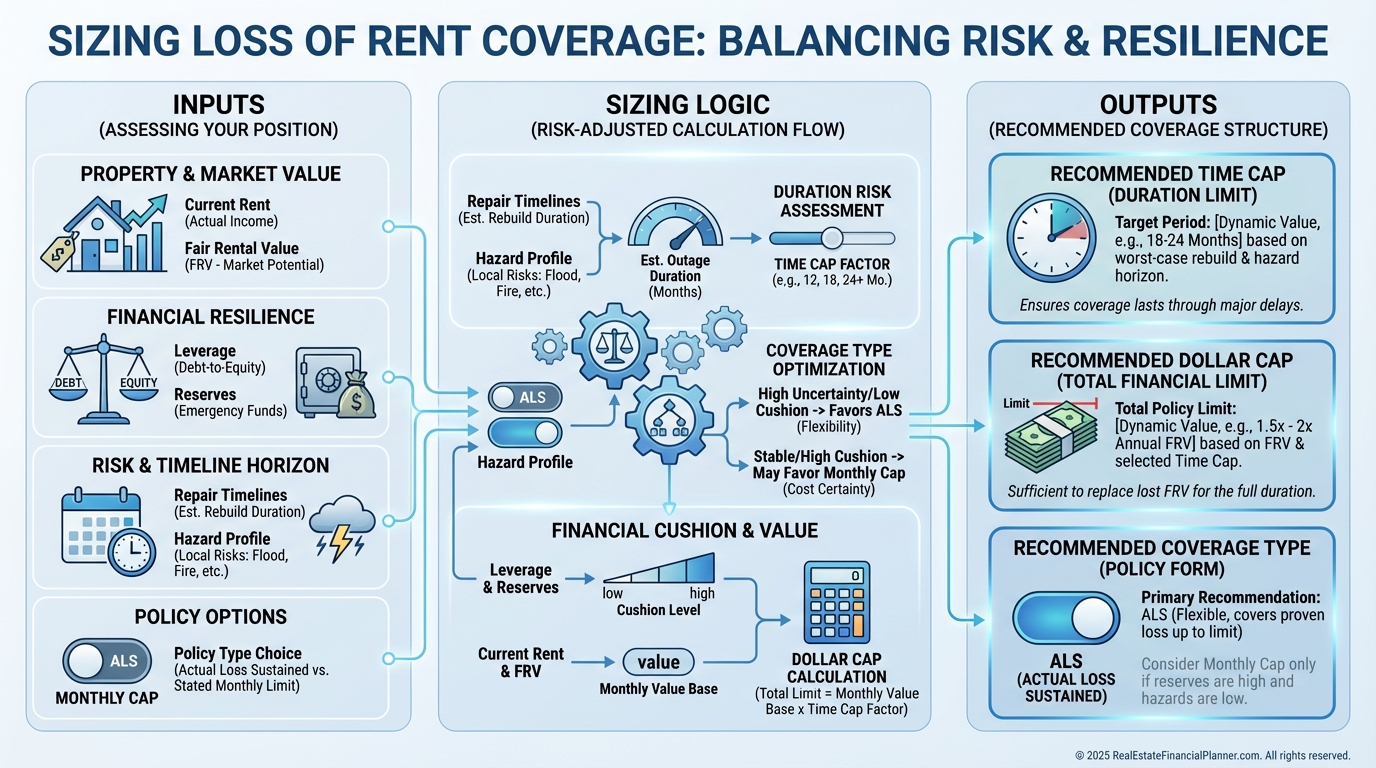

Sizing Your Coverage the Way a Pro Underwrites

Start with current, not hoped-for, monthly rent per unit.

Estimate realistic repair durations for common perils in your market.

Add time for permits, inspections, contractor availability, and material delays.

Decide whether you prefer ALS with a time cap (12–24 months is common) or a fixed monthly limit with a dollar cap.

If highly leveraged or thin on reserves, bias toward higher time caps and ALS.

I model three scenarios in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

•

Base Case: No major losses.

•

Single-Loss Case: One unit down for 6 months.

•

Stress Case: Citywide event with extended timelines.

Then I compare premium costs against the expected value of covered downtime.

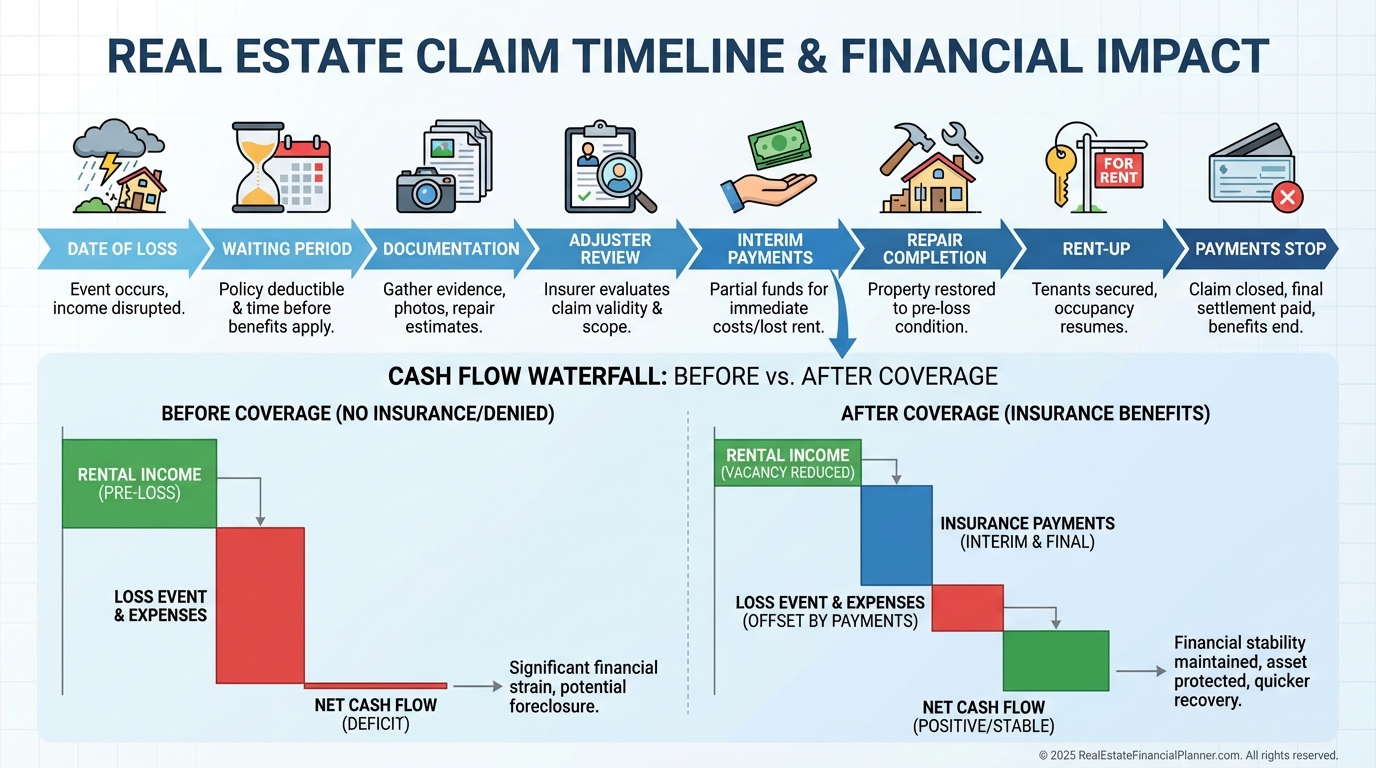

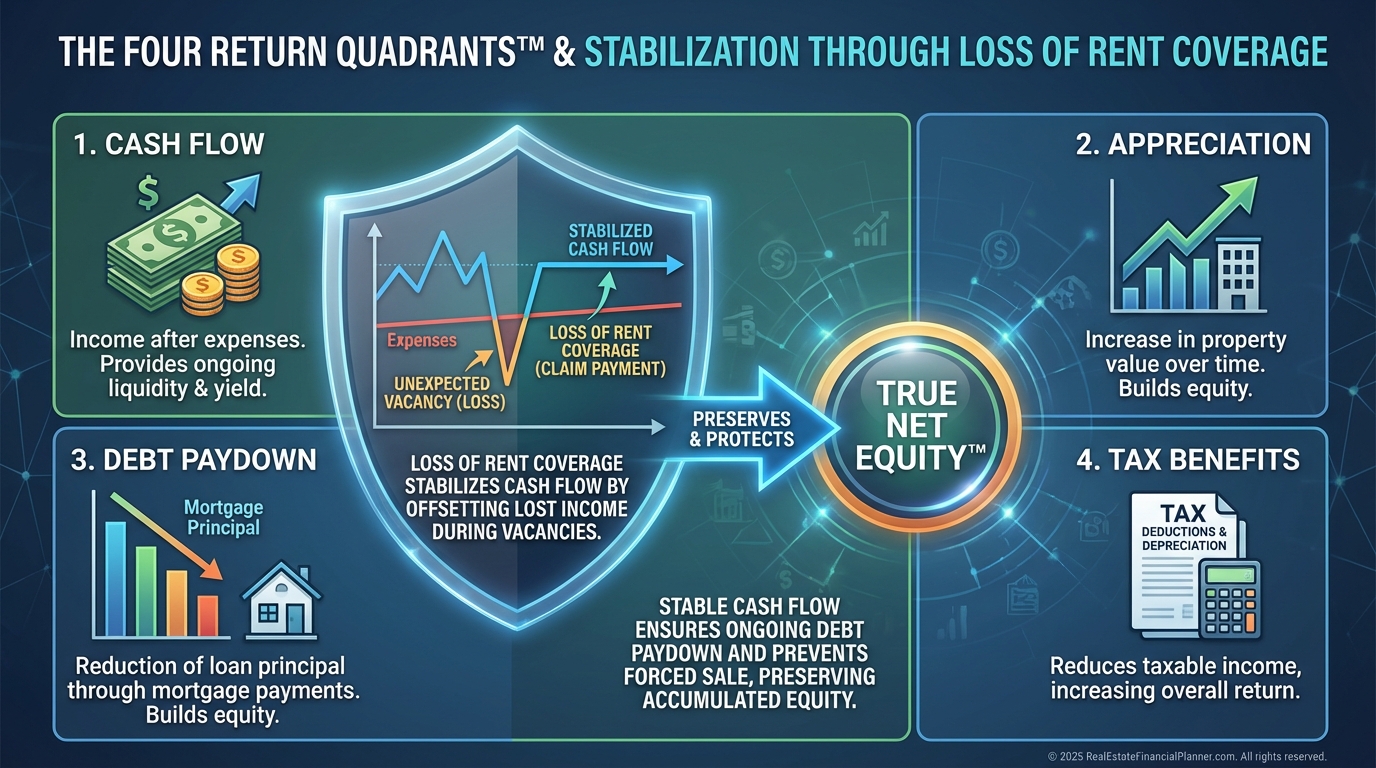

Cost vs. Benefit Through the Return Quadrants™

Premiums often run $100–$500 per year per unit depending on limits and location.

One four-month outage at $1,900 per month is $7,600 of lost income.

Paying $250 per year for that protection is often an easy decision.

In Return Quadrants™, loss of rent coverage protects the Cash Flow quadrant.

Your appreciation and debt paydown may continue, but uncovered cash flow shocks can force sales at the worst time.

I also test True Net Equity™.

A surprise vacancy with ongoing debt service erodes liquidity and can trigger distressed decisions.

Coverage is small, predictable friction that prevents large, chaotic losses.

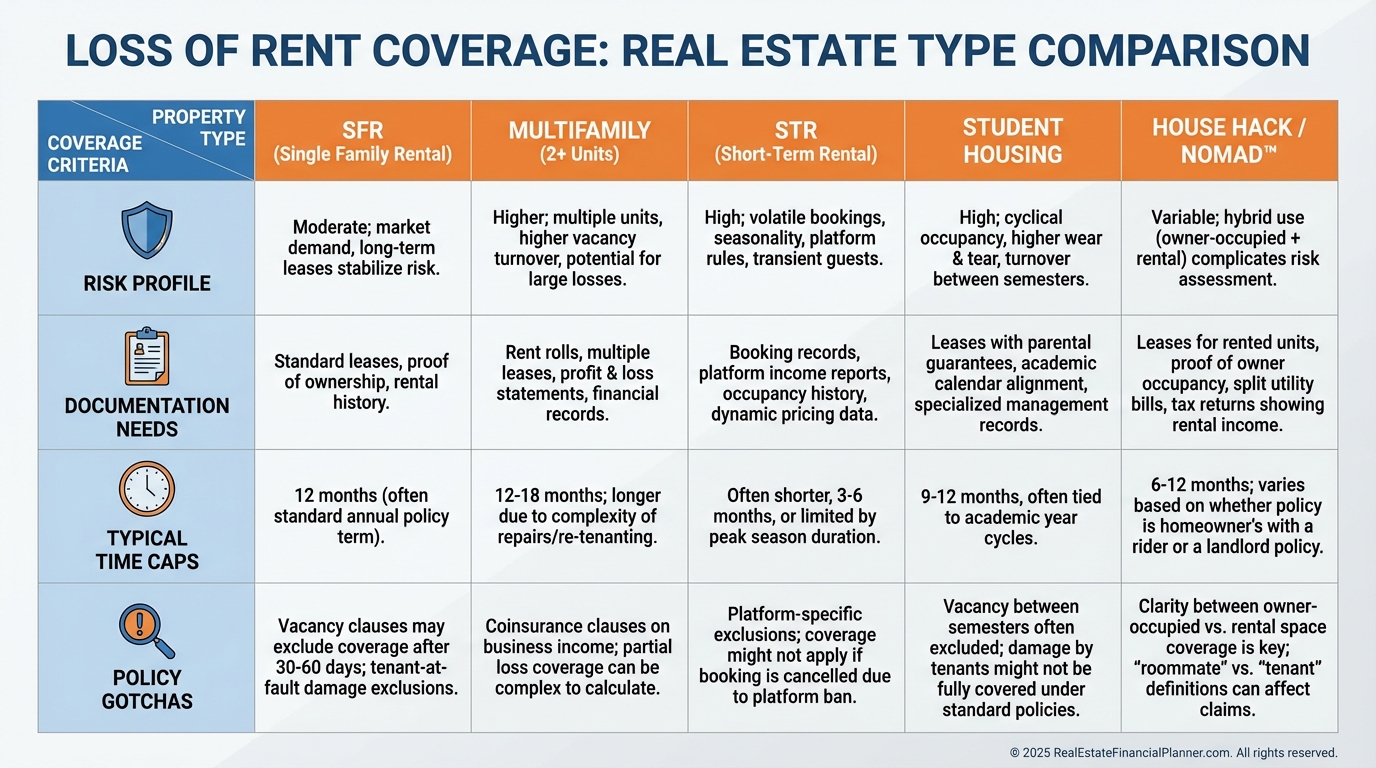

Special Property Types and Nuances

Single-family rentals usually fit a 12-month time cap, but older homes or tight contractor markets may warrant 18 months.

Multifamily risks are lumpy.

A roof event could knock multiple units offline.

Check if limits are per occurrence or per unit.

Short-term rentals need special handling.

Payouts are based on fair rental value, so document seasonal ADR and occupancy with trailing 12 reports.

Student rentals face calendar risk.

A fire in April could mean no cash flow until the next August turn, even if repairs finish in June.

House hackers and Nomad™ investors should coordinate loss of use (your unit) and loss of rent (tenant units) so no gap exists.

Policy Design: What I Ask Agents to Put in Writing

Is loss of rent included or an endorsement?

Confirm the exact limit: time cap, dollar cap, or both.

Is it ALS or a fixed monthly amount?

What’s the waiting period?

Is fair rental value determined by appraiser, market comps, or your leases?

Does ordinance or law extend time and dollars if code upgrades are required?

Does civil authority or ingress/egress apply if the street is blocked but the building is intact?

Are partial-unit losses covered if one bedroom is unusable?

For multifamily, are limits per building, per unit, or per occurrence?

I get clear answers before we bind.

Ambiguity becomes expensive on claim day.

Claims: The Playbook I Give Clients

File promptly with photos, videos, and initial contractor estimates.

Provide leases, rent roll, and payment history to prove income.

Document fair rental value with comps and your last 12 months of ads or STR data.

Ask for advance payments for ongoing losses during repairs.

Track utility bills and required expenses during downtime.

Communicate delays you can’t control and note dates for permits and inspections.

When I rebuilt after a flood years ago, my best decision was weekly documentation emails to the adjuster.

Short, dated, factual.

It sped approvals and kept payments flowing.

Modeling in The World’s Greatest Real Estate Deal Analysis Spreadsheet™

I add the annual premium under operating expenses and test sensitivity.

Then I model a vacancy shock: months offline, waiting period, and expected payout.

I compare DSCR with and without coverage to see if debt service remains safe.

I run a portfolio view.

If one building goes dark, can others cover the gap, or does coverage become mandatory?

Finally, I examine True Net Equity™ over a five-year hold with one loss scenario.

Coverage reduces variance and the risk of forced sale, which preserves compounding.

Common Mistakes That Cost Investors Real Money

Underinsuring time.

Repairs finish in six months on paper, but permits and trades push it to nine.

Choosing a fixed monthly cap that’s too low for premium STR rentals.

Skipping ordinance or law, then code upgrades blow your timeline.

Not updating coverage after rent increases.

Using pro forma rents instead of signed leases and rent rolls.

Assuming flood or earthquake are covered.

They’re not without separate policies.

The Bottom Line

Loss of rent coverage is inexpensive, targeted protection for the income stream your entire deal rides on.

Price it into your underwriting, verify the limits in writing, and keep your documentation tight.

Then sleep.

Your cash flow has a seatbelt.