Lines of Credit: The Investor’s Playbook for Liquidity, Leverage, and Risk Management

Learn about Lines of Credit for real estate investing.

Why Lines of Credit Belong in an Investor’s Toolkit

A line of credit is your reusable, on-demand capital stack backed by property equity.

When I help clients scale, a well-managed HELOC often becomes the bridge between opportunity and execution.

With a HELOC, you draw cash only when you need it, pay interest only on what you use, and redeploy capital quickly after a refinance or sale.

It’s flexible, but flexibility without rules becomes risk.

I’ll show you how I model, cap, and stress-test lines so they accelerate your plan instead of derailing it.

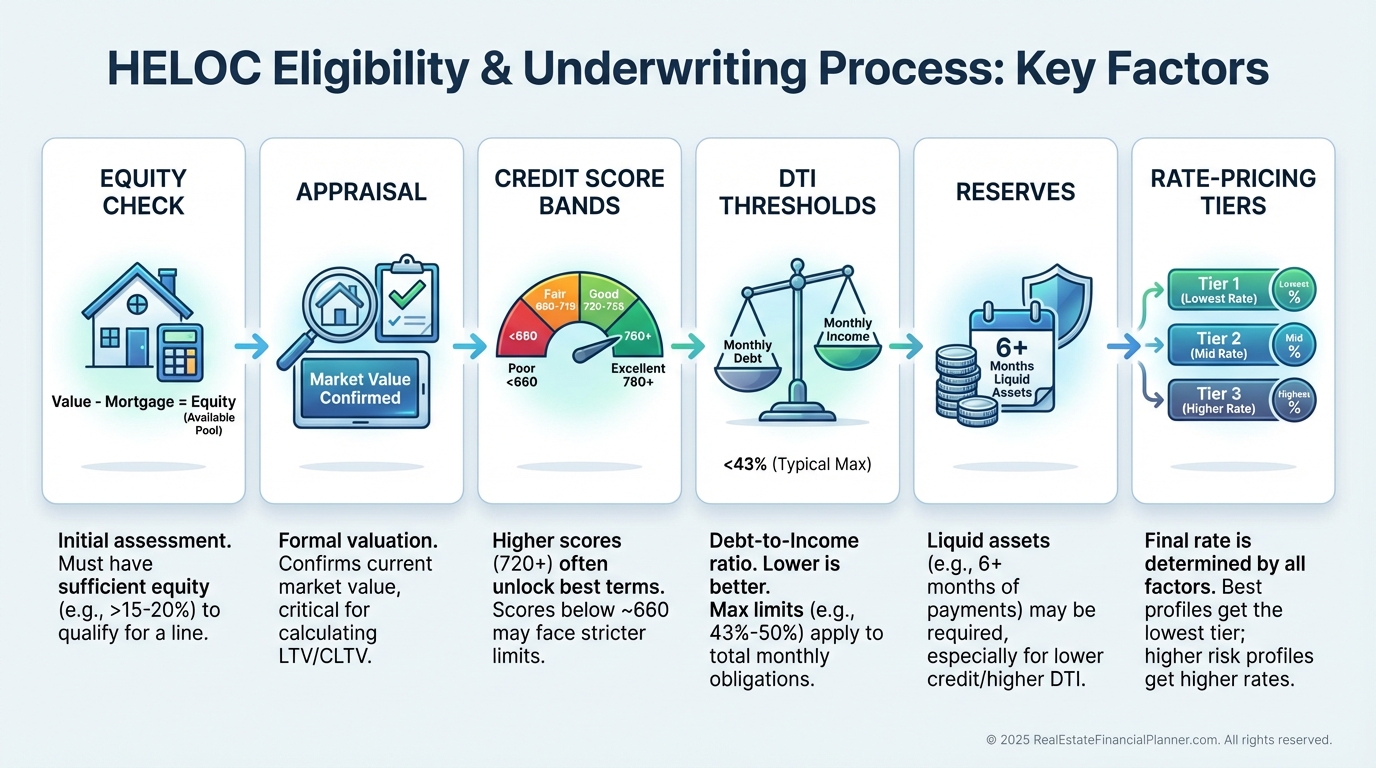

What Lenders Check: Eligibility and Underwriting

Lenders start with equity, then verify credit and income.

Expect minimum credit scores around 620–640 and a debt-to-income ratio near or under 43%, though stronger profiles get better pricing.

Income is verified, even if you plan to use the funds for investments.

For investment-property LOCs, underwriters often require lower LTVs and stronger reserves.

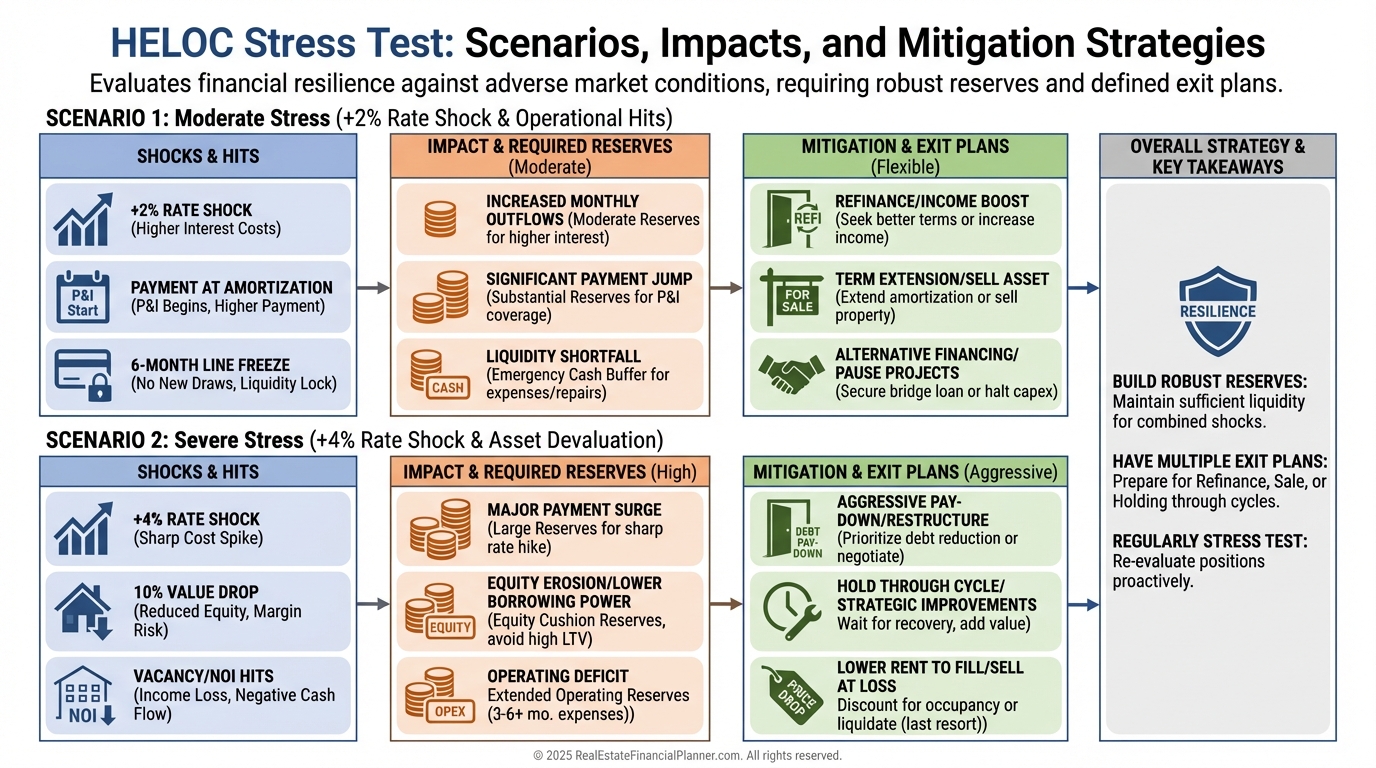

When I underwrite clients internally, I add a second test: your payment at +2% rate shock and at full amortization after the draw period.

Owner-Occupancy and Property Types

Most HELOCs are written on primary residences.

Some lenders will extend lines to second homes and investment properties, but expect higher rates and lower LTVs.

If you need a line in an LLC’s name, you’re typically shopping for a commercial line or a portfolio lender.

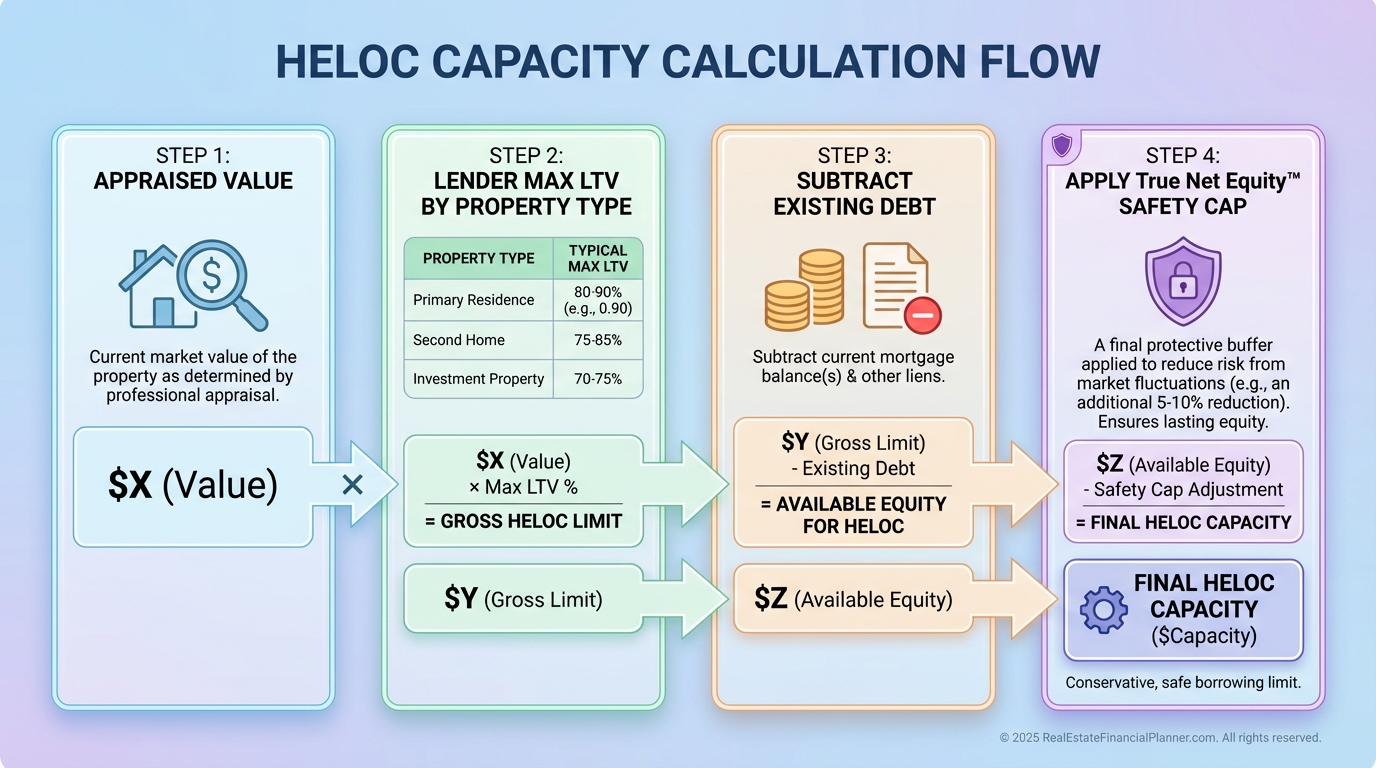

How Much Can You Borrow? LTV and Loan Limits

Your limit is set by the lender’s max LTV minus existing liens.

On a primary residence, many lenders cap combined LTV at 80%–90%.

On investment properties, caps are often 65%–75%.

Example: Your rental appraises at $500,000 and your loan balance is $300,000.

At a 70% combined LTV cap, the total allowed debt is $350,000, so your line would be up to $50,000.

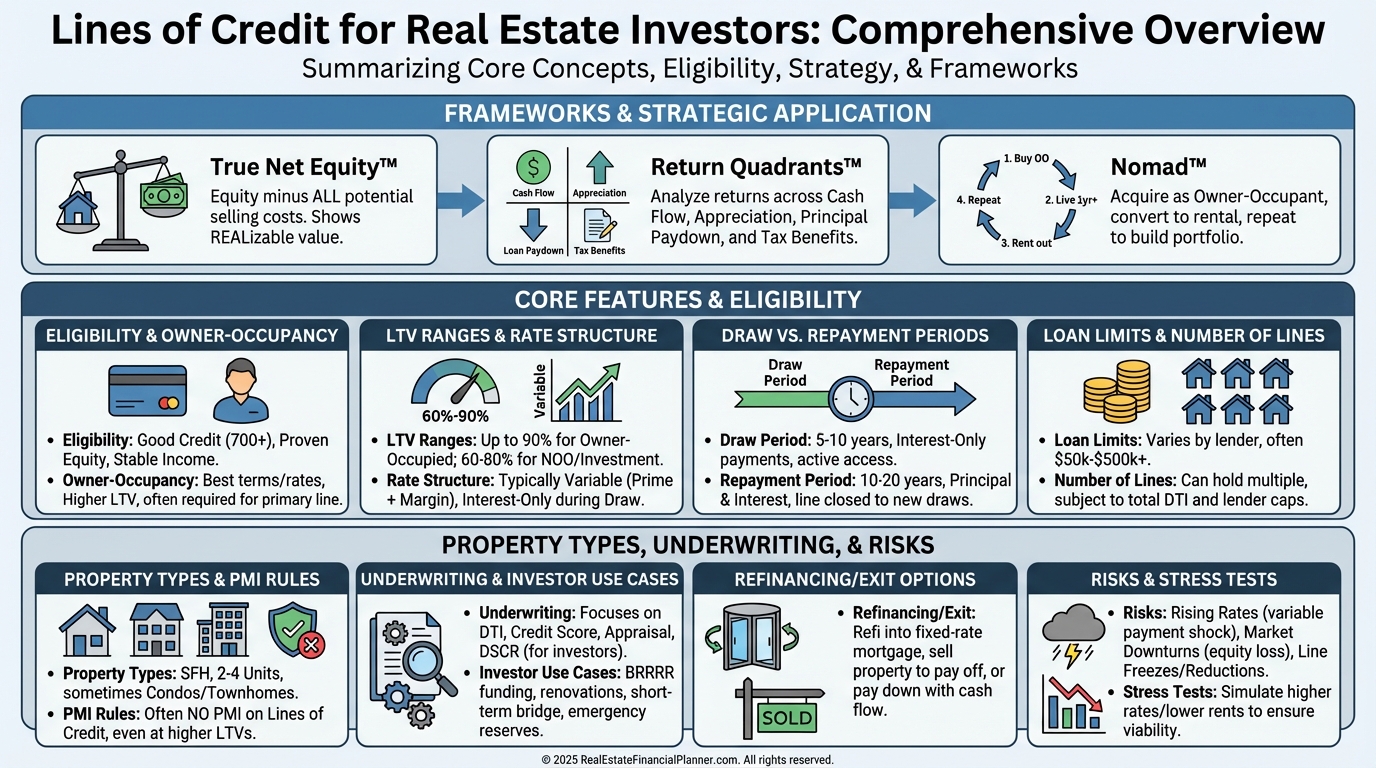

I advise clients to cap utilization at 50%–60% of True Net Equity™, not appraised equity.

True Net Equity™ subtracts selling costs, likely concessions, capital gains taxes, depreciation recapture, and the loan payoff from today’s value.

That keeps you liquid if you need to exit fast.

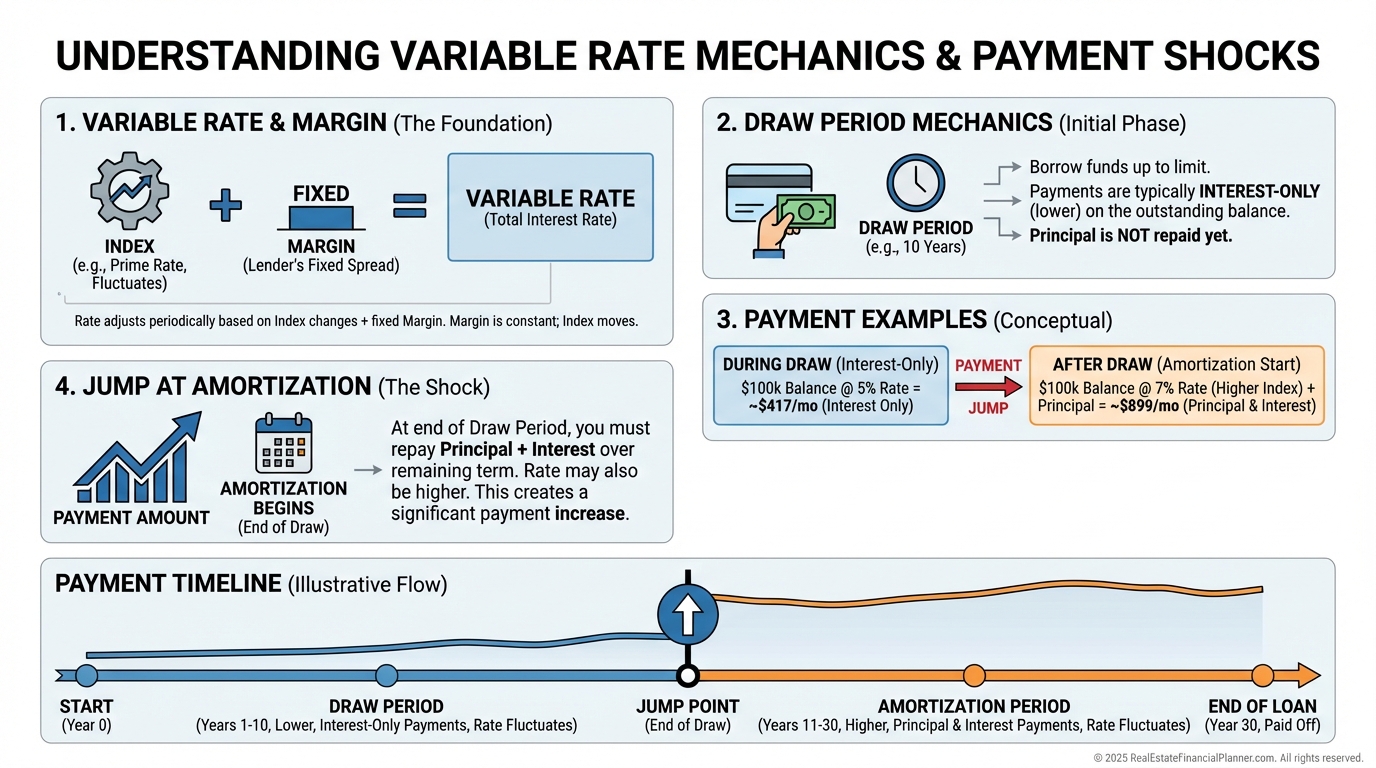

Rates, Draw Period, and Repayment Mechanics

Most lines have variable rates tied to a benchmark plus a margin.

You’ll see an interest-only draw period for 5–10 years, followed by a repayment phase with principal and interest.

This is where many investors get surprised.

At the end of the draw, the same balance is now amortized over a shorter term, so payments jump.

If you carry $100,000 at 10%, your interest-only payment is about $833 per month.

If rates rise to 12% and the line enters a 15-year repayment, payment is roughly $1,200 per month.

Model this before you draw a dollar.

Payments, Cash Flow, and Return Quadrants™

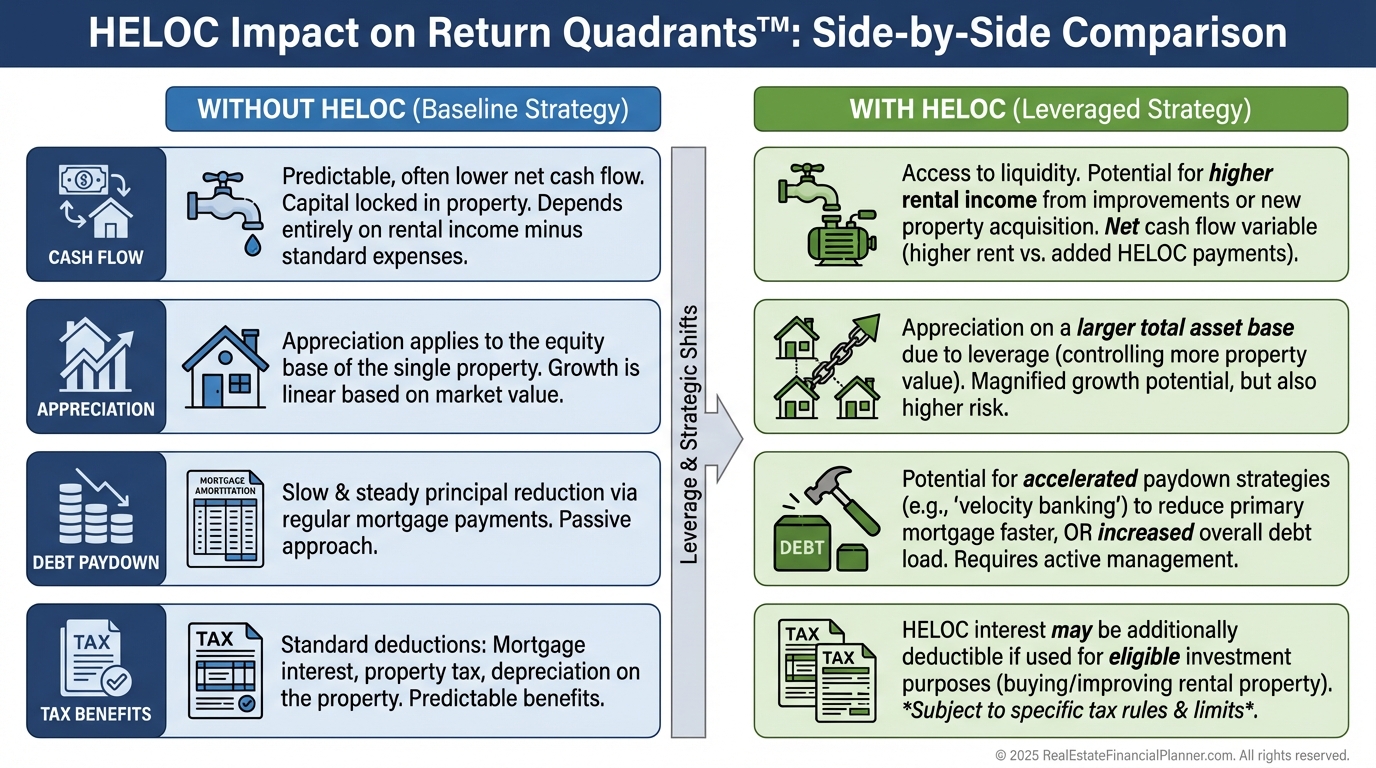

I map the impact of a HELOC across the Return Quadrants™: appreciation, cash flow, debt paydown, and tax benefits.

Interest-only draws reduce cash flow, but can increase appreciation and equity if you use funds for value-add.

Debt paydown on the HELOC is zero during draw, so plan principal reduction elsewhere.

Tax benefits may improve if HELOC proceeds are used to buy, build, or substantially improve investment property.

Match your use of funds to your CPA’s guidance so interest is properly allocated.

When I model deals, I run the baseline Return Quadrants™ without a HELOC, then overlay the HELOC scenario to see if total return improves after rate shock.

PMI, Down Payments, and Seller Concessions

Lines of credit do not require a down payment because you’re borrowing against existing equity.

There’s no PMI on a HELOC, even if your combined LTV exceeds 80%, though lender caps often prevent that on investments.

Seller concessions are irrelevant because you’re not purchasing; you’re drawing against owned equity.

Property Types Eligible

HELOCs are most common on single-family homes, condos, and townhomes used as primary residences.

Some lenders extend to second homes and investment properties with tighter terms.

For multifamily, mixed-use, or properties in entities, a commercial line or portfolio lender is often required.

Number of Lines and Titling in Entities

You can have multiple lines across different properties.

Each is limited by that property’s equity and the lender’s underwriting.

Most consumer HELOCs are titled to you personally, not an LLC.

If entity titling is required, pursue a commercial LOC secured by the asset or a global banking relationship.

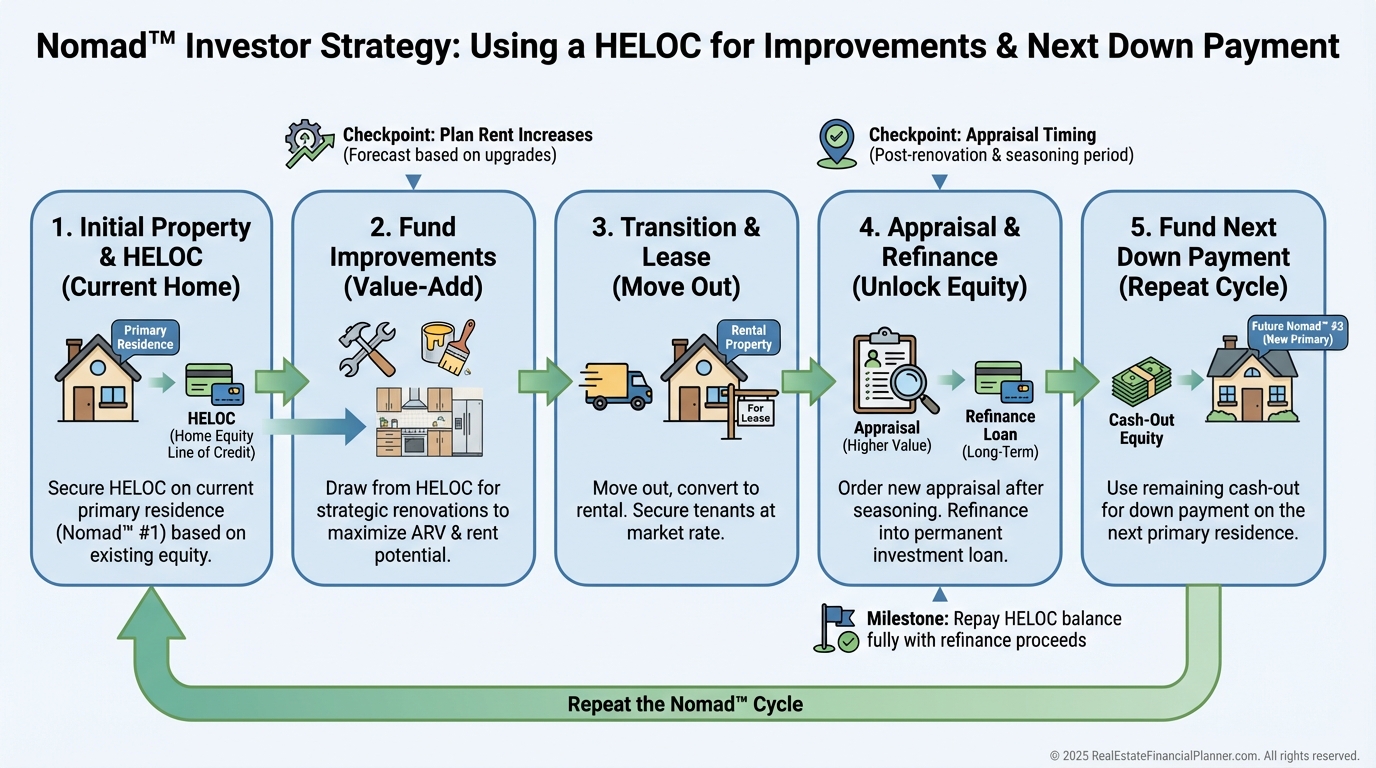

Using a HELOC Strategically with Nomad™

When Nomad™ investors move into a property, improve it, and later convert to a rental, a HELOC can fund upgrades and the next down payment.

I coach clients to limit HELOC draws to improvements that produce clear rent growth or lower expenses.

That way, when you convert to a rental, the improved NOI supports the next move.

We also set a “refi or repay” deadline before the draw period ends to avoid payment shock.

Refinancing, Recasting, and Exit Options

You can refinance a HELOC into a fixed-rate second, roll it into a new first via rate/term or cash-out, or open a new HELOC and close the old one.

Many HELOCs allow fixed-rate “locks” on portions of the balance, but check fees and rules.

Recasting is uncommon on HELOCs; once repayment starts, principal and interest payments are required.

I set decision triggers: at 70% of the draw period, evaluate a refinance to avoid end-of-draw payment spikes.

Waiting Periods After Bankruptcy or Foreclosure

After Chapter 7 bankruptcy, expect a 2–4 year wait for many lenders.

After a foreclosure, 3–7 years is common.

Season your credit, rebuild reserves, and demonstrate stable income to improve terms.

Approval and Closing Timeline

HELOCs usually close faster than purchase loans because the collateral already exists.

Still, expect an appraisal or AVM, full credit and income review, and title work.

I keep tax returns, W-2s, leases, and insurance documents ready to shave weeks off the process.

Risks You Must Model Before You Draw

Rates are variable.

Rising rates increase carrying costs and compress cash flow.

Lenders can reduce or freeze lines during market stress.

That is not hypothetical; we’ve seen it during past corrections.

Finally, your property is collateral.

Default can lead to foreclosure.

I protect clients by pairing every draw with a dated exit plan, a cash reserve buffer, and a backup refinance path.

Practical Guardrails I Require Clients to Use

Cap utilization at 50%–60% of True Net Equity™.

Stress test payments at +2% rates and at full amortization before you draw.

Only fund projects with documented rent lift, expense cuts, or resale upside.

Tie every draw to a dated exit: refinance, flip, or paydown from cash flow.

Keep six months of HELOC payments in reserves, separate from property operating reserves.

Quick Reference: What to Expect on Terms

Primary residence combined LTV limits often 80%–90%.

Investment property combined LTV limits often 65%–75%.

Draw periods commonly 5–10 years, then 10–20 years of repayment.

Variable rates tied to a benchmark plus a margin.

No PMI, no down payment, and seller concessions don’t apply.

Multiple lines allowed if equity and underwriting support them.

Tax and Documentation Notes

For investors, interest is generally deductible when used to buy, build, or substantially improve investment property.

Track uses of funds so your CPA can allocate interest correctly.

Maintain invoices, contracts, and before-and-after photos for improvements.

This paper trail preserves deductions and supports appraisals.

Final Word

A line of credit is a powerful tool if you treat it like a bridge, not a crutch.

When I model it inside your plan, it accelerates acquisitions, funds value-add, and keeps you liquid through surprises.

Use the guardrails, run the stress tests, and let the numbers decide.