Buy and Hold Investing: The Long Game That Actually Builds Wealth

Learn about Buy and Hold Investing for real estate investing.

Buy and Hold Investing is one of the most misunderstood real estate strategies, mostly because it looks boring on the surface.

That boredom is exactly why it works.

When I help clients build long-term portfolios, Buy and Hold is usually the foundation. Not because it is flashy, but because it quietly compounds wealth while life happens in the background.

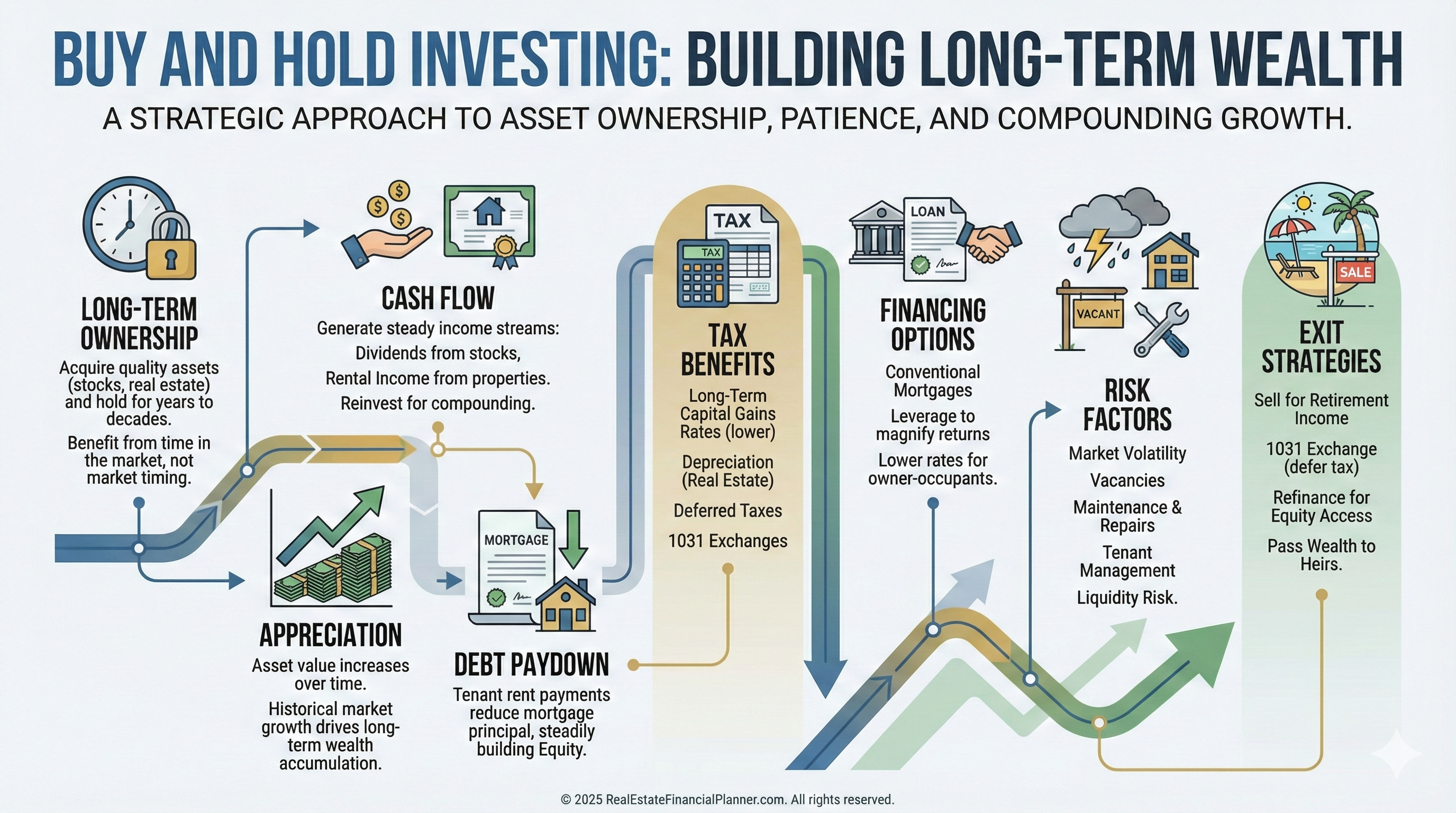

Buy and Hold Investing means you buy a property with the intention of holding it for a very long time, often decades, sometimes forever. You are not trying to time the market or flip for quick profits. You are letting time, tenants, and inflation do the heavy lifting.

This is the strategy that helped me rebuild after bankruptcy. It was not fast, but it was reliable, forgiving, and durable.

Why Buy and Hold Works

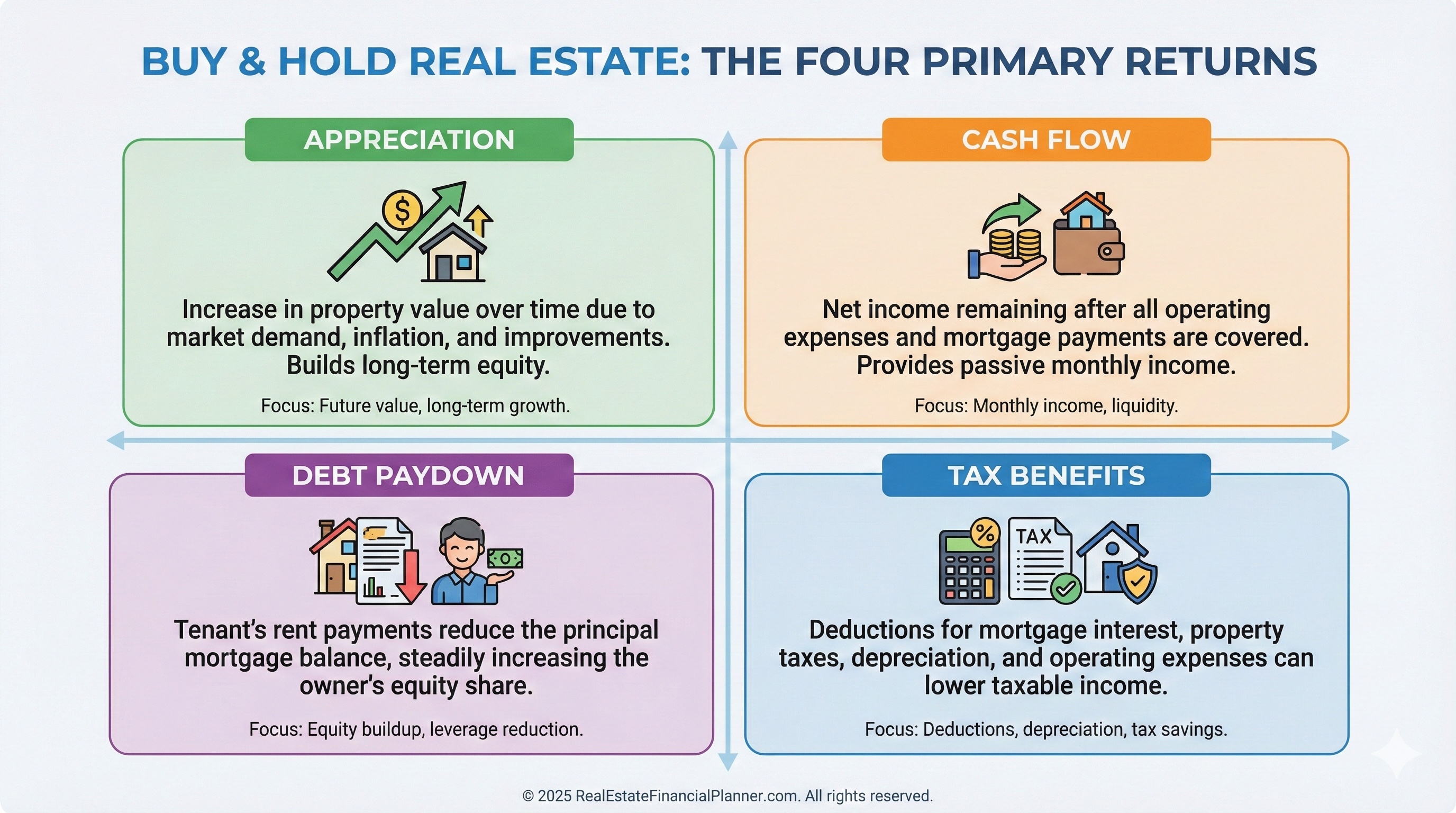

Buy and Hold works because it stacks multiple returns on top of each other.

You are not relying on a single source of profit. You are combining several.

Here is what I model for every Buy and Hold deal using the Return Quadrants™ framework.

Appreciation increases your equity over time, even though you cannot spend it until you refinance or sell.

Cash Flow puts money in your pocket each month, assuming the deal is structured correctly.

Debt Paydown happens quietly as tenants reduce your loan balance for you.

Tax Benefits, especially depreciation, often shelter some or all of that cash flow from taxes.

When investors focus on only one of these, usually cash flow, they miss the bigger picture.

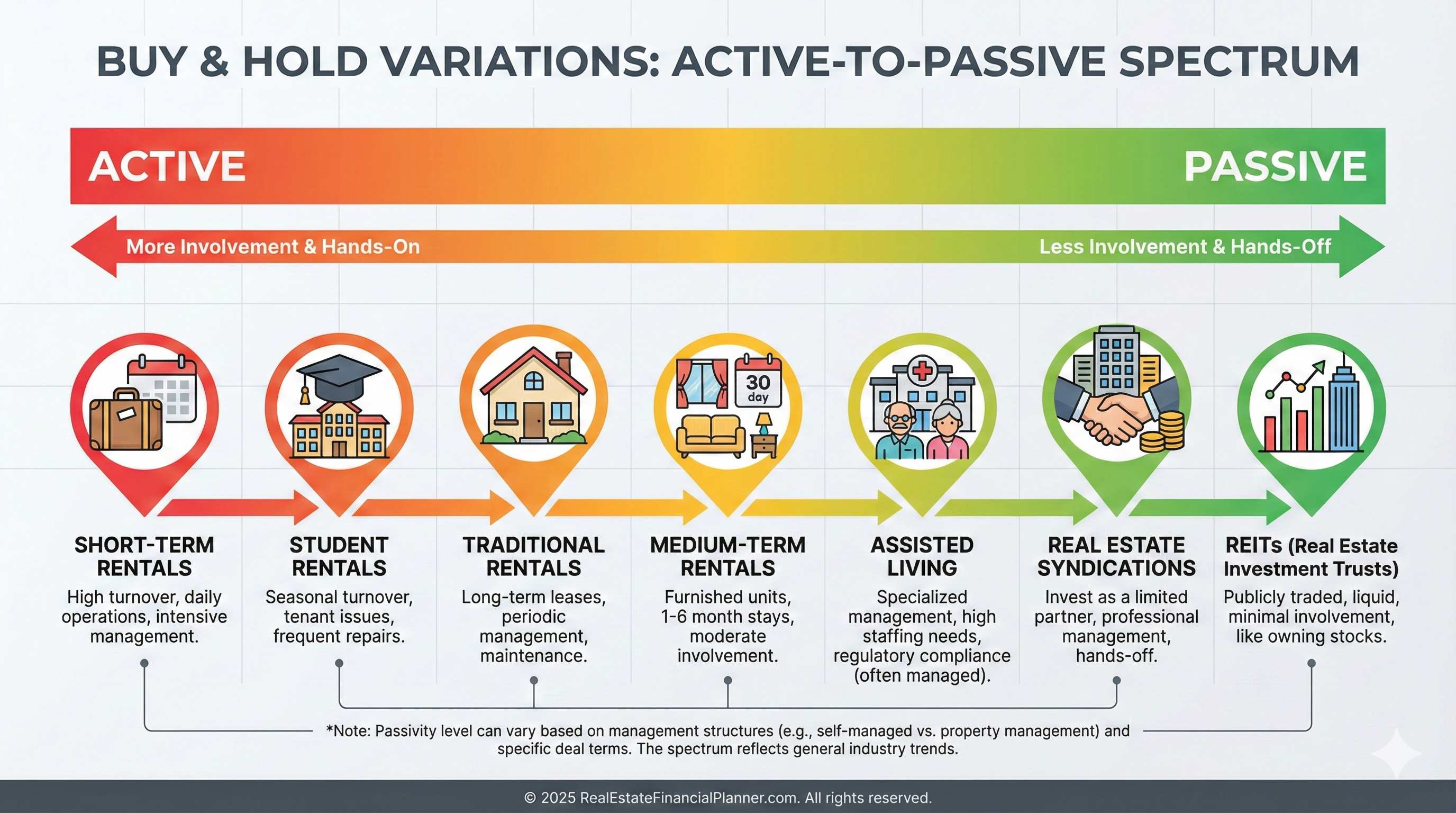

Buy and Hold Is Not One Strategy

Buy and Hold is a category, not a single approach.

Different variations fit different personalities, markets, and lifestyles.

Traditional Buy and Hold focuses on long-term tenants in single-family homes, small multifamily, or larger apartment buildings. This is where most investors should start.

Short-Term and Vacation Rentals can produce higher income, but they behave more like a hospitality business than passive investing.

Medium-Term Rentals sit in the middle and often work well for traveling professionals or furnished housing.

Student Rentals can boost income by renting per room, but they require tolerance for turnover and wear.

Storage Units reduce tenant headaches but introduce commercial considerations.

Assisted Living combines real estate with an operating business and is firmly on the entrepreneurial side.

When clients ask me which one is best, my answer is always the same. The best strategy is the one you will actually hold through a downturn.

Financing Buy and Hold Properties

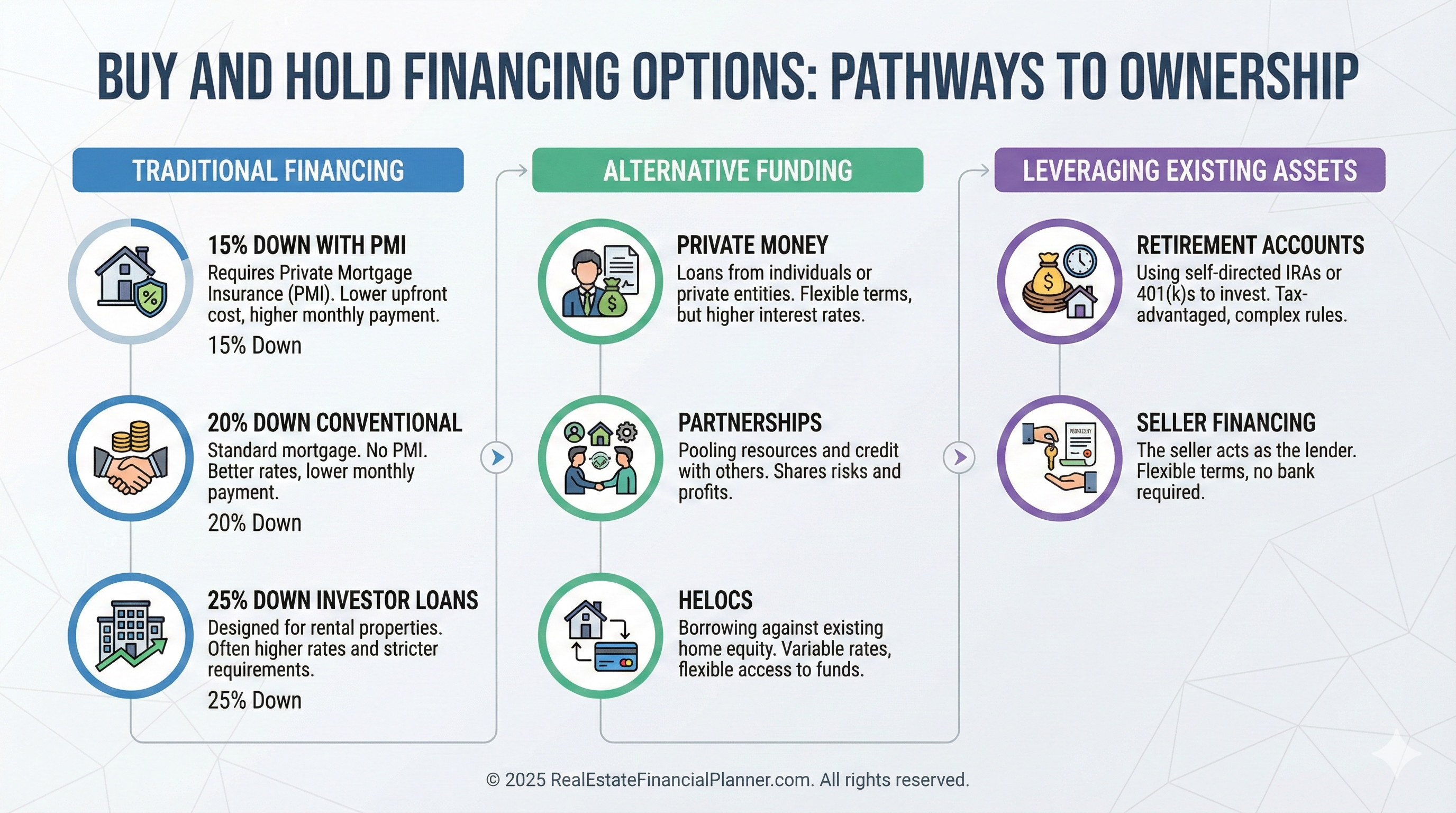

Financing is where many long-term investors quietly fail.

They either over-leverage early or under-capitalize reserves.

Most Buy and Hold investors use non-owner-occupant loans with 20–25% down. That higher down payment is not a flaw. It is a stabilizer.

Lower leverage means fewer sleepless nights when rents dip or repairs spike.

Strategies like Nomad™ and house hacking can reduce the initial cash required, but they still rely on the same long-term holding mindset.

Holding Is a Skill, Not a Default

Buy and Hold is often described as passive.

That description is misleading.

All Buy and Hold strategies are actively stable. They require attention to stay healthy.

Tenants change. Roofs fail. Markets shift.

The goal is not zero work. The goal is predictable work.

Risk, Stability, and Time

Buy and Hold carries medium risk, mostly because time magnifies both mistakes and good decisions.

I warn clients about three things upfront.

Overestimating rent growth.

Underestimating maintenance.

Ignoring reserves.

When deals fail, it is rarely because appreciation did not happen. It is usually because cash flow could not survive a short-term shock.

This is why I analyze deals using True Net Equity™ and conservative assumptions instead of optimistic projections.

Exits That Are Not Really Exits

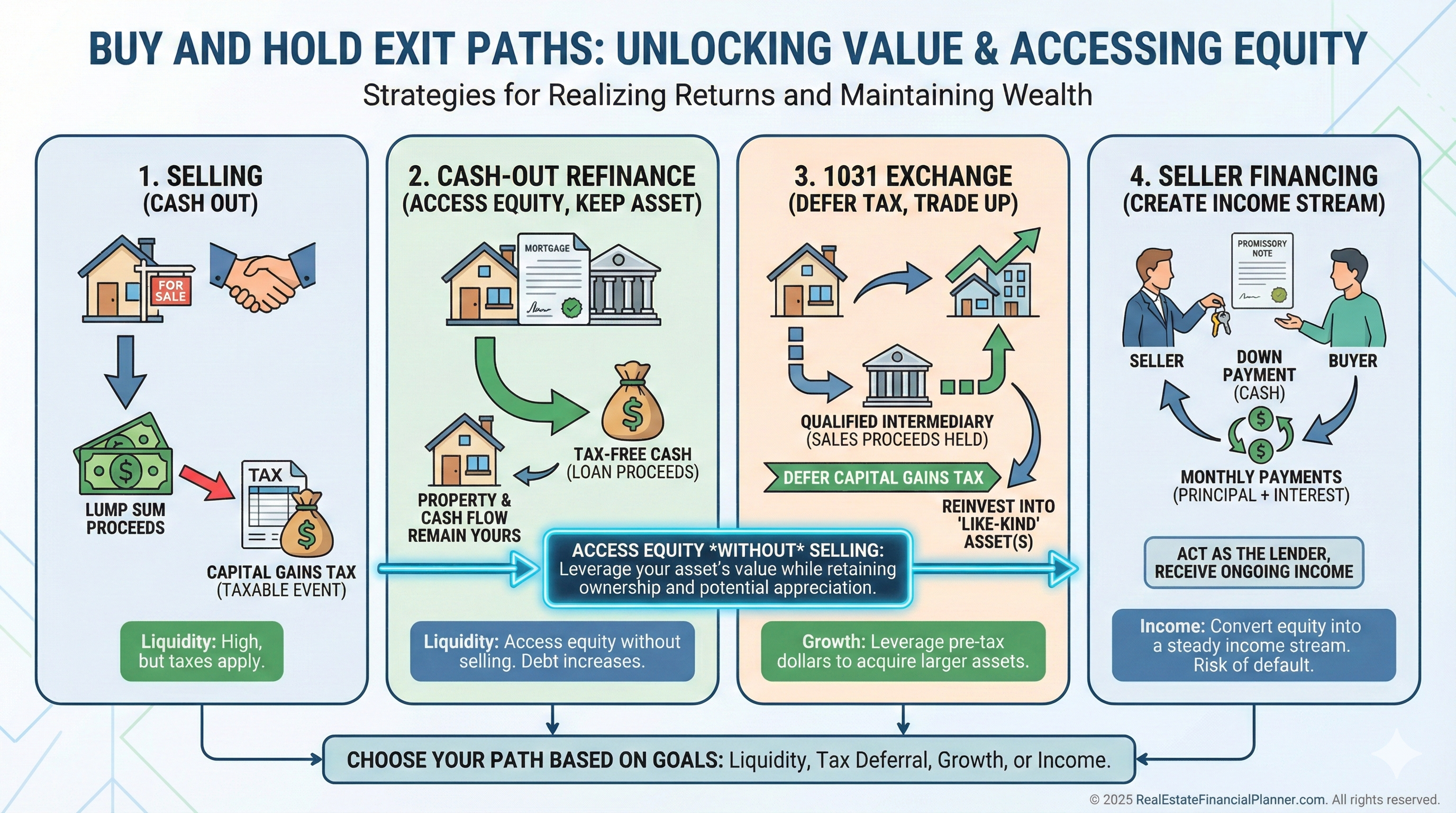

Most Buy and Hold investors do not exit by selling.

They exit by refinancing.

Refinancing lets you redeploy equity while keeping the asset.

Selling is usually a last resort or a portfolio simplification move later in life.

Analyzing Buy and Hold Deals Correctly

If Buy and Hold is the long game, analysis is the rulebook.

Every property I evaluate goes through the same process using The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

I check cash flow under conservative rents.

I stress-test interest rates.

I model long-term returns, not just year one performance.

If a deal only works under perfect conditions, it does not work.

You can download the spreadsheet here:

https://RealEstateFinancialPlanner.com/spreadsheet/

The Real Promise of Buy and Hold

Buy and Hold Investing is not exciting in year one.

It becomes exciting in year ten.

And life-changing in year twenty.

It rewards consistency, patience, and restraint. It punishes shortcuts and ego.

That is why it remains the backbone of nearly every real estate portfolio that actually survives.