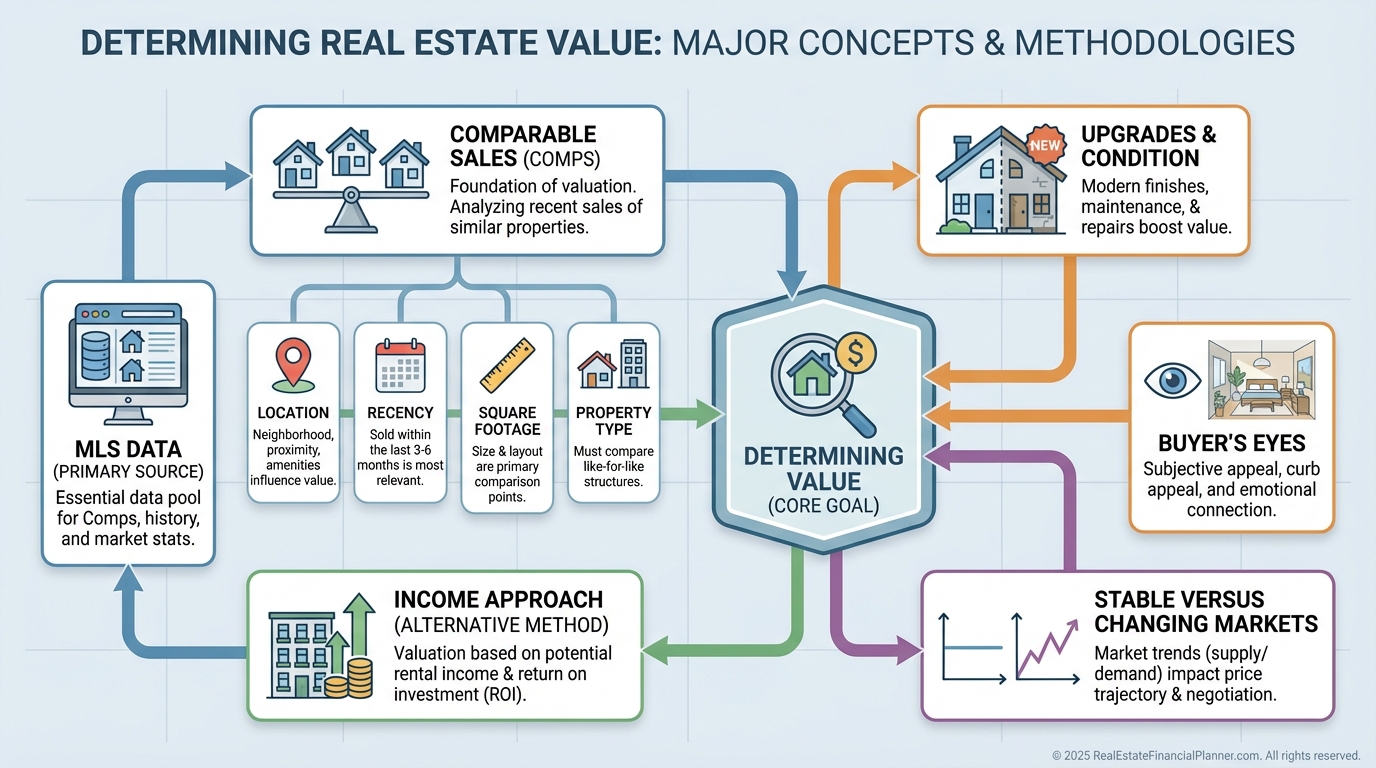

Determining Value: How Smart Investors Avoid Overpaying

Learn about Determining Value for real estate investing.

Determining a property’s value is one of the most important skills you’ll ever develop as a real estate investor.

When I help clients analyze deals, I’m rarely asking, “What’s the asking price?”

I’m asking, “What would this actually sell for in today’s market?”

That difference matters more than most investors realize.

Early in my career—and again when I rebuilt after bankruptcy—I saw how easily investors get trapped by bad assumptions about value. Overpay once, and every return you model afterward is built on sand.

Value is not what a seller hopes for.

Value is what informed buyers have already proven they will pay.

Why Comparable Sales Matter

Comparable sales, or “comps,” anchor your valuation in reality.

They answer one question that matters more than all others:

What have similar properties actually sold for?

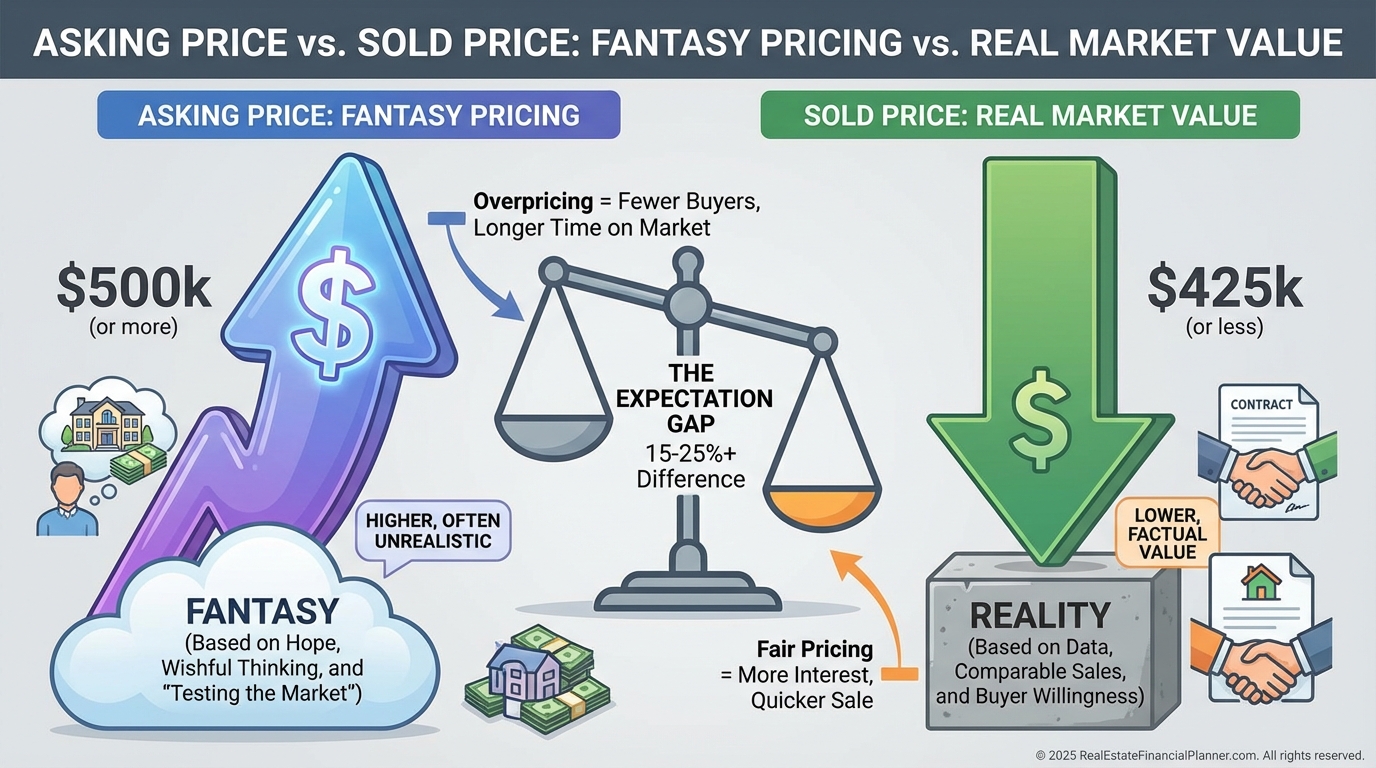

Fair Price Matters

If you overpay, you’re not just losing on day one. You’re lowering cash flow, returns, and True Net Equity™ for years.

Reality Beats Hope

Asking prices live in fantasy land. Sold prices live in the real world.

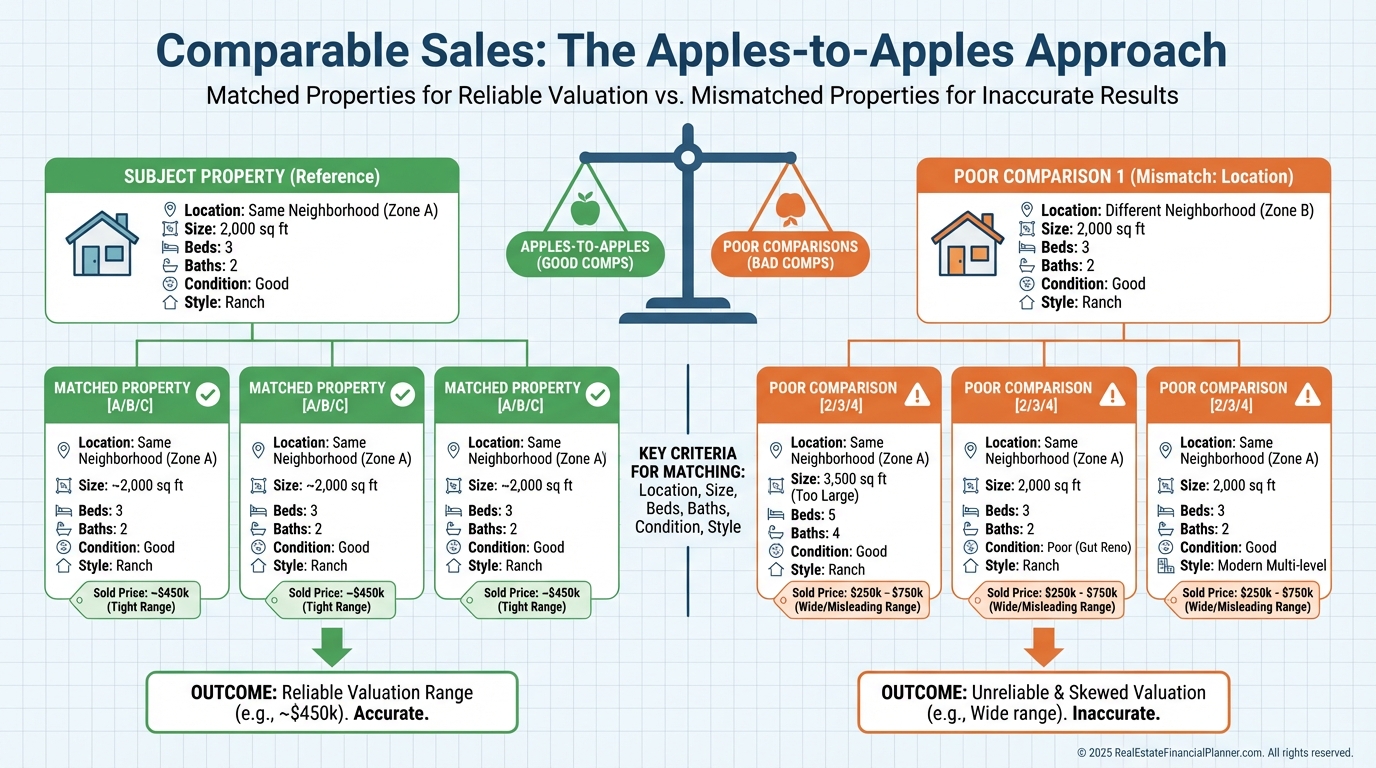

Apples to Apples Only

A small, dated home does not compare to a larger, updated one—even if they’re close together.

Similarity Drives Accuracy

The more similar the properties, the more confidence you can have in your valuation.

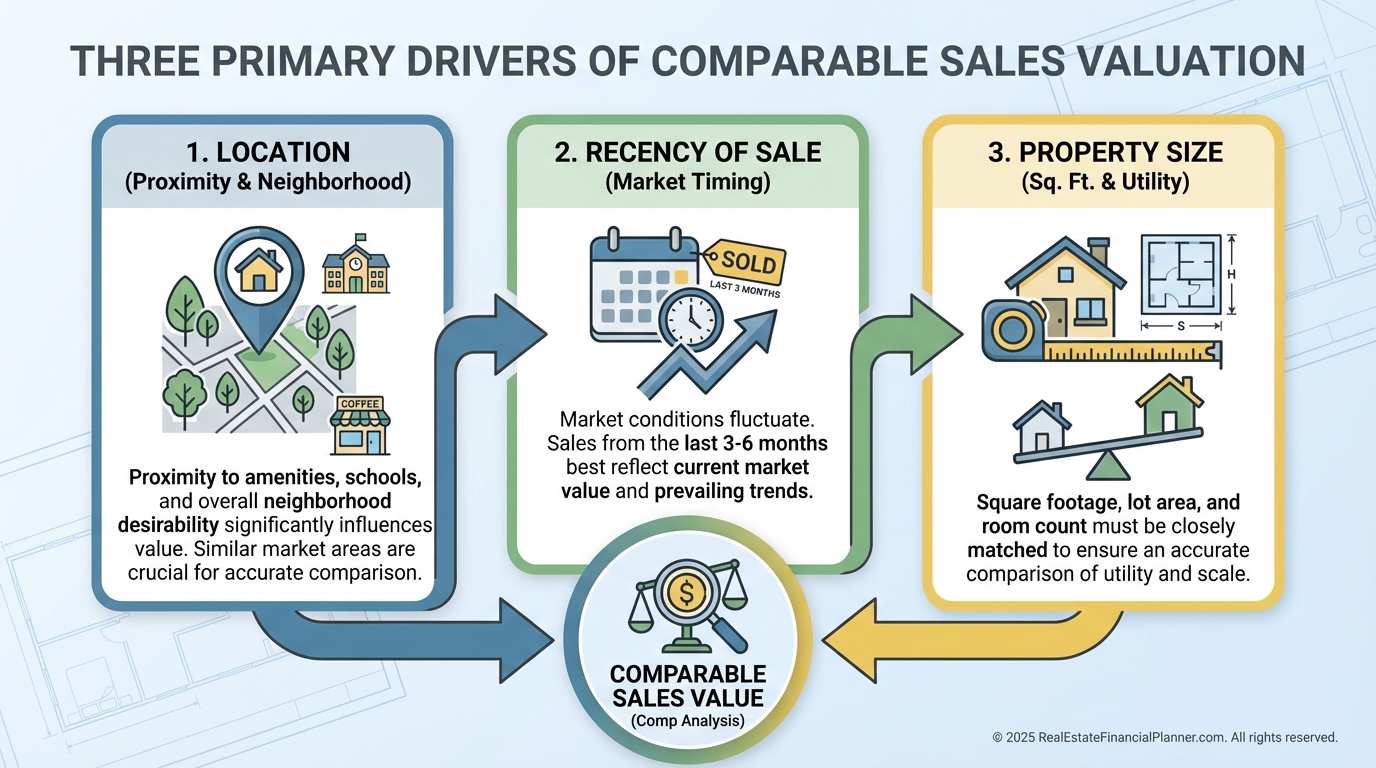

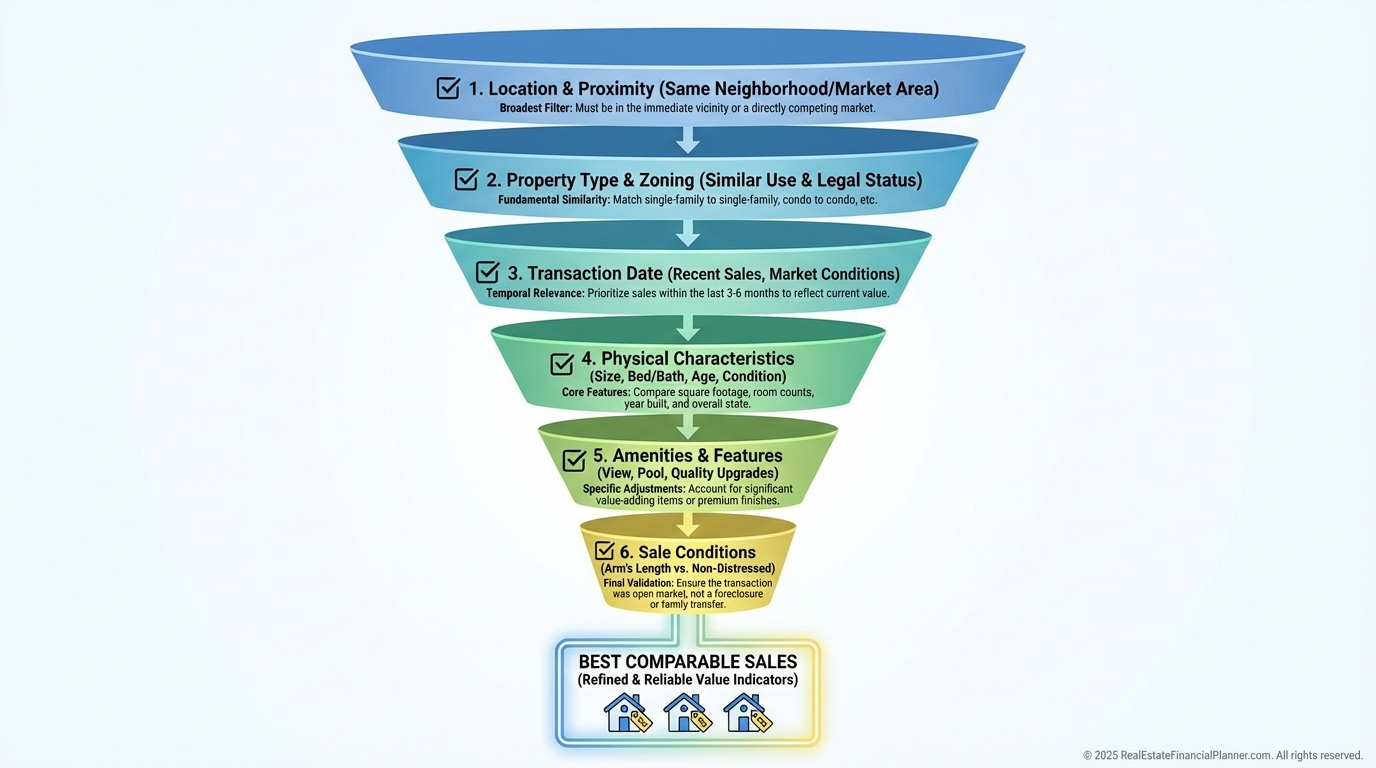

The Most Important Factors in Comps

Not all data points carry equal weight.

When I evaluate value—or sanity-check an appraisal—I focus first on three factors.

Location

Neighborhood differences matter even within the same city. School districts, street quality, and nearby amenities drive price.

Date of Sale

Markets move. Recent sales reflect current demand. Old sales reflect history.

Size

Square footage directly impacts value, but only within reasonable ranges.

Square Footage and Price Per Square Foot

Size matters, but precision matters more.

Compare homes within 10–20% of the subject property’s size.

Remove outliers when calculating price per square foot.

Use averages, not extremes.

Treat finished basements and unfinished areas separately.

Online estimates can help you get oriented, but I never trust them without verifying the underlying comps.

Proximity: How Far Is Too Far?

Start close. Expand only when necessary.

Same street or subdivision first.

Then nearby neighborhoods with similar characteristics.

Radius expansion beats zip-code shortcuts.

City-wide comps are a last resort.

The further you go, the less confidence you should have.

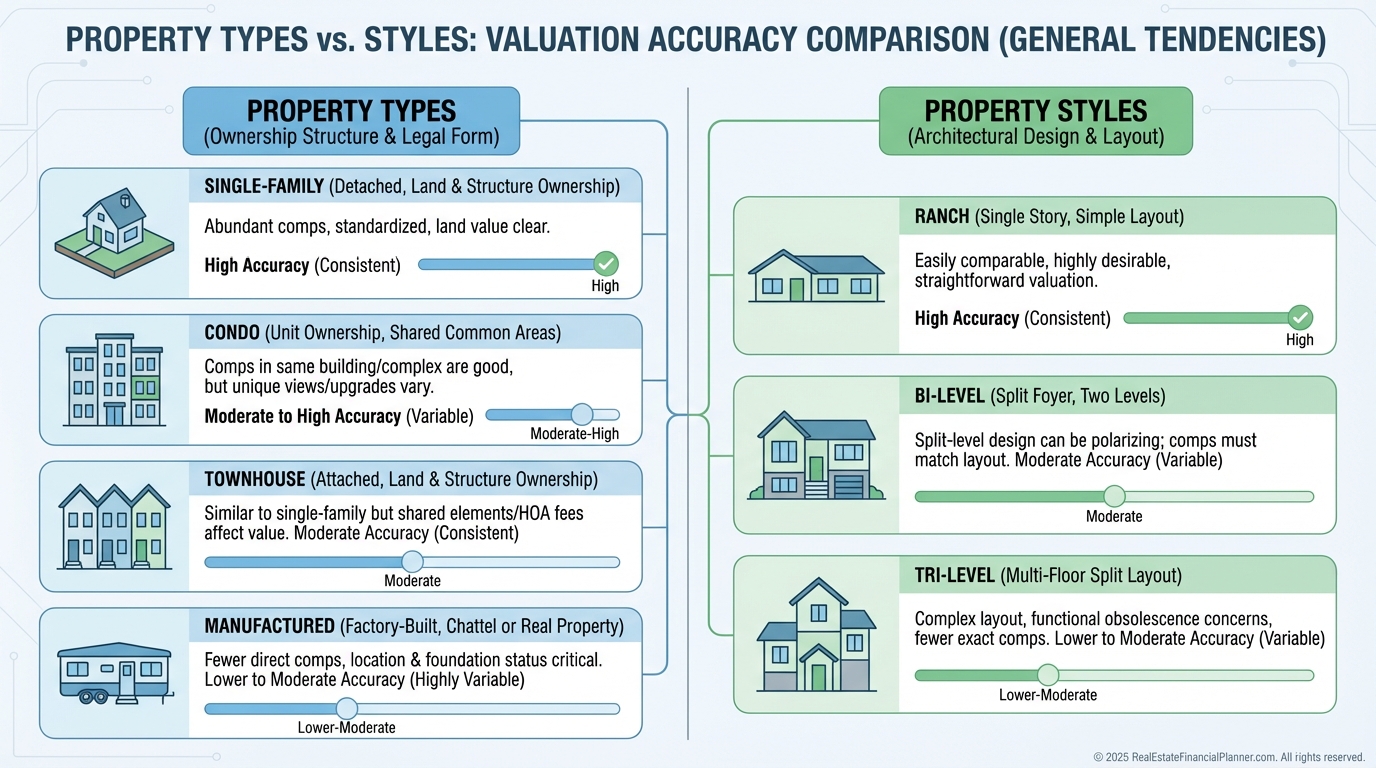

Property Type and Style Matter More Than Most Investors Think

You can’t compare unlike properties and expect reliable results.

A stick-built home does not behave like a condo.

A ranch does not compete with a tri-level.

A manufactured home lives in a different valuation universe entirely.

If I’m forced to mix styles due to limited comps, I lower my confidence—and often my offer.

Age Versus Effective Age

MLS shows year built.

Buyers experience effective age.

A 1940s home with full renovations behaves differently than a neglected 1990s home.

Use wider age ranges for older properties, and narrower ones for newer builds. The goal is similar construction, materials, and buyer expectations.

Selecting the Best Comps

I aim for about five to six strong comps.

Appraisers often use fewer, but they’re highly filtered.

My filtering order looks like this:

Beds and baths

Garage

Square footage

Proximity

Age

Type and amenities

Recency

Active Listings: Your Current Competition

Sold comps tell you value.

Active listings tell you context.

I use actives to understand buyer choice, pricing pressure, and absorption rate.

Days on market matter.

Relisting tricks matter.

Supply versus demand always matters.

Asking Price Versus Sold Price

Until it sells, price is fiction.

Sold price is fact.

I’ve watched investors justify overpaying because “everything else is listed higher.”

That logic ignores reality.

MLS Access Changes Everything

MLS data is deeper, cleaner, and more reliable than most public sites.

It shows sold data, listing history, agent notes, withdrawn listings, and price changes.

If you don’t have access, your agent should. If they won’t share it, that’s a problem.

Warning: Lack of Comparable Sales

No comps equals high risk.

When I see this, I slow down.

I lower offers.

I demand margin.

Or I switch to income-based valuation.

Do Upgrades Add Dollar-for-Dollar Value?

Almost never.

Buyers expect roofs, windows, plumbing, and HVAC to work.

They don’t usually pay extra because they do.

Upgrades help properties sell.

They don’t usually create premiums.

That’s why, in REFP modeling, CapEx lives in cash flow planning—not value inflation.

Market-Based Adjustments Beat Rules of Thumb

Pools, solar, and luxury features only add value if buyers prove they care.

The only way to know is to compare properties with and without the feature.

Assumptions are expensive.

Data is cheaper.

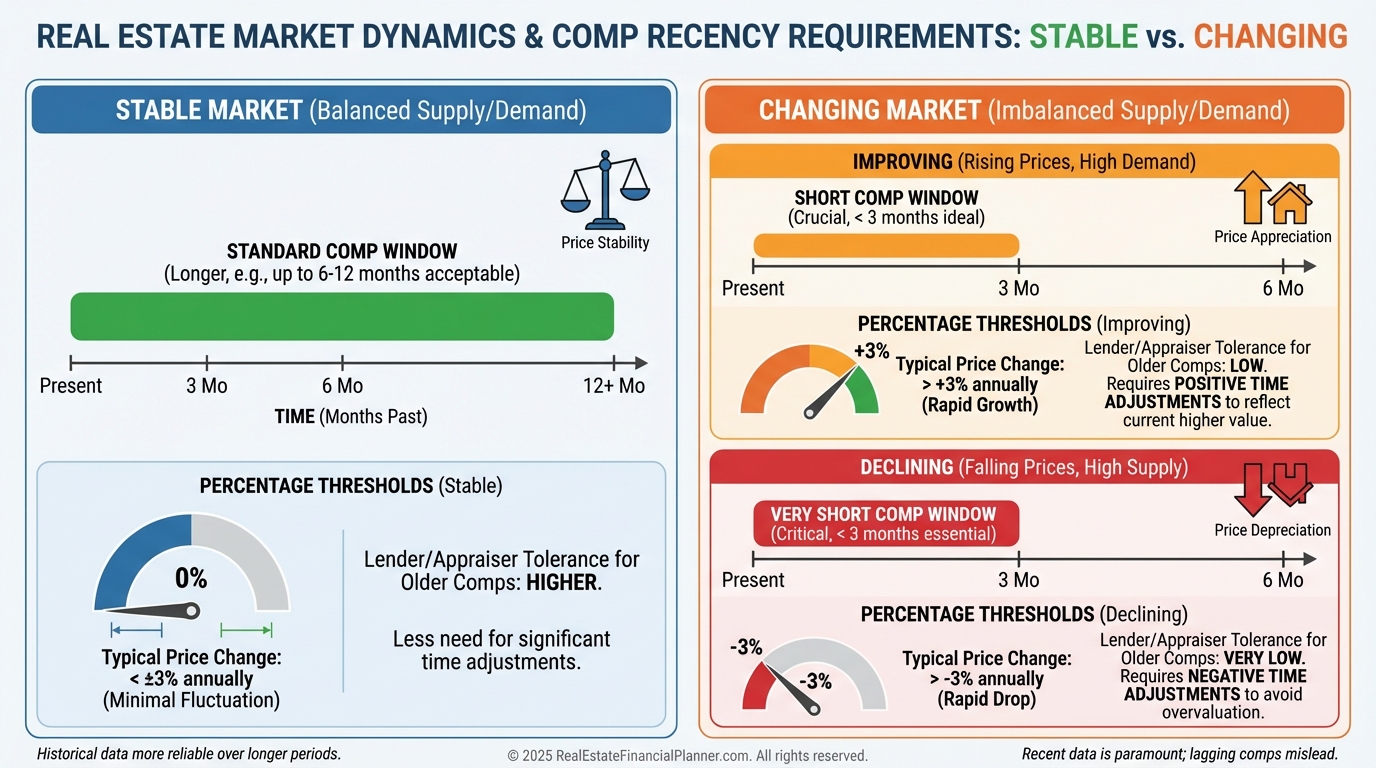

Stable Versus Changing Markets

Market speed changes how old your comps can be.

Stable markets tolerate six-month-old sales.

Changing markets demand three months or less.

Income Properties Are Different

Single-family homes use comps.

Two-to-four units use comps carefully.

Five-plus units shift to income.

Price per unit and cap rates replace emotional pricing. That’s where serious investors live.

Automated Valuations: Use With Caution

Automated estimates struggle when comps are thin or properties vary.

If you’re struggling to find comps manually, the algorithm is struggling too.

I use automated tools for orientation—not decisions.

Buyer’s Eyes: The Final Reality Check

When pricing feels close, I ask one question.

“If I had this money, would I buy this property—or the best alternative I’ve seen?”

That question cuts through spreadsheets fast.

When numbers and buyer’s eyes agree, confidence follows.