Maintenance Mastery: The Silent Lever That Protects NOI, Cap Rates, and True Net Equity™

Learn about Maintenance for real estate investing.

When I help clients model deals, the line item that blows up cash flow most often isn’t vacancy or taxes—it’s maintenance they didn’t plan.

One $15,000 HVAC replacement can erase a year of profit, stall refinancing, and delay portfolio growth.

I learned this the hard way early in my investing career, so I rebuilt my process to treat maintenance like a strategic investment instead of a surprise bill.

That shift changed my returns, my cap rates, and my True Net Equity™.

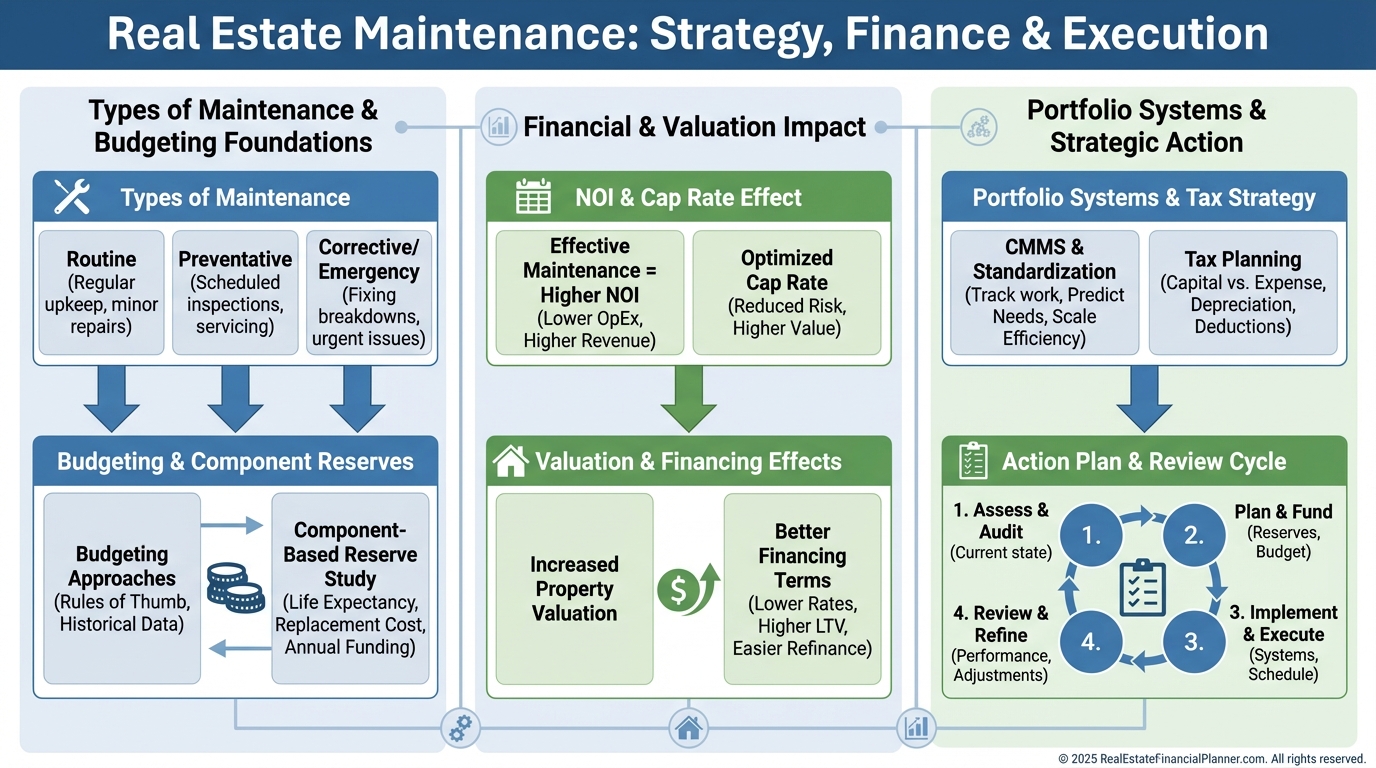

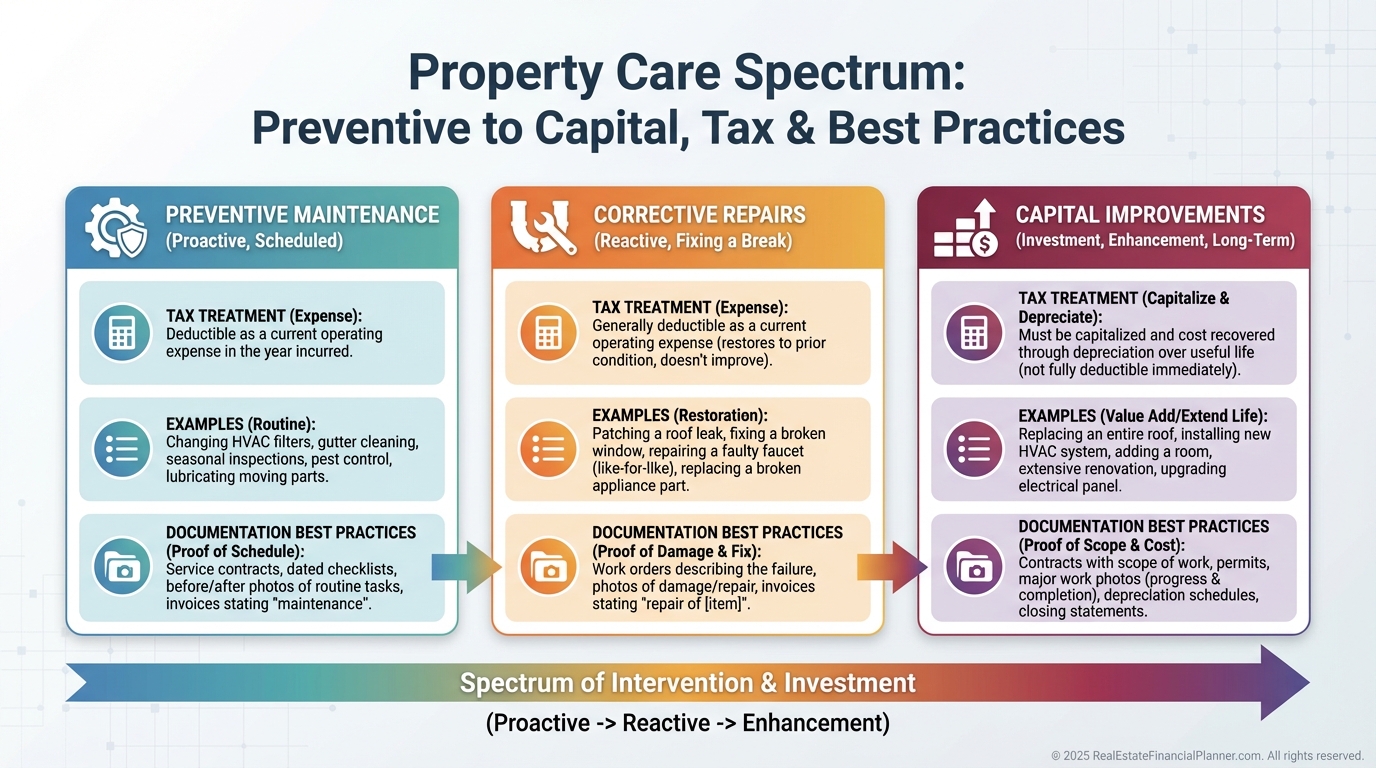

What Maintenance Really Means (And Why the IRS Cares)

Maintenance keeps a property in good operating condition.

Repairs restore function after a failure.

Capital improvements add value or extend useful life in a meaningful way.

For taxes, maintenance and repairs are generally deductible now.

Capital improvements are depreciated over time and must be tracked separately.

Get this wrong and you overpay taxes or under-document value at sale.

Preventive maintenance happens on a schedule to prevent bigger failures.

Corrective maintenance fixes something that already broke.

Deferred maintenance is the bill you postpone that grows interest in the form of lower value, higher risk, and tougher financing.

As an investor, you need all three concepts at your fingertips when you run numbers, negotiate, and file taxes.

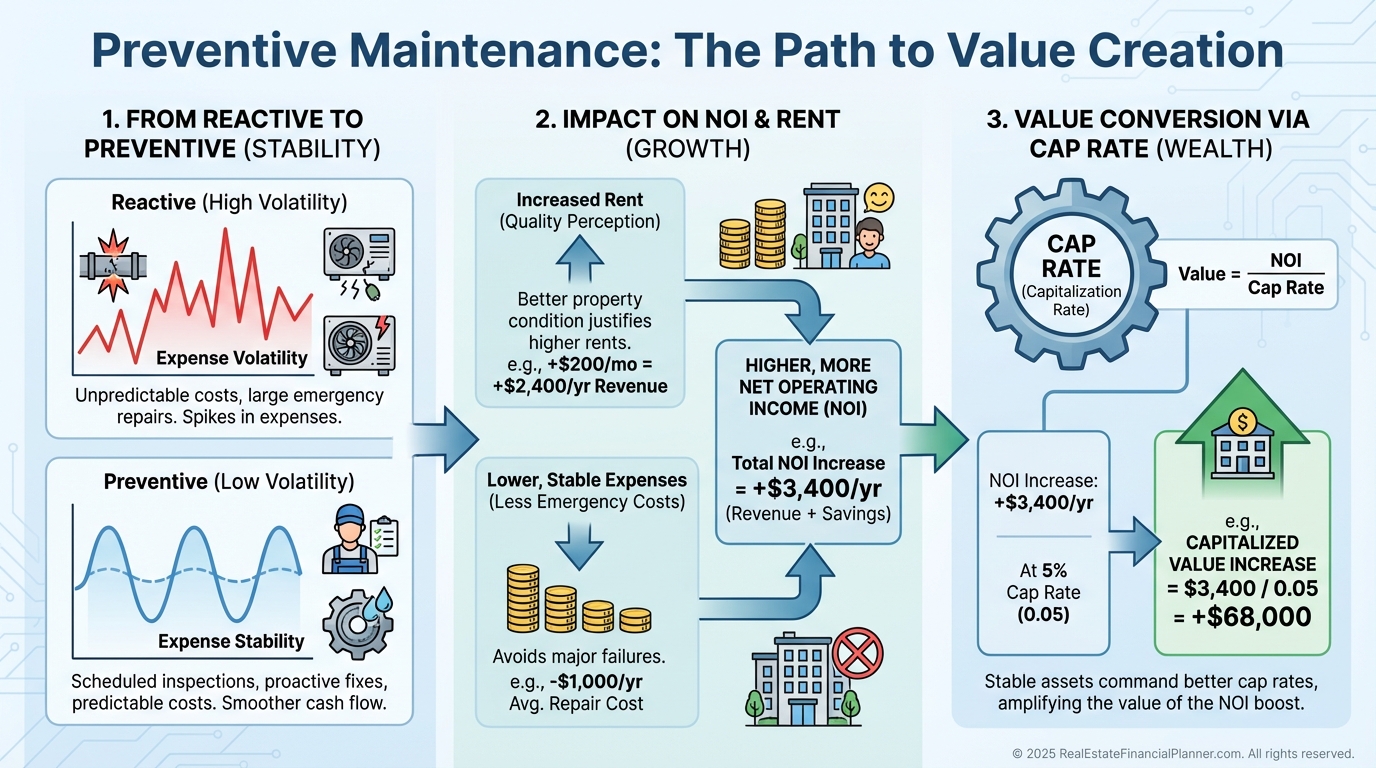

How Maintenance Moves Your Numbers

Maintenance touches revenue, expenses, and risk, so it changes your NOI and your cap rate.

Well-maintained properties often achieve 5–10% higher rents, 50% lower turnover, and fewer emergency premiums.

When I model deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I separate maintenance reserves from actual expenses.

Reserves prepare you for future needs; expenses are the checks you write today.

Every dollar of preventable repair avoided or rent premium gained capitalizes into value at your market’s cap rate.

At a 7% cap, a recurring $1,000 annual improvement in NOI is roughly $14,285 in added value.

In the Return Quadrants™ framework, smart maintenance improves cash flow, reduces capital expenses, and supports appreciation by protecting condition.

It also lowers risk, which increases your financing options and your ability to compound.

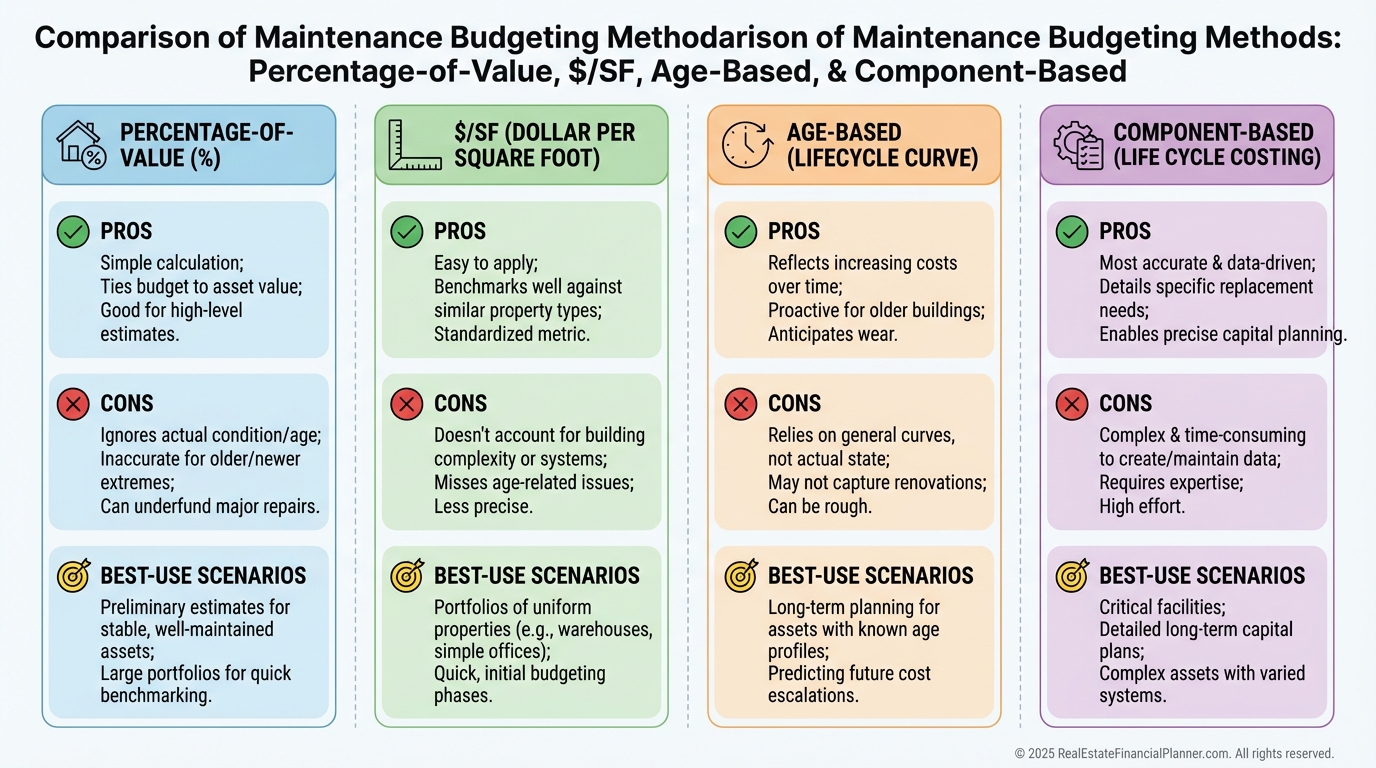

The Four Ways to Budget Maintenance (And When to Use Each)

Rules of thumb are starting points, not strategies.

Use multiple methods and triangulate to set a reality-based budget.

•

Percentage of value: 1% of property value per year is common, but often light for older assets or harsh climates.

•

Dollars per square foot: $1–$2 per SF annually adjusts better for size and materials.

•

Age-based: Newer (0–10 yrs) 0.5–1%, mid-life (10–25 yrs) 1–1.5%, older (25+ yrs) 1.5–2.5%.

•

Component-based: Lifespan and replacement cost per system, summed into a reserve schedule.

When I underwrite, I start with $/SF and age-based ranges, then finalize with component-based.

That last step prevents wishful thinking.

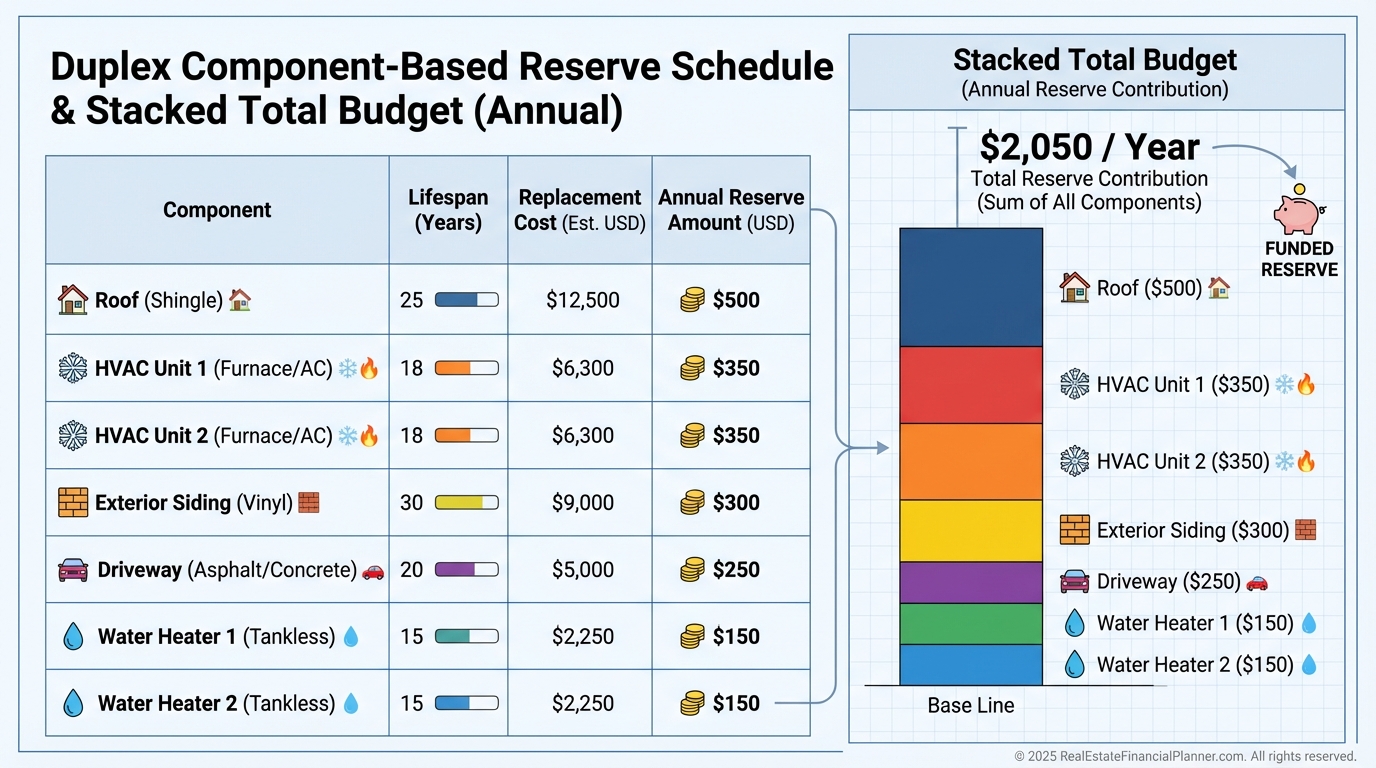

Component-Based Reserves: The Professional Standard

Let’s walk a real example I recently built for a client’s 1,450 SF duplex purchased for $190,000, built in 1996.

We priced lifespans and current replacement costs, then annualized each item.

•

Roof, 20-year life, $9,200 replace ≈ $460/year

•

HVAC (2 systems), 15-year life, $7,500 total ≈ $500/year

•

Water heaters (2), 10-year life, $2,000 total ≈ $200/year

•

Appliances package, 10-year life, $3,200 total ≈ $320/year

•

Exterior paint, 8-year cycle, $4,000 ≈ $500/year

•

Flooring turnover, 15-year average, $6,300 ≈ $420/year

Annual major systems reserve ≈ $2,400.

Then we layered routine maintenance:

•

HVAC service contracts ≈ $320/year

•

Pest control ≈ $420/year

•

Gutter cleaning ≈ $220/year

•

Misc. repairs backlog allowance ≈ $900/year

Routine ≈ $1,860.

Total annual maintenance budget ≈ $4,260, or ~2.24% of purchase price.

We entered this into The World’s Greatest Real Estate Deal Analysis Spreadsheet™, then stress-tested for a roof or HVAC early failure.

The deal still penciled, because the reserves were sized to reality.

Data Sources You Can Trust

To price components accurately, I cross-check three sources.

HomeAdvisor/Angi gives me real invoices by ZIP.

RSMeans anchors material and labor baselines.

Local vendors confirm current availability, lead times, and portfolio pricing.

Property managers with similar doors provide real maintenance ratios by vintage and construction type.

Your goal isn’t perfection—it’s to be consistently close and well-documented.

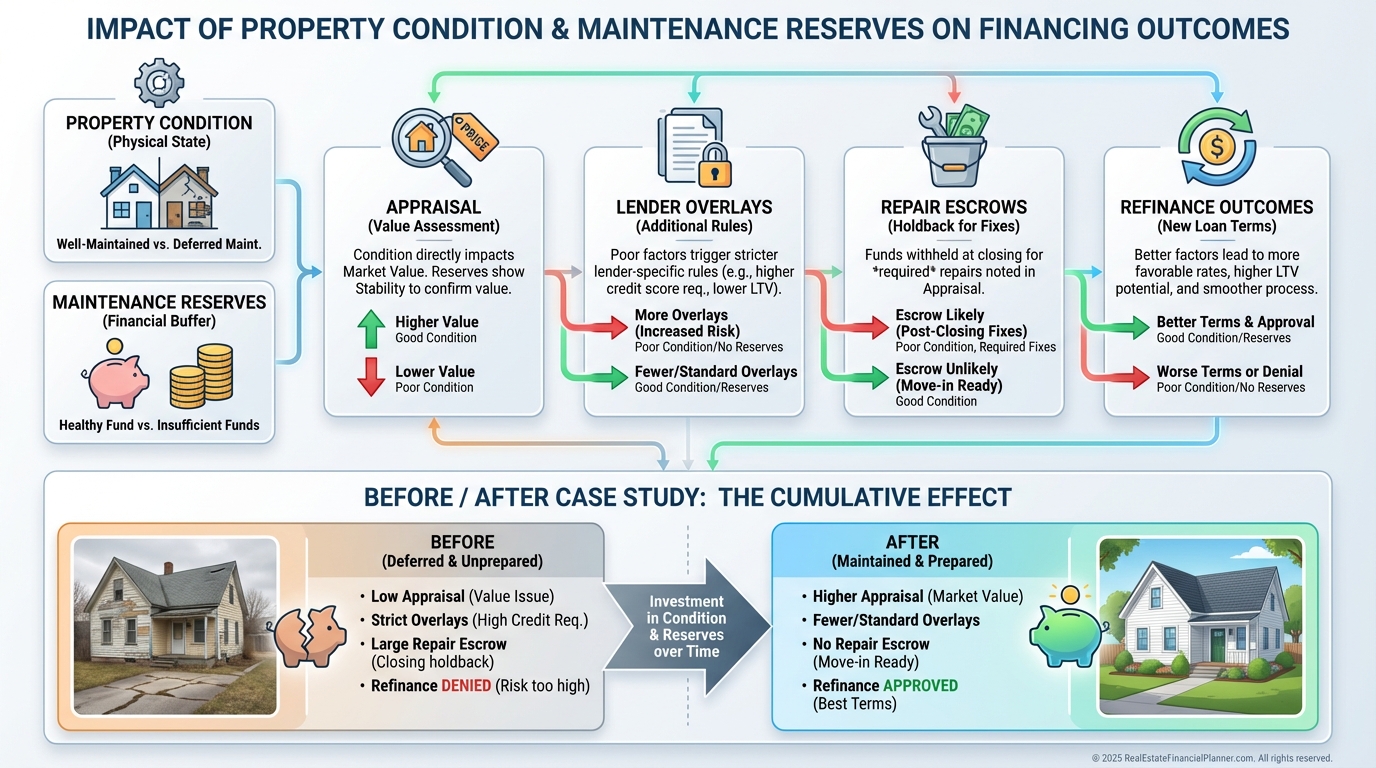

Maintenance, Valuation, and Financing

Appraisers adjust hard for physical depreciation.

Two similar fourplexes with identical rents can appraise tens of thousands apart when one shows deferred maintenance and the other shows clean systems and logs.

That gap hits True Net Equity™ immediately and may block your refinance or cash-out.

Lenders also underwrite property condition.

Conventional loans require minimum standards and can impose repair escrows.

FHA/VA are stricter, which affects your exit buyer pool.

Portfolio lenders love documented reserves and clean schedules, and they often reward them with better terms.

I’ve seen an $8,000 roof caught and addressed ahead of time unlock $50,000 of cash-out proceeds that would’ve been denied with visible deferred items.

Common Mistakes That Quietly Drain Returns

Underestimating first-year costs on mid-life systems.

Skipping seasonal maintenance and paying summer emergency premiums.

DIY heroics that become pro re-dos.

Single-vendor dependency in peak season.

Poor records that scare buyers and auditors.

Reactive-only habits that multiply costs.

Cosmetics over systems—granite with a failing roof is lipstick on risk.

When I audit clients’ portfolios, these patterns show up over and over.

We fix the system first, then the siding.

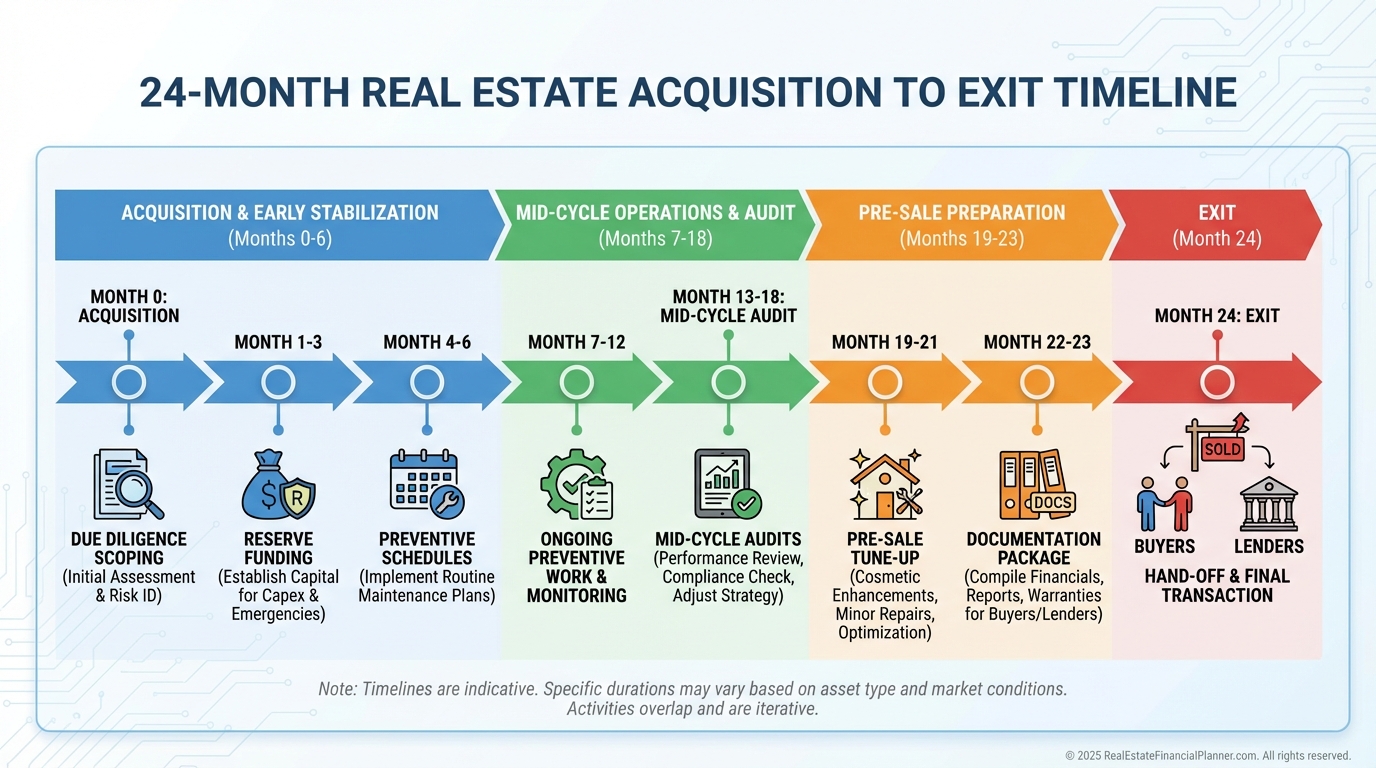

Portfolio Systems That Scale

Schedule preventive maintenance with property management software like Buildium or AppFolio.

Standardize SKUs for appliances, faucets, and finishes so techs work faster and parts are stocked.

Cultivate two to three vendors per trade and offer volume plus fast payment for priority service.

Bundle service contracts across doors for 20–30% savings.

Track work orders and receipts to build a maintenance “Carfax” you can hand to buyers and lenders.

In the Real Estate Financial Planner™, I tag properties with maintenance risk so we can prioritize reserves and refinancing windows.

Acquisition, Negotiation, and the Nomad™ Angle

On acquisition, I price deferred maintenance during due diligence with contractor walk-throughs.

Then I negotiate credits or price reductions with written bids in hand.

That sequencing optimizes your Return Quadrants™ by raising rent potential, lowering repairs, and protecting future valuations.

Taxes: Categorize Right, Plan the Calendar

Keep clean lines between deductible repairs and depreciable improvements.

Document scope, photos, and invoices so your CPA has support.

In high-income years, I time deductible repairs to offset taxes.

On larger assets, I pair maintenance records with cost segregation to accelerate depreciation on eligible components.

Your documentation is the bridge between strategy and defensibility.

Turning Maintenance Into Measurable ROI

Here’s the math I show clients.

If preventive maintenance and clean systems add a 5% rent premium on a $1,200 unit, that’s $60/month or $720/year.

At a 7% cap, that single outcome capitalizes to about $10,285 in value.

Combine fewer emergency premiums, lower vacancy, and higher buyer confidence, and preventive maintenance often clears a 200%+ ROI.

It isn’t a cost center.

It’s cash flow protection that compounds into equity.

Your 7-Step Maintenance Action Plan

•

Diagnose: Inventory all systems, ages, and conditions with photos.

•

Budget: Triangulate with $/SF, age-based, and component-based; adopt the highest credible number.

•

Reserve: Fund a dedicated maintenance reserve account and automate monthly contributions.

•

Schedule: Load seasonal and annual preventive tasks into your software with vendor assignments.

•

Standardize: Lock SKUs and finishes; stock critical spares.

•

Document: Keep receipts, logs, and warranties for a transfer-ready packet.

•

Optimize: Re-run your deal in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ every six months to verify NOI, reserves, and refinance readiness.

Do this once, and you’ll feel it in your cash flow.

Do it every year, and you’ll see it in your True Net Equity™.