Cash Later: The Wealth You Build Before You Spend It

Learn about Cash Later for real estate investing.

Cash Later Overview

You can be doing everything right and still feel broke.

I see this all the time when I help clients analyze their rental properties.

They own good assets.

They made smart purchases.

They’re building wealth every month.

But none of it shows up in their checking account.

That’s Cash Later.

Cash Later is the part of real estate investing where your wealth grows quietly in the background.

You can’t spend it today, but it’s often doing more heavy lifting than cash flow ever will.

If you misunderstand this, you will either sell too early, over-leverage, or dismiss great deals that don’t “feel” profitable yet.

Understanding Cash Later is how investors build real wealth without realizing it until years later.

What Cash Later Really Means

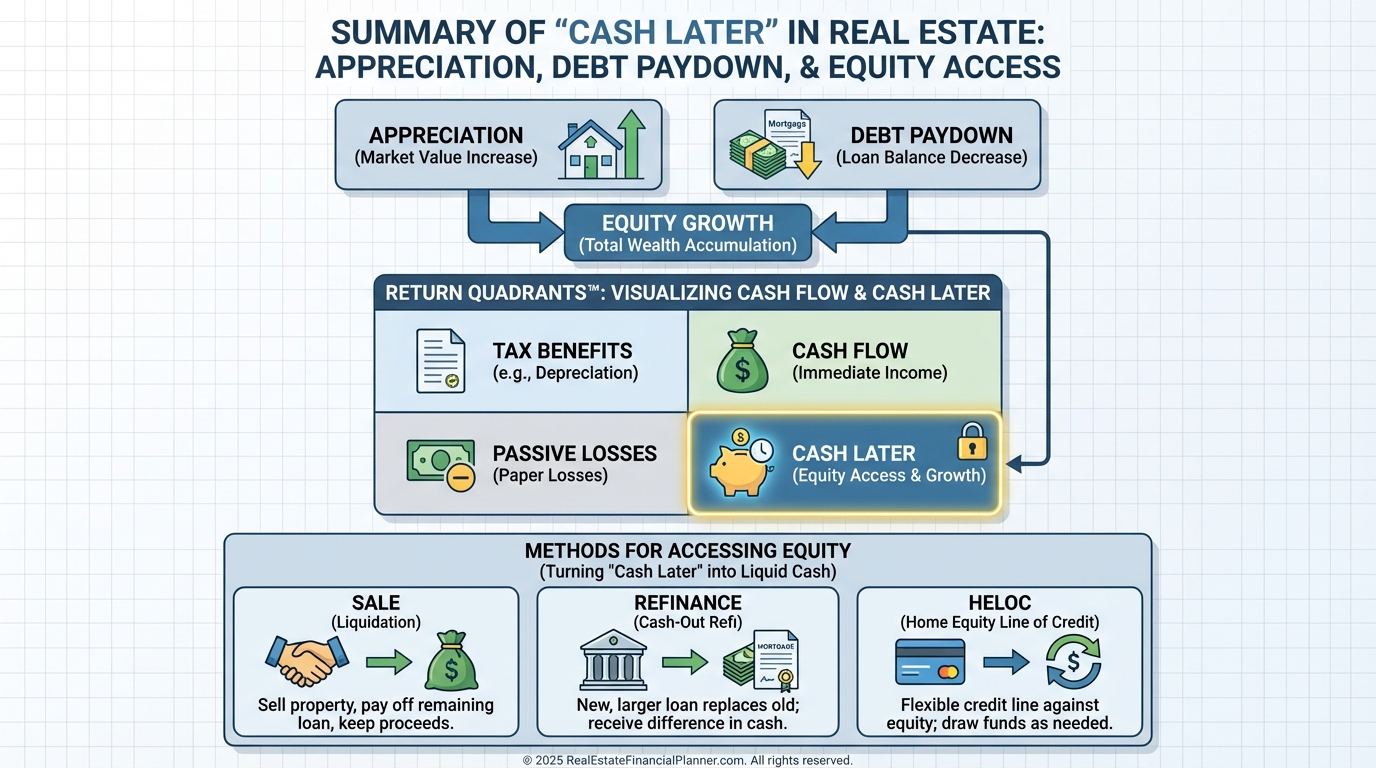

Cash Later comes from the equity side of real estate returns.

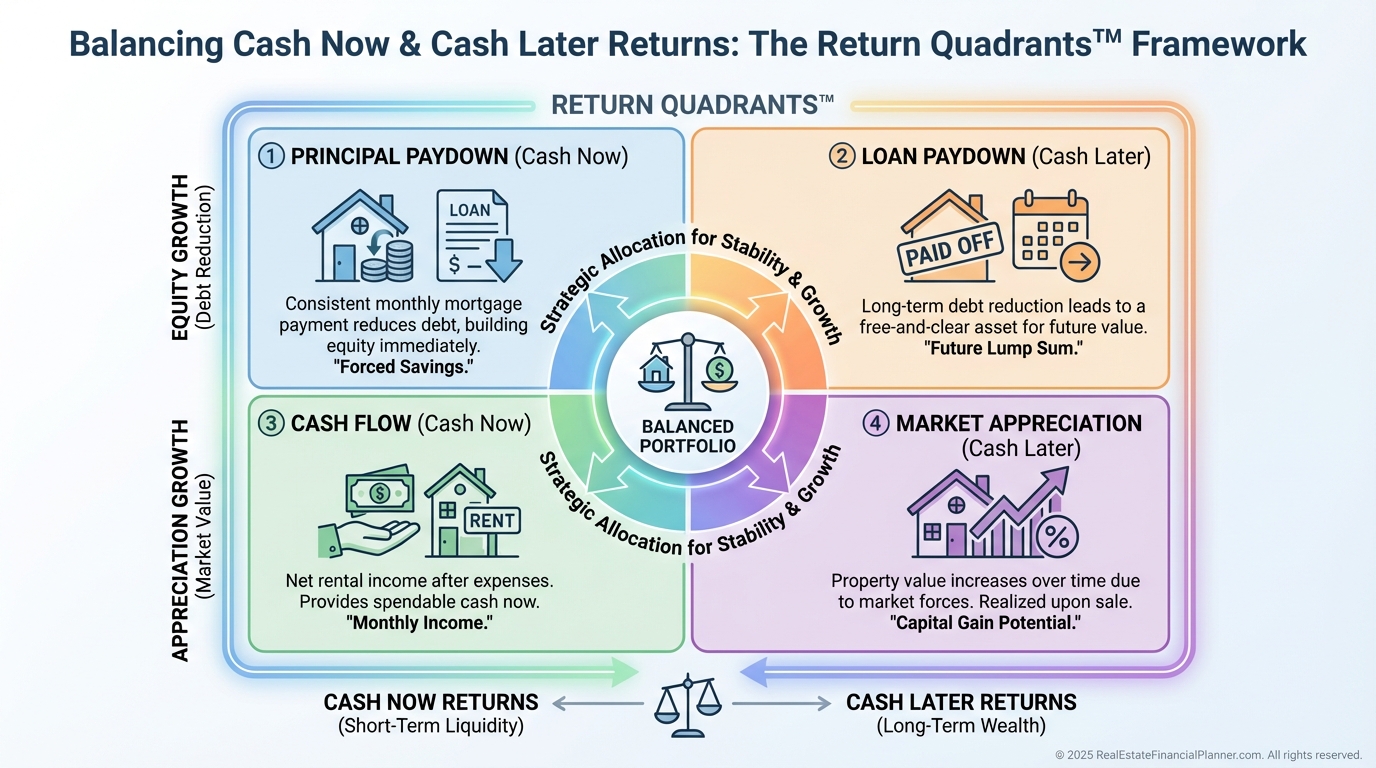

In the Return Quadrants™ framework, it includes two components:

Appreciation – The increase in your property’s value over time.

Debt Paydown – The reduction of your loan balance with every payment.

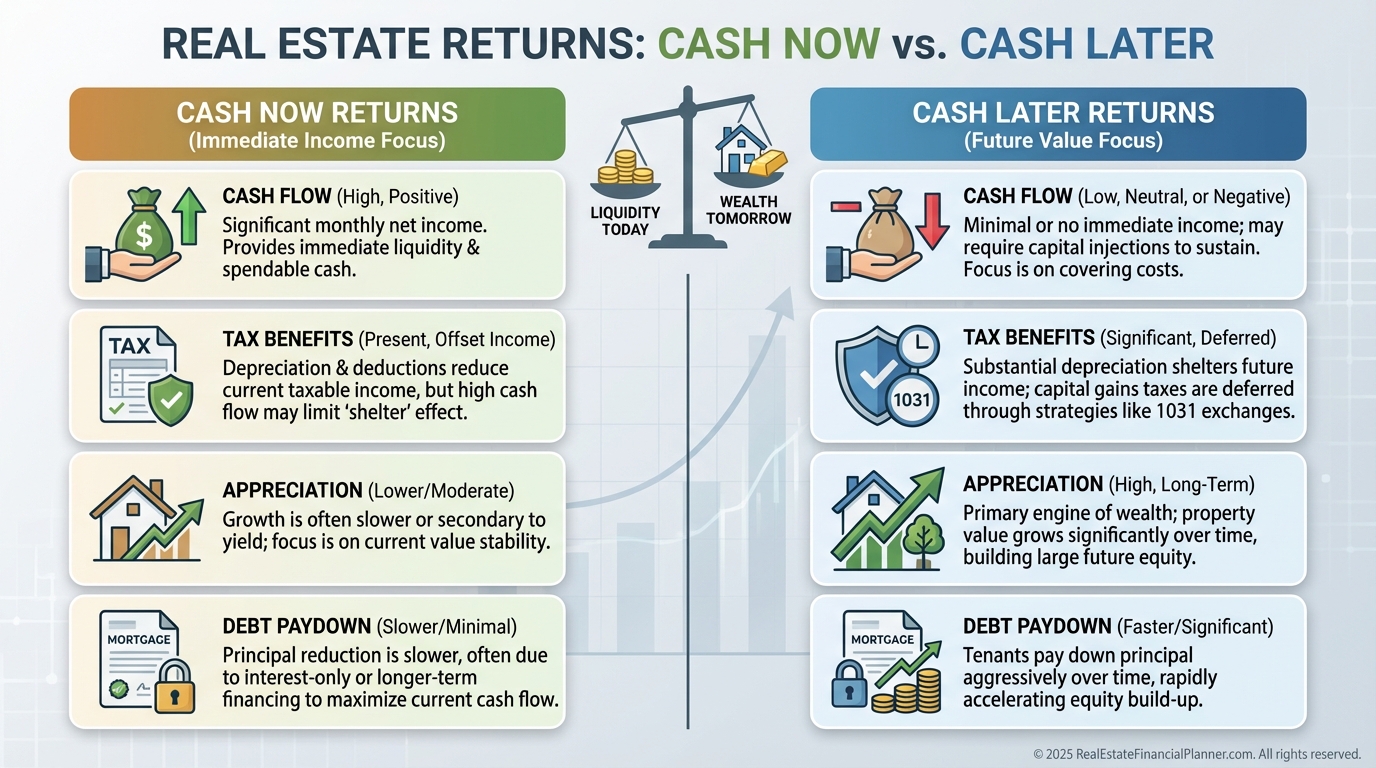

Unlike Cash Now returns, these don’t send you money each month.

They accumulate silently.

When I rebuilt after bankruptcy, Cash Later was the only reason my early deals worked.

Some properties barely broke even on cash flow, but the equity growth changed my financial future.

That’s why ignoring Cash Later is one of the most expensive mistakes investors make.

Cash Now vs Cash Later

Why Cash Later Feels Invisible

Cash Later doesn’t feel rewarding at first.

You can’t deposit appreciation.

You can’t swipe debt paydown.

This leads investors to overweight cash flow and underweight equity growth.

I warn clients about this constantly.

If you only chase what feels good today, you sacrifice what actually builds wealth tomorrow.

Cash Later forces patience.

It also protects you from yourself by keeping money locked up until you have a reason to access it.

Appreciation: The Quiet Multiplier

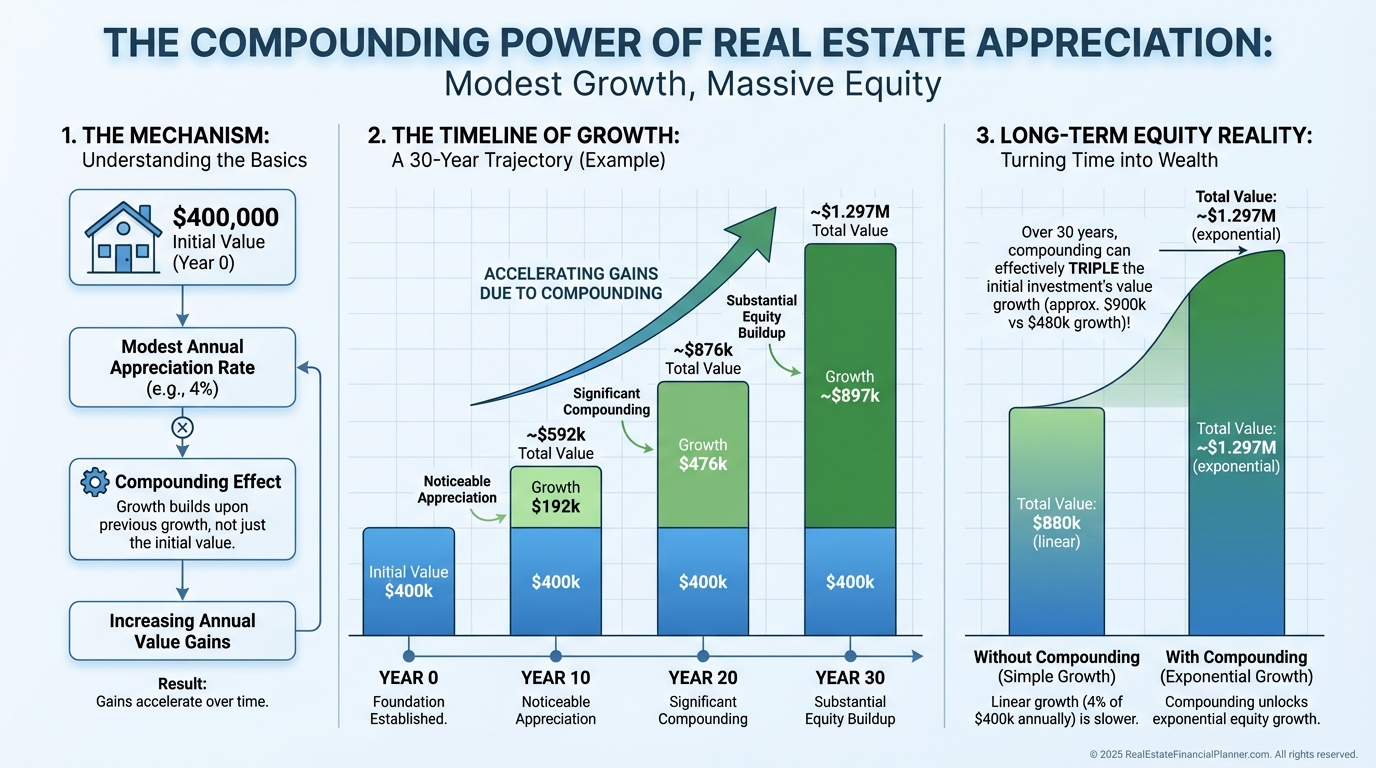

Appreciation is the least understood return.

It comes in two forms:

Natural Appreciation driven by inflation, population growth, and demand.

Forced Appreciation created by improvements, better use, or better management.

Most investors underestimate how powerful modest appreciation becomes over time.

A boring three percent annual increase doubles a property’s value in roughly twenty-four years.

That happens whether you think about it or not.

When I model deals, appreciation often dwarfs cash flow over a full holding period, especially in strong markets.

How Appreciation Compounds Over Time

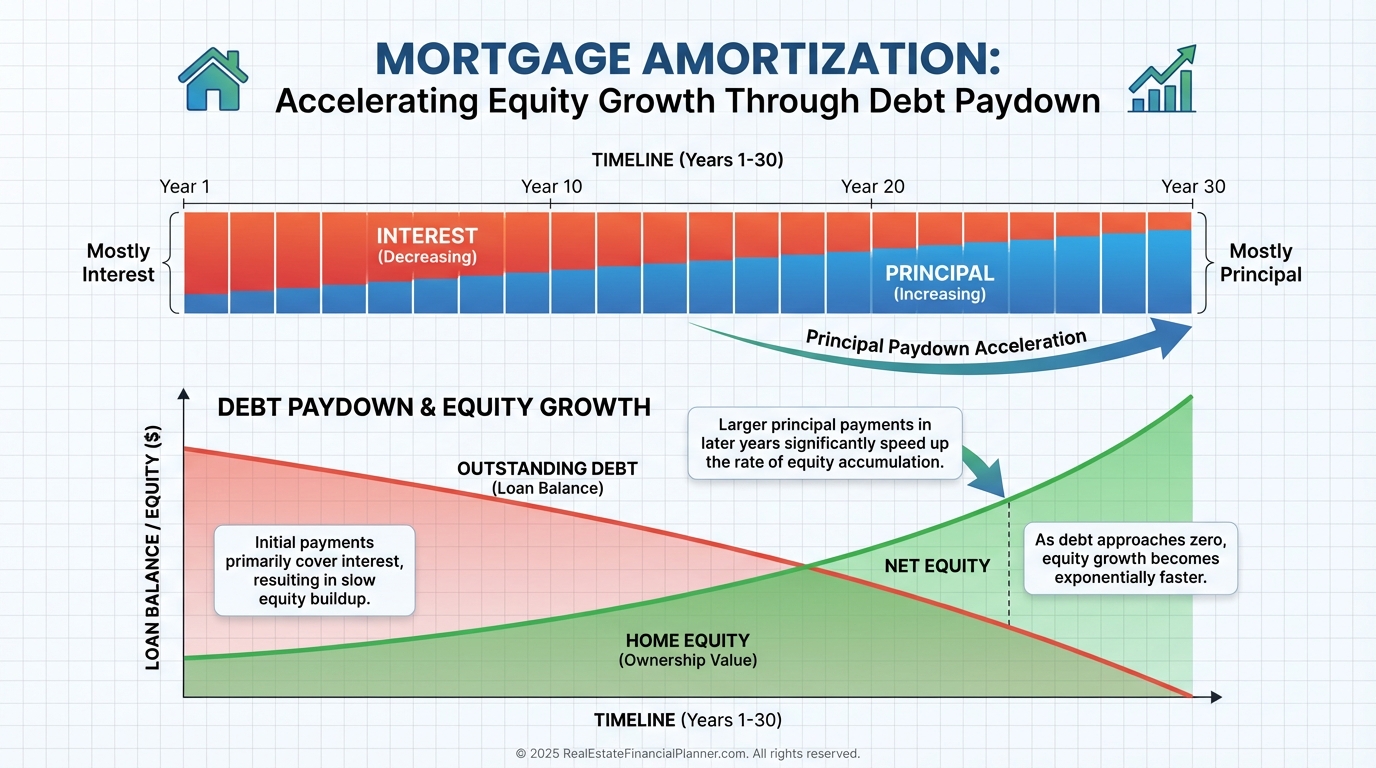

Debt Paydown: Wealth by Math, Not Hope

Debt paydown is the most reliable return in real estate.

Every payment converts debt into equity.

No market timing.

No guessing.

No appreciation required.

Early in a loan, progress feels slow.

Later, it accelerates dramatically.

By the time investors notice it, tens or hundreds of thousands of dollars of wealth has already been built.

I like debt paydown because it rewards consistency, not brilliance.

Mortgage Amortization and Equity Growth

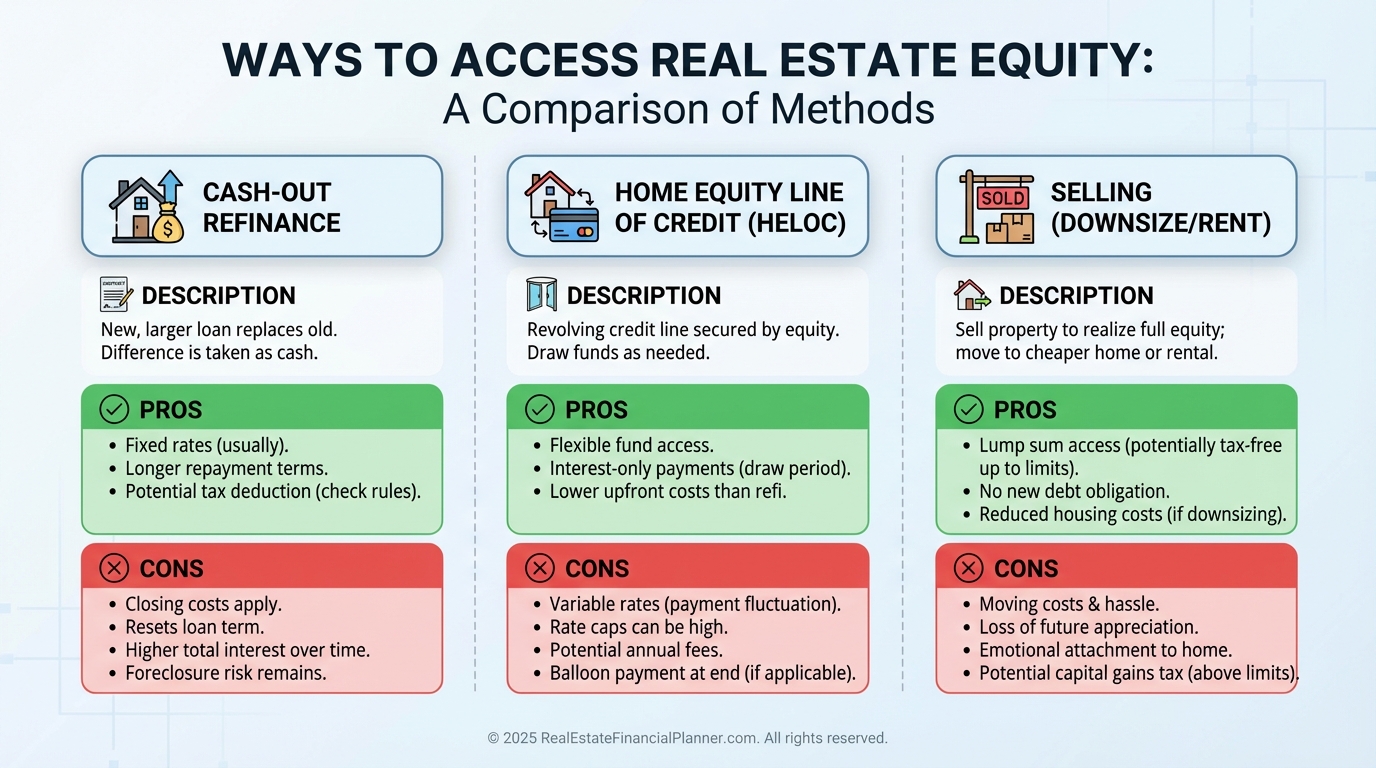

Accessing Cash Later Without Breaking the Asset

Eventually, investors want access to their equity.

There are three primary ways:

HELOC or Home Equity Loan

Selling the Property

Refinancing and HELOCs access equity without triggering taxes.

Selling converts equity into cash but usually creates tax friction.

When I run scenarios for clients, we always model these decisions using True Net Equity™.

Gross equity lies.

Net equity tells the truth.

Ways to Access Equity

Cash Later Changes How You Buy Properties

Cash Later thinking changes deal selection.

You stop asking only, “What does this pay me this month?”

You start asking, “What does this become over time?”

That’s how Nomad™ investing works.

That’s how long-term buy-and-hold portfolios outperform expectations.

Some properties are Cash Now machines.

Some are Cash Later monsters.

The best portfolios intentionally mix both.

Portfolio Balance Across Return Quadrants™

When Cash Later Becomes a Problem

Cash Later only fails when investors lose discipline.

Refinancing too aggressively.

Pulling equity for lifestyle spending.

Ignoring Return on Equity as values rise.

I’ve seen investors kill great portfolios by harvesting equity without reinvesting it wisely.

Cash Later should fund growth, not consumption.

The Real Role of Cash Later

Cash Later is how real estate quietly turns average earners into wealthy investors.

It doesn’t feel exciting.

It doesn’t show up monthly.

It doesn’t make for flashy screenshots.

But it works.

If you want financial independence instead of financial noise, Cash Later has to be part of your strategy.

And once you truly understand it, you stop chasing deals that feel good today and start building wealth that compounds for decades.