Real Estate Investment Trusts: A Practical, High-Liquidity Play for Income and Diversification

Learn about Real Estate Investment Trusts for real estate investing.

Why REITs Belong in a Real Estate Plan

When I help clients build durable portfolios, I’m not trying to win cocktail-party bragging rights.

That’s why I teach landlords and early-stage investors to add a sleeve of REITs alongside rentals.

REITs give you instant diversification, professional management, and liquidity you can’t get from a duplex.

You can trim, add, or rebalance in seconds, not months.

What REITs Are—And Why They Exist

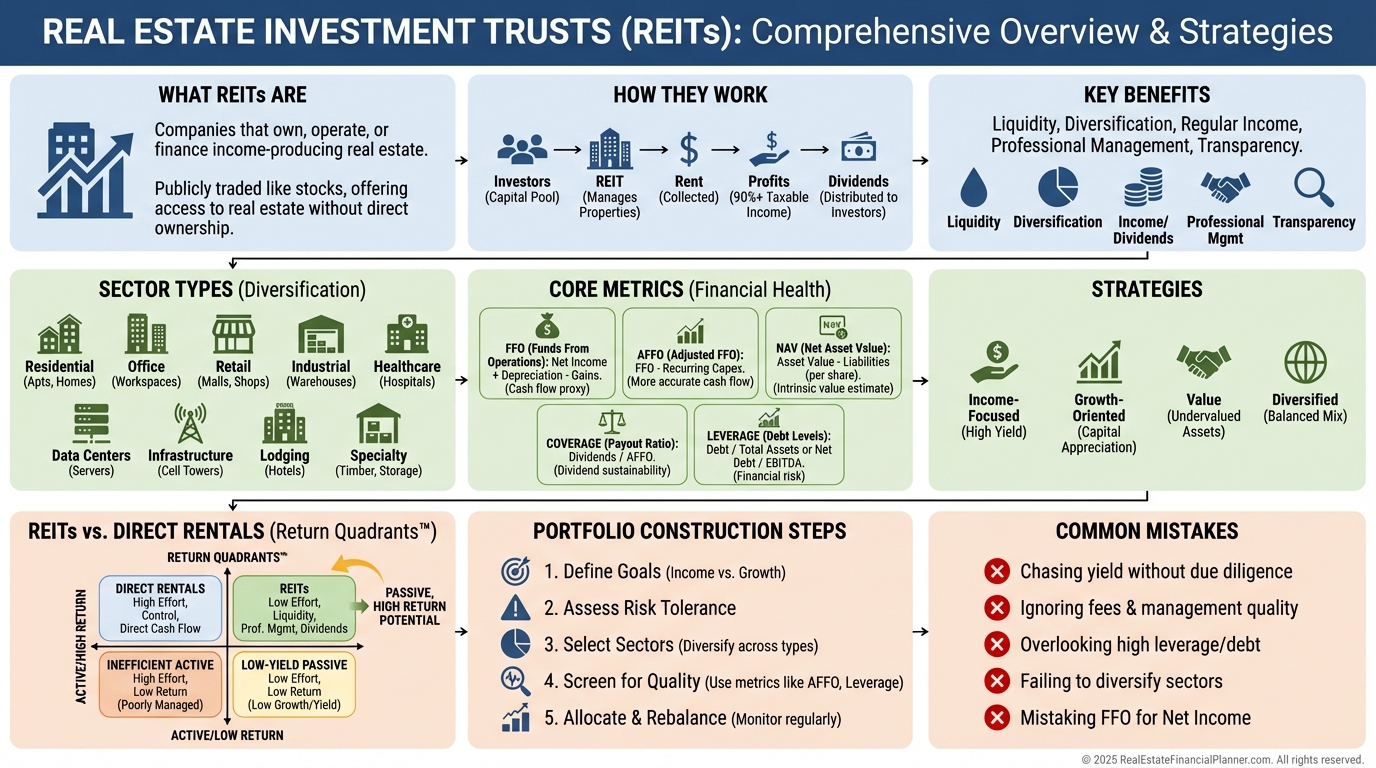

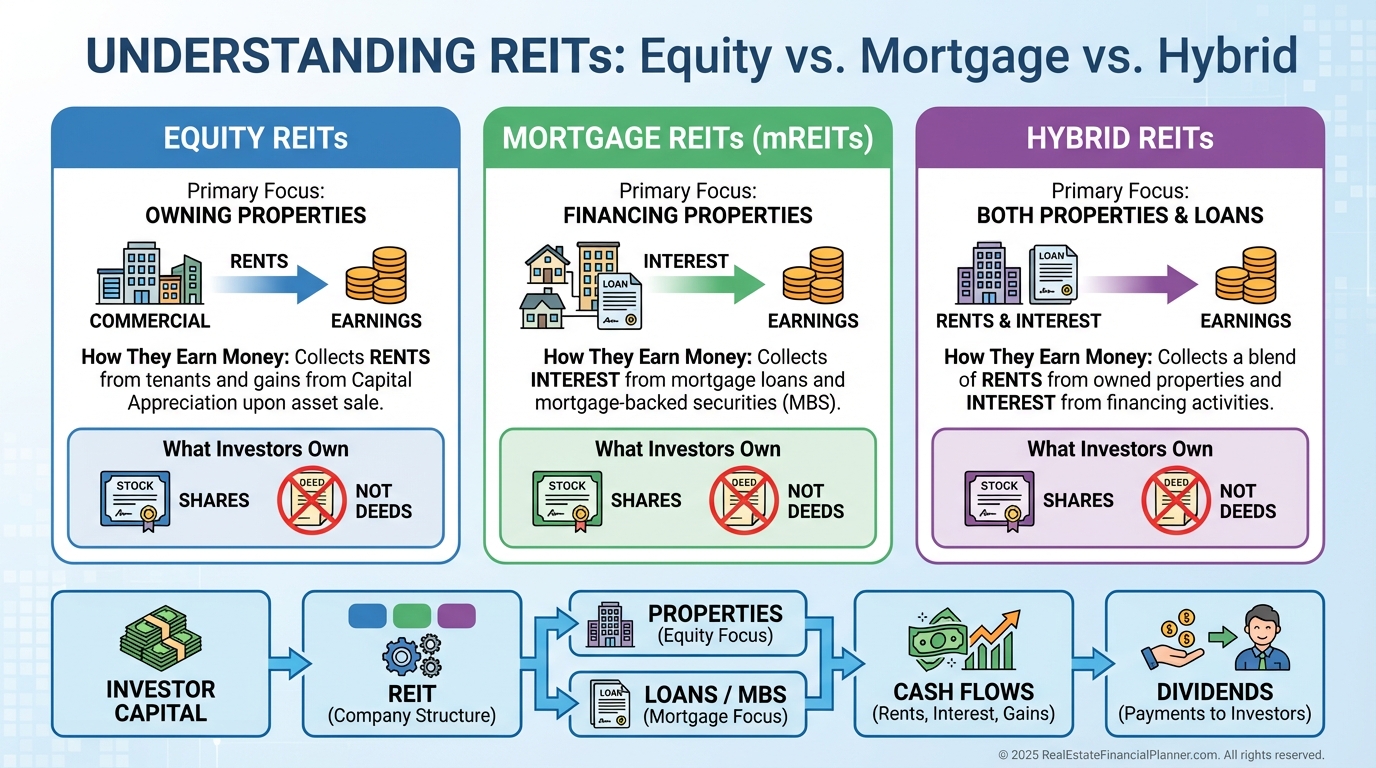

A REIT is a company that owns, operates, or finances income-producing real estate.

Congress created them to let everyday investors access institutional-grade properties and dividend income without becoming landlords.

To qualify, REITs must invest mostly in real estate, earn real-estate income, and distribute most taxable income as dividends.

That structure is why they’re such reliable income vehicles.

The Benefits Most Investors Miss

Liquidity matters when a job changes, a baby arrives, or an opportunity appears.

REITs trade like stocks, so you can right-size your real estate exposure quickly.

Professional management is an edge you can rent instead of build.

Diversification shows up on day one.

A single REIT can spread risk across markets, tenants, and lease maturities.

Dividends are the point.

Regulated payouts create a built-in income stream you can reinvest or live on.

The Property Sectors Behind the Ticker

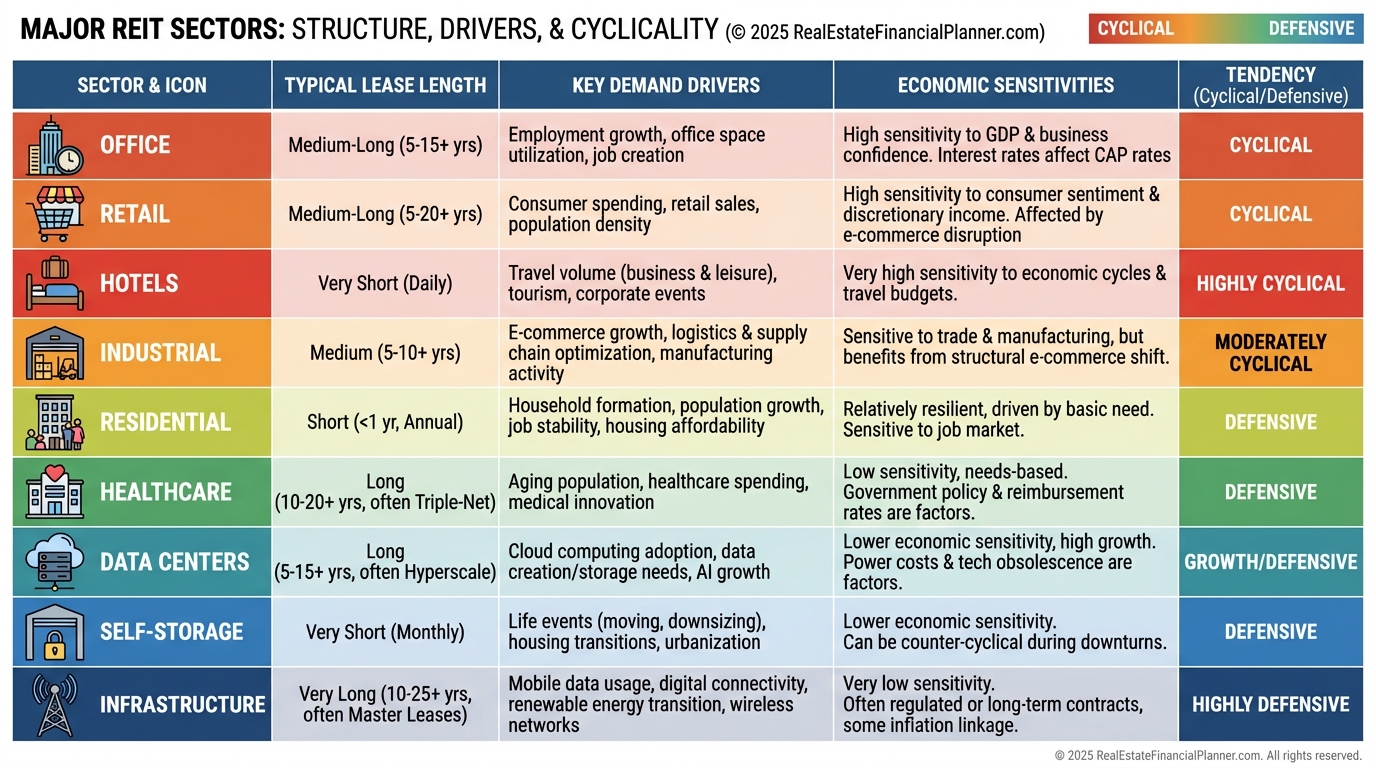

REITs specialize.

That lets you place targeted bets without buying a dozen buildings.

Common sectors include residential, office, retail, industrial, healthcare, data centers, hotels, self-storage, and infrastructure.

Each reacts differently to jobs, inflation, rates, and technology.

When I rebalance client portfolios, I treat sectors like levers to reflect the current economic cycle.

The Metrics That Actually Matter

Analyzing REITs is not the same as analyzing rentals.

You won’t run a rent roll or call a plumber, but you do need to read a REIT’s cash flow.

Here’s what I model for clients.

•

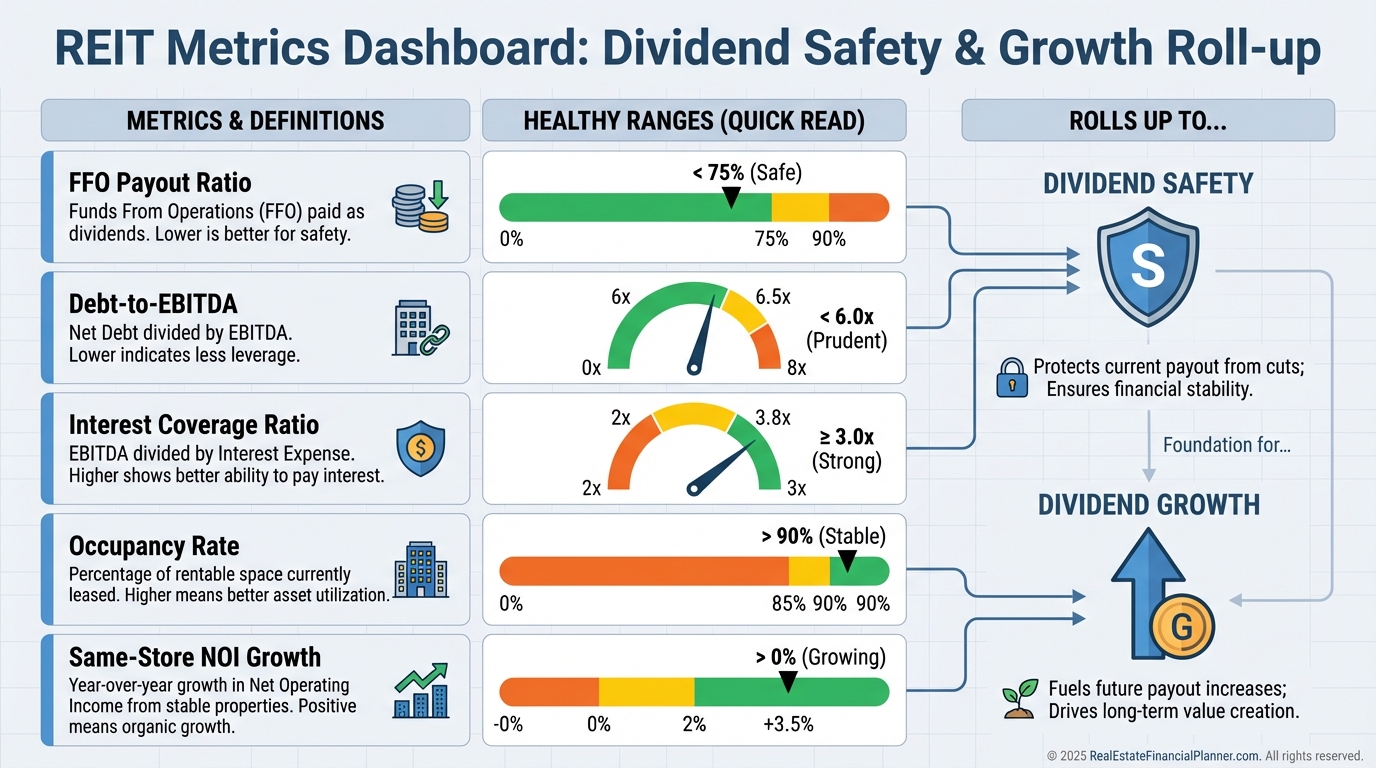

FFO: Adds back non-cash depreciation and removes one-time gains to show true operating performance.

•

AFFO: Subtracts recurring capital needs from FFO to show sustainable dividend power.

•

Dividend Coverage: AFFO divided by dividends; I prefer 1.2x or higher through-cycle.

•

Leverage: Debt/EBITDA shows risk; lower is safer when rates rise.

•

Same-Store NOI Growth: Reveals organic growth, not just acquisition-driven gains.

•

NAV and Discount/Premium: Compare share price to property value net of debt to find mispricing.

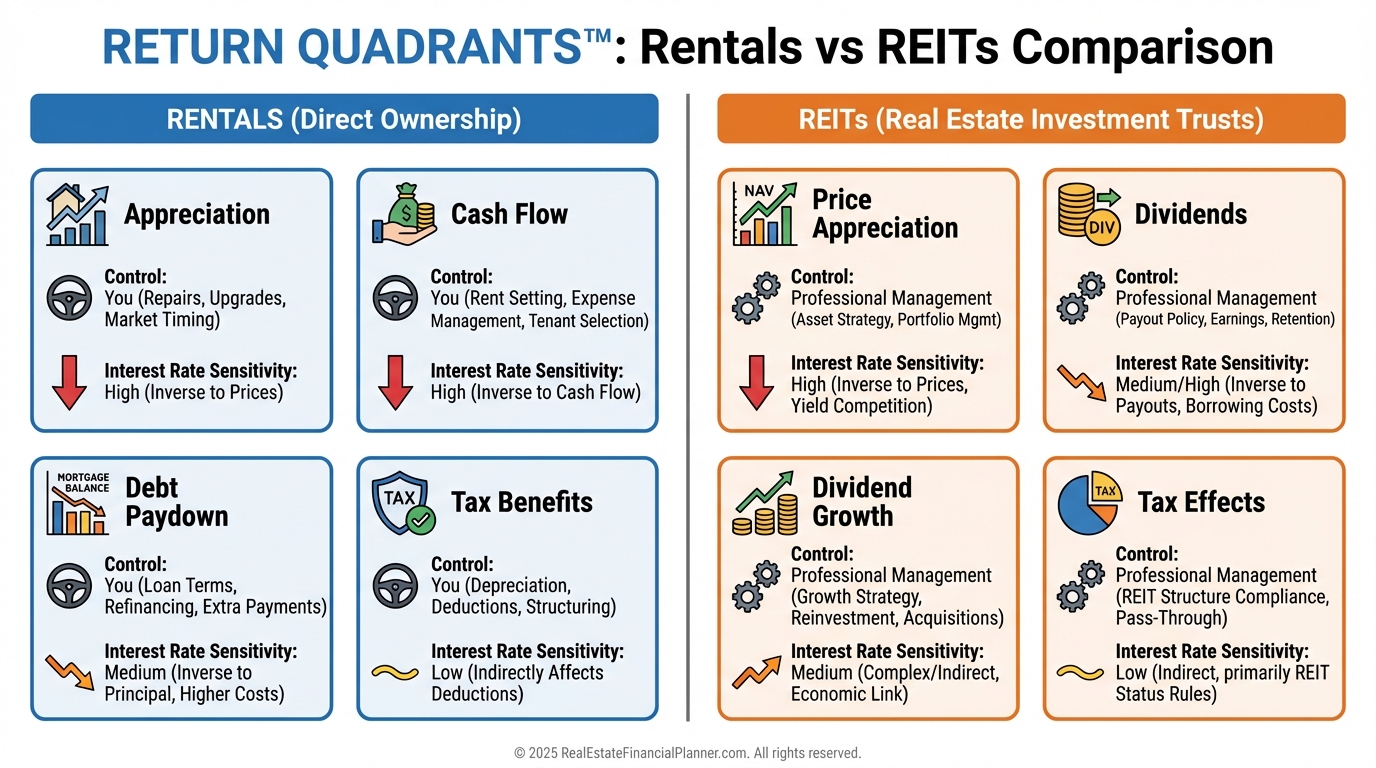

Using REFP Frameworks: Return Quadrants™ for REITs vs Rentals

The Return Quadrants™ framework clarifies where returns come from.

For REITs, you see price appreciation, dividend income, dividend growth via AFFO growth, and tax effects.

Debt paydown is indirect with REITs, because management amortizes or refinances on your behalf.

When I compare adding a rental vs a REIT for a client, I line up both Return Quadrants™ over a 10-year horizon.

Then I test shocks—rate changes, rent softness, capex spikes—to see which path holds up better.

Where True Net Equity™ Guides the Decision

Before funding a REIT sleeve, I calculate your True Net Equity™ on existing properties.

That’s your equity after selling costs, capital gains, depreciation recapture, and loan payoff.

If your Return on Equity has drifted down because equity piled up, a partial 1031, a cash-out refi, or redirecting new cash to REITs may raise total returns.

Sometimes the right move is doing nothing.

But I want that to be a deliberate choice, not inertia.

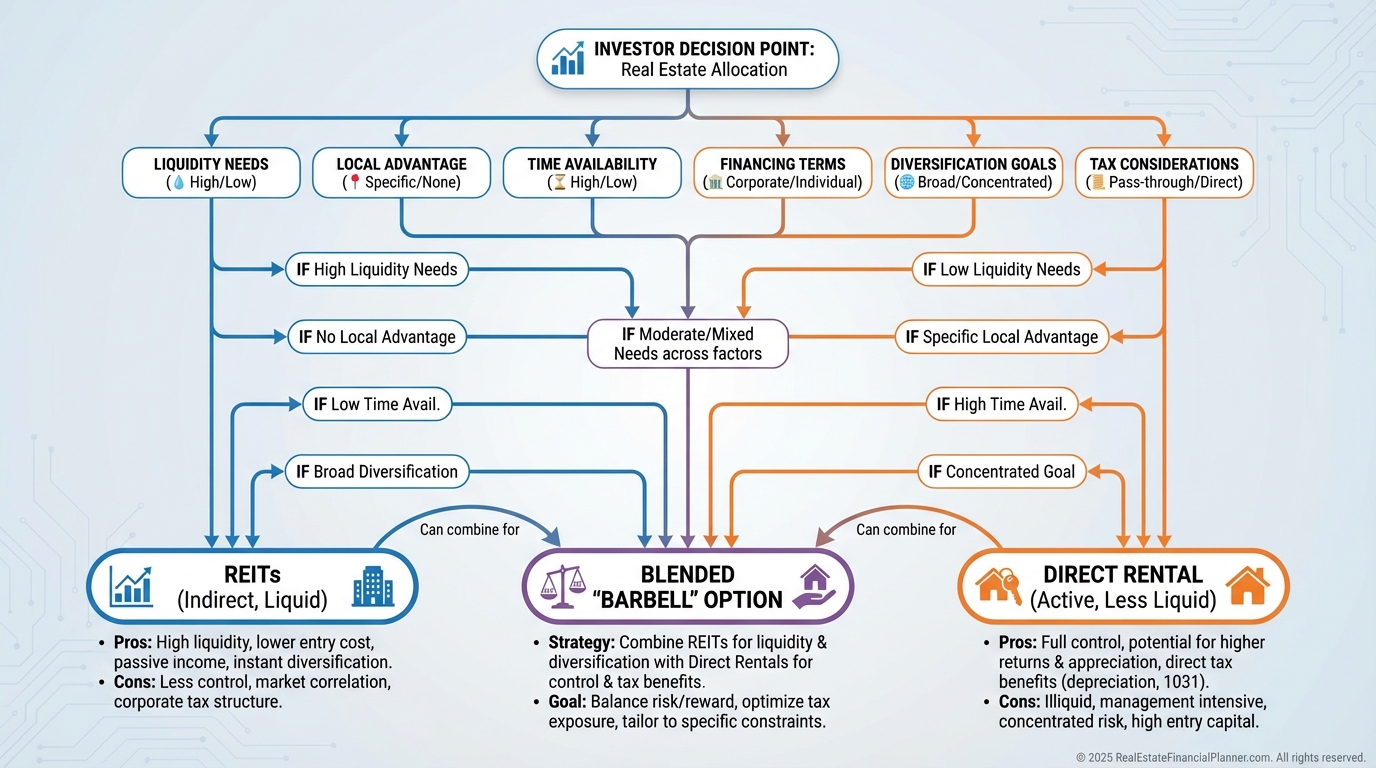

When REITs Beat Buying Another Rental

If you need liquidity, diversifying beyond your metro, or access to sectors you can’t buy locally, REITs often win.

If you have an unfair local advantage, time to operate, and a value-add plan, the next rental can win.

Inside planning meetings, I often recommend a barbell.

Hold hands-on properties where you have edge, and use REITs for breadth, balance, and cash flow smoothing.

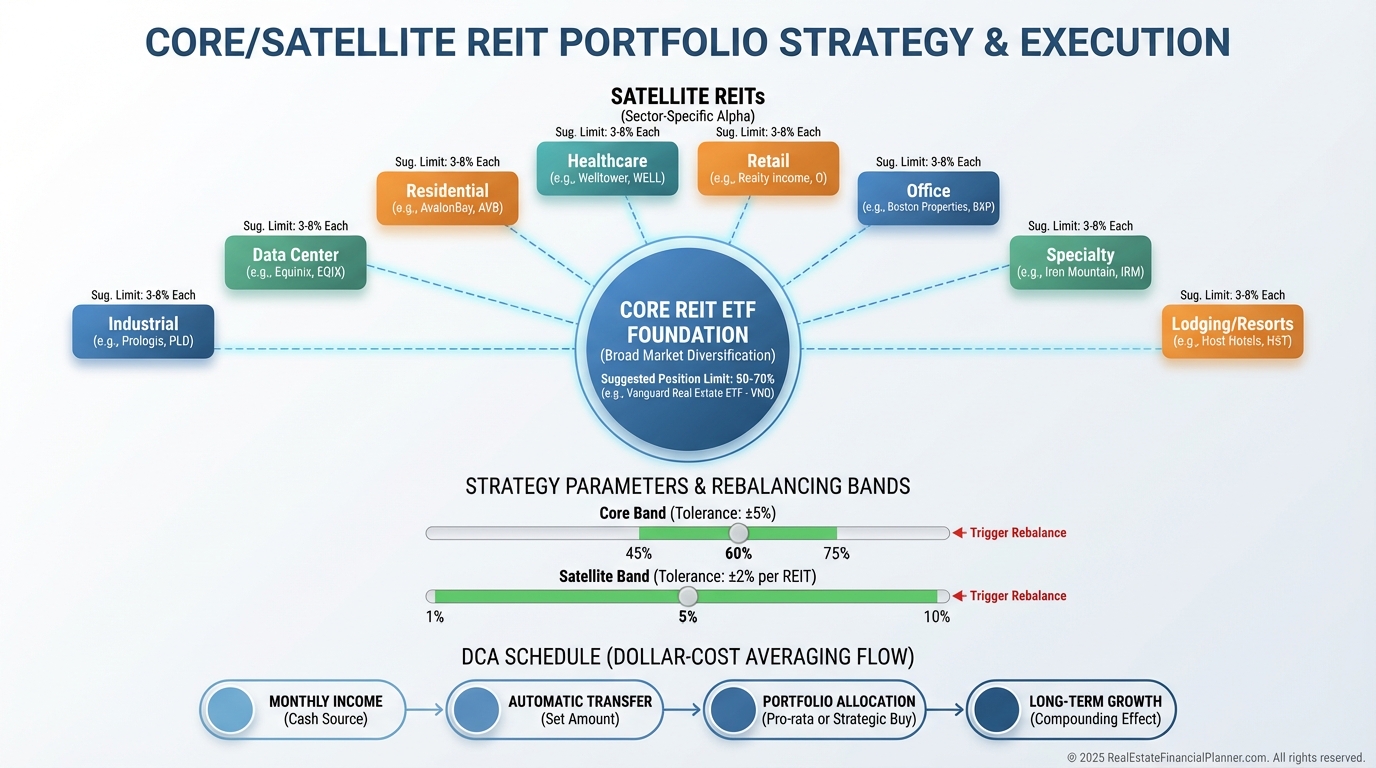

Practical Strategy: Build a REIT Sleeve With Discipline

Start with a simple core.

Use a broad REIT ETF for base exposure while you learn.

Then add 5–10 individual names across sectors with position limits so no single REIT exceeds 20% of your REIT sleeve.

Dollar-cost average monthly or quarterly.

In down markets, I increase buys if dividend coverage stays healthy.

Reinvest dividends unless you need income to cover lifestyle or reserves.

In tax-advantaged accounts, allow compounding to work quietly.

In taxable accounts, be mindful of dividend character and your bracket.

Tax rules change, so confirm current treatment before year-end planning.

How I Analyze a REIT Step-by-Step

I start with business model and sector drivers.

Then I read the investor presentation and 10-K for strategy and risks.

Next, I pull FFO, AFFO, payout ratio, leverage, and maturity ladder.

I run dividend safety under three scenarios: flat rents, mild recession, and a credit spread widening.

Finally, I sanity-check valuation against NAV and peers.

If the only reason to buy is “high yield,” I pass.

Integrating With Nomad™ and Your Acquisition Plan

If you’re using Nomad™ to acquire owner-occupant properties, a REIT sleeve can fill income gaps while you build rental count.

When a Nomad™ year stalls due to rates or inventory, I keep clients compounding via REITs.

It keeps capital productive, reduces FOMO, and maintains exposure to real estate while you wait for the next home purchase to pencil.

Tools: The World’s Greatest Real Estate Deal Analysis Spreadsheet™

Yes, it’s built for rentals, but you can adapt it.

Swap in FFO and AFFO where you’d normally track NOI and free cash flow.

Use tabs to compare a target REIT’s forward return drivers to a subject property’s Return Quadrants™.

Then allocate the next dollar where it earns the best risk-adjusted return.

I like clarity more than complexity.

This gives you clarity.

Common Mistakes I Warn Clients About

Don’t chase eye-popping yields that aren’t covered by AFFO.

Check coverage over a full cycle, not just last quarter.

Don’t overload a single sector because it’s “hot.”

Cyclicals turn fast.

Don’t ignore balance sheets.

Short debt maturities can turn a good business into a forced seller.

Don’t trade headlines.

Let cash flow growth, coverage, and valuation guide you.

Don’t compare a REIT’s yield to your best-ever flip.

Compare it to your current next-best use of capital.

That’s how pros think.

A Simple Action Plan for the Next 30 Days

Week 1: Open or confirm your brokerage and identify a broad REIT ETF for core exposure.

Week 2: Shortlist 10 REITs across 5 sectors and collect FFO, AFFO, coverage, leverage, and same-store NOI growth.

Week 3: Run a side-by-side in the Deal Analysis Spreadsheet™, including Return Quadrants™ for your next rental vs your top REIT.

Week 4: Start a modest DCA plan and set review dates for earnings seasons.

When you make these choices deliberately, the portfolio gets sturdier.

And you become the calm investor everyone else asks for advice.