Bonus Depreciation for Real Estate Investors: Front-Load Tax Savings Without Breaking the Deal

Learn about Bonus Depreciation for real estate investing.

Most real estate investors focus on purchase price, rent, and interest rates.

Very few focus on how taxes quietly decide whether a deal accelerates wealth or just limps along.

When I help investors analyze deals inside Real Estate Financial Planner™, bonus depreciation is one of the first advanced levers I check.

Not because it makes bad deals good, but because it can dramatically improve after-tax results on already solid deals.

I’ve seen investors unknowingly leave tens of thousands of dollars on the table simply because no one explained how bonus depreciation actually works, when it helps, and when it backfires.

This guide fixes that.

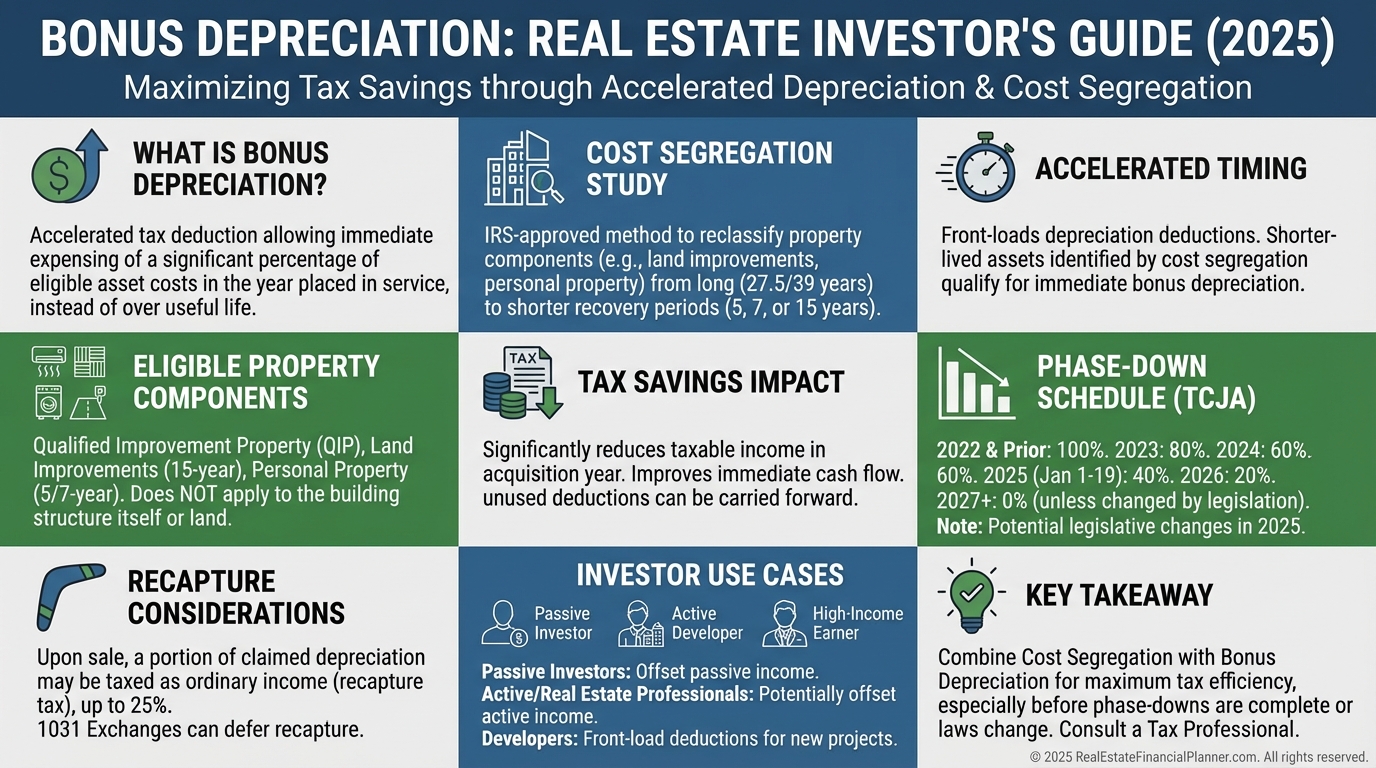

What Bonus Depreciation Actually Is

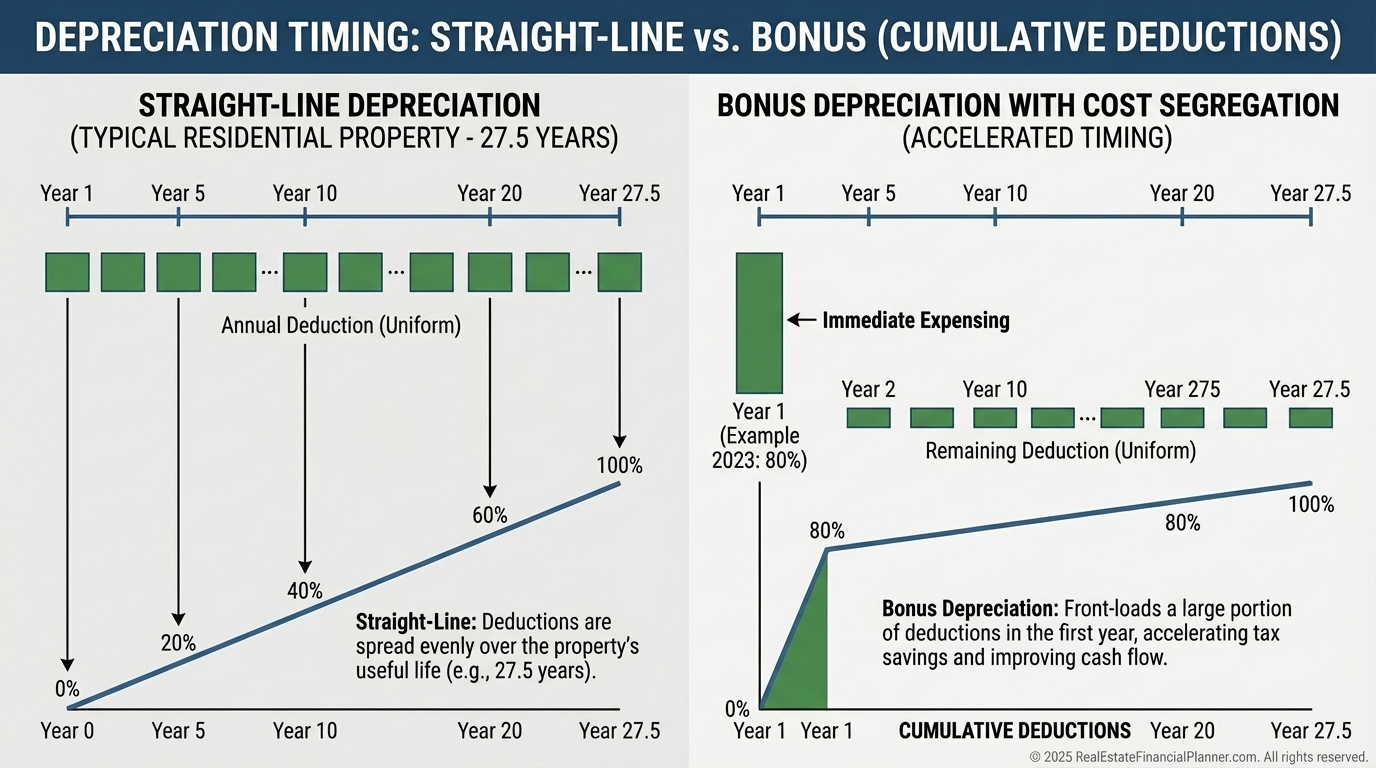

Bonus depreciation is a timing tool.

It allows you to accelerate depreciation deductions into earlier years instead of spreading them evenly over decades.

Residential rental property normally depreciates over 27.5 years.

Commercial property depreciates over 39 years.

Bonus depreciation doesn’t change the total depreciation you get.

It changes when you get it.

That timing difference matters because dollars today are more powerful than dollars decades from now.

Why Cost Segregation Is the Key

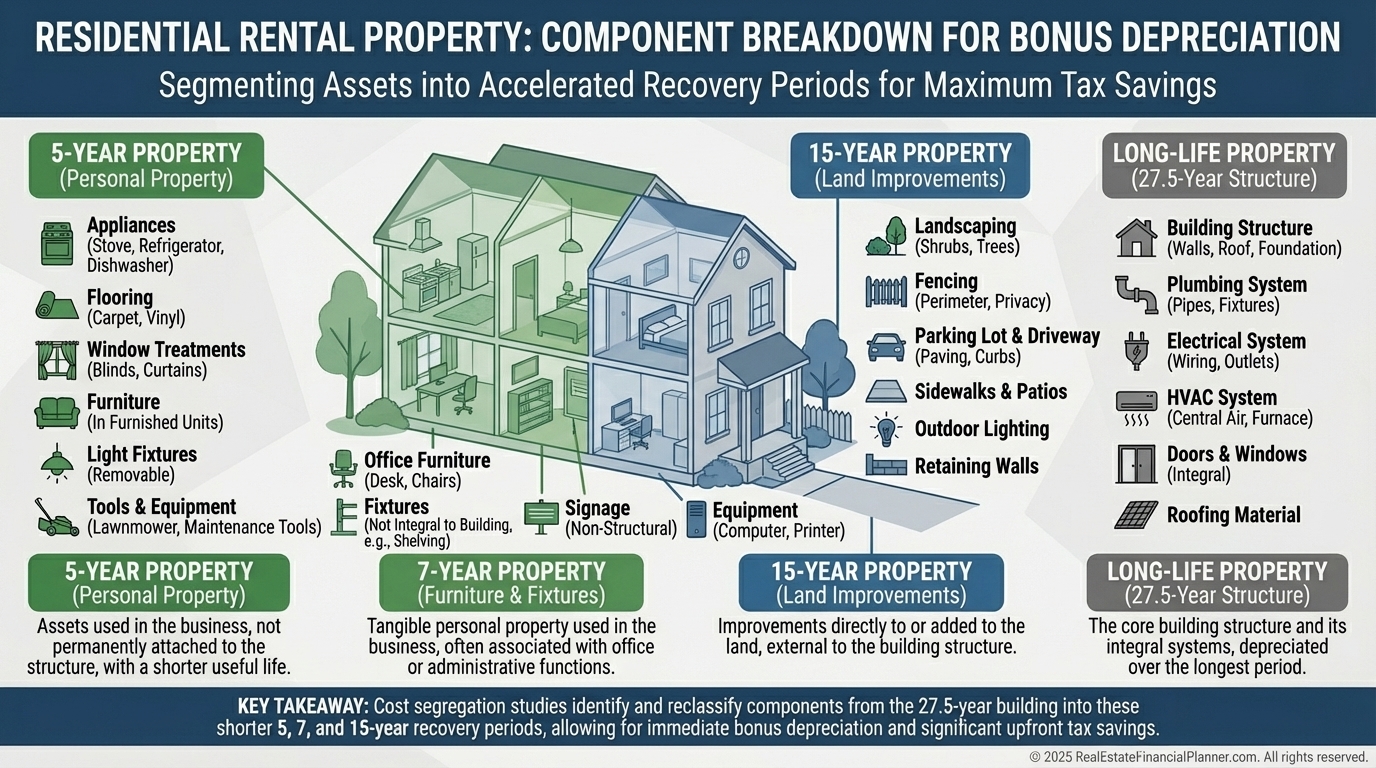

Bonus depreciation does not apply to the entire building.

It applies to specific components with shorter recovery lives.

This is where cost segregation comes in.

A cost segregation study breaks a property into parts and reclassifies certain components into faster depreciation buckets.

Common examples include appliances, flooring, wiring, lighting, cabinetry, landscaping, sidewalks, and parking areas.

When I review cost segregation reports for clients, I’m looking for realism and defensibility, not aggressive wishful thinking.

Overreaching here creates audit risk and long-term pain.

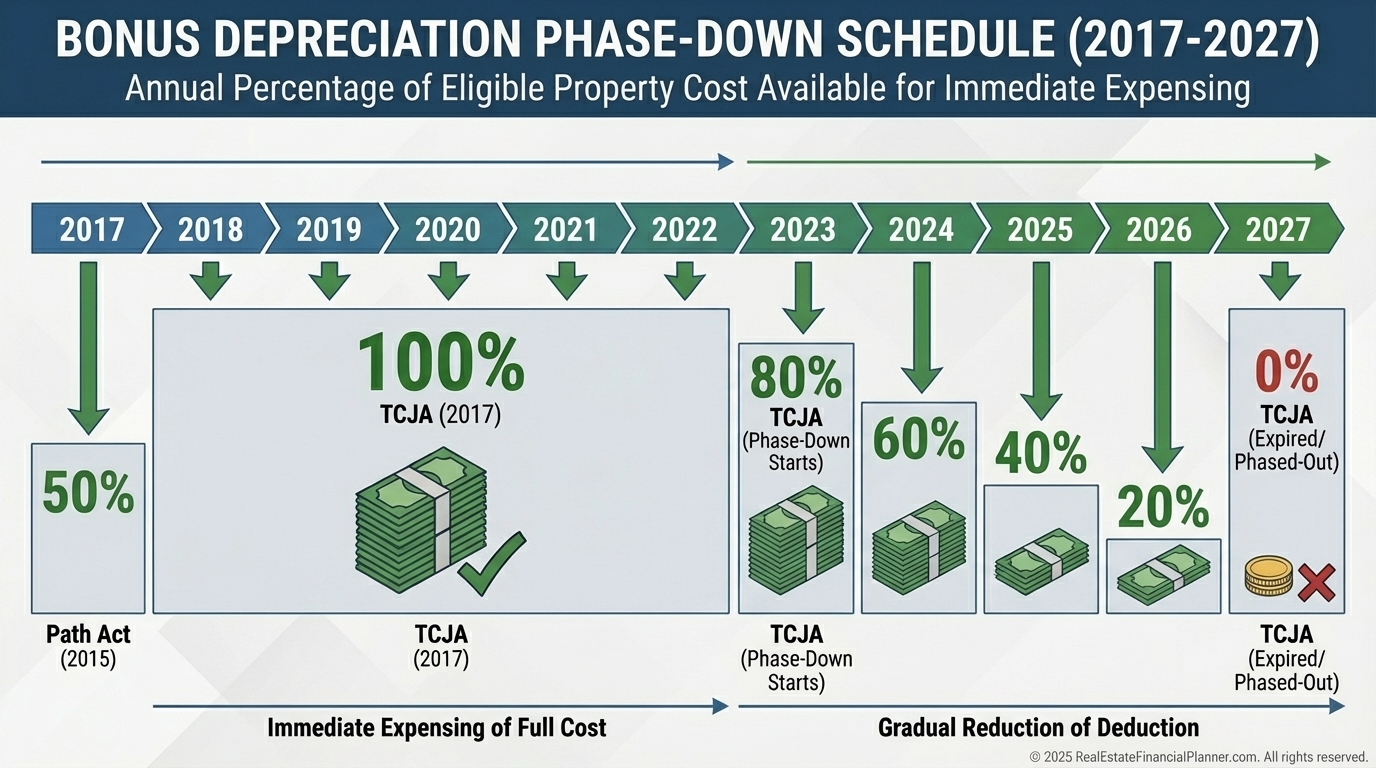

Bonus Depreciation Phase-Down Reality

Bonus depreciation is not permanent at its peak levels.

It was one hundred percent for qualifying property placed in service between late 2017 and the end of 2022.

That window closed.

Here’s where it stands now unless Congress changes the rules again:

Timing matters, but timing alone does not justify a deal.

I’ve watched investors rush into marginal properties just to chase deductions. That usually ends badly.

How This Shows Up in Real Deal Analysis

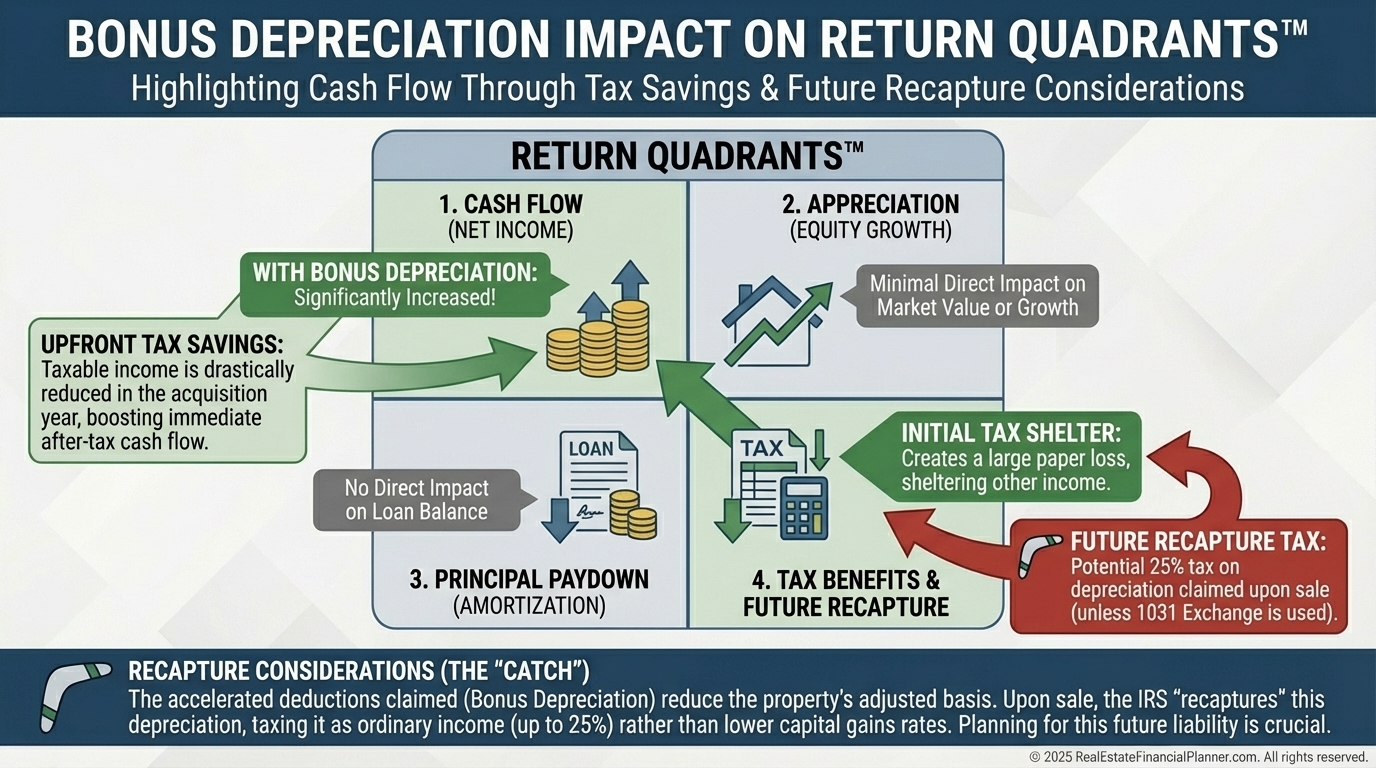

When I model bonus depreciation inside the Return Quadrants™, it shows up as improved cash flow through tax savings, not imaginary income.

A first-year deduction does not create profit.

It reduces taxes owed, which preserves cash.

That distinction matters when comparing deals on cash-on-cash return, reserves, and long-term equity growth.

This is also where True Net Equity™ comes into play.

Accelerated depreciation increases future depreciation recapture exposure, which affects spendable equity later.

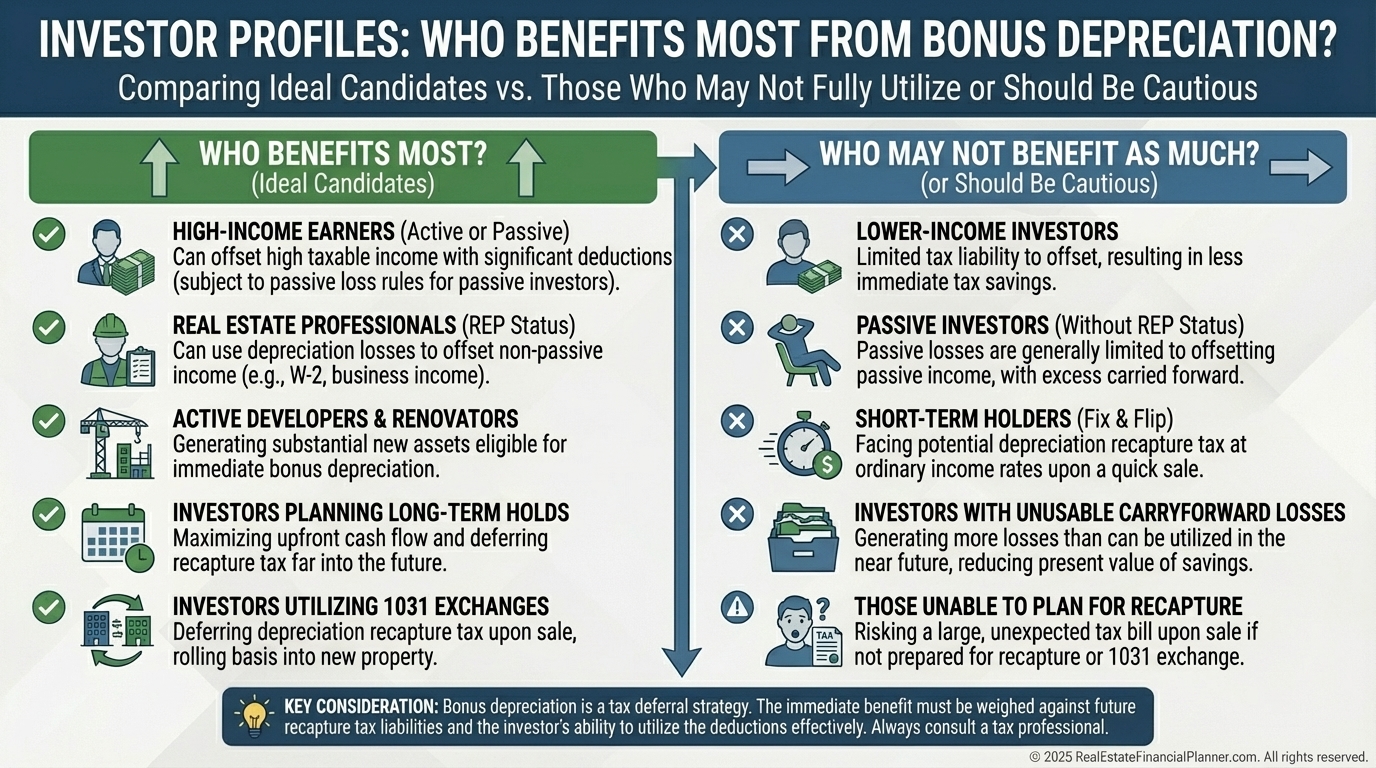

Who Benefits Most From Bonus Depreciation

Bonus depreciation is not universally helpful.

It tends to work best for investors who:

•

Have high taxable income

•

Can actually use the losses

•

Plan long-term holds or strategic exchanges

•

Understand depreciation recapture before using it

Real estate professionals often benefit more flexibility, but that designation is not automatic and not casual.

I always warn clients not to assume they qualify.

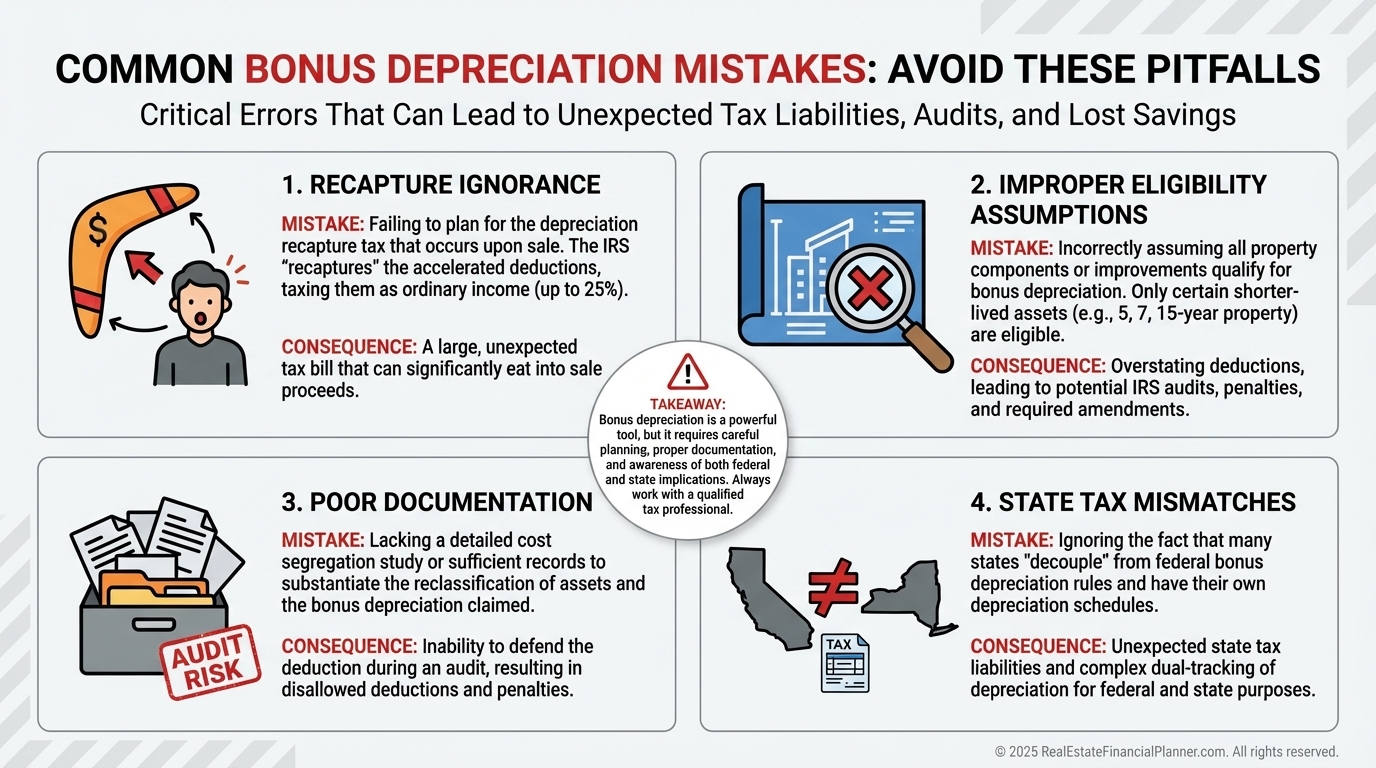

The Mistakes I See Over and Over

The biggest mistake is ignoring depreciation recapture.

Accelerating deductions now means paying some of it back later.

That is not inherently bad, but pretending it doesn’t exist leads to bad refinance and sale decisions.

Another common error is doing cost segregation on properties that are too small to justify it.

Fees matter. Complexity matters.

I also see investors forget state tax treatment.

Some states ignore federal bonus depreciation entirely, which changes the math.

How I Approach It After Starting Over

After rebuilding from bankruptcy, I became far more conservative about tax strategies that look great on paper but create long-term friction.

Bonus depreciation is powerful, but it is not magic.

It rewards discipline, planning, and patience.

I never recommend using it to justify buying a deal you wouldn’t buy without it.

I do recommend using it to improve strong deals and accelerate reserves responsibly.

Action Steps

Review properties over roughly two hundred fifty thousand dollars for cost segregation potential.

Model bonus depreciation scenarios inside your deal analysis instead of guessing.

Coordinate early with a CPA who understands real estate, not just tax software.

Used correctly, bonus depreciation improves velocity without distorting reality.

Used poorly, it creates future regret wrapped in short-term excitement.