Legal Entities for Real Estate Investors: Build Lawsuit Protection, Tax Efficiency, and Scalable Structure

Learn about Legal Entities for real estate investing.

The Moment You Need Protection Most

You close on rental number five. A tenant slips on ice. The claim is $500,000.

If the title is in your name, your house, savings, and future earnings are all invited to the party.

When I help clients at RealEstateFinancialPlanner.com set up structure, I’m not chasing paperwork. I’m building a moat so one bad day doesn’t sink a great portfolio.

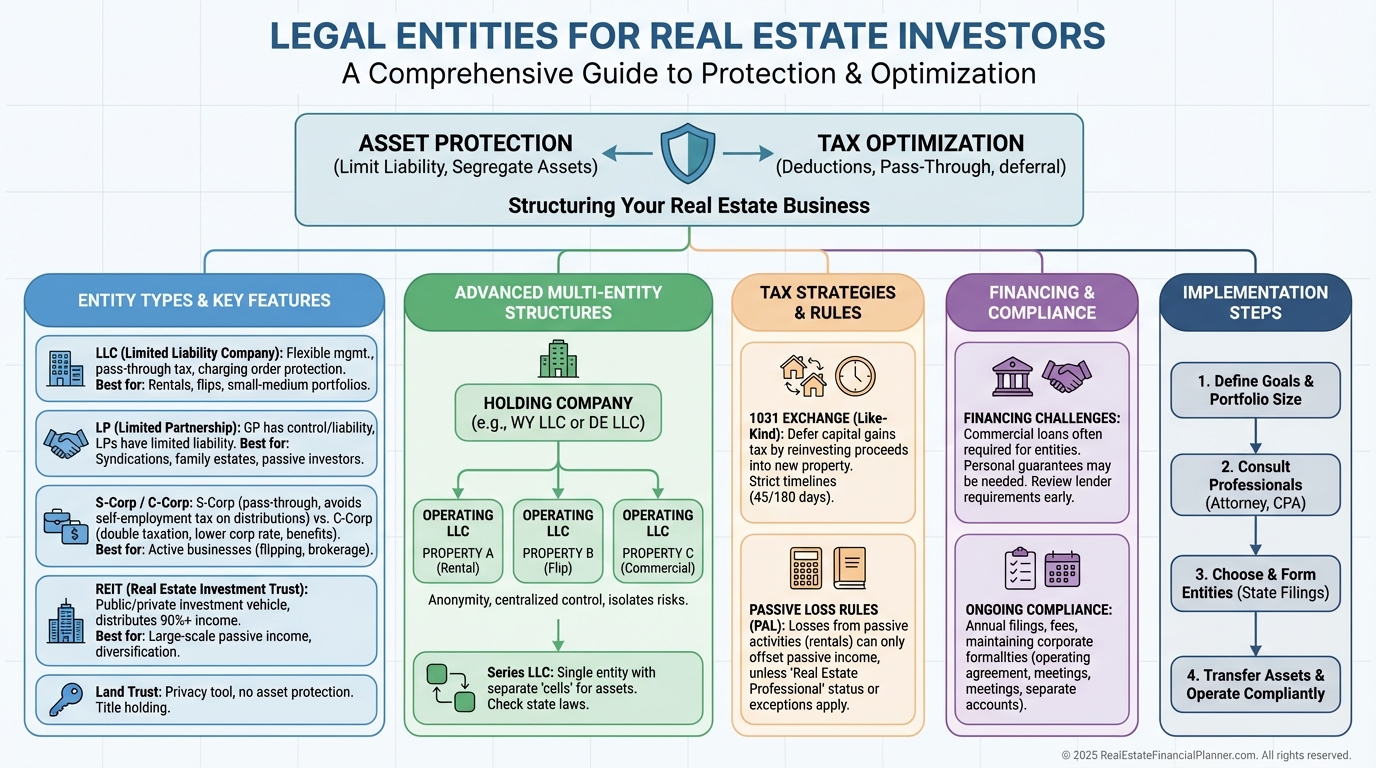

Why Legal Entities Matter

Asset protection is first. Segregate business risk from personal wealth so a single claim doesn’t domino your entire net worth.

Tax optimization is second. The right entity determines how profits flow, how depreciation hits your return, and how much you keep after the IRS.

Scalability is third. Lenders, partners, and property managers operate smoother when your structure is designed for growth, not just your first duplex.

Estate planning is the quiet fourth. Clean structure makes it simpler to transfer, gift, or sell without chaos.

Overview of Common Structures

Sole proprietorship. Easy, cheap, and offers zero liability protection.

General partnership. Two people, no shield, and shared unlimited liability. Hard pass for real estate.

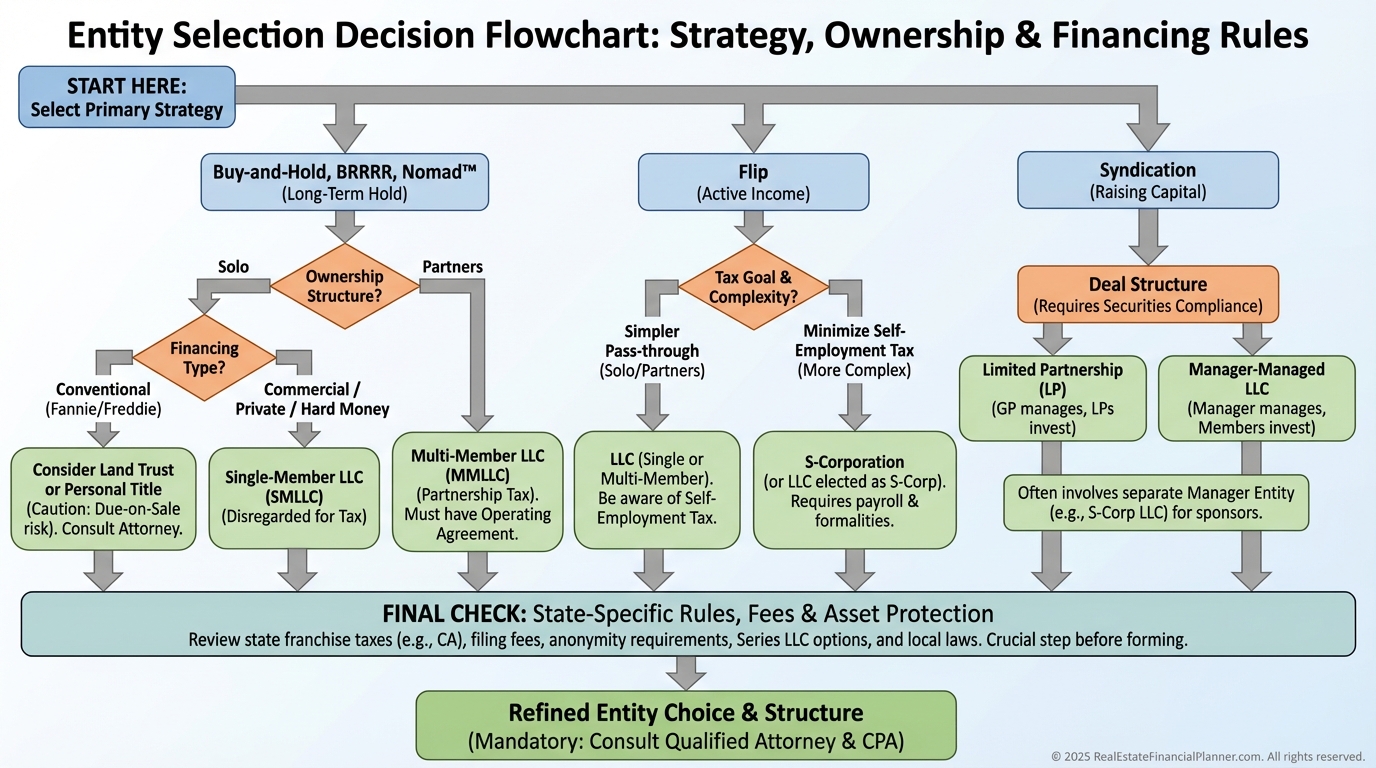

Limited partnership (LP). General partner manages and has unlimited liability; limited partners are passive with limited risk. Useful for syndications.

Limited Liability Company (LLC). The workhorse. Liability protection with flexible taxation and flexible ownership.

S Corporation. Strong for active businesses with payroll. Often suboptimal for holding rentals due to depreciation and basis issues.

C Corporation. Double taxation on profits. Rare for holding rentals, but useful as a management or development company in larger ecosystems.

REIT. A specialized, regulated vehicle for large-scale holdings and pooled capital. Not a typical starting point for individual investors.

Land trust. Privacy tool, not a protection tool. Often paired with an LLC that is the beneficiary.

Deep Dive on LLCs

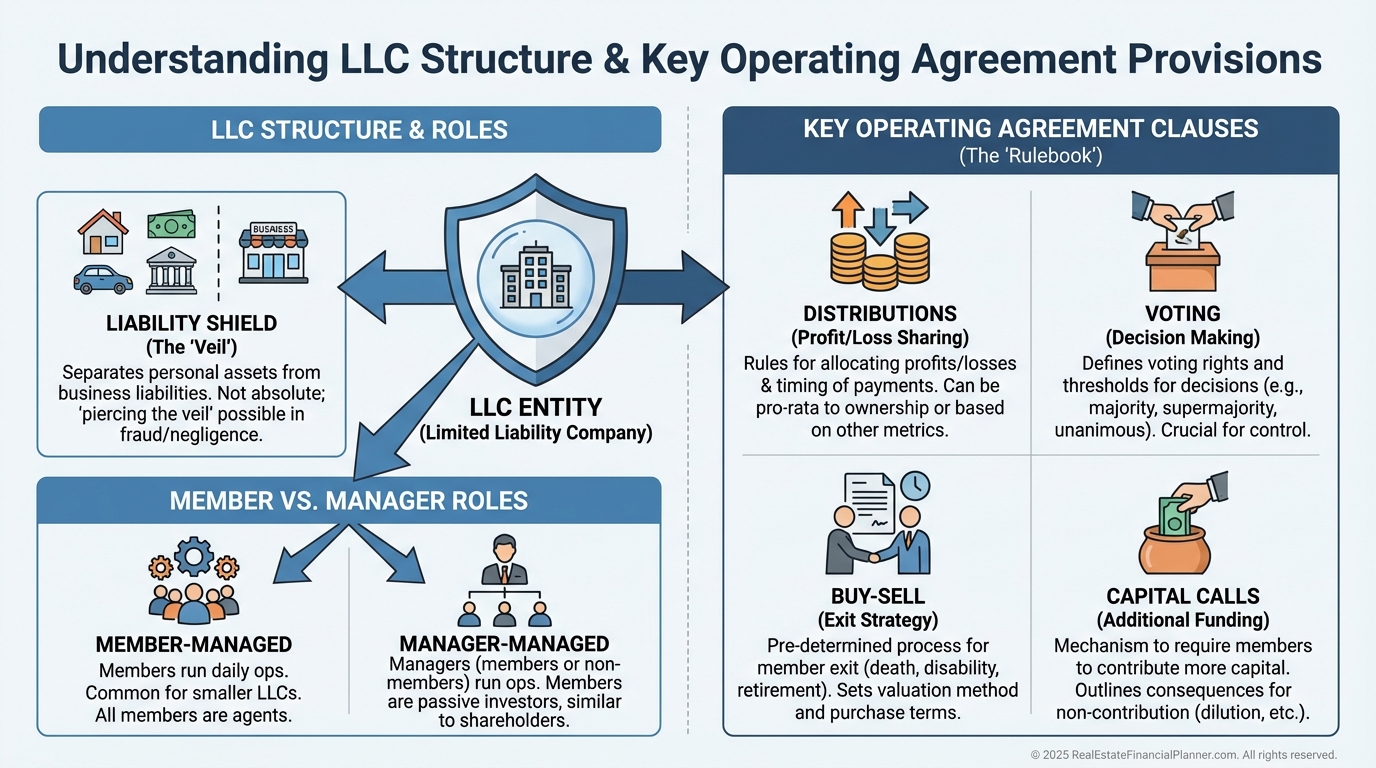

LLCs give you a shield, flexible ownership, and pass-through taxation by default.

Single-member LLCs are simple and disregarded for tax, which keeps filing easy while keeping the legal wall.

Multi-member LLCs require a strong operating agreement. Decide who manages, who votes, and how cash flows before there’s cash to fight over.

When I draft what to include, I insist clients decide distributions, buyout formulas, capital calls, and deadlock procedures. Your operating agreement is your business prenup.

Series LLCs let you split assets into cells under one umbrella. Filing can be cheaper. Court-tested liability between series varies by state, so I treat it as helpful but not magic.

Tax elections add flexibility. You can elect partnership, S-Corp, or C-Corp taxation for the LLC depending on the activity and income profile.

State rules matter. California has higher fees. Wyoming and Delaware have investor-friendly laws. Real estate is governed where it sits, so foreign registration often still applies.

Advanced, Scalable Structures

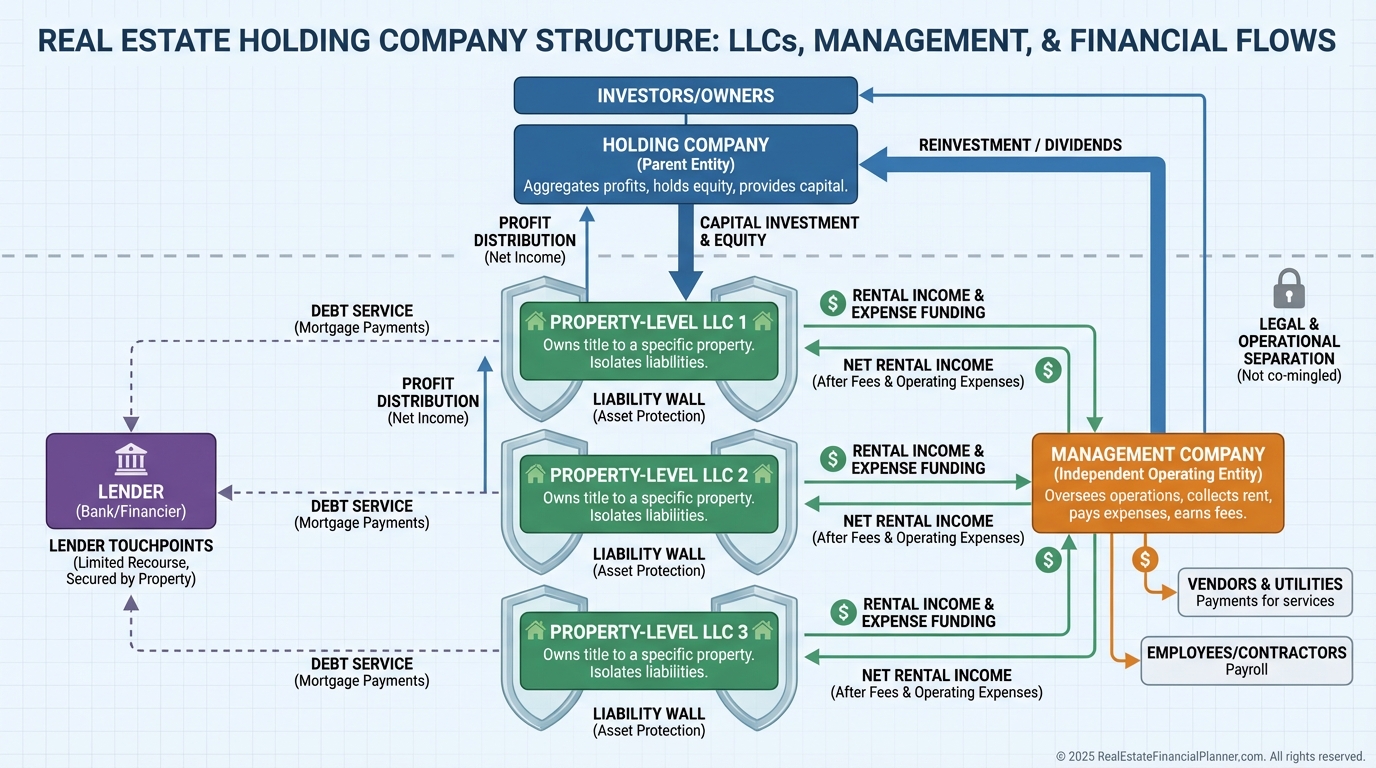

Most mature portfolios use a holding company and single-asset LLCs.

Each property sits in its own LLC to containerize risk. The holding company owns each property LLC and centralizes decision-making.

A separate management company entity runs operations, earns fees, and can elect S-Corp taxation for payroll efficiency on active income.

Equity stripping is a defensive play. Intercompany loans, properly documented and at market rates, reduce exposed equity per property.

Parent–subsidiary setups help larger teams standardize services, share systems, and negotiate with lenders while preserving liability separations.

Delaware vs home state is usually a distraction for small and mid-sized portfolios. If the real estate sits in Colorado, Colorado law rules the dirt.

International investors add FIRPTA and treaty layers. Here, specialized counsel is not optional.

What I Model Before Choosing an Entity

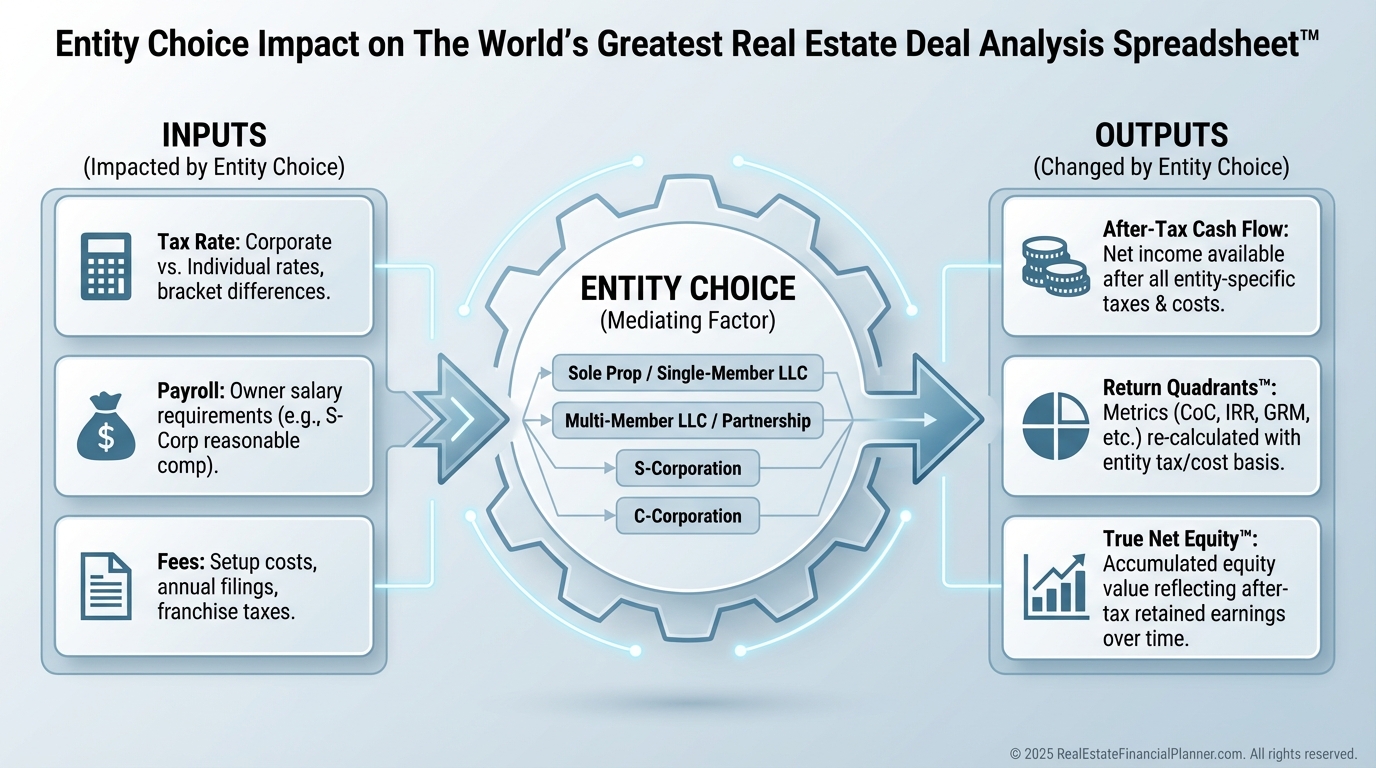

I run Return Quadrants™ for each deal to see how entity choice changes after-tax cash flow, appreciation, principal paydown, and tax benefits.

I stress test True Net Equity™ by property. I look at equity net of transaction costs, capital gains, depreciation recapture, and loan payoff to see what’s really at risk.

I map where management fees and payroll land. A management company S-Corp can reduce self-employment tax on active income, while rental income usually remains passive.

I confirm lender overlays. Some lenders dislike lending to LLCs, or they require personal guarantees. Guarantees are common, but your entity can still block cross-contamination between properties.

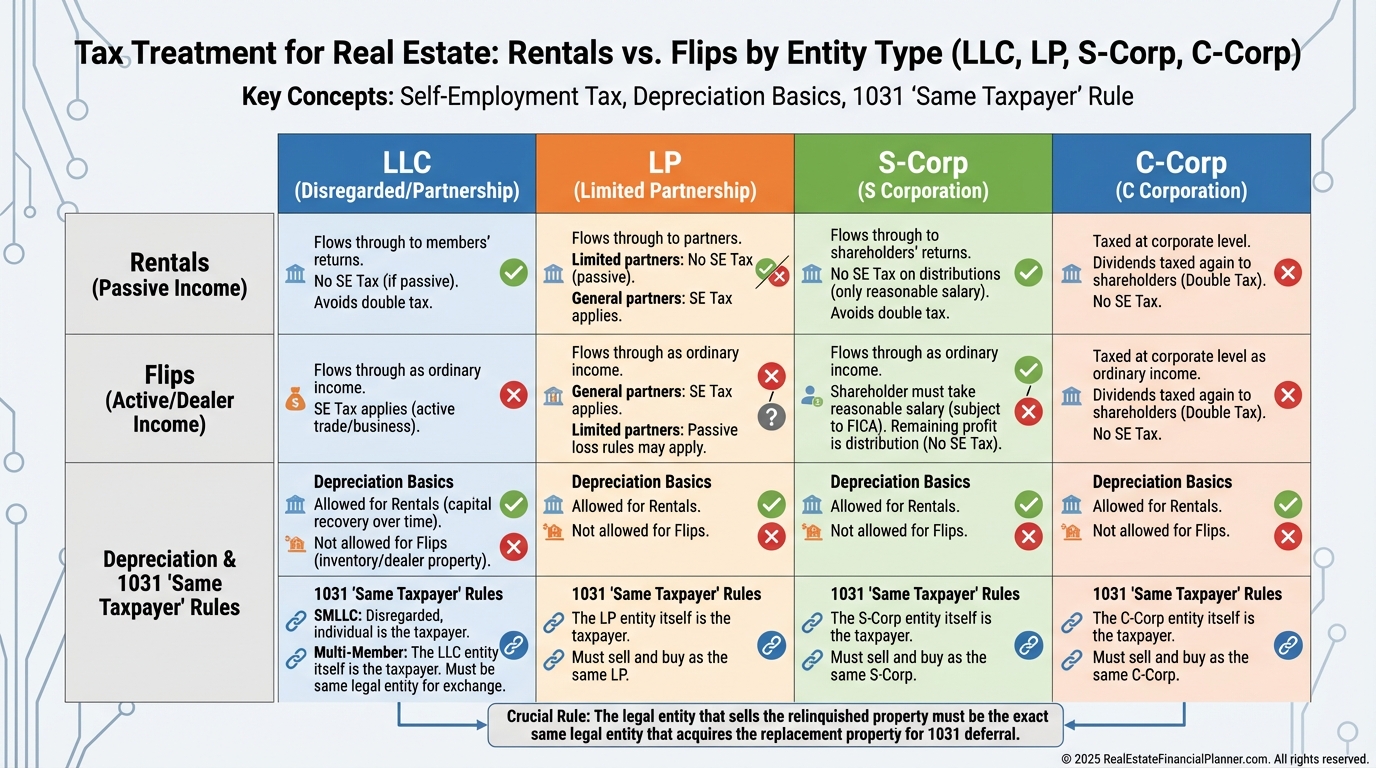

I verify 1031 chain continuity. Title must match from sale to purchase. Single-member LLCs make “same taxpayer” easier. Partnerships require planning to avoid last-minute “drop and swap” drama.

Taxes by Entity, in Plain English

Pass-through entities (LLC taxed as partnership or disregarded, S-Corp, LP) avoid corporate-level tax. Income flows to owners.

C-Corps pay tax at the corporate level. Dividends get taxed again. Use sparingly and purposefully.

Self-employment tax hits active income like flips, wholesaling, and management fees. It usually does not hit rental income.

Bonus depreciation and cost segregation accelerate deductions. Entities don’t create depreciation, but the right setup helps you use it.

1031 exchanges require title and taxpayer consistency. Plan your entities before you sell, not after.

Opportunity Zones require qualifying entities and timelines. Get counsel before you file, not after you invest.

Passive activity loss rules and Real Estate Professional Status determine if losses offset other income. Your entity won’t change the law, but it can help you document and group activities.

How This Shows Up in Deal Analysis

In The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I plug in entity-level costs, management fees, and tax elections that change after-tax returns.

I calculate return on equity, then True Net Equity™ after taxes and costs, so we know the real yield if you sold or refinanced.

I overlay Return Quadrants™ to compare how two identical properties perform under different entity setups and tax elections.

The structure you choose can move you from a mediocre after-tax return to a great one without changing the dirt.

Choosing Your Structure Step-by-Step

Map ownership. Solo is simpler. Partners require rules, documentation, and exit pathways.

Align with lenders. Ask if they will lend to the LLC directly or require you to close in your name and transfer later. Get it in writing.

Plan the exit. 1031, refinance, or sale? Your entity should make the exit smoother, not harder.

Decide on segregation. One property per LLC is clean. A Series LLC may help in select states. A holding company unifies control.

Write the rules. Operating agreement, management agreement, and loan documents between entities make your structure real.

Common Mistakes I See (And Fix)

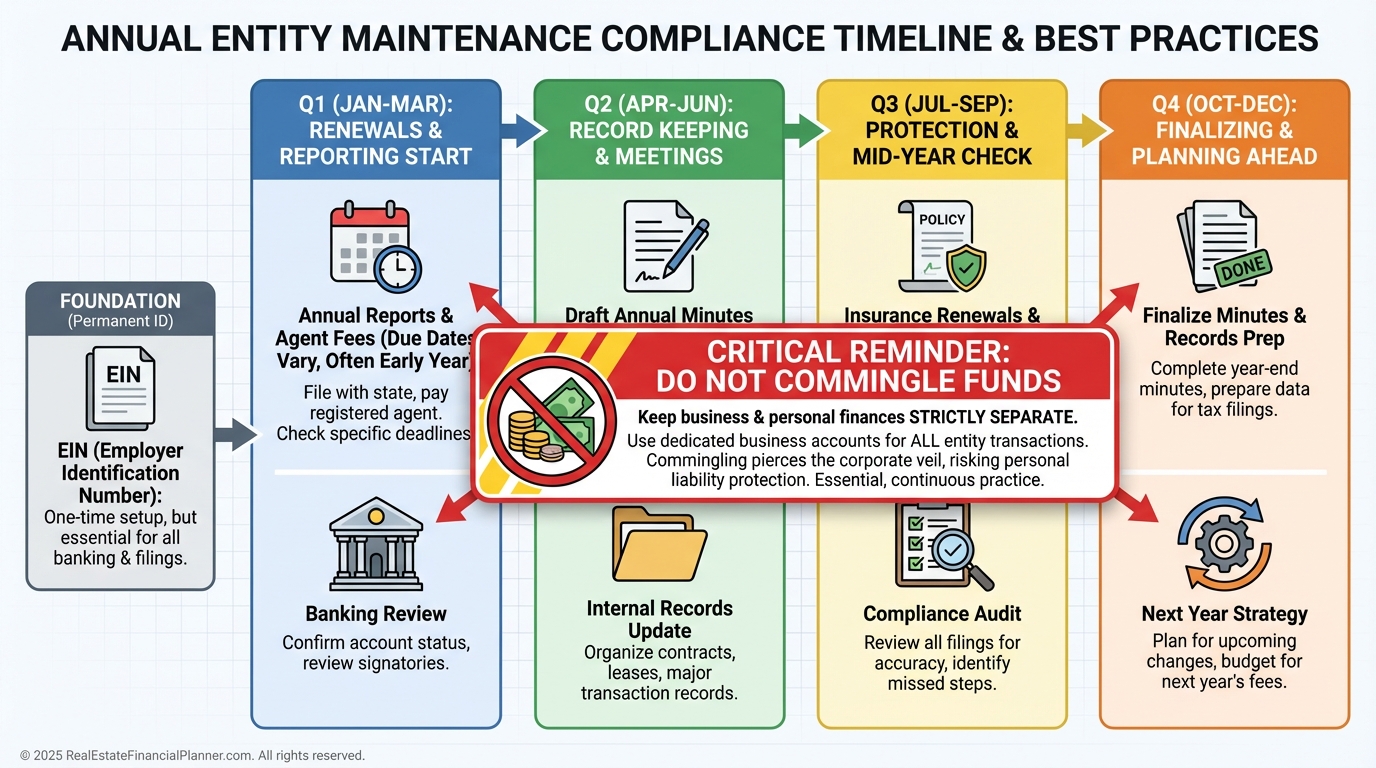

Commingling funds. Separate bank accounts from day one. No exceptions.

Weak or missing operating agreements. Even single-member LLCs should have one.

Ignoring formalities. Annual reports, registered agent, minutes if required, and documented intercompany agreements matter in court.

Transferring property without lender consent. Know your due-on-sale clauses.

Using an S-Corp to hold rentals. It can trap depreciation and complicate 1031s. Use with caution and purpose.

Delaying insurance. Entities protect legally; insurance pays practically.

Implementation Checklist

Form the entity or entities. Decide DIY or attorney. I recommend counsel for multi-member or multi-entity setups.

Get the EIN. Open business checking and credit cards. Do not run rentals through personal accounts.

Draft the operating agreement and management agreement. Spell out fees, duties, and approval thresholds.

Set insurance layers. Property, liability, and an umbrella policy sized to your total risk.

Calendar compliance. Annual reports, franchise tax, and registered agent renewals.

Update titles, leases, and vendor contracts to the correct entity names.

Special Cases You Should Anticipate

Nomad™ investors often purchase as owner-occupants to get better financing, then convert to rental. Plan timing around lender guidelines and title transfers.

Partnerships need buy-sell terms that work in real life. Price formulas, timelines, and funding sources prevent stalemates.

Short-term rental activity may trigger self-employment considerations. Confirm how services are delivered and who receives fees.

International investors must model withholding, treaty rules, and structure before capital arrives. Surprises are expensive.

A Simple Path Forward

Start with one LLC that aligns with your first property and lender constraints.

Add a management company if you run active operations or flips alongside your rentals.

Segregate assets as you add doors. Graduate to a holding company and single-asset LLCs when scale justifies the admin.

Document everything. Maintain everything. Review annually.

When I coach investors through this, we don’t chase perfect. We install the next right structure that protects today and scales tomorrow.

This article is educational. It is not legal, tax, or accounting advice. Hire qualified pros to tailor your structure. The cost is small compared to the protection and tax efficiency you gain.