Lease Options for Real Estate Investors: Structure Win‑Wins, Control Property, and Protect Your Downside

Learn about Lease Options for real estate investing.

Why Lease Options Belong in Your Toolkit

They let you “test‑drive” the property, lock a price, and engineer a path to closing while protecting your downside.

I don’t use lease options to squeeze desperate sellers.

I use them to trade time, certainty, and monthly income for a fair price and a clean exit for the seller.

Lease-Option Fundamentals In Plain English

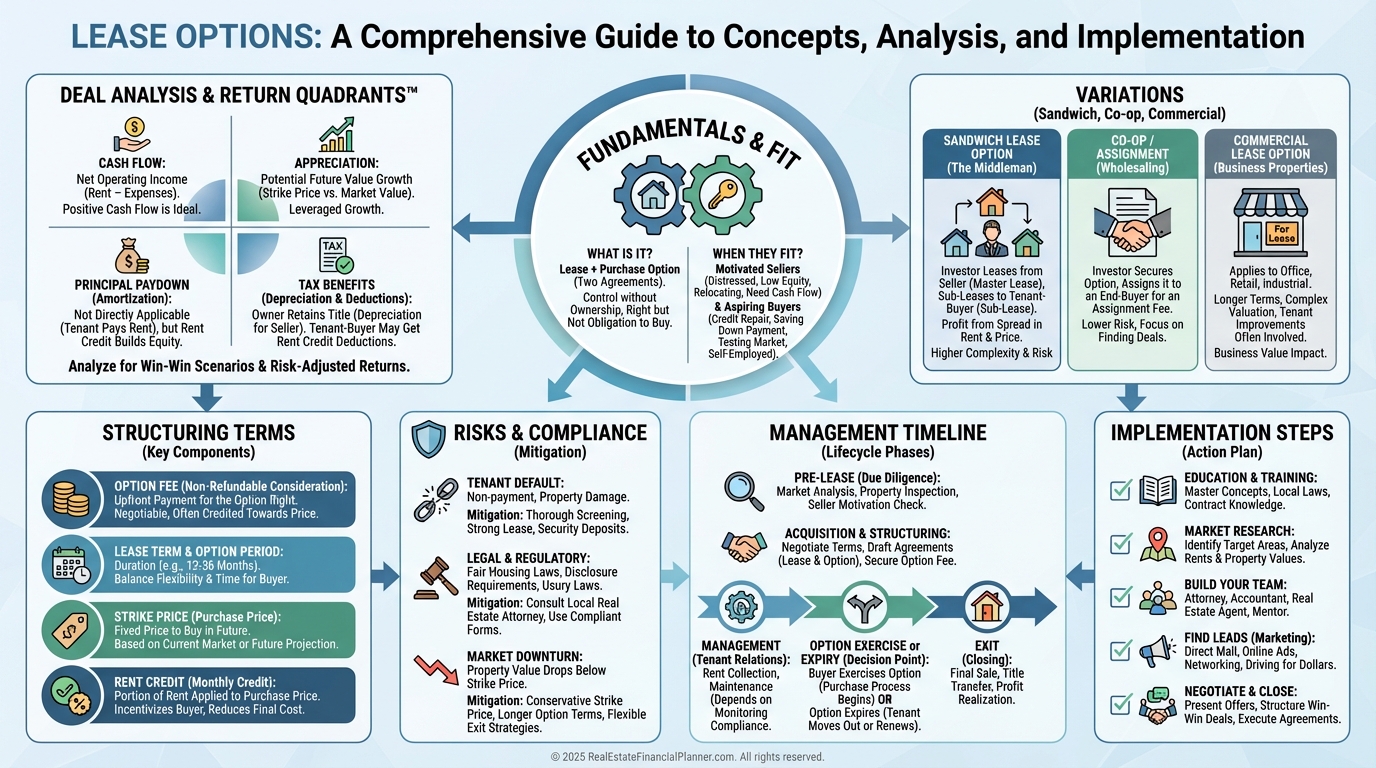

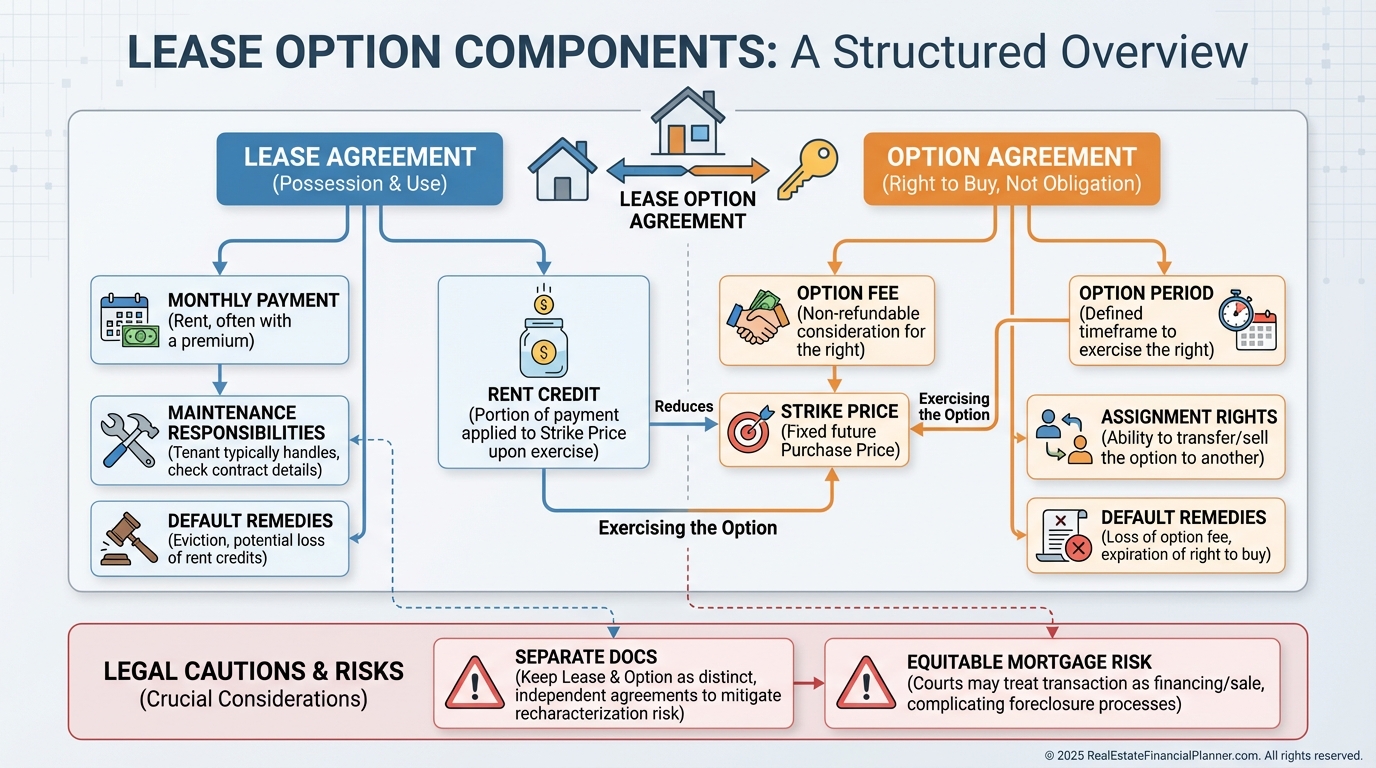

A lease option is two documents: a lease for possession and an option granting the right—not the obligation—to buy at a set price within a set term.

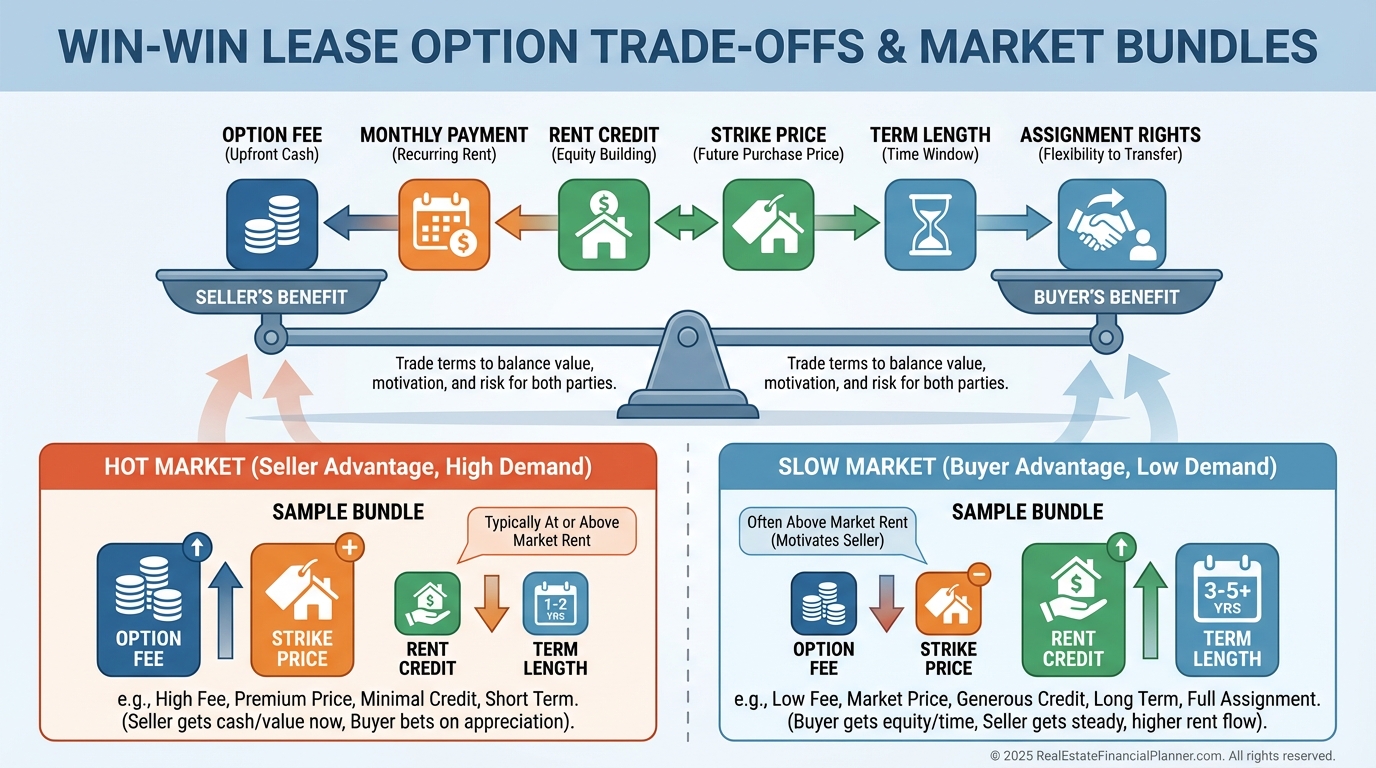

The key levers are option fee, monthly payment, rent credit (if any), strike price, option period, maintenance split, and assignment rights.

The option fee is typically 1–5% of the price and is usually non‑refundable, credited if you exercise.

Rent credits are optional and must be drafted carefully to avoid equitable mortgage issues in strict states.

Your strike price can be fixed today, stair‑stepped annually, or formula‑based off a future appraisal minus a negotiated discount.

Keep lease and option in separate agreements, and use an attorney who understands your state’s rules.

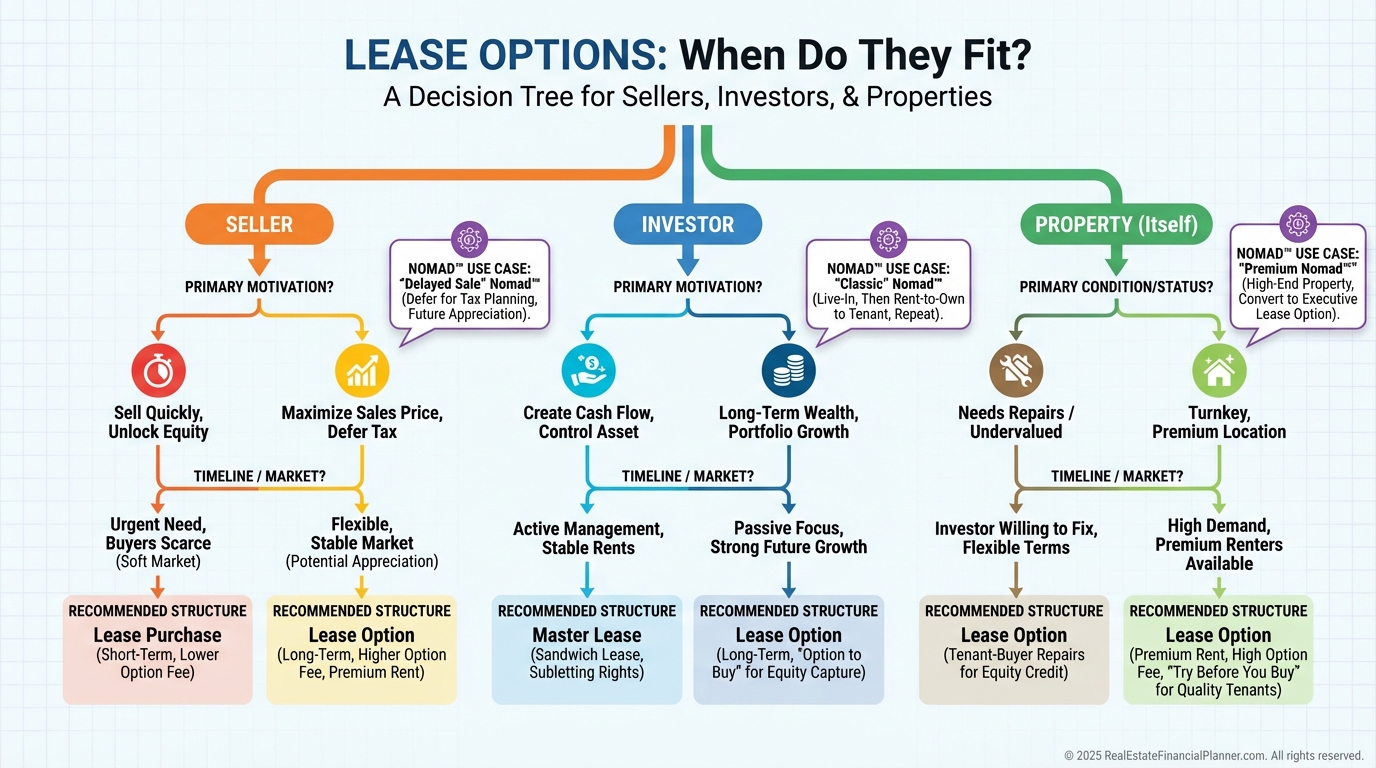

When Lease Options Make Sense

For sellers, they shine when relocation pressure, soft market conditions, or estate timing make a quick sale unlikely.

They also work when monthly income today matters more than a lump sum, or when minor improvements and time can lift price.

For investors, they fit when financing needs seasoning, income is strong but credit needs work, or you want to prove a submarket before committing.

They also help when you want appreciation exposure with limited capital at risk.

I target move‑in‑ready properties in stable areas with strong rental demand, typically in price bands that attract reliable tenant‑buyers.

Nomad™ investors sometimes use lease options to secure their next owner‑occupant home while finishing out a current lease.

Deal Analysis With REFP Tools

I model every lease option in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ before I write terms.

I test three paths: exercise and buy, assign the option, or walk away with managed downside.

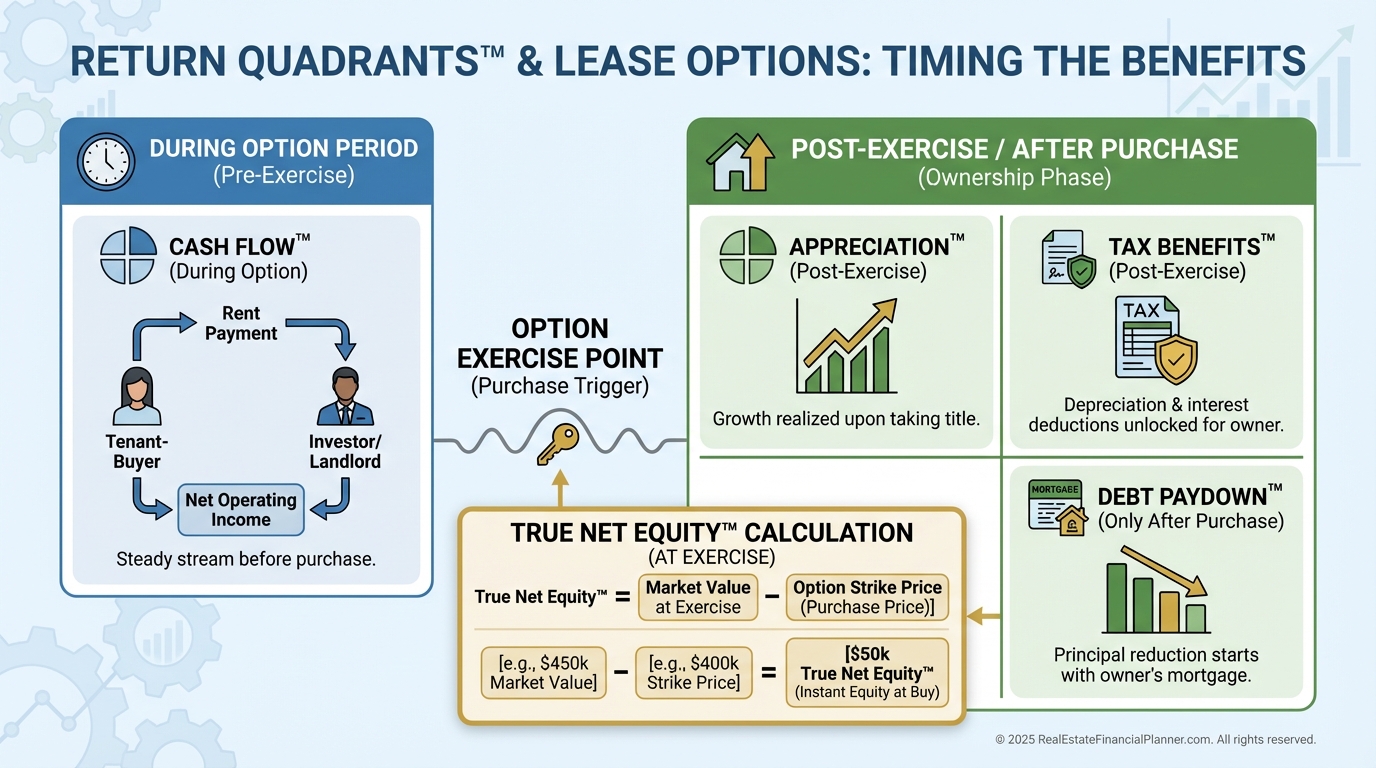

I use the Return Quadrants™ to see how the deal pays me: appreciation, cash flow, debt paydown after exercise, and tax benefits.

During the option period, I model cash flow separately and assume no debt paydown or depreciation until I close.

I calculate True Net Equity™ at exercise as appraised value minus selling costs, minus acquisition costs, minus total capital in (option fee plus closing), minus any rent credit that effectively raised my payment.

If option fee recovery via cash flow takes too long, I renegotiate or pass.

Finding and Vetting Opportunities

I market with “We can lease your home with an option to buy—fast occupancy, professional management, and a set exit date.”

I also ask agents for stale listings with payment‑sensitive sellers who still want a fair price.

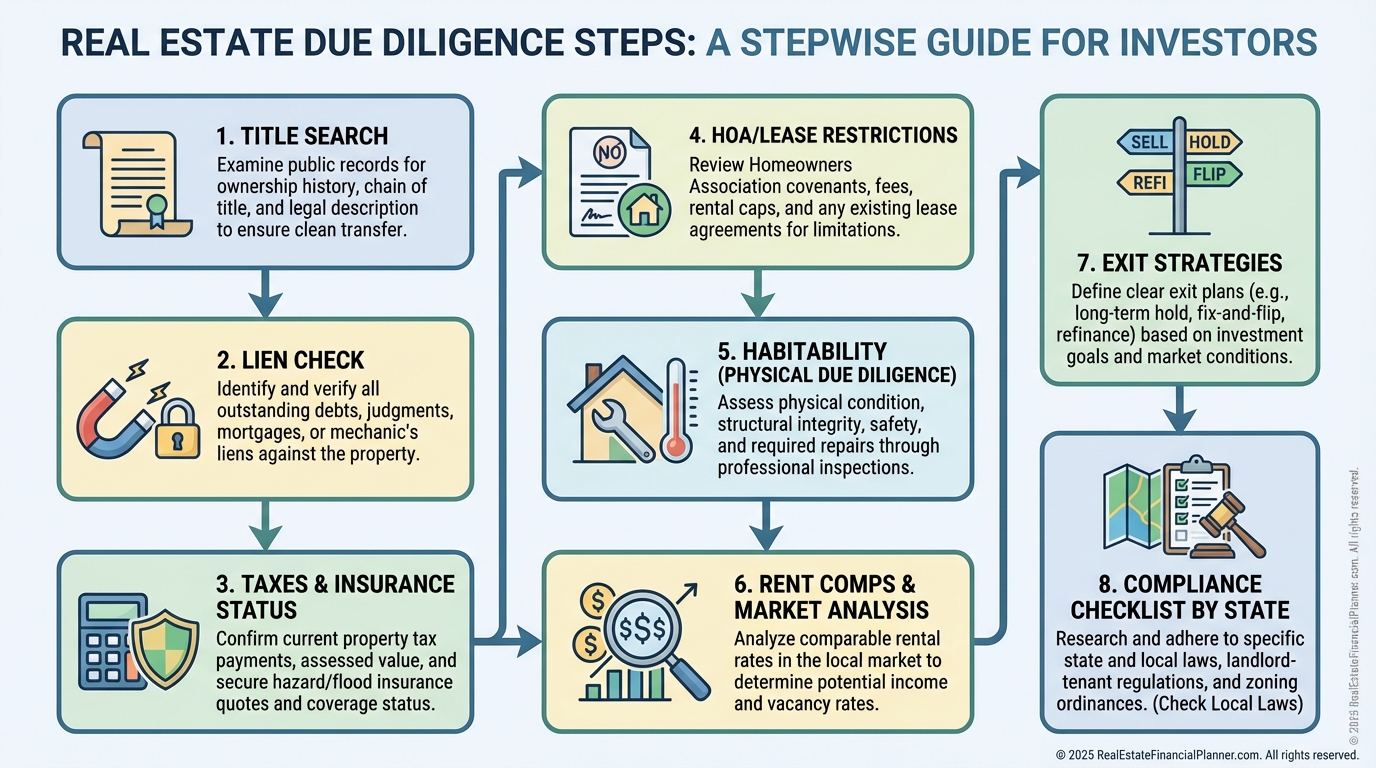

Before terms, I pull preliminary title, verify taxes and insurance, and read the HOA documents for any anti‑lease or assignment restrictions.

I confirm the property is insurable, safe, and rentable on day one.

Then I map at least two exits besides exercise in case the market shifts.

Structuring Win‑Win Terms

I let the seller pick what matters: more up‑front, more monthly, or more price.

I trade concessions across the three, never all three.

Common win‑wins include a slightly higher strike price for a longer term, or a bigger option fee for more assignment flexibility.

I keep rent credits modest and clearly documented to avoid recharacterization as financing.

Maintenance works best with a dollar threshold: I handle major systems, the tenant‑buyer handles minor repairs, and improvements need written approval.

Insurance, access, and default remedies are explicit, and option exercise steps are calendar‑driven.

Variations You’ll Actually Use

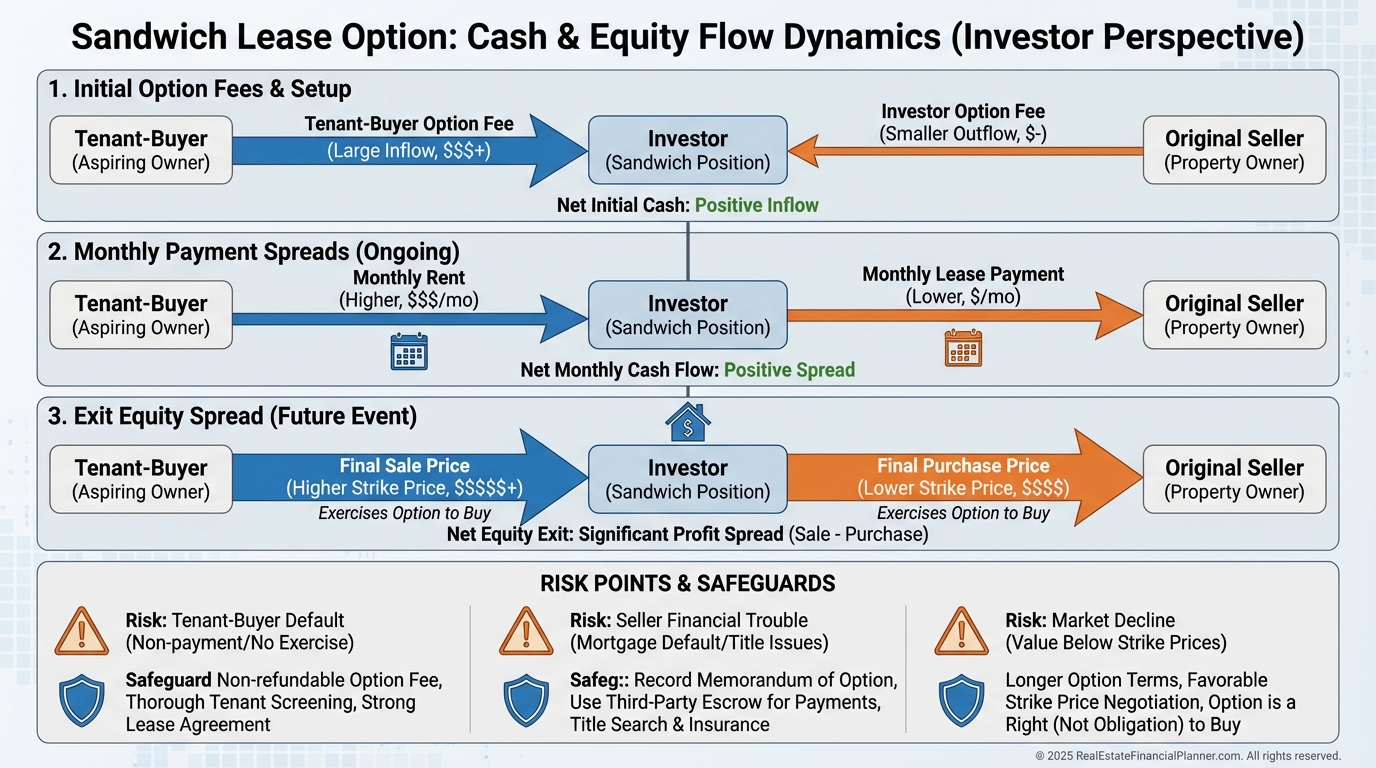

A sandwich lease option places you in the middle: you option from the seller and option to a tenant‑buyer at improved terms.

You earn from the option fee spread, monthly cash flow spread, and eventual price spread.

Cooperative assignments pair you with the seller to place a ready tenant‑buyer and assign your position for a fee.

Commercial lease options are shorter, with higher fees and often triple‑net structures.

I increase reserves and legal precision as complexity rises.

Managing the Option Period

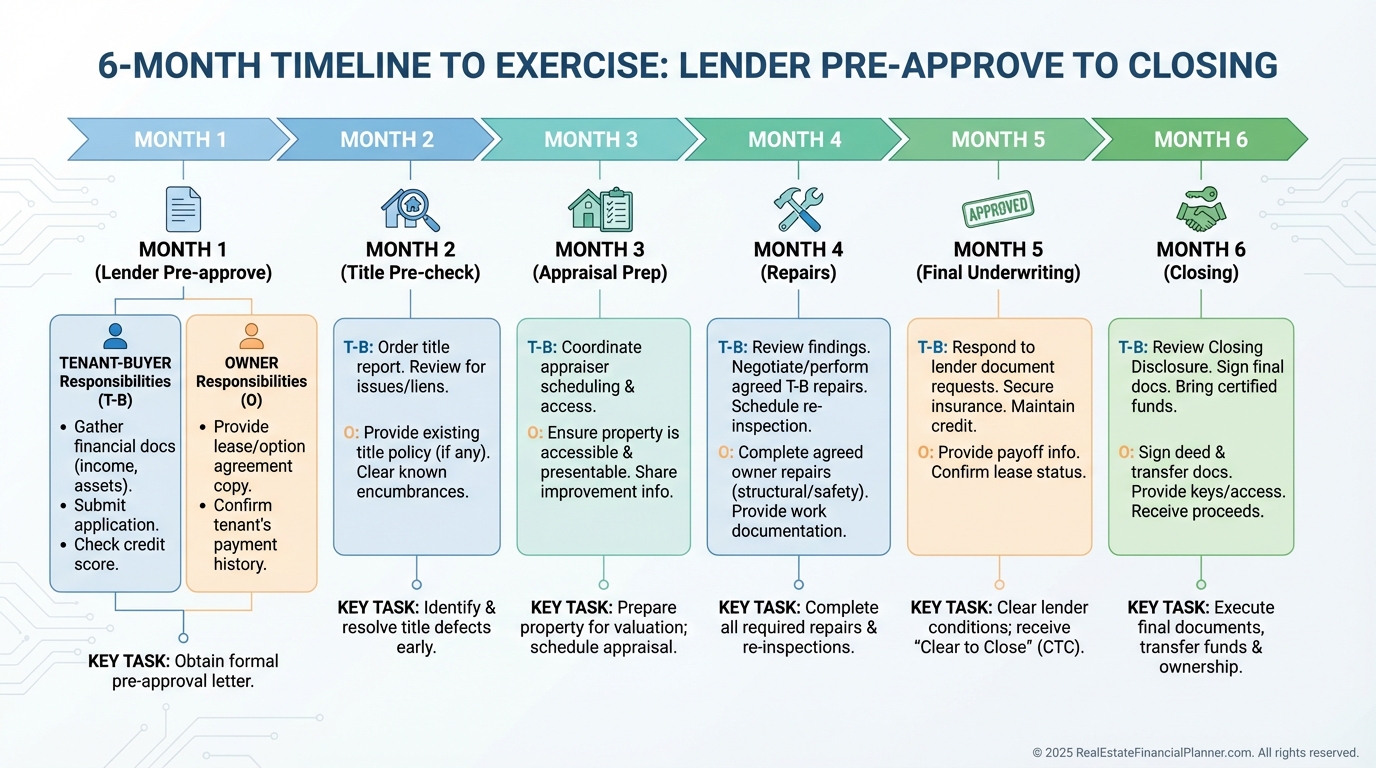

When I place a tenant‑buyer, I onboard them with a clear mortgage‑ready plan, credit coach, and monthly check‑ins.

I keep separate accounting for rent versus option‑related credits and document property condition with dated photos.

At six months from target closing, I verify lender readiness, order preliminary title, and schedule any repairs that could impact appraisal.

If they stall, I activate a backup buyer list early.

Common Pitfalls and How I Avoid Them

Equitable mortgage risk rises with high rent credits, long terms, or blurred lease/option documents.

I mitigate by capping credits, separating contracts, and following state guidance.

Market decline can trap weak structures.

I price conservatively, prefer 12–24 month terms in volatile markets, and include renegotiation triggers tied to third‑party indices where legal.

Tenant‑buyer default is a screening problem first and a documentation problem second.

I require meaningful option fees, verify real savings patterns, and maintain a bench of replacements.

Implementation Plan: First 30 Days

In week one, I meet my attorney and tune state‑specific templates for lease and option.

In week two, I build my marketing and set up accounting to track option fees and credits separately.

In week three, I practice scripts and load The World’s Greatest Real Estate Deal Analysis Spreadsheet™ with my default assumptions.

In week four, I launch outreach to out‑of‑state owners, stale listings, and FSBOs.

For your first deal, insist on clean title, clear HOA language, and at least two exits besides exercise.

Structure terms you can defend to a judge, a seller’s spouse, and your future self.

A Quick Mini‑Case

A client in a softening suburb needed to move in 45 days but refused a discount to list price.

We offered a 24‑month option, 3% option fee, a fair market rent, modest credits, and a fixed strike price near today’s value.

My client assigned the option to a well‑screened tenant‑buyer, recovered their option fee in six months of cash flow, and left three ways to win.

We modeled all three exits in Return Quadrants™ and protected True Net Equity™ with conservative assumptions.

Final Checks Before You Offer

Confirm market rent supports your payment, reserves, and a small spread if you plan a sandwich.

Stress test at −5% and −10% appreciation in the spreadsheet.

Get the seller’s lender contact to confirm the loan allows leasing and to watch for due‑on‑sale triggers.

Document property condition thoroughly at move‑in to avoid end‑of‑term disputes.

When terms are fair, paperwork clean, and numbers resilient, lease options become a reliable tool—not a trick.

Ready to analyze your first lease‑option deal?

Download The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and model your three exits before you write a single term.