Cash Flow vs Appreciation Markets: How Smart Investors Choose the Right Strategy for Each Stage of Life

Learn about Cash Flow vs Appreciation Markets for real estate investing.

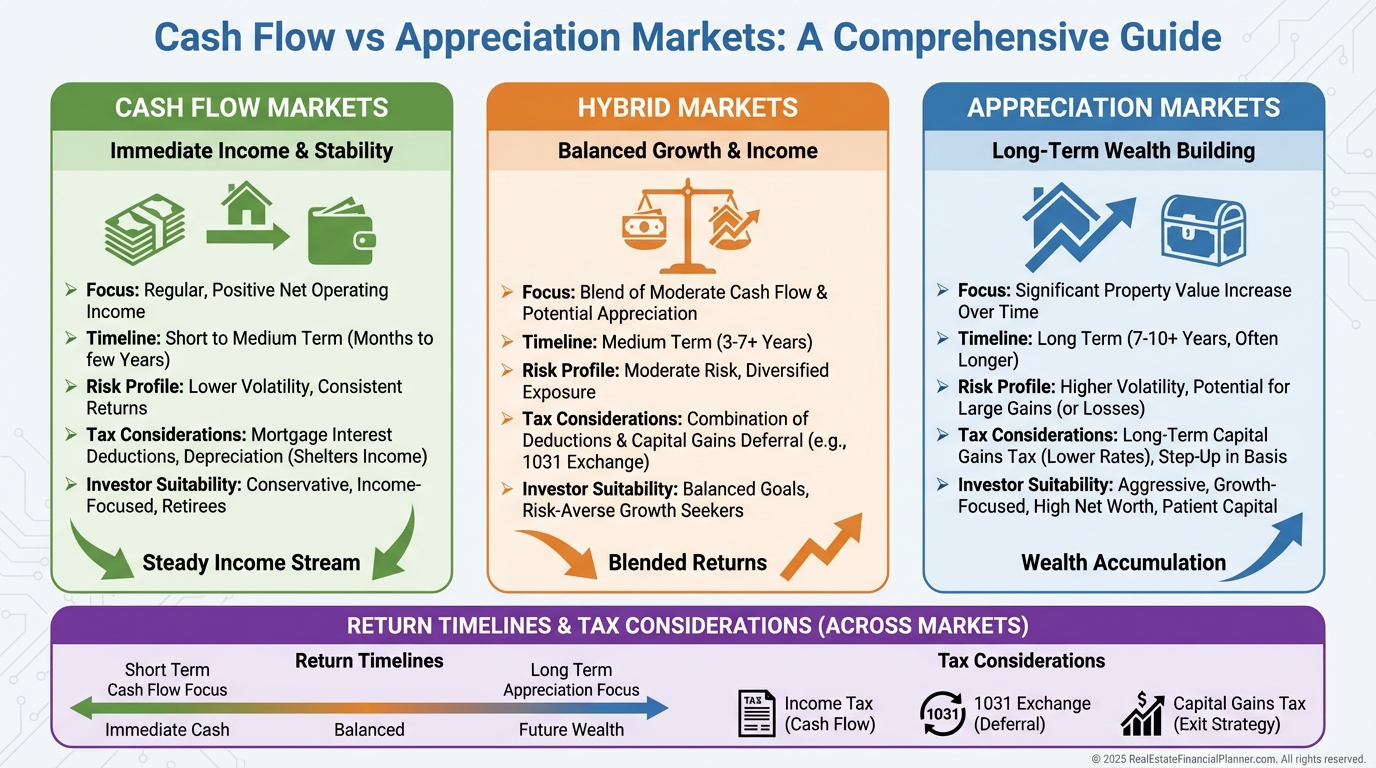

Cash Flow vs Appreciation Markets Overview

Every real estate investor eventually runs into this decision, even if they do not realize it at first.

When I help clients analyze deals, the question almost always shows up indirectly.

“Why does this property feel safer?”

“Why does this one feel stressful but exciting?”

What they are really asking is whether they are buying into a cash flow market or an appreciation market.

I learned this lesson the hard way rebuilding after bankruptcy. I could not afford to be wrong about income, and I could not afford to ignore long-term equity either.

Cash flow vs appreciation markets is not a philosophical debate. It is a math problem tied to your life stage, income, and tolerance for uncertainty.

Understanding Cash Flow Markets

Cash flow markets pay you for owning the property.

These markets produce income first and equity second.

When I review cash flow deals with clients, the focus is always the same. Does the property pay you every month after everything?

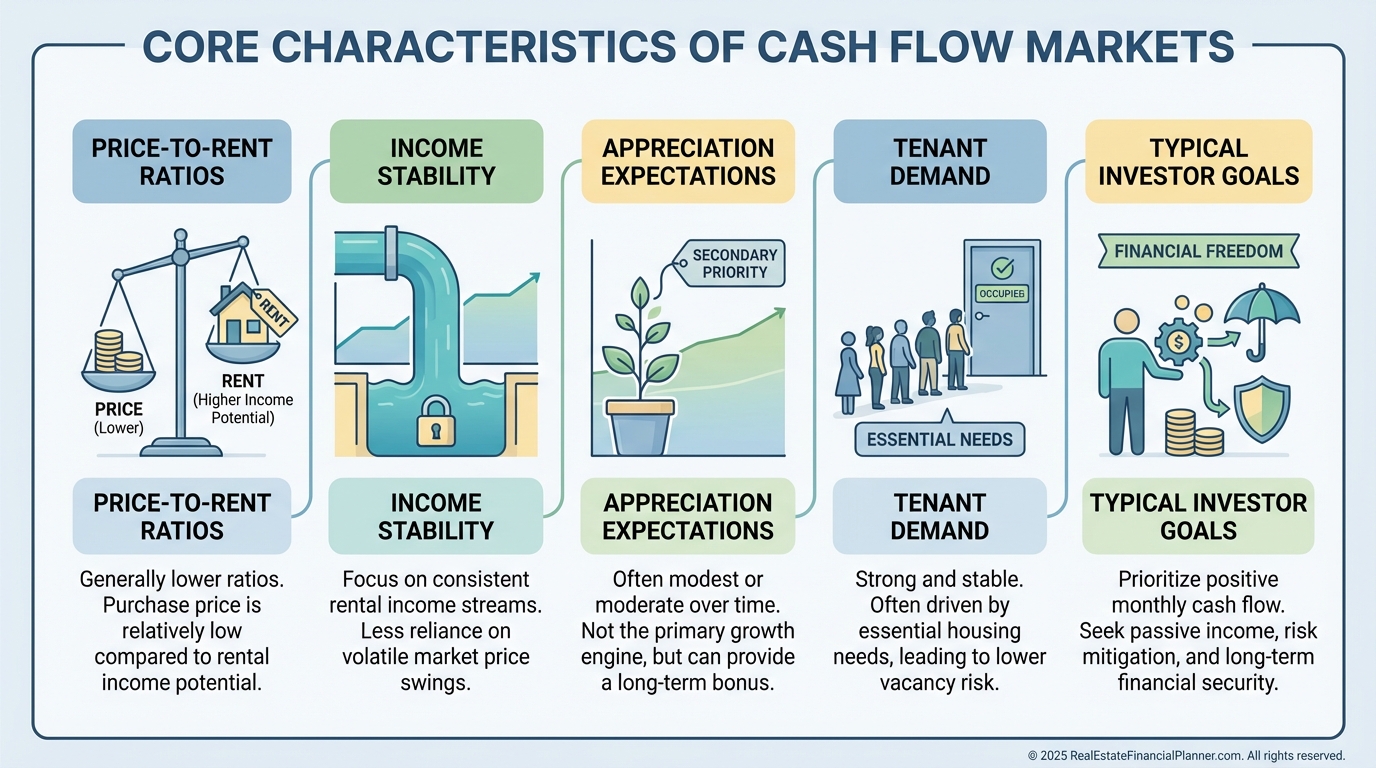

Characteristics of Cash Flow Markets

In markets like this, I am less interested in what the property might be worth someday.

I am interested in what it does for you this month.

Key metrics matter more here than anywhere else. Cash-on-cash return tells you how hard your invested dollars are working. Cap rate helps sanity-check pricing. Debt Service Coverage Ratio protects you from overleveraging.

Cash flow markets shine for investors replacing income, stabilizing finances, or qualifying for future loans.

The tradeoff is rarely hidden. Maintenance tends to be higher. Tenant turnover is more common. Management matters more than spreadsheets.

Cash flow is not passive if you pretend it is not work.

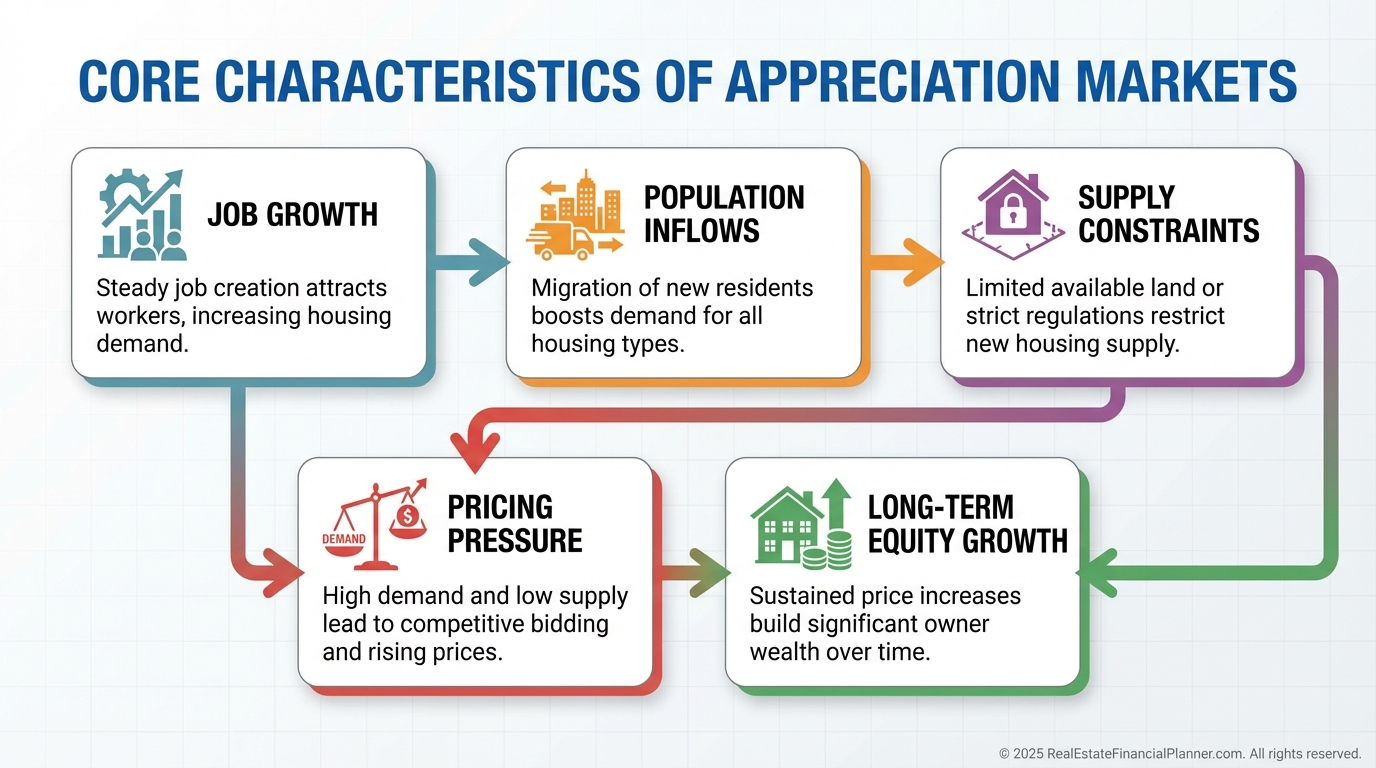

Understanding Appreciation Markets

Appreciation markets pay you later.

Sometimes much later.

When I analyze appreciation-focused deals, the spreadsheet usually looks uncomfortable in year one. Sometimes year three.

That discomfort is the price of admission.

Appreciation markets are driven by scarcity, job growth, capital inflows, and supply constraints. These are the markets everyone wants to live in, not necessarily the markets that pencil easily.

Characteristics of Appreciation Markets

In appreciation markets, equity growth often dwarfs annual cash flow differences.

I have seen clients gain more in a single appreciation year than a decade of modest cash flow would have produced elsewhere.

The risk is obvious. Negative cash flow requires discipline. Market corrections test patience. Overleveraging turns optimism into panic very quickly.

Appreciation markets reward investors with strong incomes, long timelines, and emotional control.

They punish investors who assume appreciation is guaranteed.

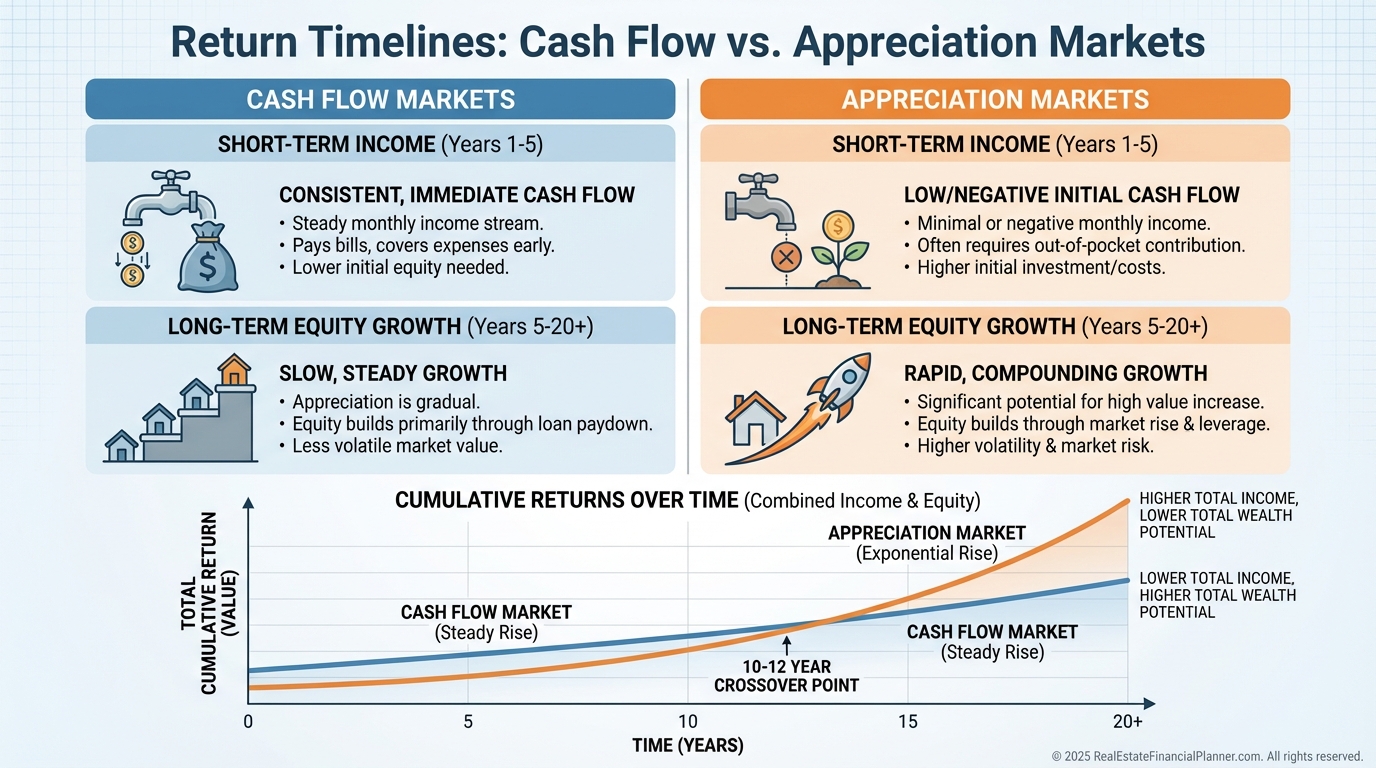

Comparing Cash Flow vs Appreciation Over Time

This is where most investors finally see the difference clearly.

Cash flow markets reward you early. Appreciation markets reward you late.

Return Timelines Compared

When I run scenarios inside the Return Quadrants™, the distinction becomes impossible to ignore.

Cash flow shows up immediately in the cash flow quadrant. Appreciation dominates the appreciation quadrant later, often explosively.

Taxes amplify this difference. Cash flow is taxed annually, softened by depreciation. Appreciation is taxed when realized, often deferred or eliminated with planning.

Neither is “better.” They behave differently under pressure.

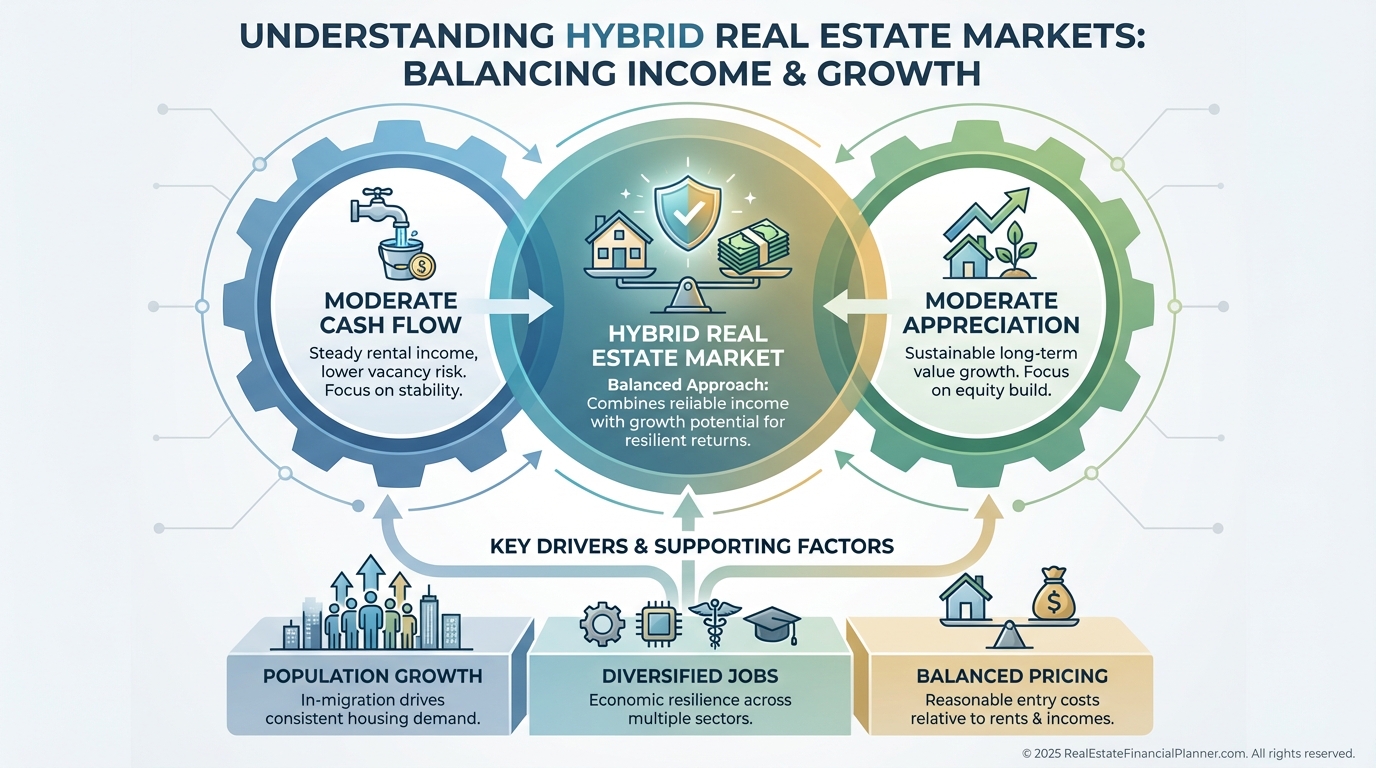

Hybrid Markets and the Middle Ground

Most investors eventually ask if they can have both.

Sometimes the answer is yes.

Hybrid markets sit between extremes. They offer modest cash flow and meaningful appreciation without requiring heroic assumptions.

Hybrid Market Sweet Spot

When clients ask where Nomad™ investing often works best, this is usually the answer.

Live there. Rent later. Capture income and growth.

Hybrid markets are rarely flashy. That is usually why they work.

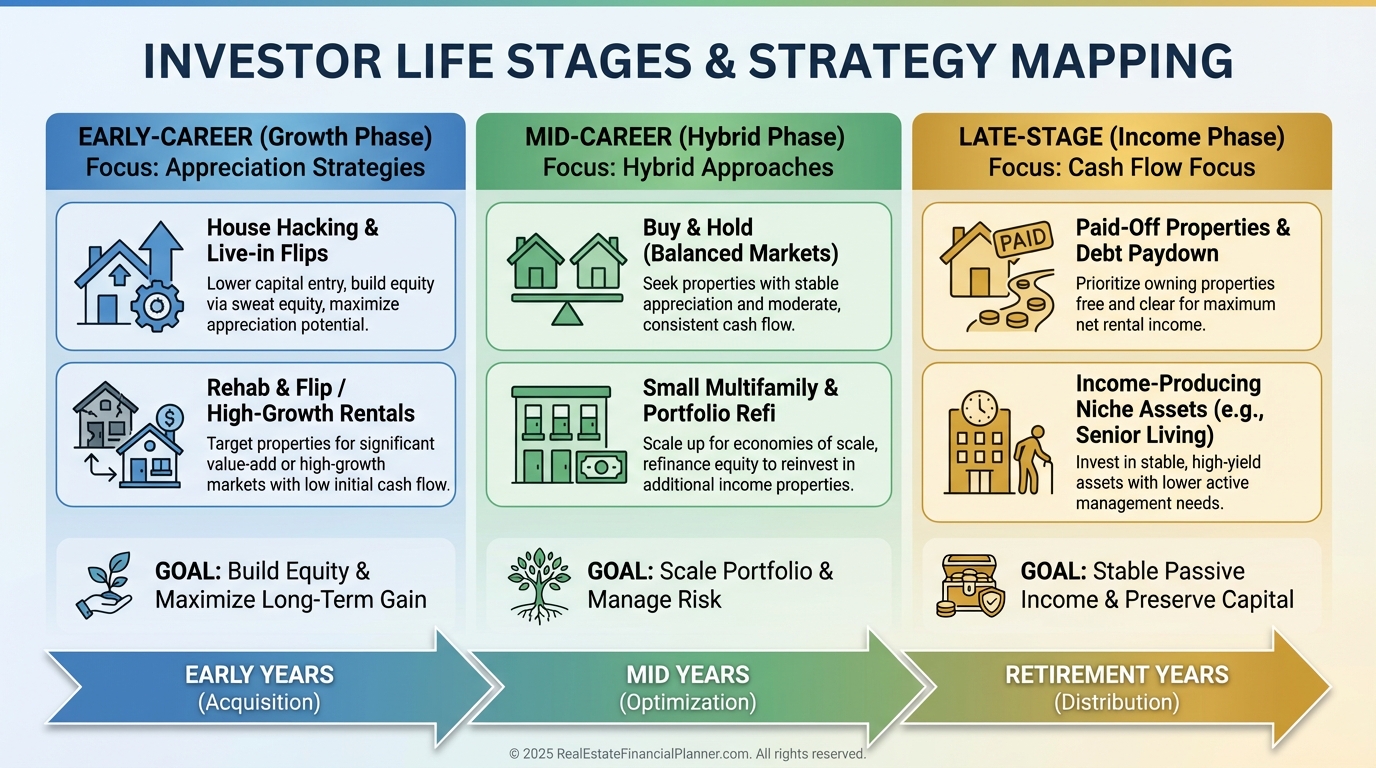

Choosing the Right Strategy for Your Life Stage

This is the part most investors skip.

Strategy without context is dangerous.

When I sit down with someone, we do not start with markets. We start with life.

Strategy by Investor Life Stage

If you need income, cash flow is not optional. If you have time and income, appreciation compounds quietly.

Many investors evolve. I did.

Early survival requires cash flow. Long-term freedom often comes from appreciation layered on top.

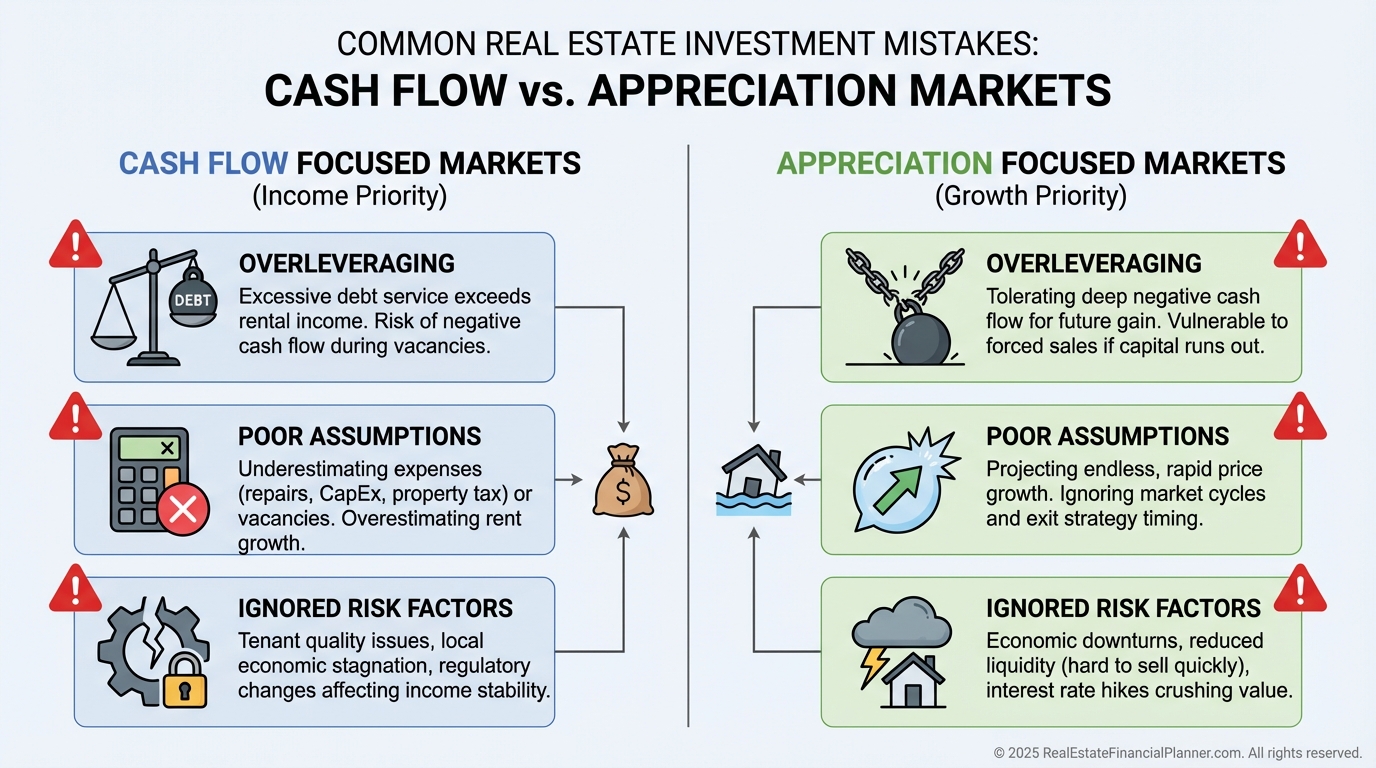

Common Mistakes I See Repeated

The same errors show up again and again.

Chasing high cash flow in bad neighborhoods.

Assuming appreciation will fix weak fundamentals.

Ignoring True Net Equity™ when evaluating exits.

Overestimating emotional tolerance for negative cash flow.

Common Investor Mistakes by Market Type

Spreadsheets do not fail investors. Unchecked assumptions do.

Final Perspective

Cash Flow vs Appreciation Markets is not an argument to win.

It is a framework to use.

The best investors I know are not ideological. They are adaptive. They run numbers. They stress-test. They change strategies as life changes.

Real estate rewards clarity, patience, and humility.

Pick the strategy that supports your life today while building options for tomorrow.