Capital Expenditures (CapEx): The Expense That Quietly Breaks Rental Cash Flow

Learn about Capital Expenditures (CapEx) for real estate investing.

Capital Expenditures (CapEx) Overview

Capital expenditures, or CapEx, are the expenses that don’t show up often, but when they do, they hit hard.

When I help clients analyze rental properties, CapEx is usually the line item that determines whether the deal survives reality or collapses under pressure.

After rebuilding from bankruptcy, I stopped pretending these costs were “future problems.”

They are present-day decisions with delayed consequences.

CapEx is not optional.

Roofs fail. HVAC systems die. Water heaters burst at the worst possible time.

If you don’t plan for these expenses upfront, your cash flow is fiction.

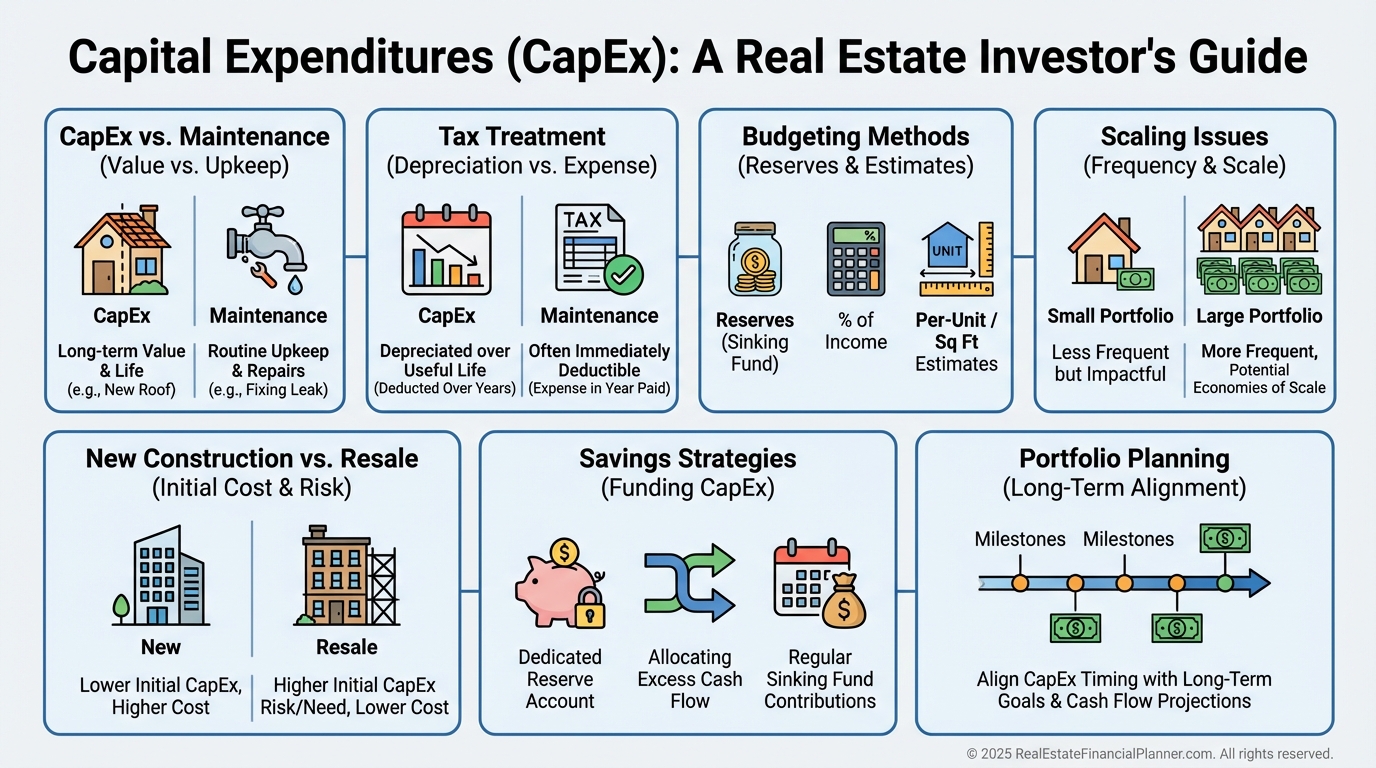

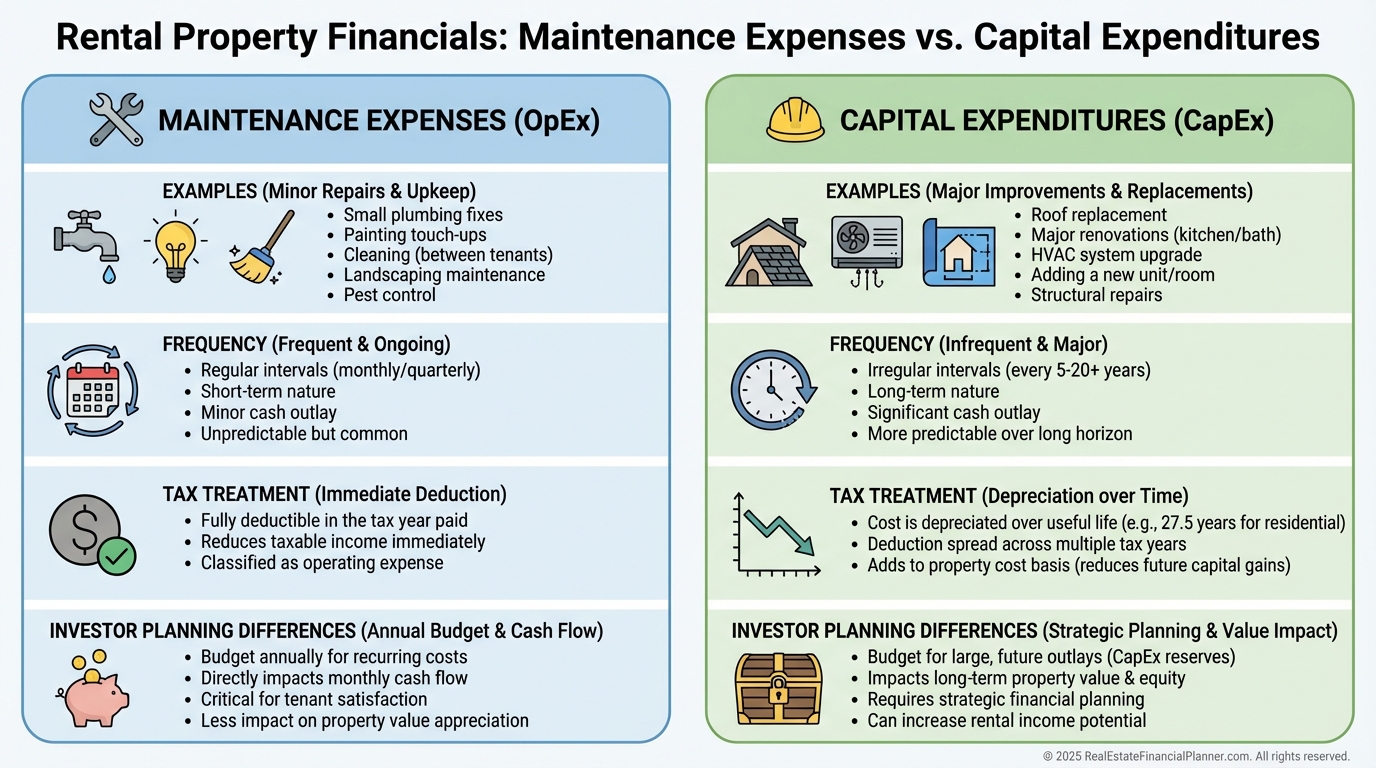

Maintenance vs Capital Expenditures

Maintenance keeps the property operating.

CapEx extends the property’s useful life.

That distinction matters for taxes, planning, and deal analysis.

Maintenance is small, frequent, and predictable.

CapEx is large, infrequent, and inevitable.

From a tax standpoint, maintenance is usually deductible in the year it occurs.

CapEx must be capitalized and depreciated over time, subject to IRS rules and Safe Harbor thresholds.

From an investor standpoint, the real mistake is pretending CapEx is just “extra maintenance.”

It’s not.

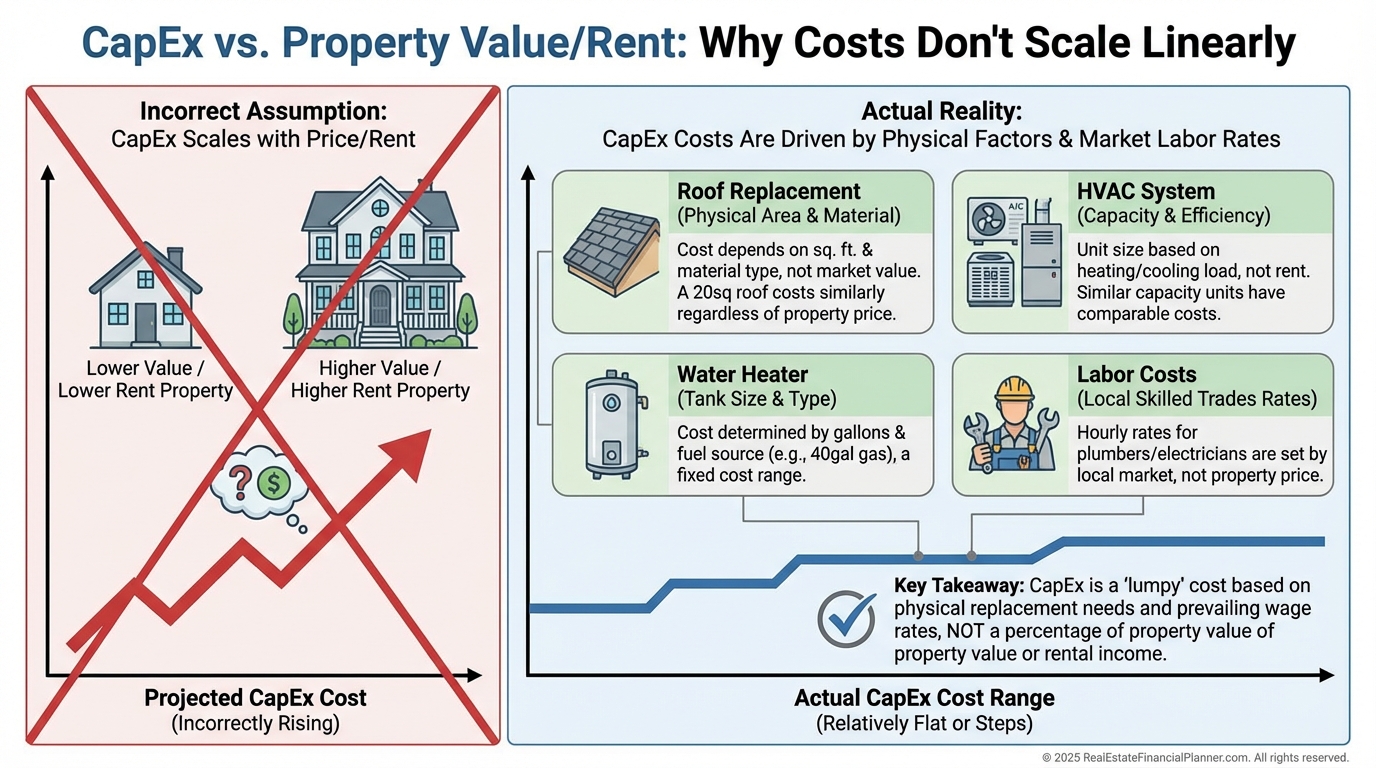

How Investors Should Actually Think About CapEx

When I analyze deals using The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I separate maintenance and CapEx on purpose.

Maintenance scales with income.

CapEx does not.

That difference is everything.

Maintenance is usually modeled as a percentage of Gross Operating Income (GOI).

As rents rise, maintenance naturally rises with them.

CapEx is different.

A roof does not care what your rent is.

That’s why CapEx should be modeled in dollars, not percentages.

Why CapEx Doesn’t Scale With Rent

This is where many investors get fooled.

Paint, flooring, roofs, water heaters, and labor cost roughly the same for similarly sized properties.

But the income does not.

That means CapEx eats a much larger percentage of income on lower-priced rentals.

I’ve seen investors assume “ten percent maintenance” without realizing that paint and flooring alone consumed nearly fourteen percent of their GOI.

The math doesn’t lie.

Rules of thumb do.

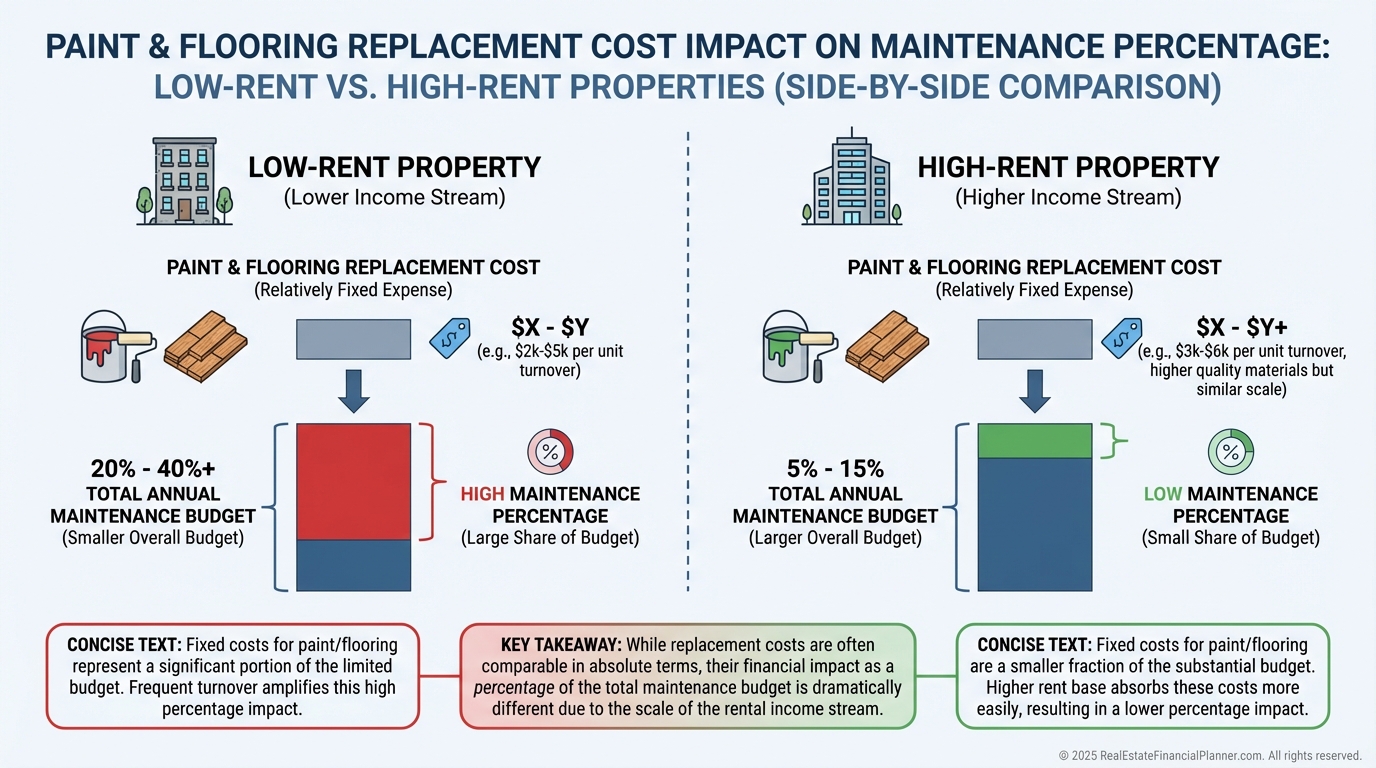

Paint and Flooring Cost Impact Example

Paint and flooring live in a gray area.

Some investors treat them as maintenance.

Others treat them as CapEx.

What matters is consistency and realism.

The same $1,600 per year hurts a $1,000-per-month rental far more than a $2,500-per-month rental.

This is why I never give a universal maintenance percentage.

You must do the math for your property.

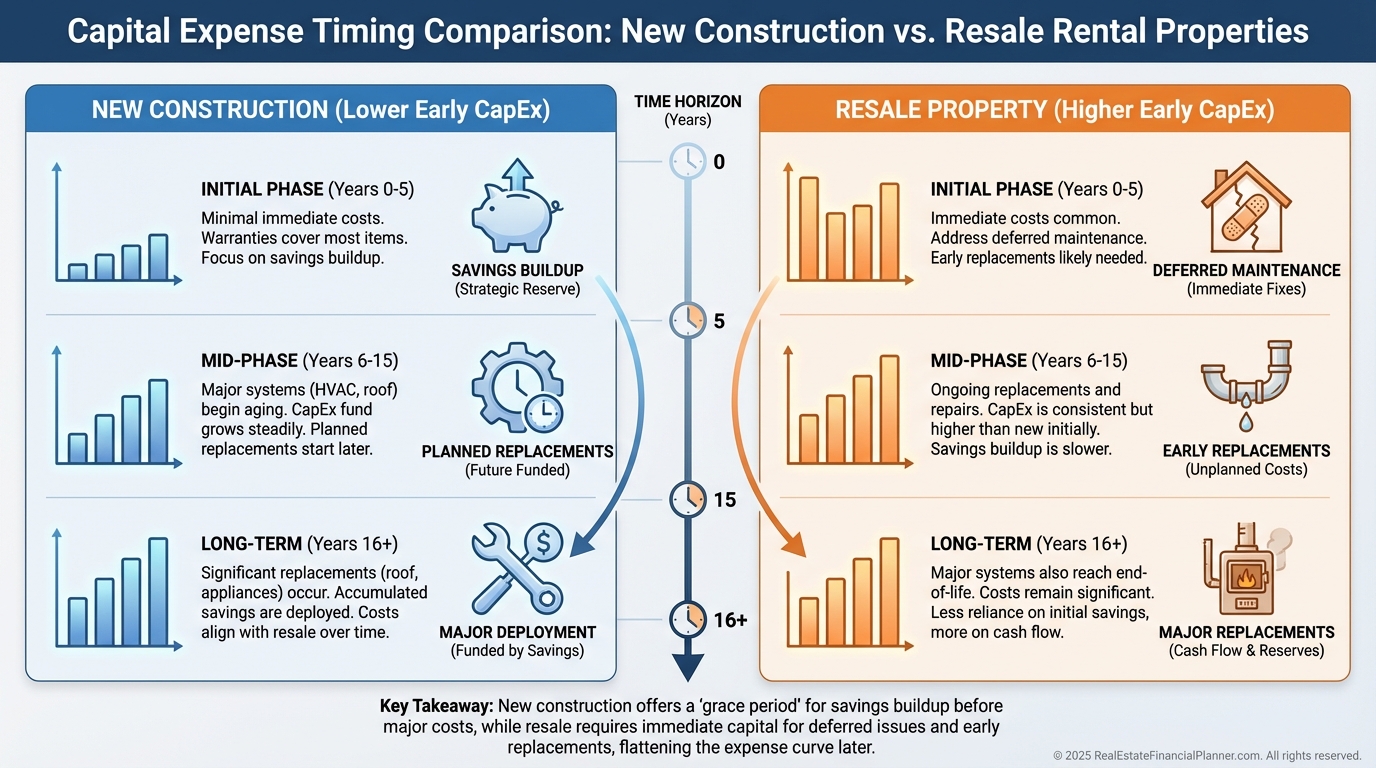

New Construction vs Resale CapEx Timing

New construction gives you time.

Resale properties steal it.

When I model these scenarios for clients, resale properties almost always require higher monthly CapEx savings or a larger starting balance.

Deferred maintenance doesn’t disappear just because you bought the property.

It just becomes your problem.

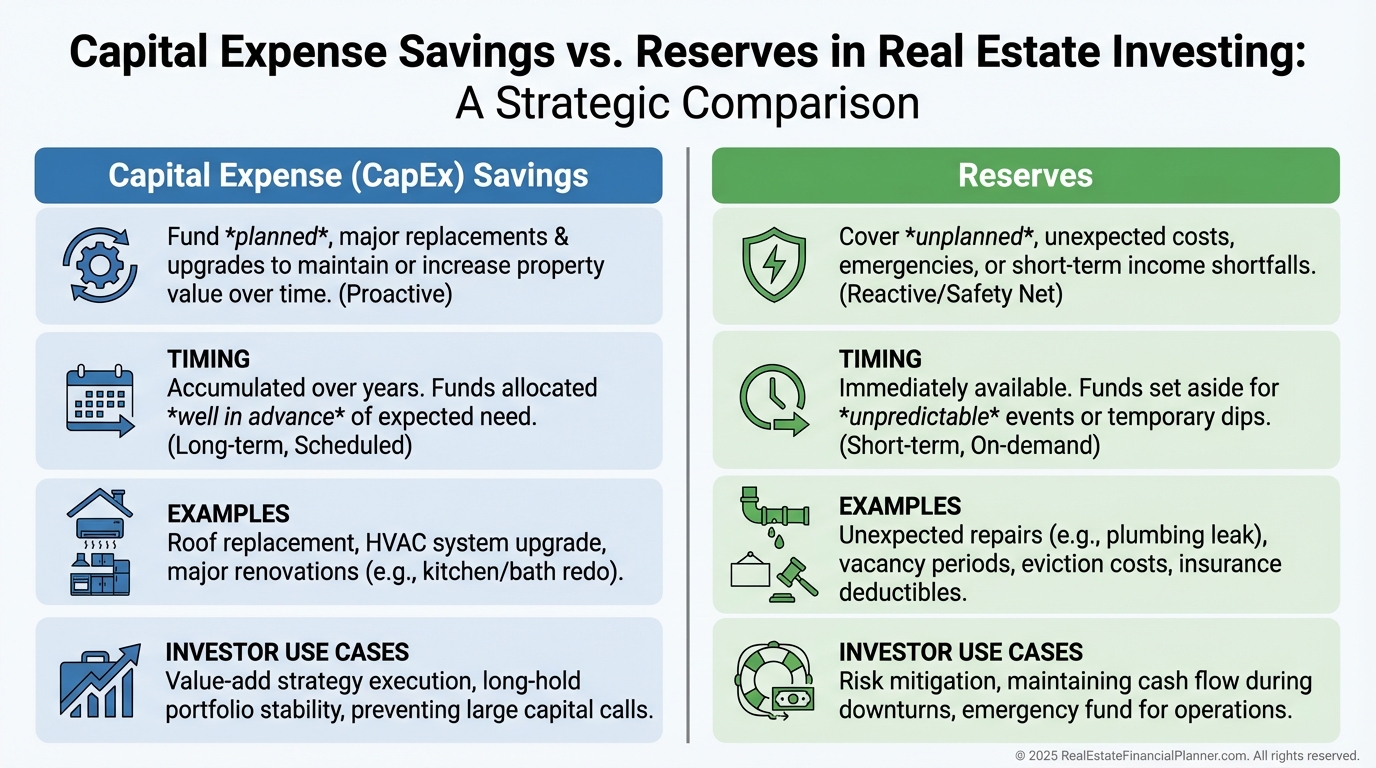

CapEx Savings vs Reserves

This confusion causes real damage.

Reserves are for emergencies.

CapEx savings are for planned inevitabilities.

Vacancy is unpredictable.

Roofs are not.

If you mix these two buckets, you will eventually drain both.

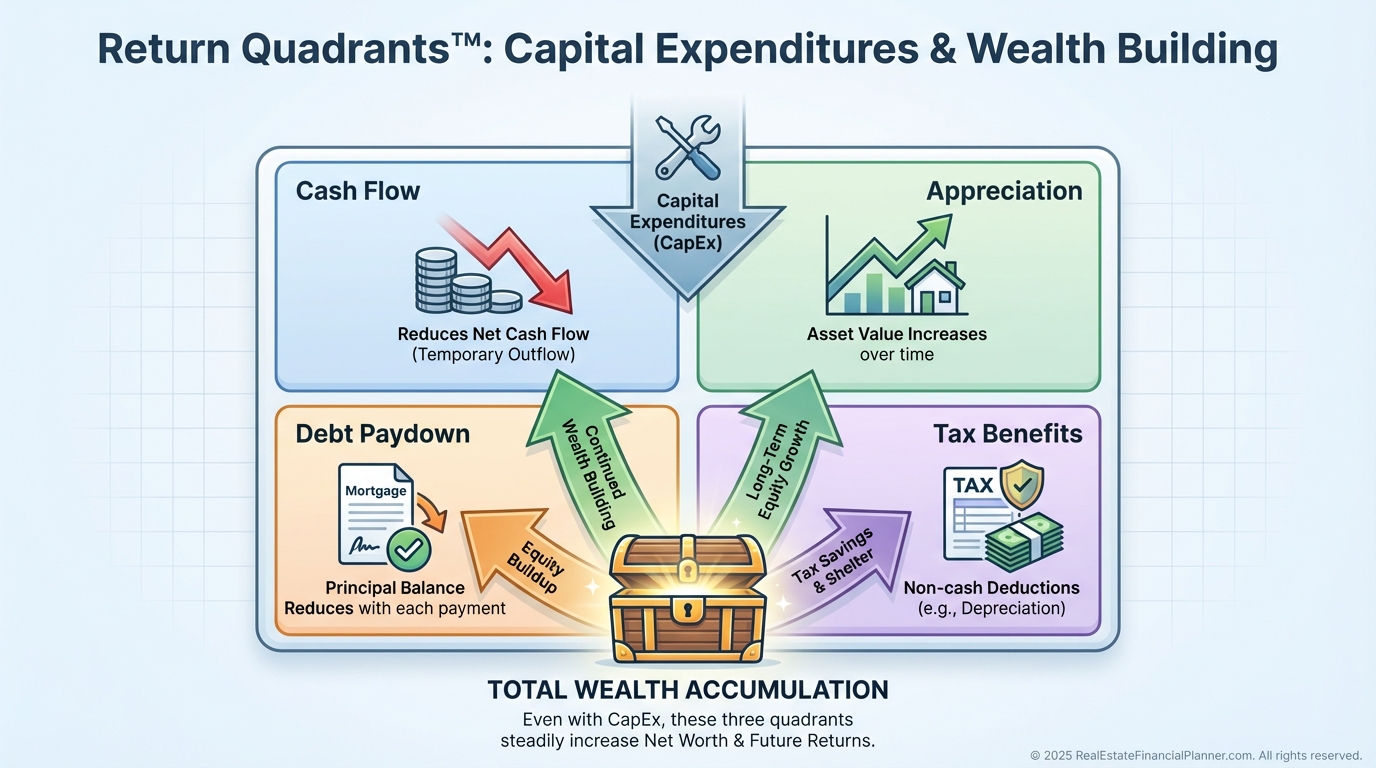

CapEx in the Return Quadrants™

CapEx reduces cash flow.

That does not mean the deal is bad.

When I review deals, I remind investors that appreciation, debt paydown, and tax benefits still exist.

Ignoring CapEx doesn’t increase returns.

It just delays pain.

Portfolio-Level CapEx Planning

CapEx decisions compound at the portfolio level.

More properties mean more roofs.

More LLCs mean more complexity.

More age means more replacements.

This is why portfolio design matters as much as deal analysis.

I’ve watched investors hit financial independence faster by owning fewer, higher-quality properties with predictable CapEx profiles.

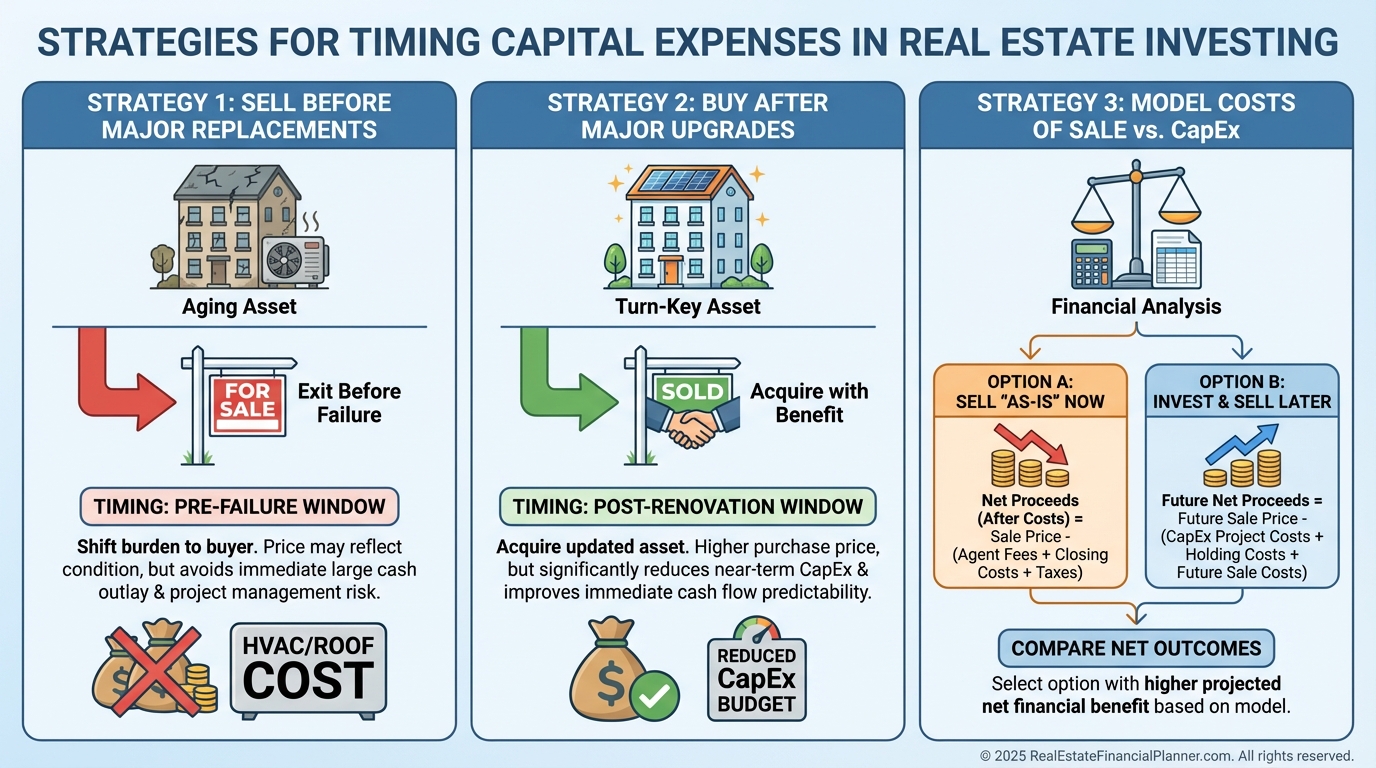

Timing CapEx Through Buying and Selling

Sometimes the best CapEx strategy is not paying it at all.

That might mean selling before a roof replacement.

Or buying after one.

But you must model the full picture, including costs of sale, taxes, and True Net Equity™.

The Real Lesson of CapEx

CapEx is not a surprise expense.

It’s a scheduled one.

If your analysis can’t survive a roof replacement on paper, it won’t survive it in real life.

Plan it.

Fund it.

Respect it.

That’s how rental portfolios stay boring, stable, and profitable.