Self-Directed Retirement Accounts: How to Buy Real Estate the Right Way (Loans, Rules, and Returns)

Learn about Self-Directed Retirement Accounts for real estate investing.

Why Self-Directed Retirement Accounts for Real Estate

When I help clients unlock idle retirement dollars, Self-Directed Retirement Accounts (SDRAs) are often the missing bridge.

They let you buy investment real estate with SDIRA or Solo 401(k) funds while keeping the tax advantages of the account.

But the rules are strict, the loans are different, and mistakes can be expensive.

Let’s walk through how I structure these safely, what I model, and what I warn clients to avoid.

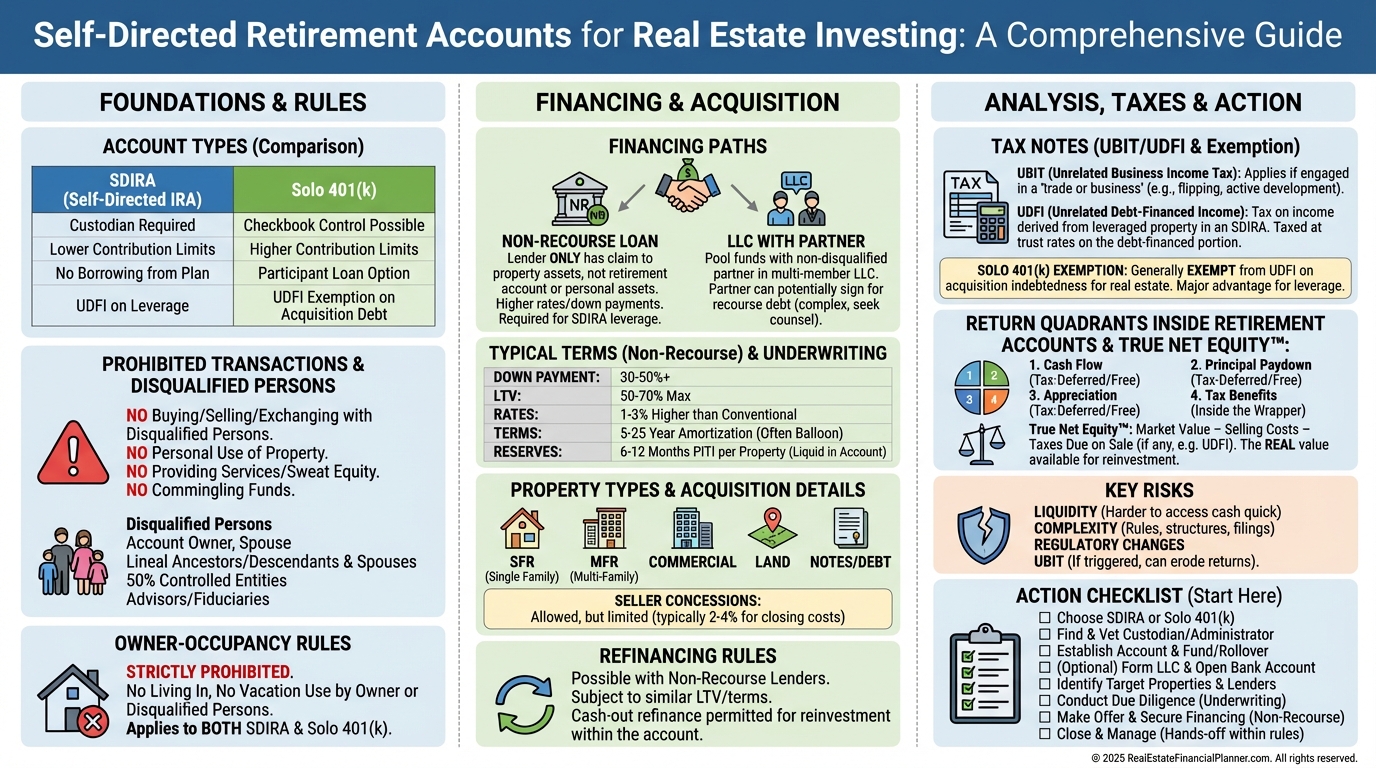

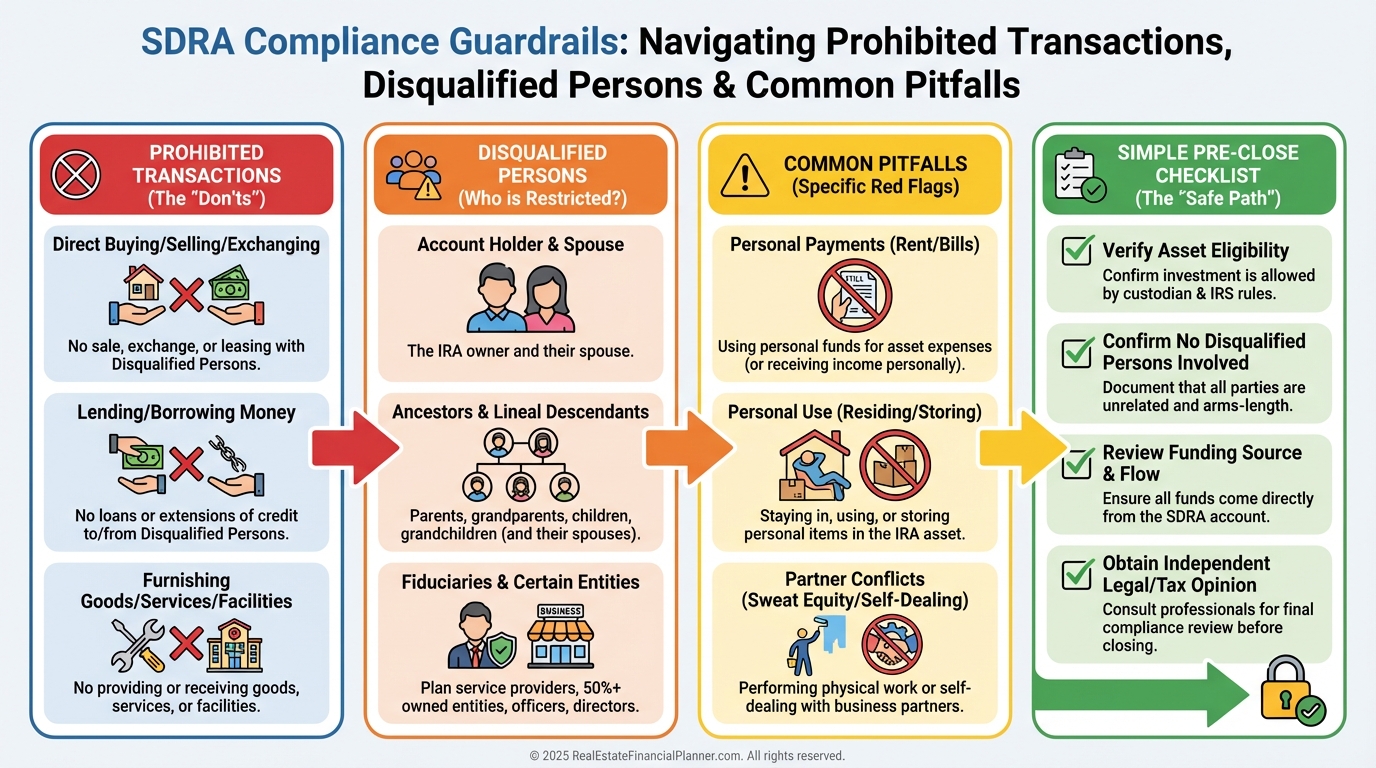

What You Can and Cannot Do

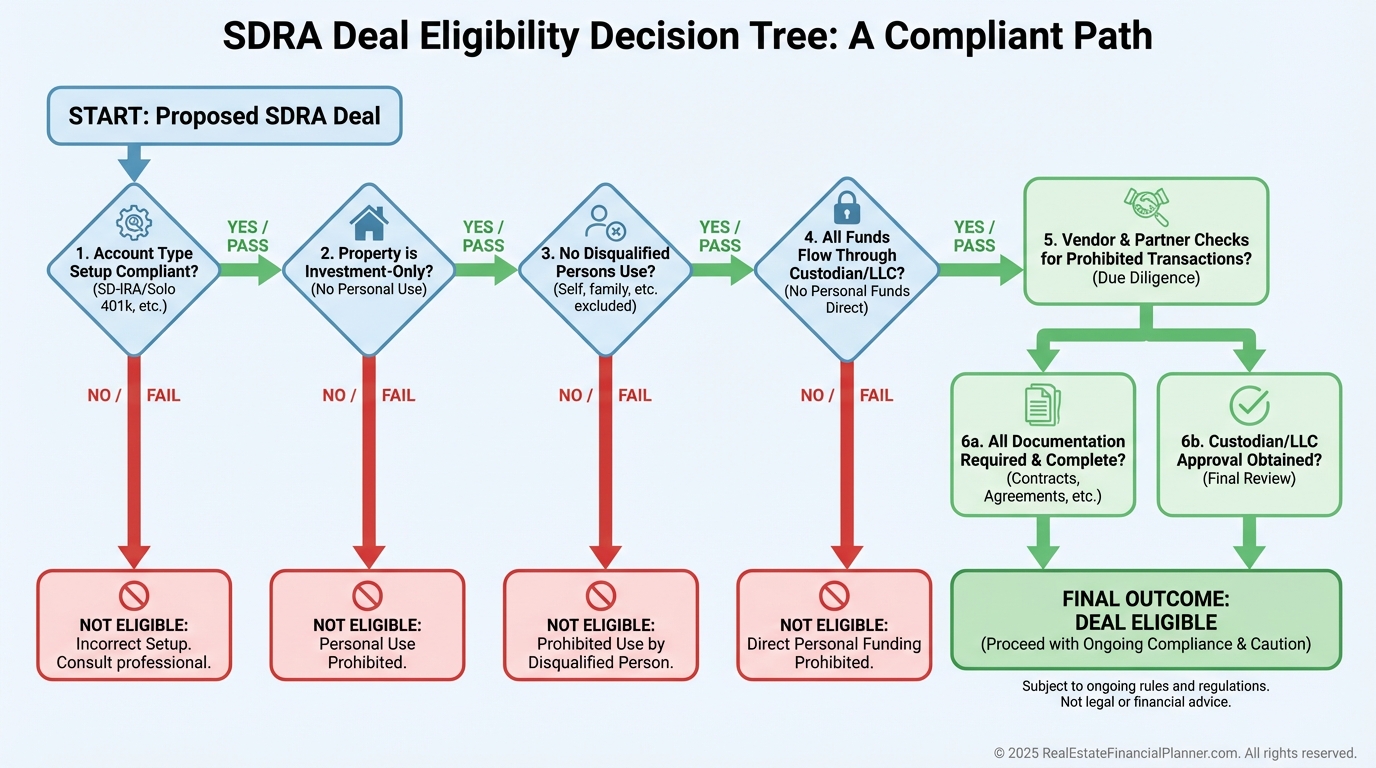

You’ll need a qualifying self-directed account: a Self-Directed IRA (traditional or Roth) or a Solo 401(k).

You typically work with a specialized custodian, or set up checkbook control via an LLC the account owns.

No owner occupancy. Ever. You, your spouse, ascendants/descendants, or lineal relatives cannot live in, vacation in, or personally benefit from the property.

All income and expenses must flow to and from the retirement account or its LLC. No commingling. No “I’ll just pay this bill personally” shortcuts.

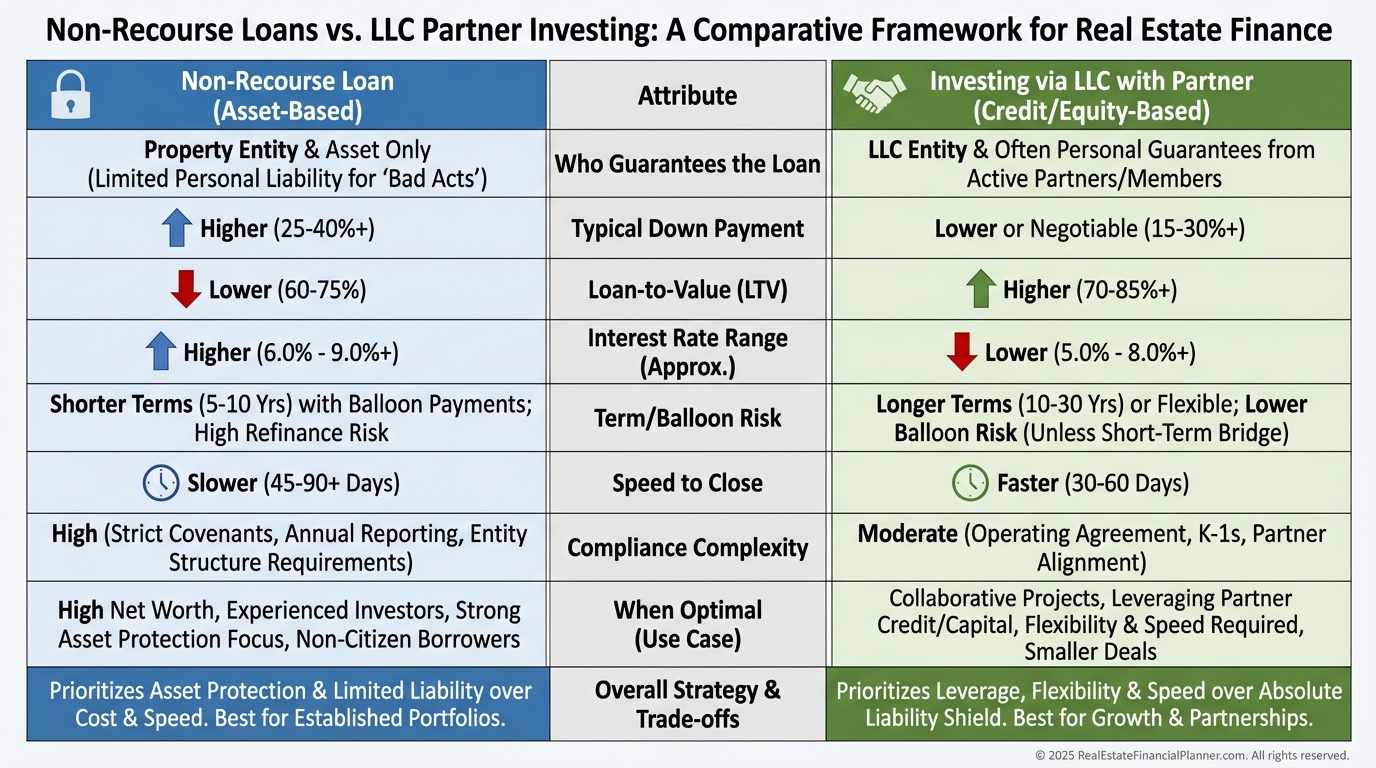

Two Primary Financing Paths

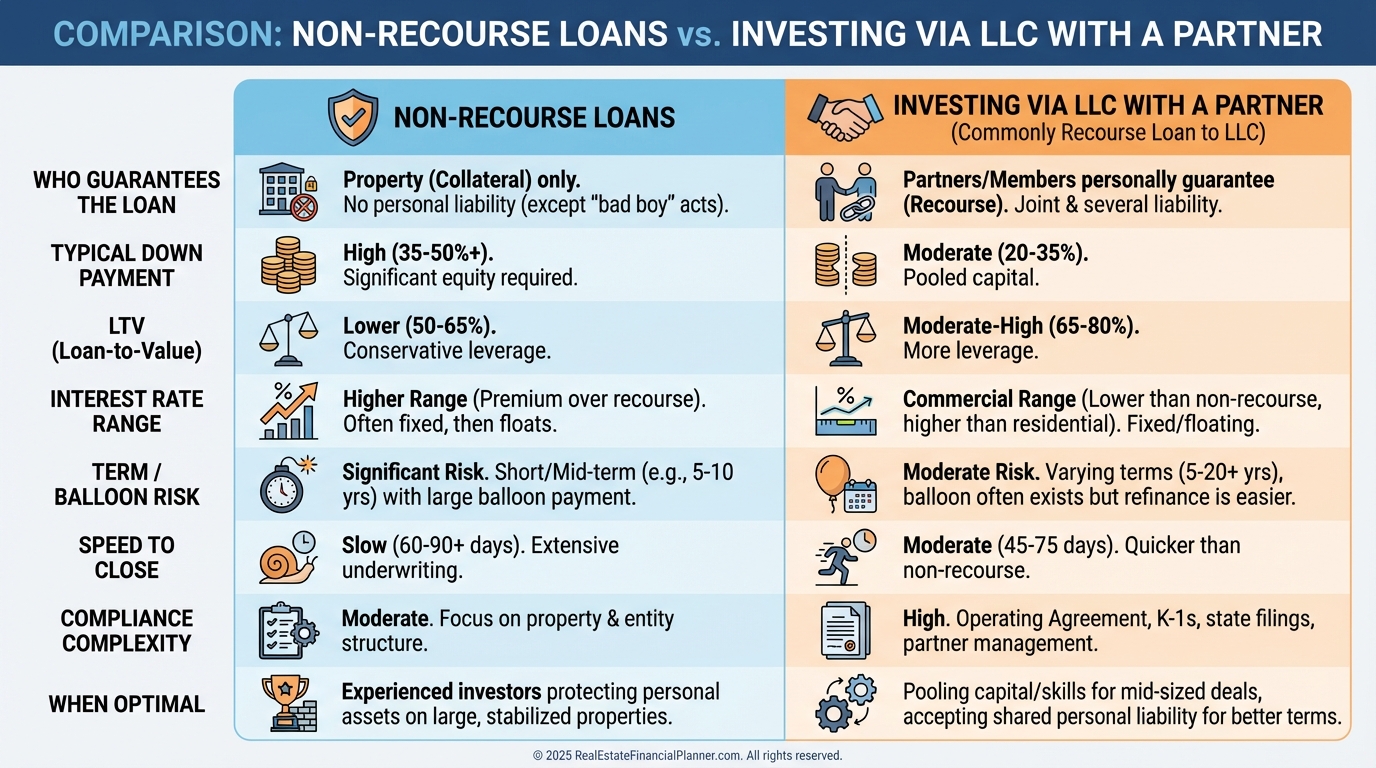

There are two common ways we finance SDRA purchases.

Path 1: Non-recourse loan to the retirement account or its wholly owned LLC.

The lender’s only recourse is the property. Expect bigger down payments and higher rates.

Path 2: Contribute your retirement funds into an investment LLC with a qualified partner who signs a recourse loan personally.

Your partner’s guarantee allows lower down payments, but the structure must avoid prohibited transactions and disqualified persons.

When I evaluate these paths, I model both scenarios side-by-side before writing offers.

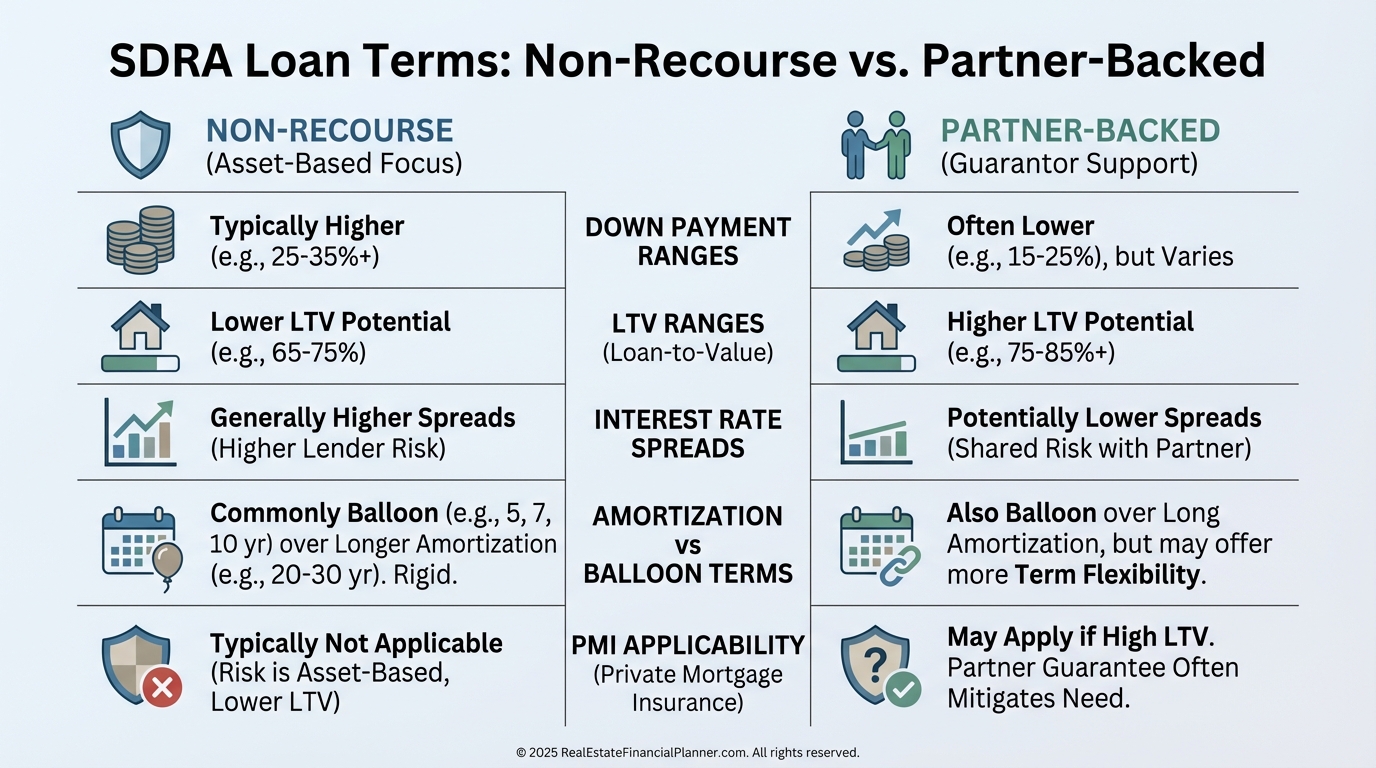

Down Payment, LTV, Rates, and Terms

Here’s what I tell clients to expect.

Down Payment and LTV:

•

Non-recourse: 35–40% down is common. LTV often 60–65%.

•

LLC with partner (recourse to partner): often 20–25% down. LTV 75–80%.

Rates:

•

Non-recourse rates typically run 1–3% higher than standard portfolio loans.

•

LLC with partner uses the signer’s credit profile, often securing more competitive pricing.

Amortization and Term:

•

Non-recourse loans often amortize over 20–30 years with 5–10 year balloons.

•

LLC with partner can open doors to longer terms and more conventional options.

PMI:

•

Not applicable. High down payments or portfolio structures mean PMI isn’t used here.

Underwriting, Approval, and Loan Limits

Non-recourse lenders underwrite the property first.

Your personal credit has less weight, but it can still influence pricing.

There are no regulatory loan “limits” for SDRAs.

The ceiling is defined by LTV, property income, and your account’s cash.

I plan reserves more conservatively with SDRAs because capital calls must come from the account, not your pocket.

Owner-Occupancy, Use, and Property Types

You cannot house hack, Nomad™, or spend a weekend at the property.

SDRA purchases must be pure investments.

Eligible property types include single-family homes, condos, townhomes, small multifamily, commercial, and even land.

Short-term rentals are possible if managed at arm’s length and all revenue/expenses stay inside the account.

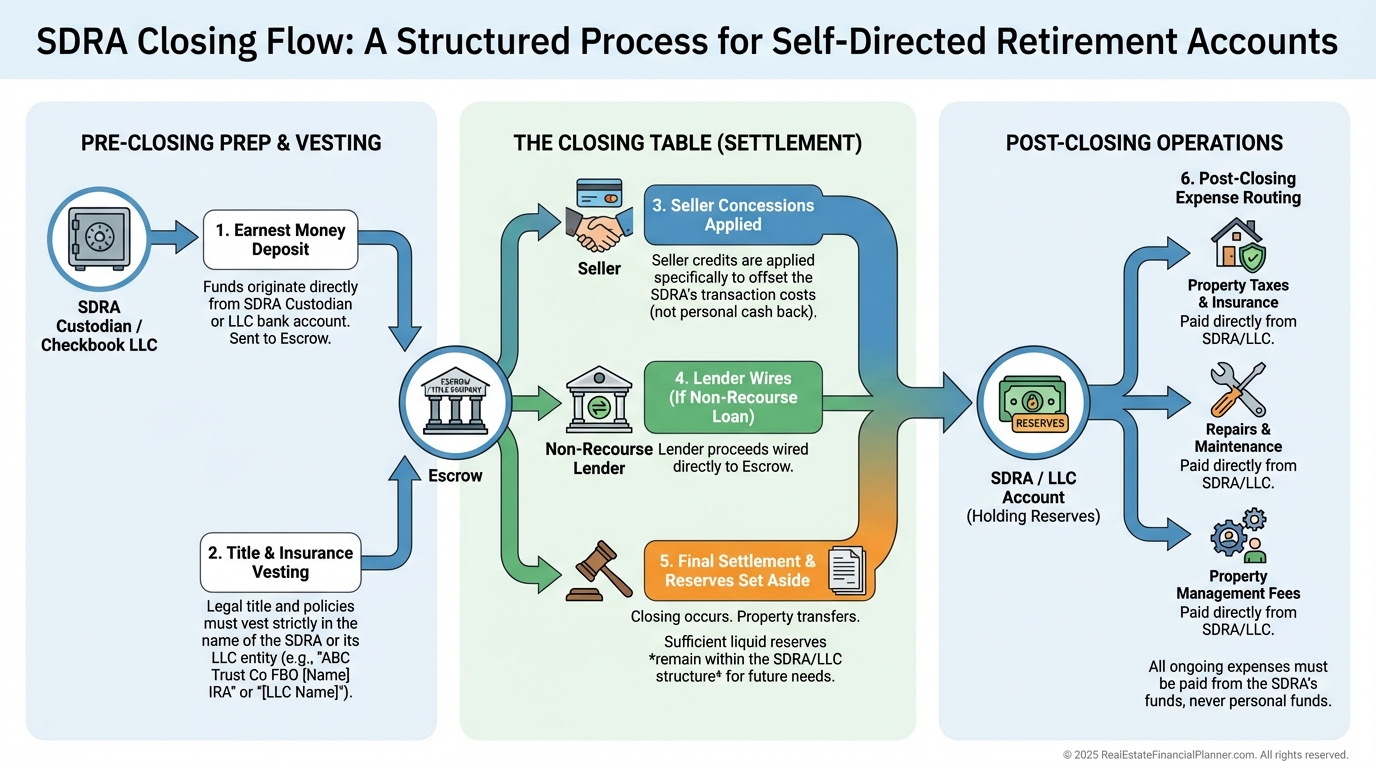

Seller Concessions and Closing Mechanics

Seller concessions are allowed if they benefit the retirement account, not you.

We use them for closing costs or to seed a repair reserve held by the custodian/LLC.

At closing, the buyer is the SDRA (or its LLC), earnest money comes from the account, and all invoices are paid by the account.

I double-check that the purchase contract names the account/LLC correctly and that title and insurance reflect the retirement account as owner.

Refinancing and After Major Financial Events

Rate-and-term refinances are possible, but the loan must remain non-recourse if the account owns the property.

Cash-out refinances are generally off the table.

Recasting is rarely offered on these loans.

After bankruptcies or foreclosures, some non-recourse lenders still lend because they underwrite the asset.

Expect pricing premiums until your track record improves.

Special Structures and Partners

SDRAs can own property directly or via an LLC.

If you partner, make sure the partner is not a disqualified person.

Document roles, ownership percentages, capital calls, and exit plans.

When I structure partnerships, I pre-write the “what if” clauses: who funds shortfalls, buyout rights, and decision deadlocks.

Taxes Inside Retirement Accounts: What Changes

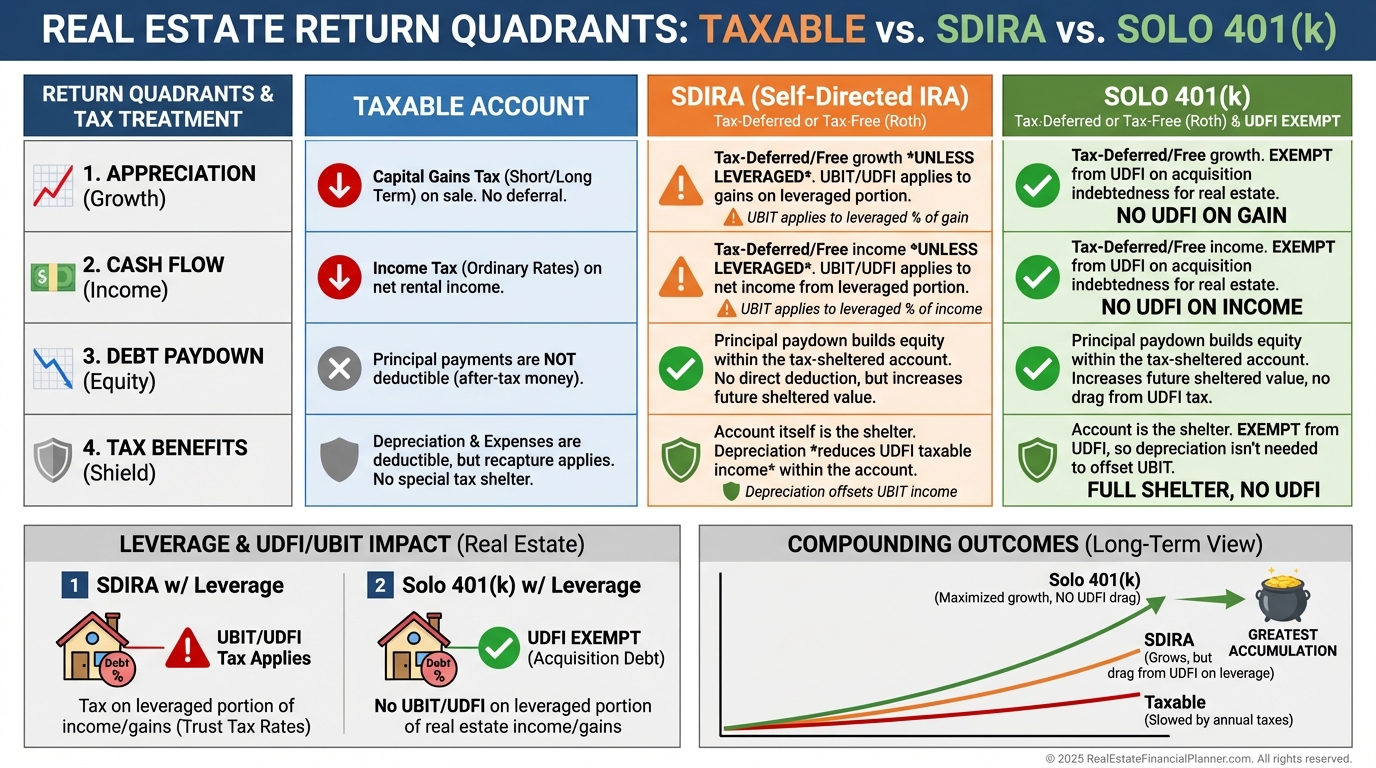

Return Quadrants™ still apply—Appreciation, Cash Flow, Debt Paydown, and Tax Benefits—but the tax quadrant behaves differently.

Inside an SDIRA or Solo 401(k), depreciation and write-offs don’t flow to your 1040.

Instead, the account compounds tax-deferred (traditional) or tax-free (Roth).

Leverage in an SDIRA can trigger UDFI, which may cause current-year UBIT on the debt-financed portion of income/gains.

Solo 401(k)s are generally exempt from UDFI on acquisition indebtedness for real estate, which is a big structural advantage.

When I model SDRA deals, I run two cases: SDIRA-with-UDFI vs Solo 401(k)-exempt, then compare long-run compounding.

Modeling True Net Equity™

True Net Equity™ is our way of asking, “What can I actually keep?”

For SDIRAs, I adjust equity for:

•

Sale costs

•

Potential UDFI/UBIT on leveraged gains

•

Time delays getting custodian approvals

•

Liquidity discounts if the asset is hard to sell

For Solo 401(k)s, I remove UDFI on acquisition debt but still model sale costs and liquidity.

Then I compare that adjusted equity to alternative uses of the same retirement dollars.

Risks and Guardrails

The biggest risks I warn clients about:

•

Prohibited transactions: paying personally for repairs, self-dealing, or using disqualified vendors.

•

Concentration risk: one big property inside a small account.

•

Liquidity: every expense must come from the account; keep thicker reserves.

•

Interest rate and balloon risk on non-recourse debt.

•

UDFI/UBIT surprises on leveraged SDIRA deals.

My guardrails:

•

Pre-clear vendors and partners.

•

Keep 12 months of PITI and CapEx in the account for leveraged deals.

•

Choose fixed rates and plan for balloons 18–24 months early.

•

Re-underwrite annually.

A Quick Example I Often Model

Price: $400,000 rental.

Path 1: Non-recourse at 65% LTV, 7.75% rate, 25-year amortization, 35% down from SDIRA.

•

I check DSCR at current and stress-tested rents.

•

I estimate UDFI on the debt-financed share of income.

•

I set 12 months of reserves inside the SDIRA.

Path 2: LLC with partner, 80% LTV at 6.75% with the partner guaranteeing.

•

I check the operating agreement for capital calls and buyout rights.

•

I model returns to each member by ownership percentage.

•

I verify the partner is not disqualified and all funds flow through the LLC.

I then compare 10-year outcomes using Return Quadrants and True Net Equity, and choose the path that meets the investor’s risk and liquidity constraints.

Practical Checklist to Execute Cleanly

•

Select account type: SDIRA vs Solo 401(k); weigh UDFI implications.

•

Pick custodian or checkbook LLC; open, fund, and test wires.

•

Identify lender: non-recourse or partner-backed.

•

Underwrite deal: DSCR, LTV, reserves; model Return Quadrants and True Net Equity.

•

Draft clean purchase contract with correct vesting.

•

Route earnest money and all costs through the account.

•

Order title/insurance to the account/LLC.

•

Confirm seller concessions benefit the account.

•

Pre-clear property manager, vendors, and partner.

•

Line up post-closing reserves and CapEx plan.

•

Calendar balloon reminders and yearly re-underwriting.

Final Notes on Limits, PMI, and Number of Loans

There’s no formal cap on the number of loans your SDRA can take.

The constraint is your reserves, LTV, and the availability of lenders.

PMI doesn’t apply.

Loan amounts are dictated by lender LTVs and property economics, not a fixed SDRA limit.

When I rebuilt after a tough cycle, I favored safer LTVs, bigger reserves, and Solo 401(k) structures to minimize tax friction and balloon risk.

That same playbook still serves investors well today.