Option Fee Mastery: Control Real Estate, Multiply Exits, and Scale with Less Cash

Learn about Option Fee for real estate investing.

Why Option Fees Belong in Your Toolkit

When I help clients compete in tight markets, the option fee is often the edge that wins the deal without overcommitting capital.

It gives you control, time, and choices while keeping your downside capped.

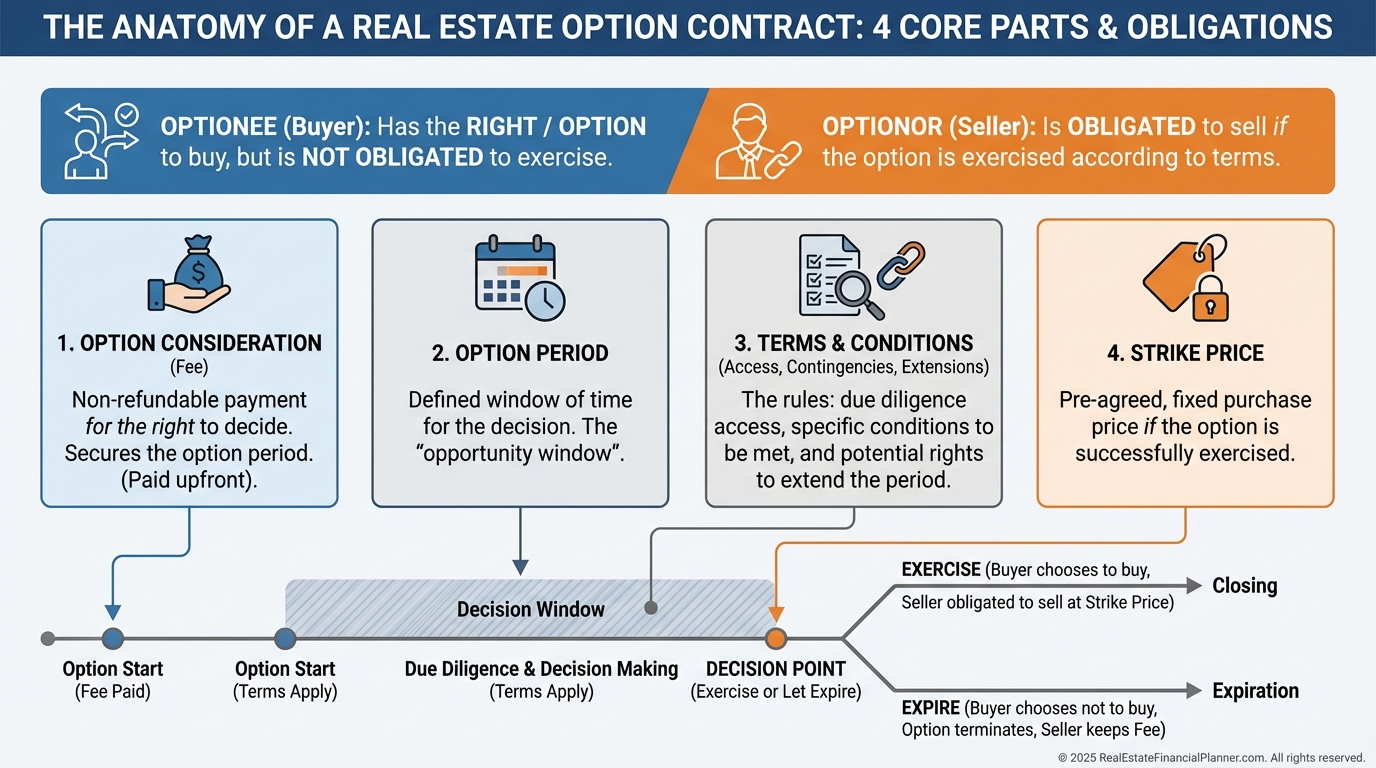

You buy the right to buy, not the obligation to buy.

That small difference changes everything about risk and return.

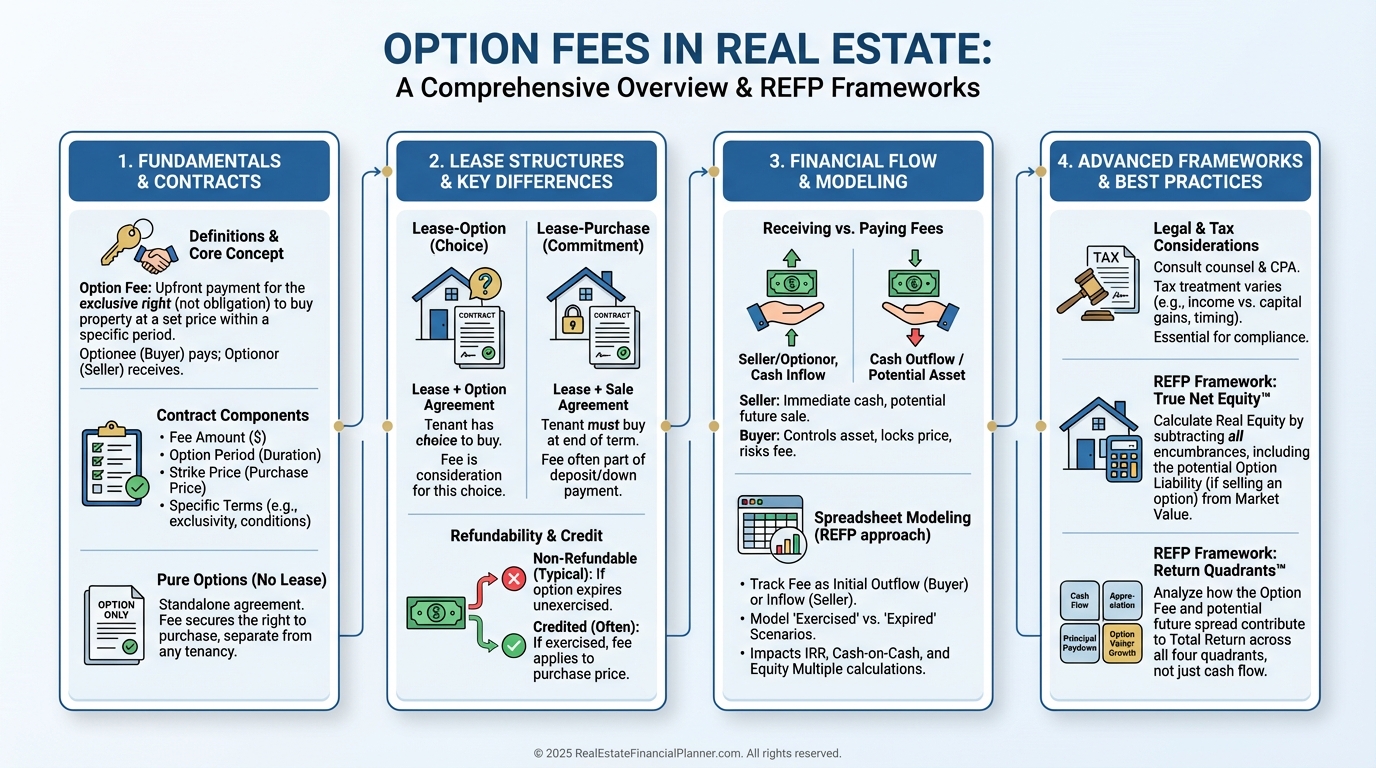

What Is an Option Fee, Really?

An option fee is a non-refundable payment for the exclusive right to buy a property at an agreed price before a deadline.

You get control of price and timeline, while the seller gets certainty and compensation for taking the property off the market.

How Options Work and Where the Profit Hides

When you pay an option fee, the seller must sell if you exercise, but you can walk away.

That asymmetry is why options can be so profitable when structured and analyzed correctly.

I model three things first: acquisition timing, carrying risks for the seller, and my exit paths.

Then I ask, “What must be true for me to exercise, assign, or let it expire?”

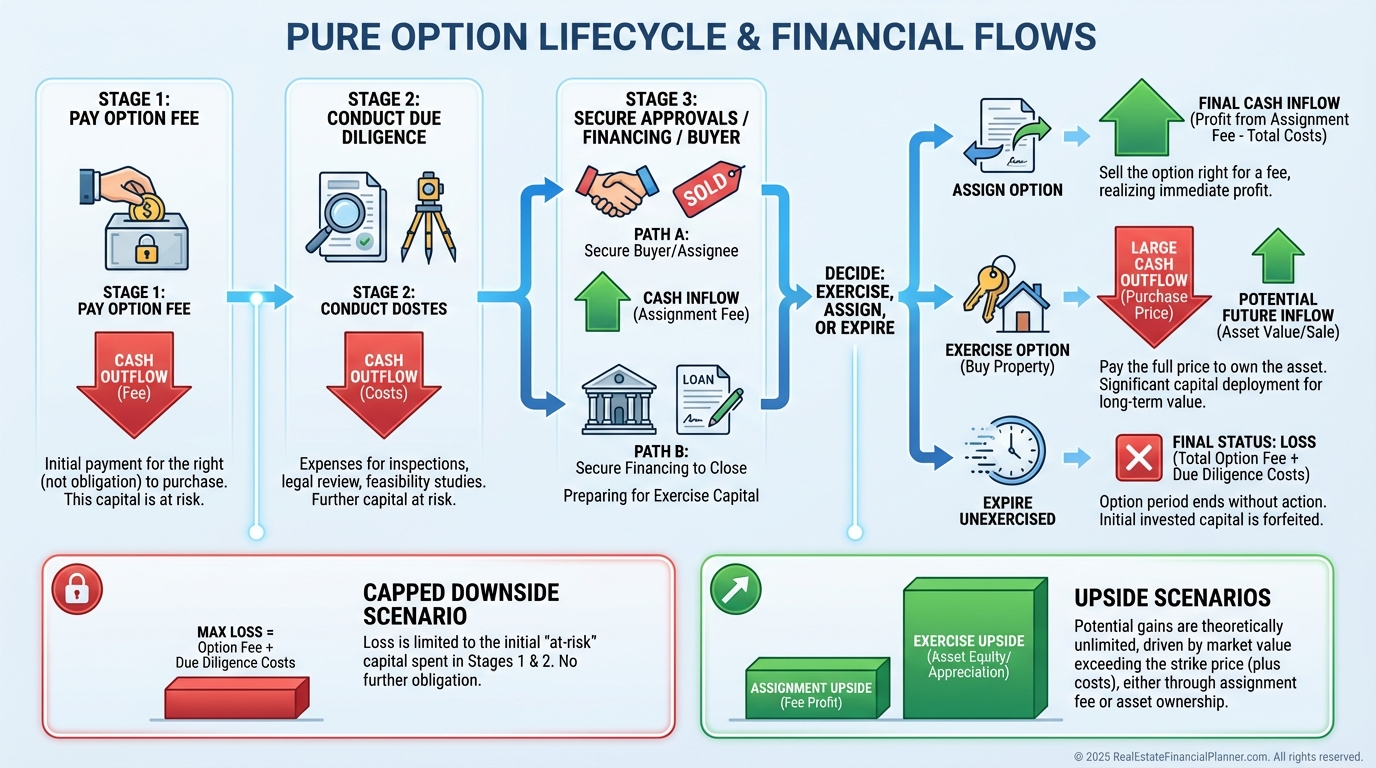

Pure Options: Control Without Ownership

Pure options are my default when I need time to confirm value, approvals, or capital partners.

No lease. No possession. Just the right to buy at a fixed price by a fixed date.

Consider a 10-acre parcel at $500,000 with a $10,000 option for 24 months.

If approvals come through and value rises to $650,000, exercising the option could net six figures after closing costs.

If approvals fail, your loss is the $10,000, not the $500,000 you would have risked.

Lease-Options vs. Lease-Purchases: Choose Intentionally

When I place tenant-buyers, I’m explicit about vocabulary because the legal and operational outcomes diverge.

A lease-option uses two contracts: a lease and a separate option to purchase.

The tenant-buyer has the right, not the obligation, to buy.

A lease-purchase is a purchase contract with a delayed closing and earnest money, not an option fee.

It creates an obligation to buy and can require foreclosure rather than eviction if they default.

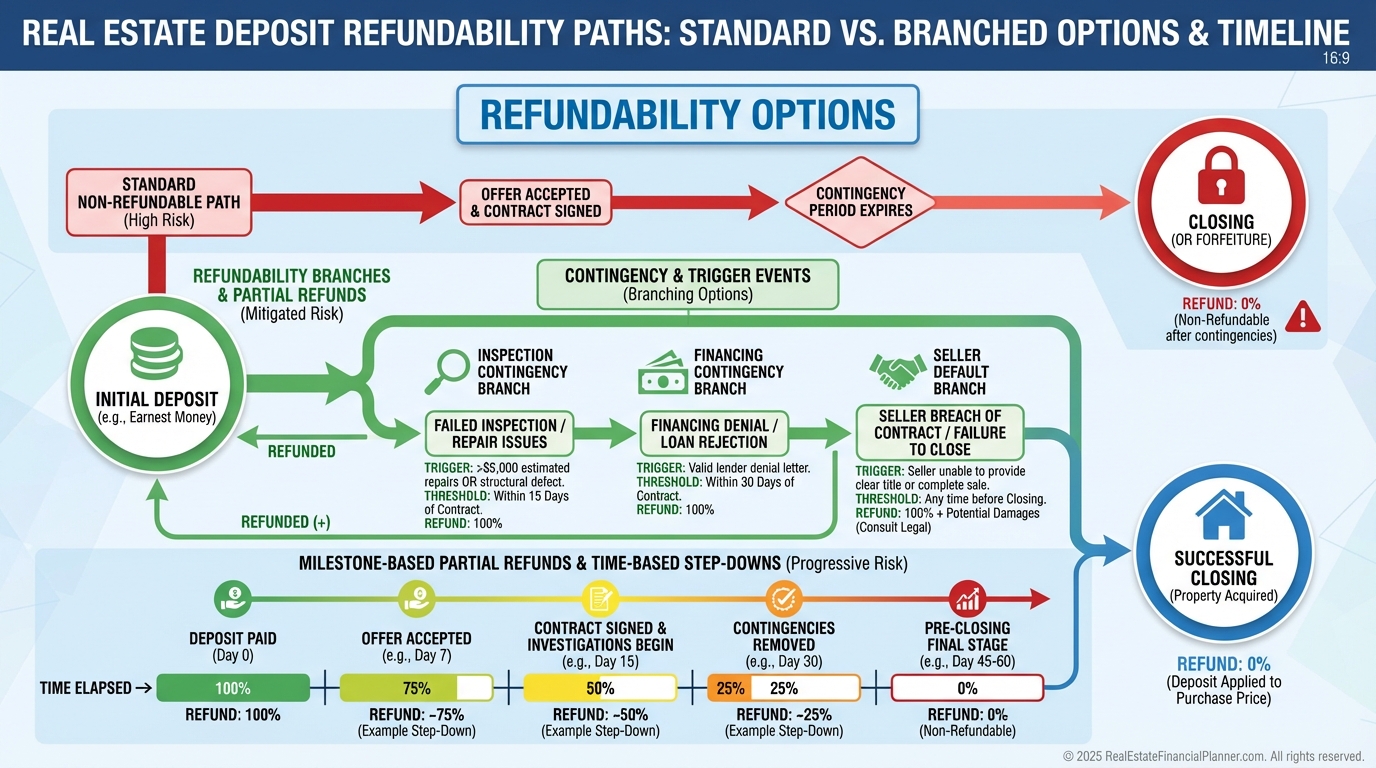

Structuring the Option Fee: Non-Refundable by Default, Smartly Conditional When Needed

Most option fees are non-refundable because that’s the consideration for exclusivity.

But I sometimes use narrowly drafted refundability clauses to get deals done without weakening the commitment signal.

Inspection-based refunds above a repair threshold keep both sides fair.

Financing contingency refunds can be partial and time-limited to reward early certainty.

Milestone schedules can step down refundability as approvals are achieved.

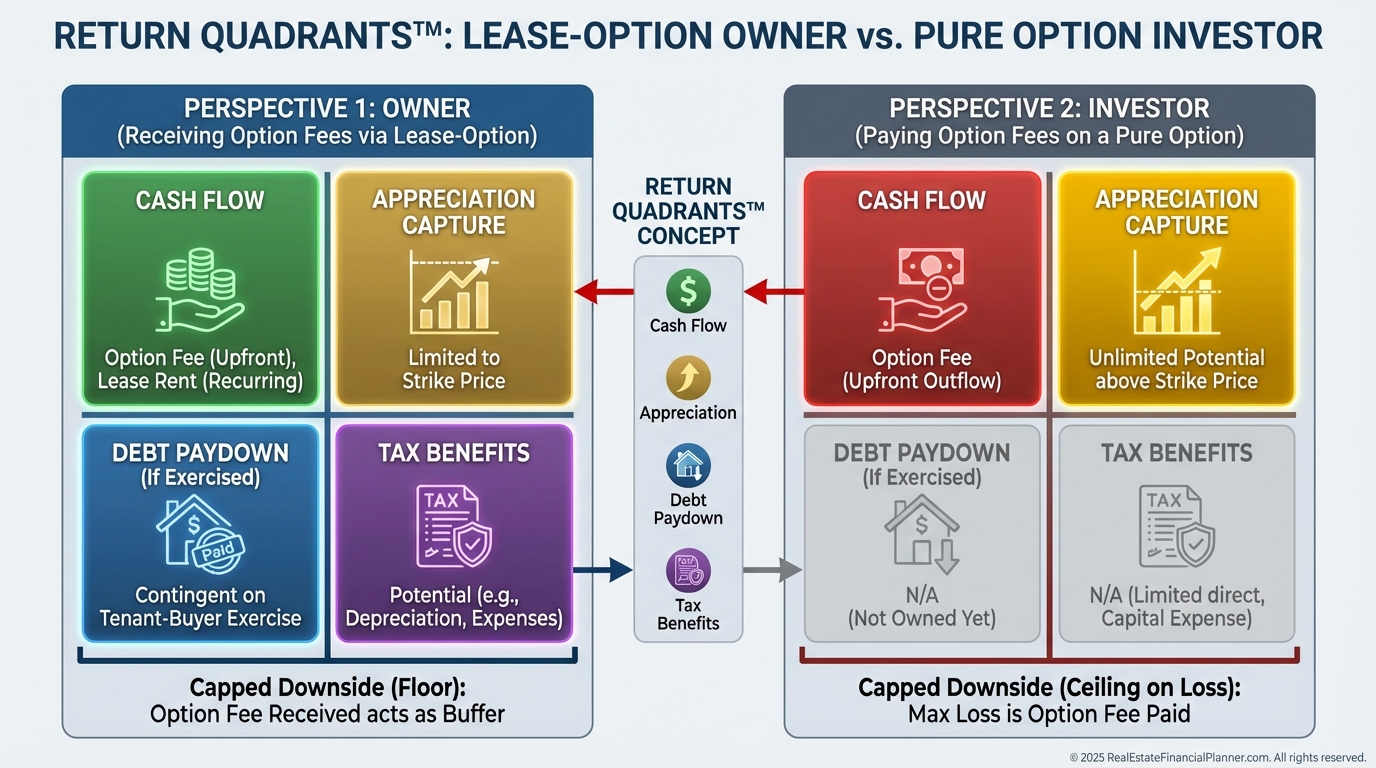

Receiving Option Fees from Tenant-Buyers

When I coach landlords converting to lease-options, I tell them to treat this like retail, not rentals.

Market to future homeowners with temporary financing hurdles, not traditional renters.

Typical option fees run 1–5% of price, with premium rent and optional rent credits to align behavior.

Most tenant-buyers won’t exercise, historically 10–30%, so build your plan to deliver a great path but withstand non-exercises.

I track each deal’s True Net Equity™ both if they buy and if they don’t.

That prevents me from overvaluing “maybe” money.

Paying Option Fees to Tie Up Deals Creatively

When I negotiate as the buyer, I aim for the smallest fee that still secures commitment and adequate time.

I start with the minimum viable option fee, then earn extensions with progress updates rather than more money.

Distressed sellers, estates, developers, and retiring landlords are prime candidates because time is as valuable as price.

For wholesaling with options, I negotiate enough runway to market ethically and professionally, then assign the option rather than double-close when possible.

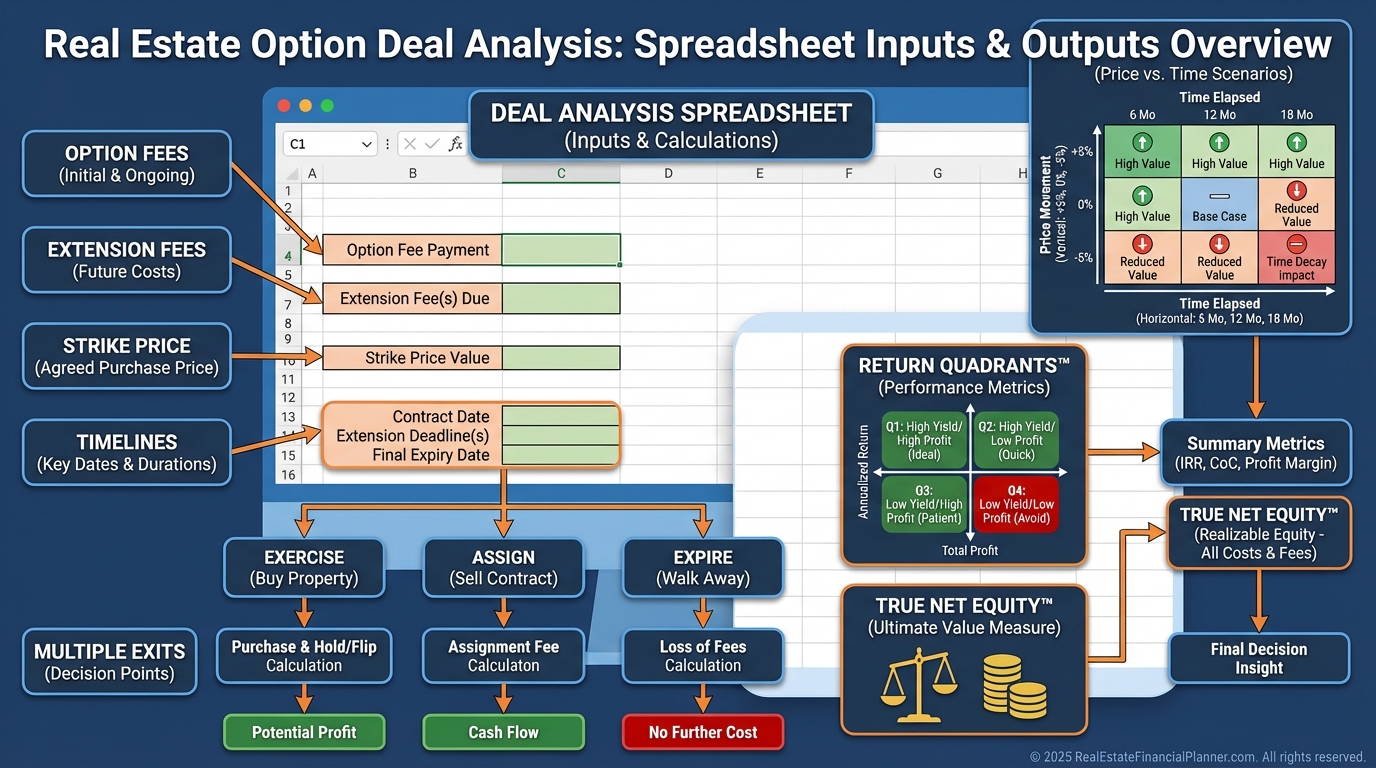

Model It Before You Commit: The World’s Greatest Real Estate Deal Analysis Spreadsheet™

Options live and die on timing, sensitivity, and exit flexibility.

I enter the option fee as an acquisition cost, add any extension fees, and create scenarios for exercise, assignment, or expiry.

Then I run Return Quadrants™ to see where the deal pays me: fee income, appreciation capture, or tax benefits if I close and own.

I also run a True Net Equity™ snapshot at exercise to confirm the spread after all costs is worth deploying capital.

The Math I Check Before Writing Any Option Fee

I write the worst-case first: if I lose 100% of the option fee, does my portfolio still meet plan?

Then I price the time value.

If I need 6 months to verify feasibility, I won’t pay 6% of value for 6% of time.

I prefer paying for milestones, not months, because progress protects value.

And I always align the option period with my real-world approval, funding, or resale timeline.

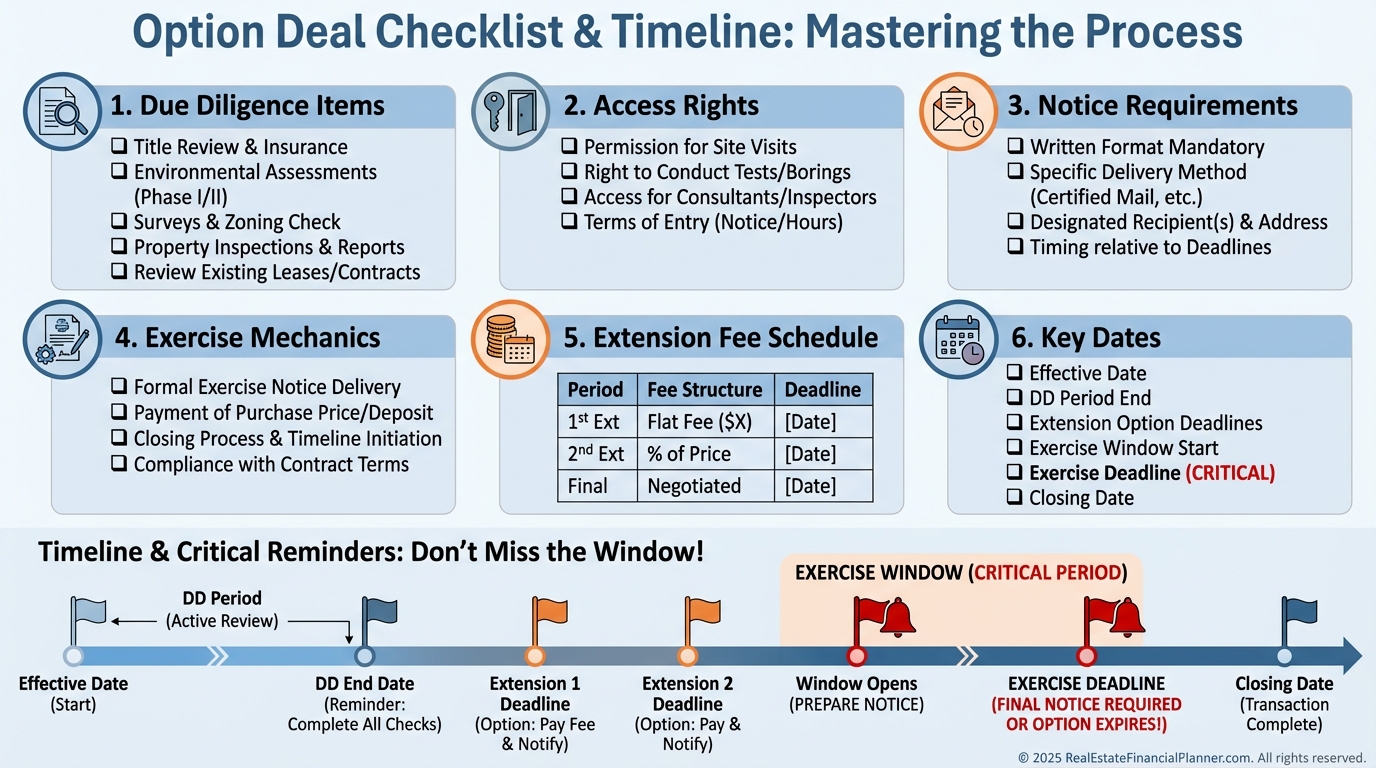

Recording, Memorandums, and Title

I often record a memorandum of option to protect my position.

Recording gives public notice and helps block a sneaky resale.

But it can complicate the seller’s refinance or future transactions, so I use it strategically and promise prompt releases upon payment.

Title companies appreciate clean documents, so I give them the option, any amendments, and explicit exercise instructions early.

Taxes, Accounting, and Paper Trails

When I receive an option fee, I treat it as income unless it will be a credited deposit under a specific structure.

When I pay an option fee and exercise, I capitalize it into basis.

If the option expires worthless, I treat it as a loss.

I keep option ledgers with dates, amounts, conditions, and notices because documentation wins disputes.

Hybrid Strategies I Use with Clients

They also reduce repairs because tenant-buyers behave like owners.

On acquisition, pure options help land developers, builders, and value-add investors cap downside while creating outsized upside.

Risk Controls I Insist On

I keep inspection access explicit, including invasive testing where needed.

I set notice procedures and exercise mechanics in writing with dates and delivery methods.

I ask for pre-agreed extensions with a fee schedule so time never beats me by 48 hours.

I maintain seller communication so no one is surprised when I assign or exercise.

Common Pitfalls I See (And How to Avoid Them)

Paying too much for too little time kills spreads.

Vague terms invite disputes and slow closings.

Under-screened tenant-buyers lead to vacancy churn and reputational risk.

And the worst mistake is failing to reserve cash to exercise when you should, turning a great option into a missed opportunity.

Putting It Together: Your First Option Fee Play

Pick one candidate this week: a stale listing, a cooperative seller, or a tenant who wants to buy.

Structure a modest, clearly non-refundable option fee with the right to credit it at closing.

Set a realistic option period tied to your specific milestones.

Then model three exits in the spreadsheet and greenlight only if all three clear your thresholds.

When I rebuilt after a tough market, options let me move fast without betting the farm.

Use them to buy time, stack exits, and only deploy big capital when the value is proven.