Cash-In Refinances: The Quiet Way Investors Buy Better Rates

Learn about Cash-In Refinances for real estate investing.

Cash-In Refinance Overview

Most investors hear the word “refinance” and immediately think about pulling money out.

When I help clients analyze refinancing options, that assumption alone costs them thousands of dollars per year.

A cash-in refinance is the opposite of what most investors expect, and it is one of the most underused tools for improving long-term portfolio performance.

I see it most often with investors who already own good properties but are stuck with mediocre loan terms.

They are so focused on not writing a check at closing that they miss what better terms actually buy them over time.

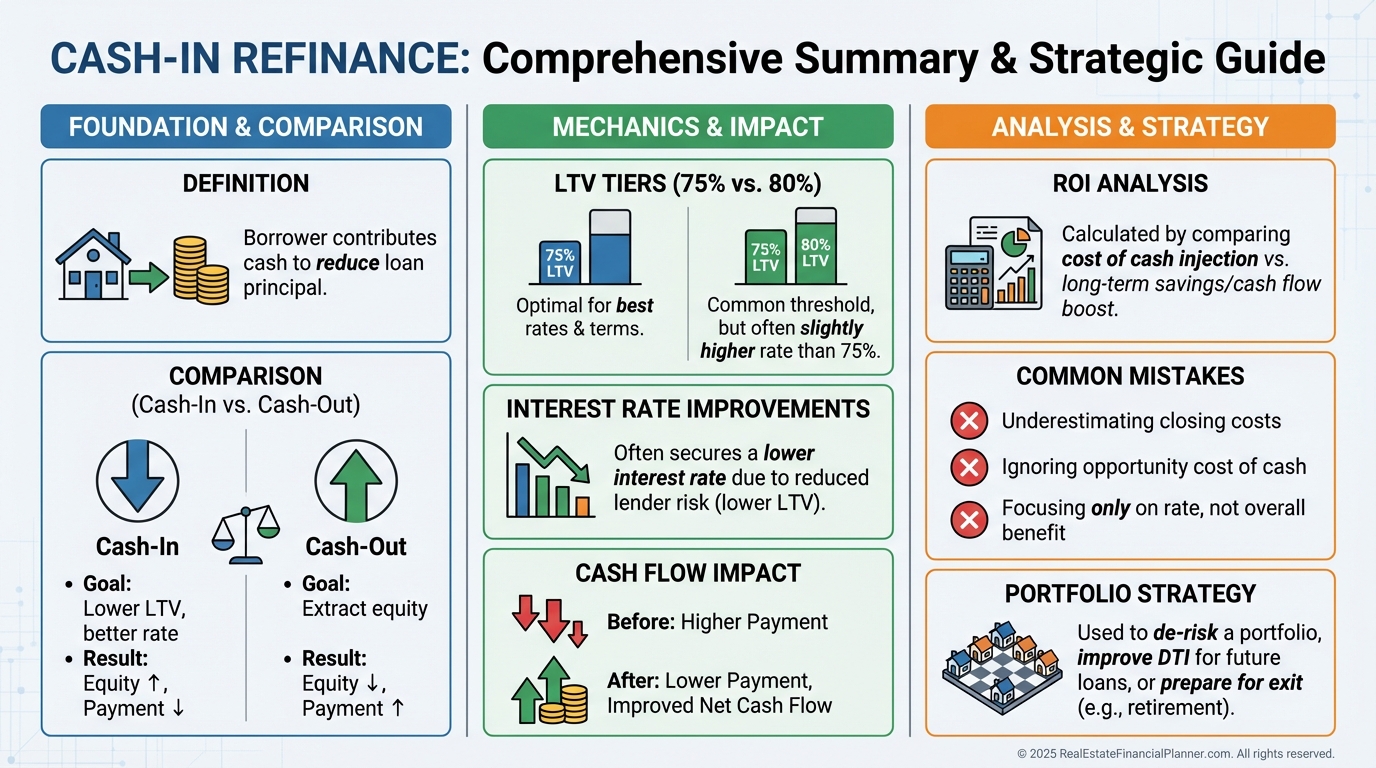

What a Cash-In Refinance Really Is

A cash-in refinance means you bring money to the closing table to pay down your loan balance.

The goal is simple: reduce your loan-to-value ratio so the lender gives you a meaningfully better interest rate.

This is not about “feeling safer” or “sleeping better at night.”

This is about math.

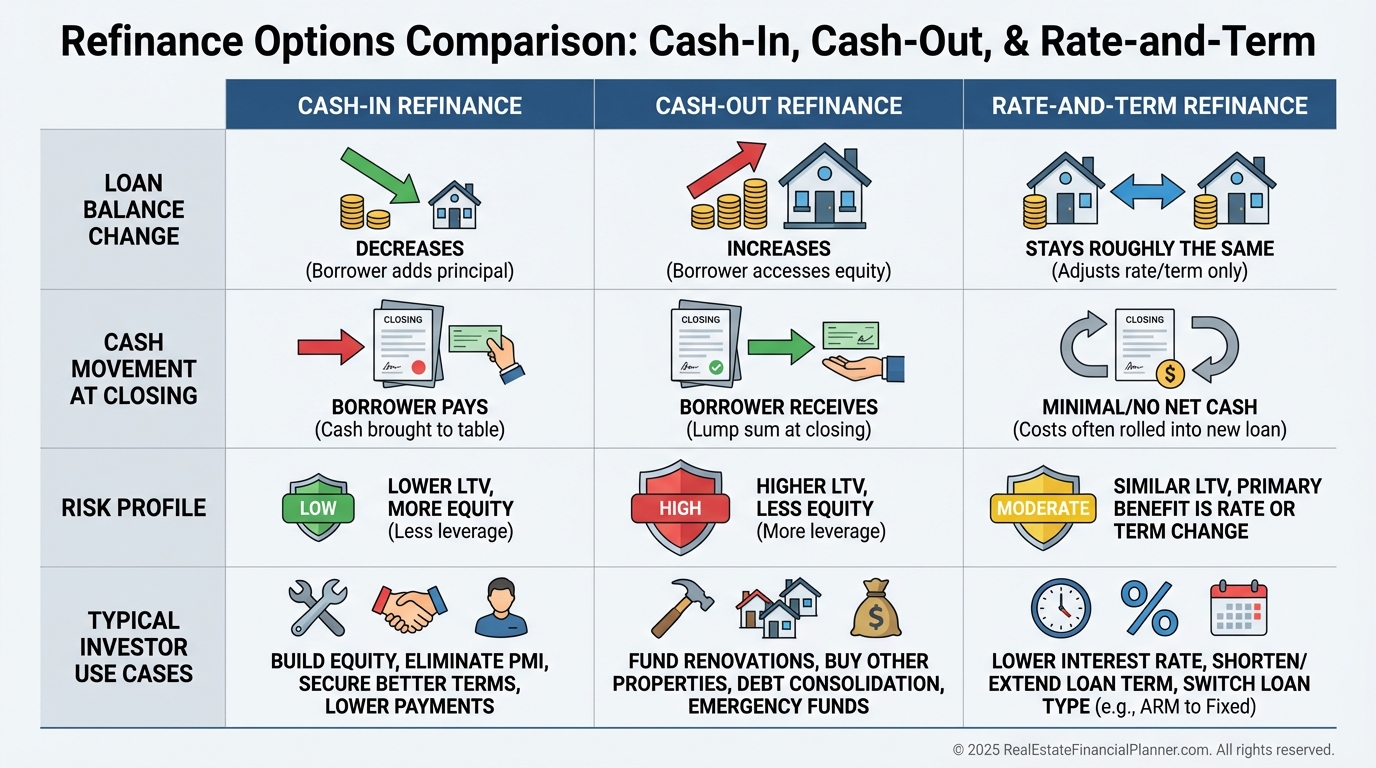

Cash-In vs Cash-Out vs Rate-and-Term

A cash-out refinance increases your loan balance and pulls equity out.

A rate-and-term refinance changes the loan but keeps the balance roughly the same.

A cash-in refinance reduces the balance, lowers leverage, and unlocks better pricing.

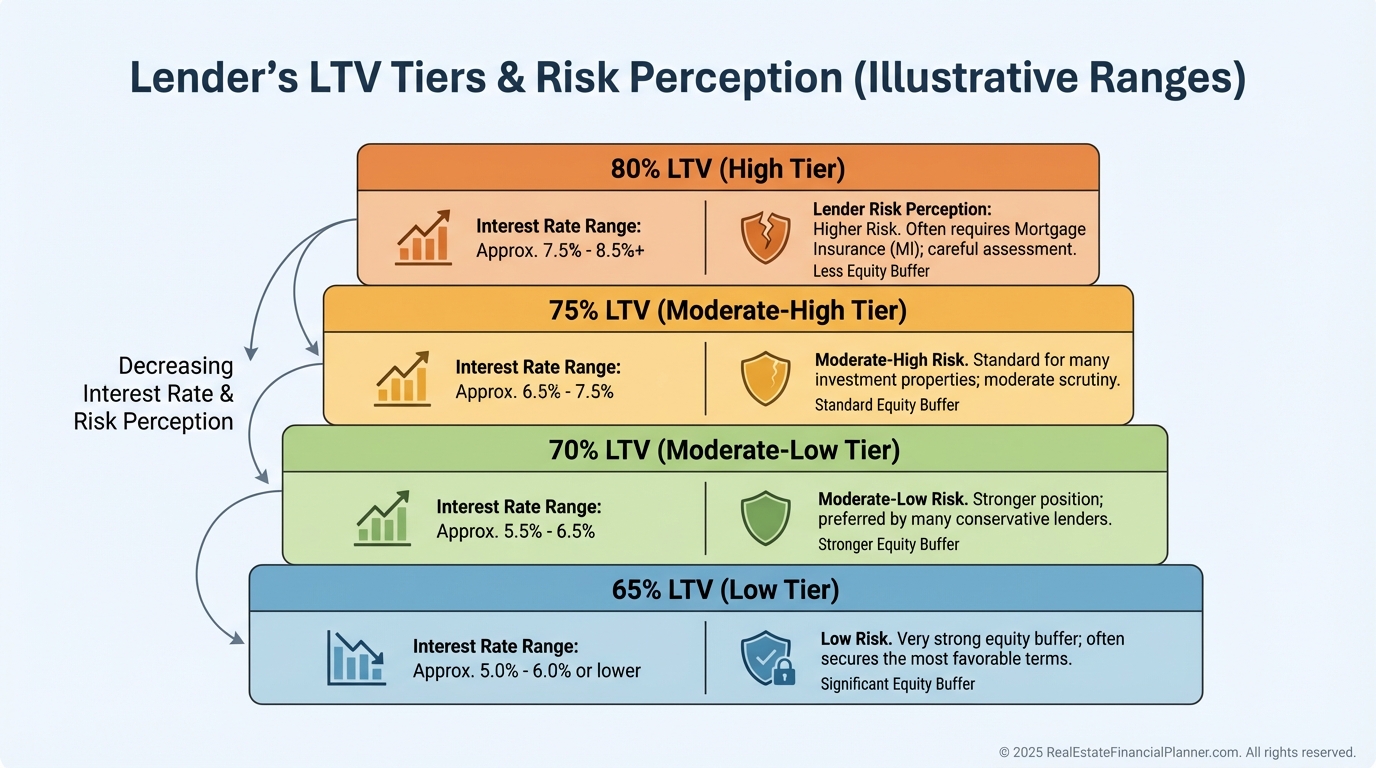

Most lenders price loans in tiers.

Drop below seventy-five percent LTV, and rates often fall fast.

Why LTV Tiers Matter More Than Most Investors Realize

When I rebuilt my portfolio after bankruptcy, I became obsessed with understanding lender risk buckets.

Lenders are not emotional.

They are statistical.

Loan-to-Value Rate Tiers

Dropping from eighty percent to seventy percent LTV often reduces rates by three-quarters of a percent or more.

That does not sound dramatic until you look at the monthly payment difference over thirty years.

This is where cash-in refinances quietly outperform flashier strategies.

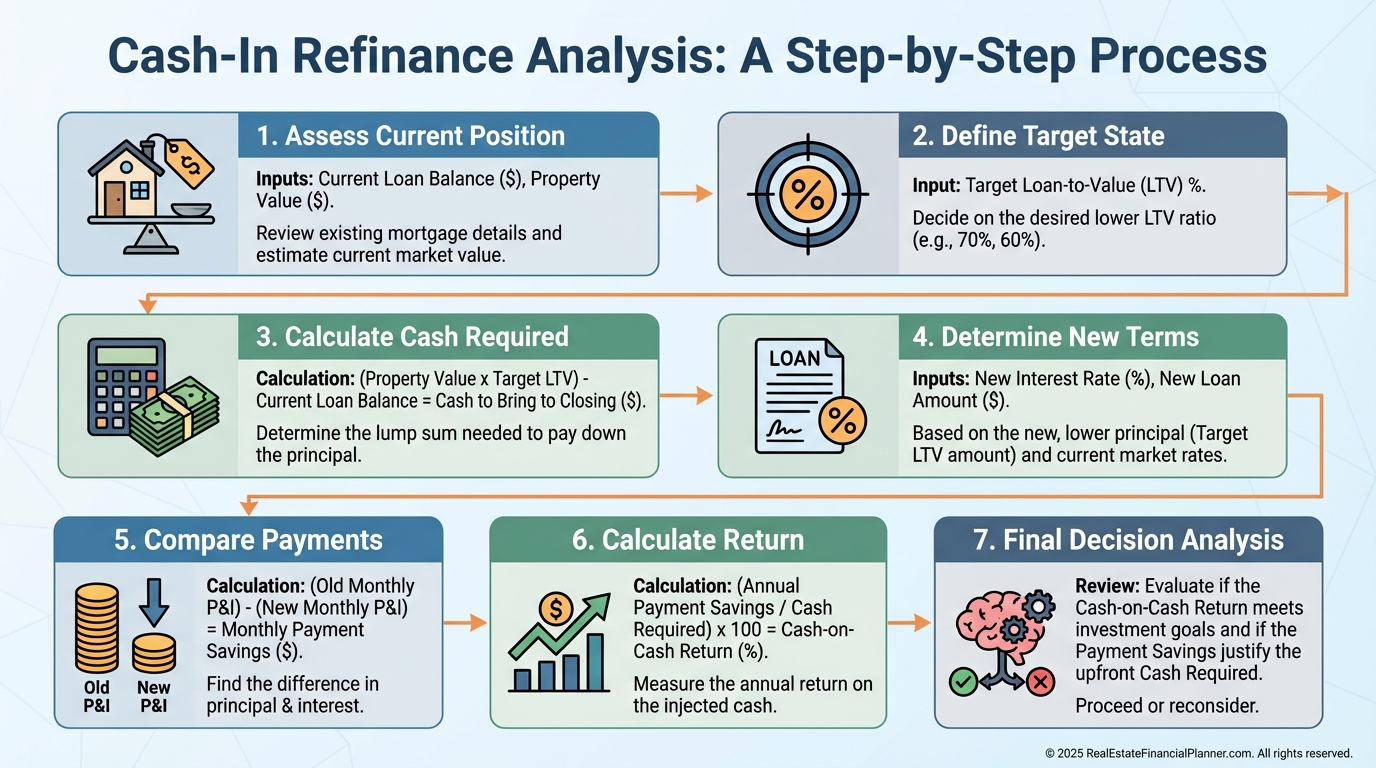

How I Calculate Cash-In Refinance Returns

I never look at a refinance without running it through returns.

Not feelings.

Not rules of thumb.

Returns.

Cash-In Refinance Calculation Steps

I start with the current loan balance.

Then I look at realistic property value, not optimistic guesses.

Next, I model different LTV targets and the rate improvement at each tier.

Finally, I calculate how much cash is required and what that cash earns me in improved cash flow.

This is where The World’s Greatest Real Estate Deal Analysis Spreadsheet™ earns its keep.

It forces you to see the return on the cash you are about to deploy.

A Simple Example That Changes How Investors Think

Sarah owns a duplex worth $300,000.

She owes $240,000 at a 7.5 percent rate.

At eighty percent LTV, her payment is painful.

By bringing $30,000 to closing and covering closing costs, she drops to seventy percent LTV and locks in a much lower rate.

Her monthly payment drops by hundreds of dollars.

That savings shows up every single month.

When I plug this into the Return Quadrants™, the cash flow improvement alone produces a double-digit return on the cash invested.

That return is contractually guaranteed by the loan terms.

No tenant appreciation.

No rent growth assumptions.

Just math.

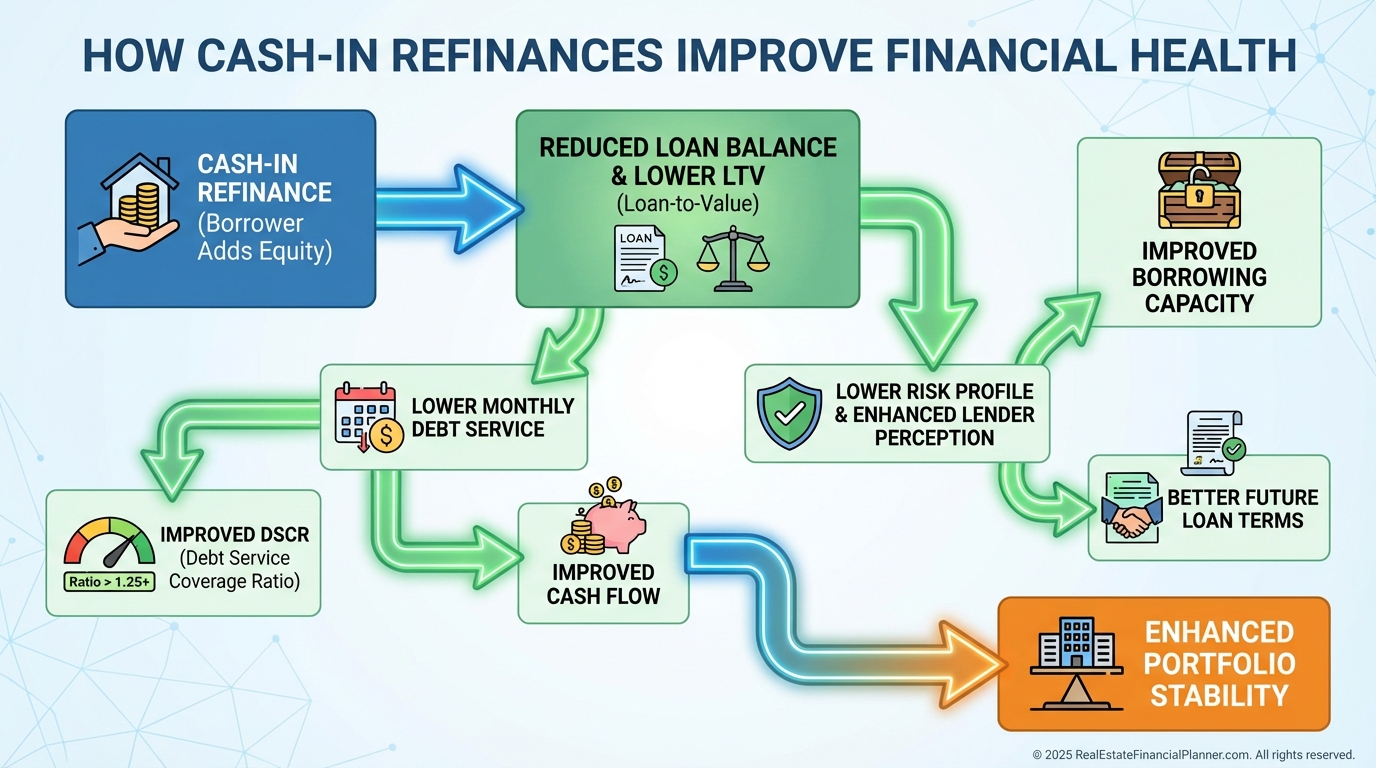

How Cash-In Refinances Improve Your Entire Portfolio

This is the part most investors miss.

Cash-in refinances do not just help one property.

Portfolio Ripple Effects

Lower payments improve debt service coverage ratios.

Better DSCR improves future loan approvals.

Lower leverage reduces portfolio risk during downturns.

This is how investors quietly build resilience instead of chasing leverage.

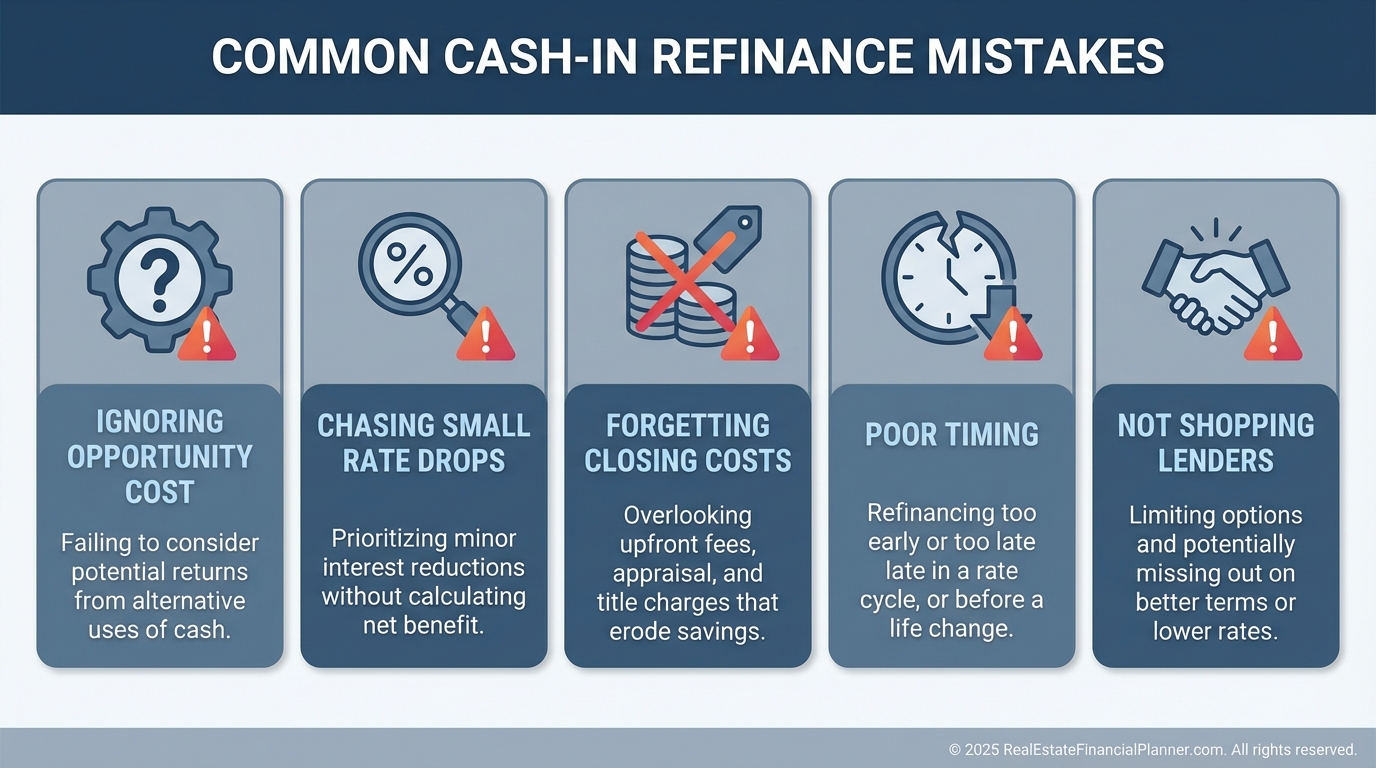

Common Mistakes I Warn Clients About

I see the same errors over and over.

Cash-In Refinance Mistakes

The biggest mistake is ignoring opportunity cost.

If that cash earns higher returns elsewhere, do not force a refinance.

The second mistake is chasing tiny rate improvements.

If the rate does not move at least three-quarters of a percent, I usually pass.

Closing costs matter.

Prepayment penalties matter.

And shopping lenders absolutely matters.

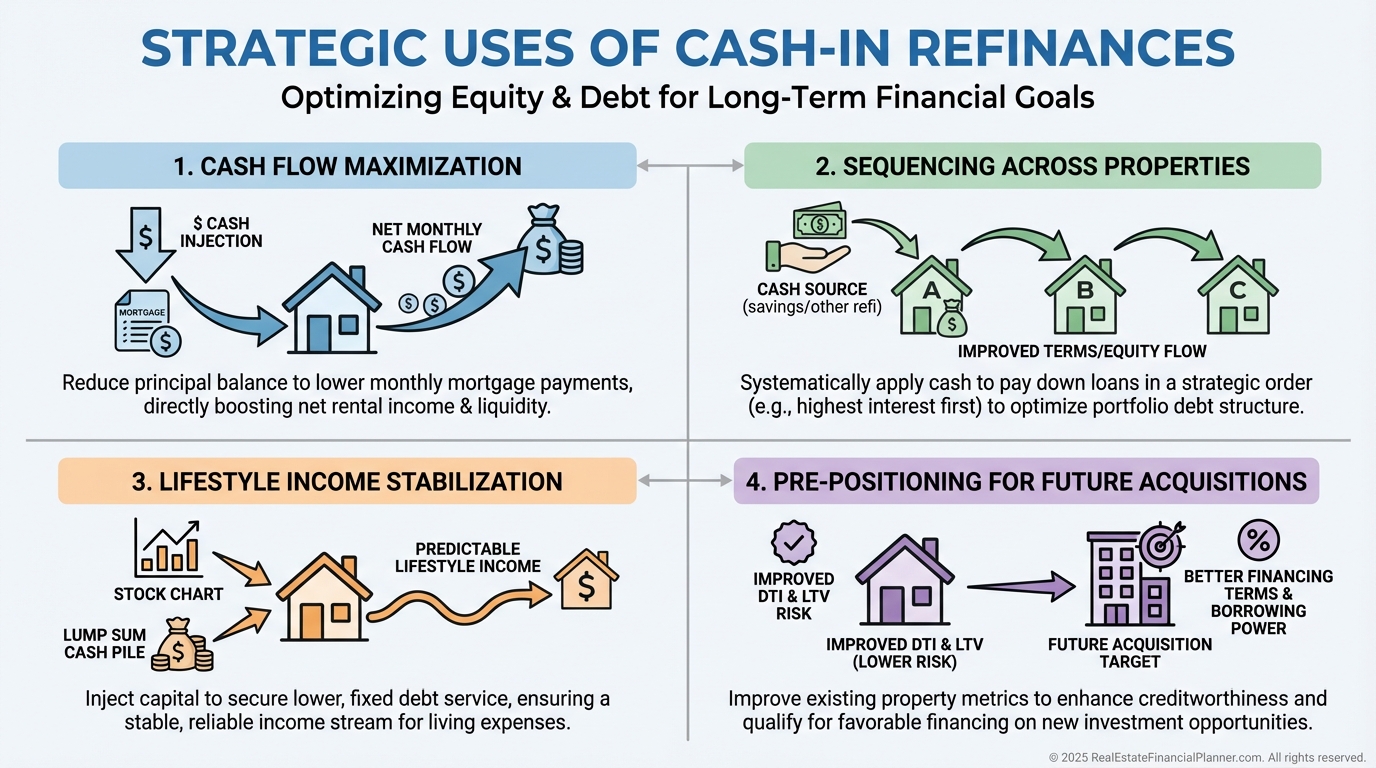

Strategic Uses That Separate Strong Investors From Average Ones

The best investors do not use cash-in refinances randomly.

Strategic Uses of Cash-In Refinances

They target properties where payment reduction has the biggest impact.

They sequence refinances so savings fund the next move.

They use improved cash flow to stabilize income before expanding again.

This is how portfolios self-correct over time.

Why Cash-In Refinances Fit Long-Term Investors Best

Cash-in refinances are not flashy.

They do not generate bragging rights.

They generate durable returns.

When I model long-term plans using True Net Equity™, cash-in refinances often outperform doing nothing and outperform many new acquisitions on a risk-adjusted basis.

Lower leverage gives you options.

Options are what keep investors alive during bad markets.

Cash-in refinances are not about being conservative.

They are about being intentional.