After Repair Value (ARV): How Smart Investors Avoid Overpaying and Overbuilding

Learn about After Repair Value (ARV) for real estate investing.

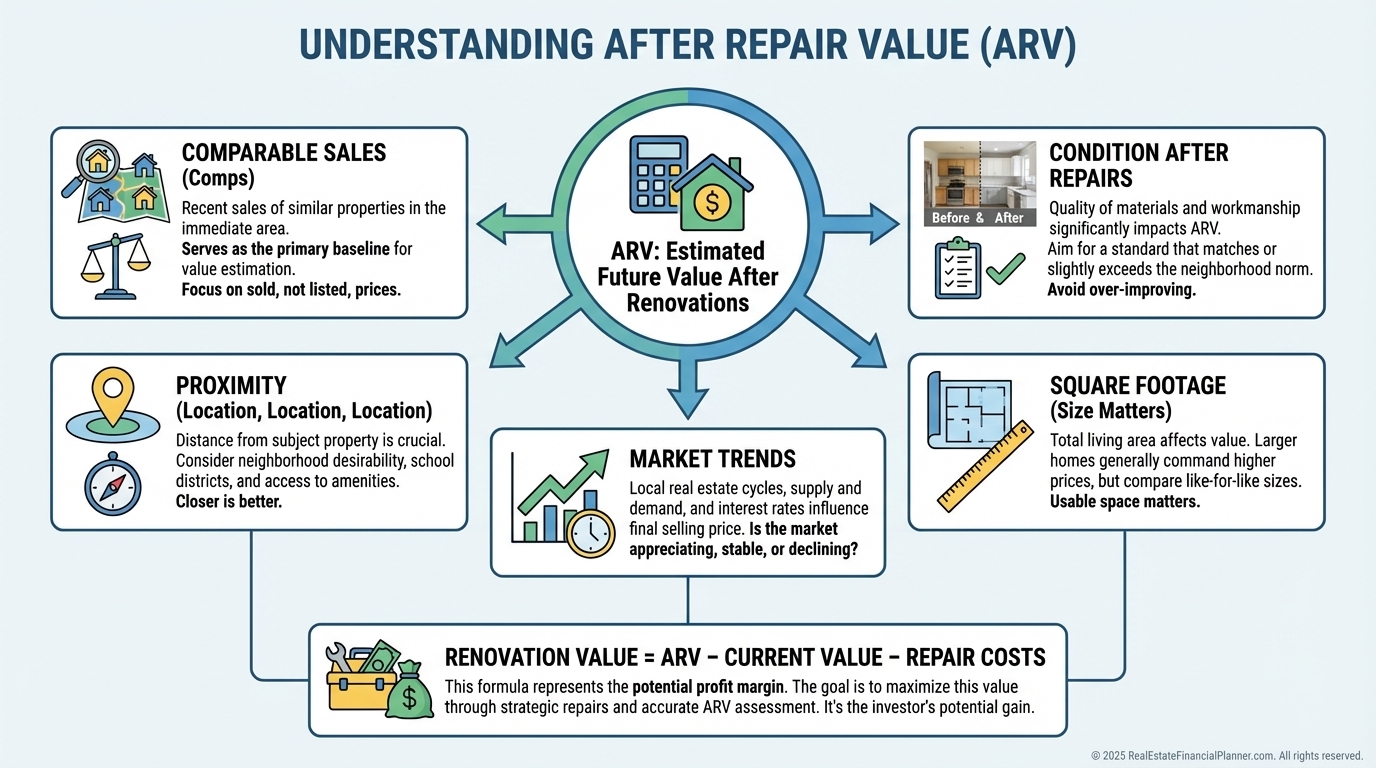

What After Repair Value Really Means

After Repair Value (ARV) is what a property is worth after you finish all repairs and upgrades.

It is not what you hope it will be worth.

It is not what a Zestimate says today.

ARV is the foundation of every flip and BRRRR deal I review. When it’s wrong, everything downstream breaks.

When I help clients analyze deals, ARV is the first number I try to kill. If it survives scrutiny, the deal usually survives too.

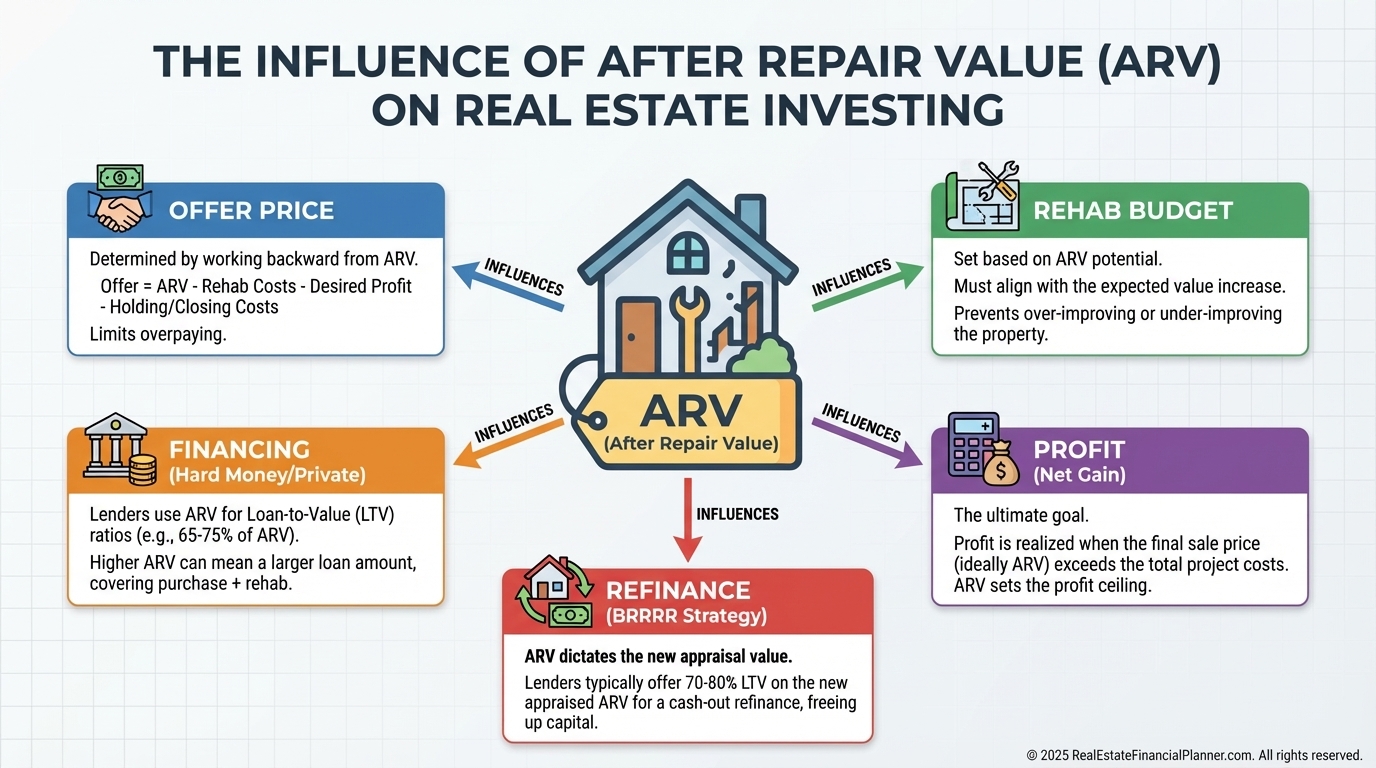

Why ARV Comes Before the Offer

ARV determines how much you can safely pay, how much you can rehab, and whether the deal produces profit or pain.

I’ve seen investors do beautiful rehabs on deals that never had a chance because the ARV was fantasy from the start.

ARV Is Based on Comparable Sales, Not Opinions

ARV comes from comparable sales of properties that already look like your finished product.

That last part matters more than most investors realize.

You are not comparing to fixer-uppers.

You are comparing to fully renovated, retail-ready homes.

If the comps don’t exist, the ARV is weak.

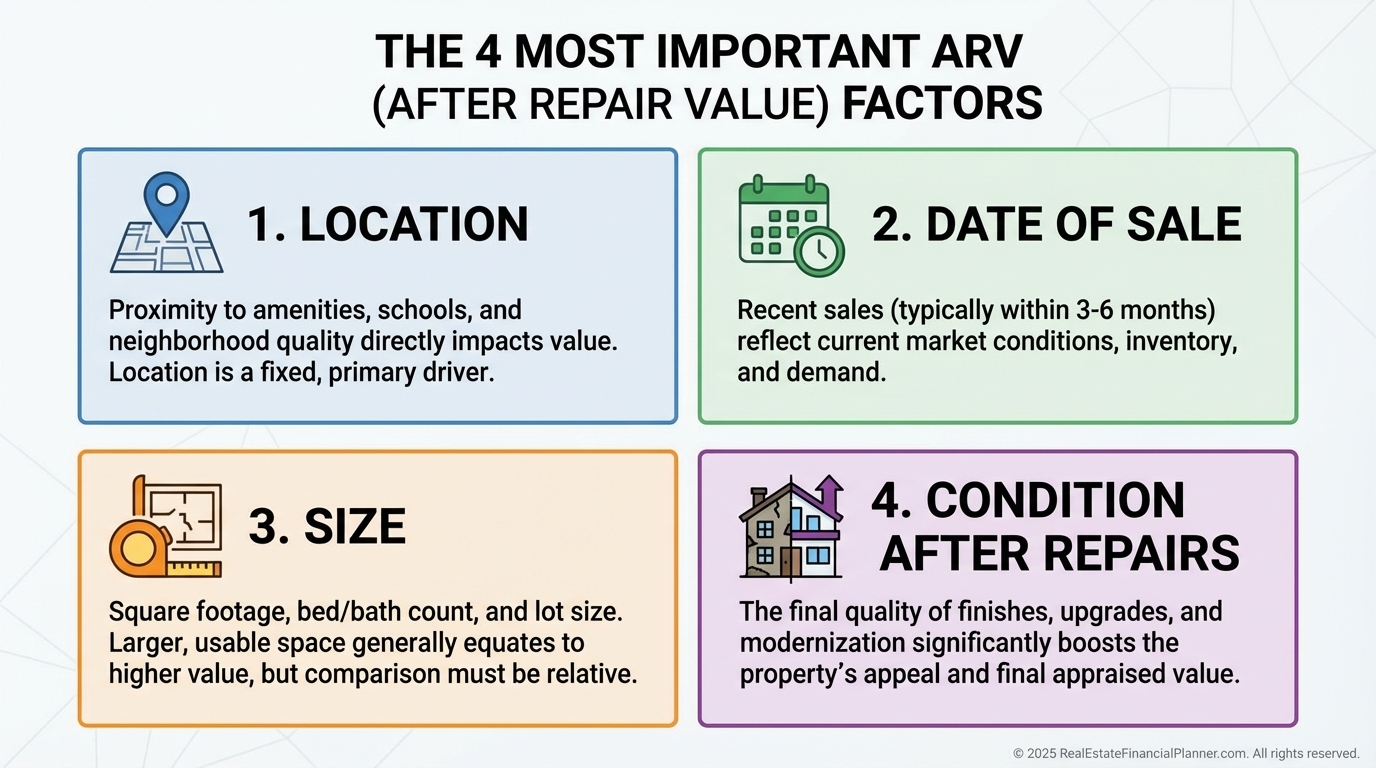

The Four Factors That Matter Most

When appraisers and experienced investors disagree, it’s usually because someone ignored one of these four variables:

•

Location

•

Date of Sale

•

Size

•

Condition After Repairs

Everything else is secondary.

Condition After Repairs Is the Most Abused Variable

Most ARV mistakes happen here.

Investors compare their future renovation to someone else’s partial update and call it close enough.

It isn’t.

When I rebuilt after bankruptcy, I learned to be brutally honest about finish levels. Granite isn’t quartz. Builder-grade isn’t custom. Buyers know the difference.

Your ARV comps must reflect the exact quality you plan to deliver.

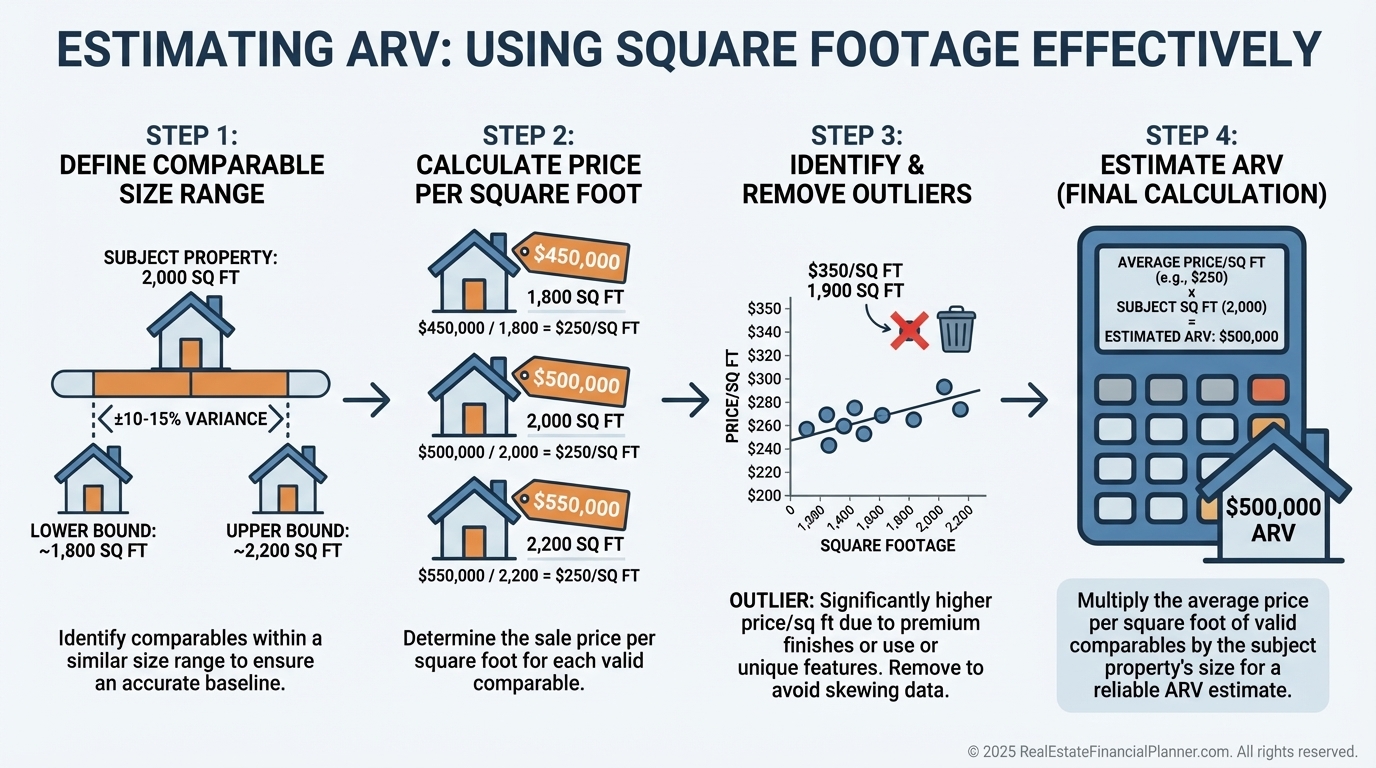

Square Footage and Reality

Size matters, but only within reason.

I typically keep comps within ten to twenty percent of projected finished square footage. Anything outside that range needs serious justification.

Price per square foot can help, but only after removing obvious outliers.

Proximity Is a Confidence Lever

Start close. Expand slowly.

Same street beats same neighborhood.

Same neighborhood beats same zip code.

When investors push comps too far geographically, I lower my confidence in the ARV immediately.

If you have to go city-wide, the deal is already yelling at you.

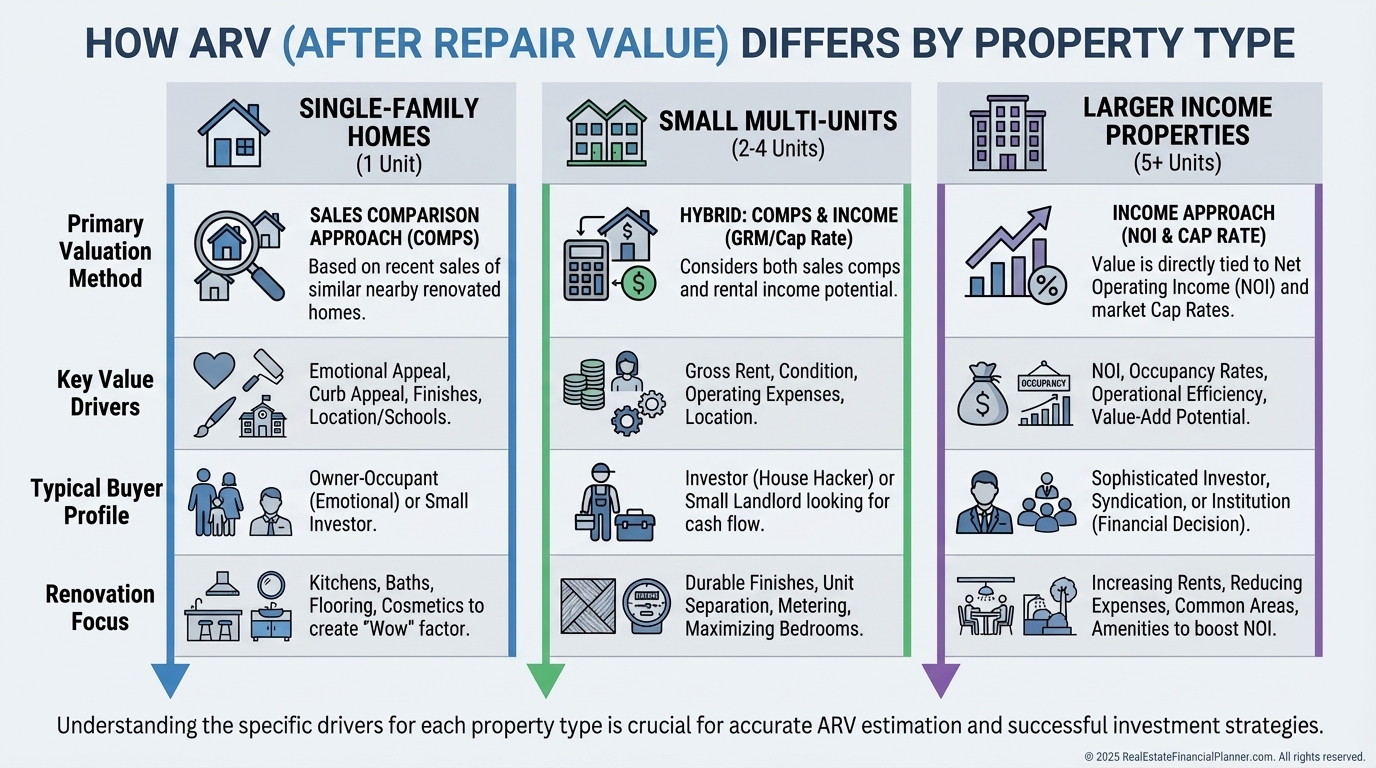

Property Type and Style Are Not Optional Filters

A ranch compares to a ranch.

A duplex compares to a duplex.

Mixing property types introduces noise that ARV cannot survive.

For properties with more than four units, ARV shifts from comparable sales toward income-based valuation.

Year Built vs. Effective Age

I almost ignore year built once renovations are substantial.

Buyers care how a home feels, not the date on the tax record.

A 1950 home that feels like 2015 competes with other 2015-feeling homes.

Your comps should reflect that reality.

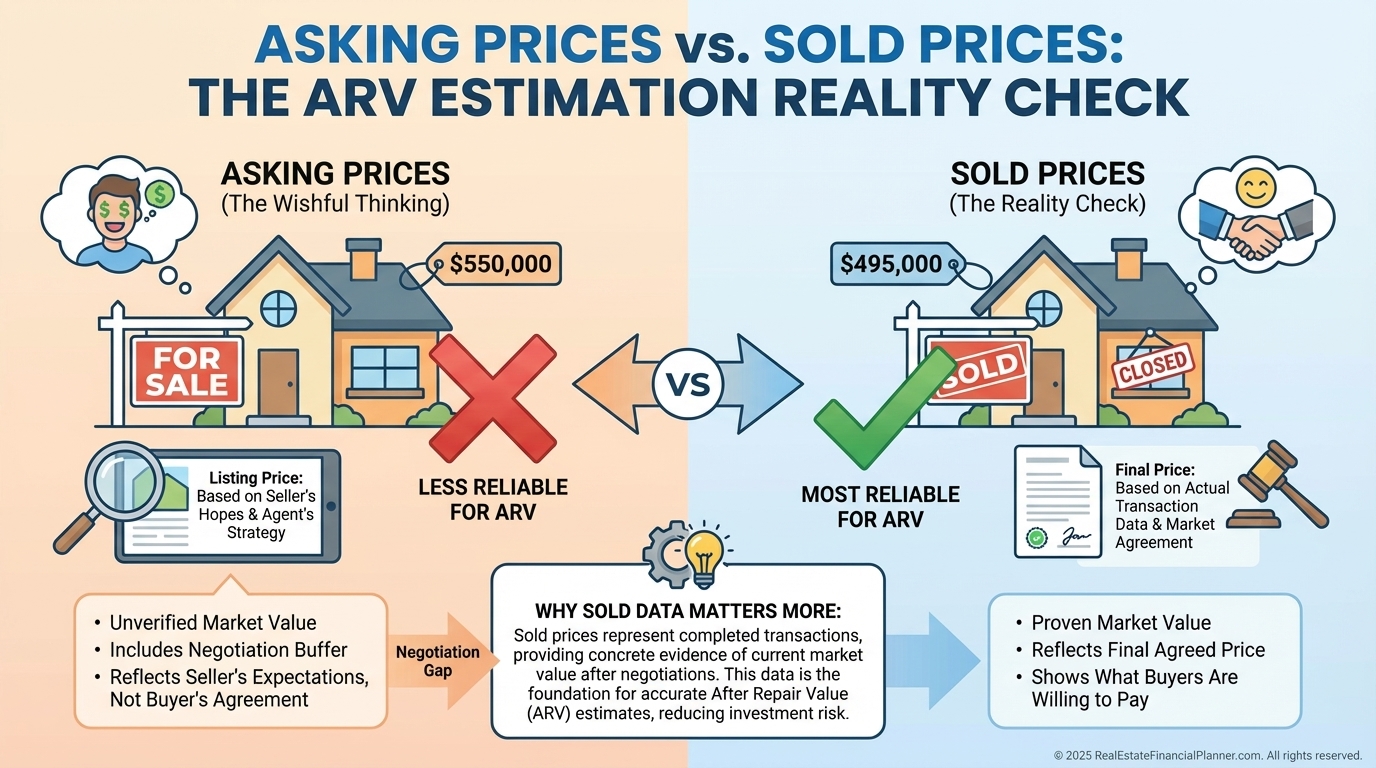

Sold Prices Beat Asking Prices Every Time

Asking prices live in fantasy land.

Sold prices live in reality.

If your ARV relies heavily on asking prices, you are underwriting hope.

I weight sold comps far more heavily than active listings, every time.

Active Listings Show Your Competition

Sold comps set the ceiling.

Active listings show the battlefield.

If similar renovated homes are sitting, overpriced, or stale, your ARV needs humility.

This is where I apply buyer’s eyes.

Would I choose my finished property over the competition at that price?

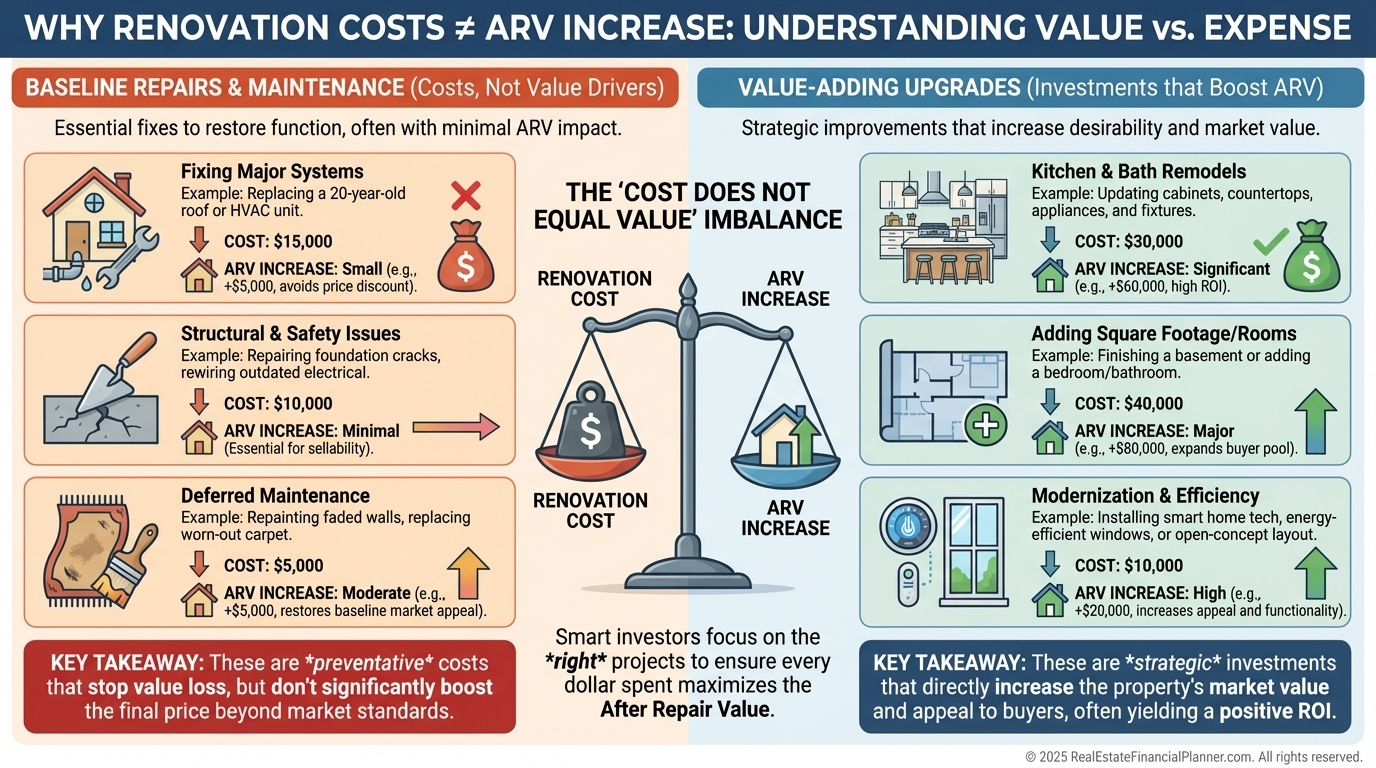

Upgrades Do Not Equal Dollar-for-Dollar Value

A ten-thousand-dollar roof does not add ten thousand dollars of ARV.

It restores baseline expectations.

True value comes from layout, livability, kitchens, baths, and usable space.

Over-improving is just as dangerous as under-improving.

Stable Markets vs. Changing Markets

In stable markets, six-month-old comps can still work.

In changing markets, anything older than three months is suspect.

When markets move fast, ARV must move with them.

Conservatism keeps investors alive.

Automated Valuations Are Not ARV

Zestimates are not ARVs.

Algorithms do not know your renovation plan. They do not understand finish quality. They do not walk the comps.

Use them for context, not conviction.

The MLS Is a Serious Advantage

MLS data shows photos, comments, withdrawn listings, and price reductions.

This context matters.

If you don’t have access, work with someone who does. Guessing costs more.

The Biggest ARV Warning Sign

If you cannot find solid renovated comps, stop.

Lack of data is the market telling you something.

Lower your offer. Lower your budget. Or walk.

That discipline saved me more money than any spreadsheet formula ever did.

ARV Is a Skill, Not a Guess

When investors treat ARV seriously, deals get boring in a good way.

When they don’t, even great renovations can’t save bad math.

ARV is not optimism.

It is evidence.