Real Estate Taxes for Investors: Deductions & Strategies

Learn about Taxes for real estate investing.

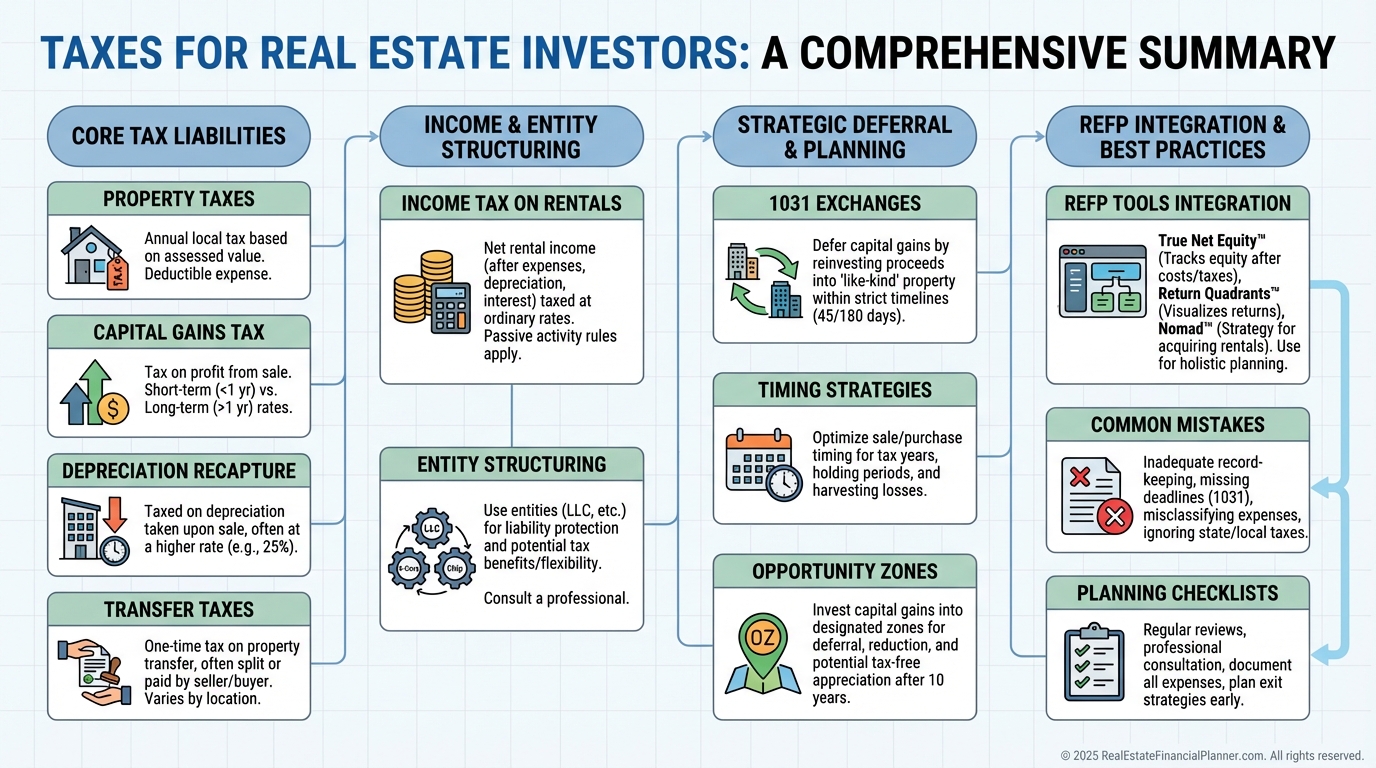

Why Taxes Decide Your Real Returns

When I help clients model deals, taxes are usually the biggest variable destroying hidden ROI.

The same property can perform like a 15% return or a 9% return depending on your tax plan.

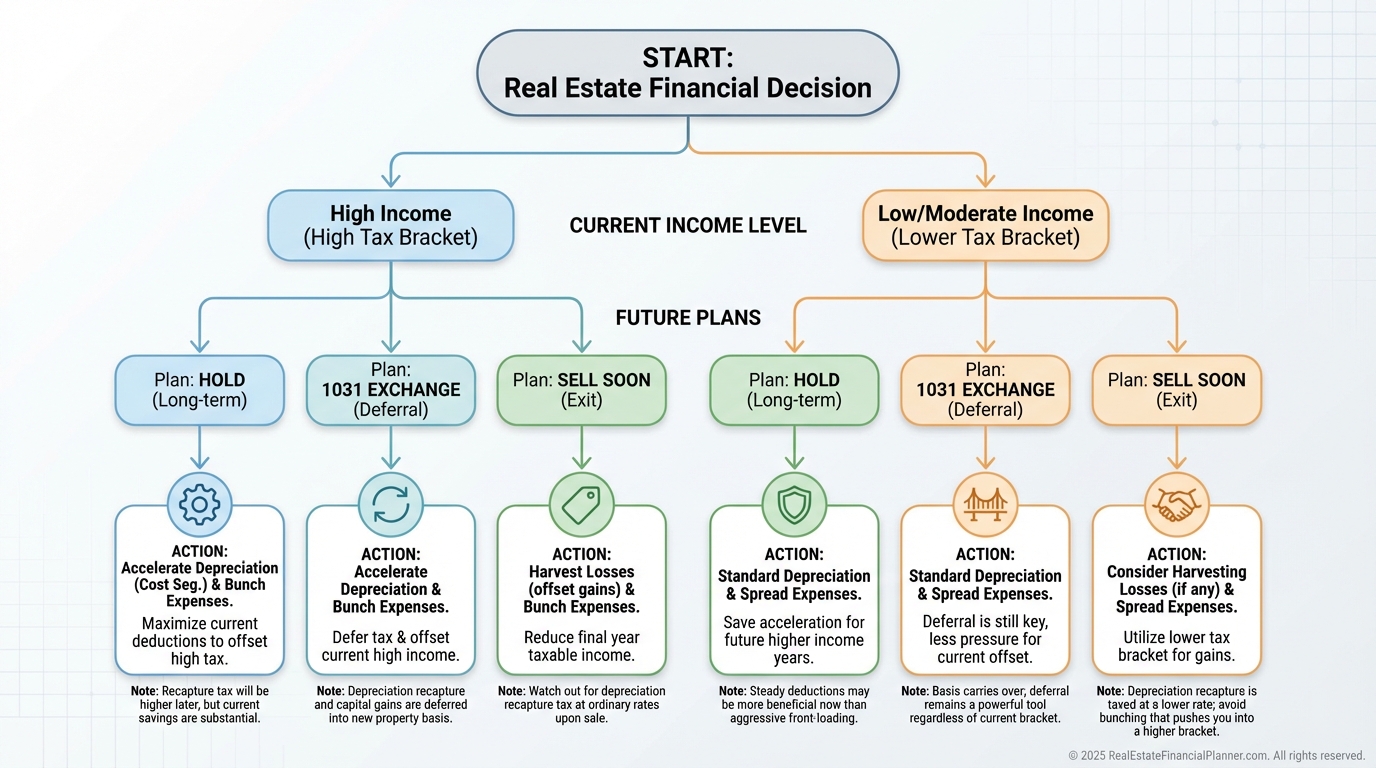

I teach clients to use Return Quadrants™ to see where taxes show up.

Cash flow is taxed as ordinary income.

Appreciation is mostly deferred, but property taxes skim it annually.

Debt paydown isn’t taxed now, but it triggers taxes when you sell.

And tax benefits (depreciation) help today, then boomerang as recapture later.

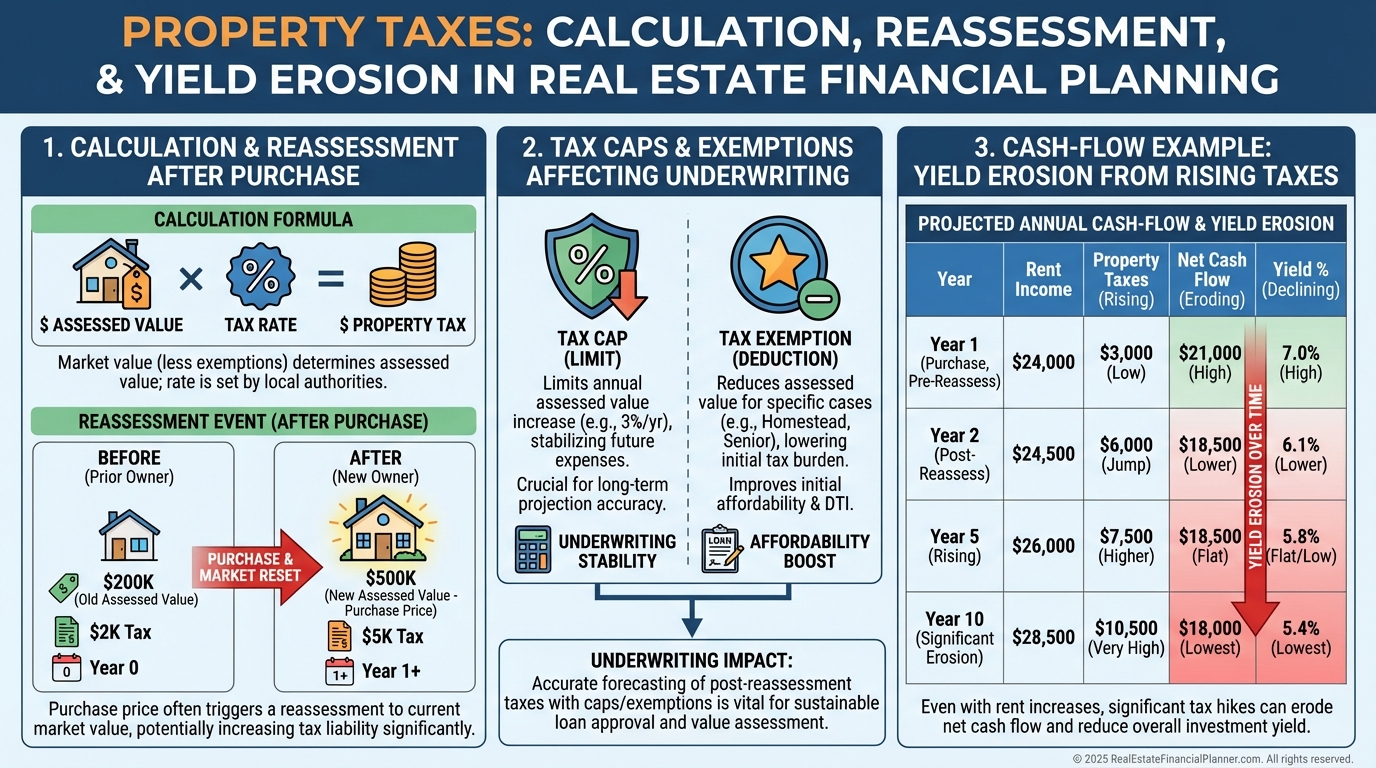

Property Taxes: The Persistent Drag

Property taxes hit every year whether you’re profitable or not.

They’re calculated on assessed value times the local rate, often quoted in mills.

I model two values for clients: current taxes and likely post-purchase reassessment.

In many markets, closing resets your assessed value to your purchase price.

That can crush cash flow if you only underwrite the seller’s tax bill.

Rates vary widely by state and county.

Underwriting a move from 0.8% to 1.8% can flip a deal from winner to loser.

As values climb, assessed values follow, so you’re paying a small annual tax on unrealized gains.

That’s why I warn clients: appreciation increases taxes before you ever sell.

Appeal obvious over-assessments, track comps, and use caps and exemptions where allowed.

If you invest actively, consider markets with slower reassessment or capped annual increases.

Capital Gains: Timing Is Everything

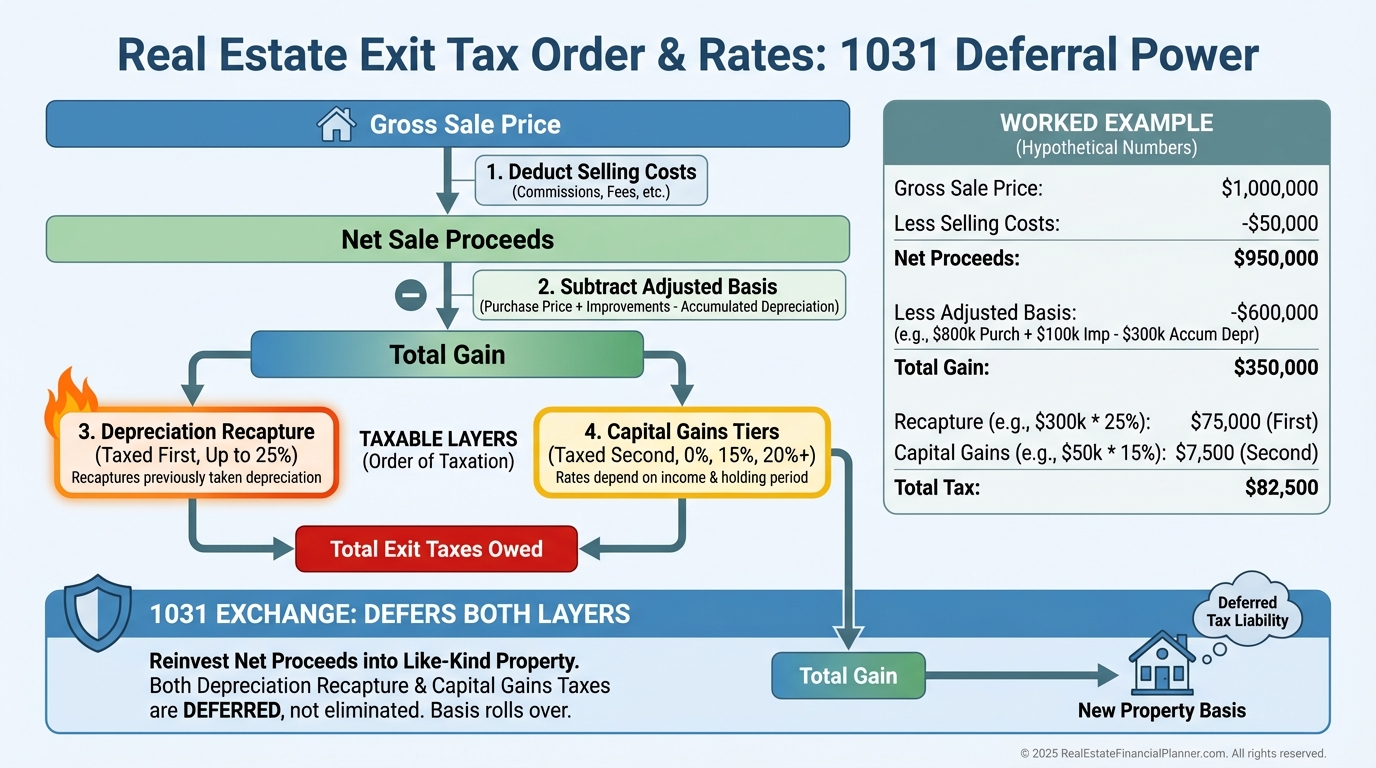

Capital gains tax applies when you sell for more than your adjusted basis.

Hold over a year and you likely pay 0%, 15%, or 20% based on income.

Your gain is sale price minus selling costs minus adjusted basis.

Basis equals purchase price plus capital improvements minus depreciation taken.

I time sales for clients in years when other income is low to drop them into lower brackets.

If you can harvest losses elsewhere, you can offset gains dollar for dollar.

Installment sales can spread gains across years and smooth brackets.

If you’ve lived in the property two of the last five years, the primary residence exclusion can save six figures.

Nomad™ investors often plan a move-in period before selling to qualify.

Depreciation Recapture: The Boomerang Tax

Depreciation shelters income today, but you pay it back on sale via recapture.

It’s generally taxed up to 25% on the depreciation you claimed or that you should have claimed.

This number often blindsides sellers who only plan for capital gains.

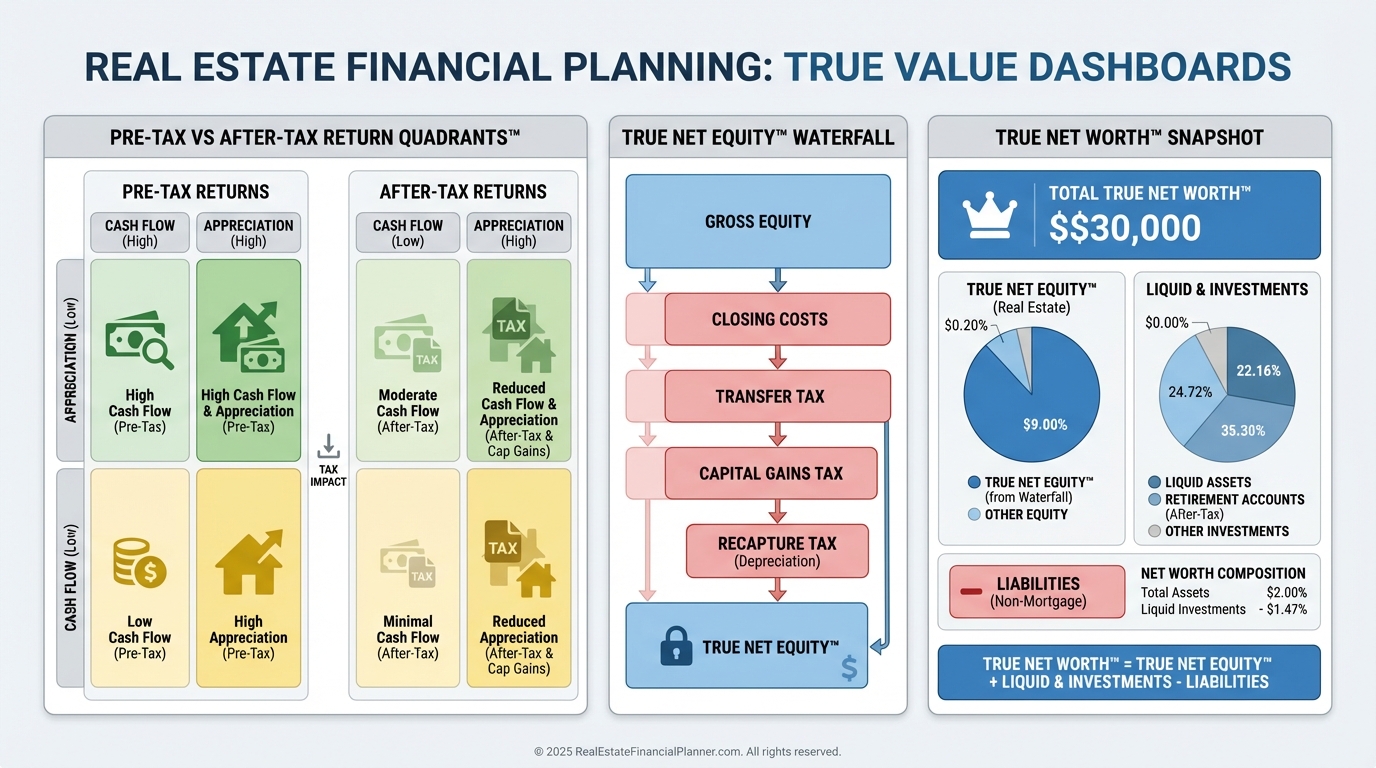

I never present a True Net Equity™ estimate without subtracting both capital gains and recapture.

If you plan to 1031, you can defer both.

If not, weigh front-loading depreciation via cost segregation against a bigger future recapture bill.

Sometimes the time value of money makes that trade well worth it.

But skipping depreciation rarely pencils out.

Transfer Taxes: The Round-Trip Cost Many Miss

Transfer taxes are one-time charges when property changes hands.

They can be 0.1% to 2% or higher and are paid by the buyer, seller, or split, depending on the locale.

For flippers and short holds, paying on both sides can eat 3%–4% of the deal.

I negotiate liability in the contract when the market allows and adjust minimum profit targets to account for these costs.

Some jurisdictions allow entity interest transfers with different tax treatment, but follow the law carefully.

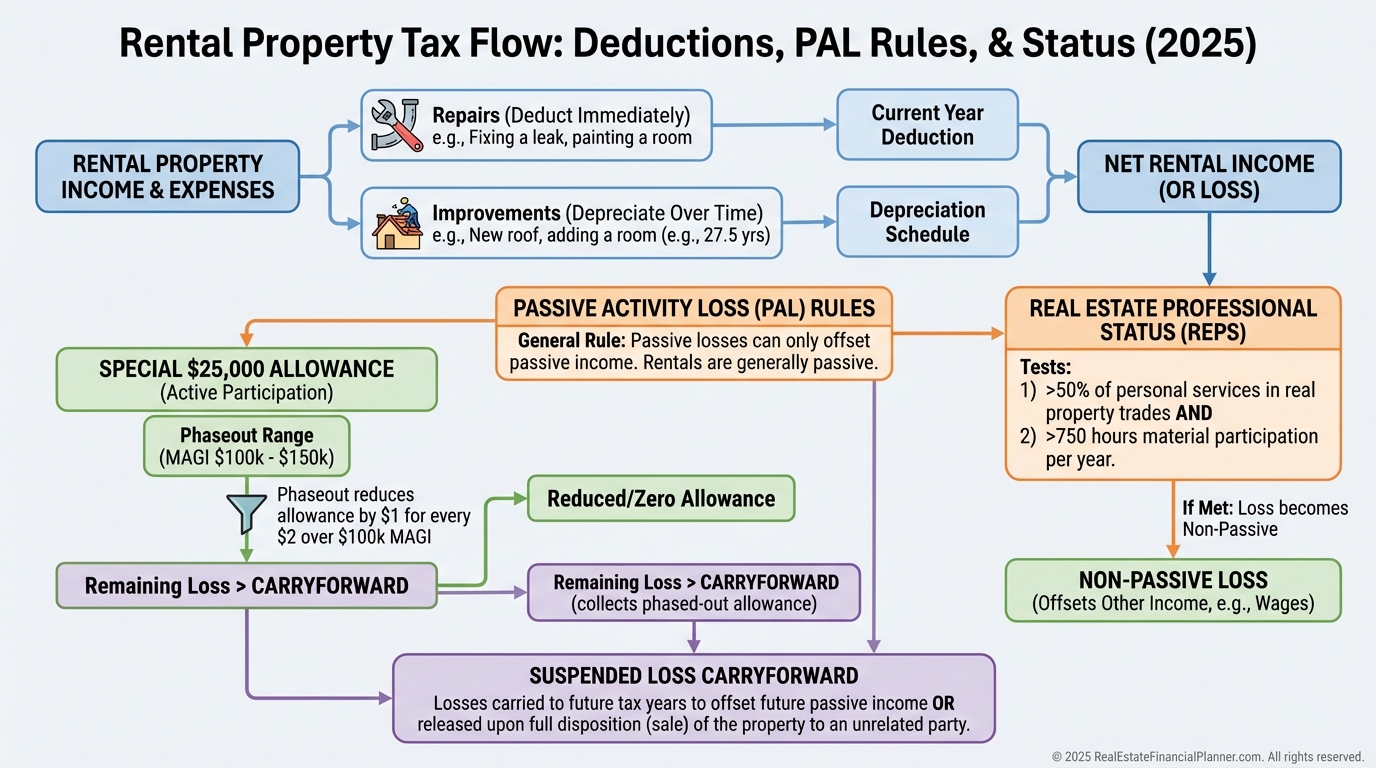

Rental Income: Ordinary Tax With Extra Tools

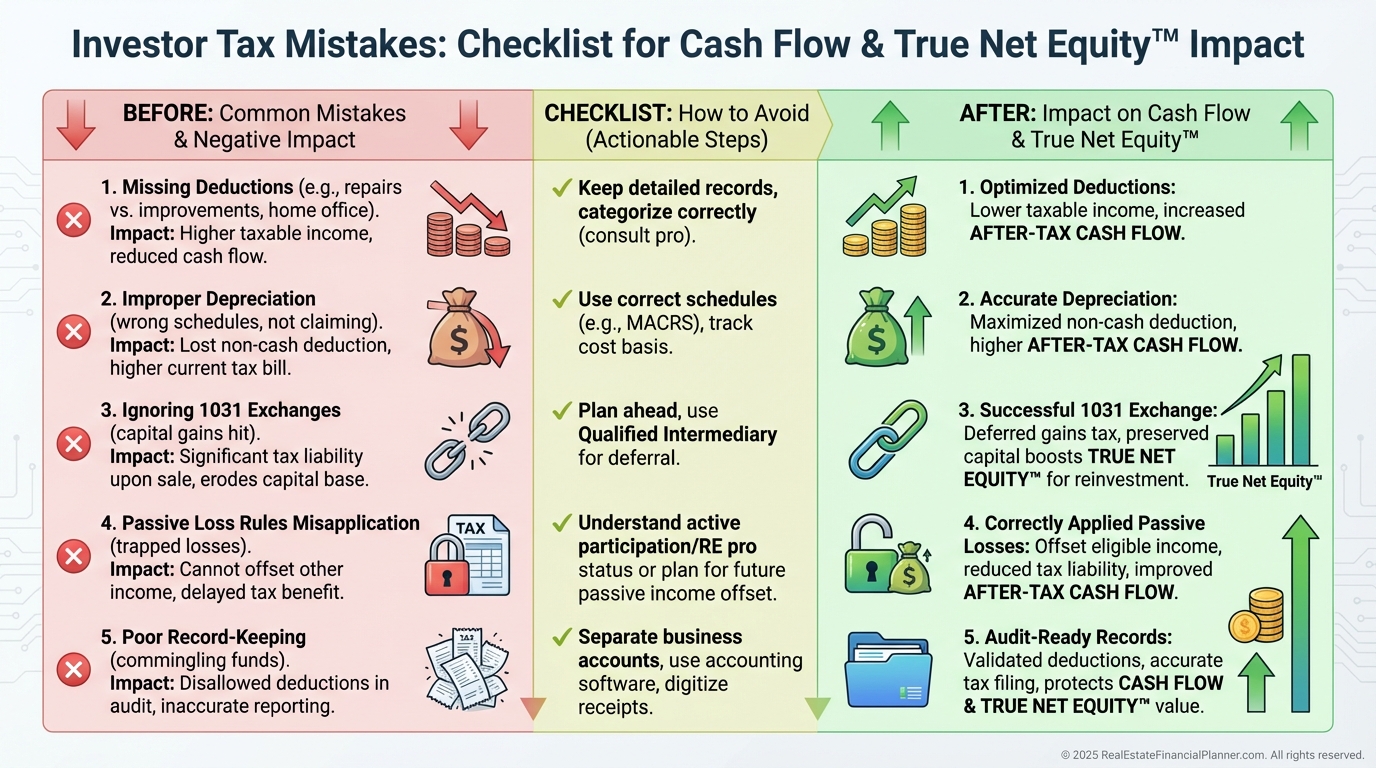

Rent is taxed as ordinary income, but real estate gives you deductions that can zero out the tax in many years.

Deductible items include interest, taxes, insurance, repairs, maintenance, management, utilities you pay, advertising, professional fees, and depreciation.

Repairs are expensed now; improvements are capitalized and depreciated.

I keep a running improvements ledger for every client to protect basis on exit.

Passive loss rules limit using rental losses to offset W-2 income once AGI creeps over $100,000, phasing out by $150,000 for the $25,000 allowance.

Unused passive losses carry forward and unlock on sale.

Real estate professionals who materially participate can often use losses against other income.

Cost segregation can accelerate depreciation, which boosts current cash flow after tax.

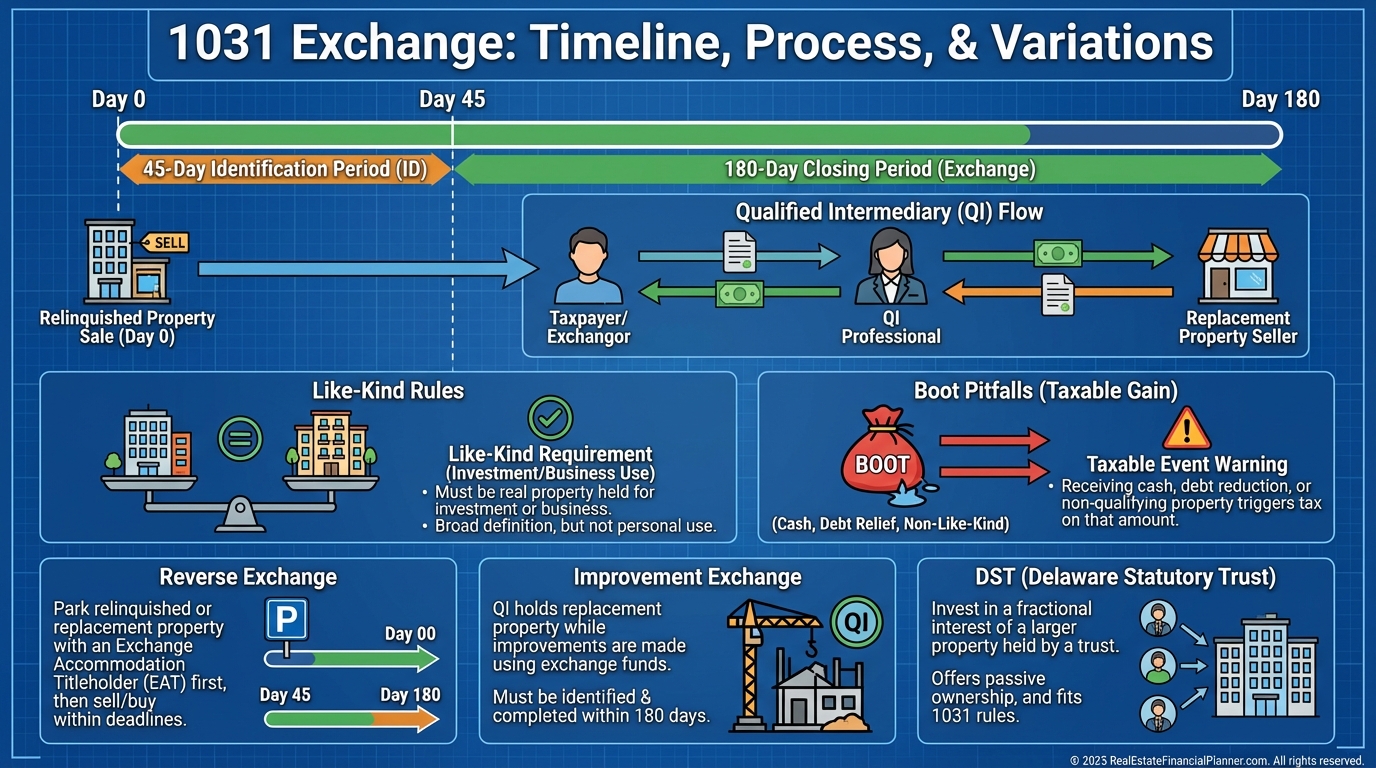

1031 Exchanges: The Compounding Engine

A 1031 lets you sell investment property and buy another without recognizing gain now.

You defer both capital gains and depreciation recapture, keeping 100% of equity compounding.

The rules are strict.

You have 45 days to identify, 180 days to close, must reinvest all proceeds, and use a qualified intermediary.

You can exchange across property types as long as both are for investment or business use.

Advanced plays include reverse exchanges, improvement exchanges, and Delaware Statutory Trusts for passive options.

Some investors stack exchanges for decades, then pass assets with a step-up in basis at death.

Timing Strategies: Harvest Brackets, Bunch Deductions

I help clients bunch deductions into high-income years and push income into low-income years.

Selling in a sabbatical or early-retirement year can drop long-term gains to 0%.

You can prepay some expenses, schedule large repairs, or complete a cost segregation when rates are high.

If your future tax rate will be lower, accelerating depreciation today can be smart even with future recapture.

If you plan to 1031 indefinitely, the acceleration is even more attractive.

Entity Structuring and Advanced Moves

LLCs protect assets and provide pass-through taxation, which is ideal for most rentals.

S-Corps can reduce self-employment tax on active flipping businesses, but rentals typically don’t owe SE tax.

Self-directed IRAs and Solo 401(k)s enable tax-deferred or tax-free growth with strict prohibited transaction rules.

Opportunity Zones can defer original gains and may allow tax-free appreciation if held long enough and rules are met.

Match the structure to the strategy, not the other way around.

Integrate Taxes Into Your REFP Models

I never present cash flow without a property tax reassessment check.

In The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I underwrite current taxes and expected post-purchase taxes.

I model Return Quadrants™ both pre- and after-tax so clients see how taxes shift each component.

True Net Equity™ subtracts selling costs, transfer taxes, capital gains, and recapture so you know what you’d actually keep.

True Net Worth™ rolls that across the entire portfolio assuming liquidation today.

We then test scenarios: sell, 1031, or refi and hold.

Common Tax Mistakes I See Weekly

Underwriting last year’s property taxes instead of the reassessed amount after purchase.

Treating improvements as repairs and losing basis.

Missing 1031 deadlines by a day.

Mixing personal and business expenses and inviting audits.

Ignoring state taxes while optimizing only for federal.

Skipping documentation and then fearing to claim legitimate deductions.

Your Operating Rhythm: Plan, Document, Review

Taxes are not a year-end scramble; they’re a weekly habit.

I keep a simple system: scan receipts, log mileage, tag repairs vs improvements, and reconcile monthly.

Quarterly estimates prevent penalties and keep cash planning honest.

Before big exits, I model three paths: sell and pay, 1031, or hold and refi.

When I rebuilt after bankruptcy, I learned that tax planning is cash flow planning.

The investors who win treat taxes as a controllable input, not a surprise.

Work with a CPA who lives and breathes real estate.

State-specific rules can tilt your entire strategy, so plan for them early.

Plug the leaks, and taxes turn from a drag into a durable advantage.