S Corporations for Real Estate Investors: When They Save You $10k–$50k and When They Don’t

Learn about S Corporations for real estate investing.

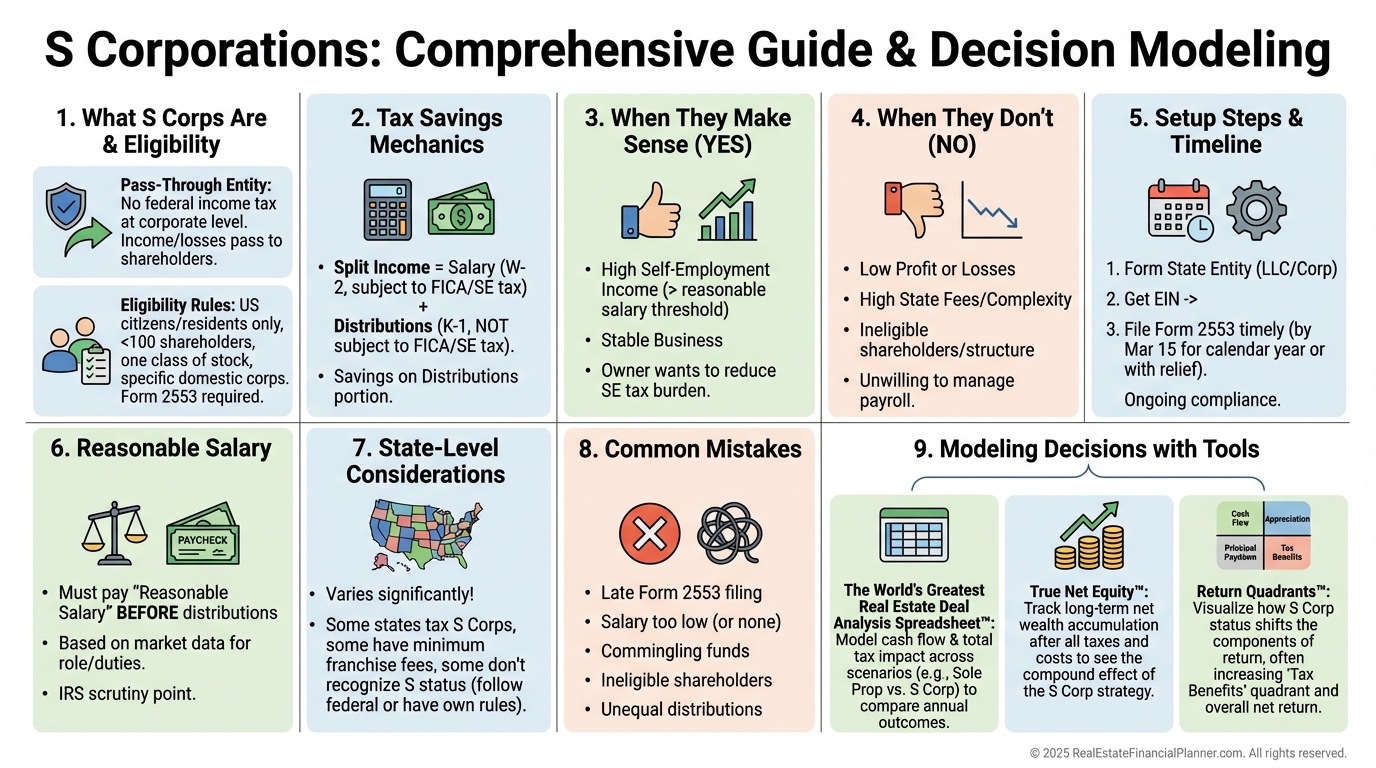

What S Corporations Are (and Aren’t)

When I help clients, I start here because the label hides the key feature. Profits pass through to you, but you can split income between W‑2 salary and owner distributions.

That split is the lever that often creates the $10,000–$50,000 annual savings for active real estate businesses.

To qualify, you need no more than 100 shareholders, only one class of stock, and all shareholders must be eligible persons (generally U.S. individuals and certain trusts).

And there’s a big rule many miss. S Corps must treat shareholders equally, which means distributions must be strictly pro rata by ownership.

Why Real Estate Investors Consider S Corps

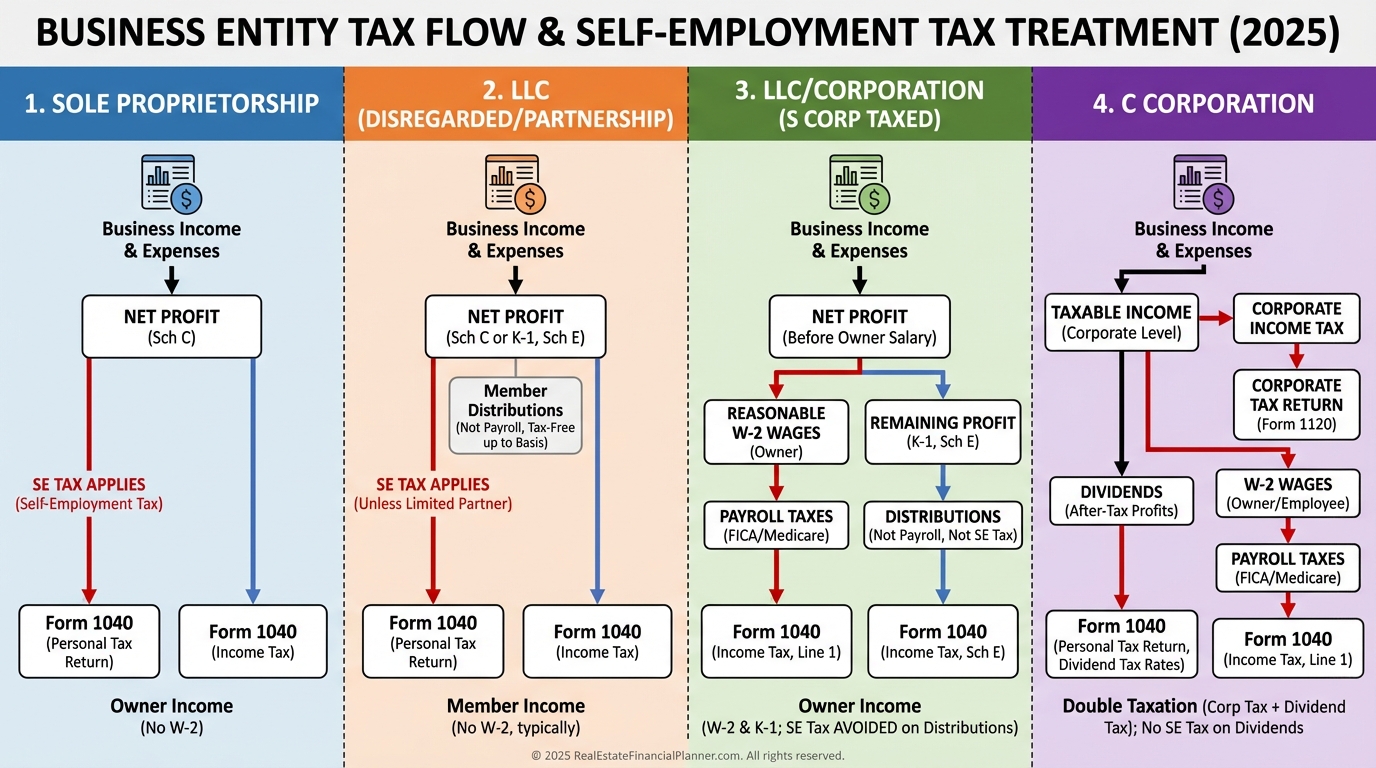

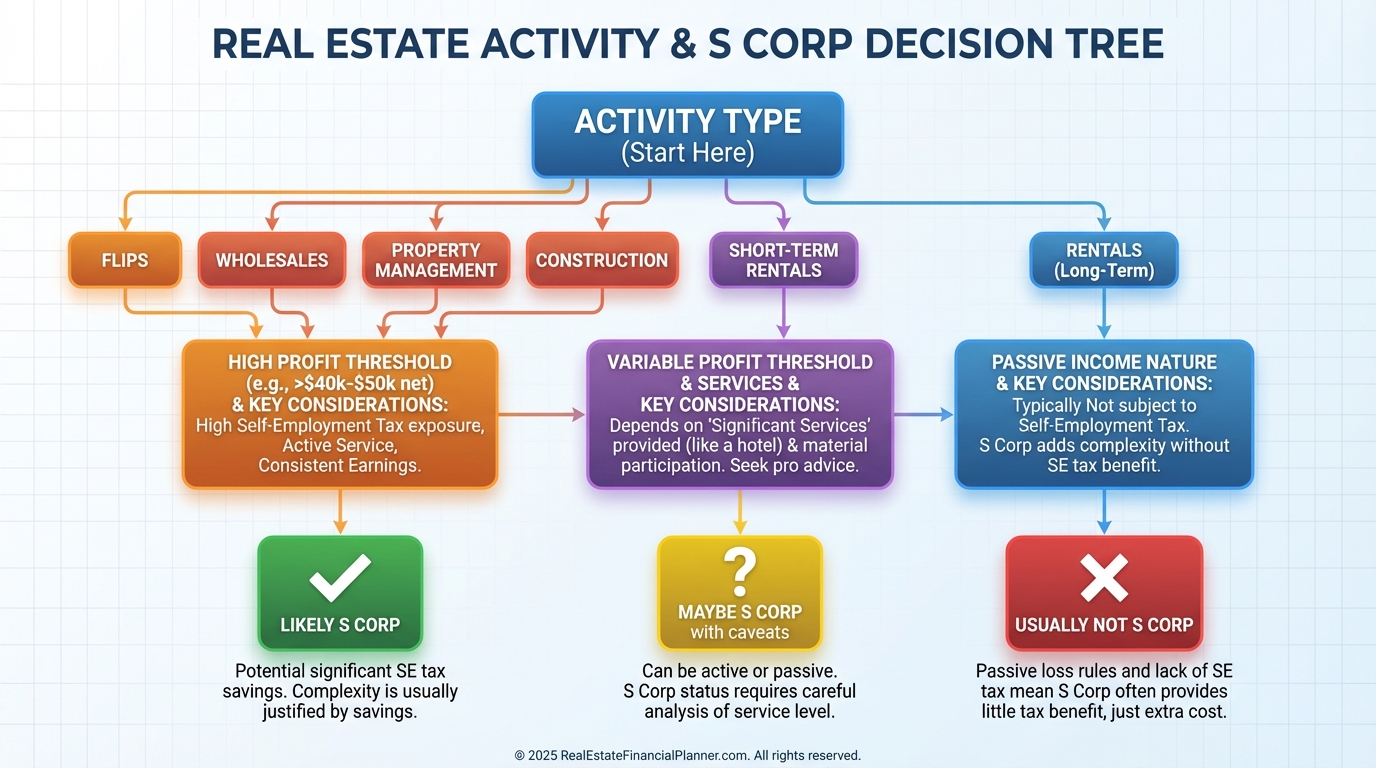

If your income is active (flips, wholesales, commissions, construction, property management), S Corp treatment can reduce self-employment tax.

You pay yourself a reasonable salary (subject to payroll taxes) and take remaining profit as distributions (not subject to self-employment tax).

When I model this with The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I add a payroll expense line and compare after-tax cash flow.

I also check QBI implications, because W‑2 wages reduce QBI but can help satisfy the wage limitation at higher incomes.

When an S Corp Makes Sense

I tell clients to consider S Corp once net profit from active real estate consistently lands above about $60,000–$80,000 per year.

Below that, compliance costs can eat the benefit. Above that, savings compound.

Flippers and wholesalers often see immediate wins because all their profit is ordinary active income subject to self-employment tax without S Corp.

Property management and construction companies also tend to benefit since their income is active and recurring.

When an S Corp Usually Doesn’t Fit

Long-term rental income is generally passive and not subject to self-employment tax. That limits S Corp benefits.

I rarely recommend holding appreciating rentals inside an S Corp because distributions of property can trigger taxable gain and complicate exits.

Instead, I separate. Rentals live in their own LLCs for liability containment and clean basis tracking.

If you run a short-term rental with substantial services, or you bundle a property management company with rentals, we revisit S Corp for the service arm.

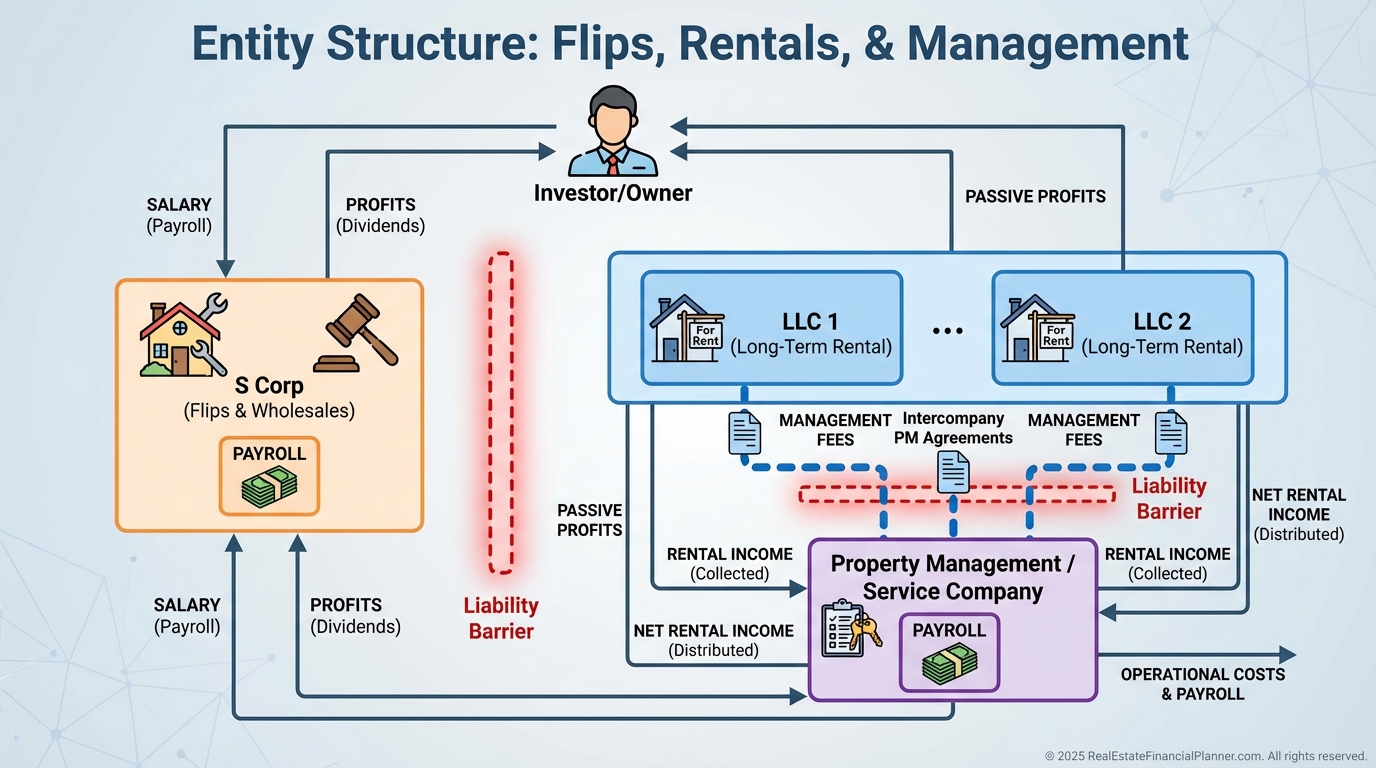

How I Structure Entities for Clients

For mixed strategies, I separate activities by risk and tax treatment.

Active income lives in an S Corp. Rentals sit in individual or series LLCs.

If needed, a property management entity bills the rental LLCs and runs payroll through the S Corp.

This keeps True Net Equity™ accurate by isolating liabilities and cash flow sources, and it clarifies Return Quadrants™ by separating appreciation and amortization from ordinary business profit.

The Numbers: A Simple Example

Assume your flip business nets $200,000 pre-owner-comp.

As a sole prop, all $200,000 is subject to self-employment tax (up to applicable limits), plus income tax.

As an S Corp, you pay yourself, say, a $90,000 reasonable salary, then distribute the remaining $110,000.

Only the $90,000 bears payroll tax. Savings often land in the $10,000–$15,000 range before considering other planning moves.

When I run this in the Spreadsheet, I add payroll cost, employer-side taxes, and payroll service fees, then compare after-tax net to confirm true savings.

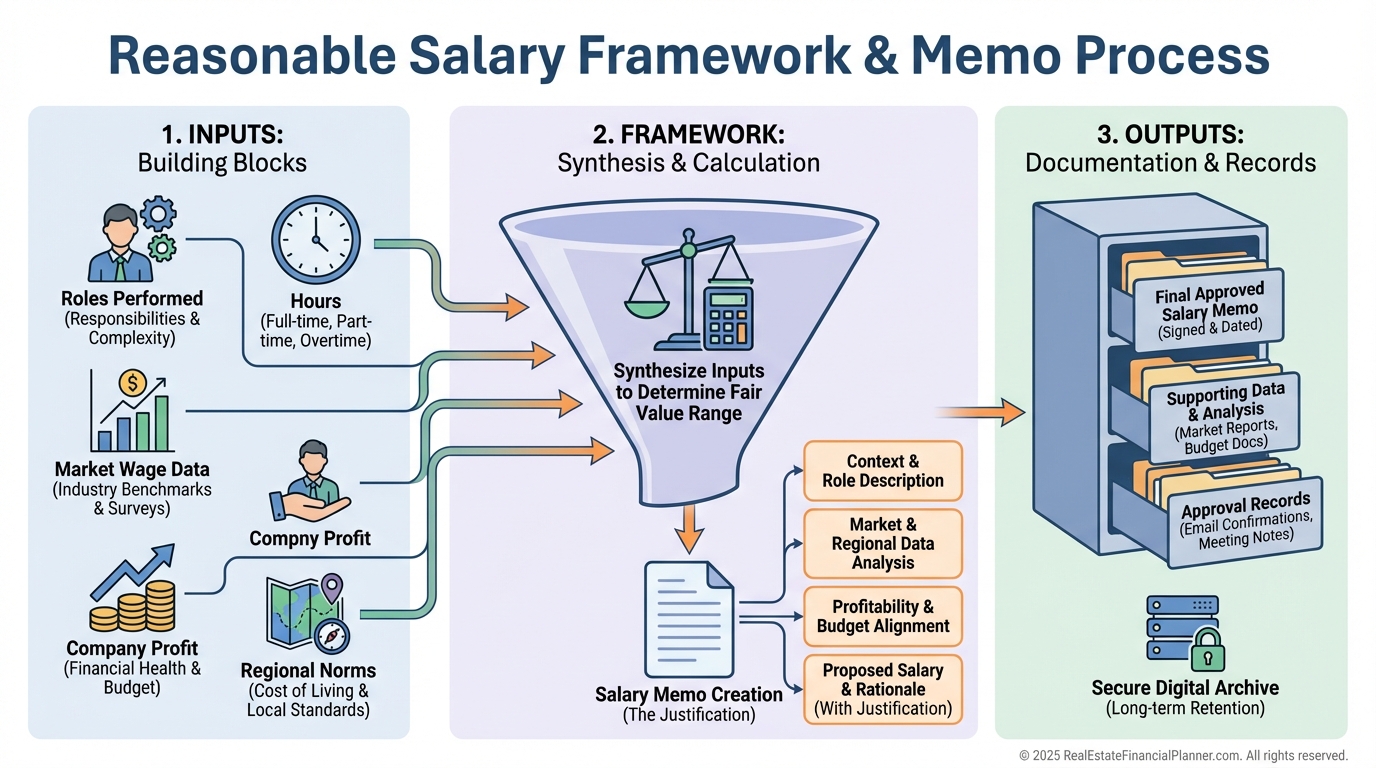

Reasonable Salary: How I Set and Defend It

There’s no single percentage that fits all. I triangulate.

I document hours, roles, and revenue per function. I pull market comps for similar roles, and I reconcile salary to profitability.

For many investor-operators, I see 30%–50% of net profit land as reasonable salary, but facts drive the final number.

I keep a memo in the corporate record with sources, time logs, and rationale.

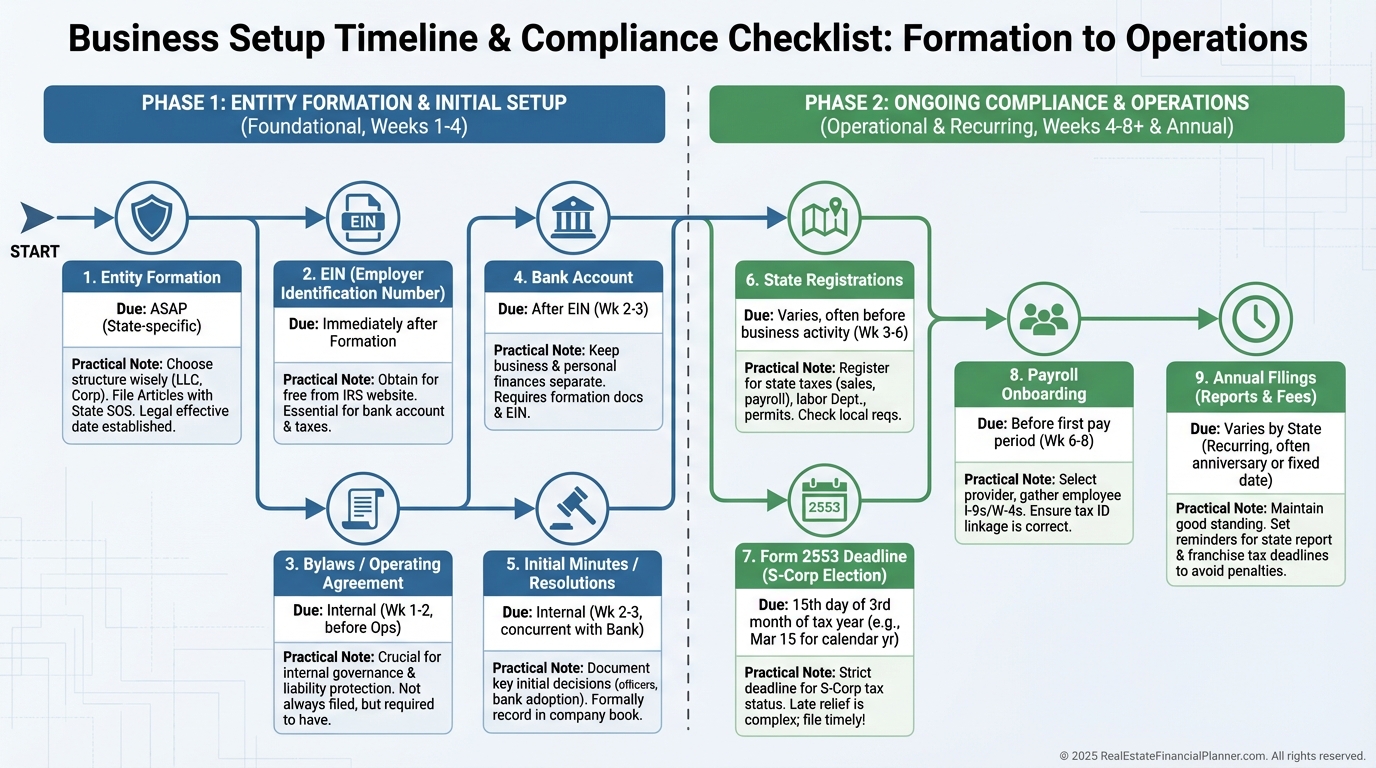

Setting Up an S Corp the Right Way

Form an LLC or corporation with your state first. Most investors prefer an LLC taxed as an S Corp for flexibility.

Get an EIN, open a dedicated bank account, and keep books clean from day one.

File IRS Form 2553 within 75 days of formation or by March 15 to be effective for the current year. If you miss it, late election relief may be available, but don’t rely on it.

Start payroll immediately once profitable. Consistency matters.

Create bylaws or an operating agreement, even if you’re solo, and record resolutions for major decisions.

If you operate in multiple states, register as a foreign entity and meet each state’s separate rules.

Year-Round Tax Planning Moves

I schedule quarterly reviews to adjust salary and distributions to actual profit.

We maximize legitimate deductions: home office, vehicle, education, software, professional fees.

For retirement, I model Solo 401(k) or SEP-IRA contributions up to current IRS limits (for example, up to $69,000 total in 2024, plus catch‑up if eligible).

If you’re near QBI phase-outs, wages, retirement contributions, and deal timing can swing your outcomes.

I use Return Quadrants™ to show how your business profit integrates with appreciation, cash flow, amortization, and tax benefits from your rental portfolio.

State-Level Traps and Edge Cases

Some states impose entity-level taxes or fees on S Corps that chip away at savings.

California hits S Corps with 1.5% of net income plus a minimum franchise tax.

A few jurisdictions require separate S elections, and some cities (like NYC) don’t recognize S status for local tax.

I confirm rules before the election and bake those costs into the Spreadsheet to ensure after-tax savings are real.

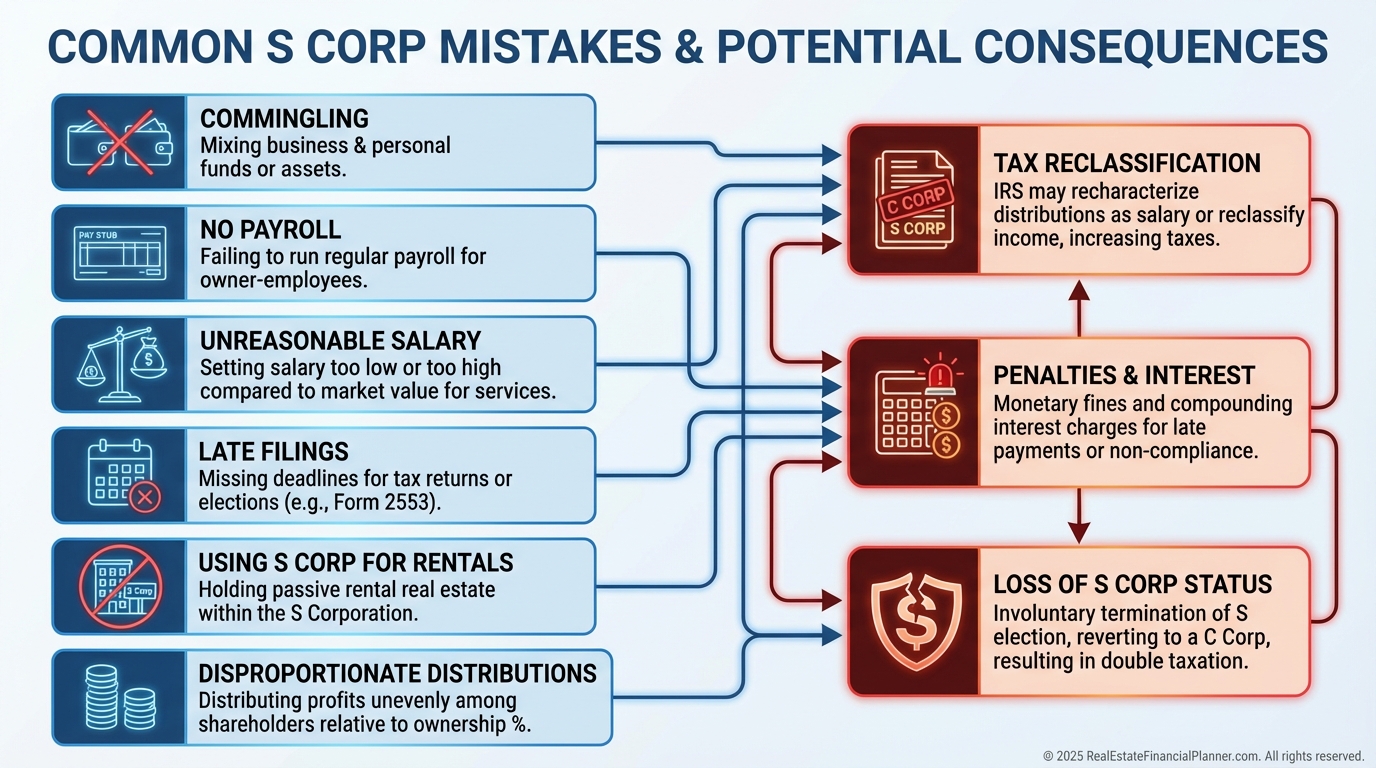

Common Mistakes I See (And Fix)

Commingling kills liability protection and credibility. Keep transactions clean and documented.

Skipping payroll or paying an unreasonably low salary invites IRS reclassification and penalties.

Missing 2553 deadlines, annual reports, or payroll deposits can turn savings into fines.

Using an S Corp to hold appreciating rentals creates exit pain and surprise taxes.

Trying to do disproportionate distributions violates the single-class-of-stock rule. Keep distributions pro rata.

A Quick Case Study You Can Copy

A client wholesaled and flipped to a $220,000 net year after COGS but before owner comp.

As a sole prop, projected self-employment tax plus income tax left about $142,000 after tax.

We converted to an S Corp, set salary at $100,000 with comps, and ran payroll. After employer taxes, payroll costs, and a 1.5% state entity tax, he kept about $154,000.

That $12,000 delta funded a Solo 401(k), which further reduced income tax and improved his long‑term True Net Equity™.

We then used the Spreadsheet to pressure-test a $300,000 year and set quarterly salary adjustments so cash flow stayed smooth.

Action Plan

If your active real estate profit will exceed $60,000–$80,000 this year, run the S Corp scenario now.

Model both cases in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ with payroll, entity fees, state taxes, and retirement contributions.

Document reasonable salary with comps and a time log. Start payroll as soon as you elect.

Keep rentals in LLCs, keep services in your S Corp, and keep records clean.

Before you file Form 2553, have a CPA who understands real estate review your numbers and state obligations.

That’s how we protect returns, align with the rules, and compound savings year after year.